Vincent van Gogh Avenue of Poplars at Sunset 1884

Something’s brewing alright…

• Short-Sellers Sense An Opportunity As China Trade Tensions Brew (R.)

Escalating trade tensions between Washington and Beijing may have sent tremors across the U.S. stock market but short-sellers are taking the opportunity to boost bearish bets against U.S. companies exposed to a full-blown trade war. Planemaker Boeing, automaker General Motors, casino operator Las Vegas Sands, package delivery company FedEx and agricultural trader Bunge – companies that could feel the pain from growing trade tensions with China – have drawn a noticeable pickup in shorting activity this month, according to financial analytics firm S3 Partners.

“I think the change in short interest is directly related to the increase in trade tensions,” said Ihor Dusaniwsky, head of research at S3 in New York. Short-sellers aim to profit by selling borrowed shares with the hope of buying them back later at a lower price. On Friday, U.S. President Donald Trump said he was pushing ahead with hefty tariffs on $50 billion of Chinese imports, and Beijing immediately vowed to respond in kind. Tensions escalated further on Monday, after Trump threatened to hit $200 billion of Chinese imports with 10 percent tariffs if Beijing retaliated. Multinationals that rely on China for large parts of their business are seen as particularly at risk from a potential trade war.

…but who’s going to come up on top, the shorts or the squeezers?

• The Greatest Short-Squeeze In History (ZH)

A quick glance at the stock market – particularly big-tech – and once can quickly discern that “something’s up.” Every dip is met by a wall of buying, ramping the market ever higher, and ever more ignorant of the increasingly uncertain world around it.

Why? Simple… it’s a massive, unprecedented short-squeeze…

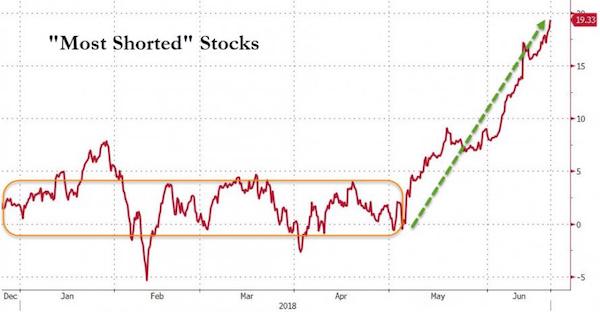

The “most shorted” stocks in America are up 20% in the last two months, almost incessantly.

While the chart above is ridiculous enough, it turns out that this is actually accelerating and is now the great short-squeeze in the history of the data…

The ‘Relative Strength Index’ of the “most shorted” stocks has never been higher and each time it has reached this level, stocks have fallen hard.

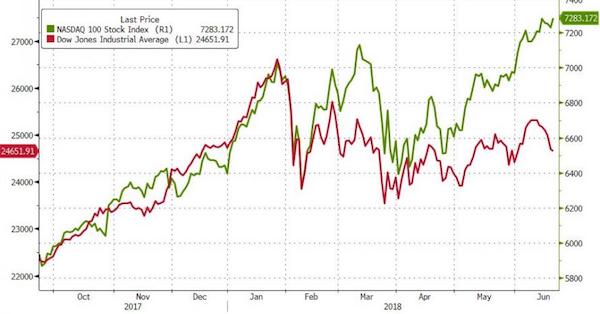

But as a reminder – amid all of this – The Dow is down for the 7th day in a row, its longest losing streak in 18 months.

Xi needs to keep his foreign reserves at home.

• Chinese Investment In The US Drops 90% Amid Political Pressure (CNBC)

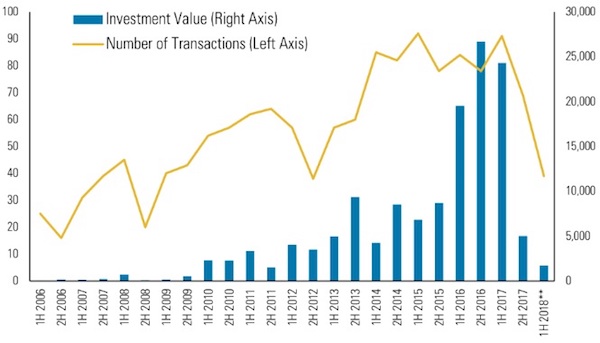

Chinese acquisitions and investments in the U.S. fell 92 percent to just $1.8 billion in the first five months of this year, consulting and research firm Rhodium Group said Tuesday. Counting divestitures, net Chinese deal flow to the U.S. during that time was a negative $7.8 billion, the report said. The decline follows a sharp drop in the second half of last year as pressure from both Beijing and the Trump administration curbed a recent surge in cross-border investment. Completed Chinese deals in the U.S. hit a record $46 billion in 2016, and dropped to $29 billion in 2017, according to Rhodium. In a search for investment opportunities, Chinese companies went on an overseas buying spree in 2015 and 2016.

But now, China wants to limit capital flight and excessive leverage. The U.S. is worried about intellectual property protection and has increased scrutiny of deals on the basis of national security. The Trump administration has also threatened restrictions on investment based on a “Section 301” investigation, the same study that led to the latest tariff announcements. As a result, acquisitions worth more than $2 billion in the first five months of this year have fallen apart, Rhodium Group’s Thilo Hanemann said.

Still negotiating.

• China Warns Washington’s ‘Capricious’ Trade Actions Will Hurt US Workers (R.)

China’s commerce ministry on Thursday accused the United States of being “capricious” over bilateral trade issues, and warned that the interests of U.S. workers and farmers ultimately will be hurt by Washington’s penchant for brandishing “big sticks”. Previous trade negotiations with the United States had been constructive, but because the U.S. government is being unpredictable and challenging, Beijing has had to respond in a strong manner, commerce ministry spokesman Gao Feng said in a regular briefing in Beijing.

President Donald Trump threatened on Monday to hit $200 billion of Chinese imports with 10 percent tariffs if Beijing retaliates against his previous announcement to target $50 billion in imports. The United States has alleged that China is stealing U.S. intellectual property, a charge denied by Beijing. Washington’s accusations of forced tech transfers are a distortion of reality, and China is fully prepared to respond with “quantitative” and “qualitative” tools if the U.S. releases a new list of tariffs, Gao said. “It is deeply regrettable that the U.S. has been capricious, escalated the tensions, and provoked a trade war,” he said. “The U.S. is accustomed to holding ‘big sticks’ for negotiations, but this approach does not apply to China.”

China will have to move.

• China Could Strike Back At Dow-Listed Firms Over Trade: Global Times (R.)

China could hit back at U.S. firms listed on the Dow Jones Industrial Average if U.S. President Donald Trump keeps exacerbating tensions with China over trade, state-controlled Chinese tabloid The Global Times said on Thursday. Trump threatened on Monday to hit $200 billion of Chinese imports with 10 percent tariffs if China follows through with retaliation against his previous targeting of $50 billion in imports. The Dow, which counts Boeing, Apple and Nike among its constituents, ended down 0.17 percent on Wednesday. The 30-stock share index has declined 0.25 percent year-to-date.

“If Trump continues to escalate trade tensions with China, we cannot rule out the possibility that China will strike back by adopting a hard-line approach targeting Dow Jones index giants,” the Global Times said in a commentary. The world’s two biggest economies seemed increasingly headed towards open trade conflict after three rounds of high-level talks since early May failed to reach a compromise on U.S. complaints over Chinese trade practices and a $375 billion trade deficit with China. Despite taking steps in self-defense, China will not stray from its path of deepening reform and opening up, said the tabloid, which is run by the People’s Daily.

Deutsche = derivatives.

• Deutsche Bank Troubles Raise Worries About The Future Of The Eurozone (Polleit)

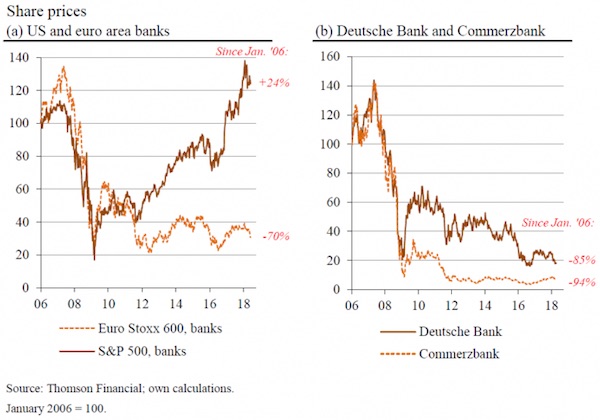

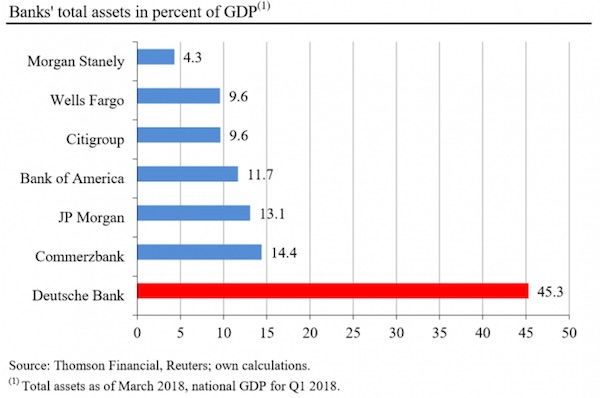

The euro banking sector is huge: In April 2018, its total balance sheet amounted to €30.9 trillion, accounting for 268% of GDP in the euro area. Unfortunately, however, many euro banks are in lousy shape. They suffer from low profitability and carry an estimated total bad loan exposure of around €759 billion, which accounts for roughly 30% of their equity capital. Share price developments suggest that investors have lost quite some confidence in the viability of euro banks’ businesses: While US bank stocks are up 24% since the beginning of 2006, the index for euro-area bank stocks is still down by around 70%. Perhaps most notably, ’Germany’s two largest banks, Deutsche Bank and Commerzbank, have lost 85 and 94%, respectively, of their market capitalization.

With a balance sheet of close to €1.5 trillion in March 2018, Deutsche Bank accounted for around 45% of German GDP. In international comparison, this an enormous, downright frightening dimension. It is mostly the result of the bank still having an extensive (though not profitable) footprint in the international investment banking business. The bank has already started reducing its balance sheet, though. Beware of big banks — this is what we could learn from the latest financial and economic crises 2008/2009. Big banks have the potential to take an entire economy hostage: When they get into trouble, they can drag everything down with them, especially the innocent bystanders – taxpayers and, if and when the central banks decide to bail them out, those holding fiat money and fixed income securities denominated in fiat money.

Sure.

• Greece Expects Substantive Debt Relief Conditions From Eurogroup (R.)

Greece expects eurozone finance ministers to deliver on promised debt relief this week so that it can at last plan its financial future “like any ordinary country,” the government spokesman said on Wednesday. Ministers in the Eurogroup will meet in Luxembourg on Thursday to consider plans for easing the debt burden, which at 179.8% of annual Greek GDP is proportionately the greatest in the 19-nation euro zone. “We are optimistic that we are on the verge of a solution with substance,” spokesman Dimitris Tzanakopoulos said, adding that this would “have a multiplying effect on the momentum of the Greek economy.” Shut out of debt markets in 2010, Greece is set to exit its international bailout program formally in August.

The Eurogroup will discuss debt relief to ensure Athens can return to market financing after eight years of loans from euro zone governments and the IMF. “The accepted criteria for all sides is that this solution be convincing for markets and embed the creditworthiness of our country – the final act in restoring the credibility of Greece to be able to plan for the next day like any ordinary country,” Tzanakopoulos told a news briefing. The European Stability Mechanism (ESM) holds more than half of the country’s public debt and, as its biggest creditor, is keen to see Greece regain market access sustainably. EU officials have repeatedly said the meeting will be crucial to seal Greece’s financial future.

Decisions will need to be made on the use of about €40 billion that remain unspent under its third, €86 billion bailout programme which expires on Aug. 20. Greece has already received substantial debt relief during the crisis. Private creditors cut the value of their holdings of Greek government bonds by more than half in 2012. As a result Greek debt stock was cut by about €107 billion. Official creditors do not accept such “haircuts” but have eased lending terms which reduced the net present value of the loans granted to Athens, resulting in further budget savings. European creditors will probably grant frontloaded debt relief to Greece by using the funds left over in the third bailout to buy out part of the IMF loans..

“..a tool for the automated surveillance and control of its users..”

• EU Committee Approves New Rules That Could ‘Destroy The Internet As We Know It’

An EU committee has approved two new copyright rules that campaigners warn could destroy the internet as we know it. The two controversial new rules – known as Article 11 and Article 13 – introduce wide-ranging new changes to the way the web works. Article 13 has been criticised by campaigners who claim that it could force internet companies to “ban memes”. It requires that all websites check posts against a database of copyrighted work, and remove those that are flagged. That could mean memes – which often use images taken from films or TV shows – could be removed by websites. The system is also likely to go wrong, campaigners say, pointing to previous examples where automated systems at YouTube have taken down a variety of entirely innocent posts.

Smaller sites might not even be able to maintain such a complicated infrastructure for scanning through posts, and therefore might not be able to continue to function, activists claim. Some companies and sites have already had to shut down as a result of the EU’s new GDPR data rules. It has been opposed by a whole host of internet experts, many of them involved with the creation of the central technologies and services of the internet. An open letter published last week was signed by more than 70 experts, including web creator Tim Berners-Lee, Wikipedia co-founder Jimmy Wales and internet pioneer Vint Cerf. “By requiring Internet platforms to perform automatic filtering all of the content that their users upload, Article 13 takes an unprecedented step towards the transformation of the Internet, from an open platform for sharing and innovation, into a tool for the automated surveillance and control of its users,” that letter read.

The authors note that copyright is an important part of law, which exists to encourage creators to ensure their work is put out into the world. But the automatic systems being considered by the EU are not the right ways of controlling that, they argue. “We support the consideration of measures that would improve the ability for creators to receive fair remuneration for the use of their works online,” the letter reads. “But we cannot support Article 13, which would mandate Internet platforms to embed an automated infrastructure for monitoring and censorship deep into their networks.”

They all do it.

• Trump’s Military Drops a Bomb Every 12 Minutes, and No One Talks About It (TD)

There was basically a media blackout while Obama was president. You could count on one hand the number of mainstream media reports on the Pentagon’s daily bombing campaigns under Obama. And even when the media did mention it, the underlying sentiment was, “Yeah, but look at how suave Obama is while he’s OK’ing endless destruction. He’s like the Steve McQueen of aerial death.” And let’s take a moment to wipe away the idea that our “advanced weaponry” hits only the bad guys. As David DeGraw put it, “According to the C.I.A.’s own documents, the people on the ‘kill list,’ who were targeted for ‘death-by-drone,’ accounted for only 2% of the deaths caused by the drone strikes.”

Two percent. Really, Pentagon? You got a two on the test? You get five points just for spelling your name right. But those 70,000 bombs dropped by Bush—it was child’s play. DeGraw again: “[Obama] dropped 100,000 bombs in seven countries. He out-bombed Bush by 30,000 bombs and 2 countries.” You have to admit that’s impressively horrific. That puts Obama in a very elite group of Nobel Peace Prize winners who have killed that many innocent civilians. The reunions are mainly just him and Henry Kissinger wearing little hand-drawn name tags and munching on deviled eggs.

However, we now know that Donald Trump’s administration puts all previous presidents to shame. The Pentagon’s numbers show that during George W. Bush’s eight years he averaged 24 bombs dropped per day, which is 8,750 per year. Over the course of Obama’s time in office, his military dropped 34 bombs per day, 12,500 per year. And in Trump’s first year in office, he averaged 121 bombs dropped per day, for an annual total of 44,096. Trump’s military dropped 44,000 bombs in his first year in office. He has basically taken the gloves off the Pentagon, taken the leash off an already rabid dog.

Why the EU should not be in the hands of people who need to win national elections. Not Brussels either, obviously. This is disastrous.

• Circle Closed: Merkel, Macron Want EU Border States To Deal With Refugees (RT)

With no end in sight to the EU refugee crisis, Berlin and Paris look to put the burden of dealing with asylum seekers on the countries where they first register. The seeming return to ‘old rules’ is poised to split Europe further. During their meeting ahead of the EU summit, German Chancellor Angela Merkel and French President Emmanuel Macron pledged to “jointly and resolutely tackle” what they euphemistically called “secondary movements inside the EU.” An elusive wording used in the so-called Meseberg Declaration adopted by the two leaders effectively means one thing: Macron and Merkel want all the newly arrived asylum seekers and migrants to stay in the EU countries where they were first registered while their cases are being processed.

This would leave the EU southern member states to deal with the new arrivals alone. The problem, however, is that the same rules embodied in what is known as the ill-fated EU Dublin Regulation already proved to be dysfunctional at the height of the 2015 refugee crisis. “It is a de-facto return to the Dublin Agreement, which was disavowed by Merkel herself when she opened Germany’s borders for refugees back in 2015,” Evgenia Pimenova, an expert at the International Studies Center of the Moscow State Institute of International Relations (MGIMO), told RT. It seems, however, that the leaders of Europe’s two powerhouses do not have much of a choice in a situation when they face a growing opposition to the old migration policies both at home and at the European level.

This apparent attempt to save face and gain some political points without giving up on their principled stance on immigration issues, however, might lead Berlin and Paris to a situation in which they only sow seeds of further discord in a bloc, which is already beset with political differences. “It is not a revolution” in a field of migration policy, Alain Corvez, a former advisor to the French Defense and Interior Ministries, told RT. “It is only a tactical decision [aimed at dealing] with the current threats” and “pressure” that Merkel and Macron and facing “in their own countries.”

5Star must be careful with continuing support for Salvini.

• Italian Coastguard Ship Carrying 522 Migrants Docks In Sicily (AFP)

An Italian coastguard ship carrying more than 500 migrants, including dozens rescued by the US Navy off Libya last week, arrived Tuesday night at a port in Sicily, days after the new far-right interior minister banned NGO rescue ships from docking in Italy. “Diciotti ship finally lands in Pozzallo taking 522 people to safe port,” the UNHCR Italy tweeted. “They were rescued in multiple operations, 42 of them survived drowning and they need urgent medical care and psychological support,” the UN refugee agency said, adding that it was at the scene along with Italian authorities and humanitarian organisations.

A dozen very dehydrated migrants, including six children, three women and one man, had already been sent to Pozzallo and taken into care by the Italian Red Cross. It is not known whether they were part of the group of 41 migrants rescued from a vessel in distress off Libya last Tuesday by the USNS Trenton, which transferred them to the Diciotti. The crew of the US fast transport ship also spotted 12 bodies in the water but were unable to locate them during a search after the rescue, the US Navy said. A nearby ship from the NGO Sea Watch offered to help provided it could dock with the migrants at an Italian port, which the Italian authorities refused.

Wonderful story from an unexpected source, the attacker from Manchester United and Belgium. Moving.

• I’ve Got Some Things to Say (Romelu Lukaku)

I remember the exact moment I knew we were broke. I can still picture my mum at the refrigerator and the look on her face. I was six years old, and I came home for lunch during our break at school. My mum had the same thing on the menu every single day: Bread and milk. When you’re a kid, you don’t even think about it. But I guess that’s what we could afford. Then this one day I came home, and I walked into the kitchen, and I saw my mum at the refrigerator with the box of milk, like normal. But this time she was mixing something in with it. She was shaking it all up, you know? I didn’t understand what was going on. Then she brought my lunch over to me, and she was smiling like everything was cool. But I realized right away what was going on.

She was mixing water in with the milk. We didn’t have enough money to make it last the whole week. We were broke. Not just poor, but broke. My father had been a pro footballer, but he was at the end of his career and the money was all gone. The first thing to go was the cable TV. No more football. No more Match of the Day. No signal. Then I’d come home at night and the lights would be shut off. No electricity for two, three weeks at a time. Then I’d want to take a bath, and there would be no hot water. My mum would heat up a kettle on the stove, and I’d stand in the shower splashing the warm water on top of my head with a cup.

There were even times when my mum had to “borrow” bread from the bakery down the street. The bakers knew me and my little brother, so they’d let her take a loaf of bread on Monday and pay them back on Friday. I knew we were struggling. But when she was mixing in water with the milk, I realized it was over, you know what I mean? This was our life. I didn’t say a word. I didn’t want her to stress. I just ate my lunch. But I swear to God, I made a promise to myself that day. It was like somebody snapped their fingers and woke me up. I knew exactly what I had to do, and what I was going to do. I couldn’t see my mother living like that. Nah, nah, nah. I couldn’t have that.