Vincent van Gogh The garden of the asylum at Saint-Rémy 1889

The winner from the Texas Sand Sculpture Festival.

Eli Crane

Eli Crane laser focused pic.twitter.com/i47qcPZIgN

— Citizen Free Press (@CitizenFreePres) May 27, 2023

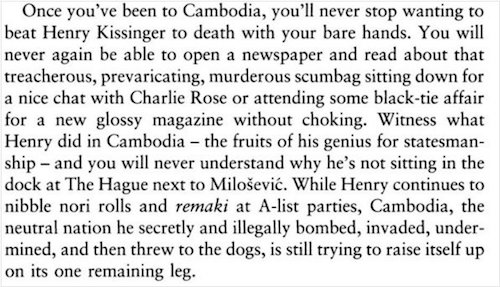

Anthony Bourdain

Rogan Smith

Comedian Dave Smith shocks Joe Rogan with his view about NATO expansion, the 2014 Ukraine coup, and how American policies led to the War in Ukraine, bringing the world closer to a potential nuclear World War III….. pic.twitter.com/Gt9y2uuxA8

— Richard (@ricwe123) May 26, 2023

Veritas

THIS IS PIZZAGATE: Project Veritas whistleblower, Ryan Montgomery, a cybersecurity professional, was given a tip about a disturbing website and after a bit of digging, he found a vast network of self-proclaimed pedophiles, murderers and rapists using the open Internet to prey on… pic.twitter.com/BZJ7FBepin

— LIZ CROKIN (@LizCrokin) May 23, 2023

Carrey

Jim Carrey warned you long ago.https://t.co/Y0NbDhWsmP https://t.co/PMib2yNOS5

— Kim Dotcom (@KimDotcom) May 27, 2023

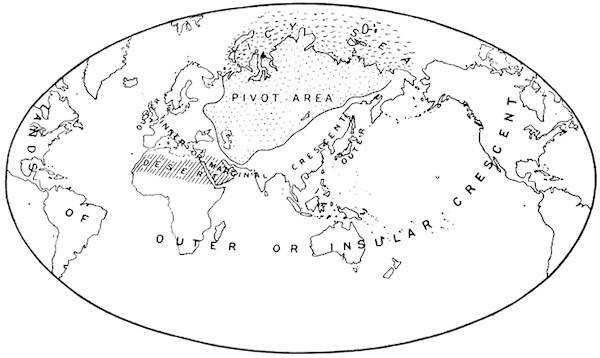

Perhaps it’s time to see Mackinder from a Chinese perspective. In 1904 that may not have seemed important, but today?!

• No Truce With the Heartland (Luongo)

Ukraine has always represented the apotheosis of the Neocon/Neoliberal world order. As Crooke points out, they are facing a very unpleasant choice: “The war is now, in this way, being projected as a binary choice: ‘End the war’ versus ‘Win the war’. Europe is tergiversating –standing at the cross-roads; hesitantly starting down one road, only to reverse, and indecisively take a few cautious steps down the other. The EU will both train Ukrainians to fly F-16s; and yet is coy about providing the planes. It smacks of tokenism; but tokenism is often the father to mission-creep.” Indeed it is. Because of the closed-mindedness of those in power in the West — their biases, racism, and arrogance — they will not stop in Ukraine until they are forced to by circumstances.

Those circumstances will likely be dictated by the revamped Russian military now configured to fight a longer and different kind of war than the one that began in February 2022. Every day we see signs that Russia’s military-industrial capacity is increasing rapidly while the EU languishes. The US is rapidly trying to bring back onshore manufacturing lost to the ZIRP and Greenspan Eras, but this is a slow and painful process especially since it has run out of room on the balance sheet to deficit spend to accelerate things. “Biden” and his merry band of vandals in D.C. are more than happy to burn the place to the ground more thoroughly than the British did in the War of 1812 if they can’t get their way on unlimited taxing and spending.

So, here we are. Bakhmut has fallen. The Ukrainian counter-offensive is non-existent. If anything it was already absorbed by Putin and Prigozhin. Zelenskyy will now get F-16s to attack Crimea and use that as some moral high ground for justifying NATO’s official involvement after Russia’s inevitable counter-attack. Then the air will be thick with the smell of thermobarics in the morning. But, regardless of any of that, there will be no truce in the Heartland. Russia will not back down. China will back them to the end, as will OPEC+ and the rest of Central Asia. But they will not escalate one inch further than they need to. Allowing the West to keep thinking they can win is the ultimate form of grinding out a superior opponent.

[..] While the West fights desperately to stave off defeat of the Heartland, it’s clear the rest of the World Island is making plans to leave them behind. At some point there are simply too many people and too much pressure to keep pushing the world towards a conclusion it doesn’t want to go. And that’s when everything changes, literally overnight. Until then, it will be another day, another escalation, another pointless political knife fight and thousands of people dying needlessly. When he published that paper in 1904 all Mackinder did was formalize British imperial thinking into an easily-digested thesis for morons. Today we are being gaslit by these morons into believing our lives depend on fighting for ‘freedom’ in central Ukraine. It was written as the British empire’s grip on power was beginning to wane. World War I would put the capper on that.

More heartland. BRICS + Central Asia.

• Eurasian Heartland Rises to Challenge the West (Pepe Escobar)

President Xi Jinping telling President Putin at the end of their summit last March in Moscow that we’re now facing “great changes not seen in a century” directly applies to the new spirit reigning across the Heartland. Cue to the China-Central Asia summit last week in Xian, the former imperial capital, where Xi solidified the expansion of the Belt and Road Initiative (BRI) from Western China in Xinjiang to its western neighbors and then all the way to Iran, Turkey and Eastern Europe. Xi in Xian particularly stressed the complementing aspects between BRI and the Shanghai Cooperation Organization (SCO), once again showing that all five Central Asian “stans”, acting together, should counter-act the proverbial external interference via “terrorism, separatism and extremism”.

The message was stark: these hybrid war strategies are all integrated with the attempt by the Hegemon to continue fostering serial color revolutions. The purveyors of the “rules-based international order”, Xi implied, will go no holds barred to prevent ongoing Heartland integration. The usual suspects in fact are already spinning that Central Asia is falling into a potential trap, fully captured by Beijing. Yet this is something Kazakhstan’s “multi-vector diplomacy”, coined way back in the Nazarbayev years, would never allow. What Beijing is developing, instead, is an integrated approach via a C+C5 secretariat with no less than 19 separate channels of communication. The heart of the matter is to turbo-charge Heartland connectivity via the BRI’s Middle Corridor.

And that, crucially, includes technology transfer. As it stands, there are dozens of industrial transfer programs with Kazakhstan, a dozen in Uzbekistan, and several in discussion with Kyrgyzstan and Tajikistan. These are extolled by Beijing as part of “harmonious Silk Roads”. Xi himself, as a post-modern pilgrim, detailed the connectivity in his keynote speech in Xian: “The China-Kyrgystan-Uzbekistan highway that runs across the Tian shan Mountains, the China-Tajikistan expressway that defies the Pamir Plateau, and the China-Kazakhstan crude oil pipeline and the China-Central Asia Gas Pipeline that traverse the vast desert – they are the present-day Silk Road.”

[..] Moscow is very much aware of the high stakes. For instance, for a year and a half virtually every month a Russian delegation arrives in Tajikistan to implement, in practice, the “pivot to the East”, developing projects in agriculture, health care, education, science and tourism. Central Asia should have a leading role in BRICS+ expansion – something supported by both BRICS leaders Russia and China. The idea of a BRICS + Central Asia is being seriously floated from Tashkent to Almaty. That would imply establishing a strategic continuum from Russia and China to Central Asia, South Asia, West Asia, Africa and Latin America – spanning the logistics of connectivity trade, energy, manufacture production, investment, technological breakthroughs and cultural interaction.

“Zelensky’s supporters no longer believe in the myth of Ukrainian victory..”

• After Bakhmut (Douglas Macgregor)

Until the fighting begins, national military strategy developed in peacetime shapes thinking about warfare and its objectives. Then the fighting creates a new logic of its own. Strategy is adjusted. Objectives change. The battle for Bakhmut illustrates this point very well. When General Sergey Vladimirovich Surovikin, commander of Russian aerospace forces, assumed command of the Russian military in the Ukrainian theater last year, President Vladimir Putin and his senior military advisors concluded that their original assumptions about the war were wrong. Washington had proved incurably hostile to Moscow’s offers to negotiate, and the ground force Moscow had committed to compel Kiev to negotiate had proved too small. Surovikin was given wide latitude to streamline command relationships and reorganize the theater.

Most importantly, Surovikin was also given the freedom of action to implement a defensive strategy that maximized the use of stand-off attack or strike systems while Russian ground forces expanded in size and striking power. The Bakhmut “Meatgrinder” was the result. When it became clear that Ukraine’s President Volodymyr Zelensky and his government regarded Bakhmut as a symbol of Ukrainian resistance to Russian military power, Surovikin turned Bakhmut into the graveyard of Ukrainian military power. From the fall of 2022 onward, Surovikin exploited Zalenskiy’s obsession with Bakhmut to engage in a bloody tug-of-war for control of the city. As a result, thousands of Ukrainian soldiers died in Bakhmut and many more were wounded. Surovkin’s performance is reminiscent of another Russian military officer: General Aleksei Antonov.

As the first deputy chief of the Soviet general staff, Surovikin was, in Western parlance, the director of strategic planning. When Stalin demanded a new summer offensive in a May 1943 meeting, Antonov, the son and grandson of imperial Russian army officers, argued for a defensive strategy. Antonov insisted that Hitler, if allowed, would inevitably attack the Soviet defenses in the Kursk salient and waste German resources doing so. Stalin, like Hitler, believed that wars were won with offensive action, not defensive operations. Stalin was unmoved by Soviet losses. Antonov presented his arguments for the defensive strategy in a climate of fear, knowing that contradicting Stalin could cost him his life. To the surprise of Marshals Aleksandr Vasilevsky and Georgy Zhukov, who were present at the meeting, Stalin relented and approved Antonov’s operational concept. The rest, as historians say, is history.

Macgregor

If President Putin and his senior military leaders wanted outside evidence for Surovikin’s strategic success in Bakhmut, a Western admission appears to provide it: Washington and her European allies seem to think that a frozen conflict—in which fighting pauses but neither side is victorious, nor does either side agree that the war is officially over—could be the most politically palatable long-term outcome for NATO. In other words, Zelensky’s supporters no longer believe in the myth of Ukrainian victory. The question on everyone’s mind is, what’s next? In Washington, conventional wisdom dictates that Ukrainian forces launch a counteroffensive to retake Southern Ukraine. Of course, conventional wisdom is frequently high on convention and low on wisdom.

On the assumption that Ukraine’s black earth will dry sufficiently to support ground maneuver forces before mid-June, Ukrainian forces will strike Russian defenses on multiple axes and win back control of Southern Ukraine in late May or June. Roughly 30,000 Ukrainian soldiers training in Great Britain, Germany, and other NATO member states are expected to return to Ukraine and provide the foundation for the Ukrainian counterattack force. General Valery Gerasimov, who now commands the Russian forces in the Ukrainian theater, knows what to expect, and he is undoubtedly preparing for the Ukrainian offensive. The partial mobilization of Russian forces means that Russian ground forces are now much larger than they have been since the mid-1980s.

Given the paucity of ammunition available to adequately supply one operational axis, it seems unlikely that a Ukrainian offensive involving two or more axes could succeed in penetrating Russian defenses. Persistent overhead surveillance makes it nearly impossible for Ukrainian forces to move through the twenty- to twenty-five-kilometer security zone and close with Russian forces before Ukrainian formations take significant losses. Once Ukraine’s offensive resources are exhausted Russia will likely take the offense. There is no incentive to delay Russian offensive operations. As Ukrainian forces repeatedly demonstrate, paralysis is always temporary. Infrastructure and equipment are repaired. Manpower is conscripted to rebuild destroyed formations. If Russia is to achieve its aim of demilitarizing Ukraine, Gerasimov surely knows he must still close with and complete the destruction of the Ukrainian ground forces that remain.

Repeat every day.

• Counteroffensive Can Start At Any Moment – Ukrainian Official (RT)

Ukrainian forces are “ready” to launch their much-touted counteroffensive, the head of the National Security and Defense Council told the BBC in an interview on Saturday. Aleksey Danilov said the military top brass are now waiting for the right moment to launch the attack. “It could happen tomorrow, the day after tomorrow or in a week,” Danilov answered when pressed about a potential start of the counteroffensive, which Kiev has been talking about for months. A major assault was initially expected to start in spring or even late winter, but Kiev repeatedly postponed it, citing adverse weather conditions and the need to obtain all necessary weapons and equipment from western backers. Danilov said it would have been “weird” for him to reveal the exact date, as “that cannot be done.”

He described the planned attack as a “historic opportunity” that his nation “cannot lose” if it wants to become a “big European country.” “We understand that we have no right to make a mistake,” he added. In April, The New York Times reported that Ukraine’s Western supporters might start to pressure Kiev into launching talks with Moscow should the much-anticipated offensive fail to yield any major gains. Kiev has been sending mixed signals on the counteroffensive. Earlier this week, Ukrainian President Vladimir Zelensky’s aide, Mikhail Podoliak, told Italy’s Rai TV channel that it “has been going on for several days”. However, on Thursday, another presidential advisor, Igor Zhovkva, contradicted that statement, saying Ukrainian forces were still preparing for the operation.

Danilov denied the offensive had already begun, claiming that Ukrainian strikes against Russian “control centers” and “military equipment” were just routine operations. Danilov’s remarks came as Russia outlined its conditions for ending the conflict with Ukraine. Russian Deputy Foreign Minister Mikhail Galuzin told TASS on Saturday that Kiev should abandon the idea of joining NATO and the EU, guarantee the rights of minorities, and declare Russian a state language. Ukraine must also recognize the “new territorial realities,” the high-ranking diplomat said, referring to four former Ukrainian territories that joined Russia following referendums in autumn 2022, as well as Crimea, which reunited with Russia in 2014 following another referendum. However, Danilov stated earlier in May that there could be no peace talks “on Russia’s terms.”

Does Germany wish to be a target?

• Ukraine Demands German Missiles Capable Of Striking Moscow (RT)

Ukraine has asked Berlin to provide it with long-range air-launched missiles that could potentially reach Moscow, a spokesperson for Germany’s Defense Ministry confirmed on Saturday. On Friday, the Frankfurter Allgemeine Zeitung newspaper reported, citing two unnamed “insiders” within the German military, that Ukraine “urgently wants” Swedish-German Taurus missiles. These munitions could be allegedly placed on US-made F-16 fighters, which are now being considered for delivery to Kiev by several Western countries. Ukrainian President Vladimir Zelensky is said to have asked for the missiles during his meeting with German Chancellor Olaf Scholz in Berlin earlier this month.

For now, it is unclear whether Berlin, which earlier said it did not have any F-16s to send to Kiev, will grant this request. The report said the demand presents Berlin with a dilemma, as some in the German government doubt whether Ukraine would sensibly use such a weapon – which can travel 500km (310 miles) and is armed with a 500kg warhead. As Kiev may use the Taurus to strike Moscow from the border, “some fear that in a situation of dire need, Kiev could allow the war to escalate uncontrollably,” the paper added. According to the outlet, another problem is that the Taurus needs extremely precise and up-to-date information to stage attacks, raising questions as to whether Berlin would be willing to share such data with Kiev.

Earlier this month, the UK decided to supply Ukraine with Storm Shadow missiles with a range of over 250km (155 miles), with Moscow’s Foreign Ministry condemning the move as another step towards a “serious escalation.” Later, the Russian Defense Ministry said that Kiev used the weapon to conduct a strike on civilians in the Donbass city of Lugansk, resulting in six children injured, according to local authorities. Even without long-range missiles, earlier this month Kiev unsuccessfully attempted to conduct a strike on the Kremlin using two drones, which according to Moscow was an attempt to assassinate Russian President Vladimir Putin. Kiev has denied any involvement, with Ukrainian President Vladimir Zelensky claiming that “we fight on our territory” and “we don’t have… enough weapons for this.”

“..the aggressive imposition of Western ‘new values’ causes growing rejection there and only brings Russia and African countries closer together.”

• Africa Foresees End Of Unipolar World – Russian Envoy (RT)

The West’s attempts to pressure Africa to turn on Russia have failed as people on the continent realize the true nature of the conflict in Ukraine and see that the unipolar world order is coming to an end, according to the head of the Russia-Africa Partnership Forum. Oleg Ozerov, who is also Russia’s ambassador-at-large, told Newsweek on Friday that the attendance of 40 out of 54 nations of the continent at the Russia-Africa Interparliamentary Conference had “shattered the myth of Russia’s alleged isolation due to the events in Ukraine, persistently promoted in the West.” “People in Africa understand very well that the former Soviet republic has turned into an arena of confrontation between the new and the old world paradigms, between different visions of the future, not just a trivial feud between neighbors,” he said.

According to the diplomat, the well-balanced and neutral approach towards “Russia’s confrontation with the West” by Africa, China, India and Latin American nations “confirms once again that the transition to… multipolar architecture is irreversible.” Those countries clearly understand that the time for “unipolar world-order is running out,” he added. What Africa needs now is promotion of local solutions and national interests, as well as deliverance “from the rigid constraints of globalism promoted by neo-liberalist ideologists,” Ozerov said. “African countries count on Russia’s support” in achieving those goals, he stated. Moscow is backing efforts to complete the decolonization process in a number of African countries, while also working to put together a broad anti-terrorist front on the continent “free from any hidden agenda or double standards,” the diplomat continued.

“The US and EU want Africa to play the role of a mere supplier of raw materials to the ‘civilized world,’” Ozerov said. But Russia has a different approach as its “primary interest is to assist the development of Africa’s domestic energy and electricity markets, where we have considerable expertise, especially as regards nuclear energy,” he explained. Moscow has “no vested interests, such as to preserve its zone of influence or aggressively guard markets from any ‘outsiders,’” and Africans see that, the envoy said. And that’s the reason why “the unprecedented pressure by the West on Russia’s partners in Africa is not that effective in practice.” Ozerov said that, during his trips to the continent, it became obvious to him that “the aggressive imposition of Western ‘new values’ causes growing rejection there and only brings Russia and African countries closer together.” Russia is due to host a high-level Russia-Africa Summit in St. Petersburg in July, with the envoy saying that recent developments indicate that the event is going to be “a success.”

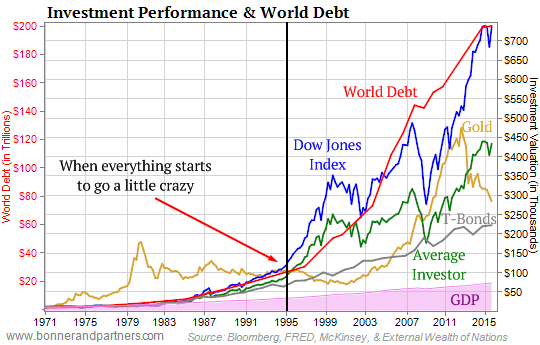

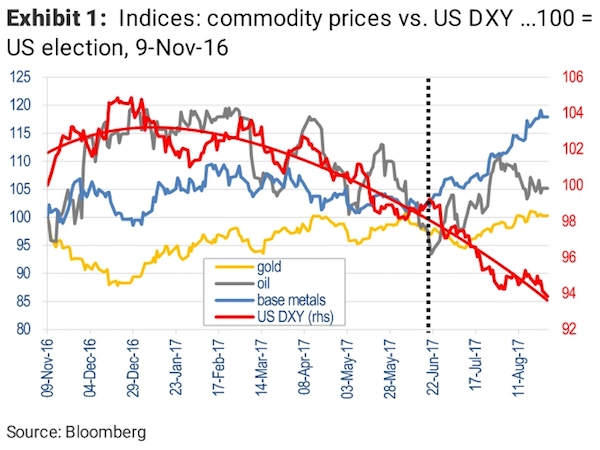

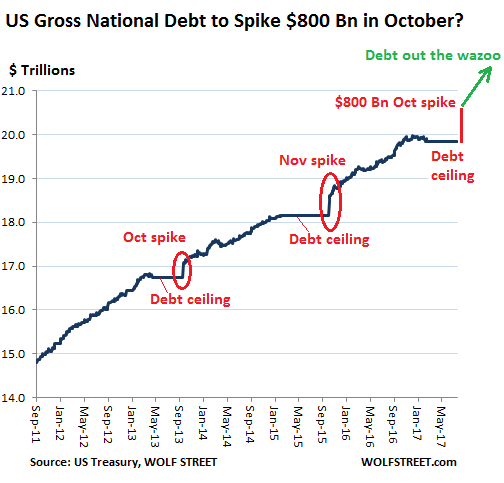

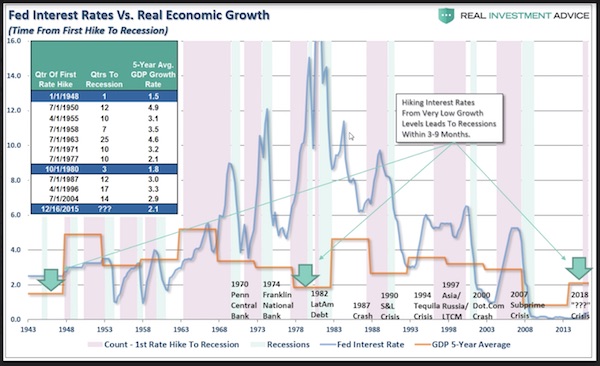

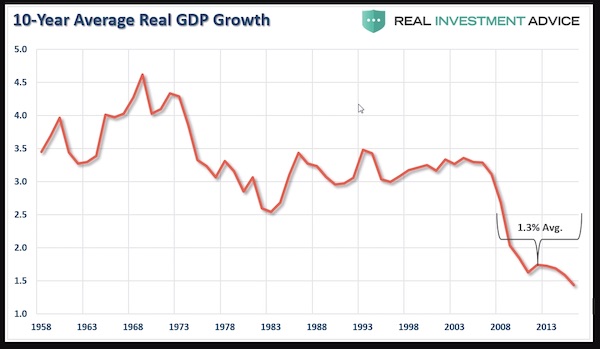

What’s the influence on Treasury purchases?

• Credit Rating Agency Downgrades US (RT)

China Chengxin International Credit Rating (CCXI) slashed its sovereign credit score for the US by one notch earlier this week, becoming the first among top rating firms to make the move. The leading Chinese agency, a joint venture between Beijing Zhixiang Information Management Consulting and US ratings giant Moody’s, lowered the US to AAg+ from AAAg, having placed it on review for a further downgrade, according to a statement released on Thursday. “The intensification of political divisions between the two parties in the United States has increased the difficulty of resolving the debt-ceiling issue,” the statement reads.

“Even if a consensus is reached, the brinkmanship would pose uncertainty to the US government’s policy path and dampen economic confidence, which could trigger further volatility in the US politics and economy,” the agency added. According to CCXI, US debt sustainability is currently being seriously challenged, with the highest level of borrowing among the previously AAAg-rated nations, while the issue is being complicated by hawkish policies of the US Federal Reserve. The regulator has hiked the key interest rate several times over the past few months, raising the risk of asset depreciation on the balance sheets of many financial institutions. The credit rating agency Fitch previously put the US on watch for a potential downgrade, having warned that the nation could soon lose its AAA score due to an inability to pay its bills, within a matter of days.

Meanwhile, Moody’s said a mid-June interest payment on Treasuries will be critical for maintaining its top AAA grade. Republicans and Democrats have struggled to reach an agreement to increase the debt ceiling for weeks, prompting warnings from Treasury Secretary Janet Yellen that the US is “highly likely” to default if Congress does not act soon. The move would be a first in American history, as the government has never defaulted on its debt, which has swelled to more than $31 trillion. Late on Friday, Yellen extended the deadline for a potentially devastating default, saying the government has just a few more days to argue over the debt ceiling before it runs out of cash.

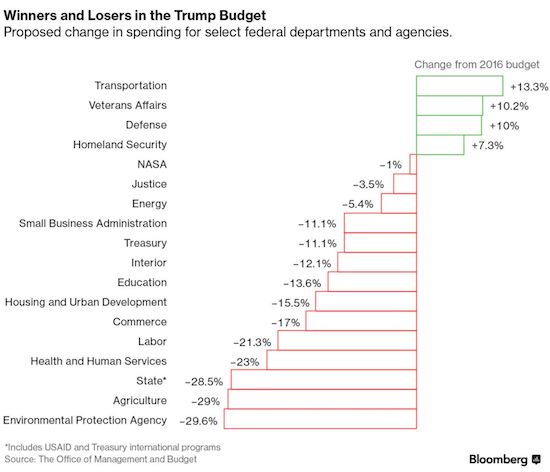

“The debt ceiling deal “cuts” spending by 0.2% of GDP or about $50 billion. Is that good enough?”

“Of the $80 billion Democrats appropriated to the IRS over ten years, the “deal” rescinds $1.9 billion. You read that right. That’s the kind of “get” that’s so good McCarthy agreed to increase the debt ceiling $4 trillion.”

• Debt Ceiling Deal Between White House And GOP Reached In Principle (ZH)

The White House and GOP negotiators have reached an agreement in principle to raise the US debt ceiling, averting a default. The deal raises the debt limit and keeps non-defense spending ‘near flat’ for two years, while cutting and capping various federal programs, the NY Times reports. After 2025, however, there will be no budget caps. It was structured with the aim of enticing votes from both parties, though it would most likely draw the ire not only of conservative Republicans but also Democrats furious at being asked to vote for cuts they oppose with the threat of default looming. If the progressives or the Freedom Caucus don’t blow it up, the plan has a chance of Congressional passage before June 5, the date Treasury Secretary Janet Yellen has warned any deal must be finalized by in order to avoid hitting the “X-date”, when the Treasury can no longer meet its obligations.

“After weeks of negotiations, we have come to an agreement in principle,” said House Speaker Kevin McCarthy, adding that there are “historic reductions in spending” and “consequential reforms.” “There are no new taxes, no new government programs,” McCarthy continued, adding that they would be spending tonight writing the agreement. McCarthy expects a vote on Wednesday. In the House, Republicans hold a narrow majority – meaning unhappy right-wing lawmakers who have demanded significantly larger budget cuts in exchange for raising the ceiling may hold it hostage (lookin’ at you Gaetz). That said, McCarthy can at least say he tried – inking in principle a compromise that would effectively freeze federal spending that had been slated to expand.

“European diplomats are hesitant to openly name and shame those who stall the negotiations, allegedly out of fear that more EU countries suspected of facilitating sanctions-evasion could also rebel.”

• EU Sanctions Talks Hit Roadblock – Politico (RT)

The negotiations over the European Union’s 11th package of sanctions against Russia have been stalled amid opposition from Athens and Budapest, who demand their companies be removed from the Kiev-compiled list of “war sponsors,” according to Politico. Two rounds of talks in Brussels this week ended with no deal in sight, as there was “no pressure” to discuss smaller issues until crucial objections by the member states are addressed, the publication reported on Saturday citing multiple anonymous diplomatic sources. The main roadblock is said to be Kiev’s notorious list of “sanctions-evaders” and “international sponsors of war,” which features multiple European companies because they maintained business ties with Russia.

Compiled by the National Agency on Corruption Prevention (NACP), the list includes such giants as German wholesaler Metro, French retailer Auchan, Italian cement company Buzzi Unicem and Austrian banking group Raiffeisen, among others. Hungary was the only EU state to voice objections during a foreign ministers’ meeting on Monday, insisting that Kiev’s baseless accusations against its leading financial institution OTP Bank could be formalized with the bloc’s next round of sanctions. On Wednesday, however, Greece stepped into the forefront of the discussion, saying that allegations of sanction circumvention could be “very damaging” to its economy as well.

“Greece reiterated that, should there be concrete evidence of violation of sanctions, these should be brought to the attention of the member states concerned, at the technical level, so that this be adequately investigated and then due action will be taken,” an unnamed EU diplomat told the publication. Politico claimed that the Ukrainian list and the next sanctions package are “not linked” and the duo was simply holding the talks hostage as “political leverage.” However, European diplomats are hesitant to openly name and shame those who stall the negotiations, allegedly out of fear that more EU countries suspected of facilitating sanctions-evasion could also rebel. In the meantime, two sources said that the EU’s top diplomat, Josep Borrell, acknowledged the problem and “it is now up to him to work with the Ukrainians on a solution.”

Budapest has taken a neutral stance in the ongoing conflict between Moscow and Kiev, as it refused to provide military aid to Ukraine or allow Western aid to pass through its territory. Although Hungary had largely taken part in the existing EU sanctions against Russia, it has repeatedly criticized the restrictions and opposed those that might affect its own economy, including its conventional and nuclear energy sectors. Athens also defied the bloc’s efforts to cut all economic ties with Moscow, with imports of Russian goods by Greece more than doubling to a record €9.33 billion ($10 billion) last year. The trade balance between the two countries in 2022 was negative, however, with the value of Greek exports to Russia last year decreasing to €156.4 million from €206.6 million in 2021.

They’re arming Taiwan. So what is there to talk about?

• China Rebuffing All Contact With US Military: Pentagon (ZH)

Top Pentagon officials have once again said that China is ignoring and rebuffing the US military’s attempts to establish and open line of communication, which is crucial to avoiding inadvertent conflict in regions such as in the South China Sea where both naval powers operate. “Open communication channels between the US and China are important in maintaining peace and stability across the Taiwan Strait, US Assistant Secretary of Defense for Indo-Pacific Affairs Ely Ratner said on Thursday,” regional media reports. “The Pentagon’s attempts to reach out to China’s military in recent months have been ignored or rebuffed,” Ratner told an audience at the DC-based Center for Strategic and International Studies.

He sought to stress that the Pentagon “believes in the importance of open lines of communication with the PRC [People’s Republic of China] and we have sought to build out those open lines of communication. Unfortunately… we’ve had a lot of difficulty when we have proposed phone calls, meetings, dialogues.” “The US and Department of Defense have had an outstretched hand on this question of military to military engagement, but we have yet to have consistently willing partners,” Ratner emphasized further. Earlier this month there was hope that US-China dialogue would be back on track following the meeting between National Security Advisor Jake Sullivan and Chinese Communist Party Politburo Member and China’s Director of the Office of the Foreign Affairs Commission Wang Yi in Vienna on May 10-11.

That meeting was generally reported and regarded as positive, given that before that all such high level diplomatic contacts had been off ever since the ‘spy balloon’ shootdown incident over the American east coast in early February. But even if the rival militaries are struggling to keep open communications, Washington and Beijing are pushing forward with trade talks: “U.S. Secretary of Commerce Gina Raimondo sat down with her Chinese counterpart Wang Wentao in Washington D.C. on Thursday to discuss “concerns” surrounding bilateral trade. Marking the first cabinet-level exchange between the two countries in months, the U.S. talked about American companies operating in China. According to a readout by the Commerce Department, “The two had candid and substantive discussions on issues relating to the U.S.-China commercial relationship, including the overall environment in both countries for trade and investment and areas for potential cooperation.”

“..part of the effort to bury the Russiagate hoax the way the Warren Commission buried the facts of the Kennedy assassination for many years.”

• John Durham and the Burying of American History (Patrick Lawrence)

I appreciate the Durham Report for the chronology of events it indicates. This is now easier to follow than it has been previously. In simple terms, Clinton authorized an operation to frame Trump within days of the leak of emails from Democratic Party servers in July 2016. The FBI’s leadership acted quickly to set this operation in motion. It first considered using the offhand remarks of George Papadopoulos, a minor Trump campaign volunteer, to obtain surveillance warrants against various of Trump’s advisers. When that proved too flimsy, the agency’s top officials turned to the Steele Dossier. The agency knew it was junk, but they punched it up sufficiently to get the warrants needed to proceed against Trump and his people. This was Crossfire Hurricane, the FBI’s anti–Trump op at the heart of the Russiagate hoax.

“The truth is, we had almost all of the information a long time ago. What we didn’t have was the certification of the information by a government authority, by a legal authority,” Walter Kirn remarks in America This Week. “I think Durham did a job of showing reach to the highest levels of the government. Apparently everyone was briefed on the reality of this thing early on, very early on. All the highest authorities knew it was bullshit.” Perfectly fair comment, an astute summation. Then Kirn continues in a very curious way: “In a way, I guess it became necessary that the system vindicates itself by finding that which could not be found and asserting that which could not be proved, to the point that the moment where it mattered passed away. President Trump’s no longer president. All of the harms that were done by this thing have been done. They changed our history, they changed our media. They changed our sense of information and why it’s important.”

Kirn is right to suggest that “the system” appears to figure that a report such as Durham’s can now be released because it is all water under the bridge—a little in the way the U.S. will acknowledge one or another of its coup operations long after the facts have ceased to matter. Similarly, it looks as if Garland found this an opportune moment to send the Durham Report to Capitol Hill, effectively to remove the entire Russiagate affair from the common American consciousness. With a presidential election 18 months away, Biden’s attorney-general must dispose of Russiagate and Durham’s probe as hastily and as best he can.

But I am not with Kirn when he asserts all the harm has been done. No, it has not. Russiagate changed history all right. And the destruction of this history is to my mind the greatest harm of all. This is the very oddest thing about the Durham Report: It purports to rip off the veil shielding the plot against Donald Trump from view, but it shapes up after a few days’ consideration as part of the effort to bury the Russiagate hoax the way the Warren Commission buried the facts of the Kennedy assassination for many years.

He’s been doing it for 50 years.

• Roger Waters Under Criminal Probe Over Anti-Nazi Satire (RT)

German police have launched a criminal investigation into English rock legend and Pink Floyd co-founder Roger Waters on suspicion of glorifying Nazism during two concerts in Berlin. The musician has insisted the performance was in opposition to fascism. On Friday, in a statement quoted by several media outlets, the Berlin police said that Waters was suspected of inciting hatred, and that the probe was centered on his performances on May 17 and 18 in the German capital. In footage posted on social media, the musician can be seen wearing a leather trench coat resembling a Nazi uniform with two crossed hammers and a red armband. He then proceeds to take a mock gun and shoot into the crowd.

“The context of the clothing worn is deemed capable of approving, glorifying or justifying the violent and arbitrary rule of the Nazi regime in a manner that violates the dignity of the victims and thereby disrupts public peace,” the police said. Nazi-related symbols are outlawed in Germany, with an exception being made for educational or artistic purposes. Waters’ performance was apparently in reference to the film “the Wall,” an adaptation of the eponymous 1979 Pink Floyd album. The rock star appears as the album’s protagonist who hallucinates being a fascist dictator addressing a Nazi rally. Waters’ concerts also featured a pig-shaped balloon floating in the air, with a logo of the Israeli weapons company Elbit Systems and the Star of David.

The show also involved showing the names of people fading in on the screen, including Anne Frank, a Jewish diarist who died in a Nazi concentration camp, and Palestinian Al Jazeera journalist Shireen Abu Akleh, who was killed while covering an Israeli military operation in May 2022. The Israeli UN Ambassador Danny Danon suggested that Waters wanted to compare Israel to the Nazis, describing the musician as “one of the biggest Jew haters of our time.” On Friday, the musician addressed the controversy, writing on Twitter that he had become a target of “bad faith attacks” from those who disagreed with his political views. “The elements of my performance that have been questioned are quite clearly a statement in opposition to fascism, injustice and bigotry in all its forms”, he said, adding that he had spent his entire life speaking out “against authoritarianism and oppression.”

“Therapist doll that, when squeezed, whispers, “Don’t tell your parents.”

• Fisher-Price Introduces ‘My First Gender Transition’ Playset (BBee)

In a show of solidarity with a vocal minority of gender activists who don’t purchase their products, Fisher-Price introduced the “My First Gender Transition” playset for kids ages 2 to 9. “The My First Gender Transition playset helps your child have a fun time playing pretend while in no way being inculcated with an emotionally destructive ideology,” said Product Manager Murthina Spillwig who may soon be updating her resumé. “Parents in our focus groups were excited to force their kids to pretend to enjoy the playset for Instagram.” The playset is bursting with a plethora of features to confuse your toddler, including:

-My First Gonadotropin-Releasing Hormone Analogue puberty-blocking toy syringe

-Top Surgery For Tykes toy surgical table

-Barnyard and jungle-themed breast binders and packing underwear

-Therapist doll that, when squeezed, whispers, “Don’t tell your parents.”

-A lifesize poster of inspiring role model Dr. Rachel Levine

In anticipation of the success of the gender-affirming playset, Fisher-Price has announced they will soon be releasing the “My First Detransition” playset.

Perfect job

The perfect job might actually exist pic.twitter.com/OmDNcMxvjj

— B&S (@_B___S) May 27, 2023

Bukele

Pres. @nayibbukele saw clearly the old model, in place since 1648, had reached its end game, so he set out to reinvent sovereignty. Making #Bitcoin legal tender (and eschewing shitcoins) is a key part.

So far, the results are brilliant.

— Max Keiser (@maxkeiser) May 27, 2023

Aweeeee

Aweeeeeeeee this is so beautiful. pic.twitter.com/Nitzmrl0mo

— Figen (@TheFigen_) May 27, 2023

Iguana

https://twitter.com/i/status/1662395821977894916

Deactivate a cat

How to deactivate a cat

[source: https://t.co/UbHiNh6Q4I]

[the science behind it: https://t.co/Qz14kbMPhj] pic.twitter.com/lx7jpxLnL3— Massimo (@Rainmaker1973) May 27, 2023

Sea slug

https://twitter.com/i/status/1662378744160440321

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.