Vincent van Gogh Landscape with Couple Walking and Crescent Moon 1890

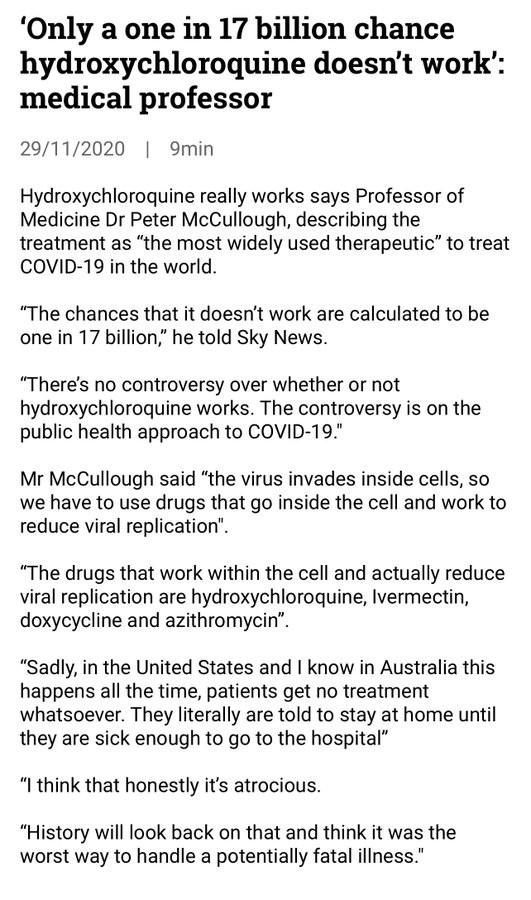

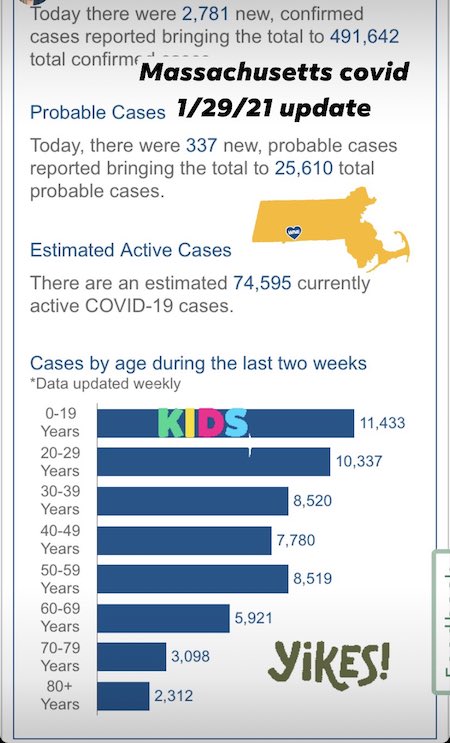

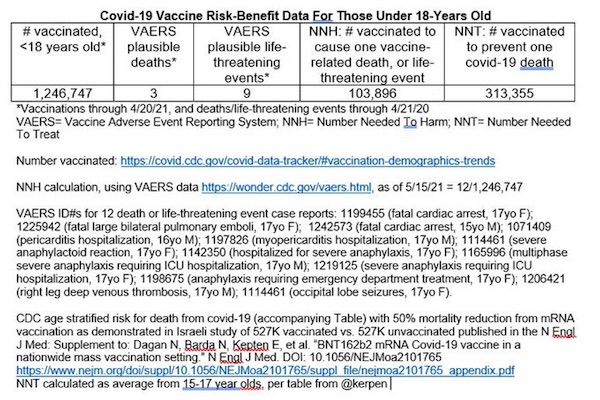

“According to the scientific data…

Vaccinating 300,000 people under 18yo is statistically likely to prevent one COVID death and likely to cause 3 vaccine-reaction deaths.”

Testing? That’s so yesterday.

Must read.

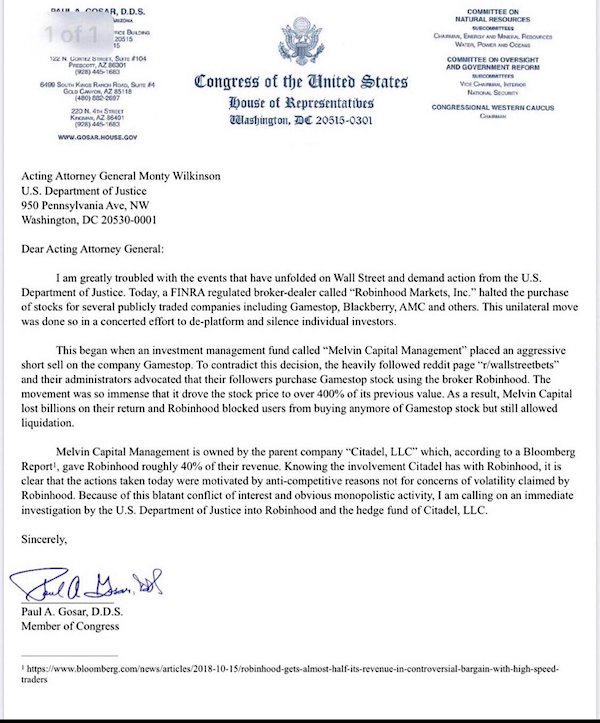

• Second Stage Terror Wars (Edward Curtin)

It is well known that the endless US war on terror was overtly launched following the mass murders of September 11, 2001 and the linked anthrax attacks. The invasion of Afghanistan and the Patriot Act were immediately justified by those insider murders, and subsequently the wars against Iraq, Libya, Syria, etc. So too the terrorizing of the American people with constant fear-mongering about imminent Islamic terrorist attacks from abroad that never came. It is less well known that the executive director of the U.S. cover story – the fictional 9/11 Commission Report – was Philip Zelikow, who controlled and shaped the report from start to finish.

It is even less well known that Zelikow, a professor at the University of Virginia, was closely associated with Condoleezza Rice, George W. Bush, Dickey Cheney, Paul Wolfowitz, Brent Scowcroft, et al. and had served in various key intelligence positions in both the George H. W. Bush and George W. Bush administrations. In 2011 President Obama named him to his President’s Intelligence Advisory Board as befits bi-partisan elite rule and coverup compensation across political parties. Perhaps it’s unknown or just forgotten that The Family Steering Committee for the 9/11 Commission repeatedly called for Zelikow’s removal, claiming that his appointment made a farce of the claim that the Commission was independent. Zelikow said that for the Commission to consider alternative theories to the government’s claims about Osama bin Laden was akin to whacking moles.

This is the man, who at the request of his colleague Condoleezza Rice, became the primary author of (NSS 2002) The National Security Strategy of the United States of America, that declared that the U.S. would no longer abide by international law but was adopting a policy of preemptive war, as declared by George W. Bush at West Point in June 2002. This was used as justification for the attack on Iraq in 2003 and was a rejection of the charter of the United Nations. So, based on Zelikow’s work creating a magic mountain of deception while disregarding so-called molehills, we have had twenty years of American terror wars around the world in which U.S. forces have murdered millions of innocent people. Wars that will be continuing for years to come despite rhetoric to the contrary. The rhetoric is simply propaganda to cover up the increasingly technological and space-based nature of these wars and the use of mercenaries and special forces.

Simultaneously, in a quasi-volte-face, the Biden administration has directed its resources inward toward domestic “terrorists”: that is, anyone who disagrees with its policies. This is especially aimed at those who question the COVID-19 story. Now Zelikow has been named to head a COVID Commission Planning Group based at the University of Virginia that is said to prepare the way for a National COVID Commission. The group is funded by the Schmidt Futures, the Skoll Foundation, the Rockefeller Foundation and Stand Together, with more expected to join in.

“This ideological mass psychosis is religion—not science.”

• Fear Is the Mind-Killer (Alice)

Can you imagine what master propagandist Edward Bernays would have done with access to today’s mainstream media conglomerate combined with the global surveillance infrastructure of Big Tech? And you really think that’s not happening now—with another century of psychological, neurological, and technological research under their belts? The present ability to curate reality and coerce obedience is unprecedented, far beyond what Orwell envisioned in 1984, Bradbury in Fahrenheit 451, Huxley in Brave New World, and Burgess in A Clockwork Orange. A textbook example of Problem Reaction Solution, the current tsunami of worldwide hysteria is the latest and potentially most threatening example of mass control in history.

The recipe is simple. Take a naturally occurring phenomenon, say a seasonal virus, and exaggerate its threat far beyond every imagining—despite exhaustive evidence to the contrary. Suppress, silence, ostracize, and demonize every individual who dares present facts that expose the false mono-narrative. Whip up a witches’ brew of anger, envy, and, most importantly, fear, escalating emotions to a boil so as to short-circuit our faculties of reason and logic. Isolate us from one another, supplant real-world interactions with virtual feuds, label nonconformists as a threat to the group, and pump the public with a disinformation campaign designed to confuse and atomize. In essence, foster a cultlike mentality that shuts down thought to guarantee assent.

Cultivate and wield our cognitive biases—especially ingroup bias, conformity bias, and authority bias—against us in a comprehensive divide-and-conquer policy that keeps us too busy squabbling amongst each other to recognize and unite against those corralling us into a Matrix-like collective delusion that enables the powerful to extract our resources for their own gain. This ideological mass psychosis is religion—not science. If this were about science, the Media–Pharmaceutical–Big-Tech complex would not be memory-holing every dissenting voice, vilifying every thought criminal, and censoring every legitimate inquiry in quest of the truth.

With obesity such a major factor in Covid deaths, two birds with one stone.

• How To Cure Type 2 Diabetes – Without Medication (G.)

[..] Modest words for a man whose “useful contribution to society” has given hope to the 3.9m people diagnosed with the condition in the UK and who has shown doctors a new way to fight a disease which causes 185 amputations and 700 premature deaths every week. Now, he wants to go one step further and share everything he has learned directly with the public, in a new book, Your Simple Guide to Reversing Type 2 Diabetes. It’s a 153-page paperback that takes you through the latest research on how the disease develops and explains why rapid weight loss can be so effective at reversing the condition in the early stages – which usually means during the first six years of a diagnosis.

“If people really do want to make it happen, then in the first few years of diagnosis, it’s almost universal that their health can be returned to normal,” says Taylor, who is professor of medicine and metabolism at Newcastle University. In one study, he found that nine out of 10 people with “early” type 2 diabetes were cured after losing more than 2 1/2 st (15kg). The book also explains who is at greatest risk and why some people who have a “normal” Body Mass Index (BMI) develop the disease, when many people who are more overweight – or even obese – do not. Taylor’s “Newcastle” weight loss programme is a clinically proven method of reversing early type 2 diabetes and his approach is currently being rolled out to people with the condition by the NHS. It involves cutting your calorie intake to 700-800 calories a day.

In the book, he explains how the people in his programme managed to do this – typically by consuming only slimming meal shakes and non-starchy vegetables, plus one cup of tea or coffee each day with skimmed milk – lost a life-changing amount of weight in just eight weeks. And how you can do the same, safely, at home. [..] One of Taylor’s most important new discoveries is that everyone has their own fat threshold: an individual level of tolerance for levels of fat in the body. “It’s a personal thing. It’s nothing to do with the sort of information that’s often provided about obesity, which is about average BMI and what the population is doing. The bottom line is, a person will develop type 2 diabetes when they’ve become too heavy for their own body. It doesn’t matter if their BMI is within the ‘normal’ range. They’ve crossed their personal threshold and become unhealthy.”

He is currently in the middle of research to find out whether there’s any way of discovering, via a blood test, when people are heading into this dangerous territory and their fat cells are putting out what he describes as “distress signals”. What we do know already is that our bodies start to have trouble controlling blood sugar when fat can no longer be stored safely under the skin and it spills over into the liver and then the pancreas. If these organs get clogged with fat, they stop functioning properly and that is when you develop type 2 diabetes.

Does this address only vaccine-related T cells?

• Covid-19 Testing Turns To T Cells (Nature)

A diagnostic test based on sequencing long-lived SARS-CoV-2–specific memory T cells provides a complement to antibody testing for determining previous exposure to SARS-CoV-2. Following last month’s US Food and Drug Administration (FDA) Emergency Use Authorization for Adaptive Biotechnologies’ T-Detect COVID-19 test, routine T-cell testing has entered a new era. The Adaptive test involves laboratory-based next-generation sequencing to identify T cells that recognize SARS-CoV-2 antigens. The test is not intended for the diagnosis of active infection but is a complement to antibody tests used to confirm recent or previous infections. The lab-based procedure, which has a seven- to ten-day turnaround time, is now authorized for use on samples taken from individuals at least 15 days after the onset of symptoms.

Increasing interest is focused on the role of T-cell immunity in fighting SARS-CoV-2 infection and in providing resistance to re-infection. A new analysis of T cells from people who recovered from COVID-19 has confirmed that they remain active against three of the new SARS-CoV-2 variants of concern: B1.1.7, B.351 and B.1.1.248. The study, conducted by a team from the US National Institute of Allergy and Infectious Diseases (NIAID), Johns Hopkins University School of Medicine, Johns Hopkins Bloomberg School of Public Health and Singapore-based biotech company ImmunoScape, will further boost confidence that the efficacy of vaccines developed against the original pandemic strain will not be overly compromised as these new variants—and others—spread more widely.

Until now, researchers have mostly relied on the use of lateral flow assay or enzyme-linked immunosorbent assay (ELISA) tests for SARS-CoV-2 antibodies to determine whether a person has been exposed to the virus. Understanding the neutralizing antibody response has been considered central to establishing protection against the virus. “It’s easy to test,” says Andrew Redd of NIAID, who led the recent study. Although critical, antibodies are part of a larger and incompletely understood set of humoral and cellular immune responses, which has received little attention. These include additional antibody functions, such as antibody-dependent cellular cytotoxicity, complement activation and phagocyte recruitment. Unravelling their contribution to SARS-CoV-2 immunity is an ongoing challenge. “There are assays to do that, it’s just complicated to do,” says Redd.

The same can be said for assaying T-cell-mediated immunity. The NIAID study relied on a complex laboratory test to identify T-cell epitopes specific to SARS-CoV-2, employing a combination of mass cytometry and combinatorial staining of peptide–major histocompatibility complex (MHC)-bound tetramers. The complexity of the assay and data generated necessarily confine the assay to use in specialist laboratories. “The data that it generates are massive. The analysis side of it is a big lift,” Redd says.

You tell me what you think of the man.

• Interview with Dr Bhakdi (Schultz)

According to the UK Government’s figures, more than 1,100 people have died due to an adverse effect caused by one of the vaccines currently being rolled out via Emergency Use Authorisation. But Dr Bhakdi reveals that worse is yet to come, with manufacturers, he says, creating a false sense of security. “It’s so easy to manipulate the nano-particles,” he said. “All you need to do is take out one component, one lipid, and the vaccine will not be taken up by the cells any more. And then you have no side-effects. And you will have a vaccine that is well-tolerated. “That is what’s happening now with the mRNA vaccines, so the AstraZeneca, Johnson & Johnson and Sputnik will be removed from the market. So there will be a monopoly of the mRNA vaccines, which are being backed by Bill Gates.

“This plan was conceived years ago. Once this vaccine gets legally, fully approved, not approved for emergency use, but fully approved, no more risk analysis needs to be done. “Pfizer are going to submit an application for this in June. And the authorities have already released underground information that the approval will probably be given in October. When this happens, it means that every subsequent vaccine is automatically approved. They have to sign no more application, there will be no more trials, no more risk-benefit analysis. No more notification of side effects. “It’s such a nightmare. They can say, ‘well the care homes are overcrowded. India and South Africa…

“You know that with each subsequent vaccine the chances rise that you are going to kill people. That’s why they are starting to vaccinate children – they are going to show that the vaccine is tolerated by children – then they are going to use this wherever they want to. “Once that has come through, these guys have a free hand to do whatever they want, wherever they want. And no one can do anything about it. It’s so horrible. “How can people be so evil? How can people be so ignorant? It’s that combination of evil and ignorance that is making the world a living hell. And the only people who can do anything about it is us because we have to get the world around us to stand up and realise that they are being led to a living hell.

“It’s a devilish plan, satanic. But the very, very small chance we have is that they made a mistake, which was they thought that this vaccination programme would go through smoothly, as they were not aware that the adverse effects would be so severe and so widespread. “This is where they may trip if we can force them to turn back on the vaccination programme. Now there have been legal charges brought against the EU, for nullification against all the vaccines.”

“Trapped in their group-specific jargon, the two camps on Zoom literally couldn’t understand one another.”

• The 60-Year-Old Scientific Screwup That Helped Covid Kill (Wired)

Early one morning, Linsey Marr tiptoed to her dining room table, slipped on a headset, and fired up Zoom. On her computer screen, dozens of familiar faces began to appear. She also saw a few people she didn’t know, including Maria Van Kerkhove, the World Health Organization’s technical lead for Covid-19, and other expert advisers to the WHO. It was just past 1 pm Geneva time on April 3, 2020, but in Blacksburg, Virginia, where Marr lives with her husband and two children, dawn was just beginning to break.

Marr is an aerosol scientist at Virginia Tech and one of the few in the world who also studies infectious diseases. To her, the new coronavirus looked as if it could hang in the air, infecting anyone who breathed in enough of it. For people indoors, that posed a considerable risk. But the WHO didn’t seem to have caught on. Just days before, the organization had tweeted “FACT: #COVID19 is NOT airborne.” That’s why Marr was skipping her usual morning workout to join 35 other aerosol scientists. They were trying to warn the WHO it was making a big mistake.

Over Zoom, they laid out the case. They ticked through a growing list of superspreading events in restaurants, call centers, cruise ships, and a choir rehearsal, instances where people got sick even when they were across the room from a contagious person. The incidents contradicted the WHO’s main safety guidelines of keeping 3 to 6 feet of distance between people and frequent handwashing. If SARS-CoV-2 traveled only in large droplets that immediately fell to the ground, as the WHO was saying, then wouldn’t the distancing and the handwashing have prevented such outbreaks? Infectious air was the more likely culprit, they argued. But the WHO’s experts appeared to be unmoved. If they were going to call Covid-19 airborne, they wanted more direct evidence—proof, which could take months to gather, that the virus was abundant in the air. Meanwhile, thousands of people were falling ill every day.

On the video call, tensions rose. At one point, Lidia Morawska, a revered atmospheric physicist who had arranged the meeting, tried to explain how far infectious particles of different sizes could potentially travel. One of the WHO experts abruptly cut her off, telling her she was wrong, Marr recalls. His rudeness shocked her. “You just don’t argue with Lidia about physics,” she says.

Morawska had spent more than two decades advising a different branch of the WHO on the impacts of air pollution. When it came to flecks of soot and ash belched out by smokestacks and tailpipes, the organization readily accepted the physics she was describing—that particles of many sizes can hang aloft, travel far, and be inhaled. Now, though, the WHO’s advisers seemed to be saying those same laws didn’t apply to virus-laced respiratory particles. To them, the word airborne only applied to particles smaller than 5 microns. Trapped in their group-specific jargon, the two camps on Zoom literally couldn’t understand one another.

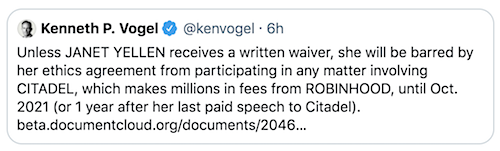

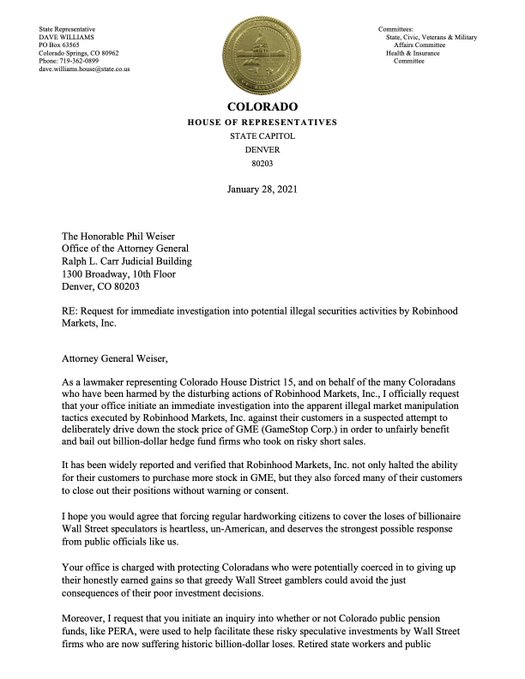

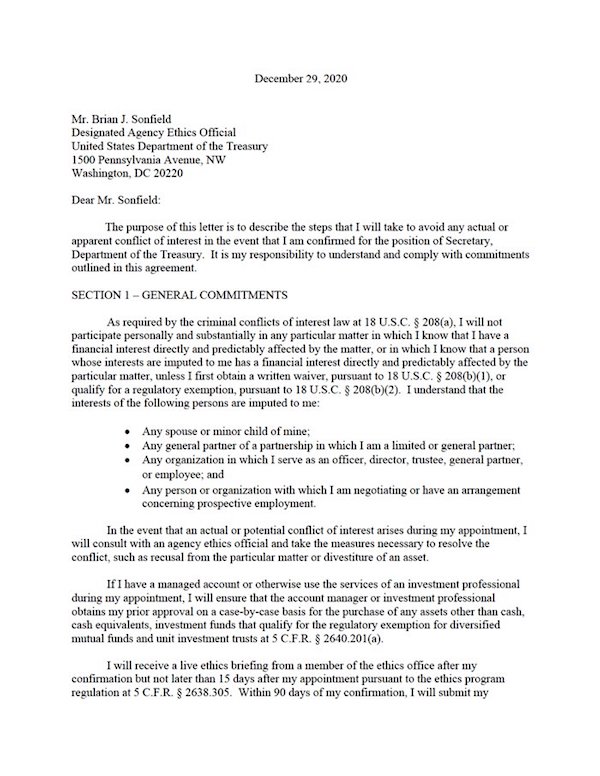

Trump nominated her to the Fed. Her nomination stalled on November 17, 2020, with a 47–50 vote in the Senate.

• War of Words Over Inflation Stirs Questions for the Fed (Judy L. Shelton)

Does it make sense, for a nation founded on the notion of individual liberty, equality under the law, and personal property rights, to allow a government agency to manipulate the value of the currency used by its citizens? Would it be better to have a stable monetary foundation to facilitate free-market outcomes, rather than empower the Federal Reserve to distort interest rates and dilute dollars in the service of government policy? It’s not as if we haven’t been here before. The question of whether rules-based monetary stability historically delivers better economic results in terms of increasing middle-class incomes than relying on the discretionary judgment of central bankers has been wholly analyzed and resolved.

In the 2015 Economic Report of the President issued under the Obama administration, a special section describes the period from 1948 to 1973 as the “Age of Shared Growth”—characterized by accelerating labor productivity, falling income inequality, and increased workforce participation. The report makes little mention of the fact that this period of remarkable growth, which increased living standards across all income levels, coincided with the existence of the Bretton Woods international monetary system under which the U.S. dollar was convertible into gold at a fixed price. The report does posit that if post-1973 productivity growth had continued at its pace from those previous 25 years, “incomes would have been 58% higher in 2013” and “the median household would have had an additional $30,000 in income.”

All of which should give pause to those who belittle the uneasiness felt by conservatives who fear that compromising monetary integrity not only violates founding principles but also economic rationality. And it’s not just conservatives per se, but rather an increasingly larger segment of the population expressing concerns about the wisdom of government officials and the correctness of government policies.

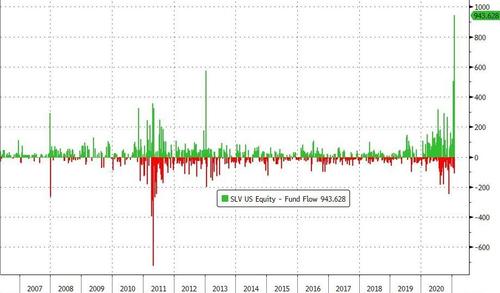

Well, that’s what it’s for.

• Druckenmiller: “There’s Been No Greater Engine Of Inequality Than The Fed” (ZH)

After his status-quo-shattering appearance on CNBC this week, during which he warned that “Fed policy is endangering the dollar’s reserve status,” billionaire fund manager Stan Druckenmiller spoke to The USC Marshall Center for Investment Studies’ Student Investment Fund Annual Meeting via Zoom, and shocked the on-lookers with his frank assessment of our current perceptions and realities. After The Bank of Canada sheepishly admitted this week that “some of the monetary policy tools it is using to address the COVID-19 pandemic, such as quantitative easing (QE), could widen wealth inequality,” Druckenmiller drops the proverbial hammer on all the hedged-speak (“could”), and blasts that

“I don’t think there has been a greater engine of inequality than the Federal Reserve Bank of the United States… so hearing the Chairman [Powell] talking about visiting homeless shelters is very rich indeed…” The outspoken fund manager went on to note that “everyone wealthy that I know is making fortunes” because “this guy [Powell] is printing money like there’s no tomorrow” adding that the kids is Harlem are not benefitting from money-printing but wealthy people are, exclaiming that “…for the life of me I can’t understand why the left is so excited about money-printing when all the data shows that the people who benefit from money-printing are rich people.”

“The odds-on bet is that we’re going to have inflation,” he continues: “and inflation is going to hurt poor people, again, a lot more than rich people.” How does this all end? “The asset bubble which [Powell] is blowing up into unbelievable proportions busts before the inflation ever really manifests itself, that’s what happened in the housing bubble in 08/09. We never really got to the inflation because the asset bubble burst… not dis-similar to what happened in 1929.” And Druck reminds us all, “there is no one, no group, that will be hurt more by a bust than the poor… they will be first in line to get screwed.”

Here's the clip. This is epic. pic.twitter.com/TRg49e47wG

— Rudy Havenstein, Gain-Of-Function Fintwit. (@RudyHavenstein) May 16, 2021

Gasparino.

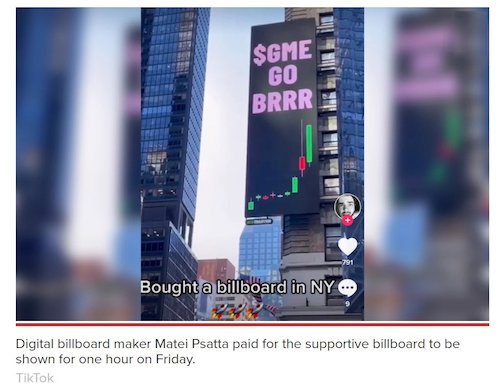

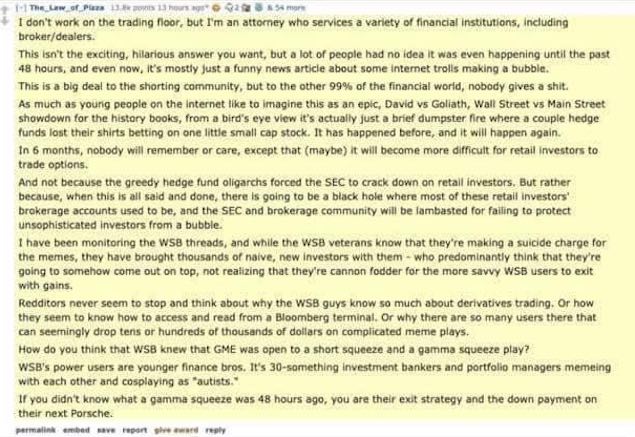

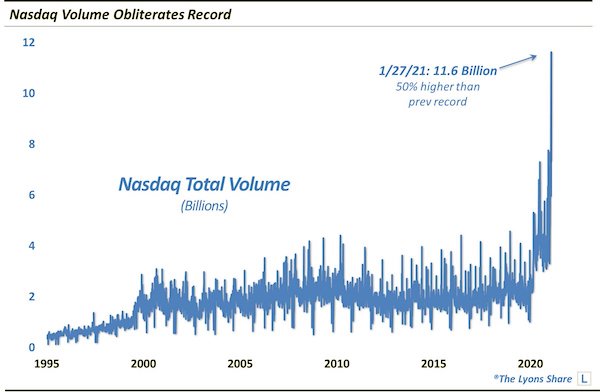

• ‘$40 Billion’ Robinhood App Tries To Vault SEC Hurdles (NYP)

It’s a lot of money for a stock-trading app that’s supposedly free. Robinhood is slated to launch an initial public offering before summer’s end that could value the Silicon Valley-based company at $40 billion or more, people close to the underwriting group say. That would make it among the biggest deals of the year – and certainly the most anticipated as the day-trading app became a cultural phenom during the pandemic. A blowout IPO would be remarkable for a company created only in 2013 and which has survived its share of controversies. Last summer, I warned that Robinhood was luring in amateurs stuck at home during the COVID lockdowns who took on day trading as a sport. They would eventually lose their shirts trading stocks on its free and easy-to-use platform, and regulators would pounce.

The party, I predicted, wouldn’t end well and it almost didn’t. Amateur traders are the lifeblood of Robinhood and its user growth, and they lost lots of money on the wrong side of bets. Then came January’s meme – stock controversy, where clearing problems stymied trading of some high-volume stocks on the app, angering customers. The company s business model came under scrutiny. Congress held hearings about the episode following the wild swings in various stocks that traded over the platform, and the IPO that was planned for March was pushed off indefinitely. But for all the noise, the clients just kept coming – and the IPO is back on. The reason is simple, company execs tell me: Robinhood is printing money. Despite the hiccups, Robinhood added some 6 million additional new customers for its crypto platform alone in the first two months of the year.

Now the app’s explosive user growth has investors clamoring for a piece of the action, people close to the deal say. And mind you, underwriters and company officials are quietly calculating their $40 billion valuation for a product that founder Vlad Tenev essentially conjured up in his dorm room.

While the US still blocks a UN ceasefire resolution.

• Italian Port Workers Refuse To Load Arms Shipment Destined For Israel (NA)

A syndicate of port workers in the Italian city of Livorno in Tuscany on Friday protested a weapons and explosives shipment after discovering it was destined for the Israeli port of Ashdod. “The port of Livorno will not be an accomplice in the massacre of the Palestinian people,” said L’Unione Sindacale di Base (USB). The USB added that the ship contained “weapons and explosives that will serve to kill the Palestinian population, already hit by a severe attack this very night, which caused hundreds of civilian victims, including many children”. A report by The Weapon Watch, a Genoa-based NGO that monitors arms shipments in European and Meditteranean ports, informed the syndicate of the destination of the ship and its contents. The NGO urged the Italian government to consider whether it was “suspending some or all Italian military exports to the Israeli-Palestinian conflict areas.”

“The Union on Saturday will also be in the square in Livorno in solidarity with the Palestinian population and to ask for an immediate stop to the bombings on Gaza and a stop to the ‘expropriations’ Palestinian homes that have lived under military occupation for years,” the USB said in a statement. Although the shipment eventually embarked its journey to Naples, as most other port workers continued to load the ship, other Italian workers’ groups have called for increased coordination between port workers to prevent shipment of weapons that could be used to bomb Gaza. Protests took place in various Italian cities this week, following Israeli forces’ attacks against Palestinians in Jerusalem and its escalation on the blockaded Palestinian Gaza Strip.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.