Vasily Polenov Étretat 1874

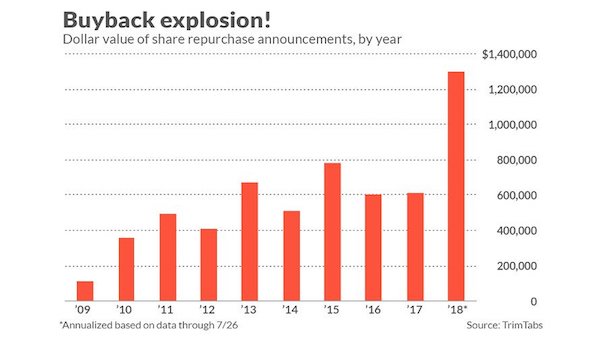

Buybacks prop up ever weaker stocks.

• Stock Market Manias of the Past vs the Echo Bubble (Tenebrarum)

The diverging performance of major US stock market indexes which has been in place since the late January peak in DJIA and SPX has become even more extreme in recent months. In terms of duration and extent it is one of the most pronounced such divergences in history. It also happens to be accompanied by weakening market internals, some of the most extreme sentiment and positioning readings ever seen and an ever more hostile monetary backdrop. The above combination is consistent with a market close to a major peak – although one must always keep in mind that divergences can become even more pronounced – as was for instance demonstrated on occasion of the technology sector blow-off in late 1999 – 2000.

Along similar lines, extremes in valuations can persist for a very long time as well and reach previously unimaginable levels. The Nikkei of the late 1980s is a pertinent example for this. Incidentally, the current stock buyback craze is highly reminiscent of the 1980s Japanese financial engineering method known as keiretsu or zaibatsu, as it invites the very same rationalizations. We recall vividly that it was argued in the 1980s that despite their obscene overvaluation, Japanese stocks could “never decline” because Japanese companies would prop up each other’s stocks. Today we often read or hear that overvalued US stocks cannot possibly decline because companies will keep propping up their own stocks with buybacks.

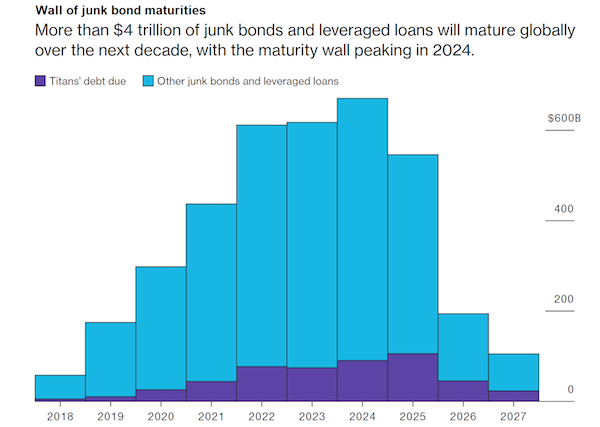

Of course this propping up of stock prices occurs amid a rather concerning deterioration in median corporate balance sheet strength, as corporate debt has exploded into the blue yonder (just as it did in Japan in the late 1980s). The fact that an unprecedented number of companies is a single notch downgrade away from a junk rating should give sleepless nights to fixed income and stock market investors alike – as should the oncoming “wall of maturities”. A giant wall of junk bond maturities is looming in the not to distant future. Unless investors remain in a mood to refinance all comers, this threatens to provide us with a spot of “interesting times”. Something tells us that “QT” could turn into a bit of a party pooper as the “Great Wall” approaches.

It should also be mentioned that past stock market peaks as a rule coincided with record highs in buybacks. This indicates that record highs in buybacks are mainly a contrarian indicator rather than a datum providing comfort at extreme points. Of course, what actually represents an “extreme point” can only ever be known with certainty in hindsight, as extremes tend to shift over time – particularly in a fiat money system in which the supply of money and credit can be expanded willy-nilly. What can be stated with certainty is only whether the markets are entering what we would call dangerous territory.

But the Fed is retreating.

• US Bond Market Takes Looming Treasuries Deluge In Stride (R.)

U.S. government debt supply will likely continue to boom, but bond market investors seem to be taking it in stride. The Treasury Department is having to sell more debt to finance the government’s ballooning deficit, stemming from the massive federal tax overhaul in December and the spending deal passed in February. Still, bond yields have remained in a narrow range, suggesting investors may not be fretting about the swelling debt supply. “There will be no relief from supply especially from bills going into October,” said Tom Simons, money market strategist at Jefferies & Co in New York. Supply is expected to run high at least until the Treasury provides updated forecasts on its borrowing needs, next due in November – and might even accelerate further.

This week, the Treasury will sell $34 billion in three-year notes, with $26 billion in 10-year debt on Wednesday and $18 billion in 30-year bonds on Thursday. It will also auction $51 billion in three-month bills and $45 billion in six-month bills, together with an expected $65 billion in one-month bills. The supply will fall short of a record week of $294 billion set in March but continues a trend higher since February. Analysts, who said the market would have no trouble digesting this week’s offerings, see the government as becoming increasingly dependent on private investors for cash as the Fed further reduces its bond holdings. The goal is to shrink a balance sheet that had grown to more than $4 trillion from three massive rounds of asset purchases to combat the previous recession.

“That loose civic concept known as the American Dream [..] has been shattered.”

• America 10 Years After The Financial Crisis (NYMag)

If you were standing in the smoldering ashes of 9/11 trying to peer into the future, you might have been overjoyed to discover this happy snapshot of 2018: There has been no subsequent major terrorist attack on America from Al Qaeda or its heirs. American troops are not committed en masse to any ground war. American workers are enjoying a blissful 4 percent unemployment rate. The investment class and humble 401(k) holders alike are beneficiaries of a rising GDP and booming stock market that, as measured by the Dow, is up some 250 percent since its September 10, 2001, close. The most admired person in America, according to Gallup, is the nation’s first African-American president, a man no one had heard of and a phenomenon no one could have imagined at the century’s dawn. Comedy, the one art whose currency is laughter, is the culture’s greatest growth industry. What’s not to like?

Plenty, as it turns out. The mood in America is arguably as dark as it has ever been in the modern era. The birthrate is at a record low, and the suicide rate is at a 30-year high; mass shootings and opioid overdoses are ubiquitous. In the aftermath of 9/11, the initial shock and horror soon gave way to a semblance of national unity in support of a president whose electoral legitimacy had been bitterly contested only a year earlier. Today’s America is instead marked by fear and despair more akin to what followed the crash of 1929, when unprecedented millions of Americans lost their jobs and homes after the implosion of businesses ranging in scale from big banks to family farms.

It’s not hard to pinpoint the dawn of this deep gloom: It arrived in September 2008, when the collapse of Lehman Brothers kicked off the Great Recession that proved to be a more lasting existential threat to America than the terrorist attack of seven Septembers earlier. The shadow it would cast is so dark that a decade later, even our current run of ostensible prosperity and peace does not mitigate the one conviction that still unites all Americans: Everything in the country is broken. Not just Washington, which failed to prevent the financial catastrophe and has done little to protect us from the next, but also race relations, health care, education, institutional religion, law enforcement, the physical infrastructure, the news media, the bedrock virtues of civility and community. Nearly everything has turned to crap, it seems, except Peak TV (for those who can afford it).

That loose civic concept known as the American Dream — initially popularized during the Great Depression by the historian James Truslow Adams in his Epic of America — has been shattered. No longer is lip service paid to the credo, however sentimental, that a vast country, for all its racial and sectarian divides, might somewhere in its DNA have a shared core of values that could pull it out of any mess. Dead and buried as well is the companion assumption that over the long term a rising economic tide would lift all Americans in equal measure. When that tide pulled back in 2008 to reveal the ruins underneath, the country got an indelible picture of just how much inequality had been banked by the top one percent over decades, how many false promises to the other 99 percent had been broken, and how many central American institutions, whether governmental, financial, or corporate, had betrayed the trust the public had placed in them. And when we went down, we took much of the West with us. The American Kool-Aid we’d exported since the Marshall Plan, that limitless faith in progress and profits, had been exposed as a cruel illusion.

“If anything, banks today are even more on government support.”

• Nassim Taleb: ‘No One Who Caused The Crisis Paid Any Price’ (ST)

A year or so after the 2008 crisis, Nassim Taleb, a financial trader turned bestselling author, was called to Washington to talk to a commission that was compiling a report on what went wrong. Taleb, after all, had predicted the crisis with eerie prescience in his 2007 book The Black Swan, which talked about the underappreciated “tail risks” faced by the global economy. “They heckled me for about two or three hours on technicalities,” he recalls. “But not a single one of my points was in the report. Bunch of f****** bureaucrats. No wonder people voted for Donald Trump.” Taleb believes we have learnt nothing from the crisis. “Not only did people not get why it happened,” he says, “but the moral hazard in the system actually increased.”

The problem, in Taleb’s view, is what he calls a “Bob Rubin trade”. In the build-up to the crash, Robert Rubin, a former Treasury secretary under Bill Clinton, spent years advising the investment bank Citigroup, eventually becoming its chairman. After the crash happened, he resigned and walked away having made tens of millions. “What’s most depressing is that nobody who was involved in causing the crisis paid any price for it,” Taleb says. “America’s debt is now trillions higher because people transferred risk to the state, owing to mistakes made by individuals.” The crisis highlighted the licence to take risk that banks had, knowing the government would step in if things went wrong.

“People realised that, hey, you can do that with impunity,” Taleb says. “If anything, banks today are even more on government support.” He does identify one bright spot. “Some people have realised there was a problem,” he says. “There is an immense amount of disgruntlement by people who see this point, on the left in Europe and on the right in America. “So you have what is mislabelled ‘populism’ as a first-order reaction, which may be correct or incorrect. But at least some people are starting to see these methods are bullshit.”

Yet another variation of Brexit.

• Fears Of A ‘Car-Crash Brexit’ Make Life Difficult For Mark Carney (G.)

There may be times when Mark Carney regrets extending his stint at the Bank of England by an extra year. Had things gone as originally planned, Carney would have handed over the keys to Threadneedle Street a month ago and someone else would have had the task of steering the economy through what is certain to be a fiendishly tricky period. That would be the case even without Brexit. The UK economy has recovered more slowly and more unevenly than Carney envisaged when he took over at the Bank from Mervyn King in 2013. It was only last week that the Bank’s monetary policy committee felt confident enough to raise interest rates above the 0.5% emergency level that they reached in March 2009.

But Brexit is taking up half the governor’s time and it is clear that he is starting to get concerned. Certainly, his remarks when questioned on the BBC Today programme on Friday were blunt. With just eight months to go before Britain leaves the European Union, the risk of a no-deal Brexit is “uncomfortably high”. There was a time when such plain speaking from the governor of the Bank of England would have raised a few eyebrows in Downing Street. Not now. The line since the cabinet signed up to Theresa May’s soft Brexit plan is that the government has made all the concessions it can, and that means unless Brussels gives something in return there is a danger of chaos next March.

So the prime minister would not have been troubled when Carney said that a no-deal Brexit would be “highly undesirable” and something all parties should seek to avoid, because that’s the official Whitehall line. There will be no complaints if the governor continues to stress the importance of London as a source of low-cost capital for European governments and companies.

Britain reveals what it really is.

• Rich, Reckless Brexit Zealots Are Fighting A New Class War (G.)

We now know it beyond doubt: however we leave the European Union, the result is likely to be damage that Britain is in no position to absorb. Job losses are certain. A stack of Brexit impact reports from local authorities obtained last week by Sky News identified a catalogue of dire consequences, from farms in Shetland that could be plunged into impossible losses, through social care services in East Sussex already being hit by labour shortages, to the M26 being turned into a giant lorry park. With his characteristic emollience, the trade secretary, Liam Fox, says a no-deal Brexit is now more likely than a negotiated deal; Jeremy Hunt reckons we could fall off the came cliff-edge “by accident”, and reports about stockpiled food and medicines attest to the awfulness of any such prospect.

March 2019, then, could well mark a watershed point in a drawn-out disaster. But so, in a different way, could somehow nullifying the result of the referendum and staying put. It would be comforting to think that what George Orwell called “the gentleness of the English civilisation” would mean that an overturning of 2016’s outcome would be grudgingly swallowed by the vast majority of leave voters, but I would not be so sure. Ukip is back in the polls, and has newly strengthened links to the far right. A couple of weeks ago, I was in Boston in Lincolnshire, the town whose 75.6% vote for Brexit made it the most leave-supporting place in the UK. Many of the people I spoke to were already convinced that Brexit was doomed, and full of talk of betrayal.

Some of what I heard was undeniably ugly, though much of it was based on an undeniable set of facts. People were asked to make a decision, and they did. The referendum was the one meaningful political event in millions of voters’ lifetimes, and we were all assured that its result would be respected. Whatever the noise about a second referendum, this is the fundamental reason why the likelihood of Brexit interrupted remains dim.

Our best friends.

• Saudi Expels Canadian Envoy, Recalls Its Own Over ‘Interference’ (AFP)

Saudi Arabia said Monday it was expelling the Canadian ambassador and had recalled its envoy while freezing all new trade, in protest at Ottawa’s vigorous calls for the release of jailed activists. The kingdom gave the Canadian ambassador 24 hours to leave the country, in an abrupt rupture of relations over what it slammed as “interference” in its internal affairs. The move, which underscores a newly aggressive foreign policy led by Crown Prince Mohammed bin Salman, comes after Canada demanded the immediate release of human rights campaigners swept up in a new crackdown. “The Canadian position is an overt and blatant interference in the internal affairs of the kingdom of Saudi Arabia,” the Saudi foreign ministry tweeted.

“The kingdom announces that it is recalling its ambassador to Canada for consultation. We consider the Canadian ambassador to the kingdom persona non grata and order him to leave within the next 24 hours.” The ministry also announced “the freezing of all new trade and investment transactions with Canada while retaining its right to take further action”. Canada last week said it was “gravely concerned” over a new wave of arrests of women and human rights campaigners in the kingdom, including award-winning gender rights activist Samar Badawi. Samar was arrested along with fellow campaigner Nassima al-Sadah last week, the latest victims of what Human Rights Watch called an “unprecedented government crackdown on the women’s rights movement”.

“street fighter-style deceitful drama of extortion and intimidation”.

• Chinese State Media Slams Trump For ‘Extortion’ In Trade Dispute (R.)

Chinese state media on Monday lashed out at U.S. President Donald Trump’s trade policies in an unusually personal attack, even as they sought to reassure investors about the health of China’s economy as growth concerns roiled its financial markets. China’s strictly controlled news outlets have frequently rebuked the United States and the Trump administration as the trade conflict has escalated, but they have largely refrained from specifically targeting Trump.

The latest criticism from the overseas edition of the ruling Communist Party’s People’s Daily newspaper singled out Trump, saying he was starring in his own “street fighter-style deceitful drama of extortion and intimidation”. Trump’s desire for others to play along with his drama is “wishful thinking”, a commentary on the paper’s front page said, arguing that the United States had escalated trade friction with China and turned international trade into a “zero-sum game”. “Governing a country is not like doing business,” the paper said, adding that Trump’s actions imperiled the national credibility of the United States.

So buy them new ones. But seriously, can anyone explain how Wells Fargo is still in business?

• Wells Fargo Blames Computer Glitch For Customers Losing Homes (Hill)

Wells Fargo is blaming a computer glitch for more than 400 customers losing their homes between 2010 and 2015. The bank revealed in regulatory filings last week that the technological error resulted in 625 customers being denied loan modifications, and about 400 costumers having their houses foreclosed on, CNN Money reported on Friday. The filing says the bank has set aside $8 million to compensate the affected customers, it added. Wells Fargo apologized for the error and said in a statement that it is “providing remediation” to customers whose mortgages were affected, according to CNN.

The Treasury Department set up a program in 2009 to help Americans struggling to pay their mortgages, offering them the opportunity to apply for loan modifications, the network noted, adding that the computer error rejected applications from 625 Wells Fargo customers. A bank spokesperson told CNN that there is “not a clear, direct cause and effect relationship” between the error and foreclosures, but said some customers who were denied loan modifications lost their homes. Multiple government agencies are also probing Wells Fargo for its financing of low-income housing developments, Reuters reported. The embattled bank last week agreed to pay more than $2 billion to settle allegations related to offering subprime mortgages in the years before the 2008 financial crisis.

Russia hysteria all over.

• Russian Gas Is A Problem For Germany (R.)

For decades, the Friendship pipeline has delivered oil from Russia to Europe, heating German homes even in the darkest days of the Cold War. But a new pipeline that will carry gas direct from Russia under the Baltic Sea to Germany is doing rather less for friendship, driving a wedge between Germany and its allies and giving Chancellor Angela Merkel a headache. For U.S. President Donald Trump, Nord Stream 2 is a “horrific” pipeline that will increase Germany’s dependence on Russian energy. Ukraine, fighting Russian-backed separatists, fears the new pipeline will allow Moscow to cut it out of the lucrative and strategically crucial gas transit business.

It comes at an awkward time for Merkel. With the fraying of the transatlantic alliance and an assertive Russia and China, she has acknowledged that Germany must take more of a political leadership role in Europe. “The global order is under pressure,” Merkel said last month. “That’s a challenge for us … Germany’s responsibility is growing; Germany has more work to do.” In April she accepted for the first time that there were “political considerations” to Nord Stream 2, a project she had until then described as a commercial venture. Most European countries want Germany to do more to project European influence and protect eastern neighbors that are nervous of Russian encroachment.

But letting Russia sell gas to Germany while avoiding Ukraine does the opposite, depriving Kiev of transit revenues and making it, Poland and the Baltic states more vulnerable to cuts in gas supplies. “The price would be an even greater loss of trust from the Baltics, Poland and Ukraine,” said Roderich Kiesewetter, a Merkel ally on the parliamentary foreign affairs committee. “We Germans always say that holding the West together is our ‘center of gravity’, but the Russian approach has succeeded in dragging Germany, at least in terms of energy policy, out of this western solidarity.”