Paul Gauguin Farm in Brittany 1894

“One must still have chaos in oneself to give birth to a dancing star.”

– Friedrich Nietzsche

“I was not born to be forced. I will breathe after my own fashion. Let us see who is the strongest”.

– Henry David Thoreau, ‘Civil Disobedience’

UK politics has gone completely bonkers….

• We Are Living Through a Time of Fear (Cook)

Welcome to the age of fear. Nothing is more corrosive of the democratic impulse than fear. Left unaddressed, it festers, eating away at our confidence and empathy. We are now firmly in a time of fear – not only of the virus, but of each other. Fear destroys solidarity. Fear forces us to turn inwards to protect ourselves and our loved ones. Fear refuses to understand or identify with the concerns of others. In fear societies, basic rights become a luxury. They are viewed as a threat, as recklessness, as a distraction that cannot be afforded in this moment of crisis. Once fear takes hold, populations risk agreeing to hand back rights, won over decades or centuries, that were the sole, meagre limit on the power of elites to ransack the common wealth. In calculations based on fear, freedoms must make way for other priorities: being responsible, keeping safe, averting danger.

Worse, rights are surrendered with our consent because we are persuaded that the rights themselves are a threat to social solidarity, to security, to our health. It is therefore far from surprising that the UK’s draconian new Police and Crime Bill – concentrating yet more powers in the police – has arrived at this moment. It means that the police can prevent non-violent protest that is likely to be too noisy or might create “unease” in bystanders. Protesters risk being charged with a crime if they cause “nuisance” or set up protest encampments in public places, as the Occupy movement did a decade ago. And damaging memorials – totems especially prized in a time of fear for their power to ward off danger – could land protesters, like those who toppled a statue to notorious slave trader Edward Colston in Bristol last summer, a 10-year jail sentence.

In other words, this is a bill designed to outlaw the right to conduct any demonstration beyond the most feeble and ineffective kind. It makes permanent current, supposedly extraordinary limitations on protest that were designed, or so it was said, to protect the public from the immediate threat of disease. Protest that demands meaningful change is always noisy and disruptive. Would the suffragettes have won women the vote without causing inconvenience and without offending vested interests that wanted them silent? What constitutes too much noise or public nuisance? In a time of permanent pandemic, it is whatever detracts from the all-consuming effort to extinguish our fear and insecurity. When we are afraid, why should the police not be able to snatch someone off the street for causing “unease”?

The UK bill is far from unusual. Similar legislation – against noisy, inconvenient and disruptive protest – is being passed in states across the United States. Just as free speech is being shut down on the grounds that we must not offend, so protest is being shut down on the grounds that we must not disturb.

… and I mean completely.

• Covid: £5,000 Fine For People Going On Holiday Abroad (BBC)

A £5,000 fine for anyone in England trying to travel abroad without good reason is due to come into force next week as part of new coronavirus laws. The penalty is included in legislation that will be voted on by MPs on Thursday. Foreign holidays are currently not allowed under the “stay at home” rule which ends on Monday. But then the ban on leaving the UK at this time will become a specific law backed up by the threat of the fine. Under the current plan for easing restrictions, the earliest date people in England could go abroad for a holiday would be 17 May. However, another surge in Covid cases in continental Europe, as well as the slow rollout of vaccines across Europe, has cast doubt on the resumption of foreign travel.

Health Secretary Matt Hancock said restrictions on travelling abroad were necessary to guard against the importation of large numbers of cases and new variants which might put the vaccine rollout at risk. Shadow Cabinet Office minister Rachel Reeves told BBC Breakfast that Labour supported measures to keep the UK’s borders secure and avoid the importation of new variants but said the government’s “slowness to react” had contributed to the country’s high death rate. Prime Minister Boris Johnson warned on Monday the UK should be “under no illusion” that it will feel the effects of a rising number of cases on the continent. One of his ministers, Lord Bethell, said England might put “all our European neighbours” on the “red list” of countries. However, Mr Hancock told BBC Radio 4’s Today programme there were no plans to do this.

A two week lockdown can achieve something. A one year lockdown can only achieve something other than the stated intent.

An entire library on lockdown effectiveness is at The Fat Emperor.

• Lockdown One Year On – It Was Never Supposed To Work (OffG)

And so we come to March 23rd, and lockdown’s first birthday. Or, as we call it here, the longest two weeks in history. 1 year. 12 calendar months. 365 increasingly gruelling days. It’s a long time since “2 weeks to flatten the curve”, became an obvious lie. Sometime in July it turned into a sick joke. The curve was flattened, the NHS protected and the clapping was hearty and meaningful. …and none of it made any difference. This was not a sacrifice for the “greater good”. It was not a hard decision with arguments on both sides. It was not a risk-benefit scenario. The “risks” were in fact certainties, and the “benefits” entirely fictional.Because Lockdowns don’t work. It’s really important to remember that.

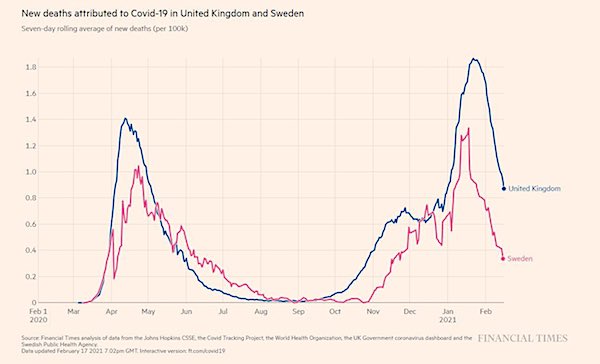

Even if you subscribe to the belief that “Sars-Cov-2” is a unique discrete entity (which is far from proven), or that it is incredibly dangerous (which is demonstrably untrue), the lockdown has not worked to, in any way, limit this supposed threat. Lockdowns. Don’t. Work. They don’t make any difference, the curves don’t flatten and the R0 number doesn’t drop and the lives aren’t saved (quite the opposite, as we’ve all seen). Just look at the graphs. This one, comparing “Covid deaths” in the UK (lockdown) and Sweden (no lockdown):

Or this one, comparing “Covid deaths” in California (lockdown) and Florida (no lockdown):

From Belarus to Sweden to Florida to Nicaragua to Tanzania, the evidence is clear. “Covid”, whatever that means in real terms, is not impacted by lockdowns. Putting the entire population under house arrest doesn’t benefit public health. In fact, it’s (rather predictably) incredibly counter-productive. The damage done by shuttering businesses, limiting access to healthcare, postponing treatments and diagnoses, postponed surgeries, increasing depression, soaring unemployment and mass poverty has been discussed to death. The scale of the impact cannot be overstated.

Dr David Nabarro, World Health Organization special envoy for Covid-19, said this of lockdowns back in October: “We in the World Health Organization do not advocate lockdowns as the primary means of control of the virus[…]just look at what’s happened to the tourism industry…look what’s happening to small-holding farmers[…]it seems we may have a doubling of world poverty by next year. We may well have at least a doubling of child malnutrition […] This is a terrible, ghastly global catastrophe.”

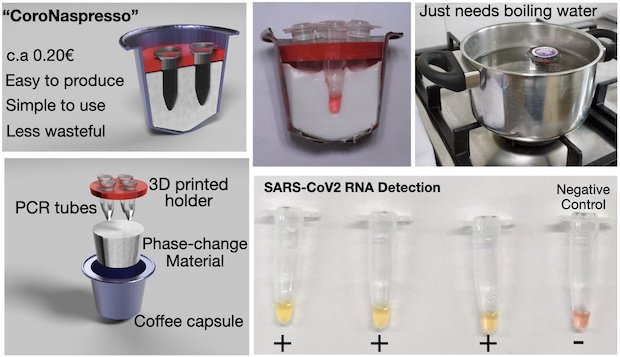

Haven’t read the whole document yet, but the picture looks intruiging.

• CoroNaspresso: A Cheap, Rapid and Simple Home Test (chemrxiv)

Development of a novel LAMP device which is cheap, reusable, and can be produced in large amounts in a short period of time. The device was designed such not to require chemical exothermic reactions, have limited waste produced and with a minimum cost of the device as a whole. The device was tested for the detection of SARS-CoV2 RNA.

In Lebanon, it’s one crisis on top of another crisis on top of another.

• Every Day We Discuss Closure And Then Decide To Keep Going (MENA)

Once bustling with life, Beirut’s famed Gemmayze Street is now deserted. Lined with damaged homes, collapsed buildings and closed businesses, the residential and commercial hub was one of the city’s most vibrant destinations – but not any more. “It’s like a nightmare. We’ve never seen anything like this before,” said Charbel Bassil, owner of renowned Le Chef restaurant, on the first day of reopening after a nationwide lockdown. One of Beirut’s oldest and most popular restaurants, Le Chef, in in Gemmayze, is one of many businesses struggling to stay afloat under the weight of Lebanon’s compounding crises. The family business reopened its doors on March 22, as per the government’s lockdown strategy, but customers were hardly pouring in.

The modest space, which was often full to the brim for lunchtime, now welcomed only three tables after a full day of work, or about 10 customers. The burst of vigor and energy that characterised the dining experience at Le Chef was replaced by a sense of moping and melancholy. “We’re doing our best to keep going, but everything is a mess,” Mr Bassil told The National. Le Chef , founded in 1967, weathered civil wars and crises, but none harmed trade like Lebanon’s current events. “This is our family business. I’ve been working here since I was a child, but nothing we lived through was as bad as this,” Mr Bassil said. After almost losing the restaurant in the Beirut blast, Le Chef was able to rebuild thanks to donations, $5,000 of which came from the actor Russell Crowe.

But what the port explosion could not destroy, the economic crisis shattered. “We can’t work in this crisis. Suppliers won’t give us goods because of the market rate and we don’t know how to price our dishes,” Mr Bassil told The National. “We’re a restaurant for the people. We want to serve high-quality food for affordable prices.” Lebanon’s currency lost more than 80 per cent of its value since the beginning of the economic crisis, declared one of the worst in the country’s history. In one year, the Lebanese pound, which once traded at 1,500 to the US dollar, slumped to 15,000 on the parallel market. The minimum wage shrank from $450 to an average of $50, leaving people with insufficient salaries to cover rising living costs.

[..] Despite the opportunity to be back in business, Lebanon’s hospitality sector is wary about reopening because operational costs now outweigh profits. Fewer than 1,000 restaurants and cafes are expected to reopen this week, said Aref Saade, treasurer at the Syndicate of Owners of Restaurants, Cafes, Night-Clubs and Pastries. Prior to the crisis, Lebanon had about 8,500 tourist institutions in business. The number decreased to 4,500 when Covid-19 struck, and is anticipated to sink below 1,000 due to the soaring and unstable currency exchange rate. “Businesses are refraining from reopening – it’s just not worth it,” Mr Saade told The National.

“If I can save you,” he said referring to his father, “I can tell you, I save anybody.”

• Top Yale Doctor: ‘Ivermectin Works,’ Including For Long COVID (TSN)

A Yale University professor and renowned cancer researcher has pored over the COVID-19 literature and treated several dozen patients. He can remain silent no longer. Dr. Alessandro Santin, a practicing oncologist and scientist who runs a large laboratory at Yale, believes firmly that ivermectin could vastly cut suffering from COVID-19. Santin joins a growing group of doctors committed to using the safe, generic drug both as an early home treatment to prevent hospitalization and alongside inpatient treatments like steroids and oxygen. “The bottom line is that ivermectin works. I’ve seen that in my patients as well as treating my own family in Italy,” Santin said in an interview, referring to his father, 88, who recently suffered a serious bout of COVID. “We must find a way to administer it on a large scale to a lot of people.”

Santin’s statements carry the prestige of a leadership position at Yale School of Medicine and the gravitas of a top uterine cancer researcher, who has authored more than 250 science journal articles and pioneered treatment, used worldwide, for the most aggressive form of uterine cancer. At Yale, he is an OB/GYN professor, team leader in gynecologic oncology at the Smilow Comprehensive Cancer Center, and co-chief of gynecologic oncology. When COVID came along, Santin began reading about how best he might help his cancer patients, 10 to 20 percent of whom were coming in infected with COVID. He began using ivermectin after the National Institutes of Health changed its advisory in January to allow the drug’s use outside of COVID trials. Santin’s endorsement is not only important but broad.

He said he has seen ivermectin work at every stage of COVID — preventing it, eliminating early infection, quelling the destructive cytokine storm in late infection, and helping about a dozen patients so far who suffered months after COVID. One of them is an athlete and mother of two, 39, who had been disabled by post-COVID chest pain, shortness of breath and fatigue; she confirmed in an email to me her joy at being able to walk up a hill again and breathing better within 72 hours of her first dose. “When you have people that can’t breathe for five, six, eight, nine months and they tried multiple drugs and supplements with no success, and you give them ivermectin,” Dr. Santin said of long-haul patients, “and you see that they start immediately feeling better, this is not placebo. This is real.”

[..] Beyond his outpatients, Santin has treated family members and friends infected with COVID in both his home community in Connecticut and in his native Italy via telemedicine. There, he prescribed ivermectin to more than 15 families, in which parents, children or others had became infected; the goal was both to treat early and prevent severe COVID, as studies have shown ivermectin does. “I have not a single one that right now had to go to the hospital to receive oxygen,” he said. “I have no doubt ivermectin saved my 88-year-old father’s life.” His father survived COVID despite high blood pressure, cardiac disease that led previously to seven stents and open heart surgery, and lung problems. “If I can save you,” he said referring to his father, “I can tell you, I save anybody.”

Google translate.

• Logic In Lockdown: The German Corona Policy Is In Ruins (NZZ)

Instead of easing concepts, the Chancellor and Prime Minister present the extension and tightening of the lockdown. The citizens have to pay for what the government has missed for months. Chancellor Angela Merkel and the Prime Minister wrestled with each other for twelve hours on Tuesday. Anyone who expected a big hit after this nightly marathon was disappointed: The result of the conference is shameful. Not only that the tentative easing of the corona measures has been discarded. Germany should also go into a tough lockdown at Easter. “We thought again today,” said the Chancellor in the early hours of the morning. In order to “break through” the third corona wave a little bit, April 1st and 3rd at Easter will be “one-off days of rest”, as “extended rest time”.

Rethought? With these resolutions, Germany’s government surrenders to the principles of reason. If you wanted to avoid hamster purchases and crowds in supermarkets until now, the opposite is now the case: the closing of supermarkets over Easter is forcing citizens to replenish their supplies. You don’t need a crystal ball to predict the resulting overcrowding of the shops on Holy Saturday. Is that still wanton or already deliberate bad planning? Either way, it lacks any logic. Religious freedom could also be a victim of the comfortably formulated “extended rest period at Easter” – for all those for whom five months of rest are not enough – there should be no Easter services with an audience in attendance, according to the will of the conference.

So while in the past few days 700 Hansa Rostock football fans were allowed to go to the stadium with a negative quick test and 1,000 classical music fans who also tested negative were allowed to go back to the Berlin Philharmonic, is it not possible to organize a gathering of Christians at their highest festival? Not if you leave it to this government, that’s for sure. Local politicians such as Tübingen’s Mayor Boris Palmer show that there is another way. With test stations he enables the citizens of his city to live a little and the business people to survive.

“..the lowest reported inventory since the Realtors association began tracking it in 1982..”

• US Home Sales Fell Nearly 20% In February (F.)

Single-family home sales dropped 18.2% from January to February, according to the U.S. Census Bureau, even as annualized sales remain much higher than pre-pandemic rates. 775,000 (at a seasonally adjusted annual rate) new single-family homes were sold in Feb. 2021—that’s a large drop from the 958,000 homes sold rate in Jan. 2021. Adjusted home sale rates are still far higher than they were pre-pandemic: 716,000 new single family homes were sold in Feb. 2020. The median price of new homes sold in February was $349,000 and the average sale price was $416,000. The National Association of Realtors said the decline from January was due to “historically-low inventory”, and said home sales are ahead of total 2020 sales. At the end of December 2020, there were just 1.07 million homes for sale—the lowest reported inventory since the Realtors association began tracking it in 1982.

“Brussels “has consistently destroyed all mechanisms without exception that existed on the basis of an agreement on partnership and cooperation.”

• EU Has ‘Destroyed’ Once Friendly Ties With Russia – Lavrov (RT)

Months of political tension and a wave of new sanctions have severed all links between the EU and Russia, Moscow’s top diplomat has said, adding that his country is ready to resume cooperation if Brussels decides it is interested. Speaking at a press conference alongside his Chinese counterpart on Tuesday, Foreign Minister Sergey Lavrov said that currently, “there are no relations with the EU as an organization. The entire infrastructure of these relations has been destroyed by unilateral decisions made from Brussels.” Some individual European countries, he argued, are still seeking closer ties with Moscow, “guided by their national interests.” However, these are being fast outpaced by growing partnerships with China, Lavrov told journalists.

“If and when Europeans decide to eliminate these anomalies in contacts with their largest neighbor, of course, we will be ready to build up these relations based on equality,” the diplomat confirmed, “while in the East, in my opinion, we have a very intensive agenda, which is becoming more diverse every year.” In February, the foreign minister stated that Moscow’s relations with the bloc had taken a tumble in 2014, after the EU “blamed the Russian Federation for everything that is happening” in Ukraine following the Maidan. Since then, he argued, Brussels “has consistently destroyed all mechanisms without exception that existed on the basis of an agreement on partnership and cooperation.”

As part of a fiery broadcast interview, Lavrov warned that if the bloc’s leadership sought to impose sanctions on Russia that hit sensitive areas of the economy, Moscow could break off diplomatic contact altogether as a last resort. “Of course, we do not want to isolate ourselves from living in the world, but we must be ready for this. If you want peace, prepare for war,” he stressed. Earlier this month, the EU unveiled a new package of sanctions against four Russian officials it claimed were responsible for the detention of opposition figure Alexey Navalny, and “human rights violations” during the policing of subsequent protests held in his support. At the time, the Foreign Ministry in Moscow said the bloc had “missed yet another opportunity to review its … approach to relations with Russia.”

“The United States is not qualified to talk to China in a condescending manner. The Chinese people will not accept that.”

• Welcome To ‘Shocked & Awed’ 21st Century Geopolitics (Escobar)

With a Russia-China-Iran triple bitch slap on the hegemon, we now have a brand new geopolitical chessboard… It took 18 years after Shock and Awe unleashed on Iraq for the Hegemon to be mercilessly shocked and awed by a virtually simultaneous, diplomatic Russia-China one-two. How this is a real game-changing moment cannot be emphasized enough; 21st century geopolitics will never be the same again. Yet it was the Hegemon who first crossed the diplomatic Rubicon. The handlers behind hologram Joe “I’ll do whatever you want me to do, Nance” Biden had whispered in his earpiece to brand Russian President Vladimir Putin as a soulless “killer” in the middle of a softball interview.

Not even at the height of the Cold War the superpowers resorted to ad hominem attacks. The result of such an astonishing blunder was to regiment virtually the whole Russian population behind Putin – because that was perceived as an attack against the Russian state. Then came Putin’s cool, calm, collected – and quite diplomatic – response, which needs to be carefully pondered. These sharp as a dagger words are arguably the most devastatingly powerful five minutes in the history of post-truth international relations. In For Leviathan, it’s so cold in Alaska, we forecasted what could take place in the US-China 2+2 summit at a shabby hotel in Anchorage, with cheap bowls of instant noodles thrown in as extra bonus.

China’s millennial diplomatic protocol establishes that discussions start around common ground – which are then extolled as being more important than disagreements between negotiating parties. That’s at the heart of the concept of “no loss of face”. Only afterwards the parties discuss their differences. Yet it was totally predictable that a bunch of amateurish, tactless and clueless Americans would smash those basic diplomatic rules to show “strength” to their home crowd, distilling the proverbial litany on Taiwan, Hong Kong, South China Sea, “genocide” of Uighurs. Oh dear. There was not a single State Dept. hack with minimal knowledge of East Asia to warn the amateurs you don’t mess with the formidable head of the Foreign Affairs Commission at the CCP’s Central Committee, Yang Jiechi, with impunity.

Visibly startled, but controlling his exasperation, Yang Jiechi struck back. And the rhetorical shots were heard around the whole Global South. They had to include a basic lesson in manners: “If you want to deal with us properly, let’s have some mutual respect and do things the right way”. But what stood out was a stinging, concise diagnostic blending history and politics: “The United States is not qualified to talk to China in a condescending manner. The Chinese people will not accept that. It must be based on mutual respect to deal with China, and history will prove that those who seek to strangle China will suffer in the end.”

It is a weird piece of legislation.

• H.R.1 – Is It Really “For the People”? (Farrell)

A lot has been written about H.R.1 — the so-called “For the People Act of 2021.” Former Vice President Mike Pence has opined on the bill. The Editorial Board of the Wall Street Journal sounded the alarm back in January. The editors of National Review come right out and call it a “partisan assault on American democracy.” H.R.1 purports to, “expand Americans’ access to the ballot box, reduce the influence of big money in politics, strengthen ethics rules for public servants, and implement other anti-corruption measures for the purpose of fortifying our democracy, and for other purposes.” The Bill is 791 pages long. Here are just a few of the more egregious federal power grabs in H.R.1 concocted against the 50 states that run elections under the U.S. Constitution:

• Ban voter ID laws and allow ballot harvesting; • Expand Election Day to “election season” by mandating mail-in ballots be counted 10 days after the election would normally be over; • Automatic voter registration of people who apply for unemployment, Medicaid, Obamacare and college, or who are coming out of prison. There is a lot more, and it gets worse. Substantially worse. There are First Amendment restrictions on political speech and on the support or opposition of a bill and/or a candidate. Remember: This is supposed to be “fortifying our democracy.” If you are interested in a “through the looking glass” annotated analysis of H.R.1 — then head over to the Brennan Center for Justice. They are happy to explain how those pesky constitutional rights can be whittled down to something more “fair” for everyone.

For example, the Brennan Center analysis confidently assures readers about how H.R.1 “affirms Congress’ power to protect the right to vote, regulate federal elections, and defend the democratic process in the United States.” It seeks to airbrush Article I, Section 4 — The Elections Clause — from history and practice. The Clause directs and empowers states to determine the “Times, Places, and Manner” of congressional elections. H.R.1 would federally strangle the Elections Clause. In order to find our way out, it is helpful to know how we got into this terrible predicament. The foundation for the madness of H.R.1 is legal positivism, a thesis, according to the Stanford Encyclopedia of Philosophy, which states “that the existence and content of law depends on social facts and not on its merits.” H.R.1 is nearly 800 pages of meritless, militant, social engineering targeting the foundations of the U.S. Constitution, voting rights and political free speech — all dressed-up as being “for the people.”

Too late now.

• Leaked Docs Show Obama FTC Gave Google Its Monopoly (Bovard)

Eight years ago, the Federal Trade Commission had the chance to face down Google — the giant of Silicon Valley whose power now alters the free flow of information at a global scale, distorts market access for businesses large and small, and changes the nature of independent thought in ways the world has never experienced. Instead, the FTC blinked — and blinked hard, choosing to close the investigation in early 2013. A remarkable leak to Politico of agency documents about the 2012 Google investigation reveals that, despite ample evidence of market distortions and threats to competition presented by the agency’s lawyers, the five commissioners of the FTC deferred instead to speculative claims by their economists.

Records and reporting about the 2012 investigation suggest the FTC did so while bending to political pressure from the Obama White House — which was, in turn, bending to political pressure from Google. William Kovacic, a former FTC chair under President George W. Bush, reviewed the more than 300 pages of documents leaked to Politico and concluded the agency overlooked “what many experts and regulators would consider clear antitrust violations,” calling the specificity of issues outlined “breathtaking.” In short, where we find ourselves today — with Google as the primary filter of the world’s information, engaging in a network of exclusionary contracts and anti-competitive conduct, and subject to an antitrust lawsuit led by the Department of Justice and joined by 48 state attorneys general — could have, and should have, been avoided.

That it wasn’t, however, provides key takeaways about where we are now with Big Tech, and, in particular, the method of enforcement of our antitrust laws, whose application has become too tightly wrapped around the axle of price, and captured by the speculative science of economic forecasting. It also reveals just how politicized antitrust enforcement has become — influenced by the siren song of internet exceptionalism and the powerful tug of Google, one of the world’s richest companies. Perhaps the most stunning takeaway in the 2012 documents is the extent to which the recommendations of the FTC’s lawyers sharply differed from those of the agency’s economists, on whose judgment the FTC commissioners ultimately relied in their decision to drop the investigation into Google.

The FTC’s antitrust attorneys concluded that Google was breaking the law by “banishing potential competitors” with a series of exclusionary contracts on mobile phones — much of which forms the basis for the lawsuit brought nearly a decade later by the Trump Department of Justice. The FTC’s economists, however, demurred, insisting that claims of Google’s market dominance were unfounded and would soon give way to competition. This required a markedly un-curious treatment of key facts.

Whatever Big Oil backs can never be good.

• Big Oil Backs Carbon Tax (Reason)

Executives from leading oil companies, including ExxonMobil, BP, Chevron, ConocoPhillips, and the American Petroleum Institute (API), met virtually with Biden administration officials to discuss policies aimed at addressing the problem of man-made climate change. The Wall Street Journal reported that company leaders said that “they wanted to work with the administration and pledged support for policies that would make it more expensive to emit the gases that contribute to climate change.” In a statement issued after the virtual meeting, API CEO Mike Sommers declared, “We are committed to working with the White House to develop effective government policies that help meet the ambitions of the Paris Agreement and support a cleaner future.” The API is rumored to be considering coming out in support of carbon emissions pricing.

ExxonMobil and ConocoPhillips previously endorsed the bipartisan Climate Leadership Council’s (CLC) revenue neutral carbon tax and dividend proposal in which escalating taxes collected on oil and natural gas at the wellhead and on coal at the minehead would be entirely rebated in equal sums to each American as an annual payment. The CLC cites a 2018 study that finds that 70 percent of American households would receive more in dividend payments then they would pay in increased energy prices. Once the CLC’s carbon tax plan is adopted, all other regulations and subsidies aimed at reducing carbon dioxide emissions, such as automobile fuel efficiency and renewable portfolio standards, are supposed to be permanently repealed.

However, lots of climate activists oppose carbon taxes. Why? InsideClimateNews offered the example of Matto Mildenberger, a political scientist at the University of California, Santa Barbara, who has argued that carbon taxes make climate action unpopular because they front load the costs immediately onto consumers while the eventual benefits of lower temperatures, less fierce storms, and lower sea levels stretch into the future. As InsideClimateNews explained: “In the view of Mildenberger and others who’ve studied climate politics around the world, subsidies, regulation, and other policies that provide more immediate and visible benefits—like jobs creation—are a better way to jump-start climate policy, even if they cost more in the short run. That’s because they stimulate investment to help lower the cost of alternative energy, and at the same time help broaden political support for stronger climate policy. New actors with real investments they want to protect and advance will want more aggressive action, and politicians will respond.”

Drilling under the Mississippi. Leave it be.

• Minnesota Police Ready For Pipeline Resistance (IC)

As you drive toward the Mississippi River’s headwaters from the east, the lakes that open up on either side of the highway are still white-blue with ice. The Mississippi River, however, is flowing. The open water — a trickle compared to the expanse it will become farther south — is a hopeful sign of the end of another long Minnesota winter, but it also has opponents of pipeline construction in the area on edge. Enbridge, the Canadian energy-transport firm, is planning to route its Line 3 pipeline under the Mississippi, near where it crosses Highway 40. In winter, a pollution-control rule bars drilling under the frozen waters. As the ice melts away, so do the restrictions. Those organizing against the project worry that Enbridge could begin tunneling under the Mississippi and other local rivers any day — and the pipeline-resistance movement is getting ready for it.

“They got a lot of money, they got a lot of equipment, but we got a lot of people,” said Anishinaabe water protector Winona LaDuke at an event last week with actor and activist Jane Fonda, which took place in front of the flowing Crow Wing River, not far from where Enbridge seeks to drill under its shores. “Spring is coming. Let’s be outdoorsy.” Enbridge’s Line 3 project began construction four months ago. It was designed to replace a decaying pipeline of the same name; however, a large portion of its 338-mile Minnesota section, which makes up most of the U.S. route, plows through new land and waters. The project would double Line 3’s capacity for carrying tar sands oil, one of the most carbon-intensive fossil fuels in the world, at a moment when a rapid shift away from fossil fuels has become critical to address the climate crisis.

The delicate waterway ecosystems through which the pipeline passes have become the central organizing point of the anti-pipeline, or water protector, movement. Hundreds of rivers, streams, and wetlands face the specter of a tar sands leak after the replacement Line 3 begins operating. And the particularly intensive form of drilling required to tunnel the pipeline under rivers holds its own set of risks during construction.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

God Save the Queen

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.