Robert Rauschenberg Buffalo II 1964

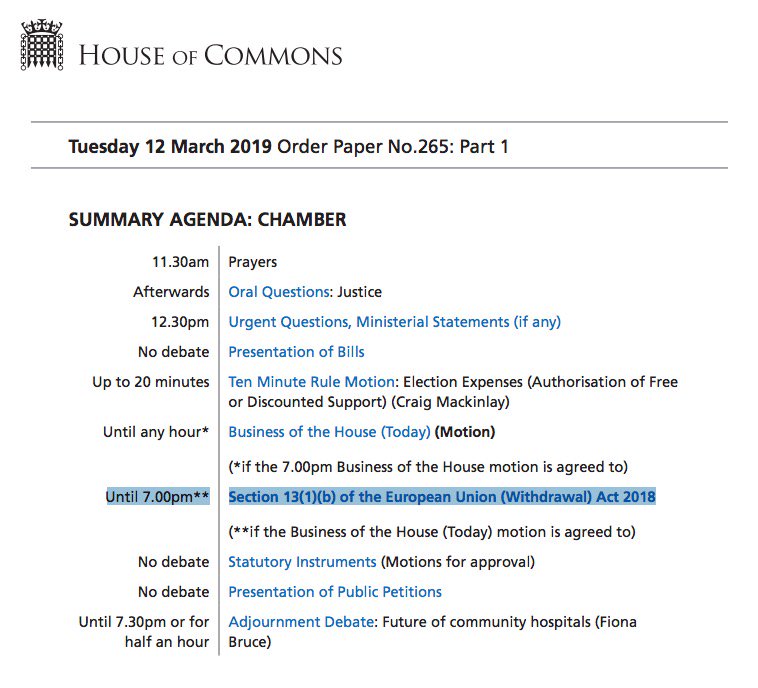

Trying to patch together an idea of what was decided. It all appears vacuous. May assures Britain that the EU can’t make the backstop permanent, but 1) it can, and 2) it never wanted to, provided Ireland is taken care of properly. I can’t get rid of the notion that the UK can’t get rid of the notion that Ireland is a second-class country.

Biggest ‘gain’ for May: the UK can unilaterally declare that it believes it can unilaterally halt the backstop.

Today will be all lawyers trying to translate the hollow terms into legalese, but I haven’t found anything that could convince anyone anything has changed since two days ago. Maybe she’ll swing a handful votes, but she lost by 203 last time around.

WSJ: “The EU offered a new legal instrument that would allow the U.K. to seek independent arbitration if it believed the EU was not negotiating a new trade agreement in good faith. If the U.K. claim were upheld and the EU continued to drag its feet, the U.K. could be freed from the customs arrangement. The EU also offered a legally binding pledge to work quickly on a future trade agreement to ensure that the backstop is temporary. The two sides also agreed that the U.K. would set out its own interpretation of the deal, which would state that the U.K. believes it has the option to bring the customs union arrangement to an end.”

Jeremy Corbyn on Twitter: “The Prime Minister’s negotiations have failed. Last night’s agreement with the European Commission does not contain anything approaching the changes Theresa May promised Parliament, and whipped her MPs to vote for.”

Green Party’s Molly Scott Cato on Twitter: “I’ve never before seen a prime minister deliberately try to mislead her own Parliament. There have been no legally binding changes to the withdrawal agreement. This is action worthy of an autocratic leader from a banana republic not the leader of a democratic country.”

• Theresa May Claims ‘Legally Binding’ Changes To Brexit Deal (Ind.)

Theresa May claims to have secured significant changes to her Brexit deal in a last-minute dash to Europe just hours before she must put her plan to a critical vote in parliament. In a late night statement on Monday in Strasbourg she argued the new-look deal meant Britain could not be trapped in the “Irish backstop” so hated by Eurosceptic Tories and her DUP allies, but major doubts remain over whether it is enough to win their backing on Tuesday. The prime minister’s deputy David Lidington warned that if her deal is rejected for a second time by MPs it will “plunge the country into a political crisis”. European leaders warned there would be no “third chance”, but Conservative Brexiteers insisted there are still “very worrying features” to the agreement, while Labour leader Jeremy Corbyn said “MPs must reject this deal tomorrow”.

The announcement came after another dramatic day in Westminster on Monday, which began with talk of Ms May potentially delaying Tuesday’s vote on her deal after a seemingly fruitless weekend of talks. But speaking an hour before midnight, she said: “MPs were clear that legal changes were needed to the backstop. Today we have secured legal changes. “Now is the time to come together, to back this improved Brexit deal, and to deliver on the instruction of the British people.” The backstop is an arrangement in the existing withdrawal agreement that comes into play if the EU and UK fail to agree future trading arrangements by the end of 2020, thus keeping the Irish border open, but also locking the UK into a customs union with the EU on a potentially indefinite basis.

[..] In a commons statement Mr Lidington revealed that the UK had secured two new documents, a “joint legally binding instrument on the withdrawal agreement” and a “joint statement to supplement the political declaration” on future relations. There is also a third element – a unilateral declaration from the UK setting out what actions it would take if it felt the backstop is being abused by the EU. Mr Lidington said the new legal “instrument” confirmed that the EU could not try to trap the UK in the backstop indefinitely, because commitments they had made to not do so were now legally binding.

It often takes going through several articles to get a rounded picture.

• Legal Uncertainty Hangs Over Brexit Vote (EUO)

Uncertainty continued to hang over Tuesday night’s (12 March) big vote on Brexit in the UK parliament, as British MPs tried to make sense of last-minute tweaks to the exit deal. The opposition Labour party indicated it would vote against the accord. “This evening’s agreement with the European Commission does not contain anything approaching the changes [British prime minister] Theresa May promised parliament and whipped her MPs to vote for,” Labour leader Jeremy Corbyn said on Monday. “It sounds again that nothing has changed,” his shadow Brexit minister, Keir Starmer said. Two MPs from May’s ruling Conservative party said the same. “Seems UK is still permanently locked into the EU, but can ‘argue’ it can leave. The catch? EU decides if we can leave,” Adam Afriyie said.

“We’re being played,” Sam Gyimah, a former Tory minister said. Nigel Farage, the EU-phobic British MEP for the UK Independence Party, was the most outspoken. “Nothing has changed. Reject. Reject. Reject,” he said. Meanwhile, the so-called Independent Group of ex-Labour and ex-Tory MPs said Brexit ought to be delayed in order to hold a second referendum. Dominic Grieve, Britain’s former attorney general, echoed their position. “The proper thing to do is to put it back to the public in a people’s vote, in a second referendum,” he said on Monday. Afriyie’s comment on being “locked into the EU” referred to the so-called ‘backstop’ – the previous deal that the UK would remain in the EU customs union until it found a mutually acceptable way to avoid a hard border on the island of Ireland.

The backstop prompted a historic majority of 230 MPs to reject the withdrawal deal in January, raising the prospect of a no-deal Brexit on 29 March. But EU commission president Jean-Claude Juncker and British prime minister Theresa May agreed three new documents at a meeting in Strasbourg, France, late on Monday designed to assuage those fears. The first one said the UK could start a dispute in an arbitration court to quit the backstop if the EU did not want to let it out. The second one said the EU and UK would try to find alternative arrangements to the backstop by the end of 2020. The third one was a unilateral British declaration in which the UK said it could quit the backstop if the talks on alternative arrangements broke down.

Both May and Juncker were emphatic in saying that the tweaks gave the UK the “legally binding” guarantees it needed to avoid being locked in to EU customs rules. “It [the backstop] would never be a trap, if either side were to act in bad faith, there is a legal way for either side to exit,” Juncker said.

Jonathan Freedland is a bit of a douche, I avoid him mostly. But he makes some points here.

• May Tries To Claim Victory – But The EU Has Conceded Next To Nothing (G.)

Think of what the ERG and the Democratic Unionists object to about the key stumbling block: the Northern Irish backstop, the insurance policy designed to avoid a hard border on the island of Ireland. They don’t like the fact that it has no time limit, that it could, theoretically, go on forever. And yet the best that May’s new motion laid before parliament could say is that the new legally binding joint instrument “reduces the risk that the UK could be held in the Northern Ireland backstop indefinitely”. “Reduces the risk” is not the same as “eliminates the risk” – and it’s that that many of those Brexiters wanted to hear. (Put aside the fact that it was always an unrealistic demand: you could say the same about the entire case for Brexit.)

A second demand of the Brexiters, one bizarrely endorsed in January by May herself and a majority of the Commons, was that the backstop be replaced by “alternative arrangements.” Gamely, May tried to pretend that she’d won an EU concession on that too, and that those alternative arrangements will be in place by December 2020. As indeed they will – if they exist by then. But for now, the technological wizardry so great that it would render the backstop redundant does not exist. And so this was another hollow victory.

Finally, the Brexit crowd wanted the UK to have the unilateral right to exit the backstop whenever it liked. May did indeed get something unilateral – the right to issue her own unilateral declaration, in which she could freely state that “it is the position of the United Kingdom that there would be nothing to prevent the UK instigating measures that would ultimately dis-apply the backstop.” This is rather like my son winning the right to declare that it is his position that he should get more pocket money. It doesn’t mean I’ve agreed to give him more pocket money. The clue is in the word “unilateral.” The EU is not bound by this UK declaration and has, in fact, conceded nothing.

Anyone checked what the bookmakers say on the date? UK elections for the EU Parliament would be hilarious.

• Britain Must Leave EU By May 23 Or Hold Own EU Vote (R.)

Britain must leave the European Union by the time EU voters elect a new European Parliament on May 23-26 or will have to elect its own EU lawmakers, European Commission President Jean-Claude Juncker said on Monday. Writing to EU summit chair Donald Tusk after agreeing a deal to break Brexit deadlock with British Prime Minister Theresa May, Juncker wrote: “The United Kingdom’s withdrawal should be complete before the European elections that will take place between May 23-26 this year.” “If the United Kingdom has not left the European Union by then, it will be legally required to hold these elections.”

Seems obvious.

• Former Australian PM Calls Brexit Trade Plan ‘Utter Bollocks’ (G.)

The claims that British trade with the Commonwealth can make up for leaving the EU is “the nuttiest of the many nutty arguments” advanced by Brexit supporters and “utter bollocks”, the former Australian prime minister Kevin Rudd has said. In a lacerating piece for the Guardian, Rudd dismissed the claims by some Brexit supporters that the UK could strike deals with his country, New Zealand, Canada and India to soften the blow and said the UK risked undermining western values by leaving the EU in a weaker position when it left.

“I’m struck, as the British parliament moves towards the endgame on Brexit, with the number of times Australia, Canada, New Zealand and India have been advanced by the Brexiteers in the public debate as magical alternatives to Britain’s current trade and investment relationship with the European Union,” he wrote. “This is the nuttiest of the many nutty arguments that have emerged from the Land of Hope and Glory set now masquerading as the authentic standard-bearers of British patriotism. It’s utter bollocks.” Of the prospect of a free trade deal with Delhi, he writes: “As for India, good luck!”

[..] he cast serious doubt on suggestions the UK could quickly come to a free trade agreement (FTA) with India, pointing out that talks he began with the nation on behalf of Australia a decade ago are still going on. “A substantive India-UK FTA is the ultimate mirage constructed by the Brexiteers. It’s as credible as the ad they plastered on the side of that big red bus about the £350m Britain was allegedly paying to Brussels each week. Not.”

Have a nice summer.

• Mueller Probe Already Financed Through September: Officials (R.)

Special Counsel Robert Mueller and the team he assembled to investigate U.S. President Donald Trump and his associates have been funded through the end of September 2019, three U.S. officials said on Monday, an indication that the probe has funding to keep it going for months if need be. The operations and funding of Mueller’s office were not addressed in the budget requests for the next government fiscal year issued by the White House and Justice Department on Monday because Mueller’s office is financed by the U.S. Treasury under special regulations issued by the Justice Department, the officials said. “The Special Counsel is funded by the Independent Counsel appropriation, a permanent indefinite appropriation established in the Department’s 1988 Appropriations Act,” a Justice Department spokesman said.

There has been increased speculation in recent weeks that Mueller’s team is close to winding up its work and is likely to deliver a report summarizing its findings to Attorney General William Barr any day or week now. Mueller’s office has not commented on the news reports suggesting an imminent release. Representatives of key congressional committees involved in Trump-related investigations say they have received no guidance from Mueller’s office regarding his investigation’s progress or future plans. The probe, which began in May 2017, is examining whether there were any links or coordination between the Russian government led by Vladimir Putin and the 2016 presidential campaign of Trump, according to an order signed by Deputy Attorney General Rod Rosenstein.

Little Marco lost so bigly in 2016, why’s he still around? Court jester? Or is he going for McCain’s place as warmonger in chief?

• Marco Rubio Accuses CNN Of ‘Russian Collusion’ (RT)

Senator Marco Rubio, the most outspoken cheerleader of US regime change in Venezuela, lashed out at several major outlets for not using his preferred terminology, going so far as to accuse CNN of ‘Russian collusion.’ “In order to undermine the constitutional basis for [Juan Guaido’s] interim Presidency [sic], Putin’s Russia repeatedly describes him as the ‘self-proclaimed’ president of Venezuela. And so does CNN,” Rubio (R-Florida) tweeted on Wednesday, adding, “Russian collusion?” It was the latest in a string of tweets by the senator whom President Donald Trump is, for some unknown reason, allowing to drive US foreign policy on Latin America.

On Tuesday, Rubio targeted the Washington Post and the Wall Street Journal for their coverage of Guaido, this time objecting to their use of the term “opposition leader.” Rubio’s badgering of the media came shortly after State Department spokesman Robert Palladino tried to do the same thing with diplomatic correspondents in Foggy Bottom. Referring to Guaido as anything other than “interim president” was feeding “the narrative of a dictator who has usurped the position of the presidency and led Venezuela into the humanitarian, political, and economic crisis that exists today,” Palladino argued.

CNN and Manafort, both. And neither.

• Manafort To Jail – Not About Justice; Not About Russia (Ron Paul)

Former Trump campaign official Paul Manafort has been sentenced to nearly four years in prison for acting as an unregistered agent for Ukraine. But looking at the media coverage of the case one would never know that “taking down” Manafort was not all about Russia collusion. Reporting…or propaganda?

Have they asked the CIA? Has Elizabeth Warren?

• News Corp’s Australian Arm Calls For Google Breakup (R.)

The Australian arm of Rupert Murdoch’s News Corp called for an enforced break-up of Alphabet Inc’s Google, acknowledging the measure would involve global coordination but calling it necessary to preserve advertising and the news media. The demand, published on Tuesday as part of a government inquiry, goes beyond the recommendations of the Australian Competition and Consumer Commission (ACCC) which crossed swords with Google by requesting a new regulatory body to oversee global tech operators. In an 80-page submission largely centered on Google, News Corp Australia said the U.S. company had created an “ecosystem” where it could control the results of people’s internet searches and then charge advertisers based on how many people viewed their advertisements.

Efforts to curtail Google’s market dominance around the world had failed because of the search engine operator’s record of “avoiding and undermining regulatory initiatives and ignoring private contractual arrangements”. When Google had agreed to change its methods in response to investigation or new regulations in other countries, it often soon replaced the conduct with new methods which had the same effect: directing traffic and sales to its own sites and hurting competition. Calling Google’s behavior “anti-competitive”, News Corp accused the Mountain View, California-based internet company of damaging publishers’ ability to generate revenue and ultimately the sustainability of the news industry.

And restores them again. But what nincompoop did that? Does (s)he still have a job today?

• Facebook Removes Warren Ads Calling For Facebook Breakup (Pol.)

Facebook removed several ads placed by Sen. Elizabeth Warren’s presidential campaign that called for the breakup of Facebook and other tech giants. But the social network later reversed course after POLITICO reported on the takedown, with the company saying it wanted to allow for “robust debate.” The ads, which had identical images and text, touted Warren’s recently announced plan to unwind “anti-competitive” tech mergers, including Facebook’s acquisition of WhatsApp and Instagram. “Three companies have vast power over our economy and our democracy. Facebook, Amazon, and Google,” read the ads, which Warren’s campaign had placed Friday. “We all use them. But in their rise to power, they’ve bulldozed competition, used our private information for profit, and tilted the playing field in their favor.”

A message on the three ads said: “This ad was taken down because it goes against Facebook’s advertising policies.” A Facebook spokesperson confirmed the ads had been taken down but said the company is in the process of restoring them. “We removed the ads because they violated our policies against use of our corporate logo,” the spokesperson said. “In the interest of allowing robust debate, we are restoring the ads.” Warren swiped at Facebook over the removal, citing it as evidence the company has grown too powerful. “Curious why I think FB has too much power? Let’s start with their ability to shut down a debate over whether FB has too much power,” she tweeted. “Thanks for restoring my posts. But I want a social media marketplace that isn’t dominated by a single censor.”

How long’s it been, 3-4 years?!, that Facebook blocked the Automatic Earth account? Still waiting for an explanation.

• Facebook Bans Zero Hedge (ZH)

Over the weekend, we were surprised to learn that some readers were prevented by Facebook when attempting to share Zero Hedge articles. Subsequently it emerged that virtually every attempt to share or merely mention an article, including in private messages, would be actively blocked by the world’s largest social network, with the explanation that “the link you tried to visit goes against our community standards.” We were especially surprised by this action as neither prior to this seemingly arbitrary act of censorship, nor since, were we contacted by Facebook with an explanation of what “community standard” had been violated or what particular filter or article had triggered the blanket rejection of all Zero Hedge content.

To be sure, as a for-profit enterprise with its own unique set of corporate “ethics”, Facebook has every right to impose whatever filters it desires on the media shared on its platform. It is entirely possible that one or more posts was flagged by Facebook’s “triggered” readers who merely alerted a censorship algo which blocked all content. Alternatively, it is just as possible that Facebook simply decided to no longer allow its users to share our content in retaliation for our extensive coverage of what some have dubbed the platform’s “many problems”, including chronic privacy violations, mass abandonment by younger users, its gross and ongoing misrepresentation of fake users, ironically – in retrospect – its systematic censorship and back door government cooperation (those are just links from the past few weeks).

The Democrats are killing their chances if they go with the old crowd. But then, they are controlled by that crowd.

• Biden on the Relaunch Pad: He’s Worse Than You Thought (CP)

When the New York Times front-paged its latest anti-left polemic masquerading as a news article, the March 9 piece declared: “Should former Vice President Joseph R. Biden Jr. enter the race, as his top advisers vow he soon will, he would have the best immediate shot at the moderate mantle.” On the verge of relaunching, Joe Biden is poised to come to the rescue of the corporate political establishment — at a time when, in the words of the Times, “the sharp left turn in the Democratic Party and the rise of progressive presidential candidates are unnerving moderate Democrats.” After 36 years in the Senate and eight as vice president, Biden is by far the most seasoned servant of corporate power with a prayer of becoming the next president.

When Biden read this paragraph in a recent Politico article, his ears must have been burning: “Early support from deep-pocketed financial executives could give Democrats seeking to break out of the pack an important fundraising boost. But any association with bankers also opens presidential hopefuls to sharp attacks from an ascendant left.” The direct prey of Biden’s five-decade “association with bankers” include millions of current and former college students now struggling under avalanches of debt; they can thank Biden for his prodigious services to the lending industry. Andrew Cockburn identifies an array of victims in his devastating profile of Biden in the March issue of Harper’s magazine. For instance:

• “Biden was long a willing foot soldier in the campaign to emasculate laws allowing debtors relief from loans they cannot repay. As far back as 1978, he helped negotiate a deal rolling back bankruptcy protections for graduates with federal student loans, and in 1984 worked to do the same for borrowers with loans for vocational schools.” • “Even when the ostensible objective lay elsewhere, such as drug-related crime, Biden did not forget his banker friends. Thus the 1990 Crime Control Act, with Biden as chief sponsor, further limited debtors’ ability to take advantage of bankruptcy protections.” • Biden worked diligently to strengthen the hand of credit-card firms against consumers. At the same time, “the credit card giant MBNA was Biden’s largest contributor for much of his Senate career, while also employing his son Hunter as an executive and, later, as a well-remunerated consultant.”

“..you miserable, morbidly obese, tattooed gorks watching this out on the Midwestern buzzard flats should have thought twice before dropping out of community college to drive a forklift in the Sysco frozen food warehouse..”

• Ides and Tides (Jim Kunstler)

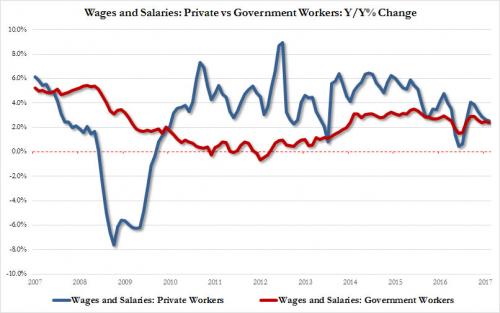

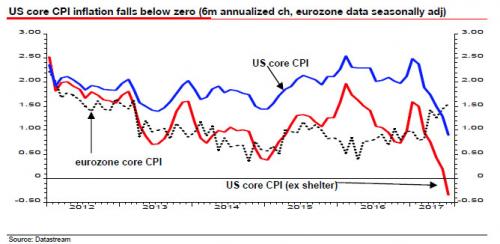

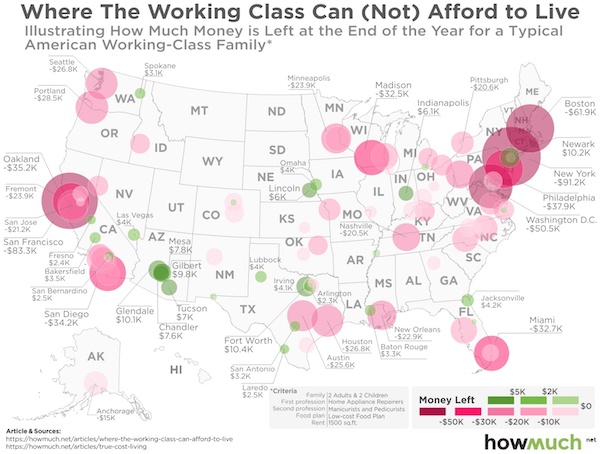

What you really had to love was Mr. Powell’s explanation for the record number of car owners in default on their monthly payments: “…not everybody is sharing in this widespread prosperity we have.” Errrgghh Errrgghh Errrgghh. Sound of klaxon wailing. What he meant to say was, hedge-funders, private equity hustlers, and C-suite personnel are making out just fine as the asset-stripping of flyover America proceeds, and you miserable, morbidly obese, tattooed gorks watching this out on the Midwestern buzzard flats should have thought twice before dropping out of community college to drive a forklift in the Sysco frozen food warehouse (where, by the way, you are probably stealing half the oven-ready chicken nuggets in inventory).

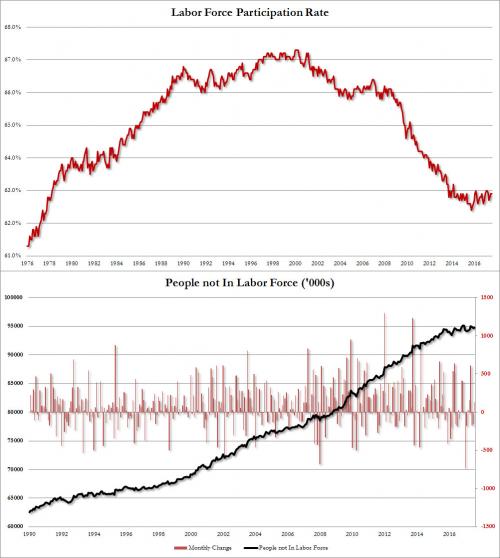

Interlocutor Scott Pelley asked the oracle about “those half-a-million people who have given up looking for jobs.” Did he pull that number out of his shorts? The total number out of the workforce is more like 95 million, and when you subtract retirees, people still in school, and the disabled, the figure is more like 7.5 million. There was some blather over the “opioid epidemic,” the upshot of which was learn to code, young man. Personally, I was about as impressed as I was ten years ago when past oracle Ben Bernanke confidently explained to congress that the disturbances in Mortgage-land were “contained.”

David Leonhardt of The New York Times had a real howler in his Monday column on the state of the economy: “Americans are saving more and spending less partly because the rich now take home so much of the economy’s income — and the rich don’t spend as large a share of their income as the poor and middle class.” Suggestion to Mr. Leonhardt: Learn to code.

Our chances of survival drop by the minute.

It’s Daly-Townsend’s take on the 2nd law of Thermodynamics: “No organism can survive in a medium of its own waste. “

The reason is that an organism’s waste is toxic to that organism.

If they don’t teach that in schools, why bother to attend?

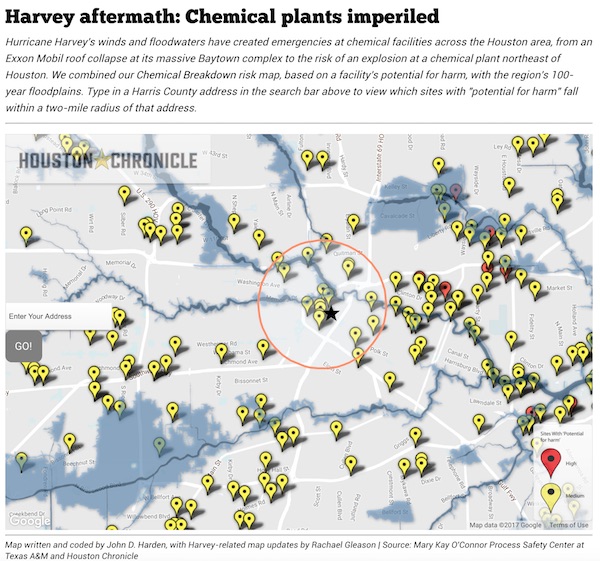

• Synthetic Chemicals Use Doubled In 20 Years, Will Double Again In Next 10 (G.)

Sales of synthetic chemicals will double over the next 12 years with alarming implications for health and the environment, according to a global study that highlights government failures to rein in the industry behind plastics, pesticides and cosmetics. The second Global Chemicals Outlook, which was released in Nairobi on Monday, said the world will not meet international commitments to reduce chemical hazards and halt pollution by 2020. In fact, the study by the United Nations Environment Programme found that the industry has never been more dominant nor has humanity’s dependence on chemicals ever been as great.

“When you consider existing pollution, plus the projected growth of the industry, the trends are a cause for significant concern,” said Achim Halpaap, who led the 400 scientists involved in the study. He said the fastest growth was in construction materials, electronics, textiles and lead batteries. More and more additives are also being used to make plastics smoother or more durable. Depending on the chemical and degree of exposure, the risks can include cancer, chronic kidney disease and congenital anomalies. The World Health Organization estimated that the burden of disease was 1.6 million lives in 2016. Halpaap said this was likely to be an underestimate.

In addition to the human health dangers, he said chemicals also affect pollinators and coral reefs. Global chemical production has almost doubled since 2000 and is now – if the pharmaceutical business is taken into account – the world’s second largest industry, the report noted. This is expected to continue for at least the next decade owing to massive increases in the expanding economies of Asia, Africa and the Middle East. By 2030, the industry is projected to almost double again from 2017 levels to hit $6.6tn (£5tn) in sales; China is forecast to account for 49.9% of the world market.