Vincent van Gogh Courtesan (after Eisen) 1887

Everyone to the same side of the boat!

• Same Old Greed In A Shiny New Wrapper (Felder)

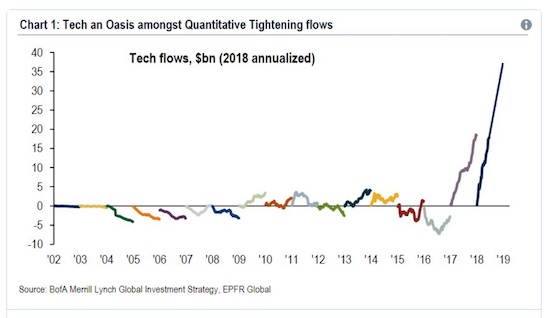

The flows into tech funds of late have been absolutely astounding if not totally surprising. The FAANNG stocks have been the market darlings for quite some time now so it’s understandable investors would chase this performance just as they do during every bull market.

It’s not just tech-focused funds overweighting the FAANNG stocks. There is a huge number of non-tech-focused funds that own these stocks, as well, and in a significant way further supporting their popularity in the marketplace. You can find them represented in size today in everything from consumer discretionary, retail, media and entertainment to momentum, cloud computing, internet and social media. In fact, without Amazon and Netflix, the consumer discretionary sector would be down on the year rather than up.

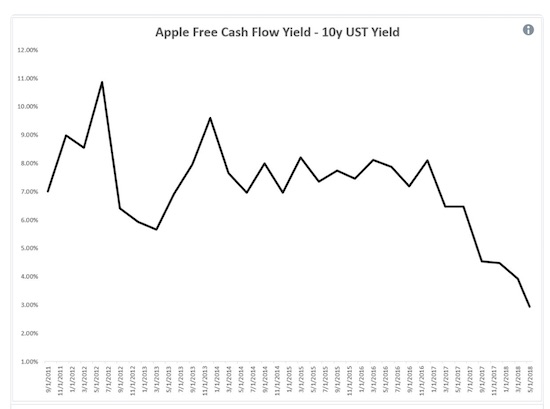

What’s more, in many cases, the ownership of these companies in many funds appear to be clear violations of their implicit if not explicit mandates. To demonstrate, let’s just run through the FAANNG stocks by market cap beginning with the biggest: Apple. There are fully 92 ETFs, according to ETFdb.com, that not only own the stock but also have an overweight (relative to the S&P 500) allocation to the shares. So not only are Apple fans and traditional passive investors buying tons of Apple stock, these other ETF investors are even more aggressively acquiring shares.

What I found notable in this case was that Apple was found in both value and growth-focused ETFs. I guess this isn’t really much of a stretch theoretically. A high-growth stock can become cheap just like any other. What is strange in Apple’s case, though, is that the stock now trades at its highest price-to-free cash flow in years. At the same time, the company’s 5-year average revenue growth is now the lowest in its history. Still, these systematic funds somehow find reason to not just own it but to overweight it as both a value stock and as a growth stock.

Deutsche Bank should be scared.

• Brexit To Put £29 Trillion In Derivatives Contracts At Risk – BOE (G.)

Britain’s chief financial watchdog has warned that contracts worth trillions of pounds between UK and European Union banks remain at risk of collapse following Brexit, after Brussels’ failure to implement protective legislation. In a warning to EU officials that time is running out before next March to devise rules for EU banks, the Bank of England’s financial policy committee (FPC) said £29tn worth of contracts could be declared void. Derivatives contracts, which provide banks and corporations with protection from interest rate rises, could come to an end without fresh legislation from the UK and EU, the committee said in its latest quarterly health check on Britain’s financial services industry.

The warning will be seen as a direct response to the European Banking Authority, which argued earlier this week that the UK was dragging its feet preparing for Brexit. In an increasingly bitter war of words, EBA officials said there was little preparation by the UK authorities and individual banks for life outside the EU. The FPC hit back, saying the Treasury was well advanced in its efforts to bridge the gap between banks in London and those on the continent, but Brussels had made little obvious effort to support its own financial institutions. “The biggest remaining risks of disruption are where action is needed by both UK and EU authorities, such as ensuring the continuity of existing derivatives contracts. As yet the EU has not indicated a solution analogous to a temporary permissions regime,” it said.

The incompetence is almost funny.

• EU To Raise Pressure On May Over Chances Of No-Deal Brexit (G.)

The European Union’s 27 leaders are to ratchet up the pressure on Theresa May by giving her a strong warning about the growing risk of a no-deal Brexit, as countries across Europe confirmed they were intensifying work on their contingency plans for Britain crashing out of the bloc. With a complete absence of progress on key issues, including that of avoiding a hard border on the island of Ireland, the prime minister will be pressed at a summit in Brussels to reassure her fellow leaders about her intentions. The Danish prime minister, Lars Løkke Rasmussen, told his parliament in Copenhagen on Wednesday: “It is the first time we are saying clearly to the British that we can end, in the worst scenario, [with] no deal.”

May has agreed to address the leaders at a dinner on Thursday night after discussions with Donald Tusk, the European council president, earlier this week in Downing Street. She is expected to sketch out her intentions for the coming few weeks before they come to their conclusions on the state of the negotiations the following morning. Asked whether Tusk was more confident about the future following his last meeting with May, a senior EU official laughed, adding: “Well, I don’t think he is less optimistic.” On the so-called backstop solution for the Irish border – a default state to be in place until a free trade deal or bespoke technological solution is agreed – the official said there had “frankly been no progress, and that’s reason to express concern”.

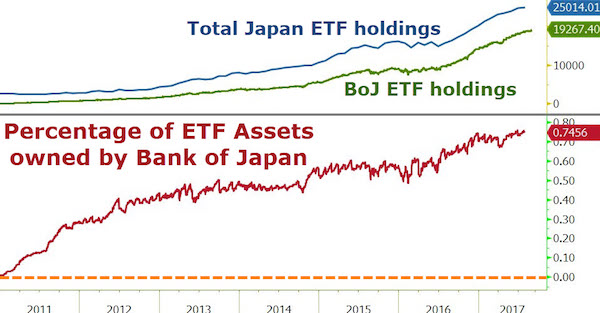

I made up that headline. It’s a little exaggerated. But only a little. It’s a crazy experiment Kuroda is in.

• Bank of Japan Now Owns Half the Country (ZH)

The last time we looked at how much of the stock market the Bank of Japan controls, we found that as of September, Kuroda’s central bank owned a stunning 75% of all Japanese ETFs as the central bank keeps buying stocks under its ultraloose monetary policy. Since December 2010 – when The Bank of Japan held no ETFs at all – the central bank has been buying ETFs (doubling its annual buying target to 6 trillion yen in July 2016) as part of unprecedented economic stimulus. Over this period, the Nikkei 225 Stock Average has risen 89% since December 2010. It is safe to say the two are correlated. Fast forward to today, when according to the latest BOJ holdings update following even more ETF purchases, the Japanese central bank has also become a major shareholder in nearly 40% of listed companies.

According to Nikkei calculations, the bank was one of the top 10 shareholders in 1,446 listed companies out of 3,735 at the end of March. This means that just over the past year, when the BOJ was a major owner of 833 stocks, the BOJ’s equity holdings have expanded by a staggering 70%. In addition, the Central Bank bank is now the top shareholder in Tokyo Dome, Sapporo Holdings, Unitika, Nippon Sheet Glass and Aeon. This means that the BOJ has amassed an estimated 25 trillion yen ($227 billion) of equities as a result of purchasing exchange-traded funds. Putting these holdings in context, the BOJ holdings are equal to nearly 4% of the roughly 652 trillion yen aggregate market value of stocks traded on the first section of the Tokyo Stock Exchange.

In justifying the BOJ’s relentless takeover of the stock market, Kuroda has said that buying up stocks is an integral part of the BOJ’s strategy to lift inflation to 2%, a program which “has fulfilled its role to a certain extent,” according to Kuroda. But, as the Nikkei adds, the size of the buying spree could complicate an eventual exit strategy from the monetary easing and also distort basic market mechanisms.

We’re still talking.

• Trump Says Security Panel Can Protect US Technology From China (R.)

President Donald Trump on Tuesday endorsed U.S. Treasury Secretary Steven Mnuchin’s measured approach to restricting Chinese investments in U.S. technology companies, saying a strengthened merger security review committee could protect sensitive American technologies. Trump, in remarks to reporters at the White House, said the approach would target all countries, not just China, echoing comments from Mnuchin on Monday amid a fierce internal debate over the scope of investment restrictions due to be unveiled on Friday. “It’s not just Chinese” investment, Trump told reporters when asked about the administration’s plans. Mnuchin and White House trade adviser Peter Navarro sent mixed signals on Monday about the Chinese investment restrictions, ordered by Trump on May 29.

Mnuchin said they would apply to “all countries that are trying to steal our technology,” while Navarro said they would be focused specifically on China. The restrictions are being developed to help put pressure on China to address the administration’s complaints that it has misappropriated U.S. intellectual property through joint-venture requirements, unfair licensing policies and state-backed acquisitions of U.S. technology firms. Mnuchin would prefer to use new tools associated with pending legislation to enhance security reviews of transactions by the Committee on Foreign Investments in the United States (CFIUS), some administration officials have said.

Property gains have been a substantial part of ‘growth’. Watch out Xi.

• Whack-a-Mole: China Steps Up Property Crackdown In 30 Major Cities (R.)

China said on Thursday it would renew efforts to crack down on property irregularities in 30 major cities from July to end-December, mobilizing powers from seven major Chinese government agencies in a concerted effort to rein in rising prices. Property prices in China have soared since 2016, prompting the government to roll out tightening measures in more than 100 cities to dampen demand amid bubble fears. But new home prices in May posted their fastest growth in nearly a year even as prices cooled in big cities, suggesting buyers are shifting to smaller cities. Policymakers have been careful not to tap on the brakes too hard, as real estate remains a major driver of the economy.

Growth in the world’s second-largest economy is at risk of slowing as the authorities try to tame rapid domestic credit growth at a time when trade tensions are causing worries for the economic outlook. The crackdown would be carried out by government entities including the housing ministry and the Ministry of Public Security, and the banking and insurance regulators, according to a notice posted on the housing ministry’s website. They would focus on stemming speculation, cracking down on illegal agencies and developers, and fake advertisements.

Among the 30 cities that will be scrutinized are the country’s four largest or top tier cities, including Beijing and Shanghai, and tier 2 provincial capitals such as Wuhan and Chengdu, and also smaller cities, such as Yichang and Foshan. The notice said targeted irregularities include manipulating prices, deliberately holding off sales, illegally providing loans for downpayment and publishing false price information that mislead buyers.

The party swung so far right the only way to go is left.

• Lobbyists And Business-Friendly Pundits Mourn Ocasio-Cortez’s Victory (IC)

Several Democratic pundits appeared on Fox Business Network to raise the alarm about the election. “The party is swinging left,” said Robin Biro, a former DNC delegate supporting Hillary Clinton. “It’s concerning for someone who is more moderate like myself.” Mark Penn, a strategist who owns several corporate lobbying and public relations firms and previously advised both Bill and Hillary Clinton’s presidential campaigns, attempted to downplay the significance of Ocasio-Cortez’s victory. Asked by Fox Business host Maria Bartiromo if Ocasio-Cortez’s win signified a drift toward socialism, Penn said no. “I just don’t think that’s where the Democratic Party is going. I think that’s where that district is going,” said Penn.

“I think the national implications are being overblown,” he added. Crowley was seen as the next Democratic House leader and had won support from business executives as a leading moderate. As The Intercept reported, Crowley helped spearhead efforts against bank regulations, and, as a longtime leader of the New Democrat Coalition, was widely viewed as a point person for lobbyists to influence that caucus of centrist Democrats. He also voted in support of the Iraq War and the Patriot Act. The Wall Street-friendly wing of the Democratic Party similarly attempted to diminish Ocasio-Cortez’s victory.

Matt Bennett, co-founder of Third Way, a business-friendly Democratic think tank governed by a council of finance industry executives, told Axios that Crowley lost because of his gender and the particular dynamics of the district. Ocasio-Cortez’s victory “had more to do with the nature of her very blue district than it does with national politics,” Bennett said.

Many similarities to Hillary’s loss.

• An Upset in the Making: Joe Crowley Never Saw Defeat Coming (NYT)

It was less than three weeks until Primary Day and, on first blush, the poll that Representative Joseph Crowley had been shown by his team of advisers was encouraging: He led his upstart rival, Alexandria Ocasio-Cortez, by 36 percentage points. It was the last poll Mr. Crowley’s campaign would conduct. Despite his many reputed strengths — his financial might as one of the top fund-raisers in Congress, his supposed stranglehold on Queens politics as the party boss, his seeming deep roots in an area he had represented for decades — Mr. Crowley was unable to prevent his stunning and thorough defeat on Tuesday night. Ms. Ocasio-Cortez bested Mr. Crowley by 15 percentage points, delivering a victory expected to make her, at 28, the youngest woman ever elected to Congress.

If it takes a perfect storm to dislodge a congressional leader, then Ms. Ocasio-Cortez and her crusading campaign about class, race, gender, age, absenteeism and ideology proved to be just that. She and her supporters swept up Mr. Crowley in a redrawn and diversifying 14th Congressional District where the incumbent, despite two decades in Congress, had never run in a competitive primary. She flipped the levers of power he was supposed to have — his status as a local party boss and his money — against him, using that as ammunition in an insurgent bid that cut down a possible successor to Nancy Pelosi and the No. 4 Democrat in the House. No single factor led to Mr. Crowley’s defeat, more than a half-dozen officials inside and close to his campaign said in interviews, most on the condition of anonymity.

It was demographics and generational change, insider versus outsider, traditional tactics versus modern-age digital organizing. It was the cumulative weight of them all. [..] Ms. Ocasio-Cortez, in an interview on Wednesday, dismissed race as a driving factor in her win, though she had regularly highlighted her heritage on the campaign trail. “It would be a huge mistake to just say that this election happened because X demographics live here. That is to absolutely miss the entire point of what we just accomplished,” Ms. Ocasio-Cortez said. A former organizer for Bernie Sanders, Ms. Ocasio-Cortez won across the district, carrying Mr. Crowley’s home borough of Queens by a larger margin than she won the Bronx. “She won virtually everywhere,” said Steven Romalewski, a researcher at the Center for Urban Research [..], who mapped the results.

It’s not just Facebook and Google, everyone wants a piece of the fat pie.

• Thomson Reuters Defends Its Work For ICE (IC)

The reporters at Reuters have been providing crucial, unfliching coverage of the cruel treatment of would-be immigrants under policies pushed by President Donald Trump. Meanwhile, the news agency’s parent company, Thomson Reuters, has been supplying U.S. Immigration and Customs Enforcement with data from its vast stores as part of federal contracts worth close to $30 million. A letter from a Thomson Reuters executive shows that the company is ready to defend at least one of those contracts while remaining silent on the rest. Last week, advocacy and watchdog group Privacy International wrote to Thomson Reuters CEO James Smith to “express concern” over contracts between ICE and two of the company’s subsidiaries.

Thomson Reuters Special Services sells ICE “a continuous monitoring and alert service that provides real-time jail booking data to support the identification and location of aliens” as part of a $6.7 million contract, and West Publishing, another subsidiary, provides ICE’s “Detention Compliance and Removals” office with access to a vast license-plate scanning database, along with agency access to the Consolidated Lead Evaluation and Reporting, or CLEAR, system, which Thomson Reuters advertises as holding a “vast collection of public and proprietary records.” The two West contracts are together worth $26 million. The Privacy International letter cites the practice by U.S. authorities of separating children from their parents, as well as the Trump administration’s overall “zero tolerance” approach to immigration violations.

The children — thousands of them — are typically intercepted by U.S. Customs and Border Protection with their parents; the parents are then detained by ICE while the children, having been forcibly separated, are held in conditions that some have described in horrifying terms, under the supervision of Health and Human Services. (ICE agents have also been accused of sexual abusing hundreds of detainees, underhanded arrest tactics, and more.) Privacy International’s letter requested that Thomson Reuters “commit to not providing products or services to U.S. immigration agencies which may be used to enforce such cruel, arbitrary, and disproportionate measures.”

Long read on how fraud takes place where no-one expects it. And on a scale that no-one thinks possible. Libor.

• How To Get Away With Financial Fraud (Davies)

It is not a pleasant thing to see your industry subjected to criticism that is at once overheated, ill-informed and entirely justified. In 2012, the financial sector finally got the kind of enemies it deserved. The popular version of events might have been oversimplified and wrong in lots of technical detail, but in the broad sweep, it was right. The nuanced and technical version of events which the specialists obsessed over might have been right on the detail, but it missed one utterly crucial point: a massive crime of dishonesty had taken place. There was a word for what had happened, and that word was fraud. For a period of months, it seemed to me as if the more you knew about the Libor scandal, the less you understood it.

That’s how we got it so wrong. We were looking for incidental breaches of technical regulations, not systematic crime. And the thing is, that’s normal. The nature of fraud is that it works outside your field of vision, subverting the normal checks and balances so that the world changes while the picture stays the same. People in financial markets have been missing the wood for the trees for as long as there have been markets. Some places in the world are what they call “low-trust societies”. The political institutions are fragile and corrupt, business practices are dodgy, debts are rarely repaid and people rightly fear being ripped off on any transaction.

In the “high-trust societies”, conversely, businesses are honest, laws are fair and consistently enforced, and the majority of people can go about their day in the knowledge that the overall level of integrity in economic life is very high. With that in mind, and given what we know about the following two countries, why is it that the Canadian financial sector is so fraud-ridden that Joe Queenan, writing in Forbes magazine in 1989, nicknamed Vancouver the “Scam Capital of the World”, while shipowners in Greece will regularly do multimillion-dollar deals on a handshake? We might call this the “Canadian paradox”.

There are different kinds of dishonesty in the world. The most profitable kind is commercial fraud, and commercial fraud is parasitical on the overall health of the business sector on which it preys. It is much more difficult to be a fraudster in a society in which people only do business with relatives, or where commerce is based on family networks going back centuries. It is much easier to carry out a securities fraud in a market where dishonesty is the rare exception rather than the everyday rule.

Long read on what happened since 2008.

• After the Fall (John Lanchester)

Some of the more pessimistic commentators at the time of the credit crunch, myself included, said that the aftermath of the crash would dominate our economic and political lives for at least ten years. What I wasn’t expecting – what I don’t think anyone was expecting – was that ten years would go by quite so fast. At the start of 2008, Gordon Brown was prime minister of the United Kingdom, George W. Bush was president of the United States, and only politics wonks had ever heard of the junior senator from Illinois; Nicolas Sarkozy was president of France, Hu Jintao was general secretary of the Chinese Communist Party, Ken Livingstone was mayor of London, MySpace was the biggest social network, and the central bank interest rate in the UK was 5.5 per cent.

It is sometimes said that the odds you could get on Leicester winning the Premiership in 2016 was the single most mispriced bet in the history of bookmaking: 5000 to 1. To put that in perspective, the odds on the Loch Ness monster being found are a bizarrely low 500 to 1. (Another 5000 to 1 bet offered by William Hill is that Barack Obama will play cricket for England. I’d advise against that punt.) Nonetheless, 5000 to 1 pales in comparison with the odds you would have got in 2008 on a future world in which Donald Trump was president, Theresa May was prime minister, Britain had voted to leave the European Union, and Jeremy Corbyn was leader of the Labour Party – which to many close observers of Labour politics is actually the least likely thing on that list. The common factor explaining all these phenomena is, I would argue, the credit crunch and, especially, the Great Recession that followed.

It may be smart but it can’t be good.

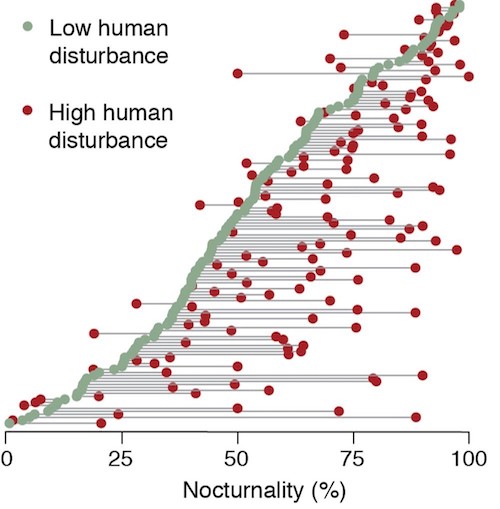

• Animals Are Becoming Nocturnal To Avoid Human Beings (Wef)

On Thursday, ecologists at the University of California, Berkeley, released a study published in Science Magazine that indicates animals are adjusting their habits to avoid the stresses of human encroachment on their habitat. According to the research from Kaitlyn M. Gaynor, Cheryl E. Hojnowski, Neil H. Carter, and Justin S. Brashares, human population growth is having a profound influence on the way animals go about their business—specifically, when they choose to go about their business. It seems that a number of mammalian species have become nocturnal in an effort to avoid us. Scientists admit that this probably works for the animals, but could have potential “ecosystem-level consequences” we don’t yet fully understand.

It’s been acknowledged in the past that mammals have been adjusting to the presence of humans by moving less, retreating to remote areas, and spending less time looking for food, according to Phys.org, who spoke with Gaynor, the leader of the study. All these altered behaviors contribute to overall stress in the animals. Gaynor’s study indicates that even things like camping and hiking could be having a negative effect on wildlife. “It suggests that animals might be playing it safe around people,” said Gaynor. “We may think that we leave no trace when we’re just hiking in the woods, but our mere presence can have lasting consequences.”