Keith Haring Pop Shop II 1988

https://twitter.com/i/status/1774949562504855745

Tucker sobriety

Tucker Carlson: "I just am worried that we're missing the obvious signs. The obvious signs are reproduction, life expectancy, sobriety. If you have a society where people just can't deal with being sober, don't wanna have children and are dying younger, you have an extremely… pic.twitter.com/Q8L7cllxZP

— Camus (@newstart_2024) April 1, 2024

Trump

BREAKING IN NEW YORK: Trump seeks indefinite adjournment of New York case citing 'Pretrial Publicity.' Trump says he cannot get a fair trial in New York under the current circumstances. Trump's trial is scheduled to begin in 14 days on April 15. WATCH pic.twitter.com/UJXw0GDAHj

— Simon Ateba (@simonateba) April 1, 2024

Matteo

From Gangsta actress to Gangsta freedom fighter Emmy award winning Soprano’s star Drea De Matteo lost it all when she refused to take the vaccine.

It was a rude awakening and like so many it turned her world and beliefs upside down.

She warns people not to be distracted by… pic.twitter.com/5QtLVWkR72

— Kat A 🌸 (@SaiKate108) April 1, 2024

Joan Rivers

This will go down in history as the greatest “ I told you so”.

— Juanita Broaddrick (@atensnut) April 1, 2024

Geert Vanden Bossche predicts the collapse of society. And the rise of ivermectin. Not sure how the two can be combined.

• This Is Not an April Fool’s Gag (Jim Kunstler)

Did you have a fabulous Transgender Visibility Day, uncluttered with any loose talk about one Jesus Christ and his travails in the Roman Levant some 2000 years ago? The Easter Bunny desisted from twerking on the White House lawn this time around, but the Party of Chaos still nailed down the vote of the .000429 percent of the population that identifies as opposite the clerical error made upon their sexual assignment at birth. All in all, this may be the last grotesque frivolity the political class indulges in for a long time to come, and I’ll tell you why.

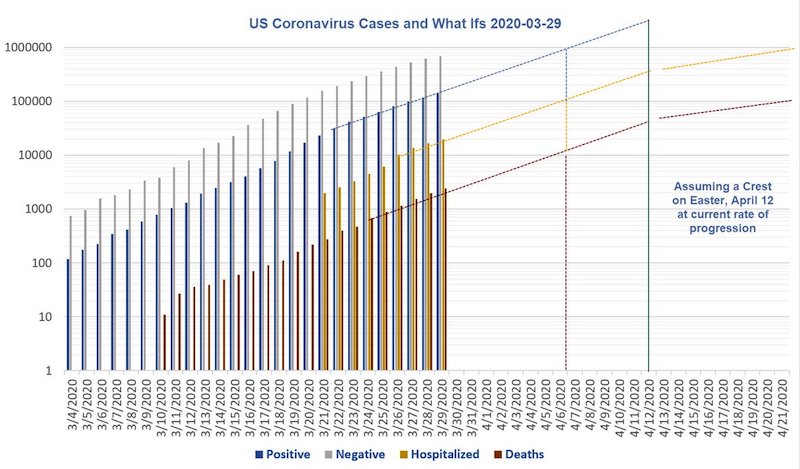

I had the honor of interviewing the Belgian virologist Geert Vanden Bossche on Friday for my podcast, and he had quite a sobering message. “What I am predicting,” he said, “is a massive, massive tsunami” of illness and death among highly-vaccinated populations with dysregulated immune systems.

“You commit errors or even crimes at the very small scale, you can hide them,” he said (at around 47:00 minutes into the hour-long discussion). “I have seen this happen with the Ebola vaccination with Africa a number of years ago. . . . However, if you do this at the very large scale, like what has happened with this mass [Covid] vaccination campaign, the truth will surface. And those who have committed these crimes who have been lying to the people, who have not been taking care of the health and safety of the people, will be severely, severely punished. . . . If these people would now go out and say, ‘Yeah, wait a minute, we have been making some mistakes, it wasn’t all right, we have to correct them, we have to revise our opinion,’ these people will be stoned in the streets. . . . They can only hope that something will happen that will distract from this issue, but it won’t. . . . The truth will surface: this has been a large-scale experiment of gain-of-function on the very human population. This will be something that will be reported in history for many many generations to come.”

A bit further on (around 55:20 minutes) he says, “You will see what will happen, for example, in the next coming weeks. . . is more and more cases of more serious long Covid. . . . They will start to replace the surge of the cancers. . . now we have a more chronic phase. It will end with a hyper-acute phase, a huge, huge wave. . . I’ve been studying this now for four years. I know what I’m talking about. I’m probably the only person, in all modesty, who understands the immunology behind this. . . . (At 1:00:12) The thing I want your audience to understand, what we will be facing in the hyper-acute Covid crisis that is imminent, is that we will have to build a completely new world. . . . It is very very clear that when this starts, our hospitals will collapse. And that means the chaos in all kinds of layers of society — financial, economic, social, you name it — will be complete. And that is what I’m very clearly predicting. . . . It’s very strange for me to make such statements, but I’m not hiding it because I’m two hundred percent convinced that it will happen.”

The kind old man with memory issues.

• Biden Denies Proclaiming Transgender Day of Visibility on Easter Sunday (RT)

US President Joe Biden has rejected criticism over his annual proclamation of March 31 as Transgender Visibility Day, which this year coincided with Easter Sunday. The president’s ambiguous remarks on the matter, however, were perceived by his critics as a flat denial of the move he had made just a day before. Biden was pressed on the matter by reporters and asked about the criticism, voiced by Republican House Speaker Mike Johnson, who called the step “outrageous and abhorrent’ tradition-busting moves.” The president stated the speaker was “thoroughly uninformed” on the matter, producing what appeared to be a flat denial to a follow-up question on how exactly Johnson was “uninformed.” “I didn’t do that.”

This you, @JoeBiden? https://t.co/p7zmhlhQLm pic.twitter.com/ZIT6v7tiHO

— Speaker Mike Johnson (@SpeakerJohnson) April 1, 2024

The remarks re-ignited the criticism, with Johnson taking to X (formerly Twitter) to poke fun at the president and posting a screenshot of Biden’s proclamation of March 31 as the Transgender Day of Visibility. “This you, Joe Biden?” the speaker wrote. Some, however, translated the president’s remarks as an attempt to explain that he was not the one to introduce the tradition in the first place, rather than a denial of his own move. The proclamation dates back to 2009, when then-President Barak Obama introduced it shortly after assuming office, marking March 31 as Transgender Visibility Day. The date will not coincide with Easter Sunday for decades to come. The White House appeared to back this position as well, with Press Secretary Karine Jean-Pierre insisting any backlash over the president’s move was “misinformation.”

“So surprised by the misinformation that’s been out there around this and I want to be very clear: every year for the past several years on March 31, Transgender Day of Visibility is marked,” she stated, adding that the nature of the situation was evident “for folks who understand the calendar and how it works.”“Easter falls on different Sundays, right, every year, and this year it happened to coincide with Transgender Visibility Day. And so that is the simple fact. That is what has happened. That is where we are,” she explained.Still, the affair has triggered a storm of criticism from prominent Christians and conservatives alike, getting further aggravated by the fact that the Biden administration has opted to ban children participating in the Easter Egg design contest from using religiously themed designs.

Watters

The left revering Obama as a Messiah was gleefully embraced, but Republicans praying at a Trump rally is a dangerous religious cult. Buying a Bible from Trump to pray? They say that makes you an ultra-Maga Bible-thumper in a cult.

While Trump was wishing America a Happy Easter,… pic.twitter.com/iODFm7zM8F

— Jesse Watters (@JesseBWatters) April 2, 2024

The next phase of the war? The end phase?

“If the current Russian plan of attack is causing swings of 300+ volts, it’s not even safe to plug in a cell phone..”

“Who knows what’s happening there. It must be chaos, and if it isn’t, it will be soon.”

• The Electric War Is Redrawing The Ukraine Map – In Black (Helmer)

The electric war, which in its first phase commenced last October and November, has now entered its second and final phase – final, that is, for the Ukraine. This is strategic; war has never been fought like this in Europe. The US and NATO general staffs and politicians have been taken by complete surprise. “The Ukrainians are building Maginot and Siegfried lines according to the instructions of their foreign advisers,” according to a Moscow analyst, “as if the Russian offensive will be men, artillery and tanks running across the landscape towards Kiev. But they won’t have to. The offensive against Ukrainian electricity cannot be stopped at these lines.” Without effective defence for its power generating plants, distribution hubs, and grid lines, the Kiev regime’s power is being stopped across the country; the major Novorussian cities in the east – Odessa, Kharkov, Dniepropetrovsk – are being blacked out and their populations forced to evacuate; the warmaking resupplies of the NATO allies are being cut off at borders which are now exposed to reversal of electricity surges threatening the plants and grids of southern Poland, Romania and Moldova.

Even European and American money for President Vladimir Zelensky’s regime needs electricity to move. “The Russian General Staff is thinking electrically,” comments a NATO veteran and expert in applying electrical engineering to war. “The way the strikes are unfolding causes the Ukrainians to perform at lot of switching. Anyone who knows anything about high-voltage switching understands that the more it’s done, the greater the likelihood there is of some kind of fault occurring, including surges or transients. So, leaving enough power on today so the Ukrainians can throw switches tomorrow may be part of the plan.” “Even if the French/NATO plan a deployment in the Ukraine, what will they be deploying to?” the military engineer adds. “If the current Russian plan of attack is causing swings of 300+ volts, it’s not even safe to plug in a cell phone.

MAP OF RUSSIAN STRIKES AGAINST UKRAINE POWER PLANT TARGETS, MARCH 30

We can safely assume that all manner of appliances and other expensive electrical or electronic equipment has been destroyed in the affected areas. Indeed, even if the power engineers manage to get the power back on, millions of light fixtures, especially the electronic/LED variety, are burned out. Diagnostic equipment (medical and technical), process instruments, programmable logic controllers, power supplies, inverters, frequency drives, bank machines, computerized checkout, refrigeration equipment, are burned up” “Who knows what’s happening there. It must be chaos, and if it isn’t, it will be soon.” The Russian General Staff doesn’t telegraph its punches. The daily Ministry of Defense operations briefing – blocked for many US and allied audiences – concentrates on the five combat groups, Western, Southern, Eastern, Centre, and Dniepr; and their operational directions along the Donbass line of contact; at present, they are Kupyansk, Donetsk, Avdeyevka, South Donetsk, and Kherson.

Last Friday, for example, the briefing began almost nonchalantly: “Tonight [March 29], the Armed Forces of the Russian Federation launched a group strike with high-precision long-range air, sea and land-based weapons, including aeroballistic hypersonic Kinzhal missiles, as well as unmanned aerial vehicles, at energy facilities and air defence of the Armed Forces of Ukraine. The objectives of the strike have been achieved. All objects are affected.” [..] “Ukraine is moving towards a truly definitive energy crisis”, Militarist reported on March 30. “In the east and west, thermal power plants are being eliminated one by one by completely demolishing the main turbine and generator sections. Dams also began to collapse from south to north. It is expected that all dams and thermal power plants will be put out of operation in the near future. The Ukrainian military industry will be destroyed both by direct attacks and by the energy crisis. The possibility of NATO-supported domestic production and maintenance will also be excluded. Thus, the logistics infrastructure in the rear may not be able to cope with events at the front.”

Macgregor

Colonel Douglas Macgregor: We've Destroyed Ukraine

Russia is enormously powerful. Why? They have an abundance of resources that they can draw upon.

They have a population that loves the country. They're Russians.

They believe in themselves. They believe in their religion. They… pic.twitter.com/2MflVMax1u— Ignorance, the root and stem of all evil (@ivan_8848) April 1, 2024

“These people are fools who should have no credibility left. But of course the MSM never holds them accountable so we will get more of the same until Ukraine finally collapses..”

• Ukraine Counteroffensive ‘Biggest Debacle In Modern Warfare’ – David Sacks (RT)

The failure of Ukraine’s 2023 summer counteroffensive against Russia was “easily predictable,” according to US tech entrepreneur and venture capitalist David Sacks, who has suggested that the Washington elite should be held accountable for talking up the doomed operation. Sacks’ comments came in response to a post on Saturday by Tesla and SpaceX CEO Elon Musk, who condemned the unnecessary loss of life suffered by Kiev’s forces as they attempted to “attack a larger army” that had superior defenses. The failed Ukrainian counteroffensive was “one of the biggest debacles in the history of modern warfare,” Sacks said in agreement, adding that Kiev’s soldiers and tanks had effectively run “headlong into minefields while Russian artillery rained down on them from heavily fortified positions.” “This should have been easily predictable,” the former PayPal COO and founder of the Yammer corporate social network stressed.

According to estimates released in March by the Russian Defense Ministry, the Ukrainian military saw over 166,000 casualties during last year’s failed counteroffensive. Kiev’s overall casualties since the outbreak of the conflict with Russia stand at 444,000, the ministry has claimed. Sacks went on to suggest that US officials such as ex-CIA chief David Petraeus, former House Speaker Nancy Pelosi, and current US Secretary of State Antony Blinken should all be held responsible for encouraging the doomed operation. “These people are fools who should have no credibility left. But of course the MSM never holds them accountable so we will get more of the same until Ukraine finally collapses,” Sacks surmised. Musk, meanwhile, has called the counteroffensive “a tragic waste of life for Ukraine,” suggesting that Kiev should not have attacked Russian forces – which had deployed vast minefields and had stronger artillery – while Ukrainian forces lacked armor or air superiority.

“Any fool could have predicted that,” the billionaire said, recalling that one year ago he had recommended that Kiev’s forces entrench and apply all resources to defense. Musk stated that Kiev would continue to have difficulty holding on to territory, but suggested that Russia was unlikely try to take over the entire country, arguing that it would face “extreme” local resistance in western regions of Ukraine. He also warned that if the conflict “lasts long enough, Odessa will fall,” and advised Kiev to reach a negotiated settlement with Moscow as soon as possible, before Russia gains more territory and Ukraine loses all access to the Black Sea. Moscow has stressed that it remains open to meaningful talks with Kiev, and has blamed the lack of a diplomatic breakthrough on the Ukrainian authorities, who refuse to accept the “reality on the ground.”

Russia knows where they all are. Sitting ducks.

• Every NATO Member Has Military Personnel In Ukraine – Estonia (RT)

Every NATO member already has military personnel in Ukraine, Estonian Defense Minister Hanno Pevkur claimed on Monday. Under no circumstances, however, will forces from the US-led bloc take part in the hostilities against Russia, the minister insisted in an interview with Austrian media outlet Die Presse. NATO servicemen are operating in the embattled country as advisers and are involved in training Ukrainian soldiers in Poland, the UK, and Estonia, Pevkur told the outlet. Western defense officials are currently planning to set up training camps in Ukraine in a bid to avoid issues with border crossings and to speed up the preparation process, he added.

At the same time, Pevkur insisted there is no talk of NATO soldiers fighting directly in the conflict, stating that “this has already been ruled out.” “The reality is that every NATO member country already has military personnel in Ukraine, such as military attaches or people who travel to Ukraine from time to time,” the official said. “What [French] President [Emmanuel] Macron said mainly related to personnel training,” he added. Macron openly raised the possibility of putting NATO troops on the ground in Ukraine in February, saying that “we cannot exclude anything” and that the West “will do everything necessary to prevent Russia from winning this war.”

The remarks, which Macron later described as having been “weighed, thought through, and measured,” prompted a wave of denials from a vast majority of NATO states and the bloc’s leadership. NATO Secretary-General Jens Stoltenberg publicly refuted the idea shortly after Macron’s initial statement, saying that no plans existed to deploy troops to Ukraine. Numerous Western leaders, including US President Joe Biden and German Chancellor Olaf Scholz, have also denied any such plans. Russian President Vladimir Putin has said any NATO troop deployments in Ukraine would not change the situation on the battlefield, given that Western soldiers are already active in the country as military advisers and mercenaries. He nonetheless warned that the ramifications of such a move would be “tragic.”

“..deep divisions in Ukraine’s parliament and more broadly in Ukrainian society.”

• ‘Too Old and in Poor Health’: Ukrainian Conscripts Unmotivated to Fight (Sp.)

Quite a few Ukrainian conscripts recruited by the “dysfunctional” and “unwieldy” drafting system are “often too old, in poor health and unmotivated,” The New York Times has cited brigade officers as saying. Alina Mykhailova, an officer in the Ukrainian Army’s Da Vinci Wolves battalion, told the newspaper that of the 200 conscripts they had received, only 25 showed a desire to fight. According to her, the goal is to “recruit volunteers faster, so that we get fewer of those people who are absolutely unmotivated.” “It’s like a market. You must try to find people with marketing methods,” another Ukrainian officer, Myroslav Hai, said, referring to public relations recruitment campaigns that aim to lure more people into joining the army. The remarks come after The Washington Post reported that the Kiev regime’s lack of any clear mobilization strategy aimed at plugging the gaping holes in the ranks of its armed forces is fueling “deep divisions in Ukraine’s parliament and more broadly in Ukrainian society.”

The Financial Times, in turn, suggested that Ukraine’s plans to mobilize half a million additional troops via a controversial new mobilization law have little hope of panning out if new Western assistance doesn’t arrive. The draft legislation, expected see a vote in Ukraine’s parliament in mid-April, looks to lower the draft age to 25, commit recruits to three years of service, and force eligible men to register via a digital portal, among other measures. Shortly after Russia started its special military operation, President Volodymyr Zelensky announced martial law and general draft in Ukraine. Under martial law, men aged between 18 and 60 are banned from leaving the country, and men aged 27 and older are eligible to be drafted, with some exceptions. In a sign that the problems of draft dodgers show no sign of being solved, draft cards are handed out not only in recruitment offices, but also on the streets, at gas stations, or in cafes.

Mass protests against Netanyahu.

• Israel’s War, Netanyahu’s Gamble (Alastair Crooke)

U.S. Democratic Party support for Israel is fast fissuring – an “ideological tremor”, Peter Beinart (editor of Jewish Currents) calls it. Since 7 Oct “it has become an earthquake” – a “Great Rupture”. This concerns the fusion of Liberalism to Zionism that long has defined the Democratic Party: “Israel’s war in Gaza has supercharged a transformation on the American Left. Solidarity with Palestinians is becoming as essential to leftist politics – as is support for abortion rights or opposition to fossil fuels. And, as happened during the Vietnam War and the struggle against South African apartheid – leftist fervour is reshaping the liberal mainstream”. Put plainly, in tandem to Israel moving to the far Right, pro-Palestinian support in the U.S. has hardened. By November 2023, 49 percent of American Jewish voters ages 18 to 35 opposed Biden’s request for additional military aid to Israel.

That is one vector; one direction of travel within the American polity. On the other path, American Jews – those most committed to Zionism; the ones who run establishment institutions – see that liberal America is becoming less ideologically hospitable. They are responding to this shift by forging common cause with the American Right. Netayanhu had made the observation that Israel and a wokish Democratic Party were on divergent paths some ten years earlier – shifting the Likud and the Israel Right away from the Democrats to the American Evangelicals (and thus, broadly in the direction of the Republican Party). As a former senior Israeli diplomat, Alon Pinkas, wrote in 2022: “With Netanyahu it was always transactional. So in the last decade or so he developed his own vile version of “replacement theory”: The majority of evangelical Christians will replace the vast majority of American Jews. Since it’s all about numbers, the evangelicals are the preferred ally”.

Beinart writes: “Supporters of Israel remain not only welcome in the Democratic Party but are also dominant. But the leaders of those institutions no longer represent much of their base”. “Senator Schumer, the highest Jewish representative in public life, acknowledged this divide in his speech earlier this month, when he said – the speech’s most remarkable line – that he “can understand the idealism that inspires so many young people in particular, to support a one-state solution”. A solution – to say it bluntly – that does not involve a ‘Zionist State’: “Those are the words of a politician who understands that his party is undergoing profound change”. Numbers of younger ‘changelings’ are larger than many recognize, especially among millennials and Gen Z; and the latter are joining a Palestine solidarity movement that is growing larger, but also more radical.

“That growing radicalism has produced a paradox: It is a movement that welcomes more and more American Jews – but correspondingly finds it harder to explain where Israeli Jews fit into its vision of Palestinian liberation”, Beinart worries. It was to bridge this Gulf that the Biden Administration confected its awkward stance at the UN Security Council this week, when the U.S. abstained on a ‘Ceasefire and Hostage Release Resolution’. The resolution was intended by the White House to ‘face both ways’, appealing to (older) American Jews who still identify as both progressive and Zionist, and – facing the other way – appealing to those who view the growing alliance between leading Zionist institutions and the Republican Party as uncomfortable, even unforgivable (and want the Gaza massacres to stop now). The Resolution ploy however, was not well thought-through (the latter lacuna becoming something of a White House habit). The content was badly mis-represented by the U.S., which stated that the resolution was ‘non-binding’. The New York Times actually mis-stated the resolution, saying that it ‘calls for’ a ceasefire. It did not.

“The African Sahel is revolting against western neocolonialism – ejecting foreign troops and bases, devising alternative currencies, and challenging the old multinationals. Multipolarity, after all, cannot flower without resistance paving its path.”

• The Sahel’s ‘Axis of Resistance’ (Pepe Escobar)

The emergence of Axes of Resistance in various geographies is an inextricable byproduct of the long and winding process leading us toward a multipolar world. These two things – resistance to the Hegemon and the emergence of multipolarity – are absolutely complementary. The Axis of Resistance in West Asia – across Arab and Muslim states – now finds as its soul sister the Axis of Resistance spanning the Sahel in Africa, west to east, from Senegal, Mali, Burkina Faso, and Niger to Chad, Sudan, and Eritrea. Unlike Niger, where the change in power against neocolonialism was associated with a military coup, in Senegal, the power change comes straight from the polls. Senegal plunged itself into a new era with the landslide victory of Bassirou Diomaye Faye, 44, in nationwide elections on 24 March. A former tax inspector who had just spent a fortnight stint in jail, Faye emerged with the profile of an underdog pan-African leader to turn the ‘most stable democracy in Africa,’ under French puppet incumbent Macky Sall, upside down.

The incoming Senegalese president now joins Ibrahim Traore, 36, in Burkina Faso, Aby Ahmed, 46, in Ethiopia, Andry Rajoelina, 48, in Madagascar, as well as future superstar Julius Malema, 44, in South Africa as part of the new, young pan-African generation focused on sovereignty. In his election manifesto, Faye pledged to reclaim Senegal’s sovereignty no less than eighteen times. Geoeconomics is key to these shifts. As Senegal becomes a substantial oil and gas producer, Faye will aim to renegotiate mining and energy contracts, including the largest ones with British Petroleum (BP) and UK gold mine operator, Endeavor Mining. Crucially, he plans to ditch the exploitative CFA franc – the French-controlled currency system used in 14 African states – even setting up a new currency as part of reshaping relations with neocolonial power France, Senegal’s top trading partner. Faye, echoing Comrade Xi Jinping, wants a “win-win” partnership.

Faye has not yet been clear on whether he intends to kick the French military out of Senegal. Were that to happen, the blow to Paris would be unprecedented, as embattled Petit Roi Emmanuel Macron and the French establishment consider Senegal the key player when it comes to blockading landlocked Niger, Mali, and Burkina Faso, which have already left Paris in the (Sahel) dust. The three latter states, which have just formed an Alliance of the Sahel States (Alliance des Etats du Sahel, AES, in the original French), are not only a major Paris nightmare after serial humiliations but also a big American headache – epitomized in the spectacular breakdown of military cooperation between Washington and Nigerien capital Niamey.

The culprit, according to the US Deep State, is, of course, Russian President Vladimir Putin. Obviously, no one in the US Beltway has been paying due attention to the Russia–Africa diplomatic flurry since last year, involving all key players from the Sahel to the new African BRICS members Egypt and Ethiopia. In sharp contrast to its prior regard of Niger as a staunch ally in the Sahel, Washington is now forced to present a calendar date to get its troops out of Niger – after a military cooperation deal was annulled. The Pentagon cannot be involved in military training in Nigerien territory anymore.

Those are dollar signs in his eyes.

• EU Can No Longer Expect US To Defend It – Rheinmetall CEO (RT)

Washington has sent a clear message to European NATO members that they can no longer rely on its military protection, the head of German defense giant Rheinmetall has argued. For decades, the EU has been taking for granted that the US would come to its rescue in case of war, but “that will no longer happen,” CEO Armin Papperger told The Financial Times. He cited the failure of the US Congress to approve continued military assistance to Ukraine as a signal to Europe that the Americans are not willing to pay for its security. The US is treaty-obligated to consider an attack on any NATO member as an attack on itself. The commitment has been put into question by former President Donald Trump, who has argued that US protection should be conditional on the other nations meeting their military spending obligations, and claimed he said as much to a European leader while in office.

President Joe Biden has denounced the remarks as “dangerous” and “un-American”. If Trump is elected president again in November, “the pressure will be higher” on Germany, Papperger said, but the risk will still be there regardless of who wins the presidency. ”The US focuses more on the Asia-Pacific area than on Europe,” he said. If a full-blown armed conflict erupts in the region, “the US will focus on Asia, and then Europe will be totally alone.” Papperger said his warning to European nations stems from his enduring perception of the world as “dangerous.” It has also shaped his response to the Ukraine crisis and the EU’s intention to ramp up arms production. Unlike people at the helm of other major producers, he did not hesitate to invest in expansion, the Financial Times report noted.

Since the Russia-Ukraine hostilities erupted in 2022, the Dusseldorf-based company’s share price has surged fivefold. Rheinmetall has announced plans to open armor and munitions factories in Ukraine, despite the risk of them being targeted by Russian forces. Kiev and its Western backers have claimed that a Russian victory in the conflict would expose NATO members in Europe to a future attack by Moscow. Russian President Vladimir Putin called this argument “simply delirious” last week, considering the vast advantage in military spending that the US-led military bloc has.

“Social power is when people have power. Then you have government. State power is when the state has power. Then you have tyranny.”

• How Private Interests Seized Control of America (Paul Craig Roberts)

One thing that we know with certainty about our time is that no Western government represents the people it rules. Western governments represent the interests of those whose campaign contributions elect the government. The government is simply purchased by campaign contributors. It is not a government in the sense of the word used by Thomas Jefferson and Albert Jay Nock. In the United States, the Supreme Court has legalized the purchase of the government by special interests who use government for their agendas. The Supreme Court actually ruled that it is a First Amendment right to purchase the government. Elsewhere in the Western world it is even worse, because the governments must first represent Washington’s interest. As representing Washington seldom conforms to their interests, no Western government has the support of the people.

I recently posted the approval ratings of the German chancellor, the British prime minister, and the French president, and they were even lower than Biden’s. The German chancellor has an approval rating of 17% In other words, 83% of Germans disapproved. Yet he rules them. Everywhere in Europe approval ratings are disapproval ratings with European leaders disapproved by 65 to 70% of the populations. How can this be called democracy? It can’t. Albert Jay Nock told us the truth of our situation in 1935 in the most important book describing the American political system that has ever been written. If you read and understand Nock’s book and read a couple of Charles Beard’s political histories of the US, you will have a very clear understanding why freedom in America is being extinguished. Albert Jay Nock distinguishes between social power and state power. Social power is when people have power. Then you have government. State power is when the state has power. Then you have tyranny.

This situation is one in which government becomes privatized by powerful interests, including government agencies, to serve their agendas and is transformed into an unaccountable state. Thomas Jefferson intended for the new nation to be governed by social power, that is, by the people. But other of the founding fathers wanted state power that they could enlist to privilege their pursuit of their own interest. Nock provides examples of this by the original founders. In my opinion, perhaps the best example of this was 60-70 years later with Abe Lincoln’s service to the railroads and support of the northern manufacturers for a tariff that would serve their interest at the expense of higher prices for the population. It was Lincoln’s support of the tariff that caused the secession of the Southern states and Lincoln’s invasion of the Confederacy. To cover up the fact that Lincoln was nothing but a shill for economic interests, historians invented a false account of Lincoln’s war against the Confederacy.

In the Western world democracy is merely an exercise used to convince the people that they are in control. I am not going to explicate Nock’s explanation of how we were doomed from the start. It began with the replacement of popular sovereignty with the state. Today unthinking patriots support the state at the expense of country and popular sovereignty. Originally, state power grew by handing out special favors to support the interests of those who gained control of the state. Today the situation has greatly worsened. The state is used to suppress those who object to the special interest agendas. For example, consider the massive repression of popular sovereignty. ( Websites, such as vDare.com, that point out the adverse consequences of the state turning a nation into a tower of babel are being suppressed by the state. vDare.com has been explaining that massive immigration of unassimilable people into a country in the name of diversity and multiculturalism actually means the destruction of the nation. The ultimate effect is to eliminate diversity.

“DeSantis wrestled control away from Disney’s handpicked board and now Disney has dropped its challenge after suffering a series of losses in court..”

• Disney’s Litigation Against Florida Collapses as the Media Shrugs (Turley)

It is a familiar pattern. Media outlets pick sides in a legal dispute and then distort the merits of the claims in favor of that party. In the fight between Disney and Florida, the media not only misrepresented a popular Florida parental rights bill (including falsely calling it the “Don’t Say Gay” law) but heralded Disney’s decision to enter the political fray to oppose the law. It then portrayed Disney’s legal moves to block state efforts to regain regulatory control over the company as brilliant and overwhelming. Some of us disagreed on all of those points, including the prospects of Disney’s ill-considered litigation strategy. Last week, that strategy collapsed with a settlement in which Disney decided to just “Let it go” and these same media outlets simply shrugged and moved on.

In a raw muscle play, Disney had its hand-picked board (the Reedy Creek Improvement District) effectively transfer authority to the company just before it was disbanded. Many in the media were thrilled by the move despite the unlikelihood of its being sustained legally. As I wrote at the time, it would be ridiculous for a court to rule that a company could stop a state from removing special treatment for a corporation like Disney. Even as the company racked up losses in court, the media and legal experts heralded its brilliance and toughness. In the meantime, as Disney itself admitted that it was losing money due to its political agenda, the media heaped praise on the corporation.

When it came to the lawsuits, the media portrayed the moves as brilliant and mocked Gov. Ron DeSantis, R-Fla., as outgunned as some of us struggled with how Disney could possibly prevail in the long term. NBC News chief political analyst Chuck Todd insisted that Republicans had “better be careful going after Disney.” MSNBC host and former 2020 Biden campaign aide Symone Sanders-Townsend agreed and said “Oh, my money’s on the Disney lobbyists, honey. My money is on the Disney lobbyists.” On a “Morning Joe,” co-host Joe Scarborough insisted “you can’t beat Disney.” MSNBC contributor Donny Deutsch agreed: DeSantis is “fighting a fight he can’t win, and this, to me, is a precursor of him on a bigger national stage. And he’s just stupid. It’s a stupid, stupid play.”

Vox wrote that “Disney is proving to be the foe that will not die.” Another Vox headline read “How Disney just beat Ron DeSantis.” The problem is that Disney was never winning, but viewers were not told that. The company was gushing money while losing in court. In the end, the Florida’s Parental Rights in Education Act continued to garner overwhelming support in the state. DeSantis wrestled control away from Disney’s handpicked board and now Disney has dropped its challenge after suffering a series of losses in court. The response from the media? Crickets. For Disney’s part, it spent millions of dollars, alienated millions of customers, and created precedent against itself. It literally achieved nothing material from its litigation against the state beyond driving up its own costs and reinforcing the regulatory authority against the company. It then walked away.

“For 55 years, every presidential administration has granted early protection to major candidates who requested it. The Biden administration is the sole outlier..”

• Weaponization of the Secret Service Has Put RFK Jr’s Life at Risk (Fleetwood)

Secret Service records recently revealed the agency’s conclusions that Kennedy is at “elevated risk for adverse attention,” and after reviewing credible armed threats against Kennedy, the agency assembled a group of eight teams ready to step in quickly after they get the go-ahead. But they never got it. The threat to Kennedy is particularly acute because of his controversial politics and his family history—his father, RFK, Sr., a U.S. senator and presidential candidate, and his uncle, John F., a U.S. president, were both assassinated. RFK Jr. has provoked and challenged some of the most powerful forces in our country, especially concerning the military-industrial complex, the CIA, and endless foreign wars that so enrich defense contractors. The perils to Kennedy arise not only because of his name but also because of the mainstream media’s relentless demonization of him.

Kennedy’s wife, Cheryl Hines, the lead actress in the popular TV series Curb Your Enthusiasm, accused Biden of “playing politics” with her and RFK Jr.’s safety. “Yesterday, an intruder climbed the fence at my home and was arrested,” Kennedy tweeted a few months ago. “After being released from police custody later in the day, he immediately returned to my home and was arrested again.” In September, a heavily armed man impersonating a U.S. marshal and the CIA, with loaded concealed firearms and an accomplice, was arrested after infiltrating a private event. No wonder Hines is scared and worried. The Kennedy name is a lightning rod, a bright target for disturbed and demented individuals. Judicial Watch, a conservative foundation, filed a Freedom of Information request and lawsuit to determine why Kennedy’s multiple requests for Secret Service protection were not answered. Finally, they obtained a trove of previously hidden emails.

“These documents confirm the bureaucratic and political runaround the Biden administration went through to ultimately deny Robert F. Kennedy Jr. the requested Secret Service protection,” said Tom Fitton, president of Judicial Watch. “The Biden administration’s refusal to provide Secret Service protection to Mr. Kennedy is dangerous and vindictive.” According to the reports, higher-ups ordered the Secret Service not to talk to Kennedy’s private security. Seventy percent of voters do not want Biden or Trump. According to a January 9, 2024, Gallup poll, Kennedy’s favorability rating of 52% is higher than Biden’s (41%) and Trump’s (42%). According to an earlier Gallup poll, 63% of U.S. adults think that the major parties do “such a poor job” of representing the American people that “a third major party is needed.”

This is a 7% increase from a year ago. Biden’s choice to deny Kennedy protection reflects insecurity, fearing Kennedy’s popularity and radical, transformative message have the potential to endanger his reelection. He might also worry that Secret Service protection will elevate Kennedy’s stature and give him a certain presidential aura as a credible contender among the media and voters. For 55 years, every presidential administration has granted early protection to major candidates who requested it. The Biden administration is the sole outlier. If another Kennedy is killed while campaigning for president, it will be a long-lasting, traumatic stain on the American psyche that will scar the soul of our democracy for decades to come. Unfortunately, we live in violent, polarized times. The United States has surpassed 400 mass shootings in 2023, a record-breaking year in gun violence.

RFK

https://twitter.com/i/status/1774977436561670316

“..it’s only natural to assume that a revived effort to paint him as a racist would follow..”

• Left Livid Over Trump Ally Efforts To Eliminate Anti-White Policies (ZH)

With Donald Trump’s popularity growing among black and latino voters, it’s only natural to assume that a revived effort to paint him as a racist would follow. In a Monday ‘exclusive’ report, Axios is absolutely beside themselves, writing “Trump allies plot anti-racism protections — for white people” There’s a plot afoot!nTrump’s Justice Department would push to eliminate or upend programs in government and corporate America that are designed to counter racism that has favored whites. Does racism still favor whites? Last we checked, white people, particularly white men – who ‘toxically mansplain’ everything, are the scourge of the universe. Anyhow, Axios has presented quite the narrative; the Trump campaign’s longstanding promise to eliminate Biden DEI initatives + efforts by Trump allies to legally combat anti-white racism “with the Supreme Court’s turn to the right” = racism. First, here’s what Trump said last year:

“Every institution in America is under attack from this Marxist concept of ‘equity,'” adding “I will get this extremism out of the White House, out of the military, out of the Justice Department, and out of our government.” Trump campaign spox Steven Cheung told Axios: “As President Trump has said, all staff, offices, and initiatives connected to Biden’s un-American policy will be immediately terminated,” adding “President Trump is committed to weeding out discriminatory programs and racist ideology across the federal government.” This is apparently a very bad thing. “Longtime aides and allies preparing for a potential second Trump administration have been laying legal groundwork with a flurry of lawsuits and legal complaints — some of which have been successful. A central vehicle for the effort has been America First Legal, founded by former Trump aide Stephen Miller, who has called the group conservatives’ “long-awaited answer to the ACLU.”

“America First cited the Civil Rights Act of 1964 in February in a lawsuit against CBS and Paramount Global for what the group argued was discrimination against a white, straight man who was a writer for the show “Seal Team” in 2017.” -Axios. Axios then picks what we can assume they consider to be the most racist example – the February filing of a civil rights complaint against the NFL over the “Rooney Rule,” which America First says violates “Title VII of the Civil Rights Act of 1964 and engaging in race and sex discrimination,” as the purpose of the 2003 rule was “increas[ing] the number of minorities hired in head coach, general manager, and executive positions,” to address “the historically low number of minorities in head coaching positions.”

The Rooney Rule has been amended several times since its adoption and now requires teams to interview at least two external minority candidates for head coach and general manager vacancies, at least one external minority for a coordinator job, and at least one minority and/or female candidate for senior level positions, such as club president and senior executives. Effectively, in the twenty years that the Rooney Rule has been in existence, all it has done – according to minority interviewees for head coaching positions and the former head of the NFL Players Association DeMaurice Smith – is result in member clubs engaging in sham interviews with minority candidates solely to check the Rooney Rule box. Given the limited timeframe to hire executives and coaches after the season, this results in fewer opportunities for similarly situated, well-qualified candidates who are not minorities.” -America First Legal.

For saying a woman is a woman..

• JK Rowling Could Be Imprisoned For “Misgendering” Trans People (MN)

Author JK Rowling could be prosecuted for “misgendering” trans people under Scotland’s odious new hate crime law that comes into force today, an SNP minister has admitted. Senior police officers are expecting a deluge of complaints over online posts after the Hate Crime and Public Order (Scotland) Act 2021 created a new crime of “stirring up hatred” relating to age, disability, religion, sexual orientation, transgender identity or being intersex. A person could now be imprisoned for up to seven years if they engage in “insulting” behaviour towards ‘protected’ groups, and the prosecution only needs to prove that the hatred was “likely” rather than “intended”. Siobhian Brown, the SNP’s community safety minister, initially stated that calling a “trans woman” (a man) “he” would not be a crime. However, after the law came into force, Brown stated, “It could be reported and it could be investigated. Whether or not the police would think it was criminal is up to Police Scotland for that.”

Rowling has vowed to continue calling biological males men and says she will now be targeted for telling the truth. During their training program on enforcing the new law, police officers were taught that even the content of plays and comedy gigs should be considered as potential hate crimes. Many have asserted that merely retweeting a Ricky Gervais joke about transgender people could amount to a hate crime in Scotland. As we previously highlighted, authorities admit that dealing with the expected flood of hate crime reports would prevent them from investigating real crimes. A Police Scotland pilot in Aberdeen which was deemed a “success” and is expected to be implemented means “more than 24,000 offences a year will no longer be allocated to a front-line officer.” Been a victim of burglary? Tough, the police are too busy clamping down on tweets that offend transgender activists.

“Despite the suspension, 71-year-old Khan will remain in jail on multiple other sentences..”

• Imran Khan’s Jail Sentence Suspended (RT)

A Pakistani court on Monday granted the country’s former prime minister Imran Khan leave to appeal his conviction for graft and suspended his 14-year jail sentence, according to Reuters, citing his lawyer. Khan and his wife Bushra Bibi were each handed a 14-year sentence on January 31 – just a week ahead of Pakistan’s February 8 elections, which Khan’s party alleges were rigged. Khan has been in prison since August last year on several charges. According to his lawyer, Barrister Ali Zafar, the Islamabad High Court said the couple’s sentences for corruption will remain suspended until a final decision on the convictions. “No evidence backs up this conviction,” he told reporters, claiming that was the reason why the court suspended the sentence on first hearing of the appeal.

Khan and his wife were charged with unlawfully selling state gifts, worth more than 140 million rupees ($500,000), while Khan was prime minister from 2018 to 2022. A list of these gifts reportedly included perfumes, diamond jewelry, dinner sets, and seven watches, mostly Rolexes. Despite the suspension, 71-year-old Khan will remain in jail on multiple other sentences imposed on the politician ahead of the polls, and which also disqualified him from holding any public office for ten years. In another such prosecution, the former PM was given ten years in prison for leaking state secrets. Khan claimed that the cable he released contained evidence of collusion between the Pakistani military and US officials to have him removed from power in April 2022. A former cricketer-turned-politician, Khan was ousted in a no-confidence vote in 2022, with the opposition accusing him of mismanaging the economy and foreign policy.

Since then, the former leader has fought dozens of legal battles. Khan repeatedly denied the allegations and claimed that he was overthrown as a result of a conspiracy. His Tehreek-e-Insaf party (PTI) also maintained that the cases were based on made-up charges to keep him out of politics. The PTI was barred from the election, forcing its candidates to run as independents. On March 3, Pakistan’s newly formed government elected Shehbaz Sharif, who heads the country’s Muslim League-Nawaz (PML-N) party, as prime minister, following a general election. The vote took place amid protests by Khan’s supporters, who insist the election was a sham. This is the second term for Sharif, who was first elected prime minister in April 2022, after Khan was ousted in the no-confidence vote.

“So if the DA’s office is telling me that they are not ready to go, what we’re going to do is we’re going to release all these individuals on their own recognizance..”

• Judge Orders Release Of ‘Border Riot’ Migrants Who Overwhelmed National Guard (ZH)

A group of migrants involved in a riot at the southern US border have been ordered to be released by an El Paso magistrate judge. The swarm of migrants overwhelmed Texas National Guard soldiers who were trying to organize them into groups to be taken into custody by Customs and Border Protection (CBP). At one point, a migrant attempted to grab a soldier’s firearm, one National Guard source told the NY Post. Following the riot, authorities confiscated knives and shanks from some of the migrants. “These people were willing to assault military,” said the Post’s source. “They were willing to assault law enforcement. They have complete disregard for our laws.” In an Easter Sunday decision, presiding Magistrate Judge Humberto Acosta ordered the rioters released after accusing the El Paso DA’s Office of being unprepared to proceed with detention hearings for each defendant, so they should be released, the El Paso Times reports.

“It is the ruling of the court is that all the rioting participation cases will be released on their own recognizance,” Acosta ordered, noting that they will only remain jailed if there’s a federal immigration hold blocking their release. The arrests were made by the Texas Department of Public Safety in connection with a March 21 stampede of asylum-seeking migrants — mostly men from Venezuela — who torn down razor wire along the Rio Grande and rushed the border fence at Border Safety Initiative Marker No. 36 in the Riverside area of El Paso’s Lower Valley. Some migrants face charges of assault of a public servant for knocking down National Guard troops before order was regained. The migrants had sought to surrender themselves to U.S. Border Patrol in bids for asylum.

It was unclear if Acosta’s decision applied only to the “riot participation” charge, or the assault and criminal mischief charges related to the border incident. It is unknown how many migrants were booked on the charge of “riot participation,” a Class B misdemeanor – though Acosta referred to “hundreds of arrestees,” who he says are entitled to individual detention hearings within 48 hours. The DA’s office requested a continuance to have the hearings at a later date, however Acosta rejected the request. “So if the DA’s office is telling me that they are not ready to go, what we’re going to do is we’re going to release all these individuals on their own recognizance,” Acosta said at the hearing.

Pouch

This family found an orphan kangaroo and helped to raise it, this is the baby kangaroo finding comfort in a pouch

📹 maggiebanton

pic.twitter.com/ZScKINaPMS— Science girl (@gunsnrosesgirl3) April 1, 2024

Pet cat

https://twitter.com/i/status/1774594071472038207

Family

https://twitter.com/i/status/1774811222216507506

7 baby ducks

She saved 7 baby ducks from a storm drain! pic.twitter.com/QW44zXoJyG

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 1, 2024

Parakat

— Why you should have a cat (@ShouldHaveCat) April 1, 2024

Buffalo

Lions fight while eating a water buffalo, then it casually walks off pic.twitter.com/JvyjNhEnoX

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 1, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.