Saul Leiter Man in straw hat 1955

The following was written by Bruce Wilds, who runs the Advancing Time blog. Bruce is a small business owner in the Midwest.

I get lots of articles sent to me, but hardly ever publish any (sorry I can’t send everyone a reply) because they’re not what I think this site should be. But with this article it’s different. I think what Bruce describes is interesting, important even. The US has been losing small businesses for a long time, and the virus response is set to greatly accelerate the process. The huge stimulus plans will bypass most small businesses, because they are too small for governments to know what to do with.

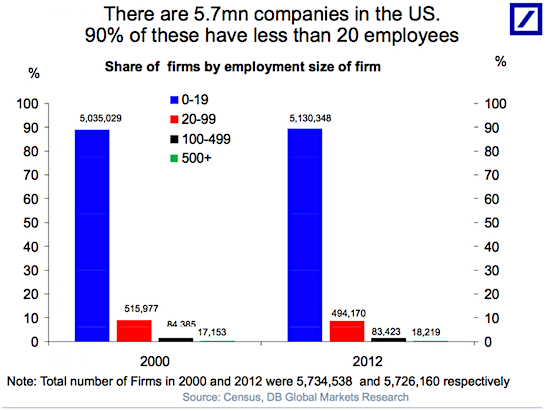

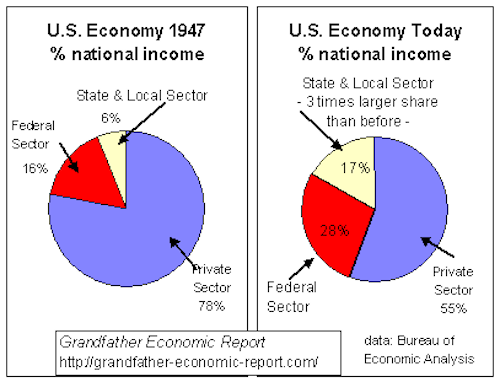

The article was written before the latest round of handouts, but there’s very little reason to believe it will change much of anything. It’s not so much a grand plan or conspiracy, it just that the system has come to recognize only that bigger is better. America doesn’t like small. This is as true for banks as it is for various levels of government. But small businnesses have not only built the country, and are crucial for the faces of Main Streets and small towns, they also employ enormous amounts of Americans.

Bruce Wilds: The Paycheck Protection Program or PPP was funded with $350 billion in the last stimulus bill, this money is now gone. Of the thirty million small businesses in America, only 1.7 million received money from the 2.3 trillion dollar aid package passed to help sustain America during this difficult time. If the government blew through this money and was only was able to help only around 5% of small businesses. it is difficult to think another 250 billion dollars will set things straight. Clearly, because when the government made promises it delayed the wave of firing while companies waited for help.

The government has failed to keep its promise so now we should expect unemployment to soar as reality sets in. One of the largest problems facing small companies is they are often underfunded and have difficulty getting financing at reasonable rates. Banks find larger companies much more profitable. The sector of the economy most damaged by the covid-19 shutdown is small business. When this is over America will find many small businesses have been decimated and are not able to reopen. Others will never recover and be forced to close within months. Since small businesses employ over 54 million people in America and their importance in the economy should not be underestimated.

• Small businesses contribute 44 percent of all sales in the country.

• Small businesses employ 54.4 million people, about 57.3 percent of the private workforce.

Rest assured government employees and bureaucrats will still continue to get paid but small business, the most productive part of the economy has a knife to its throat. As a landlord and small business owner, I can tell you the program was structured in a way that will be of little help to most small businesses. The government slammed expensive legislation through with no idea of the damage they were doing and how it will cause hundreds of thousands of businesses to close their doors forever. Washington has become so attuned to dealing with lobbyists from mega-companies it has lost sight of the fact small is small, and when this comes to business, this means usually under twenty employees, not hundreds.

The government’s answer to keeping people employed was to promise small businesses an easy to get, rapid maximum loan amount of two and a half times a company’s average monthly payroll expense over the past 12 months. This loan would turn into a grant and be forgiven if a company did not fire its employees. Sadly, legislators failed to take into consideration that not all small businesses are labor or payroll intense. Some businesses with large or expensive showrooms are getting hammered by rent, others by inventory, or things like taxes, utilities, or even by having to toss products due to spoilage.

The PPP also failed to address the issue of what these employees are going to do while the company has no customers and business barely trickling. In the past, these employees were expected to pursue activities that earned revenue and garnered profits for the business but with no costumers, this is difficult to do. The PPP also ignored the fact that by keeping these employees on the payroll a generous employer is left open to the harsh mandates laid out in the government’s previous bill. The hastily drawn up 110-page federal covid-19 economic rescue package, which Trump fully supported dealt a hard blow to small business. For a small business this is a disaster, the bill requires;

• Employers with fewer than 500 employees and government employers offer two weeks of paid sick leave through 2020.

• Those same employers must now provide up to 3 months of paid family and medical leave for people forced to quarantine due to the virus or care for family because of the outbreak

As expected, this measure, named “Families First Coronavirus Response Act.” resulted in millions of workers suddenly losing their jobs. Ironically, it was held before the voters as proof lawmakers could work together during a crisis. By framing the poorly crafted pork-packed bill this way promoters positioned themselves to demonize those unwilling to support it. Remember, this bill is was in addition to the $8.3 billion emergency spending bill first approved to curb the spread of covid-19.

As government has grown larger it seems to have become totally oblivious to the fragility of many small businesses and how much it can cost a community when they close. By framing these pork-packed bills as bipartisan their promoters imply they are fair and balanced. This is not true, small business is the big loser and hundreds of thousands will soon have to close. With so many tenants looking at foregoing rent small landlords that don’t have deep pockets also face huge problems. We have our heads in the sand if we think companies that exist on events where people gather will overnight regain their luster. It is not like someone can simply flick a switch and things will return to normal.

Reality undercuts the idea of the “V-shaped recovery” theory and the idea after the economy has come to a dead stop it can quickly reboot and be back at full speed in a few months. The government has presented us with an extension of crony capitalism structured to throw just enough to the masses to silence their outrage but in the coming weeks, we will see it failed. Large businesses with access to cheap capital are the winners and the big losers are the middle-class, small businesses, and social mobility. All those people that want a higher minimum wage can forget that ever happening if we don’t have jobs.

As for just how much small business owners make, according to figures from 2015 from the Small Business Administration the median income for self-employed individuals at an incorporated business was $49,804 and $22,424 for unincorporated firms. According to PayScale’s 2017 data, the average small business owner’s income is $73,000 per year. But, total earnings can range from $30,000 – $182,000 per year. This means it varies greatly depending on where and just how big the business is. However, it is important to remember these people have “skin in the game” and most risk losing everything if their business fails.

It is important to recognize that starting your own business has always been about the opportunity to design and build your own future. It is a symbol of freedom not a guarantee of wealth. Many people choose this path proudly, not to make more money but as a way to express their individuality. For these competent and talented people, a job in government or at a large company often offers more security and benefits but far less freedom. Do not underestimate the value of small business and what it contributes to our society. Companies such as Amazon are the anti-thesis of small business making their workers a cog in a machine and stealing their soul.

Based on the government’s promise to small businesses a great many held off on letting employees go but with each passing day in order to survive they are now in the process of letting hundreds of thousands of employees go. This is a ticking time-bomb. By telling these businesses to close and then through its failure to carry out its promise of helping them the government has created a situation with massive negative economic ramifications. To make matters worse, people going on unemployment look to get almost as much as those that do work. Why will anyone want to work, especially government workers when they can get paid to stay home? This is not about wanting more money for small business, it is about the reality that the firings are just beginning.

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.Thanks everyone for your generosity.

It’s very bad luck to draw the line

On the night before the world ends

We can draw the line some other time

X – Some other time

Support the Automatic Earth. It’s good for your mental health.