Jackson Pollock The She Wolf 1943

Sorry for you lovely summer day, but it’s time to get serious. Excellent read. “The gullibility of people today is exacerbated by the power of the internet and social media.”

• We Are Now In The Frightening Endgame (Egon von Greyerz)

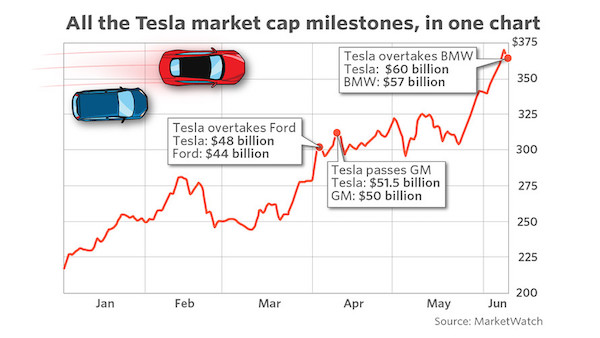

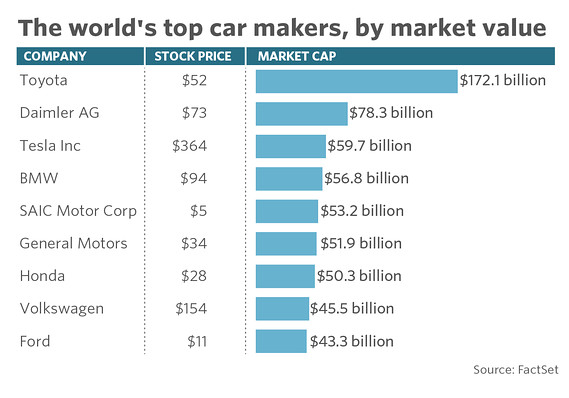

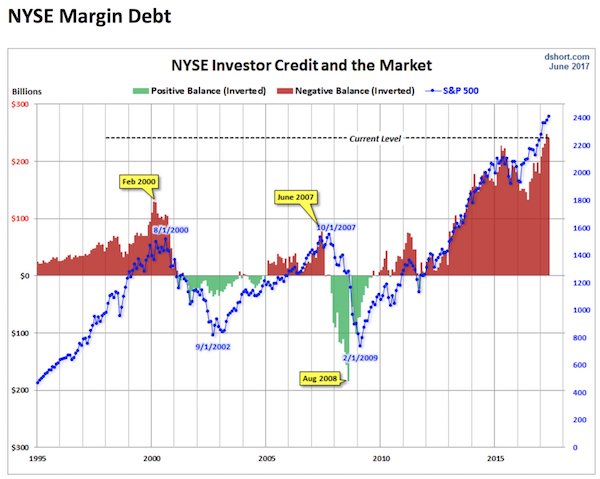

“Stock investors are rejoicing about stock markets making new highs in many countries, totally oblivious of the risks or the reasons. It seems that this is an unstoppable rally in a “new normal” market paradigm. No major increase is expected in the inflation rate or the historically low interest rates. The present rally has lasted 8 years since the 2009 low. There is virtually no fear in the stock market so investors see no reason why this favorable climate would not continue for another 8 years at least. Yes, of course it could. All that is needed is that governments worldwide print another $20-50 trillion at least and that global debt goes up by another $200-500 trillion. “The gullibility of people today is exacerbated by the power of the internet and social media. Anything we read is accepted as fact or the truth, while a major part of it is just fake news.

[..] The power of the internet and other media has facilitated spreading news and propaganda to billions of people and very few can distinguish if they hear or read “real” news or “fake” news. Anyone in government is incapable of telling the truth. Automatically when someone assumes an elected position their Pinocchio nose grows extremely long since their entire purpose is then to be all things to all people in order to be re-elected. This is why virtually no elected official has a backbone nor any morals or principles. Because if they had, telling the truth would make them unelectable.

[..] The system we now have is based on Fake News, Fake Money with no morals, no principles and no moral or ethical values. In spite of, or more correctly because of, all the lawyers, government legislation, compliance and regulations, the financial system is today functioning much worse than ever with more fraud, more government intervention and more manipulation of markets. Also, clients today are secondary. Instead, it is all about lining the pockets of the bankers with their multi-billion dollar deals and multi-million dollar bonuses and options. As we experienced in 2006-9, profits are for the bankers and losses for governments and customers. During that time of the Great Financial Crisis, many Investment Bankers received the same bonuses during the crisis years as before, in spite of the fact that most of them would have gone under without the government support they benefitted from to the extent of $25 trillion.

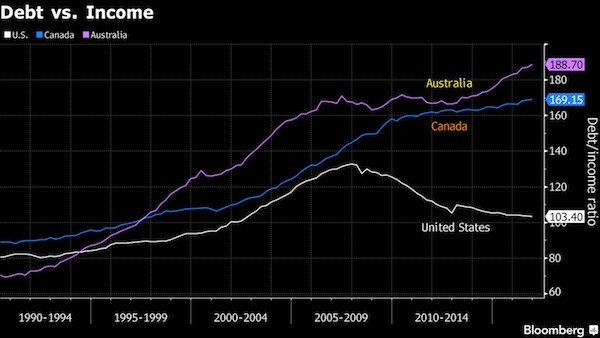

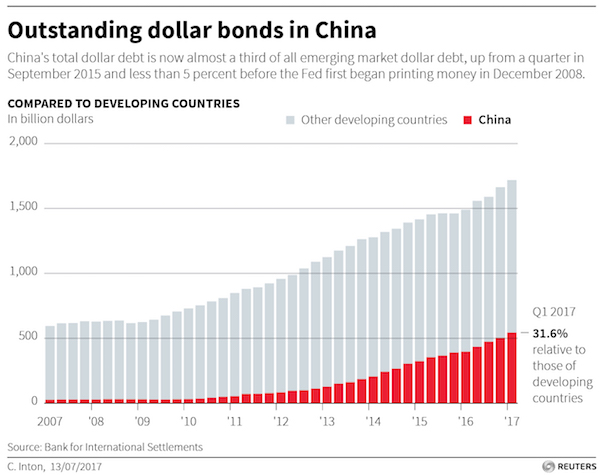

Yellen is lost in China. How can they keep the dollar low in the face of this? And how long for? Trump likes it, China needs it. But the numbers say no.

• China’s Dollar Debt Specter Haunts Fed’s Policy Meetings (R.)

In September 2015, the U.S. Federal Reserve cited risks from China as a key reason for delaying its first interest rate hike in a decade. A wall of Chinese debt maturing in the next few years could jolt the country back into the U.S. central bank’s policy deliberations. Two years ago, it was a collapse in Chinese stocks, a surprise yuan devaluation and shrinking foreign exchange reserves that roiled financial markets that delayed the Fed, but it did raise rates three months later and has tightened further since. Now, some see risks emerging in China’s dollar-denominated bonds that could give the Fed greater pause for thought as it raises rates, even as other central banks signal a shift from ultra-easy policy. To be sure, Fed officials have not publicly flagged China’s debt as a major risk in their policy discussions.

However, debt analysts point to the possibility of another September 2015 moment in which the Fed takes its cues from concerns about China. “Back then, I said that U.S. monetary policy is not made in Washington, it’s made in Beijing,” said Joachim Fels, global economic advisor at bond giant PIMCO. “China does have a major impact on monetary policies elsewhere … This year has been smooth sailing for global central banks because there were no shockwaves from China but I expect that to change if we think beyond the next few months.” The outstanding amount of dollar bonds issued by Chinese entities has grown almost 20 times since the 2008-09 global financial crisis to just over half a trillion dollars, according to data from the Bank for International Settlements.

Since September 2015, it has grown almost 50%. China’s dollar bonds are now almost a third of the emerging market total dollar issuance, up from a quarter in September 2015 and less than 5% before the Fed first began printing money in December 2008. A fifth of China’s dollar bonds mature within a year, according to BIS data. More than half are due in the next five, Thomson Reuters data show. If U.S. borrowing costs start rising as a result of the Fed’s exit from its unconventional monetary policy, that debt would have to be rolled over at higher costs, chipping away at the real economy in China. Alternatively, Chinese companies might decide to refinance their debt in local currency, creating weakening pressure on the yuan.

Either development would reverberate globally and create a major external challenge for Fed policy. For its part, the Fed doesn’t see any immediate dangers with China’s dollar debt. “You’ll find if you look at China they certainly have dollar-denominated debt but … you’ll see that they are not as reliant on external debt as people might have thought,” Dallas Fed chief Robert Kaplan said in Mexico City on Friday. Also, a significant portion of Chinese dollar borrowing makes economic sense – such as companies funding overseas investment projects. And if those dollars are converted into yuan, they could help ease any weakening pressure on the Chinese currency.

They’re stuck. Nobody wants to admit it, but they are. One way out: a huge crisis, so they can put the blame there.

• Federal Reserve Faces Prospect Of Global Monetary Policy Tightening (R.)

Prospects for tighter monetary policy in Europe and other countries could pose a fresh problem for the Federal Reserve when it meets next week to ponder its plan to reduce its $4.2 trillion bond portfolio purchased after the 2008 financial crisis. The Fed bought U.S. Treasuries and mortgage-backed securities (MBS) for about six years in a program known as “quantitative easing” which kept interest rates at record lows to spur borrowing and economic recovery. But at its June meeting this year, as well as raising interest rates for the third time in six months, the Fed also announced a plan to begin by letting $6 billion a month in Treasuries mature without reinvestment and to increase that amount at three month intervals up to $30 billion. Similarly, the Fed said it would run down its agency debt and mortgage backed securities by $4 billion a month until it reaches $20 billion.

Now, the ECB also appears likely to decide later this year on when to scale back its monthly bond purchases. When ECB President Mario Draghi first hinted at the prospect last month, world bond yields rose sharply for a while. Moreover, Canada’s central bank raised interest rates for the first time in seven years this month, and the Bank of England is expected to raise rates next year to combat rising inflation. The Fed led the way in tightening monetary policy as the global economy recovered from the 2008 recession but must now determine how plans by other central banks’ plans may affect their own policy. While a stronger European economy has been welcomed by the Fed, lessening risks to the global economy, a move by major central banks to all tighten monetary policy simultaneously has not been seen for a decade.

“The effects of ECB tapering are not limited” to euro zone countries, Cornerstone analyst Roberto Perli wrote recently. Draghi’s comments in June drove up 10-year Treasury yields US10YT=RR by the most since the U.S. election last November, and a move by the ECB to stop printing money could prompt the Fed to slow its plans for fear that financial conditions would tighten too fast. When Fed policymakers meet on July 25-26 they will need to decide a start date for reducing their bond holdings or leave more time to evaluate what Fed Governor Lael Brainard recently cited as a possible “turning point” in global monetary policy that may affect economic growth.

The failure of Abenomics is taking on comical forms.

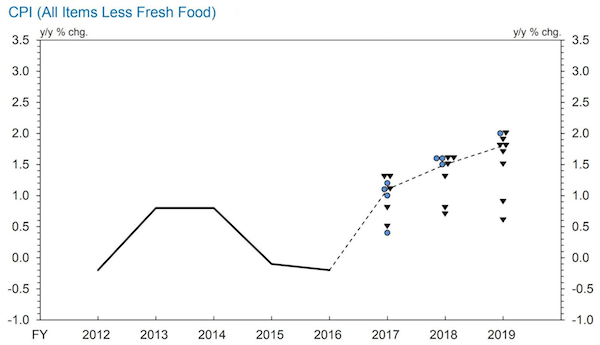

• Bank of Japan Dot Plot Paints a Pessimistic Picture of Inflation (BBG)

Even a quick glance at the Bank of Japan’s latest inflation forecasts makes for disappointing reading. The BOJ pushed back its timetable for hitting 2% price gains for a sixth time since Governor Haruhiko Kuroda took over. And it cut its estimates for core CPI for this fiscal year and the next two. A close look at the individual projections of the board’s nine members released after its July 19-20 policy meeting is cause for even more pessimism. Eight of them see risks “tilted to downside” for their price forecast for fiscal 2019 – the year when the BOJ currently hopes to reach its inflation goal. Put another way, the chances of prices dropping below forecast are way higher than beating it. Downward pointing triangles in the dot plot below represent estimates from board members who see downside risks to their projection while circles indicate risks are evenly balanced.

There are no upward pointing triangles giving reason for optimism. When the BOJ released its previous dot plot in April, there were only six downward triangles for 2019. Kuroda said it’s “regrettable” that the BOJ has had to repeatedly push back the timing of when it will reach the inflation goal, while repeating that he still sees momentum to get there eventually. “The BOJ seems to be losing a lot of confidence in its inflation outlook,” Chotaro Morita, chief rates strategist at SMBC Nikko Securities, wrote in a report Friday. So what does this mean for policy? According to former BOJ executive director Hideo Hayakawa, the delay to fiscal 2019 is an acknowledgment that the central bank will continue stimulus even beyond 2020, as it’s very unlikely the BOJ would start cutting stimulus at the same time as the government makes a planned increase to the sales tax.

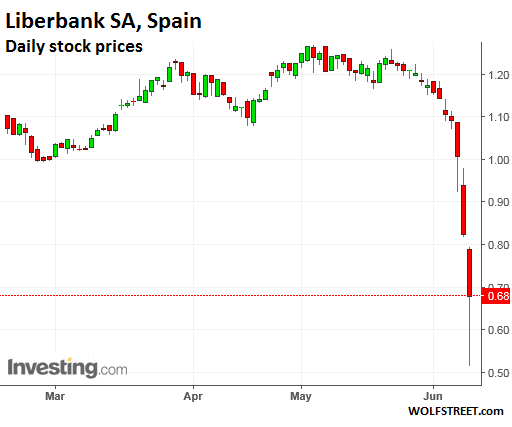

Grossly overbuilt. No easy way out: “an estimated capital shortfall of $30 billion this year.”

• European Banks Struggle To Solve Toxic Shipping Debt Problem (R.)

Dutch shipowner Vroon is finding talks with banks tough going as it tries to navigate a way out of a long slump in the shipping industry. But it is not an easy time for the lenders either. Vroon, a 127-year-old family-owned group which operates about 200 vessels and transports livestock, oil and other commodities, wants to extend its credit lines and adjust repayment schedules. But European banks that lent heavily to the sector when it boomed more than a decade ago have a heavy toxic debt burden following the 2008-09 global financial crisis and a shipping markets crash in 2010. Shipping firms and banks are caught in a vicious circle of debt, causing a credit crunch that is hindering the industry’s recovery. Overcapacity – a glut of available ships for hire – is a big concern, and another is a lack of profitability caused by problems such as slower demand and global economic turmoil.

One of the major companies, South Korean container line Hanjin, has gone under. “We have difficulty in meeting all repayment obligations that we have and that is what we are in discussion with our banks about. Those discussions are constructive but are not easy — not for us, or the banks,” Herman Marks, the chief financial officer at Vroon, told Reuters. “It is the lack of profitability for the industry that is causing the lack of availability of finance.” Shipping finance sources say the shipping industry, which transports 90% of the world’s goods including oil, food and industrial products such as coal and iron ore, has an estimated capital shortfall of $30 billion this year. Some banks are being driven out of shipping and those that remain are now more conservative in their financing, Marks said. “It is an industry that requires consolidation,” he added.

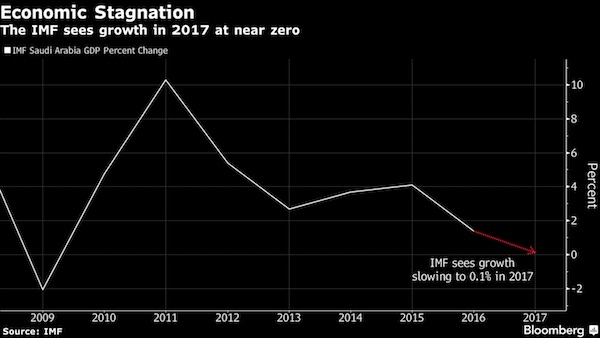

One day we will know how poorly Saudi is doing. But not now.

• Saudi Economic Pain Will Test Resolve of Prince’s Reform Push (BBG)

Saudi Arabia’s drive to reduce the economy’s reliance on oil has hit a snag: its reliance on oil. More than a year after the kingdom’s dominant leader, Crown Prince Mohammed bin Salman, unveiled a blueprint for the post-oil era, the drop in crude prices is making economists more skeptical about whether some of the plan’s medium-term targets can be met. The reason: lower oil revenue deprives the government of money needed to balance its books by 2020 while trying to stimulate growth to ease the transition’s burden on the population. IMF data released Friday underscored the challenge. The fund lowered its forecasts for Saudi economic growth this year to “close to zero.” Analysts at Citigroup, EFG-Hermes and Standard Chartered see a bleaker picture, expecting the economy to shrink for the first time since the global financial crisis in 2009.

Deeper economic pain will test the authorities’ resolve to pursue tough reform measures as they seek to go against the run of history, which suggests that successful diversification efforts depended largely on policies put in place before a price shock. “Unless you start seeing some economic growth drivers kicking in, which would really have to come from the government and would require higher oil prices, the pace of fiscal reforms would likely remain slower than in 2016,” when authorities cut spending and lowered costly subsidies, Monica Malik, chief economist at Abu Dhabi Commercial Bank, said in an interview. “We see the possibility of having a very low growth or stagnant economic environment with the deficit still remaining high,” she said. “This is a key risk.”

Brent crude prices have declined 15% this year to $48 a barrel, well below the level that the kingdom needs to balance its budget, as producers grapple with how to eliminate a global supply glut. Under an accord between OPEC and other major producers, Saudi Arabia has cut its output. The IMF revised its forecast for Saudi growth this year to 0.1% from 0.4%. And while it now expects non-oil GDP to grow 1.7% after stalling last year, the new figures compare with an earlier estimate of about 2%.

Transaction tax. It will come.

• While Hammond Looks For A Magic Money Tree, Labour Has Found One (G.)

If Hammond is to find money for higher public spending without increasing borrowing, he will either have to ditch government plans to reduce personal and corporate taxes or find new sources of revenue. One option would be for the government to embrace the idea of a financial transaction tax, AKA the Robin Hood tax. This idea, fleshed out in detail last week by Prof Avinash Persaud at an event in London, ticks all the right boxes. Persaud’s starting point is that Britain already has a financial transaction tax, and has had one for more than 300 years. It is called stamp duty, which is levied on the purchase of shares issued by British companies, and raises just over £3bn a year, half of it from citizens of other countries. Some trading activities are exempt from stamp duty and Persaud believes these exemptions should be restricted.

He also proposes that the tax should be broadened to cover transactions in corporate bonds and cash flows arising from equity and derivative transactions. He estimates that this would raise £4.7bn a year. One argument against a financial transaction tax is that it would lead to fewer transactions and so would not raise any money. Persaud said he accepted that the tax would change behaviour (indeed, that is part of the reason for having one), but that he had already made allowances for the reduction in activity in his calculations. If there was no change in behaviour, the tax would raise £13bn a year. Nor does he accept that a tougher stamp duty regime would lead to a relocation of business. Liability for the tax would depend on where the financial instruments were issued and who owned them.

A US investor, for example, would pay the tax on shares issued in the UK, but not on securities traded in the UK but not issued there. Likewise, a British investor would pay the tax on securities wherever they were issued and traded. Persaud, himself a former banker, thinks big finance is a bit of a racket. If a company wants to raise money in the City, the charges amount to 2% of the trade – a rate unchanged in more than 100 years. Put another way, all the efficiency gains since the late 19th century have been captured by those who run the industry rather than shared with the customers. It is hard to think of any other sector where this is true.

The Treasury has always been opposed to a financial transaction tax, in large part due to its institutional capture by the City. Official attitudes would change, though, with a Labour government. Why? Because Persaud’s presentation was organised by the Labour party and he was introduced by the shadow chancellor. While Spreadsheet Phil is looking for a magic money tree, John McDonnell has already found one.

Can’t beat a good rant.

• Strip Mining the World (Robert Gore)

The government is a strip mining operation, plundering the dwindling residual value of a once wealthy America. Forget ostensible justifications, policy is crafted to allow those who control the government to maximize their take and put the costs on their victims, leaving devastation in their wake. Wars are no longer about defending the country or even making the world safe for democracy. They are about appropriations, not to be won, but profitably prolonged. The Middle East and Northern Africa have been a mother lode. You would think their sixteen-year war in backward and impoverished Afghanistan would be a shameful disgrace for the military and the intelligence agencies. It’s not. They’ve milked that conflict for all its worth, and now brazenly talk about a “generational war”: many more years of more of the same.

We can also look forward to generational wars in Iraq, Syria, Libya, and Yemen. The strip miners are agitating for an Iranian foray. That’s got Into The 22nd Century written all over it, a rich, multi-generational vein, perhaps America’s first 100-year war. The only rival for richest mother lode is medicine. Health care is around 28% of the federal budget, defense 21%. Medical spending no longer cures the sick; it’s the take for insurance, pharmaceutical, and hospital rackets. The US spends more per capita on health care than any other nation (36% more than second-place Switzerland) but quality of care ranks well down the list. In education there is the same gap between per capita spending (the US ranks at or near the top) and value received, in this instance as measured by student performance.

What’s paid is out of all proportion to what’s received, especially at a time when computer and communications technology should be driving down the costs of education across the board. Indoctrination factories formerly known as schools, colleges, and universities dispense approved propaganda. For students, higher education is now on the government-sponsored installment plan. There’s a litany of excuses why Johnny, Joan, Juan, Juanita, Jamal and Jasmine can’t read, compute, or think, but lack of funding and student loans don’t wash. Education dollars fund teachers’ unions, their pensions, administrators, and edifice complexes; learning is an afterthought. This vein will play out as the pensions funds, and the governments that have swapped promises to fund them for educators’ votes, go bankrupt. Probably around the same time as the student loan bubble pops.

Tsipras is trying to put the blame on Varoufakis. He won’t find that an easy road, even if many Greeks agree. And no, the worst is not behind either him or Greece.

• Alexis Tsipras: ‘The Worst Is Clearly Behind Us’ (G.)

Today, Tsipras wants to dwell neither on Varoufakis – blamed widely by Greeks for the bungled “game of chicken” that led to the EU and IMF enforcing the harshest austerity measures yet – nor his nemesis, Germany’s finance minister, Wolfgang Schäuble. “Yanis is trying to write history in a different way,” he allows himself to say. “Perhaps the moment will come when certain truths are told … when we got to the point of reading what he presented as his plan B it was so vague, it wasn’t worth the trouble of even talking about. It was simply weak and ineffective.” Far from being a hate figure, Varoufakis held Schäuble in high esteem, Tsipras says. “I think he was his alter ego. He loved him. He respected him a great deal and he still respects him.”

Attempting to set the record straight, Tsipras says that while the Syriza government’s original strategy was one of collision politics – “in line with our mandate” – quitting the single currency, and by extension the EU, was never in question, even in the white heat of crisis when Athens was days away from default. “Leave Europe and go where … to another galaxy?” he quips. “Greece is an integral part of Europe. Without it, what would Europe look like? It would lose an important part of its history and its heritage.” Besides, Grexit would have amounted to acceptance of the “punishment plan” concocted by Schäuble that foresaw Athens taking “time out” of the bloc.

Compromise was the only option, says Tsipras, likening the measures that came with it to a ghastly medicine endured when life is at stake. “You hold your nose, you take it … You know that there is no other way … because you have tried everything else to survive, to stay alive.” Despite the firestorm of criticism he now endures, non-Greek observers say, the once firebrand leader has also shown courage in implementing policies he evidently loathes. Tsipras has managed to persuade many of those opposed to austerity to swallow the bitter pill that has kept Greece in the family of nations it has long identified with. The scenario of a “left parenthesis”, peddled by political enemies at the start of his tenure, has been put to rest.

[..] Ultimately, the great clash between Athens and the lenders keeping Greece afloat will be what is left imprinted on the collective memory, but Tsipras’s legacy, he says, will rest on something else. “It will be that I managed to take the country out of the bog in which it had been led by those who bankrupted it … and move ahead with a programme of deep reform.” That, at least, is the hope. For Greece has become an unpredictable place and, as with history itself, there are no straight lines. “No one,” he says, “can ever be sure that the crisis won’t come back.”

They found a new term: regularize. As in: regularized refugees. This can only go horribly wrong.

• European and African Ministers Discuss Plan To Tackle Flow Of Refugees (G.)

European and African ministers are to meet in Tunis on Monday to discuss a plan to try to regularise the flow of refugees from Africa to Europe to about 20,000, coupled with a much tougher strategy to deport illegal migrants from Italy and break up smuggling rings. The plan to regularise the migrant flow is being pushed by the UNHCR, the UN refugee agency, which warns that EU efforts to train the Libyan coastguard along with Italy’s intention to impose a new code of conduct on NGO rescue ships operating in the Mediterranean do not match the scale of the problem, or recognise the extent to which the flow of refugees and migrants is likely to become permanent. The aim is to set up screening systems for EU-bound migrants in countries en route to Libya, such as Mali, Niger, Burkina Faso, Ethiopia, Chad and Sudan.

The EU at a meeting in July set aside enough cash for 40,000 regularised refugees, with as many as half coming from claimants in Syria, and the remainder from Africa. Although the European commission has struggled to persuade all countries to take migrants after a similar scheme set up in following the 2015 migration crisis from Syria, the new scheme would represent a form of solidarity, and provide Italy with some relief. Italy is gripped by deep political and civil divisions on the issue, with more than 90,000 migrants reaching Italy from Libya this year. A reduction to 20,000 from Africa would represent a transformation.

Explaining the thinking, Vincent Cochetel, UNHCR’s new special envoy to the central Mediterranean, said: “We need to regularise the system and stop these dangerous journeys into Libya. Any remedy that focuses on trying to stop the flow of migrants at sea, such as a code of conduct for a NGOs, cannot be the solution. The issue has to be addressed earlier in the countries of origin and transit. “Italy also needs to be able to process claimants so the economic migrants are returned much more quickly, or else there will be no deterrent to travel to Italy. Only a third of the migrants reaching Italy are found to be in need of international protection.” He added that by the time migrants reached Libya it was often too late.

It is thought there are 300,000 Africans from outside Libya trying to get across to Europe or to get some work in Libya. They are living in Libyan detention centres or in warehouses or so-called “connection houses” in the hands of traffickers. The refugees need to be taken out of Libya and these detention centres so they can be processed elsewhere.

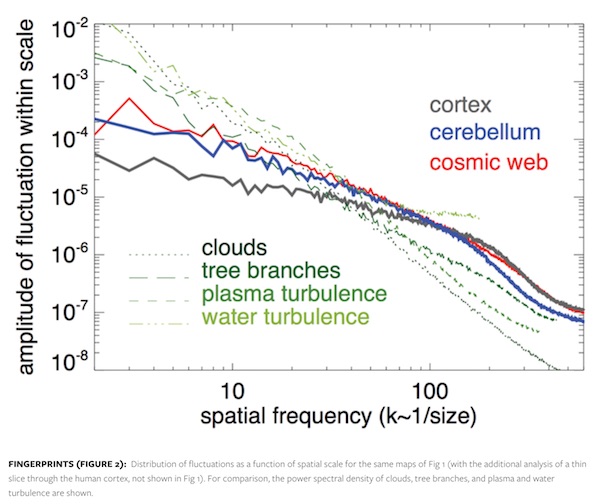

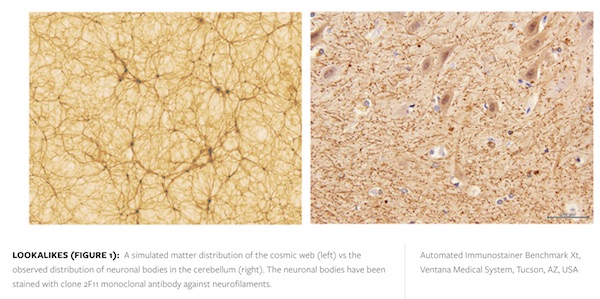

Self-similarity. The ultimate fractals.

• The Strange Similarity of Neuron and Galaxy Networks (Vazza & Feletti)

The total number of neurons in the human brain falls in the same ballpark of the number of galaxies in the observable universe.

Christof Koch, a leading researcher on consciousness and the human brain, has famously called the brain “the most complex object in the known universe.” It’s not hard to see why this might be true. With a hundred billion neurons and a hundred trillion connections, the brain is a dizzyingly complex object. But there are plenty of other complicated objects in the universe. For example, galaxies can group into enormous structures (called clusters, superclusters, and filaments) that stretch for hundreds of millions of light-years. The boundary between these structures and neighboring stretches of empty space called cosmic voids can be extremely complex. Gravity accelerates matter at these boundaries to speeds of thousands of kilometers per second, creating shock waves and turbulence in intergalactic gases.

We have predicted that the void-filament boundary is one of the most complex volumes of the universe, as measured by the number of bits of information it takes to describe it. This got us to thinking: Is it more complex than the brain? So we—an astrophysicist and a neuroscientist—joined forces to quantitatively compare the complexity of galaxy networks and neuronal networks. The first results from our comparison are truly surprising: Not only are the complexities of the brain and cosmic web actually similar, but so are their structures. The universe may be self-similar across scales that differ in size by a factor of a billion billion billion.

The task of comparing brains and clusters of galaxies is a difficult one. For one thing it requires dealing with data obtained in drastically different ways: telescopes and numerical simulations on the one hand, electron microscopy, immunohistochemistry, and functional magnetic resonance on the other. It also requires us to consider enormously different scales: The entirety of the cosmic web—the large-scale structure traced out by all of the universe’s galaxies—extends over at least a few tens of billions of light-years. This is 27 orde

rs of magnitude larger than the human brain. Plus, one of these galaxies is home to billions of actual brains. If the cosmic web is at least as complex as any of its constituent parts, we might naively conclude that it must be at least as complex as the brain.