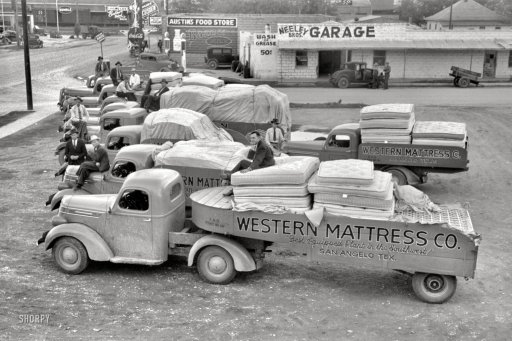

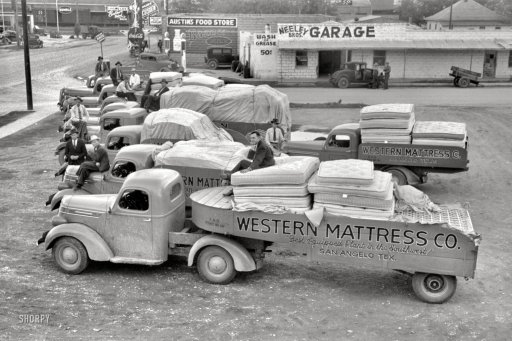

John Vachon Trucks loaded with mattresses at San Angelo, Texas Nov 1939

Ambroses say the darndest things. This Ambrose looks through rosy glasses. Probably drinks from them too. “..both countries have come to the realisation that it is possible to decarbonise without hurting economic growth..” Oh, for Christ sake.

• COP-21 Climate Deal In Paris Spells End Of The Fossil Era (AEP)

A far-reaching deal on climate change in Paris over coming days promises to unleash a $30 trillion blitz of investment on new technology and renewable energy by 2040, creating vast riches for those in the vanguard and potentially lifting the global economy out of its slow-growth trap. Economists at Barclays estimate that greenhouse gas pledges made by the US, the EU, China, India, and others for the COP-21 climate summit amount to an epic change in the allocation of capital and resources, with financial winners and losers to match. They said the fossil fuel industry of coal, gas, andoil could forfeit $34 trillion in revenues over the next quarter century – a quarter of their income – if the Paris accord is followed by a series of tougher reviews every five years to force down the trajectory of CO2 emissions, as proposed by the United Nations and French officials hosting the talks.

By then crude consumption would fall to 72m barrels a day – half OPEC projections – and demand would be in precipitous decline. Most fossil companies would face run-off unless they could reinvent themselves as 21st Century post-carbon leaders, as Shell, Total, and Statoil are already doing. The agreed UN goal is to cap the rise in global temperatures to 2 degrees centigrade above pre-industrial levels by 2100, deemed the safe limit if we are to pass on a world that is more or less recognisable. Climate negotiators say there will have to be drastic “decarbonisation” to bring this in sight, with negative net emissions by 2070 or soon after. This means that CO2 will have to be plucked from the air and buried, or absorbed by reforestation.

Such a scenario would imply the near extinction of the coal industry unless there is a big push for carbon capture and storage. It also implies a near total switch to electric cars, rendering the internal combustion engine obsolete. The Bank of England and the G20’s Financial Stability Board aim to bring about a “soft landing” that protects investors and gives the fossil industry time to adapt by forcing it to confront the issue head on. Barclays said ,$21.5 trillion of investment in energy efficiency will be needed by 2040 under the current pledges, which cover 155 countries and 94pc of the global economy. It expects a further $8.5 trillion of spending on solar, wind, hydro, energy storage, and nuclear power. Those best-placed to profit in Europe are: Denmark’s wind group Vestas; Schneider and ABB for motors and transmission; Legrand for low voltage equipment; Alstom and Siemens for rail efficiency; Philips, and Osram for LEDs and lighting.

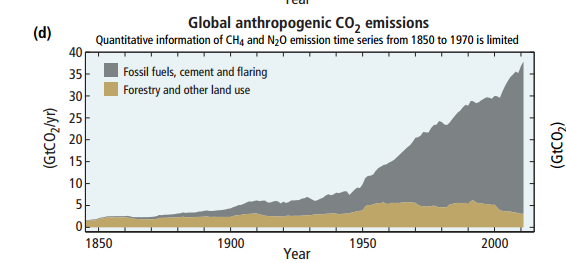

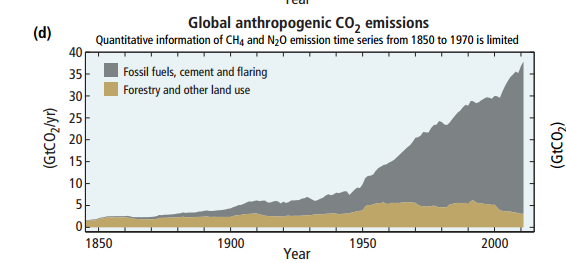

But this is a minimalist scenario. While the Paris commitments suggest a watershed moment, they do not go far enough to meet the targets set by the Intergovernmental Panel on Climate Change (IPPC). The planet has already used up two-thirds of the allowable “carbon budget” of 2,900 gigatonnes (GT), and will have used up three quarters of the remaining 1,000 GT by 2030. Barclays advised clients to prepare for a more radical outcome, entailing almost $45 trillion of spending on different forms of decarbonisation. “The fact that COP-21 in itself is clearly not going to put the world on a 2 degree track does not mean that fossil-fuel companies can simply carry on with business-as-usual. We think they should be stress-testing their business models against a significant tightening of global climate policy over the next two decades,” it said.

[..] Mr Jacobs said a deal in Paris is highly likely. “You can never rule out a break-down. These meetings always go to the wire. But we have gone past the turning point in the US and China, and both countries have come to the realisation that it is possible to decarbonise without hurting economic growth,” he said. It will not be a legally-binding treaty, but it is expected to have the same effect as each country transposes the targets into its own law. In the US it will be enforced through the legal mechanism of the Clean Air Act, anchored on earlier accords, without need for Senate ratification. The sums of money are colossal. Macro-economists say this is just what is needed to soak up the global savings glut and rescue the world from its 1930s liquidity trap. There might even be a boom.

Read more …

End of the fossil era, Ambrose? Not everyone agrees.

• Oil’s Big Players Line Up for $30 Billion of Projects in Iran (Bloomberg)

Total, Royal Dutch Shell and Lukoil are among international companies that have selected oil and natural gas deposits to develop in Iran as the holder of the world’s fourth-largest crude reserves presents $30 billion worth of projects to investors. Total is one of the companies that have been in the forefront of discussions and Eni is also looking to invest, Oil Minister Bijan Namdar Zanganeh said. Shell, Total and Lukoil all specified fields they would be interested in developing in Iran, Ali Kardor, deputy director of investment and financing at National Iranian Oil Co. said in an interview in Tehran. “Many companies are interested. Europeans are interested, Asian companies are interested,” Zanganeh told reporters at a conference in Tehran on Saturday. “Total is interested, Eni is interested.”

Iran is pitching 70 oil and natural gas projects valued at $30 billion to foreign investors at a two-day conference in Tehran as the Persian Gulf country prepares for the end of sanctions that have stifled its energy production. All banking and economic sanctions will be lifted by the first week of January,” Amir Hossein Zamaninia, deputy oil minister for international and commerce affairs, said at the event. “We are interested to come back to Iran when the sanctions are lifted and if the contracts are interesting,” Stephane Michel, Total’s head of exploration and production in the Middle East said at the conference. “We have worked in this country for a long time, so we know specific fields on which we’ve worked.”

Read more …

Eh, Ambrose? “The entire prosperity of the world has been built on cheap energy. And suddenly we are being forced into higher cost energy. That’s grossly unfair..”

• India Opposes Deal To Phase Out Fossil Fuels By 2100 (Reuters)

India would reject a deal to combat climate change that includes a pledge for the world to wean itself off fossil fuels this century, a senior official said, underlying the difficulties countries face in agreeing how to slow global warming. Almost 200 nations will meet in the French capital on Nov. 30 to try and seal a deal to prevent the planet from warming more than the 2 degrees Celsius that scientists say is vital if the world is to avoid the most devastating effects of climate change. To keep warming in check, some countries want the Paris agreement to include a commitment to decarbonize – to reduce and ultimately phase out the burning of fossil fuels like coal, oil and gas that is blamed for climate change – this century.

India, the world’s third largest carbon emitter, is dependent on coal for most of its energy needs, and despite a pledge to expand solar and wind power has said its economy is too small and its people too poor to end use of the fossil fuel anytime soon. “It’s problematic for us to make that commitment at this point in time. It’s certainly a stumbling block (to a deal),” Ajay Mathur, a senior member of India’s negotiating team for Paris, told Reuters in an interview this week. “The entire prosperity of the world has been built on cheap energy. And suddenly we are being forced into higher cost energy. That’s grossly unfair,” he said. Mathur said India, whose position at climate talks is seen by some in the West as intransigent, was committed to the 2 degrees ceiling as a long-term goal and was confident a deal would be reached.

Read more …

If PM2.5 is the threat, what good is staying indoors? You’d have to live in a bunker.

• Beijing Smog Levels So High They Move ‘Beyond Index’ (Bloomberg)

Smog levels spiked in Beijing on Monday, highlighting the environmental challenges facing China as President Xi Jinping arrives in Paris for global climate talks. The concentration of PM2.5, fine particulates that pose the greatest risk to human health, went “beyond index” in the afternoon, according to a U.S. Embassy monitor. The PM2.5 level was 678 micrograms per cubic meter near Tiananmen Square, the Beijing government said. The World Health Organization recommends average 24-hour exposure to PMI of 25 or below. Public outrage over air pollution has been a catalyst for China’s transformation into a driving force for a breakthrough deal in Paris. Leaders including U.S. President Barack Obama and Chinese President Xi Jinping are scheduled to being discussions in the French capital Monday.

Beijing on Sunday raised its air pollution alert to orange, the second-highest level in its four-tier system, for the first time in 13 months. The heavy pollution in Beijing won’t clear up until Dec. 2, according to the environment bureau. The city will ask some factories to suspend or limit production and construction sites to stop transporting materials and waste while the orange alert is active, it said. Under the orange alert, people are advised to cut down on outdoor activity, while the elderly and people with heart and lung ailments should stay inside. Severe pollution was also reported in at least 17 other cities around Beijing, Tianjin, Hebei and Shandong, according to the Ministry of Environmental Protection. Shanghai’s air was also heavily polluted, the second worst level on a six-grade scale, with the PM2.5 reading at 170.4 micrograms per cubic meter as of 12 p.m..

Read more …

I warned this would happen the moment Abe pushed pension funds to prop up stock markets: they lose big. Japanese who read this will save even more, further crippling Abenomics.

• World’s Biggest Pension Fund Loses $64 Billion Amid Equity Rout (Bloomberg)

The world’s biggest pension fund posted its worst quarterly loss since at least 2008 after a global stock rout in August and September wiped $64 billion off the Japanese asset manager’s investments. The 135.1 trillion yen ($1.1 trillion) Government Pension Investment Fund lost 5.6% last quarter as the value of its holdings declined by 7.9 trillion yen, according to documents released Monday in Tokyo. That’s the biggest percentage drop in comparable data starting from April 2008. The fund lost 8 trillion yen on its domestic and foreign equities and 241 billion yen on overseas debt, while Japanese bonds handed GPIF a 302 billion yen gain.

The loss was GPIF’s first since doubling its allocation to stocks and reducing debt last October, and highlights the risk of sharp short-term losses that come with the fund’s more aggressive investment style. Fund executives have argued that holding more shares and foreign assets is a better approach as Prime Minister Shinzo Abe seeks to spur inflation that would erode the purchasing power of bonds. [..] GPIF had 39% of its assets in Japanese debt at Sept. 30, and 21% in the nation’s equities, according to the statement. That compares with 38% and 23% three months earlier, respectively. The fund had 22% of its investments in foreign stocks at the end of September, and 14% in overseas bonds.

Read more …

Overleveraged overcapacity will disappear no matter how powerful the interests.

• Iron Ore Falls Below $40 A Metric Ton For The First Time (Bloomberg)

Most-active iron ore futures in Singapore sank below $40 a metric ton for the first time on concern that the economic slowdown in China will cut demand as supplies from the largest miners climb. [..] The raw material has been pummeled since the start of 2014 as surging supplies from low-cost producers including BHP Billiton Ltd. and Rio Tinto in Australia and Brazil’s Vale combine with faltering demand in China to spur a glut. Losses in Singapore and Dalian could presage a drop in the benchmark price for spot ore in Qingdao, which will be updated later in the day. The latest sign of new supply came from Australia, with a vessel waiting offshore on Monday to load the first cargo from Gina Rinehart’s Roy Hill mine.

“Supply continues to rise while port inventories are starting to climb, weighing on iron ore prices,” analysts at Maike Futures Co. said in a note on Monday. “The overseas producers are still profitable and are greatly reducing costs.” The top miners are betting that higher output will enable them to cut unit costs and defend market share while smaller rivals shut. Mills in China, contending with overcapacity and depressed margins, will cut steel production by almost 3% next year, according to the China Iron & Steel Association.

Read more …

The Fed can elect to ignore the law, and Congress?

• Fed To Take Up ‘Too Big To Fail’ Emergency Lending Curb (Reuters)

The Federal Reserve Board will consider on Monday a proposal to curb its emergency lending powers, a change demanded by Congress after the central bank’s controversial decision to aid AIG, Citigroup and others in 2008. A proposed rule, to be considered by the Fed’s Washington-based board in an open meeting, would require that any future emergency lending be only “broad-based” to address larger financial market problems, and not tailored to specific firms. The 2010 Dodd-Frank financial reform law instructed the Fed to curtail emergency loans to individual banks and prohibited it from lending to companies considered insolvent.

While some at the Fed worry the new rules will hamper the central bank’s response in future crises, some politicians have said the proposed regulations are too imprecise, for example in defining insolvency, to prevent the types of deals done in 2008. As the financial crisis intensified in 2008, the Fed invoked its little-used emergency lending power to stave off the failure of AIG and Bear Stearns, and help other “too big to fail” companies including Citigroup and Bank of America. The Fed also enacted a series of more general emergency programs, in all providing $710 billion in loans and guarantees. Those programs were separate from the much larger Fed asset and bond purchases known as quantitative easing.

The loans have been repaid and the guarantees ended, ultimately earning the Fed a net profit of $30 billion, according to a September Congressional Research Service review. However the effort was criticized as overreach, arguably important in limiting the crisis but also not clearly in line with the intended use of the Fed’s emergency authority. The Fed routinely lends money to banks on a short-term basis to smooth the operations of the financial system. That is part of why it exists. But since the 1930s it has had the power to lend more broadly in a crisis.

Read more …

Can’t see Lagarde crushing the expectations she herself built up. Unless there’s a dirty game going on behind the curtain.

• Did the Yuan Really Pass the IMF Currency Test? You’ll Know Soon (Bloomberg)

IMF Managing Director Christine Lagarde and some two dozen officials on the fund’s executive board will gather Monday at headquarters in Washington for one of the most-anticipated decisions outside of actually approving loans for nations in crisis. The question inside the 12th-floor, oval boardroom: whether to grant China’s yuan status as a reserve currency by adding it to the fund’s Special Drawing Rights basket. The SDR, created in 1969, gives IMF member countries who hold it the right to obtain any of the currencies in the basket – currently the dollar, euro, yen and pound – to meet balance-of-payments needs. While there’s little suspense in the main thrust of the expected approval – Lagarde already announced that fund staff had recommended the yuan be included and that she supported the finding – the IMF is likely to give more details on how it arrived at the decision.

The IMF’s highest decision-making body is its board of governors, a group of mostly finance ministers and central bankers from its 188 member countries. The board of governors has delegated most of its powers to the executive board, made up of 24 executive directors who represent the membership. The meeting Monday has been classified as “restricted,” meaning no support staff will be allowed to attend. The executive board, which meets more than 200 times a year, usually makes decisions based on consensus, rather than formal votes. Mark Sobel, the U.S. executive director who answers to the Obama administration, wields the most power, with a 17% voting stake. Together, the Group of Seven countries control 43% of the vote, making them a formidable bloc. China, which holds a 3.8% voting share, is represented by former People’s Bank of China official Jin Zhongxia.

Read more …

Beijing’s hands will be tied.

• IMF Move Would Pressure China on Management of Yuan (WSJ)

The IMF is on the verge of labeling China’s yuan a reserve currency. Now Chinese officials will have to prove they can treat it like one. The IMF on Monday is widely expected to say that next year, it will add the yuan to the elite basket of currencies that comprise its lending reserves, a status enjoyed only by the U.S. dollar, the euro, the British pound and the Japanese yen. The inclusion would represent recognition that the yuan’s status is rising along with China’s place in global finance. Now comes the hard part. The inclusion puts new pressure on Beijing to change everything from how it manages the yuan, also known as renminbi, to how it communicates with investors and the world. China’s pledges to loosen its tight grip on the currency’s value and open its financial system will come under new scrutiny.

“We will have to build up confidence in renminbi assets from investors both at home and abroad and at the same time, prevent the financial risks associated with a more global currency,” said Sheng Songcheng, head of the survey and statistics department at the People’s Bank of China, the country’s central bank. “That calls for carrying out various financial reforms in a coordinated way.” Inclusion would also put pressure on the central bank to offer the same degree of clarity and transparency that the U.S. Federal Reserve, the European Central Bank and other vital institutions strive for. That could be difficult: In the past six months alone, the PBOC shocked markets with a surprise currency devaluation, stood mostly silent during a Chinese stock-market rout and confused investors by issuing a new proclamation that turned out to be months old.

Read more …

Is the SDR Xi’s Trojan Horse?

• IMF’s Yuan Inclusion Signals Less Risk Taking In China (Reuters)

When the IMF agrees on Monday to add the Chinese yuan to its reserves basket in the biggest shake-up in more than three decades, the IMF can afford itself a congratulatory nod. By acknowledging the yuan as a major global currency alongside the dollar, euro, yen, and pound, as is widely expected, IMF members will endorse the efforts of China’s economic reformers and by doing so hope that will spur fresh change in China. But Chinese policy insiders and international policymakers say reforms may not continue at the breakneck pace of recent months. In addition, Chinese sources suggest adding the yuan to the IMF basket leaves economic conservatives better positioned to resist further significant reform in a reminder of the period following China’s entry to the World Trade Organization (WTO).

A slowing in the pace has implications for those who bet that making the yuan a global reserve currency will give it a boost. The yuan has fallen almost 3% against the dollar this year, on course for its biggest annual fall since its landmark 2005 revaluation. The IMF decision will remove a key incentive – bolstering national pride – that reformers used to push otherwise reluctant conservatives to support reforms. More importantly, however, are worries in Beijing that the rickety economy can’t handle more aggressive reform that allows a freer flow of currency across China’s borders. Beijing is already rapidly losing a taste for more experimentation with capital flows, say the sources – economists involved in policy discussions who declined to be identified because of the sensitivity of the subject.

After the stock market buckled more than 40% in the summer – which many blamed on nefarious foreign capital – regulators have made it harder for money to leave China to counter yuan selling pressure and have intervened heavily in onshore and offshore currency markets. Not just conservatives, but more liberal economists are calling for a pause. “Our ability to control financial risk has yet to be improved,” said a senior economist at the China Centre for International Economic Exchanges (CCIEE), an influential Beijing think-tank. “Any rush to open up the capital account completely could be unfavorable for controlling financial risks … we will definitely be very cautious.”

Read more …

Which is why former CEO Winterkorn left in a hurry as soon as the scandal first broke.

• VW Top Execs Knew Fuel Usage In Some Cars Was Too High A Year Ago (Reuters)

Volkswagen’s top executives knew a year ago that some of the company’s cars were markedly less fuel efficient than had been officially stated, Sunday paper Bild am Sonntag reported, without specifying its sources. VW in early November revealed that it had understated the level of carbon dioxide emissions and fuel usage in around 800,000 cars sold mainly in Europe. The scandal, which will likely cost VW billions, initially centered on software on up to 11 million diesel vehicles worldwide that VW admitted was designed to artificially suppress nitrogen oxide emissions in a test setting. The Bild am Sonntag report contradicts VW’s assertion, however, that it only uncovered the false CO2 emissions labeling as part of efforts to clear up the diesel emissions scandal, which became public in September.

Months after becoming aware of excessive fuel consumption, former Chief Executive Martin Winterkorn decided this spring to pull one model off the market where the discrepancy was particularly pronounced, the Polo TDI BlueMotion, the paper cited sources close to Winterkorn as saying. The paper did not separately cite its sources for saying that top executives knew about the fuel usage problem a year ago, however. VW at the time cited low sales figures as the reason for the withdrawal. The paper said that VW did not inform Polo TDI BlueMotion owners of the high fuel consumption, which was 18% above the nameplate value.

Read more …

Goldman, BlackRock, they are the de facto executive rulers of the world. And it makes them filthy rich.

• BlackRock Spreads its Tentacles in Brussels (Don Quijones)

Much like Goldman Sachs, Blackrock is spreading tentacles across Europe at a startling rate. In a sign of its growing influence, the firm met EU officials to discuss financial market matters more times than any other company in the seven months to July, Financial Times reported this week. During that period the firm met Jonathan Hill, European Commissioner for financial services (and former City of London lobbyist), and his team five times — one more time than HSBC and two more times than Deutsche Bank. In fact, the only institutions that met the Commissioner as many times were London Stock Exchange Group, the British Bankers’ Association and Insurance Europe.

BlackRock’s lobbying efforts have worried some investors amidst concerns that the fund house, which offers traditional active mutual funds, passive funds and alternative products such as hedge funds, could have too much influence on European policy. By pure happenstance, the growth in BlackRock’s influence coincided with a 10-fold increase in the company’s self-reported lobbying spending in Brussels: in 2012 the firm spent €150,000; by 2014 that number had catapulted to €1.5m. That kind of money gets you a heck of a lot of access and influence in Brussels, the world’s second most important lobbying hub, especially when you’re already the world’s biggest asset manager.

According to EU Integrity Watch, BlackRock held meetings with Brussels officials over issues as far-reaching as the regulatory agenda in financial services by the EU and the US – a vital issue given the looming TTIP and TiSA trade treaties – capital markets union, Mr. Hill’s plan to boost business funding and investment financing, and money market funds. BlackRock’s most audacious coup to date took place in August, 2014, when the ECB announced its decision to hire BlackRock Solutions to provide advice on the design and implementation of the central bank’s upcoming purchase of asset-backed securities. In other words, just before the ECB embarked on one of the biggest QE programs in world history, it sought the advice of the world’s largest asset manager – i.e. the company most invested in the assets it intended to buy.

To ensure that there were/are no conflicts of interest, BlackRock’s contract stipulates that there must be an effective separation between the project team working for the ECB and its staff involved in any other ABS-related activities, which, as you can imagine, is an immense relief. So too is the fact that “all external audits related to the management of conflicts of interest would be made available to the ECB,” an institution famed worldwide for its blinding institutional transparency and accountability. To put all lingering fears to bed, a spokesperson for BlackRock told FT, “BlackRock advocates for public policies that we believe are in our investors’ long-term best interests.”

Read more …

Juicy story. Let’s do a movie.

• The Silk Road Affair: Power, Pop and a Bunch of Billionaires (Bloomberg)

Even in post-Soviet Uzbekistan, an ancient crossroads where torture and bribery allegations are endemic, Gulnara Karimova, the president’s Harvard-educated daughter, stood out for her ruthlessness. As the U.S. embassy noted in a secret dispatch from 2005 that was later published by Wikileaks, Karimova was viewed by most Uzbeks “as a greedy, power-hungry individual who uses her father to crush business people or anyone else who stands in her way.” These days the 43-year-old former globetrotting socialite who once publicly praised God for “my face” is confined to her homeland along the legendary Silk Road, watched over by the security services of her aging father, Islam Karimov, who has ruled for a quarter century.

Even in isolation, though, Googoosha, as she’s called herself in music videos, remains in the eye of a storm, the protagonist in a multibillion-dollar tale of alleged greed and graft unfolding across three continents. This story stretches back more than a decade, from the fringes of the czarist empire to the tidy streets of Oslo, via Gibraltar, Geneva and beyond. It touches companies owned by six of Europe’s richest men – five Russians and a native Norwegian – and thrusts the staid Scandinavian business world into a strange new light. It also offers a glimpse into a mercurial U.S. ally, a nation of 30 million that is ranked among the most repressive and corrupt in the world by Freedom House and Transparency International, even while providing occasional logistical support for American troops in neighboring Afghanistan.

[..] In Switzerland, where Karimova once lived in a Geneva mansion, prosecutors have widened their own probe into suspected money-laundering and fraud offenses related to her role in awarding telecommunications contracts in Uzbekistan. In August, they said they’d confiscated more than 800 million Swiss francs ($781 million) of assets linked to her, without elaborating, bringing the total amount seized to about $1.1 billion. Add the $900 million VimpelCom has set aside for potential liabilities and the amount tied up in the investigations is pushing $2 billion. And that’s not even counting the impact on the market values of VimpelCom, MTS and TeliaSonera or the future costs of litigation. VimpelCom’s market value has plunged 59% to $6.3 billion since March 12, 2014, when it disclosed the U.S. and Dutch probes…

Read more …

Good overview. No charges have ever been filed. No prosecutor wants to interview Assange.

• The Strange Case Of Julian Assange (Crikey)

Julian Assange faces very serious allegations, politicians like to say. That was the description from UK Prime Minister David Cameron’s office three years ago, defending the UK s determination to extradite him to Sweden. And that was the description early this year from then-UK deputy PM Nick Clegg, too – he should go to Sweden to face very serious allegations and charges of rape, said Clegg, not long before leading his party to annihilation in this year’s general election. Clegg, of course, was peddling the oft-repeated lie that there are charges against Assange. But for very serious allegations -sexual molestation, unlawful coercion, sexual assault- the UK and Swedish governments have displayed zero interest in investigating them. In fact, the history of the case against Assange is a history of increasingly bizarre efforts by authorities to avoid questioning him.

When Swedish prosecutors first examined complaints about Assange by two women in 2010, the Chief Prosecutor of Stockholm dismissed all but one of the allegations, including the accusation of sexual assault, saying there is no suspicion of any crime whatsoever. After speaking to prosecutors, Assange remained in Sweden for another week to be interviewed about the one remaining allegation (of molestation). However, after an appeal by former Swedish politician Claes Borgstrom, another prosecutor, Marianne Ny, reopened the whole case. Assange remained in Sweden and offered to be interviewed again, but, in the first of what would turn out to be a long litany of excuses, was told Ny was ill and unable to speak to him. Ny’s office then told Assange’s lawyer he was free to leave Sweden, but once Assange did so, an arrest warrant was issued for him.

Assange then offered to return to Sweden to speak to Ny and gave her a full week of dates in which he would do so. These were all rejected. This was all despite Swedish police having access to the texts of one of the alleged victims of Assange saying she did not want to put any charges on JA but that the police were keen on getting a grip on him , that she was shocked when he was arrested given she only wanted him to take an STD test, and that it was the police who made up the charges . Ny’s unwillingnness to interview Assange would become the pattern for the next five years: Assange repeatedly offered to speak to Swedish authorities by phone, by videolink, or in person at the Australian embassy. The Swedes refused all opportunities to do so and demanded Assange return to Sweden, issuing a European arrest warrant for him.

Eventually the EAW would be upheld by British courts under UK laws, which since then have been amended. Under current British law, a similar case to Assange’s would now be successfully appealed and the EAW rejected. Once he had sought refuge in the Ecaudorean embassy in 2012, Assange continued to offer Swedish authorities the opportunity to speak with him, and they continued to reject them. But while they regularly rejected Assange s offer to be interviewed, other suspects were treated very differently: during the last five years, the Swedes have on 44 occasions asked to travel to the UK to interview, or asked British police to interview, other people in Britain in relation to allegations including violent crime, fraud and even murder. Assange, however, couldn’t be treated the same way – he had to go to Sweden.

Read more …

Nice company to keep: “Saudi Arabia, Iran, China, the United States, and Iraq are the top five countries with the most executions.”

• Saudi Arabia’s 2015 Beheadings The Most In 20 Years (Al Jazeera)

Saudi Arabia has executed at least 151 people so far this year – the most put to death in a single year since 1995. The stark rise in the number of executions has seen, on average, one person killed every two days, according to the human rights group, Amnesty International. “The Saudi Arabian authorities appear intent on continuing a bloody execution spree,” Amnesty’s report released on Monday said, quoting James Lynch, deputy director at the Middle East and North Africa programme. It is the most people put to death in the kingdom in one year since 1995, when 192 executions were reportedly carried out. Most recent years have had between 79 and 90 people killed by beheadings annually for crimes including “nonlethal offences, such as drug-related ones,” according to the London-based rights group.

The large number of executions shed further light on what Amnesty referred to as unfair judicial proceedings, with a disproportionate imposition of capital punishment on foreign nationals. “Of the 63 people executed this year for drug-related charges, the vast majority, 45 people, were foreign nationals,” the report said. Khalid al-Dakhil, a Saudi political commentator based in Riyadh, challenged “the integrity” of Amnesty’s report, saying it failed to mention Iran’s execution record. “Iran executes far more people a year than Saudi Arabia, but it does not get the negative publicity Saudi Arabia has. This is something that must be addressed,” Dakhil told Al Jazeera. Saudi Arabia, Iran, China, the United States, and Iraq are the top five countries with the most executions. In total, 71 people executed so far in 2015 have been foreigners. The majority were migrant workers from poorer countries who are often sentenced to die without any knowledge of the court’s proceedings because they don’t speak Arabic and do not receive translations.

Read more …

These people are busy creating absolute mayhem in Europe.

• EU Split Over Refugee Deal As Germany Leads Breakaway Coalition (Guardian)

Months of European efforts to come up with common policies on mass immigration unravelled when Germany led a “coalition of the willing” of nine EU countries taking in most refugees from the Middle East, splitting the EU on the issues of mandatory refugee-sharing and funding. An unprecedented full EU summit with Turkey agreed a fragile pact aimed at stemming the flow of migrants to Europe via Turkey. But the German chancellor, Angela Merkel, frustrated by the resistance in Europe to her policies, also convened a separate mini-summit with seven other leaders on Sunday to push a fast-track deal with the Turks and to press ahead with a new policy of taking in and sharing hundreds of thousands of refugees a year directly from Turkey.

The surprise mini-summit suggested that Merkel has given up trying to persuade her opponents, mostly in eastern Europe, to join a mandatory refugee-sharing scheme across the EU, although she is also expected to use the pro-quotas coalition to pressure the naysayers into joining later. Merkel’s ally on the new policy, Jean-Claude Juncker, president of the European commission, said of the mini-summit: “This is a meeting of those states which are prepared to take in large numbers of refugees from Turkey legally.” But the frictions triggered by the split were instantly apparent. Donald Tusk, the president of the European council who chaired the full summit with Turkey, contradicted the mainly west European emphasis on seeing Ankara as the best hope of slowing the mass migration to Europe.

“Let us not be naïve. Turkey is not the only key to solving the migration crisis. The most important one is our responsibility and duty to protect our external borders. We cannot outsource this obligation to any third country. I will repeat this again: without control on our external borders, Schengen will become history.” He was referring to the 26-country free-travel zone in Europe, which is also in danger of unravelling under the strains of the migratory pressures and jihadi terrorism. Merkel’s mini-summit brought together the leaders of Germany, Austria and Sweden – the countries taking the most refugees – Finland, Belgium, Luxembourg, the Netherlands, and Greece. President François Hollande of France did not attend the mini-summit because of scheduling problems, but it is understood that France is part of the pro-quotas vanguard.

The nine countries include the EU’s wealthiest. The EU-Turkey summit agreed to pay Turkey €3bn (£1.4bn) in return for a deal that would see Ankara patrolling the Aegean borders with Greece – the main point of entry to the EU for hundreds of thousands this year. Ankara is also to resume its long-stalled EU membership negotiations by the end of the year and, according to the schedule agreed, is to have visas waived by next year for Turks travelling to the EU. In response, the EU will be able to start deporting “illegal migrants” to Turkey by next summer under a fast-tracked “readmissions agreement”.

Read more …

No there there, just hot air. “..EU leaders made it clear there would be no shortcut in Turkey’s long-stalled bid to join the bloc. [..] And the Turks couldn’t say how effective the agreement would be in reducing the number of the migrants and refugees entering the EU..”

• European Union Reaches Deal With Turkey on Migration (WSJ)

The EU on Sunday agreed with Turkey’s government for Ankara to take steps to cut the flow of migrants into Europe in exchange for EU cash and help with its bid to join the 28-nation bloc. EU leaders hailed the agreement as a key step toward substantially reducing the number of asylum seekers entering the bloc, while Turkey’s Prime Minister Ahmet Davutoglu said Sunday’s summit marked a historic new beginning in the often fraught relations between Brussels and Ankara. Yet the continued lack of trust on both sides remained evident, as EU leaders made it clear there would be no shortcut in Turkey’s long-stalled bid to join the bloc.

“The issue hasn’t changed,” French President François Hollande said after leaving the summit to return to Paris for global climate talks. “There is no reason either to accelerate or to slow it down.” And the Turks couldn’t say how effective the agreement would be in reducing the number of the migrants and refugees entering the EU via Turkey. EU officials have said cooperation with Turkey is the best way to reduce migrant flows, arguing that Ankara was very effective in previous years in preventing the outflow of refugees from the country. Alongside fresh efforts to tighten their external borders, EU officials hope the Turkey agreement can help turn the tide in the bloc’s migration crisis, the biggest since the aftermath of World War II.

[..] it appeared that substantial efforts would be required to turn Sunday’s agreement into reality. European Council President Donald Tusk said the EU will closely watch Turkey’s implementation of the deal and will review Ankara’s actions on a monthly basis. EU governments are also still at loggerheads over who would pay the €3 billion Turkey is to receive for its cooperation. Moreover, Turkey must complete dozens of EU requirements to win a recommendation for visa-free access to the bloc by autumn of 2016. Even then, a final decision will need backing of all 28 member states. Meanwhile, Mr. Davutoglu acknowledged he couldn’t promise the number of migrants heading into Europe via Turkey would fall. “Nobody can guarantee a drop,” he said of the refugees heading west from war-torn Syria.

Read more …

He’s simply right.

• Tsipras Takes On Turkey’s Davutoglu On Twitter (AP)

A highly unusual online exchange took place on Twitter between the prime ministers of Greece and Turkey late Sunday before the former deleted his tweets – but only from the English version of his account. The official English-speaking account of Greek prime minister Alexis Tsipras (@Tsipras_eu) posted four tweets addressed to his Turkish counterpart Ahmet Davutoglu, needling him about Turkey’s downing of a Russian jet and Turkey’s violations of Greek airspace. “To Prime Minister Davutoglu: Fortunately our pilots are not mercurial as yours against the Russians #EuTurkey” Tsipras tweeted. Both prime ministers attended an EU-Turkey summit on refugees in Brussels Sunday. Tsipras did not explain whether his tweets reproduced a conversation between the two or were written especially for Twitter.

“What is happening in the Aegean is outrageous and unbelievable #EUTurkey” Tsipras continued. “We’re spending billions on weapons. You -to violate our airspace, we -to intercept you #EUTurkey” Tsipras said in a third tweet, referring to intrusions of Turkish planes into Greek airspace, which Turkey contests, and Greek and Turkish pilots frequently buzzing each other. Tsipras said the two countries should focus on saving refugees, not on weapons. “We have the most modern aerial weapons systems–and yet, on the ground, we can’t catch traffickers who drown innocent people #EUTurkey,” the Greek premier said in a fourth tweet. Davutoglu chose to respond to only the first tweet and not engage in a detailed dialogue.

“Comments on pilots by @atsipras seem hardly in tune with the spirit of the day. Alexis: let us focus on our positive agenda,” @Ahmet_Davutoglu responded. Then, the @Tsipras_EU account deleted the four tweets, which have remained posted, however, in Tsipras’ Greek language account, @atsipras. The deletion sparked further furious tweeting, with comments such as “who is handling your account?” being the most common. Then, the English account posted further tweets, but less controversial this time. “Important Summit today for the EU, Turkey and our broader region #EUTurkey” A last Tsipras tweet obliquely referred to the deleted ones: “We are in the same neighborhood and we have to talk honestly so we can reach solutions #EUTurkey.”

Read more …

But the disgrace goes on. And it’s ours, you, me, everyone. Want to protest something?

• As the World Turns Away, Refugees are Still Drowning in the Mediterranean (HRW)

Her name was Sena. She was four years old. She was wearing blue trousers and a red shirt. She drowned in a shipwreck on November 18 in the Aegean Sea off Bodrum, Turkey. His name was Aylan. He was three years old. He drowned on September 2nd, along with his mother and his five-year-old brother. Like Sena, he was Syrian, dressed in blue and red, and travelling with his family on a desperate journey to reach safety and a future in Europe. The picture of his tiny lifeless body washed up on shore appeared to shake Europe’s—indeed, the world’s—conscience. Yet at least 100 more children, including Sena, have drowned in the Aegean in the weeks since. This year has seen an unprecedented number of asylum seekers and migrants—over 712,000 as of this week—crossing from Turkey to the Greek islands, most of them in overcrowded flimsy rubber dinghies.

One-quarter of those risking their lives are children. We have witnessed an unbearable death toll this year, with at least 585 people missing or lost in the Aegean, most of them since Aylan’s death. War, persecution, geopolitics, dangerous smuggler tactics, the weather – all of these factors contribute to the surge in arrivals as well as the number of lives lost. The UN refugee agency, UNHCR, estimates that 60% of those coming to Greece by sea are Syrians, while 24% are from Afghanistan. The response of the European Union has to be multifaceted. It should include measures to reduce the need for dangerous journeys and tackle the root causes of refugee and migration flows in a way that respects human rights.

But the immediate imperative has to be to save lives. Turkish and Greek coast guard boats are out there every day patrolling the waters. And various EU countries have sent boats, personnel and other equipment to participate in Operation Poseidon in the Aegean, a mission of the EU’s external border agency Frontex. Combined, these actions have saved tens of thousands of lives. I’ve seen a burly Portuguese coast guard officer gently take a baby from her mother’s arms after a rescue. I’ve observed the professionalism of Norwegian police officers on patrol for Frontex. A colleague of mine was impressed by the way Greek coast guard officers handled two difficult rescues. But more needs to be done.

Read more …