DPC Chicago & Alton Railroad, Joliet, Illinois 1901

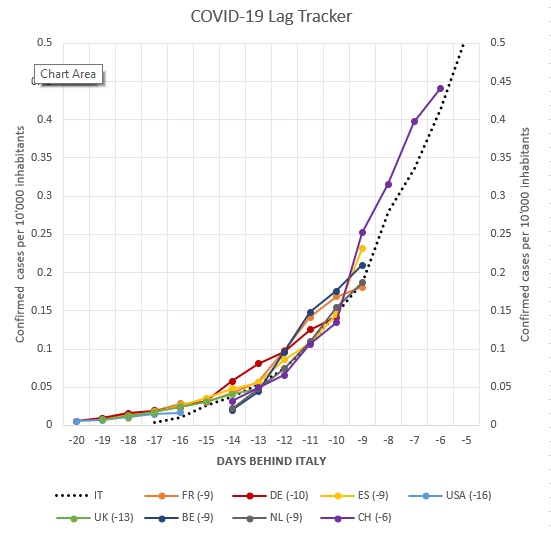

China contagion spreads.

• Asian Shares Drop To 2011 Levels As Oil Slump Intensifies (Reuters)

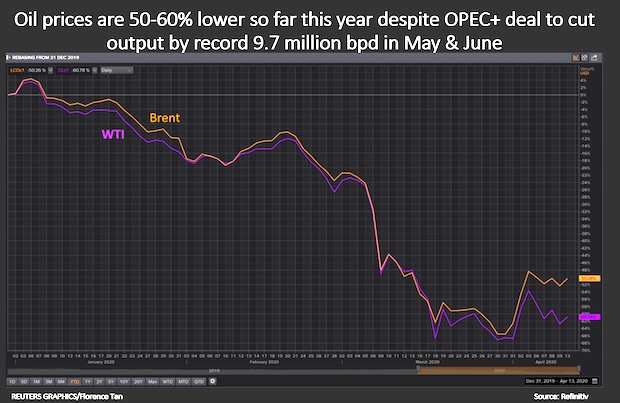

Asian shares slid to their lowest levels since 2011 on Monday after weak U.S. economic data and a massive fall in oil prices stoked further worries about a global economic downturn. Spreadbetters expected a subdued open for European shares, forecasting London’s FTSE to open modestly higher while seeing Germany’s DAX and France’s CAC to start flat-to-slightly-weaker. Crude prices faced fresh pressure after international sanctions against Iran were lifted over the weekend, allowing Tehran to return to an already over-supplied oil market. Brent oil futures fell below $28 per barrel touching their lowest level since 2003. “Iran is now free to sell as much oil as it wants to whomever it likes at whatever price it can get,” said Richard Nephew at Columbia University’s Center on Global Energy Policy.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell to its lowest since October 2011 and was last down 0.5%. Japan’s Nikkei tumbled as much as 2.8% to a one-year low. It has lost 20% from its peak hit in June, meeting a common definition of a bear market. The volatile Shanghai Composite index initially pierced through intraday lows last seen in August before paring the losses and was last up 1%. It was still down 17% this month. On Wall Street, S&P 500 hit a 15-month low on Friday, ahead of Monday’s market holiday. “The fact that U.S. and European shares fell below their August lows, failing to sustain their rebound, is significant,” said Chotaro Morita at SMBC Nikko Securities.

Read more …

They knew Iran was coming, so that’s not the main driver.

• Oil Slides To Lowest Since 2003 As Iran Sanctions Are Lifted (Reuters)

Oil prices hit their lowest since 2003 in early trading on Monday, as the market braced for a jump in Iranian exports after the lifting of sanctions against the country at the weekend. On Saturday, the U.N. nuclear watchdog said Tehran had met its commitments to curtail its nuclear program, and the United States immediately revoked sanctions that had slashed the OPEC member’s oil exports by around 2 million barrels per day (bpd) since their pre-sanctions 2011 peak to little more than 1 million bpd. “Iran is now free to sell as much oil as it wants to whomever it likes at whatever price it can get,” said Richard Nephew, program director for Economic Statecraft, Sanctions and Energy Markets at Columbia University’s Center on Global Energy Policy.

Iran is ready to increase its crude exports by 500,000 bpd, its deputy oil minister said on Sunday. International Brent crude fell to $27.67 a barrel early on Monday, its lowest since 2003, before recovering to $28.25, still down more than 2% from their settlement on Friday. U.S. crude was down 58 cents at $28.84 a barrel after hitting a 2003 low of $28.36 earlier in the session. “The lifting of sanctions on Iran should see further downward pressure on oil and commodities more broadly in the short term,” ANZ said on Monday. “Iran’s likely strategy in offering discounts to entice customers could see further downward pressure on prices in the near term,” it added. Iran’s potential new exports come at a time when global markets are already reeling from a chronic oversupply as producers pump a million barrels or more of crude every day in excess of demand, pulling down crude prices by over 75% since mid-2014 and by over a quarter since the start of 2016.

And although analysts expect Iran to take some time before being able to fully revive its export infrastructure, suffering from years of underinvestment during the sanctions, it does have at least a dozen Very Large Crude Carrier super-tankers filled and in place to sell into the market. The oil price rout is also hurting stock markets, with Asian shares set to slide to near their 2011 troughs on Monday, stoking further worries about a global economic downturn. “Growth keeps slowing … Lower commodity prices, including oil, partly reflect weakening demand itself. In addition, the downturn in mining capex and the declining income of commodity producers is weighing on exports from Asia,” said Frederic Neumann at HSBC, Hong Kong.

Read more …

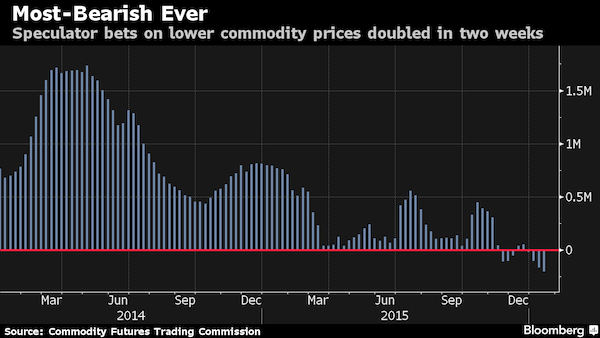

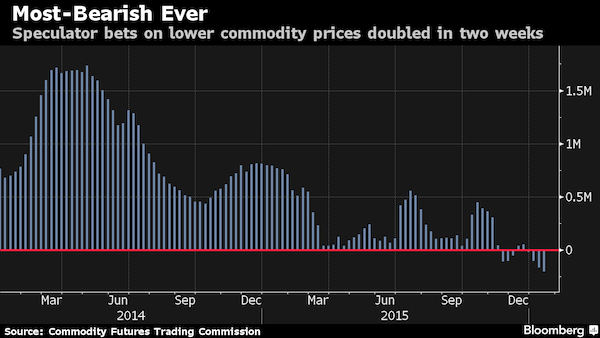

Must be a crowded trade.

• Hedge Funds Are Betting The Commodities Collapse Isn’t Over Yet (BBG)

The commodity meltdown that pushed oil to a 12-year low and copper to the cheapest since 2009 isn’t over yet. At least, that’s how hedge funds see it. Money managers increased their combined net-bearish position across 18 raw materials to the biggest ever, doubling the negative bets in just two weeks. A measure of returns on commodities last week slid to the lowest in at least 25 years. Metals, crops and energy futures all slumped amid supply gluts and an anemic outlook for the global economy. Market turmoil in China, the biggest commodity buyer, is adding to worries over consumption. A stronger dollar is also eroding the appeal of raw materials as alternative investments. While Goldman Sachs predicts that the prolonged slump will start to spur more supply cuts, the bank doesn’t expect prices to rebound until later this year.

“There’s fear in the marketplace,” said Lara Magnusen at Altegris Investments. People are “very concerned about slower economic growth and what’s going on with China and the contagion effect,” she said. With a strong U.S. dollar and the Federal Reserve considering more interest-rate increases, “there’s not a lot of places where you can put your money right now,” she said. “Short commodities is a pretty good place.” The net-short position across 18 U.S.-traded commodities expanded to 202,534 futures and options as of Jan. 12, according to U.S. Commodity Futures Trading Commission figures published three days later. That’s the largest since the government data begins in 2006 and compares with 164,203 contracts a week earlier.

Read more …

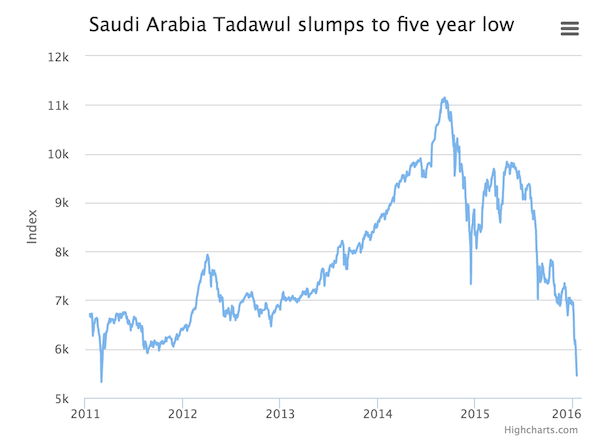

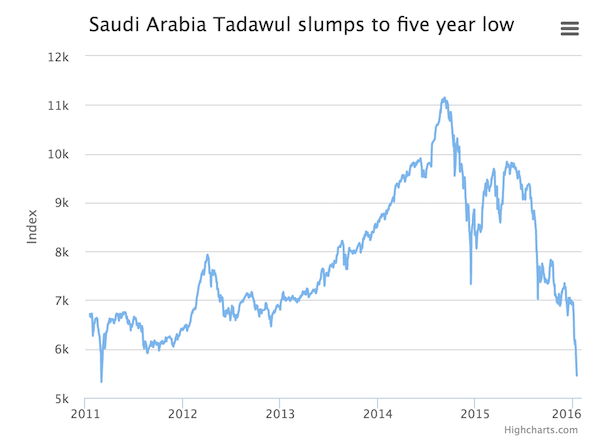

Add that to the low oil price losses.

• Gulf Stock Crash Wipes $38.5 Billion Off Markets As Iran Enters Oil War (Tel.)

Stock markets across the Middle East saw more than £27bn ($38.5 billion) wiped off their value as the lifting of economic sanctions against Iran threatened to unleash a fresh wave of oil onto global markets that are already drowning in excess supply. All seven stock markets in Gulf states tumbled as panic gripped traders. Dubai’s DFM General Index closed down 4.65pc to 2,684.9, while Saudi Arabia’s Tadawul All Share Index, the largest Arab market, collapsed by 7pc intraday, before recovering marginally to end down 5.44pc at 5,520.41, its lowest level in almost five years. The Qatar stock exchange, fell 7.2pc to close at 8,527.75, and the Abu Dhabi Securities Exchange shed 4.24pc to finish at 3,787.4. The Kuwait market returned to levels not seen since May 2004 as it slid 3.2pc lower, while smaller markets in Oman and Bahrain dropped 3.2pc and 0.4pc respectively.

The Iranian stock index gained 1pc, making it one of the best performing markets in the world with gains of 6pc since the start of the year. The dramatic moves came following the historic report from the UN nuclear watchdog, which showed that Iran has met its obligations under the nuclear deal, clearing the way for the lifting of sanctions. The Vienna-based International Atomic Energy Agency issued the landmark document late on Saturday evening, sparking mayhem as markets opened on Sunday, the first day of trading in the Middle East. The stock markets in Dubai and Saudi Arabia have been plunged into a painful bear market, losing 42pc and 38pc respectively, ever since Saudi Arabia decided to ramp up oil production in November 2014.

Oil prices fell below $30 for the third time last week as traders prepared for the prospect of Iranian oil flooding global markets. The Islamic Republic has vowed to return its oil production to pre-sanction levels, with estimates suggesting Tehran will add a further 500,000 barrels a day (b/pd) to the world’s bloated stockpiles within weeks. Fears that the Islamic Republic could quickly ramp up production sent Brent crude falling by 3.3pc to $29.43 on Friday – matching lows last seen in 2004. West Texas Intermediate also slipped back to $29.60, a decline of 4.5pc.

Read more …

“..the wealth of the poorest 50% dropped by 41% between 2010 and 2015..”

• Richest 1% Now Wealthier Than The Rest Of Humanity Combined (BBG)

The richest 1% is now wealthier than the rest of humanity combined, according to Oxfam, which called on governments to intensify efforts to reduce such inequality. In a report published on the eve of the World Economic Forum’s annual meeting in Davos, Switzerland, the anti-poverty charity cited data from Credit Suisse in declaring the most affluent controlled most of the world’s wealth in 2015. That’s a year earlier than it had anticipated. Oxfam also calculated that 62 individuals had the same wealth as 3.5 billion people, the bottom half of the global population, compared with 388 individuals five years earlier. The wealth of the most affluent rose 44% since 2010 to $1.76 trillion, while the wealth of the bottom half fell 41% or just over $1 trillion.

The charity used the statistics to argue that growing inequality poses a threat to economic expansion and social cohesion. Those risks have already been noted in countries from the U.S. to Spain, where voters are increasingly backing populist political candidates, while it’s sown tensions on the streets of Latin America and the Middle East. “It is simply unacceptable that the poorest half of the world’s population owns no more than a few dozen super-rich people who could fit onto one bus,” said Winnie Byanima, executive director of Oxfam International. “World leaders’ concern about the escalating inequality crisis has so far not translated into concrete action.” Oxfam said governments should take steps to reduce the polarization, estimating tax havens help the rich to hide $7.6 trillion. Politicians should agree on a global approach to ending the practice of using offshore accounts, it said.

Read more …

Or the other way around?

• Stock Market Crash Could Burst UK Property Bubble (Express)

Property seems to be immune from the fear now gripping the global economy, but that may not always be the case. If the share price meltdown continues and the global economy slows, eventually the UK’s house of cards may collapse as well. Chinese stock markets have plunged since the start of the year, with the FTSE 100 falling 6.5% so far. There seems no end in sight to the share sell-off, but still property powers on. The latest figures from Halifax show that property prices in the final quarter of 2015 were almost 10% higher than one year earlier. The growth seems unstoppable, with new figures from estate agency Your Move showing the average property in England and Wales has leapt £18,000 in the last year to £292,077, a growth rate of an incredible £1,500 a month.

Many Britons suspect the property market is overvalued, with the average UK home now costing more than 10 times earnings. Given that most lenders will not grant mortgages worth more than three or four times your income, this looks unsustainable. Yet few property experts are willing to say openly that the market is in peril. Most remain deaf to warnings of contagion from the share price rout, even though it has scared the life out of some investment experts. Last week, Andrew Roberts, research chief at Royal Bank of Scotland, warned investors to “sell everything except high-quality bonds” because the stock market and oil price crash has only just begun. He is worried about the growing public and company debt burden, and British households have plenty to worry about on that score.

All-time low interest rates have fuelled a borrowing spree that has seen Britons rack up a mind-boggling debt of £40billion. The latest figures show family that household debt rose by 42% in the last six months alone, according to research from Aviva. The average family now owes £13,520 on credit cards, personal loans and overdrafts, up from £9,520 last summer. Throw in a 20% increase in average mortgage debt to £62,739 over five years and households are more vulnerable than ever. Worse, family incomes are falling and many have lost the savings habit as their finances are stretched.

Read more …

The entire issue is hugely distorted by insanely elevated home prices. Take those out, and you see how bad things truly are.

• It’s Not Time For Britain To Be ‘Intensely Relaxed’ Over Household Debt (Ind.)

There seem to be three main arguments against the idea we should be concerned about household leverage. The first is that the official statistics belie the claim that the aggregate debt burden of UK households is rising and the recovery has been fuelled by borrowing. Second, we’re told UK household debt is mainly mortgage debt and reflects high domestic house prices. For each of these liabilities there is an asset, so we must look at the overall balance sheets of households, which are healthy. Plus, with interest rates still on the floor, aggregate debt-servicing costs are comfortable. Finally, we’re assured that as long as the supply of new homes remains severely restricted, high debt presents no serious financial threat because house prices are pretty unlikely to collapse.

To illustrate this final point, it is pointed out that the banks failed in 2008 because of their dodgy overseas lending, not because of their dodgy UK mortgage books. There are problems with all three arguments. Let’s take them in turn. Measured as a share of household incomes, it is true that household debt has not actually been growing. Since 2008, when the debt to income ratio peaked at 170%, households have been deleveraging. Yet at 140% of gross income, debt levels are still very high, both by historic and international standards. In the G7 only Canada has a higher household leverage ratio today. There is potential fragility here if another economic shock were to hit, as the Bank of England itself admits. To point to the UK’s deleveraging in recent years as a reason for relief is akin to a mountaineer getting halfway down Everest in a vicious storm and saying “job done”.

Debt has not been rising as a share of income but the aggregate household savings ratio, excluding pension rights, has fallen from a peak of 6% in 2010 to less than zero today. That change in household behaviour has certainly helped the economy recover. So not a recovery fuelled by debt, but a recovery fuelled by a lower savings ratio. Incidentally, there was no such savings collapse envisaged by the Office for Budget Responsibility (OBR) in 2010, reflecting how unbalanced the recovery has been relative to hopes six years ago. Moreover, the OBR today predicts that the debt to income ratio is going to race back close to pre-crisis levels over the coming five years. Why? Because the Treasury’s official forecaster expects house prices to rise faster than incomes and for people to keep buying houses. The OBR is very far from being omniscient. But that is surely one of the more plausible assumptions from Robert Chote and his team, given the dismal evolution of the housing market in recent years and decades.

Read more …

Lemme guess: anyone but Xi?!

• China’s Securities Czar Casts Wide Blame for Market Turmoil (WSJ)

What’s wrong with China’s stock market? Just about everything, according to a statement from Xiao Gang, the country’s chief securities regulator, delivered at a national meeting of Chinese securities officials and posted on his agency’s website Saturday. In the statement, Mr. Xiao defended his handling of successive market meltdowns, blaming the “abnormal volatility” on “an immature market, inexperienced investors, imperfect trading system, flawed market mechanisms and inappropriate supervision systems.” The turmoil in China’s stock market—which on Friday entered “bear” territory of 20% below its recent peak—has cast a harsh light on the performance of Mr. Xiao, 57, a former central banker and chairman of the Bank of China before he was appointed chairman of the China Securities Regulatory Commission in 2013.

During the summer, when Chinese stocks tumbled more than 40%, Mr. Xiao oversaw a slew of measures to prop up the market that many investors criticized as heavy-handed and interventionist. Those ranged from banning certain kinds of short selling and share sales to approving the purchase of hundreds of billions of yuan in equities by government-affiliated funds. Two weeks ago, Mr. Xiao was forced to abandon a circuit-breaker mechanism he’d championed as a way to halt big trading swings, when it instead ended up fanning panic selling. In his Saturday statement, Mr. Xiao defended his efforts, saying they were a successful attempt to stave off a bigger crisis.

“The response to the abnormal volatility in the stock market was essentially crisis management,” Mr. Xiao said. Various departments “addressed market dysfunctions and prevented a potential systemic risk through joint efforts.” Mr. Xiao did admit there had been “supervision and management loopholes” and he promised to crack down on illegal activities, increase market transparency and better educate investors, although he didn’t outline specific proposals. He briefly touched on the detention of some top-ranking officials in the securities industry in relation to a police investigation on alleged violation of rules, but without naming his own agency. Mr. Xiao chastised listed companies for “exaggerated storytelling” to hype up stock prices, and urged market participants to cultivate a stronger sense of social responsibility and to “huddle together for warmth”—or cooperate in the greater interest—when times are bad.

Read more …

They want to take five years to do what should have been done already. Dangerous.

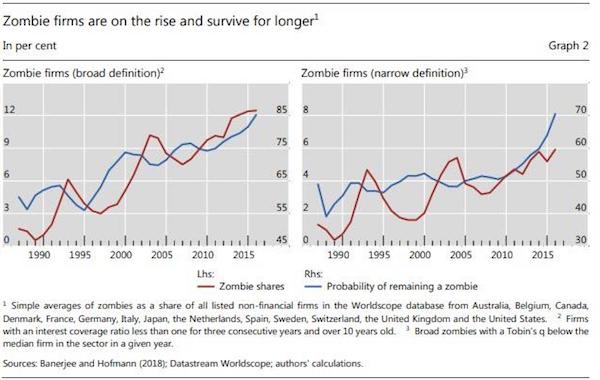

• China To Clean-up ‘Zombie’ Companies By 2020 (Reuters)

China’s top state-owned asset administrator has vowed to clean-up the country’s so-called “zombie” industrial companies by 2020, the official Xinhua News Agency has reported. Zhang Yi, Chairman of the State-owned Assets Supervision and Administration Commission (SASAC), told a central and local enterprise work conference convened at the weekend that the agency will “basically” resolve the problem of unproductive “zombie” firms over the next three years. Dealing with “zombie companies” is very difficult, Zhang said, according to the report, but “officials need to… use today’s ‘small tremors’ to prevent a future earthquake.” The central government last September rolled out the most ambitious reform program in two decades to resolve the problems at its hugely inefficient public sector companies, encouraging the greater use of “mixed ownership” while promoting more mergers to create globally-competitive conglomerates.

Zhang Xiwu, deputy head of SASAC, told a news briefing at the time that China would work to reorganize state firms to centralize state-owned capital in key industries, while restricting investment in industries not in line with national policies. Zhang said that China would use stock exchanges, property exchanges and other capital markets to sell the assets of low performing state owned enterprises. Profits at China’s state firms dipped 9.5% in the first 11 months of 2015 from a year earlier, led by profits at SASAC-controlled firms, which fell 10.4%, the Ministry of Finance said in December. On Friday, SASAC told state media that the steep decline in profits for the sector had been curtailed, and that 99 of the 106 SASAC-controlled enterprise groups achieved profitability in 2015.

Read more …

Interesting angle via ZH.

• The Problem With Getting Money Out Of China (China Law Blog)

Regular readers of our blog probably know that our basic mantra about getting money out of China is that if you have consistently follow all of China’s laws, it ought to be no problem. Not true lately. In the last week or so, our China lawyers have probably received more “money problem” calls than in the year before that. And unlike most of these sorts of calls, the problems are brand new to us. It has reached the point that yesterday I told an American company (waiting for a large sum in investment funds to arrive from China) that two weeks ago I would have quickly told him that the Chinese company’s excuse for being unable to send the money was a ruse, but with all that has been going on lately, I have no idea whether that is the case or not. So what has been going on lately? Well if there is a common theme, it is that China banks seem to be doing whatever they can to avoid paying anyone in dollars. We are hearing the following:

1. Chinese investors that have secured all necessary approvals to invest in American companies are not being allowed to actually make that investment. I mentioned this to a China attorney friend who says he has been hearing the same thing. Never heard this one until this month.

2. Chinese citizens who are supposed to be allowed to send up to $50,000 a year out of China, pretty much no questions asked, are not getting that money sent. I feel like every realtor in the United States has called us on this one. The Wall Street Journal wrote on this yesterday. Never heard this one until this month.

3. Money will not be sent to certain countries deemed at high risk for fake transactions unless there is conclusive proof that the transaction is real — in other words a lot more proof than required months ago. We heard this one last week regarding transactions with Indonesia, from a client with a subsidiary there. Never heard this one until this month.

4. Money will not be sent for certain types of transactions, especially services, which are often used to disguise moving money out of China illegally. This is not exactly new, but it appears China is cracking down on this.

5. Get this one: Money will not be sent to any company on a services transaction unless that company can show that it does not have any Chinese owners. The alleged purpose behind this “rule” is again to prevent the sort of transactions ordinarily used to illegally move money out of China. Never heard this one until this month.

What are you seeing out there? No really, what are you seeing out there?

Read more …

You just wait till the German economy starts stumbling.

• Gloom Gathers Over The Challenges That Germany Faces (FT)

This is going to be a difficult year for Germany, one in which the policies of the past may turn out to be unsustainable. The most unsustainable of all was Angela Merkel’s invitation to open the doors to Syrian refugees without limitation. The German chancellor must either have misjudged the effect or acted recklessly — or both. A few months and 1m refugees later, the discontent is growing inside the Christian Democratic Union, her party, and in the country at large. Gerhard Schröder, her Social Democratic predecessor, last week came out against the policy with exactly the same arguments as the right-wingers in Ms Merkel’s own party: Germany cannot absorb such a large number. More than 1m refugees arrived in the country in 2015. It could be twice as many this year and the same again next — more if you include family members who will eventually follow.

It is tempting to think of refugees and migrants as a new source of labour. But in this case this just is not true, at least not for now. The majority of those who arrive in Germany lack the skills needed in the local labour market. They will enter the low wage sector of the economy, and drive down wages, producing another deflationary shock. This is the last thing Germany and the eurozone need right now. I expect that this policy will change at some point this year. What I do not see, however, is a successful political coup against Ms Merkel from inside her own party. What protects her is the grand coalition with the Christian Social Union and the SPD. There is no majority to the right of her, or to the left for that matter.

The second challenge is the economic downturn in emerging markets. There are few large countries as dependent on the global economy as Germany, and few where there is so little awareness of that fact, at least in public debate. Germany has a current account surplus of 8% of gross domestic product. A global downturn tends to affect German industrial companies with a delay of one or two years because many operate in sectors like plant and machinery where multiyear contracts are customary. But eventually, the German and the global business cycles begin to synchronise once more. This will be the year when that starts to happen.

The third challenge for Germany in 2016 is the fallout from the Volkswagen emissions scandal. This could be the single biggest shock of all because Germany has been over-reliant on the car industry for far too long. Last week, suspicion fell on Renault, when the offices of the French carmaker were raided by the authorities. This is not the crisis of a single company, therefore, but of a whole industry. Nor is it just a German problem; it is a pan-European one. It appears that VW behaved more recklessly than the others, and it will pay a heavy price for its behaviour. Whether legal action in the US and in Germany will weaken VW or force it into outright bankruptcy is almost irrelevant, given the bigger picture.

Read more …

Political capital rules the EU.

• “Everything Has Come to a Standstill”: Politics Hits Business in Spain (WS)

On Friday, Spain’s benchmark stock index, the Ibex 35, plumbed depths it had not seen since the worst days of 2013, the year that the country’s economy began its “miraculous” recovery. Of the 35 companies listed on the index, 15 (or 40%) are – to quote El Economista – “against the ropes,” having lost over a third of their stock value in the last 9 months. Only one of the 35 companies — the technology firm Indra — is still green for 2016. This doesn’t make Spain much different from other countries right now, what with financial markets sinking in synchronized fashion all over the world. What does make Spain different is that it has no elected government to try to navigate the country though these testing times, or at least take the blame for the pain.

Inevitable comparisons have been drawn with Belgium, which between 2011 and 2012 endured 541 days of government-free living. However, Spain is not Belgium: its democratic system of governance is younger, less firmly rooted, and more fragile, and its civil service is more politically compromised. To make matters worse, Spain’s richest region, Catalonia, which accounts for 20% of the country’s economy, bucked expectations last week by cobbling together a last-minute coalition government that seems intent on declaring independence within the next 15 months. Meanwhile, business confidence, the cornerstone of any economic recovery, is beginning to crumble. Spain’s leading index of business confidence, ICEA, just registered a drop of 1.3%, breaking a straight eleven-quarter run of positive results.

For the first time in almost three years more business leaders are pessimistic than optimistic about the economy’s outlook. This should come as little surprise in a country where unemployment is still firmly on the wrong side of the 20% mark, over a quarter of the new jobs created last year had a contract lasting less than one week, and public debt is higher than it’s ever been. And now that there’s no elected government in office, businesses that depend on public sector contracts, including the country’s heavily indebted construction and infrastructure giants, face weeks or perhaps even months of inertia. “Everything has come to a standstill,” a contact in a Madrid-based research consultancy told me. “No decisions are being made, no funds are being released. It’s a vacuum.”

For the moment, the political backdrop has had limited impact on the price of Spanish government debt. The 10-year yield is at 1.75%, below the 10-year US Treasury yield, though it’s up a smidgen since the general elections on December 20. In its latest update, S&P left Spain’s rating unchanged, predicting 2.7% growth for 2016, despite the prevailing mood of political and economic uncertainty. In a similar vein, Deutsche Bank has forecast growth of 2.5%, regardless of what happens within or beyond Spanish borders. In other words, every effort will be made to safeguard the economic order in Spain, including putting a ridiculously positive spin on a desperate situation. To paraphrase Europe’s chief financial alchemist, Mario Draghi: do not underestimate the amount of political capital that has been invested in the European project, in particular in the Eurozone’s fourth largest economy.

Read more …

“General sentiment is downright toxic in Canada..”

• Canadian Officials Under Pressure to Stimulate Economy (WSJ)

Canadian policy makers are heading into a tough week as pressure mounts on them to revive an economy that has been among the hardest hit by the commodity rout. Prime Minister Justin Trudeau and his cabinet colleagues will convene in a seaside resort town on Canada’s east coast Monday amid more evidence growth may have stalled again after sputtering to life in last year’s third quarter. A recent string of dismal economic news—and a free-falling Canadian dollar—has led to calls for Mr. Trudeau’s government to move sooner rather than later on major infrastructure investments to stimulate growth.

On Wednesday, Bank of Canada Gov. Stephen Poloz will deliver his latest interest-rate decision, and economists are split not only on whether he will opt to cut rates, but whether such a move would do much to help the economy at this time. Analysts say the onus has shifted to Mr. Trudeau’s government to help mitigate the negative fallout from the oil-price rout. Last week the Canadian dollar hit near-13-year lows as prices for oil, a major Canadian export, continued to weaken. As of Friday, the currency has fallen 4.8% against the U.S. dollar since the start of the year and was down 17.8% year-to-year. The drop came as Canada’s stock market lost ground—it is now off 22.2% from its 2015 peak—and the central bank said Canadian companies’ investment and hiring intentions had recently weakened.

“General sentiment is downright toxic in Canada,” said Jimmy Jean, economist at Desjardins Capital Markets. Talk around Mr. Trudeau’s cabinet table likely will revolve around the appropriate response to an economic tailspin fueled by a fresh downturn in the price of crude. While the prime minister last week voiced optimism about Canada’s prospects despite disappointing growth, government officials have privately said they are very worried about the economy. Meanwhile, economists have told the government it should boost the amount of infrastructure spending planned for this year to help offset weak conditions.

Read more …

But we’ll keep driving along. Soon, in our new clean cars powered by coal plants.

• Shock Figures To Reveal Deadly Toll Of Global Air Pollution (Observer)

The World Health Organisation has issued a stark new warning about deadly levels of pollution in many of the world’s biggest cities, claiming poor air quality is killing millions and threatening to overwhelm health services across the globe. Before the release next month of figures that will show air pollution has worsened since 2014 in hundreds of already blighted urban areas, the WHO says there is now a global “public health emergency” that will have untold financial implications for governments. The latest data, taken from 2,000 cities, will show further deterioration in many places as populations have grown, leaving large areas under clouds of smog created by a mix of transport fumes, construction dust, toxic gases from power generation and wood burning in homes. The toxic haze blanketing cities could be clearly seen last week from the international space station.

Last week it was also revealed that several streets in London had exceeded their annual limits for nitrogen dioxide emissions just a few days into 2016. “We have a public health emergency in many countries from pollution. It’s dramatic, one of the biggest problems we are facing globally, with horrible future costs to society,” said Maria Neira, head of public health at the WHO, which is a specialist agency of the United Nations. “Air pollution leads to chronic diseases which require hospital space. Before, we knew that pollution was responsible for diseases like pneumonia and asthma. Now we know that it leads to bloodstream, heart and cardiovascular diseases, too – even dementia. We are storing up problems. These are chronic diseases that require hospital beds. The cost will be enormous,” said Neira.

[..] According to the UN, there are now 3.3 million premature deaths every year from air pollution, about three-quarters of which are from strokes and heart attacks. With nearly 1.4 million deaths a year, China has the most air pollution fatalities, followed by India with 645,000 and Pakistan with 110,000. In Britain, where latest figures suggest that around 29,000 people a year die prematurely from particulate pollution and thousands more from long-term exposure to nitrogen dioxide gas, emitted largely by diesel engines, the government is being taken to court over its intention to delay addressing pollution for at least 10 years.

Read more …

Follow the money, that’s all there’s to it. All the rest is window dressing and lip service, for Beijing as much as for Volkswagen.

• False Emissions Reporting Undermines China’s Pollution Fight (Reuters)

Widespread misreporting of harmful gas emissions by Chinese electricity firms is threatening the country’s attempts to rein in pollution, with government policies aimed at generating cleaner power struggling to halt the practice. Coal-fired power accounts for three-quarters of China’s total generation capacity and is a major source of the toxic smog that shrouded much of the country’s north last month, prompting “red alerts” in dozens of cities, including the capital Beijing. But the government has found it hard to impose a tougher anti-pollution regime on the power sector, with China’s energy administration describing it as a “weak link” in efforts to tackle smog caused by gases such as sulfur dioxide. No official data on the extent of the problem has been released since a government audit in 2013 found hundreds of power firms had falsified emissions data, although authorities have continued to name and shame individual operators.

“There is no guarantee of avoiding under-reporting (of emissions) at local plants located far away from supervisory bodies. Coal data is very fuzzy,” said a manager with a state-owned power company, who did not want to be named because he is not authorized to speak to the media. The manager said firms could easily exaggerate coal efficiency by manipulating their numbers. For example, power companies that also provided heating for local communities could overstate the amount of coal used for heat generation, which is not subject to direct monitoring, and understate the amount used for power. “Data falsification is a long-standing problem: China will not get its environmental house in order if it does not deal with this first,” said Alex Wang, an expert in Chinese environmental law at UCLA.

Read more …

Money trumps laws.

• Weak EU Tests For Diesel Emissions Are ‘Illegal’ (Guardian)

Planned new ‘real driving emissions’ (RDE) test limits that would let cars substantially breach nitrogen oxide (NOx) standards are illegal under EU law, according to new legal analysis seen by the Guardian. The proposed ‘Euro 6’ tests would allow diesel cars to emit more than double the bloc’s ‘80 mg per km’ standard for NOx emissions from 2019, and more than 50% above it indefinitely from 2021. The UK supported these exemptions. But they contradict the regulation’s core objective of progressively scaling down emissions and improving air quality, according to an opinion by the European Parliament’s legal services, which the Guardian has seen. In principle, the exemptions and loopholes “run counter [to] the aims and content of the basic regulation as expressed by the Euro 6 limit values,” says the informal paper prepared for MEPs on the parliament’s environment committee.

“The commission has taken a political decision to favour the commercial interests of car manufacturers over the protection of the health of European citizens,” adds a second analysis by the environmental law firm ClientEarth, also seen by the Guardian. “The decision is therefore illegal and should be vetoed by the European Parliament,” the ClientEarth advice says. Catherine Bearder, a Liberal Democrat MEP on the environment committee, told the Guardian that as well as being morally unjustifiable, the agreement to water down the emissions limits was now “legally indefensible”. “This was a political decision, not a technical one, and so it should have been subject to proper democratic accountability,” she told the Guardian. “MEPs must veto this shameful stitch-up and demand a stronger proposal, based on the evidence and not on pressure from the car industry.”

Read more …

Might as well close it down.

• 66 Institutional Investors To Sue Volkswagen In Germany (FT)

Sixty-six institutional investors are to take legal action against Volkswagen in its German home market after the carmaker cheated emissions tests in the US. The first claim will be made within the next seven days. The legal action will heap further pressure on Volkswagen, which earlier this month said its annual sales fell last year for the first time in more than a decade. Klaus Nieding, a lawyer at Nieding and Barth, the German law firm, said a capital market model claim, which is similar to a collective lawsuit in the US, will be filed “within the next week” in Germany on behalf of a US institutional investor that has suffered a “big loss”. The other 65 institutional investors are expected to join that claim.

Investors have been nursing heavy losses after the US’s Environmental Protection Agency revealed last September that the world’s second-largest carmaker had cheated US emissions tests by fitting vehicles with “defeat devices” designed to bypass environmental standards. Billions of euros have been wiped off the value of Volkswagen as a result. Nieding and Barth is working with MüllerSeidelVos, a fellow German firm, and Robbins Geller Rudman and Dowd, a US law firm, to represent investors that have contacted DSW, a German shareholder protection association. Mr Nieding said the law firms collectively represent “many foreign institutional investors, primarily from the US, with claims of several hundred million euros”. He added: “We are representing, as far as we know, the largest number of claims and of shareholders [in Germany].”

Bentham Europe, a litigation finance group backed by Elliott Management, the US hedge fund, and Australian-listed IMF Bentham, is also expected to file a damages claim in Germany. Volkswagen is facing additional legal action outside its home market. Class actions against the carmaker, which allow one person to sue on behalf of a group of individuals or companies, have already been filed in the US and Australia. Last week, the Arkansas State Highway Employees Retirement System, a $1.4bn pension fund, was named the lead plaintiff in a class action against VW in the US. “We will be prosecuting the claims on behalf of the class vigorously,” said Jeroen van Kwawegen, a lawyer at Bernstein Litowitz Berger and Grossmann. The law firm is acting on behalf of investors who put money in Volkswagen’s American depositary receipts, a type of stock that represents shares in a foreign corporation.

Read more …

Snyder should be taken to court over his decisions that led to the mayhem. Instead, Wshington sends HIM the money to solve the issue.

• Obama Declares Emergency In Flint, But Not Disaster (DFP)

President Barack Obama on Saturday declared a federal emergency in Flint, freeing up to $5 million in federal aid to immediately assist with the public health crisis, but he denied Gov. Rick Snyder’s request for a disaster declaration. A disaster declaration would have made larger amounts of federal funding available more quickly to help Flint residents whose drinking water is contaminated with lead. But under federal law, only natural disasters such as hurricanes and floods are eligible for disaster declarations, federal and state officials said. The lead contamination of Flint’s drinking water is a manmade catastrophe. The president’s actions authorize the FEMA to coordinate responses and cover 75% of the costs for much-needed water, filters, filter cartridges and other items for residents, capped initially at $5 million.

The president also offered assistance in finding other available federal assistance, a news release Saturday from the White House said. Snyder, who on Thursday night asked Obama for federal financial aid in the crisis through declarations of both a federal emergency and a federal disaster, said in a news release Saturday he appreciates Obama granting the emergency request “and supporting Flint during this critical situation.” “I have pledged to use all state resources possible to help heal Flint, and these additional resources will greatly assist in efforts under way to ensure every resident has access to clean water resources,” he said. U.S. Rep. Dan Kildee, D-Flint, welcomed the emergency declaration and issued a statement: “I welcome the president’s quick action in support of the people of Flint after months of inaction by the governor,” Kildee said.

“The residents and children of Flint deserve every resource available to make sure that they have safe water and are able to recover from this terrible manmade disaster created by the state.” On Friday, Kildee led a bipartisan effort in support of the request for federal assistance. Kildee had long called for Snyder to request federal aid. Typically, federal aid for an emergency is capped at $5 million, though the president can commit more if he goes through Congress. Snyder’s application said as much as $55 million is needed in the near term to repair damaged lead service lines and as much as $41 million to pay for several months of water distribution and providing residents with testing, water filters and cartridges.

In what’s become a huge government scandal, garnering headlines across the country and around the world, Flint’s drinking water became contaminated with lead after the city temporarily switched its supply source in 2014 from Lake Huron water treated by the Detroit Water and Sewerage Department to more corrosive and polluted Flint River water, treated at the Flint water treatment plant. The switch was made as a cost-cutting move while the city was under the control of a state-appointed emergency manager.

Read more …

Dr. Paul has been consistently on the case for years.

• When Peace Breaks Out With Iran… (Ron Paul)

This has been the most dramatic week in US/Iranian relations since 1979. Last weekend ten US Navy personnel were caught in Iranian waters, as the Pentagon kept changing its story on how they got there. It could have been a disaster for President Obama’s big gamble on diplomacy over conflict with Iran. But after several rounds of telephone diplomacy between Secretary of State John Kerry and his Iranian counterpart Javad Zarif, the Iranian leadership – which we are told by the neocons is too irrational to even talk to – did a most rational thing: weighing the costs and benefits they decided it made more sense not to belabor the question of what an armed US Naval vessel was doing just miles from an Iranian military base. Instead of escalating, the Iranian government fed the sailors and sent them back to their base in Bahrain.

Then on Saturday, the Iranians released four Iranian-Americans from prison, including Washington Post reporter Jason Rezaian. On the US side, seven Iranians held in US prisons, including six who were dual citizens, were granted clemency. The seven were in prison for seeking to trade with Iran in violation of the decades-old US economic sanctions. This mutual release came just hours before the United Nations certified that Iran had met its obligations under the nuclear treaty signed last summer and that, accordingly, US and international sanctions would be lifted against the country. How did the “irrational” Iranians celebrate being allowed back into the international community?

They immediately announced a massive purchase of more than 100 passenger planes from the European Airbus company, and that they would also purchase spare parts from Seattle-based Boeing. Additionally, US oil executives have been in Tehran negotiating trade deals to be finalized as soon as it is legal to do so. The jobs created by this peaceful trade will be beneficial to all parties concerned. The only jobs that should be lost are the Washington advocates of re-introducing sanctions on Iran. Events this week have dealt a harsh blow to Washington’s neocons, who for decades have been warning against any engagement with Iran. These true isolationists were determined that only regime change and a puppet government in Tehran could produce peaceful relations between the US and Iran.

Instead, engagement has worked to the benefit of the US and Iran. Proven wrong, however, we should not expect the neocons to apologize or even pause to reflect on their failed ideology. Instead, they will continue to call for new sanctions on any pretext. They even found a way to complain about the release of the US sailors – they should have never been confronted in the first place even if they were in Iranian waters. And they even found a way to complain about the return of the four Iranian-Americans to their families and loved ones – the US should have never negotiated with the Iranians to coordinate the release of prisoners, they grumbled. It was a show of weakness to negotiate! Tell that to the families on both sides who can now enjoy the company of their loved ones once again!

Read more …

What they flee.

• Syria 4 Years On: Shocking Images Of A Post-US-Intervention Nation (ZH)

While US intervention in its various forms has likely been ongoing for decades, March 2011 is often cited as the start of foreign involvement in the Syrian Civil War (refering to political, military and operational support to parties involved in the ongoing conflict in Syria, as well as active foreign involvement). Since then the nation has collapsed into chaos with an endless array of superlatives possible to describe the economic and civilian carnage that has ensued. However, while a picture can paint a thousand words, these four shocking images describe a canvas of US foreign policy “success” that few in the mainstream media would be willing to expose… Mission un-accomplished?

Read more …

I’m getting a bit antsy seeing people presenting arguments as new that I’ve made umpteen times in the past. We move far too slow.

• The Economics Of The Refugee Crisis Lay Bare Our Moral Bankruptcy (Guardian)

The Germans want to introduce a pan-European tax to pay for the refugee crisis. The Danish want to pass a law to seize any jewellery worth more than £1,000 as refugees arrive – apart from wedding rings. That’s what marks you out as a civilised people, apparently, that you can see the romance in a stranger’s life and set that aside before you bag them up as a profit or a loss. In Turkey people smugglers are charging a thousand dollars for a place in a dinghy, $2,500 in a wooden boat, with more than 350,000 refugees passing through one Greek island – Lesbos – alone in 2015. The profit runs into hundreds and millions of dollars, and the best EU response so far has been to offer the Turkish government more money to either hold refugees in their own country or – against the letter and the spirit of every pledge modern society has made on refugees – send them back whence they came.

Turkey is a country of 75 million that has already taken a million refugees, accepting impossible and cruel demands from a continent of more than 500 million people that, apparently, can’t really help because of the threat to its “social cohesion”. Our own government has pledged to take 20,000 refugees but only the respectable ones, from faraway camps: the subtext being that the act of fleeing to Europe puts refugees outside the purview of human sympathy, being itinerant, a vagrant, on the take. Institutions and governments represent an ever narrower strain of harsh opinion. The thousands of volunteers in Greece, the Guardian readers who gave more at Christmas to refugee charities than to any appeal before, the grassroots organisations springing up everywhere to try and show some human warmth on this savage journey to imagined safety – none of these are represented, politically, in a discourse that takes as its starting point the need to make the swarms disappear, to trick them into going somewhere else.

It’s those neutral-sounding, just-good-economics ideas that give the game away: if a million people in any given European nation suffered a natural disaster, nobody would be talking about how to raise a tax so that help could be sent. We would help first and worry about the money second. When the EU wants to rescue a government, or the banks of a member state (granted, at swingeing cost for the rescued), it doesn’t first float a “rescue tax”. The suggestion that the current crisis needs its own special tax may well be an attempt to force individual governments to confront the reality of their current strategy, which is to have no strategy. Yet it sullies the underlying principle of the refugee convention: that anyone fleeing in fear for their life be taken in on that basis, not pending a whip-round.

To repudiate that is essentially to say that human rights are no longer our core business. But without that as an organising principle, the ties that bind one nation to another begin to fray: alliances must at the very least be founded on ideas you’re not ashamed to say out loud.

Read more …