Douglas Percy Bliss High Noon, Windley 1951

Macgregor

“I don’t think we’ll ever get to the 2024 election. Things will implode in Washington before that.” —Douglas MacGreggor pic.twitter.com/DlNgnkosMw

— Lord Bebo (@MyLordBebo) July 1, 2023

Russian Ministry of Foreign Affairs

https://twitter.com/i/status/1675246410684301314

“NATO without Ukraine is not NATO..” ?!

• Kiev Must Show ‘Battlefield Results’ In Next Ten Days – Zelensky (RT)

Ukraine wants to make some progress on the battlefield in its counteroffensive against Russia before the upcoming NATO summit, President Vladimir Zelensky said on Friday, although he admitted that this would lead to new losses. Speaking to several Spanish media outlets, the Ukrainian leader stated that Kiev has to “show results” before NATO leaders convene in Vilnius, Lithuania, on July 11, adding that “every kilometer costs lives.” Zelensky noted that “torrential rains… slowed down some processes quite a bit” and reiterated calls for Kiev’s Western backers to continue sending arms to Ukraine. He also claimed that Ukraine’s offensive operations conducted last autumn were undermined by the late arrival of artillery.

“We stopped because we couldn’t advance. Advancing meant losing people and we had no artillery,” he explained. “We are very cautious in this aspect. Fast things are not always safe.” The Ukrainian president also reiterated his long-standing demands that Kiev eventually be admitted to NATO. “NATO without Ukraine is not NATO,” he stated, claiming that there were no other armies on the continent like Ukraine’s that had the same battlefield experience. Zelensky’s comments come after Igor Zhovka, a deputy head of the president’s office, warned that the Ukrainian leader could skip the NATO summit altogether if the bloc did not make a serious commitment to Kiev’s accession. Earlier, Jens Stoltenberg, the head of the US-led military bloc, stated that any discussions about Ukraine’s membership could start only on the condition that it prevails over Russia.

Ukraine launched a large-scale offensive against Russian positions in early June but has failed to gain any ground and has suffered heavy losses, according to the Russian Defense Ministry. Zelensky himself has admitted difficulties, saying that the offensive is proceeding “slower than desired” in the face of “tough resistance” from Russian troops. According to a Financial Times report from earlier this week, Western officials have been unimpressed by Ukraine’s performance on the battlefield, with the paper’s sources noting that long-term Western support for Kiev is contingent on the eventual outcome of the offensive.

So start peace talks.

• Ukrainian Counteroffensive Will Be Long And ‘Very Bloody’ – Top US General (Az. )

Ukraine’s counteroffensive will be “very difficult” and achieving significant gains could take a long time, a top US military officer has warned, Report informs, citing Yahoo. Army general Mark Milley told the National Press Club in Washington that the counteroffensive was “advancing steadily, deliberately working its way through very difficult minefields … 500 meters a day, 1,000 meters a day, 2,000 meters a day, that kind of thing”.

Mr Milley said he was unsurprised progress was slower than some people predicted. He said: “War on paper and real war are different. In real war, real people die. Real people are on those front lines and real people are in those vehicles. Real bodies are being shredded by high explosives.” Mr Milley added: “What I had said was this is going to take six, eight, 10 weeks, it’s going to be very difficult. It’s going to be very long, and it’s going to be very, very bloody. And no one should have any illusions about any of that.”

“They are currently trying to confuse our intelligence, so along the entire line of contact on the Zaporozhye front, they are constantly maneuvering and transferring troops.”

• Ukraine Preparing for Second Stage of Counteroffensive in Zaporozhye (Sp.)

Ukraine launched its long-advertised counteroffensive in early June after multiple postponements. According to the Russian Defense Ministry, Ukrainian troops continue to try but are failing to advance along three directions: South Donetsk, Artemovsk (Bakhmut) and Zaporozhye, the latter being of primary focus. Ukrainian troops are preparing to attempt the second stage of a large-scale counter-offensive in the Zaporozhye region in the coming days, Vladimir Rogov, a senior official of the Zaporozhye regional administration, told Sputnik.

“The enemy is already prepared for the second stage of a full-scale offensive. It can start any day, at any moment. They are currently trying to confuse our intelligence, so along the entire line of contact on the Zaporozhye front, they are constantly maneuvering and transferring troops. This is being done in order to hide the location of the main forces,” Rogov explained. He added that Ukrainian forces could concentrate the main blow for a breakthrough at any location of the front line. “Over the past four weeks, they have conducted the maximum number of attempts at reconnaissance in combat, offensive options, breakthroughs, studying our reaction and interaction of units, plus regular shelling of our rear in order to hit infrastructure facilities – bridges, transport hubs, units, depots with equipment and ammunition, airfields,” Rogov told Sputnik.

Russia launched its special military operation in Ukraine in February 2022, after the Donetsk and Lugansk people’s republics appealed for help in defending themselves against Ukrainian provocations. In response to Russia’s operation, Western countries have rolled out a comprehensive sanctions campaign against Moscow and have been supplying weapons to Ukraine. On September 30, 2022, Russian President Vladimir Putin and the heads of the Donetsk and Lugansk people’s republics, as well as Kherson and Zaporozhye regions, signed agreements on the accession of these territories to Russia, following referendums that showed that an overwhelming majority of the local population supported becoming part of Russia.

aka never no talks.

• Kiev Ready For Talks If It Gains Control Of 1991 Border – Zelensky (TASS)

The government in Kiev will be ready to hold talks to end the conflict in Ukraine if its armed forces gain control of the borders that the country believes are recognized internationally, Ukrainian President Vladimir Zelensky said at a joint news conference with Spanish Prime Minister Pedro Sanchez on Saturday. These borders would include the Crimea, Donbass and the Zaporozhye and Kherson regions, the president said, when asked if Ukraine would be ready for talks if its troops regained control of the positions they had held before Russia started its special military operation in February 2022.

“Are we ready for diplomatic settlement and what kind of diplomatic settlement are we ready for if we’re at the borders as of February 24?” Zelensky said, repeating a question from a reporter, according to a video of the news conference that he posted to Telegram. “It wasn’t our borders on February 24, it was a line of engagement,” he went on to say. “And so we emphasize once again: Ukraine will be ready for some format of diplomacy when we are really on our borders, on our real borders according to international law.” Zelensky also brought up the issue of the country’s much-desired NATO membership. He said he believes that there is every reason for the alliance to invite the country to join when the bloc convenes for a summit in Vilnius on July 11-12. He said he was expecting a clear signal in this context.

“..not only are they legitimate targets under the laws of war, but also the fact that they themselves most likely lack any protections under international humanitarian law..”

• Ukraine’s Growing Addiction to Foreign Mercenaries (Scott Ritter)

A Russian missile strike on a popular restaurant in the city of Kramatorsk has set off a wave of discussion over the presence of foreign military personnel in Ukraine. The Russian Ministry of Defense has described the target as a gathering place for the command and officers of the 56th Separate Motorized Infantry Brigade of the Ukrainian army and claims to have killed scores of Ukrainian soldiers—and foreign mercenaries. While the Ukrainian government has not made any mention of the presence of foreign volunteers/mercenaries at the Del Rio Pizzeria, video from the scene of the attack shows numerous personnel in uniform, many of whom are obviously foreigners, congregated at the scene, providing first aid, and helping rescue victims.

The presence of military vehicles near the destroyed restaurant reinforces the Russian contention that there was a congregation of military personnel at the time of the attack. This would appear to lay to rest any question about the legality of the Russian strike—it conformed with the accepted precepts set forth under the laws of war. The legal status of the foreign personnel working alongside the Ukrainian army is not so certain. The fact that many are dressed in camouflage uniforms and engage in social media activity which advertises the military/paramilitary aspects of the work they are engaged in only reinforces the reality that not only are they legitimate targets under the laws of war, but also the fact that they themselves most likely lack any protections under international humanitarian law when it comes to being treated as lawful combatants.

The lack of legal status, however, does not appear to serve as a deterrent for the scores of foreign soldiers of fortune that had congregated at the Del Rio Pizzeria, or the thousands of others who, like them, had travelled to Ukraine to participate in a war with Russia that is entering its sixteenth month, and which has taken the lives of hundreds of thousands of people, most of whom are combatants fighting on the side of Ukraine. The presence of these foreigners in such numbers under such conditions is suggestive of two unescapable realties: that there is a high demand for their services, and that foreign governments are actively facilitating the availability of personnel possessing skill sets attractive to the Ukrainian military.

An examination of the 56th Motorized Infantry Brigade might provide better insight into both the role played by the foreigners that had been congregated in Kramatorsk, and the scope and scale of their involvement. When the Special Military Operation began, the 56th Brigade was stationed in Mariupol, and was in the process of transitioning into a naval infantry (Marine) unit. The brigade was largely destroyed in the subsequent fighting for the city, and the surviving remnants reconstituted using mobilized personnel from the territorial forces. Most recently, the 56th Brigade was operating in the vicinity of the city of Bakhmut, where once again it suffered heavy casualties.

“US National Security Council Strategic Communications Coordinator John Kirby [..] underscored that the United States saw no Russian intentions to use nukes amid the Ukraine crisis.”

• Medvedev Raises Specter Of Poland Using Nuclear Weapons (TASS)

The potential deployment of nuclear weapons to Poland may prompt the country to use them, Russian Security Council Deputy Chairman Dmitry Medvedev told TASS. Commenting on Poland’s ambitions to take part in NATO’s Nuclear Sharing program, he said, “The only danger arising from the request to deploy nuclear weapons to Poland is that such weapons will be used.” Earlier, Polish Prime Minister Morawiecki announced that Warsaw would like to join NATO’s Nuclear Sharing program amid Russia’s intentions to deploy tactical nuclear weapons to Belarus. Speaking during an online press briefing on Friday, US National Security Council Strategic Communications Coordinator John Kirby said that he has absolutely nothing to say about this kind of negotiations. However, he underscored that the United States saw no Russian intentions to use nukes amid the Ukraine crisis.

On March 25, Russian President Vladimir Putin announced that, at Minsk’s request, Moscow would deploy its tactical nuclear weapons in Belarus, similar to what the United States has long been doing on the territory of its allies. Moscow has already provided Minsk with Iskander tactical missile systems capable of carrying nuclear weapons and has helped Minsk to re-equip its military aircraft to carry specialized weapons. As well, Belarusian missile crews and pilots have undergone training in Russia. On June 16, Putin said that the first Russian nuclear warheads had already been delivered to Belarus, while the rest would arrive before the end of this year. On June 23, Belarusian leader Alexander Lukashenko said that his republic had already received a substantial portion of warheads that were planned to be delivered.

“..He is, after all, no matter how cunning financially, an ex-hot dog cart owner with no political or military accomplishments.”

• Prigozhin’s Folly (Seymour Hersh)

[..] below is a look at what is really going that was provided to me by a knowledgeable source in the American intelligence community: “I thought I might clear some of the smoke. First and most importantly, Putin is now in a much stronger position. We realized as early as January of 2023 that a showdown between the generals, backed by Putin, and Prigo, backed by anti-Russian extremists, was inevitable. The age-old conflict between the ‘special’ war fighters and a large, slow, clumsy, unimaginative regular army. The army always wins because they own the peripheral assets that make victory, either offensive or defensive, possible. Most importantly, they control logistics. special forces see themselves as the premier offensive asset. When the overall strategy is offensive, big army tolerates their hubris and public chest thumping because SF are willing to take high risk and pay a high price. Successful offense requires a large expenditure of men and equipment. Successful defense, on the other hand, requires husbanding these assets.

“Wagner members were the spearhead of the original Russian Ukraine offensive. They were the ‘little green men’. When the offensive grew into an all-out attack by the regular army, Wagner continued to assist but reluctantly had to take a back seat in the period of instability and readjustment that followed. Prigo, no shy violet, took the initiative to grow his forces and stabilize his sector. “The regular army welcomed the help. Prigo and Wagner, as is the wont of special forces, took the limelight and took the credit for stopping the hated Ukrainians. The press gobbled it up. Meanwhile, the big army and Putin slowly changed their strategy from offensive conquest of greater Ukraine to defense of what they already had. Prigo refused to accept the change and continued on the offensive against Bakhmut. Therein lies the rub. Rather than create a public crisis and court-martial the asshole [Prigozhin], Moscow simply withheld the resources and let Prigo use up his manpower and firepower reserves, dooming him to a stand-down. He is, after all, no matter how cunning financially, an ex-hot dog cart owner with no political or military accomplishments.

“What we never heard is three months ago Wagner was cycled out of the Bakhmut front and sent to an abandoned barracks north of Rostov-on-Don [in southern Russia] for demobilization. The heavy equipment was mostly redistributed, and the force was reduced to about 8,000, 2,000 of which left for Rostov escorted by local police. “Putin fully backed the army who let Prigo make a fool of himself and now disappear into ignominy. All without raising a sweat militarily or causing Putin to face a political standoff with the fundamentalists, who were ardent Prigo admirers. Pretty shrewd.” There is an enormous gap between the way the professionals in the American intelligence community assess the situation and what the White House and the supine Washington press project to the public by uncritically reproducing the statements of Blinken and his hawkish cohorts.

The current battlefield statistics that were shared with me suggest that the Biden administration’s overall foreign policy may be at risk in Ukraine. They also raise questions about the involvement of the NATO alliance, which has been providing the Ukrainian forces with training and weapons for the current lagging counter-offensive. I learned that in the first two weeks of the operation, the Ukraine military seized only 44 square miles of territory previously held by the Russian army, much of it open land. In contrast, Russia is now in control of 40,000 square miles of Ukrainian territory. I have been told that in the past ten days Ukrainian forces have not fought their way through the Russian defenses in any significant way. They have recovered only two more square miles of Russian-seized territory. At that pace, one informed official said, waggishly, it would take Zelensky’s military 117 years to rid the country. of Russian occupation.

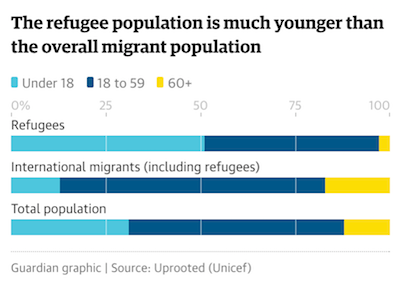

“Brussels is calling for mandatory migrant quotas once again. The Soros-empire strikes back..”

• Orban: ‘Weak Nations Will Perish, Strong Will Survive’ (Sp.)

Hungary must strengthen its own defense capabilities and law enforcement agencies, as the time will come when weak nations will perish, and only the strong ones will remain, Hungary’s Prime Minister Viktor Orban said on Saturday. “We need a strong country, a strong government, a strong economy, a strong army and, last but not least, strong law enforcement agencies… We have to train and equip ourselves,” Viktor Orban declared at a graduation ceremony at the Faculty of Law Sciences of the National University of Public Administration (NKE) in Budapest. 166 students of the Faculty of Law Enforcement were taking their oath of office at the event attended by Orban, Minister of the Interior Sandor Pinter, and Minister of National Defense Kristof Szalay-Bobrovniczky.

The prime minister warned that the world is experiencing tremendous upheavals, and “strong people are greatly needed, because the truth is worth little without strength.” Orban emphasized that Hungary must face up to the challenge that thousands of migrants from the south are “besieging our borders.” In June, Viktor Orban had slammed the European Union’s newly-adopted quotas for the equitable resettlement of migrants from the Middle East and across the Mediterranean Sea in EU member states. “Brussels is calling for mandatory migrant quotas once again. The Soros-empire strikes back,” Orban tweeted at the time. Addressing graduates on Saturday, the Hungarian PM emphasized that crime levels had gone down in the country, and today, “Hungary is one of the safest countries in Europe, or perhaps the safest,” and we are all proud of that.

As far back as in 2019, Viktor Orban has been urging the need for Hungary to beef up its military to defend itself. “I belong among those who consider NATO important, but I don’t think Hungary’s military security can be based on NATO… We need to be able to avert attacks with our own power,” Orban told US media at the time. Orban also advocated for Europeans to be able to address security threats without US assistance. In 2022, the PM said that Hungary will speed up its defense development program to “radically increase our defense capabilities.” He also emphasized that his country would not only refrain from supplying weapons to its neighbor, Ukraine, after the conflict there escalated, but would not permit such deliveries to transit through Hungarian territory.

This was a matter of national security, Peter Szijjarto, minister of foreign affairs, underscored. On May 2-23, Hungary blocked the European Union from allocating its eighth €500 million aid package from the so-called European Peace Fund to pay for military assistance to the Kiev regime. Orban has insisted that the ongoing hostilities stem from a “failure of diplomacy.” The politician has also offered especially harsh criticism of the European Union’s aggressively anti-Russian policies. Rather than pursuing a strategy of further ramping up tensions, the veteran Hungarian leader urged an immediate end to escalation by the West.

“.. Sweden has traditionally been unaligned and that “neutrality was important for Sweden before,” adding that “ought to remain that way.”

• Sweden Should Reconsider Turmoil It Would Become Part of in NATO – Maloof (Sp.)

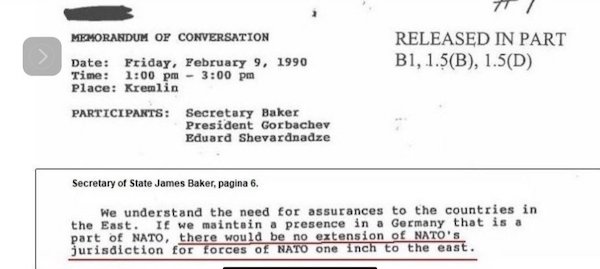

Ankara and Stockholm already have a rocky relationship as the Scandinavian state seeks to join the NATO alliance, but Turkiye has conditioned its assent for Sweden’s admission based on the ending of its support for Kurdish nationalist groups that Ankara considers terrorist organizations. Michael Maloof, a former senior security policy analyst in the US Office of the Secretary of Defense, told Sputnik that both Sweden and NATO should consider what benefit is gained by adding the Scandinavian state to the alliance, especially given the kind of tensions that further NATO expansion to the East is likely to create in the region. Maloof explained that NATO’s policy “seems to be to contain Russia at all costs, never mind anybody else and what their political considerations might be.

“I think it’s been damaging for Europe generally to have this kind of an expansion. It certainly has alarmed [Russian President Vladimir] Putin to the point that he basically said ‘it’s a red line if you do it in Ukraine,’ and they attempted that, and we saw the reaction, it had to do with fundamental security.” “The United States does not appreciate the sensitivities and the security concerns, historically, of Russia, and previous to that in the Soviet Union. When the Cold War was over, NATO expanded, but the Warsaw Pact went away. And so that raises a very serious question: what’s the point and purpose of NATO’s continued existence? Before [the conflict in] Ukraine, they were looking around for a new purpose. We had them looking into space, looking at the Arctic, NATO officials now are looking into the Asia-Pacific.

What is that? What’s that all about? What’s the point? It really raises questions about what the concerns are, really, about dominance and the need by the United States and using NATO as a basis to extend its hegemony everywhere – and at what cost,” Maloof said. The former Pentagon official noted that Sweden has traditionally been unaligned and that “neutrality was important for Sweden before,” adding that “ought to remain that way.” Stockholm already has its own security arrangements with other Scandinavian countries separate from the NATO alliance, and expanding that to include 31 other states across Europe “can have repercussions.”

RFK Jr.’s running mate?

• Tulsi Gabbard Slams Biden for Nuclear Warmongering (Sp.)

Former US presidential contender and ex-lawmaker Tulsi Gabbard has accused US President Joe Biden of pushing the world to the brink of a possible nuclear war as the Ukrainian conflict continues to escalate. “We are faced with the reality. Now, President Biden’s actions and policies have pushed us to the brink of nuclear war. This is an existential crisis, not only for us here, but the world. This proxy war against Russia using the Ukrainian people’s lives continues to escalate,” Gabbard said on Saturday at a meeting in a university in Centennial, the US state of Colorado, which was broadcast on her social media.

The politician also said that NATO’s weapons delivery to Ukraine would “only increase the likelihood” of a possible direct confrontation between the United States, NATO member states and Russia. “Now if you hear President Biden and his administration … talk about this, they talk about World War III and nuclear war as though it is just another war, just another conflict … it is so far removed from the reality … they are not being honest with the American people what the cost and consequences of these wars would look like,” Gabbard added.

Western countries have been providing financial, humanitarian and military support to Ukraine since the start of Russia’s military operation in February 2022. The support evolved from lighter artillery munitions and training in 2022 to heavier weapons, including tanks, later that year and in 2023. Russia has been warning countries giving weapons to Ukraine that it sees military shipments as legitimate targets. Moreover, Russian Foreign Minister Sergey Lavrov has said that NATO allies’ arming and training Ukrainians is tantamount to a direct involvement in the conflict.

This caught my eye: As “core inflation” rose over 5%, gas prices were cut in half. Odd.

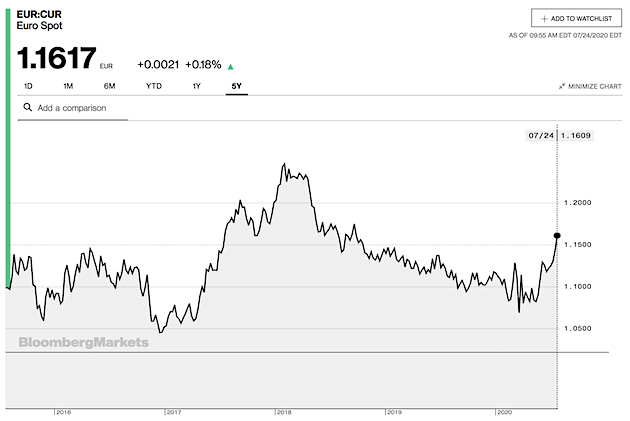

• Prices Rising Across The Eurozone (RT)

Core inflation in the euro area accelerated and stayed stubbornly high in June, a preliminary reading revealed on Friday. Head inflation in the 20 countries that share the euro hit 5.5% this month, coming in slightly lower than analyst projections. But core inflation, which excludes energy and food, remained high and surged to 5.4% as price growth in the service sector also rose to 5.4%, up from 5.0% recorded in April. “The core rate is likely to remain well above the 5% mark in the next months which will [require] further rate hikes by the ECB,” said Ulrike Kastens, an economist for Europe at DWS.

Although the Eurozone’s core inflation eased somewhat from 5.6% in April to 5.3% in May, the latest deterioration may eclipse an improvement in the headline inflation gauge, economists warn. “Base effects and statistical distortions are likely to keep the core reading elevated over the next couple of months and see the ECB hiking at least until September,” said Bloomberg’s senior economist, Maeva Cousin. Consumer price growth will be closely monitored by the European Central Bank, which hiked interest rates to their highest level in 22 years on June 15. The regulator moved the benchmark rate by 25 basis points to 4%, in a ninth consecutive rate hike.

“..abnormally warm weather, high level of gas in storage facilities and reduced demand for gas in the EU..”

• Gas Prices Fall 50% In Europe (Az.)

The price of gas in Europe in January-June 2023 fell by half, to about $425 per 1,000 cubic meters, Report informs via TASS. The main factors behind this decline were abnormally warm weather, high level of gas in storage facilities and reduced demand for gas in the EU. On December 30, 2022, gas futures were trading at about $845 per 1,000 cubic meters, but on June 30, 2023, trading closed at $425 – 50% lower compared to the beginning of the year.

And the IMF accepts it.

• Dedollarization Accelerates: Argentina Makes IMF Payment Using Yuan, SDR (Sp.)

The US dollar, which has enjoyed the status of de facto world reserve currency since 1945, has come under growing strain as countries search for alternatives amid Washington’s efforts to use its financial might to bully and sanction adversaries into submission. Argentina made a loan repayment to the International Monetary Fund worth the equivalent of $2.7 billion “without using dollars” on Friday, using Chinese yuan and special-drawing rights notes (the IMF reserve asset based on a basket of five currencies – the yuan, the euro, the dollar, the yen, and the pound) instead. Argentina’s Economy Ministry said the payment – the first ever of its kind by Buenos Aires, was made in yuan and SDRs to hang on to dwindling dollar reserves in the Argentinian Central Bank’s coffers.

The Latin American nation, which is in the grip of a major economic and debt crisis, has turned to yuan as one means to help stabilize the situation, signing a 130 billion yuan ($19 billion) currency swap agreement with Beijing in April amid plummeting agricultural exports caused by an unprecedented drought, which has already caused $20 billion in damage. Argentina and the IMF reached an agreement in 2022 to restructure the nation’s $44 billion debt. The IMF had approved a $57 billion loan to the administration of now former President Mauricio Macri in 2018, with current President Alberto Fernandez left to clean up the consequences of what he has dubbed “reckless,” “toxic and irresponsible” borrowing.

After his election in 2019, Fernandez asked the IMF not to move forward with transferring the remainder of the loan amount, citing a dearth of dollars in the nation’s coffers to pay it back with. Argentina’s economic crisis has resulted in inflation topping 110 percent, and poverty reaching 40 percent of the population, even as GDP continues to grow, rising 1.3 percent year-on-year in the first quarter of 2023. International reserves have dwindled to about $28 billion, their lowest since 2016.

“..her father returned from a deployment to Afghanistan. During the nightly fireworks show, he cowered in a fetal position while his family looked on.”

• US Military Veterans Tell Family Members Not To Enlist – WSJ (RT)

The US military’s recruiting woes have reportedly intensified as current and former troops increasingly advise their family members against enlistment, weakening a tradition of multi-generation service that has historically been the nation’s primary source of new soldiers. Veterans have soured on recommending that loved ones follow in their footsteps in the face of a tight labor market and rising concerns over low pay, debilitating injuries, suicides, and indecisive wars, the Wall Street Journal reported on Friday. The recruiting crisis also comes amid controversy over the Pentagon’s prioritization of left-wing issues, such as transgenderism and critical race theory.

The sudden end of the Afghanistan war in August 2021 added to the consternation of some current or former troops, such as US Navy veteran Catalina Gasper, the WSJ said. “We were left with the gut-wrenching feeling of, ‘What was it all for?’” said Gasper, who still suffers from a traumatic brain injury incurred during a Taliban attack on her base in Kabul. She vowed to do all she could to make sure her children never join the military. “I just don’t see how it’s sustainable if the machine keeps chewing up and spitting out” our young people.

Likewise, US Air Force officer Ernest Nisperos decided that he did not want his children to join the military after realizing the toll that his deployments took on him. One of his daughters, Sky Nisperos, said that after years of dreaming about following her father and grandfather into military service, she would instead become a graphic designer. One event that stuck in her mind came during a 2019 family trip to Disneyland after her father returned from a deployment to Afghanistan. During the nightly fireworks show, he cowered in a fetal position while his family looked on.

The video and the Twitter thread below explain what is happening. It’s serious. Twitter must protect itself and its users.

• Musk Explains New Twitter Limits (RT)

Twitter owner Elon Musk announced on Saturday that users of the platform will be limited to viewing a maximum of 8,000 posts per day, claiming that the measure would cut down on “data scraping and system manipulation.” Musk’s announcement came hours after Twitter users around the world found themselves unable to view their timelines or read comments under tweets. “To address extreme levels of data scraping & system manipulation, we’ve applied the following temporary limits,” Musk tweeted, explaining that verified accounts would be limited to reading 6,000 posts per day, unverified accounts to 600 posts per day, and new unverified accounts to 300 per day. Shortly afterwards, Musk posted an update saying that the limits would be increased to 8,000, 800, and 400 respectively. He did not say for how long the “temporary” limits would remain in force.

Since purchasing Twitter for $44 billion last October, Musk has repeatedly promised to clamp down on non-human use of the platform, for example by data-mining companies. As of Friday, Twitter has not been viewable to anyone without an account, a decision that Musk said was made as “several hundred organizations (maybe more) were scraping Twitter data extremely aggressively, to the point where it was affecting the real user experience.” Concurrently, Musk has been encouraging users to shell out for verification, which costs $8 per month. The prospect of ten times more tweets, however, has not gone down well with users, and as of Saturday evening, “#RIPTwitter” and “Goodbye Twitter” were trending topics in the US.

American whistleblower Edward Snowden explained that he could no longer use Twitter effectively as, for security reasons, he often browses the platform without logging in. Other users who follow breaking news stories on Twitter – for example updates from the conflict in Ukraine – complained that even when verified they burn through their allocated tweets in a matter of hours. It remains unclear whether Musk will keep the new restrictions in place. Shortly after purchasing Twitter last year, the billionaire said that he would end up doing “lots of dumb things” in his bid to overhaul the platform, and would “keep what works and change what doesn’t.”

Scraping

Wow. Musk has no idea the DARPA rattlesnake he just stepped on by this doing this…

My take on @elonmusk’s new rate limit policy, from the lens of the censorship industry: https://t.co/AZ5SPIgHiz pic.twitter.com/Rw4KBZsT9O

— Mike Benz (@MikeBenzCyber) July 1, 2023

Twitter thread.

• Twitter’s Rate Limiting Is Temporary (S.I.R.)

Some people asked me to share what I just shared in a space about the rate limits. I don’t work for Twitter but, I do architect IT cloud solutions as my day job. It is temporary. Twitter’s rate limiting is not what everyone is thinking it is. It is not to punish non-paying users. “Data scraping” is a big deal. This is where automated systems load the website or app and pull your tweets/data. It’s a huge security issue. Automated systems are pulling every tweet/word/user account information to store in an unknown database somewhere else. This could be state actors like China, the US Government, Australia, or other bad political actors like PAC’s that are trying to gain access to everyone’s information to analyze and use for nefarious things.

Manipulating what is said on the site can be done at scale with data scrapping. It could also be used to figure out the identity of Anons or to punish people in their country for what they tweet. Looking at you #Australia and #Canada and #UnitedKingdom. The temporary measures of limiting tweets is to protect users just as much as it is to protect the entire Twitter network from going down. They are currently scrambling to get ahead of this and tune their network security to block it from happening again. It’s also important to note that twitter has 500,000+ servers. That’s not free. In cloud data centers, the companies that use them have to pay for what is called “ingress and egress” of data going “in and out” of the servers.

A data scrapping event that is large enough for them to start limiting means that it was a MASSIVE event that could be considered an attack on the site. It would also put massive load on their servers and cost them so much money it could threaten the site’s financial ability to keep running. It could be on purpose to put twitter out of business from cost alone. Many people are misunderstanding why @elonmusk wants people to pay for twitter or for the twitter API (a programming interface that can pull data for other sites and apps). The reason he wants people to pay is because if China or porn companies want to create massive bot farms of fake accounts, it is currently free.

These bad actors are highly skilled and operate like a business. They have professional staff that continuously change their tactics and Twitter engineers have to fight 24/7 to stay ahead of them. If they have to pay for every account or pay to use the API, it would cost them A LOT of money. This limits the amount of people who could create bots, put automated porn on here, and the hacking/scrapping/DDOS attacks on the site. It protects you. It also guarantees twitter will continue to exist without bloating it with tons of ads. This is all a part of the plan to create a free-speech place we can enjoy without being controlled by outside actors or advertising companies. I know $8 is a lot to some people but, it is for many reasons. None of the reasons are to hurt or punish people.

SoF

Child trafficking is why I started posting on social media. I watched a Tim Ballard interview and it got me fired up. GODS CHILDREN ARE NOT FOR SALE.

share this trailer. It’ll make you tear up.

I’m currently fighting back tears in a coffee shop tweeting this.

Go watch this… pic.twitter.com/tXM5ip94B9

— Gentry Gevers (@GentryGevers) June 27, 2023

Cat

Happy #Caturdaypic.twitter.com/GDZ1sCn906

— Larry the Cat (@Number10cat) July 1, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.