Félix Vallotton The balloon 1899

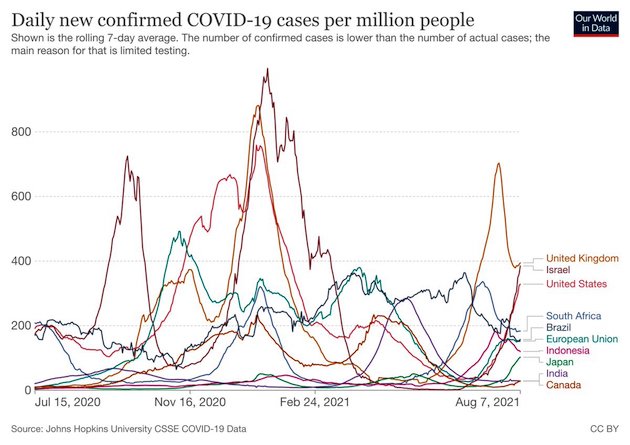

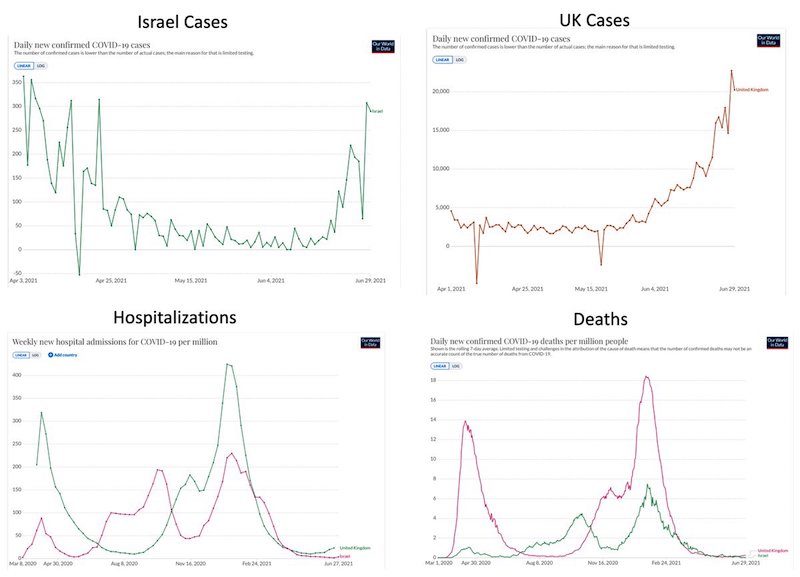

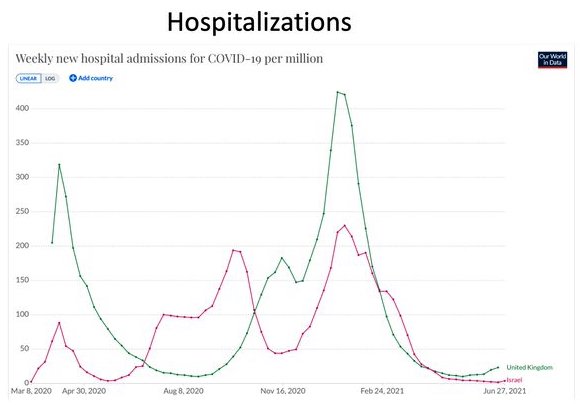

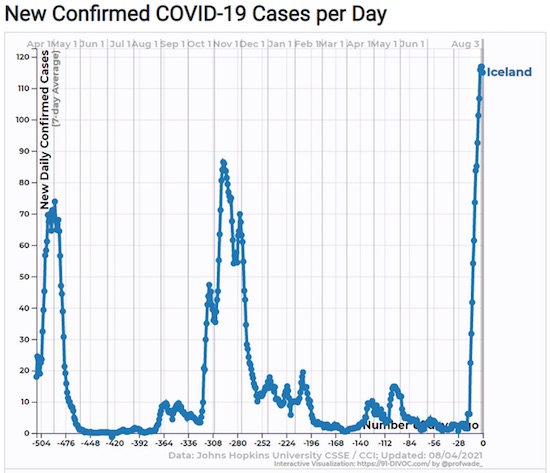

Israel

New Zealand

https://twitter.com/i/status/1421600041014284291

https://www.achgut.com/artikel/schlechtere_krankheitsverlauefe_nach_covid_impfung

Google translation from Germany.

• Worse Disease Progression After Covid Vaccination? (Ziegler)

How does ADE work? The latest publication from Pfizer, which presents the follow-up to the approval study, also proves that the vaccines are at least not effective against the severe courses of COVID . It shows no effectiveness of the vaccination against death and no relevant absolute effectiveness against severe courses (we will report on this separately). But why ADE? Because an increased viral load in the nasal epithelium in vaccinated people looks like ADE after six months. How come? Infection-enhancing antibodies ( ADEs ) bind antibodies that are formed against the vaccine after being vaccinated to bind to the virus when it is infected later. But instead of neutralizing it, the antibodies increase the uptake (endocytosis) of the virus by the types of cells that the virus can infect.

There are different molecular mechanisms for this; the antibodies act like a catalyst that accelerates the biochemical reaction, here the endocytosis of the virus-receptor complex in the cell. The phenomenon is known from vaccines against RSV (respiratory syncitial virus) and the dengue virus. It was also in the development of vaccines against the closely related with SARS-CoV-2 Coronaviridae MERS and SARS-CoV-1 observed and contributed to the unsuccessful clinical development of vaccines against these viruses. ADE is very dangerous because the syndrome can cause vaccinees who would have survived an infection naturally without vaccination to become very seriously ill or even die, even though they would have hardly developed any symptoms without vaccination.

Malone rightly points out that ADE can occur 6 to 9 months after vaccination, especially in the case of an unfortunate composition of the antibodies in the phase of titer decline. What is happening there? The antibodies promote the uptake of the virus into the cells. This accelerates virus production and the viral load in the body increases exponentially faster than without ADE, since accelerated endocytosis is a factor in the exponent of the viral replication function. Although the immune system can still form new antibodies against the whole virus even under ADE, the virus now has a massive advantage over the immune system of an unvaccinated person, which does not develop ADE.

[..] Malone’s warnings about ADE seem realistic, given the signs he’s observing. How dangerous would ADE be in relation to the autoimmune diseases that we are already seeing in vaccinees? Based on the current data, I assume that 1 per thousand to 1 or 2 percent of those vaccinated will develop or die from autoimmune diseases caused by the vaccination in the course of 12 to 24 months after the vaccination (including the previous death rate). With ADE, significantly more vaccinees could become seriously ill, the rate could also be in the double-digit percentage range as with RSV – nobody can predict that. What should be done in view of the data situation? One should stop the vaccination campaign and first observe what happens to the vaccinated with the help of prospective cohort studies. All vaccinated persons under the age of 70 who do not die from an apparent cause of death must be examined by pathologists or coroners by autopsy. Autopsies should also be performed in suspected cases of elderly vaccinated persons. Because the Hippocratic oath applies to all people treated by a doctor.

Read more …

Published: 09 September 2020

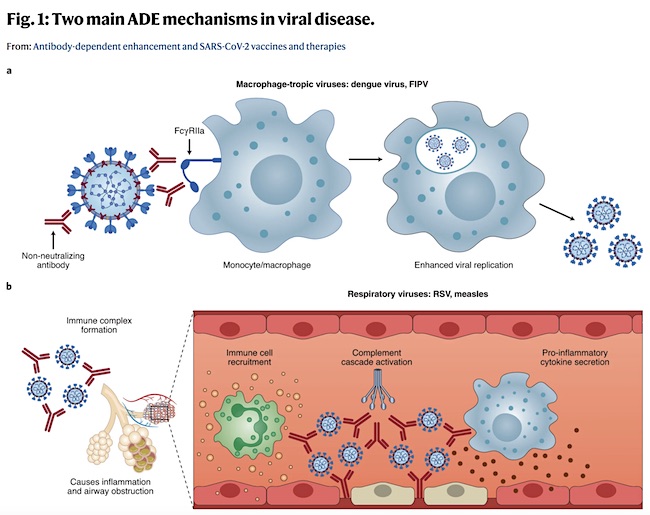

• Antibody-Dependent Enhancement and SARS-CoV-2 Vaccines and Therapies (Nature)

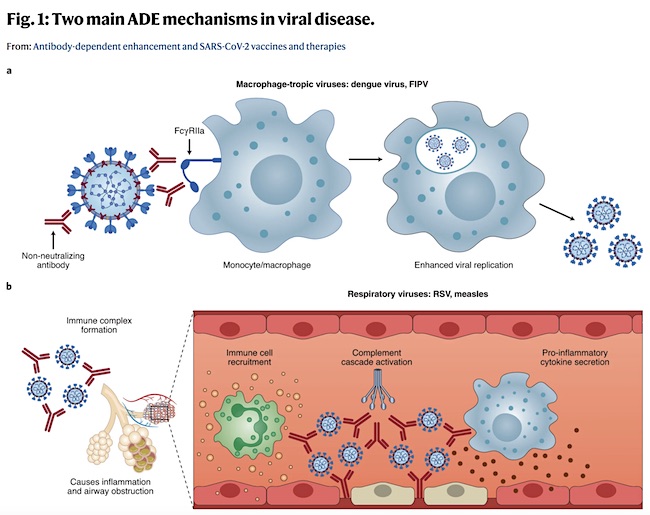

ADE has been documented to occur through two distinct mechanisms in viral infections: by enhanced antibody-mediated virus uptake into Fc gamma receptor IIa (FcɣRIIa)-expressing phagocytic cells leading to increased viral infection and replication, or by excessive antibody Fc-mediated effector functions or immune complex formation causing enhanced inflammation and immunopathology (Fig. 1, Box 1). Both ADE pathways can occur when non-neutralizing antibodies or antibodies at sub-neutralizing levels bind to viral antigens without blocking or clearing infection. ADE can be measured in several ways, including in vitro assays (which are most common for the first mechanism involving Fc≥RIIa-mediated enhancement of infection in phagocytes), immunopathology or lung pathology.

ADE via FcɣRIIa-mediated endocytosis into phagocytic cells can be observed in vitro and has been extensively studied for macrophage-tropic viruses, including dengue virus in humans16 and FIPV in cats. In this mechanism, non-neutralizing antibodies bind to the viral surface and traffic virions directly to macrophages, which then internalize the virions and become productively infected. Since many antibodies against different dengue serotypes are cross-reactive but non-neutralizing, secondary infections with heterologous strains can result in increased viral replication and more severe disease, leading to major safety risks as reported in a recent dengue vaccine trial. In other vaccine studies, cats immunized against the FIPV S protein or passively infused with anti-FIPV antibodies had lower survival rates when challenged with FIPV compared to control groups. Non-neutralizing antibodies, or antibodies at sub-neutralizing levels, enhanced entry into alveolar and peritoneal macrophages18, which were thought to disseminate infection and worsen disease outcome.

In the second described ADE mechanism that is best exemplified by respiratory pathogens, Fc-mediated antibody effector functions can enhance respiratory disease by initiating a powerful immune cascade that results in observable lung pathology. Fc-mediated activation of local and circulating innate immune cells such as monocytes, macrophages, neutrophils, dendritic cells and natural killer cells can lead to dysregulated immune activation despite their potential effectiveness at clearing virus-infected cells and debris. For non-macrophage tropic respiratory viruses such as RSV and measles, non-neutralizing antibodies have been shown to induce ADE and ERD by forming immune complexes that deposit into airway tissues and activate cytokine and complement pathways, resulting in inflammation, airway obstruction and, in severe cases, leading to acute respiratory distress syndrome.

a, For macrophage-tropic viruses such as dengue virus and FIPV, non-neutralizing or sub-neutralizing antibodies cause increased viral infection of monocytes or macrophages via Fc≥�RIIa-mediated endocytosis, resulting in more severe disease. b, For non-macrophage-tropic respiratory viruses such as RSV and measles, non-neutralizing antibodies can form immune complexes with viral antigens inside airway tissues, resulting in the secretion of pro-inflammatory cytokines, immune cell recruitment and activation of the complement cascade within lung tissue. The ensuing inflammation can lead to airway obstruction and can cause acute respiratory distress syndrome in severe cases. COVID-19 immunopathology studies are still ongoing and the latest available data suggest that human macrophage infection by SARS-CoV-2 is unproductive. Existing evidence suggests that immune complex formation, complement deposition and local immune activation present the most likely ADE mechanisms in COVID-19 immunopathology. Figure created using BioRender.com.

Read more …

July 6 2021

• Dangers of COVID-19 Vaccine Associated Enhanced Disease (Goldstein)

Antibody-dependent enhancement (ADE) is an immune system phenomenon, when neutralizing antibodies bind to a virus, but instead of or in addition to neutralizing it, help it to enter cells. The term is also used when these antibodies, not finding targets on the virus, damage the healthy cells (Hellerstein 2020). ADE might happen when the quantity (titer) or quality (matching epitopes presented by the virus) is low. ADE caused by vaccines is called VAED. In the respiratory diseases, it is sometimes called VAERD (vaccine associated enhancement of respiratory disease)…. The current COVID-19 vaccines, used in the US and most Western countries, are mRNA and viral vector vaccines, targeting only the spike protein of SARS-COV-2. For the purposes of this paper, “COVID-19 vaccines” only refer to these mRNA & viral vector vaccines, unless otherwise specified.

For SARS-COV-2, the selection of the spike (S-protein) as the only antigen was an especially bad choice, because anti-spike coronavirus vaccines are known to be especially prone to cause ADE. T-cells, rather than antibodies, provide long term immunity and do not cause ADE, but only about a quarter of T-cells associated with SARS-COV-2 target its spike, compared with half to two thirds in previous coronaviruses. Many (although not all) attempts at vaccines against other coronaviruses have failed because they caused ADE in animal models. This was the case with the experimental vaccines against SARS and MERS. The same thing happened during the attempt to develop a vaccine against FIPV, a coronavirus disease in cats. On a remarkable side note, Remdesivir was tried for FIPV in cats and failed. It was then tried on humans for COVID-19 and also failed, but still received a EUA…

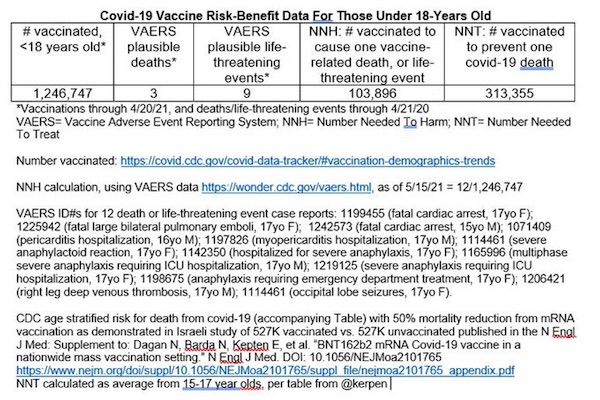

[..] Children 12-15 are expected to be impacted especially hard by the COVID-19 vaccines, due to higher reactivity of their immune systems. A Pfizer study has shown 1.76 higher antibody titers in this age group compared with 16–25 year-olds (FDA re-Amendment 2021). Some research suggests that the COVID-19 vaccines could possibly interfere with the development of immunity to common cold coronaviruses. This risk is totally unjustified. Very few persons <18 develop severe COVID-19, and 84% of them have obesity or other known chronic conditions. Suspected ADE from COVID-19 vaccines, especially spike protein-based ones, was explicitly linked to the Multisystem Inflammatory Syndrome in Children (MIS-C). A recent study suggests interference of the COVID-19 vaccines with the immune reaction to common cold coronaviruses. Some 12-year-olds, who have not developed natural immunity to all four common cold coronaviruses, might be unable to develop it because of the original antigenic sin with the anti-spike vaccine.

Read more …

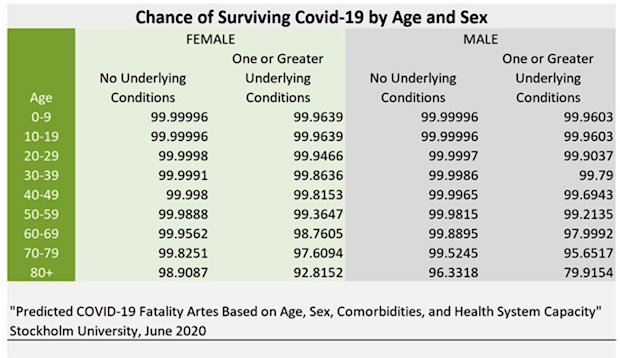

“..the data out of NYC shows that even if you’re old — 80+ — if you do not have those conditions Covid-19 is no significant threat. But the jabs are…”

• “The Most Dangerous Vaccine” – Until Now, Of Course (Denninger)

“The Most Dangerous Vaccine” Well, it was the most-dangerous vaccine. It was for Smallpox. That vaccine is very effective (unlike the Covid jabs which, on the data, are an abject failure as the virus is evolving around them and their protection wanes in months) and Smallpox kills about 30% of the people who get it with very little variation based on age (that is, 300,000 per million persons) while Covid-19 kills anywhere from 20-90,000 per million depending on your age.” Now think about this: “We know if we immunize a million people, that there will be 15 people that will suffer severe, permanent adverse outcomes and one person who may die from the vaccine,” says Dr. Paul Offit, one of the country’s top infectious disease specialists, and he knows all about vaccines that prevent those diseases. In his lab at Children’s Hospital of Philadelphia, he studies and creates new vaccines. There’s nothing new about the smallpox vaccine.”

This risk is much lower than the Covid shots which have associated more than 10,000 deaths so far out of ~170 million Americans immunized, or approximately fifty times the smallpox vaccine mortality rate. Was the smallpox vaccine worth it? Absolutely. Should it be mandated? No, but it should be made widely available. Yes, it might screw you. But if you get the disease, and it could happen in a biological attack, there is a one in three risk of death. Covid, among young and healthy people, has managed to kill under a hundred across the entire population; perhaps 50% of whom have already had it with many not knowing they had it. In most people Covid-19 produces only a mild or moderate flu-like illness. Yeah, it makes you feel like crap for a couple of days.

And just like smallpox, if you get it and survive you get broad immunity that, on the science, continues to improve for a few months afterward and which remains effective even if the virus mutates, which it will and does. If you’re old and especially if you’re fat and diabetic then Covid can be much more serious. But even then it’s a tiny fraction of the impact of smallpox. I remind you that being fat and Type II diabetic is a choice, and one that you had the last 18 months to do something about. Literally anyone could have dropped 50+ lbs over the last year and a half and the data out of NYC shows that even if you’re old — 80+ — if you do not have those conditions Covid-19 is no significant threat. But the jabs are.

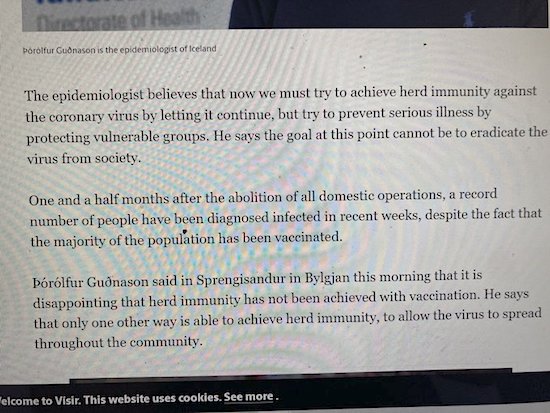

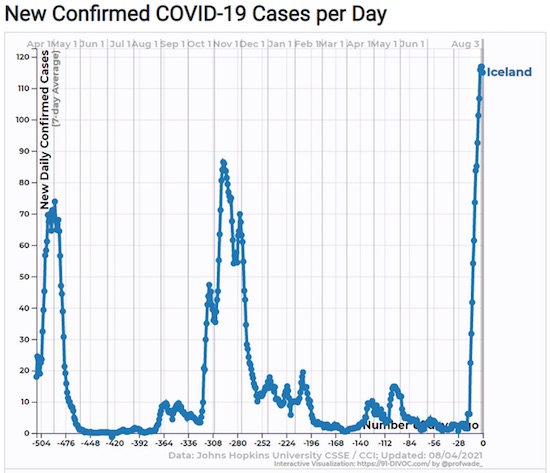

Not only do they not work very well, as seen with all these “breakthrough” infections (which is a lie, by the way: Those are vaccine failures) but in addition the data is that over six months time or so the protection wanes and there is some data that OAS may be showing up. OAS, or original antigenic sin, occurs when your immune system has been “primed” to respond to something (e.g. Covid-19) via either infection or a vaccine but when challenged with the actual infection it produces an incorrect and thus ineffective response. That is what we’re seeing in Israel, Iceland and elsewhere.

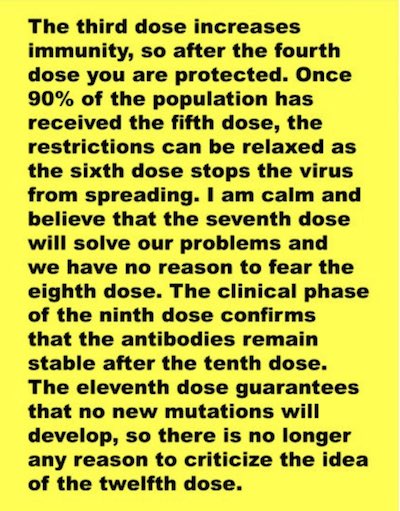

But what’s much worse is that we do not know if the risk from the jabs is individual and “one and done”; that is, if you take the jab and get no nasty side effects you won’t if you need boosters every six months, whether the risk is disconnected from the number of jabs, or much worse, the risk is multiplicative or even exponential with additional inoculations. We don’t know because we didn’t look. For some people who are at the upper end of that risk range — the old and medically frail — the jabs might be worth it even with all these unknowns. But for younger, healthy people? No.

Read more …

He has a whistleblower inside the CMS?

• Attorney Renz: MORE Than 45,000 Americans Have Died From Covid-19 Vaccines (DE)

Attorney Thomas Renz revealed on Truth For Health’s Stop The Shot live conference that the original figure of 45,000 people who have allegedly died from the Covid-19 vaccines within three days of vaccination is too low. Renz said that VAERS data from whistleblowers is currently being analysed and appears to show that the original statistic he revealed last month at an event hosted by Awakened America is only a fraction of the real number of deaths. The attorney said that the true number of deaths is likely “immensely higher” and is being hidden by the government. According to attorney Renz, the public is not being given access to all of the death and injury data from the 11 to 12 vaccine injury reporting systems.

Renz said: “Any public policy being made without independent study of this data will lead to poor and or dangerous policies being made for we the people.” Attorney Renz said that once the data has been analysed, he will release the information over the next few weeks. Previously, Renz stated at the Awaken America event last month that a whistleblower – referred to as Jane Doe – informed him that there are around 11 VAERS systems reporting adverse reactions and deaths across the US, and one system alone has allegedly has reported the shocking 45,000 deaths from the Covid jabs. Renz and his law firm, along with America’s Frontline Doctors, are currently suing the federal government for covering up the true number of deaths from the Covid-19 vaccines and for approving the jabs for use on children.

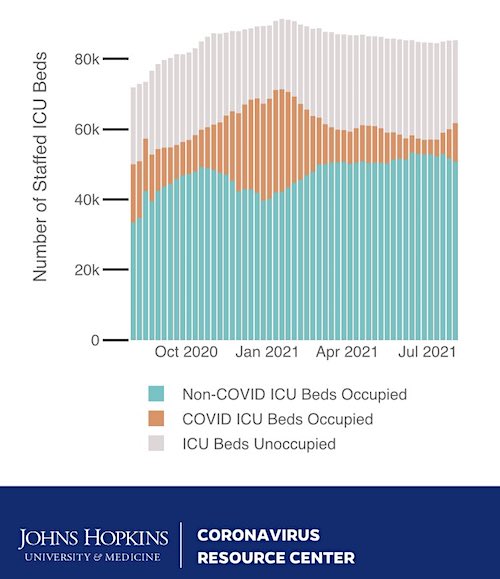

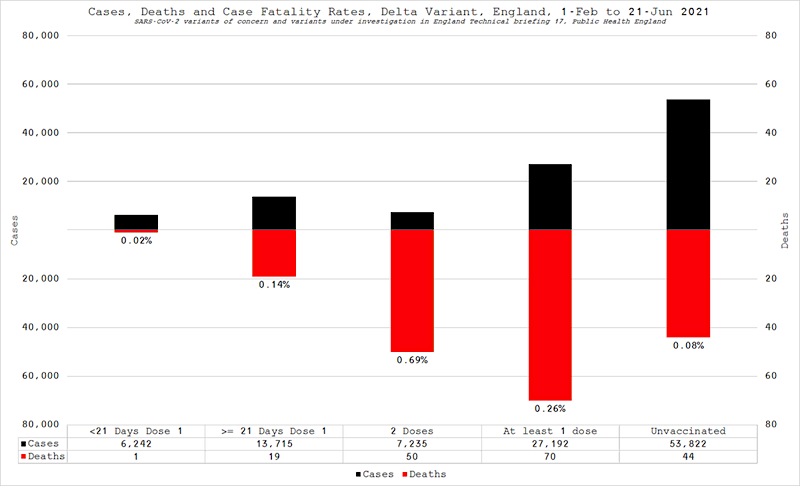

[..] Various hospital whistleblowers have come forward and revealed to Thomas Renz and his team that hospitals are seeing fully vaccinated breakthrough cases at an “astounding rate.” Renz said that numerous whistleblowers have stated that they are seeing fully vaccinated individuals in ICUs at a rate anywhere from 40% to 100%. “People who are fully vaccinated are accounting for 40% or more of admissions for Covid and Covid related illness. 40% or more, that is pretty amazing considering the government’s telling us you won’t ever be admitted and you’ll be safe if you get this vaccine.” Renz said that one hospital whistleblower revealed that there have been several periods where, in her hospital, 100% of the ICU patients were comprised of breakthrough cases. The attorney said that these Covid breakthrough cases are “exactly what we are seeing in the UK and Israel” and is proof that the Covid jab “is not safe or effective.”

Read more …

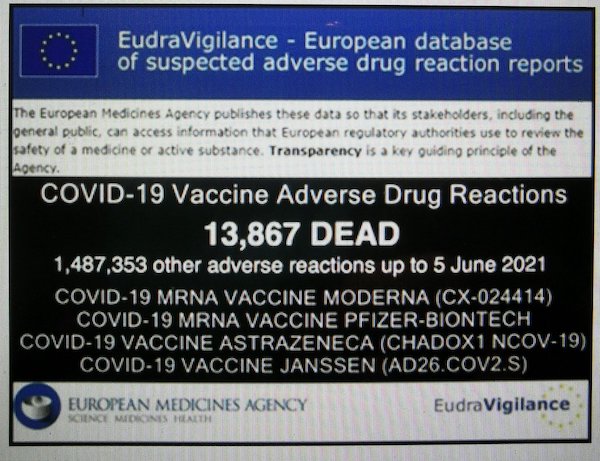

With 1-10% reported.

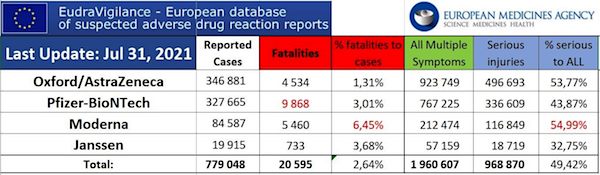

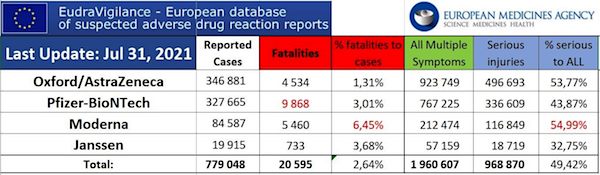

• 20,595 Dead, 1.9 Million Injured in EU Database of Adverse Reactions (GR)

The European Union database of suspected drug reaction reports is EudraVigilance, and they are now reporting 20,595 fatalities, and 1,960,607 injuries, following COVID-19 injections. A Health Impact News subscriber from Europe reminded us that this database maintained at EudraVigilance is only for countries in Europe who are part of the European Union (EU), which comprises 27 countries. The total number of countries in Europe is much higher, almost twice as many, numbering around 50. (There are some differences of opinion as to which countries are technically part of Europe.) So as high as these numbers are, they do NOT reflect all of Europe. The actual number in Europe who are reported dead or injured due to COVID-19 shots would be much higher than what we are reporting here.

The EudraVigilance database reports that through July 31, 2021 there are 20,595 deaths and 1,960,607 injuries reported following injections of four experimental COVID-19 shots:

COVID-19 MRNA VACCINE MODERNA (CX-024414)

COVID-19 MRNA VACCINE PFIZER-BIONTECH

COVID-19 VACCINE ASTRAZENECA (CHADOX1 NCOV-19)

COVID-19 VACCINE JANSSEN (AD26.COV2.S)

From the total of injuries recorded, half of them (968,870) are serious injuries.

“Seriousness provides information on the suspected undesirable effect; it can be classified as ‘serious’ if it corresponds to a medical occurrence that results in death, is life-threatening, requires inpatient hospitalisation, results in another medically important condition, or prolongation of existing hospitalisation, results in persistent or significant disability or incapacity, or is a congenital anomaly/birth defect.” A Health Impact News subscriber in Europe ran the reports for each of the four COVID-19 shots we are including here. This subscriber has volunteered to do this, and it is a lot of work to tabulate each reaction with injuries and fatalities, since there is no place on the EudraVigilance system we have found that tabulates all the results. Since we have started publishing this, others from Europe have also calculated the numbers and confirmed the totals.*

Read more …

“The perceived level of personal threat needs to be increased among those who are complacent, using hard-hitting emotional messaging. To be effective this must also empower people by making clear the actions they can take to reduce the threat.”

• Project Fear: MSM Is Doing The Government’s Covid Propaganda Work (RT)

The news stories of young, perfectly healthy – unvaccinated – people dying are relentless, while those recording the deaths of people who have died after being vaccinated are ignored. It has taken some doing, and not everyone was on board initially, thanks largely to some unexpected reactions with the AstraZeneca jab, but public health officials across the globe, with the help of the mainstream media, have now stoked up Project Fear in an effort scare people into complying with vaccine demands. Of course, there are already overreaching businesses using the threat of ‘No jab, no job’, but this is something different.

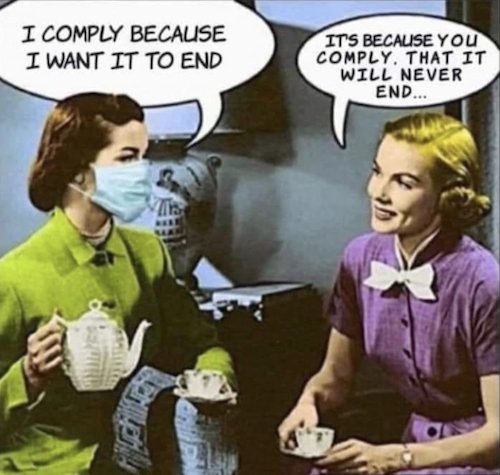

As far back as March last year, the UK Scientific Advisory Group for Emergencies (SAGE) considered a paper looking at ways to make people stick to social distancing rules that suggested: “The perceived level of personal threat needs to be increased among those who are complacent, using hard-hitting emotional messaging. To be effective this must also empower people by making clear the actions they can take to reduce the threat.” It’s clear which way the vote went on that when it came to “All those in favour?” because hard-hitting emotional messaging has been the weapon of choice throughout the pandemic. From social distancing, to hugging your granny, to refusing the vaccine, public health officials have wielded the fear factor in each instance and it’s worked… until now.

Because the end is in sight and so a vast majority of those who remain unvaccinated are thinking, ‘Well, I’ve made it this far’ and are sticking to their guns. And frankly, it’s hard to disagree. Unless the government legislates that vaccination is mandatory (which would be a draconian step too far even for it), then it’s difficult to imagine how to stoke up the fear to such an extent that everyone finally falls into line. Or should that even be the plan? After all, in the UK at least, democracy and personal freedom are the names of the game, and if you don’t feel like following the official Covid advice, then you don’t have to. Of course, there might be serious consequences to flying solo, but that’s up to each individual. Their body, their choice.

Read more …

When your own employees don’t want it.

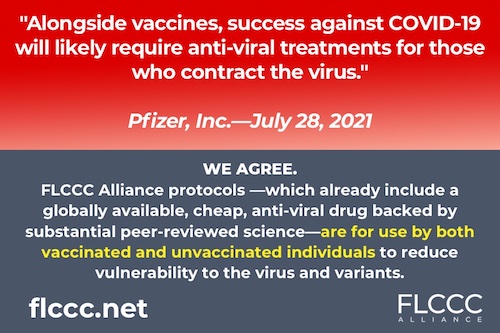

• Pfizer To Require US Workers Receive Covid-19 Vaccine Or Regular Tests (R.)

Pfizer Inc, the U.S. drugmaker that developed a COVID-19 vaccine with German partner BioNTech , said on Wednesday it will require all its U.S. employees and contractors to become vaccinated against COVID-19 or participate in weekly COVID-19 testing. Pfizer spokesperson Pamela Eisele said the company was taking the initiative in order to “to protect the health and safety of our colleagues and the communities we serve.” Employees with medical conditions or religious objections can seek accommodations. Outside of the United States, Pfizer will strongly encourage employees who are able be vaccinated in their countries to do so, Eisele said.

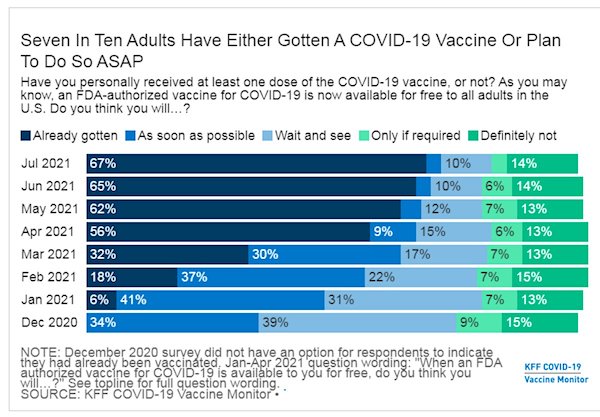

At the end of 2020, Pfizer had around 29,400 U.S-based employees. With U.S. coronavirus cases rising sharply again due to the highly transmissible Delta variant, companies like Alphabet Inc (GOOGL.O) and Walt Disney Inc (DIS.N) have started putting vaccine mandates in place for their employees. read more As of Tuesday, 70.1% of U.S. adults had received at least one dose of a COVID-19 vaccine, according to data from the U.S. Centers for Disease Control and Prevention.

Read more …

An email sent to Mike Tracey.

• “Vaccine Hesitancy” Is A Class Issue (Tracey)

I am what is called a [REDACTED] for [FORTUNE 500 COMPANY] working in the supply chain domain; this includes manufacturing, logistics, and distribution. If you share any of this information, please do not share my job title, name, or company. My job is to work with high-level company executives to understand their overall corporate strategy ($300k+ annual types), then with low-level distribution center and factory workers ($12-$15 an hour types) to understand their day-to-day jobs — and then deliver complex, multi-dimensional technology solutions that execute on those strategic goals while making life easier for floor workers. I really cut across income levels every day.

[..] I have noticed, with absolute clarity, a stark divide in vaccination behavior. I hop around between my home in [REDACTED] to our facilities in the South, Midwest, and on the West Coast. I can tell you that at each site, the picture is the exact same. [FORTUNE 500 COMPANY] has a program where you can shed the standard COVID protocols if you provide the company with your proof of vaccination. Without fail, corporate management and executives are vaccinated at near 100% rates. Likewise without fail, hourly laborers (who are almost all white in the Midwest, almost all black in the South, and all mixed up on the West Coast) are vaccinated between 5% and 15% — and vaccinations are concentrated almost entirely in the old folks.

I have heard over and over that this is a political phenomenon. “Vaccine hesitancy is a problem of white Republicans, of course!” But in reality, I don’t believe it has anything to do with race or political alignment — and everything to do with social class. I read somewhere recently a tweet from someone who seemed insightful, who said that the centers of power in this country have so heavily relied on propaganda and psyops that the hierarchies that run those centers of power have themselves begun to select for people that are most likely to buy into the propaganda. As a result, you don’t have an evil ruling class — just a delusional one that is entirely bought into its own narrative. The people who do not move up the ladder — though they may be competent and capable — are restricted by the fact that they do not buy the narrative.

If this is true, I think it makes absolute sense. The people who are most likely to be “company men” — the people whose entire lives are defined by their status in a Fortune 500 organization, who are the most married to the corporate narrative, and who are the most likely to be absent critical thought (as all executives are — once you get to VP, you stop thinking your own thoughts and instead think only your shareholders’ or board’s thoughts) are the ones who are, almost universally, vaccinated. The people who do not live in that world are, almost universally, not. I have not seen one person break it down this way. I bet if you spent a week or two digging into the research on this, you’d see just how true it was in all of the numbers available to you.

Read more …

Read more …

And breaks the back of the Republic.

• French Constitutional Court Backs Macron’s Covid Pass (B’s)

France’s top constitutional authority on Thursday approved a Covid pass that limits access to cafes, restaurants and inter-city trains and planes to people who have been vaccinated or tested negative for the virus. The controversial pass, which will become ubiquitous from Monday, drew several hundred protesters outside the Council of State in Paris. “All this undermines fundamental freedoms… Freedom is, first of all, the choice to be vaccinated or not,” said Marie Jose Libeiro, 48. “We are falling into an authoritarian state.” But the Constitutional Court said the restrictions put forward by President Emmanuel Macron and approved by parliament last month represented a “balanced trade-off” between public health concerns and personal freedom.

Prime Minister Jean Castex welcomed the court ruling, saying it “will allow the full deployment of our battle strategy against Covid-19”. The biggest change concerns restaurants which will now have to turn away patrons who fail to produce the health pass. “There will be a cost, in terms of time spent checking the pass, and in terms of sales because we will lose customers,” Herve Becam, vice president of the UMIH hotels and restaurants association, told AFP. Cyril Wafik, manager of the Indiana Cafe in central Paris, said the pass presented yet another challenge for many restaurant owners who were already having trouble getting customers to wear masks. “We’re not police, that’s not our job,” he told AFP. “This will affect our relationship with our customers.”

Visitors to some shopping centres and department stores will also need the pass, as will visitors to hospitals or care homes and people seeking non-urgent medical care. But the absence of a health pass must not be an obstacle to patients receiving treatment, the court ruled. Health workers and others whose job requires them to be in contact with people at risk of Covid must now get vaccinated by law. But the court rejected as “disproportionate” the government’s wish to force people with Covid infections into isolation for 10 days. The court’s judges also struck down another provision included in the health law that brought in the Covid pass, which would allow employers to dismiss people on fixed-term or temporary contracts if they don’t have a pass.

Read more …

“Children are falling behind in school, and are being harmed physically and psychologically by the tactics you have used to keep them from the classroom last year. We won’t allow it again.”

• Rand Paul: Mask Mandates And Lockdowns From Petty Tyrants? No, not again (RPI)

Resist. They can’t arrest us all. They can’t keep all your kids home from school. They can’t keep every government building closed – although I’ve got a long list of ones they should. We don’t have to accept the mandates, lockdowns, and harmful policies of the petty tyrants and feckless bureaucrats. We can simply say no, not again. Speaker Nancy Pelosi — you will not arrest or stop me or anyone on my staff from doing our jobs. We have all either had COVID, had the vaccine, or been offered the vaccine. We will make our own health choices. We will not show you a passport, we will not wear a mask, we will not be forced into random screening and testing so you can continue your drunk with power rein over the Capitol. President Biden — we will not accept your agencies’ mandates or your reported moves toward a lockdown. No one should follow the CDC’s anti-science mask mandates.

And if you want to shutdown federal agencies again — some of which aren’t even back to work fully — I will stop every bill coming through the Senate with an amendment to cut their funding if they don’t come to work. No more. Local bureaucrats and union bosses — we will not allow you to do more harm to our children again this year. Children are not at any more risk from COVID than they are for the seasonal flu. Every adult who works in schools has either had the vaccine or had their chance to. There is no reason for mask mandates, part time schools, or any lockdown measures. Children are falling behind in school, and are being harmed physically and psychologically by the tactics you have used to keep them from the classroom last year. We won’t allow it again.

If a school system attempts to keep the children from full-time, in-person school, I will hold up every bill with two amendments. One to defund them, and another to allow parents the choice of where the money goes for their child’s education. Do I sound fed up to you? That’s because I am. I’m not a career politician. I’ve practiced medicine for 33 years. I graduated from Duke Medical School, worked in emergency rooms, studied immunology and virology, and ultimately chose to become a surgeon. I have been telling everyone for a year now that Dr. Anthony Fauci and other public health officials were NOT following science, and I’ve been proven right time and time again. But I’m not the only one who is fed up. I can’t go anywhere these days — from work, to events, to airports and Ubers, restaurants and stores, without people coming up to me thanking me for standing up for them.

For standing up for actual science. For standing up for freedom. For standing against mandates, lockdowns, and bureaucratic power grabs. I think the tide has turned, and more and more people are willing to stand up. I see stories from across the country of parents standing up to teacher unions and school boards. I see members of Congress refusing to comply with Petty Tyrant Pelosi. We are at a moment of truth and a crossroads. Will we allow these people to use fear and propaganda to do further harm to our society, economy, and children? Or will we stand together and say, absolutely not. Not this time. I choose freedom.

Read more …

And enjoying it.

• “Authorities Are Viewing Their Own People as an Enemy” (SN)

UN Special Rapporteur on Torture Nils Melzer responded to police brutality dished out to anti-lockdown protesters in Germany last weekend by warning, “Authorities are increasingly viewing their own people as an enemy.”

As we highlighted earlier in the week, Melzer, a professor of international law, made a request for eyewitnesses after footage emerged of numerous examples of people being manhandled and beaten by police in Berlin merely for expressing their right to assemble. One clip showed a female anti-lockdown protester in Berlin being grabbed by the throat and brutally thrown to the ground by riot police, while another showed a young boy being struck in the face as he tried to come to the aid of his mother.

The response to Melzer’s request was overwhelming, with over a hundred reports of violence flooding in, leaving him with the task of “calling for clarification as well as punishment and reparation for rule violations,” reports Berliner Zeitung. The professor says there is clearly enough evidence “for an official intervention on my part with the federal government.” However, it was Melzer’s comments on the wider perspective of the crackdown that stirred the most interest. After seeing similar scenes during anti-lockdown protests in European cities across the continent, as well as “police operations in demonstrations worldwide,” Melzer came to a sobering conclusion. “Something fundamental is going wrong. In all regions of the world, the authorities are apparently increasingly viewing their own people as an enemy,” he stated.

Melzer went on to assert that it is totally unethical for police to engage in violence against the citizenry unless it is in clear self-defense. “It is absolutely unacceptable when the police take action against defenseless demonstrators because of mere administrative offenses or civil disobedience with sometimes life-threatening violence,” he said. The professor also noted the utter stupidity of police inflicting violence on demonstrators while claiming to do so in the name of “health protection.” “If the police do not clearly communicate that they see themselves as friends and helpers, but rather treat their own population as an enemy, then a dangerous spiral has been set in motion: namely that the next thing is that the population will also regard the police as an enemy,” concluded Melzer.

Read more …

Read more …

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

This is not just any girl. This is the daughter of Billy Evans, killed in the 4-2 attack at the Capitol.

He is the only Capitol Police officer killed in over 20 years.

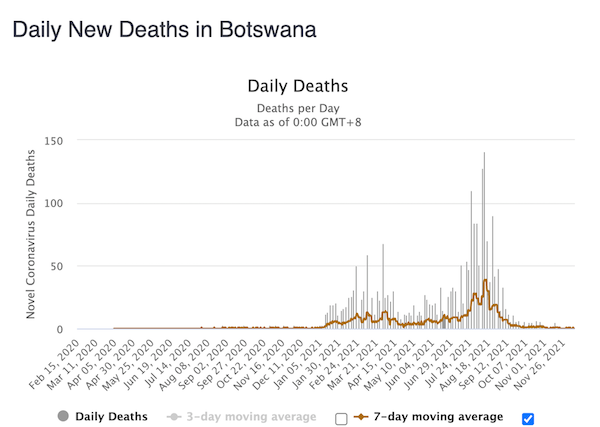

Very high vaccination rate

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.