Cy Twombly Achilles’ Shield 1978

Virtue signaling in the US of A has already reached new heights, and there’s little reason to believe it won’t reach even much higher as we happily signal along. In the process, we will find that applying logic to the undertaking will take us to unanticipated, and highly undesirable (for most protesters), places. But by then a lot of damage, whether we think that’s a good thing or not, will have been done.

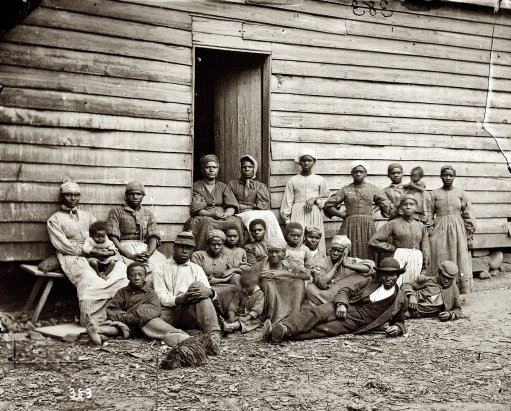

HBO opened a Pandora’s Box all of its own when it pulled Gone With the Wind, despite that fact that Hattie McDaniel was the first black American Oscar nominee AND winner. Let’s erase that too. Along with ALL other films that depict slavery in the “wrong” light, or, better yet, that depict slavery at all.

Let’s ban all links to slavery, let’s pretend it never existed, because if we don’t we will find it’s impossible to decide between what we do and do not want to last. not all people have the same preferences or opinions, and neither do all black people.

And while we’re talking movies, and Columbus statues are toppled across the nation because Christopher (before there were any “Americans”) treated indigenous Americans poorly, do let’s ban all Hollywood westerns in which “Indians” are depicted as cannon fodder. No more John Wayne for you. Gone even the few non-westerns Wayne appeared in, because his name and face are forever linked to killing “Indians”. No more Duke.

And why stop there? Just to name an example, Harper Lee’s To Kill a Mockingbird, arguably a great book and a good movie, depicts a white man “being compassionate” to a black man oppressed by other white men. Can’t have that, the oppression is obviously racist and so is the good(!) white(!) man who’s the protagonist of the story, written by a white woman(!).

Let’s leaf through all American and other world literature of the past half millennium that describes slavery, including that which talks about “good white” men. There are no good white men!

Anything to do with native Americans must go. Because they were badly treated throughout the 500 years of history they share with white people (Europeans). They still are, just like African Americans. Same difference. Phillis Wheatley, Harriet Beecher Stowe, Alice Walker, Toni Morrison? Don’t think so. They were all talking about slavery. And we’re toppling statues in order to stop that talk.

Frederick Douglass? You got to be kidding. His autobiography is called “Narrative of the Life of Frederick Douglass, an American Slave“. Isn’t that enough to topple him? James Baldwin, Ralph Ellison, they all remind us of a period we don’t want to be reminded of anymore. It’s enough! No more slavery!

Martin Luther King? Get serious, he talks about nothing but oppression. He even claims black people in his lifetime were still slaves. Muhammad Ali is obviously not welcome anymore, he spoke just about exclusively from the viewpoint of an oppressed man.

Washington, D.C. is the capital of the United States of America. George Washington was a slaveholder, he’s obviously out. D.C. stands for District of Columbia, named after Columbus, so that needs a new name. The country gets its name from a Columbus contemporary and fellow explorer who was a slave holder and treated indigenous populations of the countries he “visited” no better than Columbus did. Wikipedia:

Amerigo Vespucci wrote his will in April 1511. He left most of his modest estate, including five household slaves, to his wife.

[..] After Hispaniola they made a brief slave raid in the Bahamas, capturing 232 natives and then returned to Spain.

There once was a time when Washington, D.C. was the capital of the United States of America. But those days must soon be gone. How can you hold on to a name for your capital city that belongs to a man who was a brazen slave holder? Or the district the capital is in? And how can you breathe in a country named after a despicable Italian slaveholder and slave trader?

The US constitution was largely written by slave holders. We’re going to need a new one.

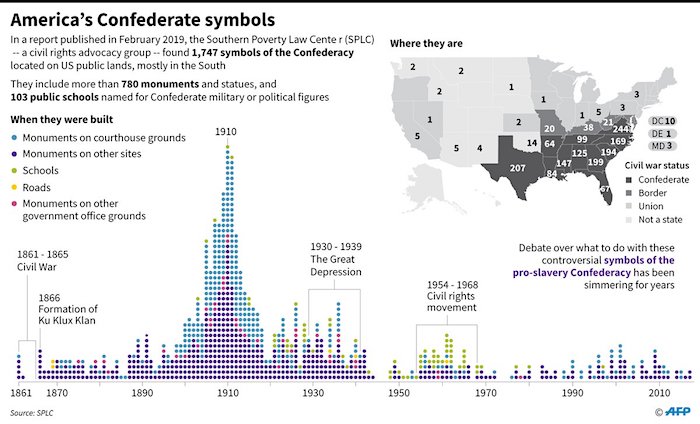

There are 1747 “symbols of the Confederacy” in the US. I’m guessing Pelosi, once those 11 statues at the Capitol have been toppled, will start work on getting rid of the other 1736 too. And mind you, this doesn’t yet include Columbus, Vespucci, or anyone else who’s “mistreated”, enslaved, murdered, native Americans. We will easily have twice the 1747 number once we include those.

For that matter, if you’re Nancy Pelosi, how and why do you dress up in the “kente cloth” fabrics that originate with the Asanthi people that ruled in present-day Ghana from mid-1600s to mid-1900s, and were themselves … slaveholders and slave traders? Who sold god knows how many African slaves to European slave traders? How can you dress up in the garb of slave traders to protest the mistreatment of the grandchildren of slaves? Short circuit? Temporary?

For all the protesters other than Pelosi, who herself obviously joined in only for political reasons, here’s a question: Do you oppose slavery, or only slavery on US soil? Because, you know, the Romans had slaves, many African tribes had slaves, present day Chinese people did. Australia? Slave country if I ever saw one. The deeper you dig into history, the more you will find. I don’t want to bore you with an extensive list, because it would be too extensive.

“There was no slavery in Australia.” Scott Morrison, 11.06.2020.

What would you call this, then ? pic.twitter.com/gUfFnQbskj

— Mike Carlton (@MikeCarlton01) June 11, 2020

Or maybe a second question, though it has mostly already been answered: Is this protest only about slavery, or about the oppression of people(s) in general? It’s already been answered in toppling the Columbus statues, since Christopher was not a slavetrader as far as we know, so, see above, we’re talking about both “indians” and “negroes”.

I use both derogatory terms on purpose, precisely because they paint the picture of what things used to be like. That they are no longer tolerated tells a story all by itself. And yes, much more is needed, but can that be achieved by toppling statues and banning books and movies? Is that how those two terms were banned?

We cannot escape our past and probably that’s the reason we shouldn’t try. What we need to do, what our role in the story is, is to not follow in the “footsteps of wrong”, and to do better. Do we have a better chance at doing better and escaping “wrong” if and when we ban all symbols of it, so we can no longer see it?

Or is our best chance to let all these things last so we can point at them to say: that is wrong!? If all the statues and books and movies are gone, how will our children know?

And I haven’t even mentioned the music yet, the unique melting pot of European melodies and African beats that gave the world blues and jazz and rock, all born from the plantation life that so many stories depict, and the music itself, growing under the statuesque eyes of the likes of Jefferson Davis or George Washington.

Maybe if you like your blues and jazz and rock and rap, you should call for the statues and books to remain standing, because without the narratives they bear witness to, there would be no blues, or anything that came after. Maybe you should celebrate your ancestors’ genius that gave America (or whatever you wind up calling it soon) its music, which, accidentally, has conquered all the countries of all the slavetraders of the past.

Maybe the music, the books, represent your ancestors’ victory over their oppressors, and maybe you risk tainting that hard-fought victory by trying to erase the memories of those they fought against to attain it.

And no, you can’t just pick the books and statues and music you would like and dump everything else. It doesn’t work that way. Your neighbor might have slightly different criteria and pick other favorites, and so on.

You can’t say we’ll hold on to Toni Morrison and throw out Harper Lee, you can’t dump Gone With the Wind but keep Guess Who’s Coming to Dinner, because each of these are part of the exact same story.

It’s a package deal, called history. And you’re not going to get the best end of that deal by pretending history doesn’t exist.

We run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the deal.

Thank you.

Support the Automatic Earth in virustime.