Laura Knight The Green Sea, Lamorna 1918

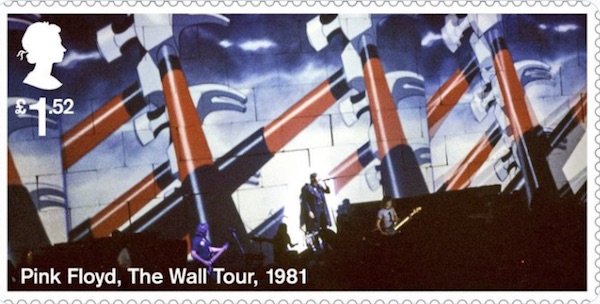

This is a Royal Mail stamp from 1981 bearing a profile of the late Queen – same hammer symbols, same tyrant uniform. McCarthyite fanatics opposed to any criticism at all of the apartheid Israeli state are trying to cancel this anti-fascist protest from our culture. @rogerwaters

Stone Putin

https://twitter.com/i/status/1666675508388458500

Zel before

Volodymyr Zelensky before he was forced by Washington….. pic.twitter.com/GUUFkktuPH

— Richard (@ricwe123) June 8, 2023

Sachs China

https://twitter.com/i/status/1666683473426534400

JFK Peace Speech

On June 10, 1963, JFK gave his famous “Peace Speech”

JFK gave that speech less than a year after the Cuban Missile Crisis, in the middle of the Cold War, but he was able to elevate his listeners to think above their personal hatred for the Soviet Union.pic.twitter.com/HzIz02Z8uA

— Kynan Thistlethwaite (@Noggatone) June 8, 2023

US media say the counteroffensive has started. Ukraine denies. Whatever it is, is a disaster.

• Ukraine Has Taken ‘Significant’ Losses This Week – US (RT)

The Ukrainian military has suffered “significant” casualties in its faltering attempt to mount a counteroffensive against Russian forces, US officials told CNN on Thursday. While Kiev has kept quiet about its losses, Moscow estimates that the offensive has already cost Ukraine almost 5,000 lives. Ukrainian troops hoping to break through Russia’s defensive lines have met “greater than expected resistance from Russian forces,”the American network reported, citing anonymous “senior US officials.” CNN’s sources described how Russian forces used anti-tank missiles and mortars to put up “stiff resistance” and inflicted “significant” casualties, as the Ukrainians struggled to get their Western-provided vehicles through densely-laid minefields. After months of delays and mixed messages from Kiev, Ukraine’s counteroffensive began on Sunday with an attack by six mechanized and two tank battalions along five sections of the frontline near Donetsk, and in other regions to the north and south.

Further attacks followed, and although pro-Ukrainian sources described these thrusts as “probing” attacks, it was clear by the beginning of this week that the counteroffensive had begun in earnest. The fiercest fighting took place on Wednesday night along the frontline near Zaporozhye, where the Russian military has spent several months constructing multiple lines of minefields, trenches, gun emplacements, and anti-tank obstacles. The Ukrainian 47th mechanized brigade attacked with a total strength of up to 1,500 troops and 150 armored vehicles, but Russian troops – backed by artillery and air support – repelled the assault, Russian Defense Minister Sergey Shoigu said on Thursday. Key to Russia’s defense has been its suppression of Ukraine’s air defense systems, allowing its fighter jets and attack helicopters to operate with impunity over the frontline.

The minister claimed that during a two-hour battle, the enemy lost 30 tanks, 11 armored personnel carriers and up to 350 troops. According to Shoigu’s daily updates, Ukraine has lost around 4,995 soldiers and almost 100 tanks since Sunday. Despite the apparently colossal losses, US National Security Adviser Jake Sullivan told CNN earlier this week that Washington believed “that the Ukrainians will meet with success in this counteroffensive.” However, General Mark Milley, the chairman of the joint chiefs of staff, urged caution, telling the network on Monday that it was “too early to tell what outcomes are going to happen.” “Everyone knows perfectly well that any counteroffensive in the world without control in the skies is very dangerous,” Ukrainian President Vladimir Zelensky said in a Wall Street Journal interview on Saturday, adding that “a large number of soldiers will die” during the operation.

How to distance yourself from failure.

• West Has Done Everything For Ukraine – Biden (RT)

Washington and its allies have exhausted their efforts to arm and prepare Ukraine for its counteroffensive against Russian forces, US President Joe Biden has claimed after meeting with UK Prime Minister Rishi Sunak at the White House. “We’ve done everything we could, collectively but individually in the United States, to make them ready, to support ..,” Biden told reporters on Thursday in a joint press briefing with Sunak in Washington. He called Kiev’s faltering attempts to mount an attack “an evolving situation where we’re very optimistic.” The US president made his comments amid reports that Ukrainian forces have suffered “significant” casualties as they battle to break through Russia’s defensive lines in the former Soviet republic. CNN admitted on Thursday that Ukraine’s troops were meeting “greater than expected resistance” and were struggling to get their Western-provided vehicles through minefields.

The long-discussed counteroffensive apparently began with a large-scale attack on Sunday, but met with withering firepower from Russian forces. Kiev admitted that its forces were “shifting to offensive actions” in some areas, but dismissed claims of its failures and losses as Russian propaganda. According to the Russian Defense Ministry, Ukrainian forces lost more than 3,700 troops, 52 tanks and hundreds of armored vehicles during the first three days of their attacks. Russian Defense Minister Sergey Shoigu said on Tuesday that only 71 Russian soldiers were killed over the same period. He added on Thursday that Ukraine’s 47th Mechanized Brigade retreated after losing 350 men and 30 tanks in the latest attack on the Zaporozhye front. Asked whether he expected to get new funding approvals from the Republican-controlled Congress to continue providing aid to Ukraine, Biden vowed “unwavering support” for Kiev. Lawmakers have approved $113 billion in Ukraine aid since February 2022. NATO members plan to discuss long-term security commitments for Kiev at a summit next month in Vilnius.

“Long-term security to deter future aggression after this war ends is the goal, and we’re advancing this goal by providing the support Ukraine needs now on the battlefield and helping them strengthen their military over the long term,” Biden said. “I believe we’ll have the funding necessary to support Ukraine as long as it takes.” Biden argued that while some lawmakers have begun to question whether the US should continue to provide aid to Ukraine, he sees broad agreement on the consequences of failing to do so. Sunak touted increases in UK defense spending, saying, “We’re lucky to have America’s investment in European security, but we need to share the burden alongside you.” He suggested that Russian President Vladimir Putin was betting on NATO members to tire of supporting Kiev. “I think it sends a strong signal to him that there is no point in trying to wait us out. We’re not going anywhere. We will be here for as long as it takes.”

They want US missiles to be fired at targets inside Russia.

• Kiev Needs Deadlier Weapons – US Lawmakers (RT)

Members of Congress have urged US President Joe Biden to provide even more advanced weaponry to Ukraine, including longer-range missiles that the White House previously warned could trigger World War III. Kiev must be given Army Tactical Missile Systems (ATACMS) to strike distant targets in Russia’s supply lines, nine lawmakers said in a letter to Biden on Thursday. The bipartisan group, led by Colorado Democrat Jason Crow, dismissed concerns that such weapons could escalate the conflict or leave US missile supplies too depleted. “We also understand the administration’s stated desire to maintain US stockpiles for future fights, but Ukraine is currently on the front lines in a fight for freedom in a war with immediate and long-term US national security implications,” the lawmakers said.

“The fight for global peace and security is playing out in Ukraine, and we believe this merits a drawdown from our existing stocks of this important capability.” ATACMS missiles can strike targets as far as 300 kilometers (190 miles) away. US National Security Advisor Jake Sullivan said last July that the Biden administration wouldn’t send such long-range missiles to Ukraine because such a precedent could provoke a wider conflict if used to attack targets in Russian territory. However, the UK has since supplied Kiev with an unspecified number of its own Storm Shadow long-range missiles, a decision that was apparently run by Washington first. While Britain has consistently pushed its allies to supply Kiev with heavier armaments, nothing happens without the US approval, NBC News reported last week.

Biden’s professed reluctance to take other potentially escalatory steps has crumbled as the conflict drags on. Last month, he agreed to allow US allies to provide F-16 fighter jets to Ukraine, while in January he approved plans to send M1 Abrams tanks to Kiev. Those concessions weren’t enough for the representatives behind Thursday’s letter. In addition to pushing for ATACMS missiles, they called for Biden to give more tanks and fighter jets to Ukraine, as well as additional Patriot air-defense systems. “Helping Ukraine fight and win is a US national security imperative and signals to the world that thee US will stand by our fellow democracies,” the nine lawmakers said. They called on Biden to do everything in his power, including using his authority under the Defense Production Act to accelerate weapons output, to give Ukrainian troops everything they need to mount a counteroffensive.

Kiev’s long-heralded attack apparently began on Sunday, and Biden said on Thursday that the US and its Western allies had already done everything they could to support the operation. According to CNN, the Ukrainian military has met with “greater than expected resistance” from Russian forces. Ukraine has lost more than 4,000 troops and dozens of tanks and armored vehicles in its failed attacks this week, according to the Russian Defense Ministry.

“in the morning, they [members of the Ukrainian delegation] gave [the proposals] to us during the negotiations and in the evening they said: ‘No, we give them up.’”

• Ukraine Gave Up Peace Deal With Russia Under US Pressure — Patrushev (TASS)

The Ukrainian leadership was ready to settle the conflict with Russia but gave up under the US pressure, Russia’s Security Council Secretary Nikolay Patrushev said on Thursday. “Had it not been for the US pressure on those whom they installed at the head of Ukraine, this situation would have not happened, Even the Ukrainian leaders themselves were ready for signing a peace treaty and gave Russia written proposals that we, in principle, approved,” Patrushev said, obviously referring to the negotiations between the Russian and Ukrainian delegations in Turkey in March last year. However, as Patrushev went on to say, “in the morning, they [members of the Ukrainian delegation] gave [the proposals] to us during the negotiations and in the evening they said: ‘No, we give them up.’”

“This happened only because the United States had put pressure on them and said that no negotiations must be held,” the secretary of Russia’s Security Council stressed. As Patrushev pointed out, “there are interested parties in this conflict,” first and foremost, the United States and Great Britain. The first Russian-Ukrainian negotiations after Russia launched its special military operation in Ukraine took place in Belarus in early March 2022 but the talks yielded no tangible results.

A new round of negotiations took place in Istanbul on March 29, 2022, following which Russian Delegation Head, Presidential Aide Vladimir Medinsky announced that Moscow had for the first time received Kiev’s principles of a possible future agreement in witting, stipulating, in particular, Ukraine’s neutral, non-aligned status commitments and its refusal to deploy foreign troops and armaments, including nuclear weapons, on its soil. Russia pulled out its forces from the Kiev and Chernigov areas. However, the negotiations on the peaceful settlement were totally frozen after that and, as Russian President Vladimir Putin said, Kiev gave up the accords reached in Istanbul. In October last year, Ukrainian President Vladimir Zelensky enacted a decision by the country’s National Security and Defense Council on banning any talks with Putin.

“For Russia, these same territories are a kind of “shrine,” he said. “These lands were settled and developed by our ancestors. We fought for these lands in two world wars. We are not indifferent to these territories, or the people living there.”

• Kakhovka Attack Lines Up With West’s Scorched Earth Scenario for Ukraine (Sp.)

The fallout from Tuesday’s attack on the Kakhovka dam continues to mount, with the Kremlin characterizing the incident as a “barbaric act” ordered “at the suggestion of [Kiev’s] Western curators,” and a calamity which has unleashed a “large-scale environmental and human disaster. A US-based private Earth imaging company released before and after satellite photos showing the consequences of the flooding, with much of the town of Novaya Kakhovka in Russia’s Kherson completely submerged in water, together with other settlements on both the Russian and Ukrainian-controlled sides of the river. A European Space Agency satellite tracking water levels June 5, 6, and 7 showed the extent of the rising water levels across the region over the three days.

The destruction of the Nova Kakhovka hydroelectric dam and monitoring via ESA Satellite Sentinel-3 (False Color based on bands S3, S2, and S1)

Sequence of June 5, 6 and 7#Russia #Ukraine #NovaKakhovka #hydroelectric #dam #ESA #Satellite #Sentinel3 pic.twitter.com/6jniWTsvZ8

— GiamMa-based researchers SDR R&D IoT (@giammaiot2) June 7, 2023

Ukrainian and NATO officials quickly blamed Moscow for the disaster, calling it an “ecological catastrophe.” Russia, which has borne an equal share of the direct fallout of the flooding, plus the prospects of the loss of water in the North Crimean Canal and cooling water for the Zaporozhye Nuclear Power Plant, dismissed the claims, pointing out that Kiev had been attacking the Kakhovka hydroplant and its environs for well over a year before Tuesday morning’s fatal blow. The Kakhovka dam attack is another example of the Zelensky regime’s absolute disregard for casualties and destruction in the ongoing NATO-Russia proxy war in Ukraine, and another demonstration of the West’s cynical maxim of “fighting Russia to the last Ukrainian,” says prominent Russian military observer Alexey Leonkov.

“When there are no impressive battlefield victories, but one needs to raise the degree of the demonization of Russia, one can really go all out. The regime in Kiev and those who control it do not care whatsoever about what happens to Ukraine in the future, or speaking more precisely, its people. They want to leave for Russia a territory in accordance with scorched earth tactics – destruction, an embittered population, preferably with environmental pollution, radioactive residues or perhaps [the fallout from] biological weapons,” Leonkov, the editor of Arsenal Otechestva, a Russian military affairs magazine, told Sputnik. Leonkov is convinced that Ukraine’s military and government lack any real independence, and carry out the policy of Western powers paying the bills.

Kiev’s patrons are “absolutely uninterested in Ukraine’s lands or the people who live there…They do not care how many people will die, how many cities and villages are destroyed, how many environmental disasters and other calamities they face. They don’t give a damn about it,” the observer said. For Russia, these same territories are a kind of “shrine,” he said. “These lands were settled and developed by our ancestors. We fought for these lands in two world wars. We are not indifferent to these territories, or the people living there. That’s why we are trying to conduct a military operation, not an all-out war that destroys everything and everyone…Our enemy, and this is clear, consists of [30 countries], all of them members of the NATO bloc. This adversary…has already stated that they will [strive to] realize their goals ‘to the last Ukrainian.’

The FBI has known for 3 years that Biden was paid for services to Burisma when as VP he was in charge of Ukraine for Obama. “Well, son of a bitch, he got fired..”

• FBI Document Alleges $5 Million Bribe Paid To Joe Biden By Burisma Exec (ZH)

Someone has leaked the contents of the stonewalled FBI document, form FD-1023, which alleges that President Joe Biden was paid $5 million by an executive of Ukrainian natural gas firm Burisma Holdings, where his son Hunter sat on the board. This, according to a confidential human source, who told this to the FBI during a June 2020 interview, according to Fox News. The form, dated June 30, 2020, is from a “highly credible” confidential human source who had detailed multiple meetings and conversations they had with a top Burisma executive over the course of several years, beginning in 2015. The CHS had been working with the FBI as a regular, reliable source of information since 2010, and has been paid approximately $200,000 by the bureau.

The Burisma executive sought the advice of the confidential source, a business professional, on gaining U.S. oil rights and getting involved with a U.S. oil company, the sources familiar with the documdnt said. The Burisma executive was speaking with the confidential source to “get advice on the best way to go forward” in 2015 and 2016 According to the FD-1023 form, the confidential human source said the Burisma executive discussed Hunter’s role on the board. The confidential human source questioned why the Burisma executive needed his or her advice in acquiring access to U.S. oil if he had Hunter Biden on the board. The Burisma executive answered by referring to Hunter Biden as “dumb.” -Fox News According to the Burisma executive, the company had to “pay the Bidens” because Ukraine’s lead prosecutor, Victor Shokin, was investigating Burisma.

According to the CHS, he suggested that the Burisma executive “pay the Bidens $50,000 each,” to which the Burisma executive replied “not $50,000,” it is “$5 million.” “$5 million for one Biden, $5 million for the other Biden,” the executive reportedly said. The $5 million payments appeared to reference some sort of “retainer” Burisma intended to pay the Bidens in order to ‘clean up’ several issues – including the investigation led by Shokin. Another source told Fox it was a “pay-to-play” scheme. The CHS believes that the $5 million payment to Joe Biden and $5 million to Hunter happened, as the Burisma executive said he “paid” the Bidens is a way “through so many different bank accounts” that investigators would not be able to “unravel this for at least 10 years.” The document also makes reference to ‘the Big Guy,’ thought (and as seen on Hunter’s laptop) to be a reference to Joe Biden.

According to the Burisma executive, they “didn’t pay the Big Guy directly.” Meanwhile, sources tell Fox that the Burisma executive appears to be at a “very, very high level” of the company, with one source suggesting it could be the president, Mykola Zlochevsky – though the executive’s name is redacted in the document. Biden notably bragged on camera about a quid-pro-quo arrangement to have Shokin fired. “I said, ‘You’re not getting the billion. I’m going to be leaving here in,’ I think it was about six hours. I looked at them and said: ‘I’m leaving in six hours. If the prosecutor is not fired, you’re not getting the money,” Biden said in 2018 at a Council for Foreign Relations event, recalling a conversation with former Ukrainian President Petro Poroshenko. “Well, son of a bitch, he got fired,” he continued. “And they put in place someone who was solid at the time.”

“..Trump is facing seven counts that include willful retention of national defense information, corruptly concealing docs, conspiracy to obstruct justice, and false statements.”

• McCarthy: Unconscionable for Biden to Indict Leading Opposing Candidate (Sp.)

US House Speaker Kevin McCarthy said Thursday it was “unconscionable” for US President Joe Biden to indict “the leading candidate opposing him” – ex-President Donald Trump. “Today is indeed a dark day for the United States of America. It is unconscionable for a President to indict the leading candidate opposing him,” McCarthy said on Twitter. “Joe Biden kept classified documents for decades. I, and every American who believes in the rule of law, stand with President Trump against this grave injustice. House Republicans will hold this brazen weaponization of power accountable.” McCarthy’s remarks reiterated similar sentiments aired by Florida Governor Ron DeSantis, who blasted the “weaponization of federal law enforcement agencies” as a “mortal threat to a free society.”

“We have for years witnessed an uneven application of the law depending upon political affiliation,” he continued, claiming that a DeSantis White House would “excise political bias and end weaponization once and for all.” Earlier Thursday, Trump revealed on Truth Social that “the corrupt Biden administration” had informed his lawyers that he had been indicted in a federal investigation over alleged mishandling of classified documents at his Florida residency, and was summoned to appear in court on Tuesday. The ex-president expressed despair over the indictment, pointing out that he is being prosecuted as polls show he is by far the leading candidate among both Republicans and Democrats.

US media reported on Thursday that Trump is facing seven counts that include willful retention of national defense information, corruptly concealing docs, conspiracy to obstruct justice, and false statements. Trump has denied any wrongdoing in the classified documents case and the other three criminal probes he is involved in, including charges of falsifying business records and the former president’s alleged involvement in the events on Capitol Hill on January 6, 2021.

“Joe Biden is a Democrat and therefore his classified documents are a mere oversight and not the foundation–shaking treachery Trump’s documents represent..”

• Mar-a-Lago Indictment Designed to Make Trump Reelection ‘Impossible’ (Sp.)

Former US President Donald Trump earlier reported that his legal team had been informed that he was being indicted over his retainment of classified documents at his Mar-a-Lago residence. The revelation came just after it was reported prosecutors had formally informed Trump’s lawyers that he was the subject of their Florida investigation. Michael Shannon, a political commentator and columnist for Newsmax, told Sputnik that he believes the investigation into Trump’s handling of classified documents and alleged obstruction of justice is part of a larger politically-motivated scheme designed to prevent the former president from running for his old seat in the 2024 election.

“This is all part of the process to indict Trump and make it difficult — if not impossible — for him to run for reelection,” Shannon asserted. “The entire investigation, raid on Mar–a–Lago and subsequent developments are entirely political and constitute a genuine attack on democracy.”

Shannon pointed to classified documents that were found at US President Joe Biden’s Delaware home and at the Biden Penn Center in Washington, DC, as evidence that the Mar-a-Lago investigation is politically driven. Earlier reports revealed that documents had been retrieved from the garage area of one of Biden’s homes, a development that later saw the president joke that they were secured along his beloved Corvette. “Joe Biden is a Democrat and therefore his classified documents are a mere oversight and not the foundation–shaking treachery Trump’s documents represent,” Shannon said. The commentator added that while classified documents were also found in the possession of former US Vice President Mike Pence, “the left doesn’t view him as a threat to Biden, the Pence documents are also no big deal.”

We know.

• I Didn’t Order Nord Stream Sabotage – Zelensky (RT)

Ukrainian President Vladimir Zelensky has claimed he had no knowledge of an alleged plot by his government to blow up the Nord Stream gas pipelines. The plan was reportedly uncovered by a European nation, which subsequently informed Washington. “I am president and I give orders accordingly,” Zelensky said, as cited by Politico on Thursday. “Nothing of the sort has been done by Ukraine. I would never act that way.” The alleged intelligence tip was reported by the Washington Post on Tuesday, based on leaked classified Pentagon materials. The pipelines, which were built to carry gas from Russia to Germany, were ruptured by powerful explosions last September, and the newspaper claimed that the US had learned of Ukrainian preparations for a sabotage operation three months prior from an unidentified ally.

The alleged mission was run by Valery Zaluzhny, the commander-in-chief of the Ukrainian armed forces, rather than rogue agents, the Post claimed. Zaluzhny was placed in charge so that Zelensky “wouldn’t know about the operation” and could maintain plausible deniability, it was reported. “I didn’t know anything, 100%,” the president said in the interview. “I said, ‘Show us proof. If our military is supposed to have done this, show us proof.’” According to the Post, Ukraine wanted to blow up the pipelines following NATO’s BALTOPS naval exercise in June 2022. Investigative journalist Seymour Hersh previously claimed that the drills were used as cover to plant remotely triggered explosives, but stated that it was US and Norwegian divers who had done so, acting on orders from US President Joe Biden. Washington and Oslo have denied Hersh’s allegations.

Zelensky’s ability to control his own secret services was previously placed in question by other materials in the trove of leaked Pentagon documents, which were allegedly shared by US Air National Guard member Jack Teixeira. One of the documents stated that the US believed that the Ukrainian agents behind an attack in March on a Russian airborne radar stationed in Belarus had not informed the president about their plans.

“..there is no way that the government was going to default on its Treasury debt because, after all, the Treasury debt is held by the wealthiest 10%..”

• Biden Admin Waging Class War Against Working Americans – Michael Hudson (Sp.)

US President Joe Biden’s economic policies have further enriched financial elites at the expense of working class Americans, Prof. Michael Hudson, US economist and former Wall Street analyst, told Sputnik’s New Rules podcast. Biden struck a debt ceiling deal with House Speaker Kevin McCarthy with a great deal of fanfare late last month following Treasury Secretary Janet Yellen’s apocalyptic prognoses with regard to a US “imminent” default. According to Hudson, however, these dramatic warnings were meant to obfuscate the Biden administration’s real objectives “There was never any debt crisis at all,” Hudson told Sputnik. “The government could have simply continued to pay its bills for projects that Congress had already approved, there is no way that the government was going to default on its Treasury debt because, after all, the Treasury debt is held by the wealthiest 10% and the government is not going to do anything that hurts the 10% and benefits the 90%.”

What really happened, as per economist, was a bipartisan agreement on a further redistribution of wealth from the 90% to the 10%. However, the Democrats could not just go for it as they have always positioned themselves as a pro-labor and pro-economic justice party. Hence, there had been a month-long “good guy-vs-bad guy wrestling match” between the president and the GOP, according to Hudson. Eventually, Biden “reluctantly” agreed on cuts to social programs, cancellation of support to the poor. One should bear in mind that Joe Biden is from Delaware – a “state where most corporations in America have their head offices because the Delaware rules are so pro-corporate and anti-labor that corporations want to be there.” “It’s all just a made up,” Hudson continued. “When they talk about cutting back the government debt, what they mean is cutting back social services.

They would like to do what Biden and [Barack] Obama wanted to do after 2009. They want to cut back Social Security. They want to privatize it as if that will somehow solve the problem. They want to cut back medical care. They want to cut back most social programs, so that the money that the government does spend will be exclusively to support the financial sector, the military sector, the insurance sector, and the real estate sector.” To illustrate his point Hudson referred to the fact that just a day after the debt agreement was struck and social programs were cut, some GOP congressmen, namely Senator Susan Collins from Maine, called for greater military spending to help fund the US proxy war in Ukraine. These military budget increases would come at the expense of US social programs, the economist pointed out.

“..as of mid-May, EU countries had frozen more than €200 billion ($215 billion) in assets belonging to the Bank of Russia, as well as over $25 billion in private funds..”

• Russia Being Robbed By The West – Kremlin (RT)

The seizure of Russian state assets and reserves and those of its citizens, by Western countries, should be perceived as outright theft, Kremlin spokesperson Dmitry Peskov has insisted. He made the statement during a press briefing on Thursday, having been asked about Russian investors’ intentions to prepare a class action lawsuit to unlock the frozen assets. “In different ways, but the government and the entrepreneurs have been robbed by the West,” he stated. According to Peskov, the Russian government and the country’s businesses are looking for ways to protect their interests and return the seized assets, though that is likely to be a very long and difficult process. Peskov noted that Russian entrepreneurs are limited in their rights in EU courts, while the efforts to defend their rights are absolutely justified and should be continued.

Moscow has been hit by multiple waves of Western sanctions since the conflict with Ukraine broke out last February. European Commission spokesman, Christian Wiegand, said recently that as of mid-May, EU countries had frozen more than €200 billion ($215 billion) in assets belonging to the Bank of Russia, as well as over $25 billion in private funds. He argued that the European Union had a legal avenue allowing it to seize frozen Russian assets and use them for the subsequent reconstruction of Ukraine. Moscow has described Western attempts to transfer the seized assets to Ukraine as “barbarism,” and “theft” that violate international law. The Kremlin has also warned that Russia will respond in kind if necessary.

Pizza.

• EU Demands Answers Over ‘Instagram Pedophile Network’ (RT)

The European Union’s Internal Market Commissioner Thierry Breton has called on social media giant Meta to take “immediate action” against child pornography on its platforms, after the Wall Street Journal and Stanford University identified Instagram as a major hub for illicit material. Breton commented on the WSJ report in a tweet on Thursday, saying that Meta’s voluntary code on child protection “seems not to work” while vowing to personally question company CEO Mark Zuckerberg on the issue at an upcoming event.“Zuckerberg must now explain [and] take immediate action. I will discuss [this] with him at Meta’s HQ in Menlo Park on 23 June,” he said, adding that new regulations under the EU’s Digital Services Act will force tech firms to “demonstrate measures to us or face heavy sanctions” after they take effect on August 25.

Published Wednesday, the Journal report was a result of a joint investigation between the outlet and researchers at Stanford University and the University of Massachusetts Amherst, finding that Meta’s Instagram “helps connect and promote a vast network of accounts openly devoted to the commission and purchase of underage-sex content.” Algorithms on the social media site actively promote such illegal material, the researchers claimed, even helping to guide users to those selling child pornography through Instagram’s “recommendation systems,” which were said to “excel at linking those who share niche interests.” While Meta acknowledged that it is not able to remove all underage sexual content on Instagram, the company told the Journal that it has created a special task force for that purpose, claiming it has taken down 27 different “pedophile networks” over the last two years.

It added that it had removed thousands of hashtags which sexualize children and altered the site’s recommendation scheme since speaking to the WSJ. Instagram is not the only large social media platform found to host child pornography, with billionaire entrepreneur Elon Musk vowing make the issue “Priority #1” after purchasing Twitter last year. Another Meta-owned site, Facebook, has also struggled to get a handle on child exploitation content circulating online.Together with Instagram, the company flagged more than 20 million examples of such material in 2020, well outpacing Meta’s competitors, according to data gathered by the National Center for Missing and Exploited Children.

“..if Putin were to be arrested by “say, Germany… all our missiles would fly to the Bundestag, to the Chancellor’s office.”

• South Africa Won’t Enforce ICC Putin Warrant – Minister (RT)

South Africa will not enforce the International Criminal Court’s warrant for the arrest of Russian President Vladimir Putin, Minister in the Presidency Khumbudzo Ntshavheni told reporters on Thursday. “The Deputy Chairperson of the Security Council of Russia has indicated that anyone who arrests President Putin will be tantamount to a declaration of war,” Ntshavheni said, referring to a statement by Dmitry Medvedev in March. At the time, Medvedev declared that if Putin were to be arrested by “say, Germany… all our missiles would fly to the Bundestag, to the Chancellor’s office.” “I don’t think this country wants us to declare war with Russia,” Ntshavheni added.

In mid-March, the International Criminal Court (ICC) issued arrest warrants for Russian President Vladimir Putin and Maria Lvova-Belova, the presidential commissioner for children’s rights. The court accused them of the “forcible transfer of population,” referring to Moscow’s efforts to evacuate children from combat zones amid hostilities with Ukraine. As a signatory to the 2002 Rome Statute, South Africa is obliged to enforce the warrant. However, the country is also hosting this year’s BRICS summit in August, at which the leaders of the world’s largest emerging economies – Brazil, Russia, India, China and South Africa – are due to meet.

Despite media reports suggesting that South Africa had asked China to host the summit, Ntshavheni told reporters that “nothing has changed,” and that the meeting would still go ahead in Johannesburg as planned. Moscow dismissed those reports as a hoax last week. Speaking to the BBC on Wednesday, Obed Bapela, a deputy minister in the South African presidency, said that the government was working on legislation that would make its national law outrank that of the ICC. If parliament passes the bill, Pretoria could then “give itself exemptions of who to arrest and who not to arrest,” Bapela explained.

“It is absurd that a single judge can issue a three-page decision that could land Julian Assange in prison for the rest of his life,,“

• Assange Dangerously Close to Extradition After High Court Rejects Appeal (RSF)

Reporters Without Borders (RSF) is deeply concerned by the UK High Court’s decision rejecting WikiLeaks publisher Julian Assange’s appeal against his extradition order, bringing him dangerously close to being extradited to the United States, where he could face the rest of his life in prison for publishing leaked classified documents in 2010. In a three-page written decision issued on 6 June, a single judge, Justice Swift, rejected all eight grounds of Assange’s appeal against the extradition order signed by then-UK Home Secretary Priti Patel in June 2022. This leaves only one final step in the UK courts, as the defence has five working days to submit an appeal of only 20 pages to a panel of two judges, who will convene a public hearing. Further appeals will not be possible at the domestic level, but Assange could bring a case to the European Court of Human Rights.

Rebecca Vincent, RSF’s Director of Campaigns: “It is absurd that a single judge can issue a three-page decision that could land Julian Assange in prison for the rest of his life and permanently impact the climate for journalism around the world. The historical weight of what happens next cannot be overstated; it is time to put a stop to this relentless targeting of Assange and act instead to protect journalism and press freedom. Our call on President Biden is now more urgent than ever: drop these charges, close the case against Assange, and allow for his release without further delay.

Stella Assange, Julian’s wife, made a statement on Twitter: “On Tuesday next week my husband Julian Assange will make a renewed application for appeal to the High Court. The matter will then proceed to a public hearing before two new judges at the High Court and we remain optimistic that we will prevail and that Julian will not be extradited to the United States where he faces charges that could result in him spending the rest of his life in a maximum security prison for publishing true information that revealed war crimes committed by the U.S. government.”

This is the latest stage in more than three years of legal proceedings in UK courts, as the US government has made its case to extradite Assange in order to try him on 18 counts in connection with WikiLeaks’ publication of hundreds of thousands of leaked classified documents that informed public interest reporting around the world. Although the first instance court ruled against extradition on mental health grounds, the Court of Appeals overturned the decision in consideration of diplomatic assurances presented by the US government. Assange would be the first publisher prosecuted under the Espionage Act, which lacks a public interest defence. He faces a combined total sentence of a possible 175 years in prison.

“Everything is gender,” SecDef Austin explained. “Even this table is gender.”

• Pentagon Struggling To Explain All 437 Earth Genders To Aliens (BBee)

Interstellar peace talks broke down Wednesday after Pentagon officials were unable to adequately explain the intricacies of all 437 Earth genders to aliens from outer space. “Okay, for the last time,” said Secretary of Defense Lloyd Austin during the third hour of talks with extraterrestrials. “Demigender are people who identify partially with one gender at the same time as another. This is totally different from Bigender, which is when a person identifies as two genders and can switch between them. Do you understand now?” “This isn’t at all confusing.”

The aliens spoke via telepathy, communicating easily without the hindrance of language barriers, yet were still unable to understand why their human counterparts kept derailing talks about joining an alliance of free planets to argue that sex and gender are two different things — or even that a developmental condition such as autism can be a gender. “Everything is gender,” SecDef Austin explained. “Even this table is gender.” President Biden was present at the meeting but was unable to communicate due to a failure by alien lifeforms to create a telepathic link to his brain. [Is this man even alive?] asked Xylor Sieth IV. [Is corpse a gender?]

“It can be,” SecDef Austin answered. “You’re catching on!” Pentagon spokesperson Jean Tangerine told reporters, “Honestly, this is a big part of why the government has kept alien life a secret for so long. They’re super bigoted and not ready for the public.” At publishing time, Xylor Sieth IV had asked to speak to Tucker Carlson instead.

Goat

https://twitter.com/i/status/1666822364963942402

Gray whale

A gray whale reaches a length of 14.9 meters (49 ft), a weight of up to 41 tonnes (90,000 lb) and lives between 55 and 70 years.

Photographer Mike Nulty captured this hypnotic close-up of the eye of one of them

[source: https://t.co/nQjzByjn3c]pic.twitter.com/eZJKujyns5

— Massimo (@Rainmaker1973) June 8, 2023

The first case of a crocodile who made herself pregnant has been identified in Costa Rica. She produced a foetus 99.9% genetically identical to herself. The phenomenon was observed in birds, fish, other reptiles, but never before in crocodiles

Baby thanks

Baby thanked him for helping. ❤️ pic.twitter.com/B9XSoecjA7

— The Best (@Figensport) June 7, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.