DPC St. Catherine Street, Montréal, Québec 1916

With a graph that offers perspective.

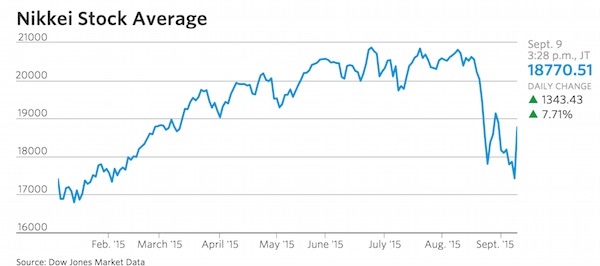

• Japan Shares Jump Most in Seven Years (WSJ)

Stocks in Japan jumped the most in more than seven years on Wednesday, shaking off unease about slowing growth in China amid a tentative rebound in Chinese stocks. The Nikkei Stock Average jumped 7.7%, or 1343.43, to 18770.51, marking the benchmark’s biggest daily percentage gain since October 2008. In point terms, it was the biggest gain since January 1994. A broad rally for shares and currencies comes after markets in the region fell Tuesday on weak Chinese trade data that had stoked concerns about a further slowdown in the world’s second-largest economy. Japanese stocks hit a seven-month low Tuesday. But on Wednesday, investor sentiment toward China took a positive turn.

China’s finance ministry said Tuesday evening that the country would roll out a “more forceful” fiscal policy to stimulate economic growth, which it said faced downward pressure. The Ministry of Finance said in a statement that it would allocate more funds to support some infrastructure projects and implement tax cuts for small businesses. It also said it would accelerate the approval process for duty-free stores to boost construction. “Authorities [have] released a slew of policies aimed at rebuilding investor confidence by introducing mid-to-long term market-regulating measures,” said Jacky Zhang, an analyst at BOC International.

Optimism that China was taking steps to help its economy gave the Shanghai Composite Index a 1.7% boost and sent the Hang Seng Index 3% higher. “Any signal that [China’s] government is going to do more to support growth is going to help sentiment,” especially measures on top of monetary easing, added Bernard Aw, market analyst at IG. Beijing has approved nearly 200 billion yuan of infrastructure projects since July, according to an article by state-owned Securities Daily Wednesday.

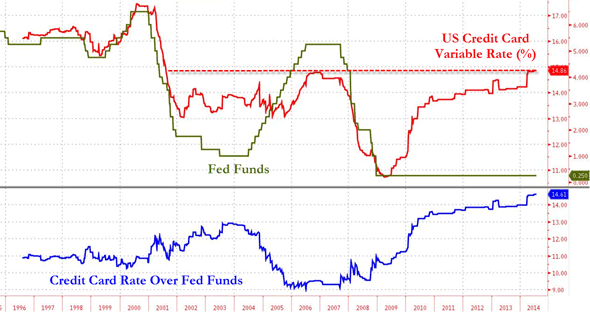

The Fed is in a bind. Not hiking rates would mean losing credibility after all the talk about it, and it would signal they don’t think the US economy is all that strong, after all the talk about that. Mind you, if it does raise rates, it will be on the back of made-up numbers, but that’s all we have left for the US, as for China.

• Bond Market Sends Fed All-Clear to Raise Interest Rates (Bloomberg)

Janet Yellen has the fixed-income market just where she wants it: ripe for the first increase in U.S. interest rates since 2006. Just about every indicator is telling the Federal Reserve Chair a move at next week’s policy meeting would cause government bonds little disruption. Her guidance has money markets pricing an extraordinarily slow pace of tightening, volatility metrics show no signs of panic, and forwards indicate benchmark rates will remain contained. Differences between shorter- and longer-term yields are flashing a positive signal for the economy. A green light from Treasuries is vital to avoid derailing the recovery that Yellen has nurtured because they help determine borrowing costs for businesses and consumers. Acting decisively now may even lend investors greater confidence in the outlook for growth.

“The debt markets have priced in a lot and it’s now time for the Fed to take advantage of that,” said Peter Tchir at Brean Capital, which has clients ranging from hedge funds and pension funds to money managers specializing in fixed-income markets. “The 10-year Treasury is at a very comfortable point, with forwards showing even a Fed hike won’t move yields much higher,” Tchir said. “Once we get through the first increase, and see the economy can do fine, it will remove the looming worry.” Bond investors have had plenty of time to get comfortable with the idea that interest rates are going to rise from near zero. As long ago as March, the Fed introduced the possibility of a move in 2015.

Policy makers said more recently they intended to act before year-end, assuming continued improvement in the labor market, as they were confident inflation would move back toward their 2% goal. With the unemployment rate at a seven-year low, futures trades are pricing in a 30% likelihood of an increase this month and 59% odds of a tightening before Dec. 31. The Fed will announce its next policy decision on Sept. 17. Even when the Fed does move, communication tools such as officials’ estimates for the future evolution of interest rates and Yellen’s own press conference may help assuage market nerves. “It’s not only about the move itself, it’s also about the statement,” said Christoph Kind at Frankfurt Trust. If “the Fed makes clear that there is a lot of time until the next hike, then there might be some relief and that could be good news.”

But does the Fed care? Surely emerging markets are not part of its mandate?!

• World Bank Economist Warns Fed Hike Could Harm Emerging Economies (WSJ)

The Federal Reserve should hold off raising rates at its policy-setting meeting later this month until global economies are stronger, Kaushik Basu, chief economist at the World Bank, said in a newspaper interview published Tuesday. An increase in rates at the Fed’s meeting next week would risk creating “panic and turmoil” in emerging markets, and would lead to “fear capital” leaving those nations along with swings in their currencies, Mr. Basu told the Financial Times. “I don’t think the Fed lift-off itself is going to create a major crisis but it will cause some immediate turbulence,” he told the newspaper. With the world economies “looking so troubled,” he said, “if the U.S. goes in for a very quick move in the middle of this, I feel it is going to affect countries quite badly.”

Where the Fed can find fodder to raise rates despite all predictions that it won’t.

• Deutsche Bank: The U.S. Dollar Rally Is “Rotating, not Ending” (Bloomberg)

Depending on which index you look at, King Dollar either gave back ground in August’s market turmoil or continued to grind higher. The most commonly cited U.S. dollar index, the DXY, retreated over the course of the month, while the Federal Reserve’s broad trade-weighted dollar index rose to its highest level since September 2003. The euro and the yen account for more than a 70% weighting in the DXY, while the broad trade-weighted dollar index, as the name suggests, tracks the greenback’s value relative to a greater array of foreign currencies. The yen and euro both gained, while stock markets tumbled, as investors unwound the popular bets made against these currencies, which also benefited from safe-haven flows.

“Fed rate expectations adjusted more than [European Central Bank] and [Bank of Japan] QE expectations (markets delayed Fed hikes but didn’t price-in more ECB/BoJ easing),” wrote researchers at Deutsche Bank, who expect the U.S. dollar to recoup its recent losses against those currencies over the next six months. The Chinese yuan, which is included in the trade-weighted dollar index but not the DXY, was devalued during the month. These two factors are at the heart of the gap between the two dollar indexes in August. And this divergence, according to Deutsche, reinforces that the U.S. dollar “upcycle” that began in 2011 is “rotating, not ending: from developed markets, to commodity foreign exchange, and now to China and Asia foreign exchange.”

Meanwhile, Goldman Sachs’s Aleksandar Timcenko and Kamakshya Trivedi have pointed out that the broad gains made by the U.S. dollar were much more a function of weakness in the other part of the currency pairs. They looked at emerging market currencies more generally, seeking to isolate how much of those foreign exchange moves over the past month could be attributed only to a U.S. dollar factor. They found that “the degree of focus on the USD factor in emerging market foreign exchange markets has waned substantially over the past month, and is near the lowest levels of the year.” Issues specific to emerging markets, they concluded, have been in the driving seat for the past month.

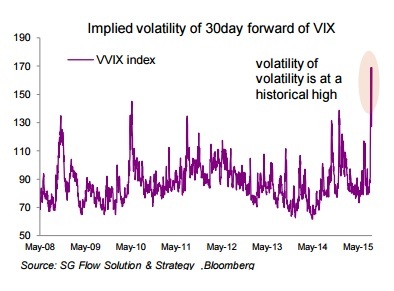

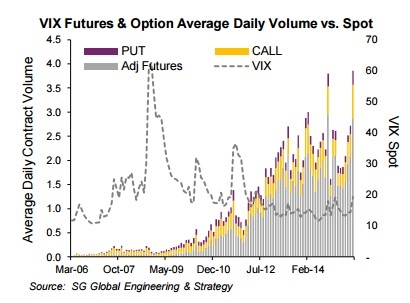

“..the explosion in the popularity of volatility trading is now feeding on itself..”

• Market Volatility Has Changed Immensely (Tracy Alloway)

On Aug. 24, as global markets fell precipitously, one thing was shooting up. The Chicago Board Options Exchange’s Volatility Index, the VIX, briefly jumped to a level not seen since the depths of the financial crisis. Behind the scenes, however, its esoteric cousin, the VVIX, did one better. For years, the VIX has been Wall Street’s go-to measure for expected stock market volatility. Derived from the price of options on the S&P 500, the volatility index has evolved into an asset class of its own and now acts as a benchmark for a host of futures, derivatives and exchange-traded products to be enjoyed by both big, professional fund managers and ‘mom and pop’ retail investors.

The dramatic events of last month underscore the degree to which the explosion in the popularity of volatility trading is now feeding on itself, creating booms and busts in implied volatility. Even as the VIX reached a post-crisis intraday high, the VVIX, which looks at the price of options on the VIX to gauge the implied volatility of the index itself, easily surpassed the levels it reached in 2008. Analysts, investors and traders point to two market developments that have arguably increased volatility in the world’s most famous volatility index, beginning with the rise of systematic strategies.

Such strategies fall under a host of names including commodity trading advisers (CTAs), volatility overlays, dynamic hedging and risk parity*, though it’s worth noting that many types of buy-side players have been dabbling in such techniques as they seek to boost returns in an era of historically low interest rates and suppressed market moves. When there’s a sudden spike in volatility, as there was last month, the price of near-term VIX futures rises. Meanwhile, volatility players – notably hedge funds and CTAs – scramble to buy protection as they either seek to hedge or cover short positions, causing a feedback loop that encourages near-term futures to rise even more.

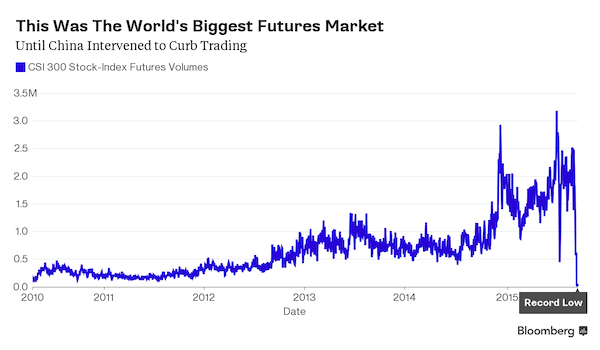

A biggie.

• China Just Killed the World’s Biggest Stock-Index Futures Market (Bloomberg)

Add the world’s biggest stock-index futures market to the list of casualties from China’s interventionist campaign to stop a $5 trillion equity rout. Volumes in the country’s CSI 300 Index and CSI 500 Index futures sank to record lows on Tuesday after falling 99% from their June highs. Ranked by the World Federation of Exchanges as the most active market for index futures as recently as July, liquidity in China has dried up as authorities raised margin requirements, tightened position limits and started a police probe into bearish wagers. While trading in Chinese equities has also slumped amid curbs on short sales and an investigation into computer-driven orders, the tumble in futures volumes may cause even greater damage because of their central role in the investment strategies of domestic hedge funds and other institutional money managers.

A failure to revive the market would undercut the government’s own efforts to attract professional investors to local stock exchanges, where individuals still account for more than 80% of trades. “It is further evidence that the Chinese authorities are not yet ready to commit to freely trading markets,” said Tony Hann at Blackfriars Asset Management. “Fully functioning developed financial markets in China will take many years.” Chinese policy makers, intent on ending a selloff that has eroded confidence in their management of the economy, are targeting the futures market because selling the contracts is one of the easiest ways for investors to make large wagers against stocks.

It’s also a favored product for short-term speculators because the exchange allows participants to buy and sell the same contract in a single day. In the cash equities market, there’s a ban on same-day trading. Yet futures are also a popular tool among sophisticated investors with longer-term horizons. For hedge funds, they provide an easy way to adjust exposure to market swings. And large institutions use them to make cost-effective asset-allocation changes. As an example, selling index futures might be cheaper than unloading a large block of shares – an order that could put downward pressure on prices. A sustained slump in liquidity may spur some institutional investors to “give up hedging in futures, unwind futures positions and reduce their stock positions,” said Dai Shenshen at SWS Futures in Shanghai.

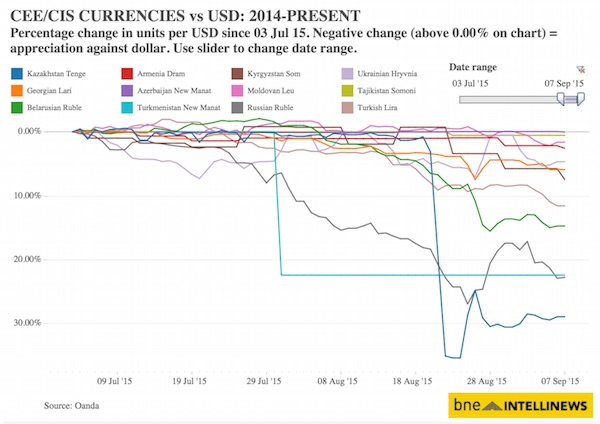

There are lots of them.

• Perfect Storm Continues To Hammer EM Currencies (BNE)

The Belarusian ruble was the world’s worst performing currency last week, hitting a record low against the dollar on August 28. A combination of market jitters over China’s economy and rising geopolitical tensions has had damaging consequences for many emerging market (EM) currencies, with the Turkish lira also hitting historic lows against the dollar. The Belarusian currency has been following the Russian ruble’s downward spiral, hit by a slump in oil prices and emerging market sell-offs. The Turkish lira also weakened to an all-time low and Turkish stocks fell on September 7 after the Kurdistan Workers’ Party (PKK) killed 16 soldiers in a single attack on September 6 in the conflict-riven southeast of the country.

The teetering Turkish currency combined with the unrest has rattled investors, causing more concerns over security ahead of the November snap election. The political uncertainty emerged after June’s inconclusive parliamentary elections kept the local currency under pressure. Falling as much as 1.29% in early trading following news of the attack on September 7, the lira weakened beyond the psychological barrier of TRY3 to the dollar. Shares dropped 1.28% on the back of the sharp decline in the lira. The lira has tumbled more than 20% this year against the dollar, making it one of the worst performing currencies on the EM landscape.

Concerns about the local currency are amplified by the prospects of a US interest rate increase later this year. Investors are also unnerved by the Turkish central bank’s reluctance to raise interest rates to defend the currency. Falling commodity prices and economic slowdowns in trading partner nations mean that Belarus and Turkey are not alone in their currency crises, with nearly all currencies in the former Soviet space taking a hit over the last month. China’s renminbi devaluation and the resultant crash in commodity prices have had a huge impact in emerging market sentiment across the globe, breeding anxiety in investors and hitting currency markets hard.

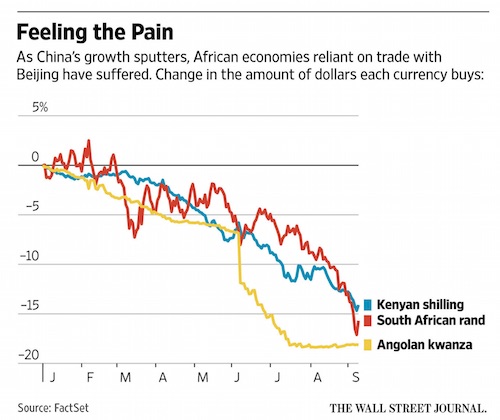

“The country hasn’t prepared itself by developing in other areas.” Channel New Zealand, Australia et al.

• China Slowdown Hits Major African Economies Hard (WSJ)

As the global oil-price slump passed its one-year anniversary in June, Angola’s President José Eduardo dos Santos booked a trip to Beijing. The long-serving autocrat hoped fresh loans and investment from China, Angola’s top trading partner, would buoy his country’s oil-dependent economy through choppy waters, according to financiers who do business with his government. On a weeklong visit, he signed a deal for China to build a $4.5 billion hydroelectric dam and a series of other projects. “China and Angola are good brothers and long-lasting strategic partners,” China’s President Xi Jinping said during meetings with Mr. dos Santos at the Chinese capital’s Great Hall of the People.

Now, Angola’s economic links to Beijing illustrate a broader problem across Africa: Nations that tied their fortunes to China find themselves hostage to its economy’s turbulence. President Xi is straining to arrest an economic slowdown in China, and that is aggravating a painful correction for oil-rich Angola, Beijing’s top African trading partner. Angolan importers are struggling to pay for critical items like medicine and grain. Moody’s Investors Service last week said rising government debt has put Angola at risk of a rating downgrade. Since January, the country’s kwanza currency has shed a quarter of its value against the U.S. dollar.

“Without the Chinese, there’s no money,” said one Angola-based financier, who said he feared retribution from Mr. dos Santos, whose family controls much of the economy. “The country hasn’t prepared itself by developing in other areas.” While forging closer economic ties with China, Angola and others also sought to consolidate their political power and aspire to Beijing’s state-led growth model. But those that bet on China’s demand for their oil and iron ore are realizing Beijing might not always be buying—and might not be able to teach them how to hang on to power indefinitely, either.

History rhymes.

• Boom, Bust And Broken Trust Mark The Ages Of Finance (John Kay)

In 1776, Adam Smith warned of the dangers of limited liability. Company directors were “the managers of other people’s money”. They could not be expected to watch over it with the “anxious vigilance” that partners would apply to their own cash. “Negligence and profusion,” Smith concluded, “must always prevail.” The South Sea bubble and other scandals of the early 18th century provided the background to Smith’s observation. For the next 150 years, corporate organisation was viewed with deep suspicion. But the huge capital requirements of rail transport paved the way for the extension of the limited liability model, which capped shareholders’ losses when their companies could not pay their debts. Still, partnership (which offers no such protection) remained the norm in finance.

The failure in 1866 of Overend Gurney, the iconic British banking collapse of the 19th century, happened just a year after its incorporation. When the House of Baring faced collapse in 1890, the Bank of England co-ordinated a rescue, but the partners were ruined. Louis Brandeis, a progressive lawyer who became a distinguished Supreme Court Justice, borrowed Smith’s “other people’s money” as the title of his excoriation of American finance sector at the beginning of the 20th century. Brandeis’s concern was the intermingling of industry and finance that was characteristic of America’s “gilded age”. It had allowed JP Morgan and Andrew Carnegie, Henry Clay Frick and John D Rockefeller to create a self-reinforcing cycle of economic and political power.

That power, Brandeis stressed, was acquired with the savings of the American public. The progressive backlash led by Brandeis and hostile journalists — the “muckrakers”, such as Ida Tarbell and Upton Sinclair — enjoyed some success in exposing the excesses of capitalism. The great industrialists of the interwar era, such as Alfred Sloan and Henry Ford, treated finance with disdain. Smith was not alone in warning that those who staked other people’s money would not treat it as carefully as their own: “When I speak of high finance as a harmful factor in recent years, I am speaking about a minority which includes the type of individual who speculates with other people’s money.” This was President Franklin Roosevelt in 1936.

The Wall Street crash and the introduction of securities regulation imposed new discipline on finance and its relationship to business. That worked for 50 years. But when Barings failed again in 1995, the organisation had become a limited company. The wealth of managers who supervised “rogue trader” Nick Leeson survived the crash; their business did not.

“I think it’s clear to all of us that the number won’t stay at 800,000..”

• Germany To Receive More Than 800,000 Refugees This Year (Reuters)

More than 800,000 refugees will come to Germany this year, the state premier of Germany’s biggest state, North Rhine-Westphalia, said on Tuesday. “I think it’s clear to all of us that the number won’t stay at 800,000,” Hannelore Kraft said, adding that this government forecast was three weeks old. She also pointed to an influx of 20,000 over the weekend. “So that the number will need to be revised upwards,” she said.

Germany says it can take in 500,000 refugees per year for years (and it will have taken closer to a million by the end of this year – 100,000 in August alone). On the other hand, France has announced it will take 24,000 refugees, and Britain 20,000 over five years (20,000 arrived in Europe just over the weekend). Other European nations refuse any refugees, and Finland, just to name an example, has so far put its quota at 800. Meanwhile, EC president Juncker prepares a grand plan to ‘resettle’ 160,000 refugees, which can’t be far from the number that arrive in one single month.

How long do you think the EU will continue to exist?

• Europe’s Alarming Lack Of Unity Over Refugees Could Break Up The EU (Ind.)

A three-year-old refugee child drowns while trying to reach the safety of a muddled and largely unwelcoming EU. Syrian refugee families are herded on and off trains in Budapest. Other refugees have their arms marked with identity numbers by Czech police. Razor-wire fences are built in Hungary – and in Calais. Germany (stiff, unyielding Germany) says: “Never mind the rules. Let them all come in.” So does Sweden. Some East European countries say: “Only Christian refugees are welcome; and not too many of those please.” Italy and Greece, swamped by refugees, demand more help from their partners. France and Austria vacillate. Spain says that it has problems enough. Britain tries, as usual, to make and play by its own rules. North vs south; east vs west; Britain vs the rest; German leadership or German dominance.

The refugee crisis is like a diabolical stress test devised to expose simultaneously all the moral and political fault lines of the European Union. The EU was born out of calamity. Over the last six decades, its policies have often been forged by resolving conflicts between member states. And yet this crisis seems more profound, more acute, more tangled, more poisonous, than any that has gone before. It is not about currencies or net contributions or farm subsidies but about the core issues of common humanity and solidarity that the EU claims to epitomise. The refugee crisis coincides with, and threatens to complicate, other existential challenges: Greek debt and the survival of the eurozone; EU reform and Britain’s in/out referendum next year. “The world is watching us,” the German Chancellor Angela Merkel said last week.

“If Europe fails on the refugee question, its close bond with universal human rights will be destroyed, and it will no longer be the Europe we dreamed of.” Open continental borders, one of the greatest of EU achievements, may be destroyed, Chancellor Merkel warned, unless the crisis is rapidly resolved. It is absurd to blame the EU for being “divided”. All the countries in Europe, and many political parties and many families, are split on how we should respond to the greatest refugee crisis on our continent for 70 years. There are no easy answers. The problem will grow even larger in the months and maybe years ahead. How could the EU not also be divided? Some of the divisions reflect genuine and honourable divergences in analysis and strategy, in geography or economic strength. Other statements hint at darker forces of extreme nationalism and racial intolerance. Disagreement is one thing. Irreconcilable differences are another.

Brilliant side effect.

• Concern Over Burgeoning Trade In Fake And Stolen Syrian Passports (Guardian)

When Mohamed paid an Afghan smuggler several hundred euros to drive him and his friends from Thessaloniki to the Greek-Macedonian border in July, he thought the money was all the smuggler would want. Instead, once on road the driver feigned a problem with the engine and persuaded the Syrians to leave the car on the pretext of avoiding detection by the police. “And then he stole our passports,” said Mohamed. Mohamed and his friends are the latest victims of a burgeoning trade in Syrian identity documents. Though most European nations have been slow to welcome more than a few Syrian refugees, the well-known preferential treatment Syrians receive within the German and Swedish asylum system has turned their passports into desired accessories for other immigrants who otherwise would not be likely qualify as refugees.

The head of the European border agency, Frontex, said this week that Arabs from outside Syria were buying counterfeit Syrian passports. Fabrice Leggeri told a French television channel that the appeal to buyers lay in how “they know Syrians get the right to asylum in all the member states of the European Union”. It’s a trade that is concerning not just Frontex, but Syrian refugees themselves, who feel that it may harm their own chances of asylum or at least slow their applications down. Hashem Alsouki, whose quest for refuge in Sweden was profiled by the Guardian earlier this year, said: “The situation with the passports is very worrying, and it might be the reason why my application for asylum is taking a long time. The officials have to spend more time working out if someone is a genuinely a Syrian citizen.”

Shale can only survive on credit.

• Citi: Capital Markets Now Control Oil Prices (Tracy Alloway)

From the concrete canyons of Lower Manhattan to the shale basins of West Texas, a new report from Citigroup underscores the degree to which Wall Street has financed the U.S. oil boom, with analysts warning that the slow grind of lower oil prices could spell tough times ahead for shale producers and their creditors. Cash-hungry shale producers have relied on a mix of bond sales and loans to finance capital-intensive gas explorations, with the interplay between the two types of financings now under the spotlight as oil companies face an intensifying credit crunch. “The shale sector is now being financially stress-tested by low prices, exposing shale’s dirty secret: many shale producers outspend cash flow and thus depend on capital market injections to fund ongoing activity,” Citi analysts wrote in research published on Tuesday.

Shale financing has zoomed into focus as U.S. oil companies embark on the latest round of semiannual discussions with lenders, known as the “redetermination of the borrowing base.” The discussions take place twice a year, in April and October, and involve shale producers and banks renegotiating the worth of oil assets securing credit facilities. With the price of crude now down 59% from its 2013 peak of $110 a barrel, October redeterminations are likely to crimp the amount of funding available to shale companies. The Citi analysts expect this year’s redeterminations to result in a 5% to 15% reduction in the borrowing base, which could in theory help spur the long-awaited shakeout in U.S. shale as producers either have to find fresh capital, merge with competitors, or simply shutter their businesses.

When it comes to the latter option, Citi argues that capital markets now wield unrivaled influence on who lives and who dies as investors choose how and at what price to fund shale producers. The wrinkle, however, is that shale companies may hang on for dear life as long as possible, thanks to perverse incentives in their corporate structure. “In an additional twist of capital markets’ influence on supply, incentives created by the capital markets may actually slow the supply rationalization for some producers in a classic case of ‘risk shifting,'” said the Citi analysts.

Brent is grossly overrated as a benchmark.

• China Intends To Oust Dollar From Oil Trade (RT)

China is planning to launch its own oil benchmark in October, similar to Brent and WTI, striving for a more important role in establishing crude prices. Unlike the Western benchmarks, the Chinese contracts will be nominated in the yuan, not the US dollar. Shanghai International Energy Exchange sent a draft futures contract to market players in August, Reuters reported quoting sources. Oil futures will be the first Chinese contract to permit direct participation of foreign investors. However, this is not the first step for greater oil market openness in China. In July, Beijing allowed private companies to import crude.

Previously importing was only done by state-run majors such as Sinopec, China National Petroleum Corporation and China National Offshore Oil Corporation, the Xinhua news agency reported. A Shanghai-based contract will compete in the crude futures market, which is worth of trillions of dollars and is dominated by two contracts, London’s Brent, seen as the global benchmark, and WTI, the key U.S. price. North Sea, Brent oil was first developed in the 1970s. The ICE Brent futures contract was developed in 1988. With an approximate output of only 1 million barrels per day, this blend is considered a benchmark and its contracts are now used to set prices for roughly 2/3 of the world’s oil. China is one of the world’s largest oil buyers. Nearly 60% of its oil consumption comes from imports.

Casino.

• Obscure Hedge Fund Is Buying Tens of Billions of Dollars of US Treasurys (WSJ)

A little-known New York hedge fund run by a former Yale University math whiz has been buying tens of billions of dollars of U.S. Treasury debt at recent auctions, drawing attention from the Treasury Department and Wall Street. Element Capital Management, led by trader Jeffrey Talpins, has been the largest purchaser in dozens of government-bond auctions over the past 10 months, people familiar with the matter said. The buying is part of an apparent effort by the fund to use borrowed money to exploit small inefficiencies in the world’s most liquid securities market, a strategy that is delivering sizable profits, said people close to the matter. Mr. Talpins is an intense and reserved trader formerly at Citigroup and Goldman Sachs.

He is known for a tenacious style that can grate on rivals and once tested the patience of former Federal Reserve Chairman Ben Bernanke. Element has been the largest bidder in many of the 62 Treasury note and bond auctions between last November and July, these people said. At many recent auctions, some of which involved sales of more than $30 billion of debt, Element purchased about 10% of the issue, these people said. That is an unusually large figure, analysts said. Element’s activity has raised questions because the cumulative purchases far exceed the hedge fund’s $6 billion in assets under management.

Treasury officials, who frequently meet with large auction participants, have asked Element about its activity, said someone close to the matter. “Their buying is eyebrow-raising,” said a trader who once worked for a firm that deals in government securities and witnessed Element’s bidding. These primary dealers often know the identity of other auction bidders. Element “never shared its strategy, but we often asked,” the trader said.

More casino.

• Yet Another Measure Of Risk In Junk-Bond Market Flashing Red (MarketWatch)

Yet another measure of risk in the U.S. junk-bond market is flashing an alarming signal. Moody’s Investors Service said its Covenant Quality Index deteriorated to its worst level on record in August from July, blowing past the previous record low set in November 2014. The index measures the degree of protection afforded to holders of junk, or high-yield, bonds sold by North American issuers. Covenants are provisions that aim to protect the credit quality of an issuer over time as a way to safeguard the bondholder’s investment. For the issuer, they are the strings attached to a deal that regulate its behavior and prevent it from further increasing its risk profile.

The Moody’s index uses a three-month rolling average covenant quality score that is weighted by each month’s total bond issuance. The scale runs from 1.0 to 5.0, where a lower score is a sign of stronger covenant quality, and a higher score is the opposite. The index rose to 4.53 in August from 4.37 in July and 4.42 in November 2014. It is now a full 116 basis points weaker than its best-ever score of 3.37 set in April 2011. “Single-month record weak scores in June and July drove the CQI to 4.53 in August for its worst score to date,” Moody’s analysts wrote in a report.

No doubt about it.

• The City’s Stranglehold Makes Britain An Oh-So-Civilised Mafia State (Monbiot)

It is not just that the very rich no longer fall while the very poor no longer rise. It’s that the system itself is protected from risk. Through bailouts, quantitative easing and delays in interest-rate rises, speculative investment has been so well cushioned that – as the Guardian economics editor, Larry Elliott, puts it – financial markets are “one of the last bastions of socialism left on Earth”. Public services, infrastructure, the very fabric of the nation: these too are being converted into risk-free investments. Social cleansing is transforming central London into an exclusive economic zone for property speculation. From a dozen directions, government policy converges on this objective. The benefits cap and the bedroom tax drive the poor out of their homes.

The forced sale of high-value council houses creates a new asset pool. An uncapped and scarcely regulated private rental market turns these assets into gold. The freeze on council-tax banding since 1991, the lifting of the inheritance tax threshold, and £14bn a year in tax breaks for private landlords all help to guarantee stupendous returns. And for those who wish simply to sit on their assets, the government can help here too, by ensuring there are no penalties for leaving buildings empty. As a result, great tracts of housing are removed from occupation. Agricultural land has proved an even better punt for City money: with the help of capital gains, inheritance and income tax exemptions, as well as farm subsidies, its price has quadrupled in 12 years.

Property in this country is a haven for the proceeds of international crime. The head of the National Crime Agency, Donald Toon, notes that “the London property market has been skewed by laundered money. Prices are being artificially driven up by overseas criminals who want to sequester their assets here in the UK.” It’s hardly surprising, given the degree of oversight. Private Eye has produced a map of British land owned by companies registered in offshore tax havens. The holdings amount to 1.2m acres, including much of the country’s prime real estate. Among those it names as beneficiaries are a cast of Russian oligarchs, oil sheikhs, British aristocrats and newspaper proprietors. These are the people for whom government policy works – and the less regulated the system that enriches them, the happier they are.

Offer Greece a safe way out and people will vote for it.

• Majority of Greeks Say Adopting Euro Has Harmed Country (Gallup)

As the Greek debt crisis came to a head again earlier this summer, it’s no surprise that leaders in more solvent eurozone countries expressed doubts about Greece’s participation in the monetary union — but these doubts are also widespread among Greeks themselves. A majority of adults in the country -55%- said in a poll conducted May 14-June 16 that they think converting from the Greek drachma to the euro in 2001 has harmed Greece, while one-third (34%) said the common currency has benefited the country. The situation in Greece reached a critical point on June 30 -shortly after the survey was completed- when Greece became the first developed country to default on a loan payment to the IMF. In a July 5 referendum, Greeks resolutely voted against an extension of the country’s second eurozone bailout, in protest against the new austerity measures it would have carried.

Greeks’ doubts about the euro reflect the effects of austerity measures over the past five years, including higher taxes and deep cuts in public spending, that many economists say have contributed to the country’s sharp economic contraction and soaring unemployment. Whether Greece would have been better off had it never joined the euro remains a matter of debate, however, as the country saw increased economic growth and a much-improved inflation rate through most of the 2000s. Greeks are less likely to harbor doubts about their country’s membership in the European Union. In fact, responses to this question are essentially the inverse of those regarding eurozone participation: 54% of Greeks say EU membership benefits the country, while 35% believe the opposite.

The EU has a much longer history than the euro, and Greece has been a member since 1981; thus, a much larger proportion of the Greek population is too young to remember a time when the country wasn’t an EU member. That generational difference may be reflected in the finding that the Greeks aged 60 and older are somewhat less likely to feel EU membership is a benefit (48%) than those younger than 60 (56%). While Greeks are less likely to say EU membership harms the country than they are to say the same about participation in the euro, the finding that about one-third overall feel this way is remarkable in light of the fervor with which many southern and eastern European countries have pursued membership over the past 20 years.

Piketty, Varoufakis, Steve Keen etc. And yes, the world is in dire need of international restructuring laws. They could protect Greece from Brussels, for one thing.

• EU Nations Must Support UN Sovereign Debt Restructuring Proposals (19 Economists)

On September 10, the United Nations General Assembly will vote on nine principles concerning the restructuring of sovereign debts. Abiding by such principles would have avoided the pitfalls of the Greek crisis, in which political representatives gave in to creditor demands despite their lack of economic sense and their disastrous social impact. This public interest resolution must be supported by all European states and brought into the public debate. The Greek crisis has made clear that individual states acting alone cannot negotiate reasonable conditions for the restructuring of their debt within the current political framework, even though these debts are often unsustainable over the long term.

Throughout its negotiations with creditor institutions, Greece faced a stubborn refusal to consider any debt restructuring, even though this refusal stood in contradiction to the IMF’s own recommendations. At the UN in New York exactly one year ago, Argentina, with the support of the 134 countries of the G77, proposed creating a committee aimed at establishing an international legal framework for the restructuring of sovereign debts. This committee, backed up by experts of the UNCTAD, today submits to vote nine principles that should be respected when restructuring sovereign debt: sovereignty, good faith, transparency, impartiality, equitable treatment, sovereign immunity, legitimacy, sustainability and majority restructuring.

In recent decades, a debt market has emerged that states are constrained to submit to. Argentina, standing at the forefront of these efforts, has been fending off “vulture funds” ever since it restructured its debt. These funds recently succeeded in freezing Argentina’s assets in the United States through the intervention of the American courts. Yesterday Argentina, today Greece, and tomorrow perhaps France as well: any indebted country can be blocked from restructuring its debt in spite of all common sense. Establishing a legal framework for debt restructuring, allowing each state to solve its debt problems without risking financial collapse or the loss of its sovereignty, is a matter of great urgency in promoting financial stability.

Key qeustion: could Russia mess up Syria even worse than “we” have done?

• Russia Demands Answers As Bulgaria, Greece Deny Syria Flights (AFP)

Moscow on Tuesday demanded answers from Greece and Bulgaria after Sofia banned Russian supply flights to Syria from its airspace and Athens said it had been asked by Washington to do the same. “If anyone – in this case our Greek and Bulgarian partners – has any doubts, then they, of course, should explain what the problem is,” deputy foreign minister Mikhail Bogdanov told the Interfax news agency. “If we are talking about them taking some sort of restrictive or prohibitive measures on the Americans’ request, then this raises questions about their sovereign right to take decisions about planes from other countries – Russia in particular – crossing their air space,” he said. “We explain where our planes are flying to, and what their purpose and their cargo is,” he added.

He said that ferrying cargo, which included humanitarian and military aid, through the airspace of a third party – as well as obtaining permission to do so – should be a routine procedure. “We’ve never had any problems before,” he said. Washington has expressed concern following reports suggesting Moscow may be boosting military support to Syrian President Bashar al-Assad and had sent a military advance team to the war-torn country. Earlier on Tuesday, NATO member Bulgaria confirmed it had refused permission late last night for an unspecified number of Russian aircraft to cross its airspace. Greece said on Monday that Washington had asked it to ban Russian supply flights to Syria from its airspace. It said it was examining the US request but gave no further details. Moscow has dismissed US concerns about its alleged Syria buildup, saying its military aid to the Assad regime was nothing out of the ordinary.

Advice from Larry Summers? C’mon, Yanis…

• How Europe Crushed Greece (Yanis Varoufakis)

[..] Mr. Schäuble felt that accepting an alternative plan for Greece’s recovery, in place of the troika’s program, would weaken Germany’s hand vis-à-vis the French. Thus little Greece was crushed while the elephants tussled. We had such a plan. In March, I undertook the task of compiling an alternative program for Greece’s recovery, with advice from the economist Jeffrey Sachs and input from a host of experts, including the former American Treasury Secretary Larry Summers, and the former British chancellor of the Exchequer Norman Lamont. Our proposals began with a strategy for debt swaps to reduce the public debt’s burden on state finances. This measure would allow for sustainable budget surpluses (net of debt and interest repayments) from 2018 onward.

We set a target for those surpluses of no more than 2% of national income (the troika program’s target is 3.5%). With less pressure on the government to depress demand in the economy by cutting public spending, the Greek economy would attract investors of productive capital. As well as making this possible, the debt swaps would also render Greek sovereign debt eligible for the European Central Bank’s quantitative easing program. This in turn would speed up Greece’s return to the money markets, reducing its reliance on loans from European institutions. To generate homegrown investment, we proposed a development bank to take over public assets from the state, collateralize them and so create an income stream for reinvestment.

We also planned to set up a “bad bank” that would use financial engineering techniques to clear the Greek commercial banks’ mountain of nonperforming loans. A series of other reforms, including a new, independent I.R.S.-like tax authority, rounded out our proposals. The document was ready on May 11. Although I presented it to key European finance ministers, including Mr. Schäuble, as the Greek Finance Ministry’s official plan, it never received the endorsement of our own prime minister. The reason? Because the troika made it abundantly clear to Mr. Tsipras that any such document would be seen as a hostile attempt to backtrack from the conditions of the troika’s existing program. That program, of course, had made no provision for debt restructuring and therefore demanded cripplingly high budget surpluses.

No. Sorry.

• Can Hobbits Save New Zealand? (CNBC)

As New Zealand’s dairy industry – a key pillar of the economy – crumbles under the pressure of a supply glut and slowing demand out of China, tourism in the land of hobbits is picking up some of the slack. But, this won’t be sufficient to reverse the slowdown in growth in the once “rock star” economy, say analysts, flagging the likelihood of further monetary easing as soon as this week. “With very low dairy prices and confidence falling sharply, New Zealand’s economy is slowing from the rapid pace of growth recorded in 2014,” said Paul Bloxham and Daniel Smith, economists at HSBC. Dairy products are the country’s biggest export earner, totaling 12 billion New Zealand dollars ($7.5 billion) in the year to June 30. However, this was down almost a quarter compared to the same period a year earlier, reflecting the slump in global diary prices.

Dairy prices sank to a 12-1/2-year low in August as the slowdown in China, the Middle East and other emerging markets damped on demand for protein and other producers stepped up production. [..] Weakness in the dairy sector not only hurts farm incomes, it has implications for the broader economy, say economists. “Low prices will reduce farm incomes, with many farmers facing negative cash-flow for the second season in a row. More worryingly, the malaise in the dairy sector appears to be spreading to other sectors,” said Bloxham and Smith. “Confidence has fallen sharply in the agricultural sector, but has also declined to varying degrees across all other business sectors.”

Lucky for New Zealand, as demand for its milk product cools, it is enjoying an uptick in inbound tourists, many of them inspired by the highly successful The Lord of Rings films trilogy shot in the country. Arrivals have also flocked from China – the country’s second largest visitor market after Australia. Over 315,000 mainland tourists traveled to the country between August 2014 and July 2015, up 30% on year, according to Tourism New Zealand. [..] tourism is set to overtake dairy as New Zealand’s biggest export earner as visitor arrivals continue to set new records, according to analysts.