Charles Sprague Pearce Lamentations over the Death of the First-Born of Egypt 1877

Scholz

https://twitter.com/i/status/1779509472391495791

Coastguy

Neil Oliver: "The climate crisis, the world at boiling point, rising sea levels, dying polar bears—it's all lies… Renewable energy is another scam… Electric vehicles are made using the energy from fossil fuels, and they're powered with electricity generated by burning more… pic.twitter.com/U41D99cBWi

— illuminatibot (@iluminatibot) April 14, 2024

Constanza

People say actors should stay in their lane and not commentate on politics… But Jason Alexander, (George Costanza) Had the single best deep dive into the collective Psychology of the Israeli state….

A real foreign policy genius. pic.twitter.com/qpuAKs52Qr

— CatGirl Kulak 😻😿 (Anarchonomicon) (@FromKulak) April 13, 2024

I thought we established that Michael Cohen had an affair with Stormy Daniels, paid for with Trump’s money. Anyhoo, it should be a spectacle.

• Trump Set For Monday ‘Fake Biden Trial’ With ‘Highly Conflicted’ Judge (ZH)

Former President Trump will take his 2024 campaign to New York on Monday, where he’ll be sitting in a Manhattan courtroom for what he decried as a “Fake Biden Trial” to face 34 counts of falsifying business records in connection with the Stormy Daniels ‘hush money’ embroglio. The trial comes after an unsuccessful bid to adjourn the case due to overwhelming pretrial publicity, which Judge Juan Merchan denied, calling adjournment “not tenable.” Trump has taken to Truth Social in recent days, suggesting on Sunday that Merchan is “perhaps the most highly conflicted Judge in New York State history,” who gave Trump’s legal team insufficient time to analyze “hundreds of thousands of pages of documents that D.A. Alvin Bragg illegally hid, disguised, and held back from us.” As the WSJ notes, “The 34 felony counts in the indictment are all tied to records that prosecutors said Trump falsified as he reimbursed Cohen for the Daniels deal. They include 11 invoices, 12 general ledger entries and 11 checks.”

As Mike Shedlock of Mishtalk notes, expect a media circus. “A Recording Crime. District Attorney Alvin Bragg took each receipt, invoice, and ledger receipt and made a separate felony charge out of each of them. Then Bragg twisted those charges into an intent to commit other crimes. Yet Trump is not charged with other crimes, only falsifying records. And it’s plausible that Trump had no direct knowledge of the mess. This story goes back to Michael Cohen, a former attorney of Donald Trump, who landed in prison for by paying adult-film star Stormy Daniels $130,000 in 2016 to keep quiet about an alleged sexual encounter she had with Trump a decade earlier. The Journal notes that Falsifying business records is a misdemeanor under New York state law, but it can be elevated to a felony if records were falsified to conceal or commit another crime. What other crime? Trump is charged with none.”

Meanwhile as Politico reports, in addition to taking a “wrecking ball to Michael Cohen,” with nearly half of the respondents in a recent Politico/Ipsos poll saying that Cohen is not honest… Manhattan DA Alvin Bragg’s “Star Witness, Trump could try “asking the judge to give the jury the option of convicting him on lesser, misdemeanor offenses instead of the felony counts that have actually been brought by Manhattan District Attorney Alvin Bragg and his team of prosecutors.” Journalist Laura Loomer, a Trump supporter, has posted several receipts over the past several weeks showing Merchan’s various conflicts – including the fact that his daughter professionally brags about “doing ground-breaking, historical work for clients” including “Kamala Harris, Adam Schiff, and others.” Loomer also noted that Andrew Laufer, the lawyer for Michael Cohen (DA Alan Bragg’s “Star witness”), is tight with NY Attorney General Letitia James – who Merchan’s wife worked for in what Loomer describes as a “major conflict of interest.”

“The threat of future prosecution and imprisonment would become a political cudgel to influence the most sensitive and controversial presidential decisions..”

• 19 Retired Generals, Admirals File SCOTUS Brief Against Trump Immunity Bid (ET)

More than a dozen former Defense Department officials, generals, and admirals filed a brief with the Supreme Court arguing against former President Donald Trump’s presidential immunity arguments. It comes as the U.S. Supreme Court is set to hear arguments on the former president’s assertions that he should enjoy immunity from prosecution for activity that he carried out while he was president. The former president invoked that argument after he was accused by federal prosecutors of attempting to illegally overturn the 2020 election results. The amicus brief’s signatories include former CIA Director Michael Hayden, retired Admiral Thad Allen, retired Gen. George Casey, retired Gen. Charles Krulak, and more. They claimed that granting President Trump immunity against criminal claims could lead to activity that put U.S. national security at risk.

“The notion of such immunity, both as a general matter, and also specifically in the context of the potential negation of election results, threatens to jeopardize our nation’s security and international leadership,” their brief stated. “Particularly in times like the present, when anti-democratic, authoritarian regimes are on the rise worldwide, such a threat is intolerable and dangerous.” The arguments submitted by President Trump will “risk jeopardizing America’s standing as a guardian of democracy in the world and further feeding the spread of authoritarianism, thereby threatening the national security of the United States and democracies around the world,” the group added. The former secretary of Defense under President Trump, Mark Esper, was critical of their submission to the Supreme Court, arguing during a CNN interview that he “would prefer to see retired admirals and generals not get involved.”

But President Trump’s lawyers have contended that the president’s office cannot function without immunity from the threat of prosecution because it could “incapacitate every future president with de facto blackmail and extortion while in office and condemn him to years of post-office trauma at the hands of political opponents,” arguing that such a phenomenon is playing out right now after the former president was indicted multiple times last year. The U.S. Circuit Court of Appeals had earlier issued a ruling against President Trump’s arguments that he should be declared immune from prosecution. The appeals process, meanwhile, has put on hold the former president’s trial in Washington. “A denial of criminal immunity would incapacitate every future president with de facto blackmail and extortion while in office, and condemn him to years of post-office trauma at the hands of political opponents. The threat of future prosecution and imprisonment would become a political cudgel to influence the most sensitive and controversial presidential decisions, taking away the strength, authority and decisiveness of the presidency,” according to President Trump’s filing issued last month.

They want every Democrat to be able to cast 1,000 votes.

• Judge Upholds Georgia’s Voter Citizenship Verification Requirements (ET)

A federal judge has dismissed a legal challenge to Georgia’s voter citizenship verification requirements, keeping in place the state’s process of cross-checking citizenship status to determine voter eligibility and handing a win to election integrity advocates. Judge Eleanor Ross of the U.S. District Court for the Northern District of Georgia issued a ruling on April 11 that dismisses a lawsuit brought by a coalition of advocacy groups nearly six years ago that claimed Georgia’s voter citizenship verification requirements unfairly discriminated against naturalized citizens, who are more likely to be people of color. Following a three-day trial, the judge ruled that all four of the plaintiffs’ claims—including that the protocols violated multiple federal laws, the U.S. Constitution, and unfairly burdened the right to vote—are dismissed.

In so doing, the judge sided with a motion for summary judgment made in 2021 by the defendant, Georgia Secretary of State Brad Raffensperger, who argued that the state’s protocols for matching naturalized citizens’ voter registrations with the state’s citizenship records were “entirely reasonable” and placed a “minimum burden” on applicants. Mr. Raffensperger argued that, in almost every case, the requirement was fulfilled by matching driver’s licence or state identification numbers submitted for voter registration with corresponding records at the Georgia Department of Driver Services (DDS) to confirm citizenship status. When a naturalized citizen registers to vote in Georgia, their county registrar verifies proof of citizenship using DDS data. If that voter’s citizenship cannot be verified through that database, the onus is on the voter to submit proof of citizenship within 26 months or their voter registration application will be canceled.

The plaintiffs have alleged that DDS data is often outdated, leading many naturalized citizens’ voter registrations to be flagged and canceled unfairly. Mr. Raffensperger disputed the claim that this issue affected many people, arguing in his motion that “any arguable burden on this small group of people to demonstrate they are now citizens is minimal and does not go beyond the ‘usual burdens of voting’ because it can be resolved as simply as showing the same photo identification that every Georgia voter is required to show in order to vote in person in Georgia.” He also argued that the citizenship process serves a “compelling interest” in ensuring that only eligible voters are allowed to cast a vote, an argument raised by election integrity advocates across the country amid various disputes over voting rules.

The plaintiffs sued Mr. Raffensperger in 2018, arguing that the state’s protocols for matching naturalized citizens’ voter registrations with the state’s citizenship records violated Section 2 of the Voting Rights Act (VRA) and the 14th Amendment’s Equal Protection Clause. They also claimed that these protocols put an unfair burden on the right to vote, in violation of 1st and 14th Amendment protections, while also claiming that the requirements ran counter to the National Voter Registration Act (NVRA) by delaying or denying qualified voters from registering to cast ballots.

The coalition of groups asked the court to rule that the citizenship matching protocols were illegal, and to permanently block their enforcement. The case eventually went to trial on April 8, 2024, leading to a favorable ruling for Mr. Raffensperger and delivering a win to election integrity advocates more generally. “Ensuring that only U.S. citizens vote in our elections is critically important to secure and accurate elections,” Mr. Raffensperger said in a statement praising the ruling. “Georgia’s citizenship verification process is common sense and it works. With this ruling, we are able to continue ensuring that only U.S. citizens are voting in our elections,” he added.

X thread.

The self-serving Low IQ history of how Trump’s assassination of Iranian general Soleimani supposedly unleashed an era of peace and tranquility across the Middle East is so painfully idiotic. In one of the most brutishly stupid acts of Trump’s entire presidency, he and his rabidly interventionist Secretary of State, Mike Pompeo, manufactured a fake pretext to launch the brazen, region-destabilizing attack. Trump fabricated what his administration claimed was a “self-defense” rationale for the assassination — arguably the most severe instance of direct state-on-state warfare between the US and Iran since the Islamic Revolution of 1979. Trump and the hardcore interventionists and regime change fanatics with which he filled his administration actually tried to invoke the 2002 AUMF in Iraq — yes, the Iraq War resolution that Joe Biden infamously voted for — as justification for the Soleimani strike.

They lied and claimed there was an “imminent threat” to the US, parroting the Bush Administration’s language used to sell the Iraq invasion. They even absurdly claimed that part of the rationale for the assassination was that Iran had provided material support to the 9/11 hijackers. No argument was too preposterous. The drone-bombing of one of the most prominent figures in Iranian society effectively destroyed any prospect of future diplomatic engagement between the US and Iran. Millions flooded the streets in protest, including in Iraq, where the drone strike took place. US embassies and other installations were hit with rockets and ransacked.

The Iraqi parliament demanded the immediate expulsion of all US troops from the country, but rather than take this opportunity to finally extricate US forces, Trump refused and kept them there. Reprisal attacks were launched against US troops and continued for months, with 62 soldiers receiving Purple Hearts for the traumatic brain injuries they endured from Iran’s retaliatory missile strikes. Trump loaded up his administration with anti-Iran regime change obsessives like Pompeo, Mike Pence, John Bolton, Nikki Haley, among others, deferred to the fanatically “pro-Israel” prerogatives of his chief financial patron Sheldon Adelson, and was heralded by Bibi Netanyahu for carrying out the most hardcore pro-Israel and “anti-Iran” policy agenda of any President in US history.

This was all part of the so-called “maximum pressure” strategy against Iran favored by Netanyahu and the fanatically pro-Israel “GOP establishment” to whom Trump essentially handed over control of his administration. As with many issues, there’s been more continuity between the Trump and Biden administrations than either like to let on, with the cratering of US-Iran relations continuing to this day. Trump still brags about how much pointless suffering his “crippling sanctions” (a term borrowed from Obama) inflicted on ordinary Iranian citizens. On the one hand, MAGA will brag about how un-warlike Trump allegedly was, but on the other, they’ll brag about how awesome it was that he drone-assassinated Iran’s top military official and hurtled the region into chaos — the consequences of which still reverberate today. This pro-Trump argument is idiotically schizophrenic, but that’s nothing new for Low IQ partisans.

“The entire post-WWII elite American mindset is built on the foundation of worldwide profit expansion via silicon and fire..”

• Will the American Oligarchy Accept Limits or Choose World War Three? (NC)

The US is a market state that is dominated by and run for transnational capital. Its foreign policy and the military are a tool of the American oligarchy. Therefore, any serious policy discussion needs to deal with the fact that national interests as they’re expressed today are not in any real sense national but representative of the interests of a small cohort of the super wealthy. When US officials go on about spreading “freedom,” they’re not lying. It’s just their idea of freedom is a state devoted to high profits – free from the political whims of local populations that could degrade an investment’s expected return. Let’s remember there likely wouldn’t be any problem with Russia had Putin not put an end to the 1990s shock therapy administered by the Western finance capitalists who were making a killing by pillaging Russian resources. Like Bert Hoover, they’re haunted by that opportunity snatched away from them, and they’ve been trying to get it back for a quarter century now.

The question is will American capital ever voluntarily give up? Will it ever say “okay, we’re satisfied with what we’ve got here, you do your thing in your sphere of influence”? It’s not like Moscow and Beijing haven’t tried. Russia for example floated the idea of joining NATO or working out some other security arrangement. For decades after the end of the USSR, Russia tried to be accepted into the West’s club to no avail. China, too, constantly repeats the refrain that the world is big enough for both Beijing and Washington. It invited the US to join it in its Belt and Road Initiative. The US could have helped steer projects that would have benefited both countries. While such cooperation between the two big powers wouldn’t be a panacea for all the world’s problems, it would likely mean a lot better spot than current one. Instead the US wanted the whole pie and instead we got the TPP, sanctions, export bans, a new Cold War, a spy balloon scandal, the disastrous effort to weaken Russia before taking on China, the successful effort to sever Europe from Eurasia to disastrous effect for Europe, and the desire to see a Ukraine sequel in Taiwan and/or the South China Sea.

There is a lot of confusion over why the West keeps escalating in a losing effort. Why, for example, are Western governments going around begging for shells to send Ukraine rather than accepting the L? The desperation seems to stem from the creeping realization that their system is coming undone. The entire post-WWII elite American mindset is built on the foundation of worldwide profit expansion via silicon and fire, and if they throw everything at Russia and lose, well a whole new domino theory could come into play – one where parasitic Western finance capital is driven back. (Granted it might in most cases be replaced by a more local form, but it’s nonetheless frightening for the Western honchos.) Just look at what’s happening to France in Françafrique! And the US in the Middle East!

Machiavelli: “..a prince should make himself feared in such a way that if he does not gain love, he at any rate avoids hatred.”

• America Has a Problem With Love and Fear (Suchkov)

In the early 1990s, when Washington was celebrating victory over the USSR, proclaiming “the end of history” and believing that the whole world would now rise up under the banner of liberal democracy and the market economy, Gates became head of the CIA. The main task at the time was to make the most of the “unipolar moment” – to widen the gap between the US and its competitors, to turn yesterday’s enemies into friends, friends into allies, and them make them all vassals. Another fashionable concept of the time – which still occupies the minds of many internationalists – was “soft power”. This justified America’s global dominance by virtue of the appeal of its culture (music, cinema, education). No one wanted to argue with this, especially when videotapes of action films like Rambo and Terminator, and later the queues at the first Moscow McDonald’s, clearly proved the validity of such an ideology. American pop culture made the world extremely permeable to American ideas and interests. The task of various structures, including the one headed by Gates, was to make as many ordinary people (and politicians, of course) around the world fall in love with America, believe in the myth of the “American Dream” and adopt it as their way of life.

As the “unipolar moment” faded and the international environment became more difficult for the US, it became more and more difficult to get others to feel the love. Especially after the bombing of Yugoslavia. A brief period of global sympathy for the Americans after the attacks of 11 September 2001 was replaced by outrage over the invasion of Iraq. Even some of the closest NATO allies did not approve of the illegal intervention. In the post-Soviet space, attempts at “colour revolutions” – to replace rulers who did not love America fervently enough – were somewhat effective in the short-term, but exacerbated disagreements with Moscow. Vladimir Putin’s manifesto speech at the Munich Conference in 2007 signalled the end of the romance with the US, not only for Russia but for many other countries as well. Most states were still open to American cultural and educational products, but Washington’s policies were increasingly perceived critically. In acute situations, dissatisfaction with America as a power was projected onto cultural images associated with it – images of windows broken at McDonald’s, Stars and Stripes set on fire, etc.

Gradually, American soft power collided with its use of hard power. Washington used NGOs to invest billions in public diplomacy and educational exchange programmes, in the manipulation of “civil society” and the media. However, Washington’s coercive actions undermined efforts to win the sympathy of the world’s peoples. Meanwhile, Gates returned to Washington as head of the Pentagon to rescue the Bush Jr. administration from the fiasco in Afghanistan and Iraq. Led by Vice President Dick Cheney, the team was less concerned with winning the love of the rest of the world than with Theodore Roosevelt’s principle: ‘If you’ve got them by the balls, their hearts and minds will follow.” The term “neoconservatives” is associated more with Republicans. In fact, it is a large and influential bipartisan, ideologically charged, group in the establishment for whom the primacy of “make them afraid of us” over “encourage them to love us” is unquestioned.

Barack Obama’s 2008 election victory swung the ideological pendulum in the opposite direction, favouring love over fear. Administrators from the Clinton presidency returned to the White House, and Obama himself spoke of ‘inclusion’, a new globalisation and hopes for a democratic revival. Gates was the only secretary of state to retain his post under the new Democratic president. Even during the election campaign, Obama had promised to end the wars in Iraq and Afghanistan. Thus, a pragmatic, cross-party Secretary of Defence seemed the best solution. The aforementioned Roosevelt had an apt saying for this case: “Speak softly, but carry a big stick”. Obama was responsible for the former, Gates for the latter. “However, the “big stick” did not help much: by the end of the 2010s, pro-Iranian forces were ruling a fragmented Iraq, and in Afghanistan, attempts to put an end to the Taliban (an organisation banned in the Russian Federation) by increasing the US contingent and allocating astronomical sums of money to the authorities in Kabul did not yield results.

[..] Interestingly, the US has stopped loving itself and is actively reaching for nostalgia in own identity and the recent past – especially in culture and politics. The resulting yearning for a time when America was “great” calls for efforts to regain that greatness by any means necessary. Whether leadership should be based on fear or love is one of the key questions in the theory and practice of leadership. In his sixteenth-century treatise The Prince, the Florentine thinker and politician Niccolo Machiavelli argued: “The answer is that one would like to be both the one and the other; but because it is difficult to combine them, it is far safer to be feared than loved if you cannot be both.” This maxim has been adopted by many rulers in different historical periods. But problems began for those who forgot that Machiavelli went on to warn:“a prince should make himself feared in such a way that if he does not gain love, he at any rate avoids hatred.”

“It is the absence of countervailing power in the Middle East that has made the region a tinderbox..”

• A Tempering of American-Israeli Aggression? (Paul Craig Roberts)

It has taken a long time for Zionist Israel to discredit itself. It did so with Israel’s declared policy of genocide of the Palestinians. As it was our bombs, missiles, and money that Israel used, America was also discredited. The self-inflicted diminution of American prestige and its isolation as the supporter of Israel’s attempted genocide of Palestine has altered the balance of power and influence in the world. With the impoverished Houthis standing up to mighty America and Israel, and with Iran finally standing up to Israel, it is possible that the American-Israeli aggression leading to nuclear war has been tempered. The recent firing of Undersecretary of State Victoria Nuland is another possible indication.

Haaretz, the only objective Israeli newspaper, says Netanyahu should accept that the Iranian response was a limited attack provoked by Israel’s attack that murdered Iranian officials in Damascus and refrain from further military action. US bases throughout the Middle East and Israel’s Dimona nuclear arsenal are easy targets for a heavy Iranian attack. If Israel pushes further, a major war will erupt. Perhaps it will dawn on Putin and Xi to stabilize the Middle East with announcement of a Russian-Chinese-Iranian mutual defense treaty. It is the absence of countervailing power in the Middle East that has made the region a tinderbox.

Scott Ritter @RealScottRitter: “I spent one decade protecting Israel from Iraqi missiles. I spent another decade trying to protect Israel from Iranian missiles. All Israel had to do was try to live in peace and harmony with its neighbors. Israel proved not to be up to the task. Israel deserves everything it has coming to it.”

• Scott Ritter: Iran’s Retaliatory Attack ‘Reestablished Deterrence’ (Sp.)

Iran’s mission to the United Nations stated earlier that Tehran’s retaliatory drone and missile attack against Israel had “concluded.” The “military action” was a response to Israel’s “aggression against our diplomatic premises in Damascus,” it said, adding that the strike “hit designated targets.” By launching its retaliatory drone and missile attack on Israel, Iran “reestablished deterrence,” former UN weapons inspector Scott Ritter told Sputnik. “Israel believed that it could launch a strike against Iran and suffer no consequence. That is no longer the case,” Ritter noted. As Israeli military officials survey the damage done to their bases, “they understand the following: that Iran deliberately chose not to inflict extremely lethal action against Israel,” the analyst remarked. bIran launched a massive drone and missile attack against Israel overnight, assisted by Hezbollah and the Yemeni Houthis.

Over 300 projectiles were fired at Israeli territory from Iran, with Iran’s mission to the United Nations stating that its retaliatory attack on Israel had “concluded,” and that the strike “hit designated targets.” Israel’s military has claimed that 99% of the projectiles were intercepted.nbIran’s strike was designed to send a signal to Israel and the United States, “that it could do what it did in Nevatim, at Ramona, anywhere in Israel, anywhere in the Middle East, and there was nothing the United States or Israel could do in response.” “This is deterrence. This means that in the future, if either Israel or the United States plan on carrying out an action against Iran, they have to weigh in the consequences of their actions knowing that Iran has the capacity to reach out and touch any place, any spot, any target in the region in Israel or out of Israel, and there’s nothing anybody could do to stop that,” the retired US Marine Corps intelligence officer said.

US President Joe Biden issued a statement on Iran’s attack against Israel after he spoke on the phone with Israeli Prime Minister Benjamin Netanyahu. The POTUS condemned the strike “in the strongest possible terms.” He also reaffirmed Washington’s “ironclad commitment” to help support Israel, and added that there were no attacks on US forces or facilities on Saturday, but that the US “will remain vigilant to all threats.” Secretary of State Antony Blinken said the US does “not seek escalation,” but will “continue to support” Israel’s defense. “I will be consulting with allies and partners in the region and around the world in the hours and days ahead,” he added. Weighing in on the flurry of talks between US and Israeli leaders, Scott Ritter said: “This is why President Biden has been on the phone with Benjamin Netanyahu, the prime minister of Israel, telling him, ‘Do not retaliate.’ The United States will not be a partner in any offensive action against Iran. Not because the United States is friendly to Iran, but the United States understands the consequences that will accrue, should such an attack take place. The United States has been deterred against further action against Iran.”

It cost Israel $1 billion to defend against Iran’s $100 million worth of -mostly old- projectiles.

• Netanyahu Called Off Retaliation Strikes After Speaking To Biden – NYT (RT)

Israeli Prime Minister Benjamin Netanyahu canceled a plan to launch immediate retaliatory strikes against Iran after speaking to US President Joe Biden by phone on Saturday night, Israeli officials have told the New York Times. According to two anonymous officials, Netanyahu’s war cabinet presented him with a list of responses to a massive drone and missile attack by Iran on Saturday evening. While some members of the cabinet reportedly pushed for an immediate military response, Netanyahu ultimately chose not to follow their advice at Biden’s request, the sources said. The full details of Biden’s conversation with Netanyahu were not revealed by the White House. According to a report on Sunday by Axios, however, Biden told Netanyahu that Israel had essentially prevailed in this clash with Iran and advised him to “take the win.”

It was also made clear during the call that any retaliatory action by Israel would not be supported by Washington, the American outlet reported. Netanyahu’s war cabinet met on Sunday afternoon to discuss Israel’s response to the Iranian attack, while Iran’s top military commander declared that the “Zionist regime” had been adequately “punished,” and that Tehran would not pursue further military action unless Israel struck again. Iran launched multiple waves of missiles and kamikaze drones at Israel on Saturday, with the Israel Defense Forces (IDF) stating that at least 300 projectiles were fired. While the IDF claimed to have shot down 99% of the incoming drones and missiles, video footage showed numerous impacts on Israeli soil.

Iranian officials insisted that they had “more success than expected” with the barrage, and claimed that two Israeli bases had been destroyed. The IDF acknowledged only minor damage to one military facility. The attack came two weeks after an alleged Israeli airstrike hit an Iranian consulate in the Syrian capital of Damascus. The strike killed seven officers of the Islamic Revolutionary Guard Corps (IRGC) Quds Force, including two high-ranking generals. Tehran telegraphed its response, with Iranian Supreme Leader Ayatollah Ali Khamenei warning for over a week that Israel could expect a “slap in the face.”

“Iran’s attack on Israel did not happen in a vacuum – it was a response to the shameful inaction of the UN Security Council..”

• Russia Slams UNSC for Ignoring Attack on Iranian Consulate (Sp.)

Russia’s Permanent Representative to the United Nations Vasily Nebenzia criticized the UN Security Council for failing to act on the Israeli attack on the Iranian consulate in Syria as he urged an end to bloodshed in the Middle East during an emergency UNSC meeting on Sunday. “It is regrettable that unlike the meeting today, you did not propose to bring it to brief the Council on the 2nd of April,” he said, adding that Russia called an emergency briefing to discuss the Israeli strike against the consular premises in Damascus. Nebenzia criticized Israel for not complying with the UN Security Council resolutions, which he said was “an obvious disrespect shown to the Council, to all of you who are here in the members seats, and a complete disregard to the decisions made by the Security Council.” “This high level confrontation and bloodshed must be stopped. We think it’s urgent for the entire international community to undertake all the efforts necessary to de-escalate the situation,” Nebenzia said.

Iran’s attack on Israel did not happen in a vacuum – it was a response to the shameful inaction of the UN Security Council, the Russian ambassador stressed. “What happened on the night of April 14 did not happen ‘in a vacuum.’ Iran’s steps were a response to the shameful inaction of the United Nations Security Council [and] a response to Israel’s blatant attack on Damascus… by no means the first. Syria is constantly being bombed by Israel,” Nebenzia said. On April 3, the US and UK refused to discuss Russia’s proposed draft UN Security Council statement on the Israeli strike on the Iranian consulate in Damascus. London and Washington then cited the fact that there was no unity in the meeting’s assessment of what happened. On Sunday, an urgent meeting of the UN Security Council is taking place in connection with the retaliatory strike that Iran carried out on the territory of Israel.

Meanwhile, shortly before that, Iran’s mission to the UN said that if the Security Council had condemned the Israeli strike on the Iranian consulate and brought the perpetrators to justice, the need for Iran to punish the Israeli side “could have been eliminated.” Russia calls for restraint on all sides involved in the incident with Iran’s attack on Israel, Russia’s permanent representative to the UN highlighted. Russia calls on Israel to follow the example of Iran, which has said it does not want further escalation, Nebenzia said. “We note Tehran’s signal of unwillingness to further escalate hostilities with Israel. We urge West Jerusalem to follow its example and abandon the practice of provocative forceful actions in the Middle East, fraught with extremely dangerous risks and consequences on the scale of the entire region, already destabilized as a result of the escalation of the Palestinian-Israeli confrontation,” Nebenzia emphasized.

“..suggesting Ukraine would drive up global oil prices with attacks on Russian refineries if US aid were not forthcoming..”

• Zelensky Takes Advantage of Iran-Israel Crisis to Plead for More Money (Miles)

President Volodymyr Zelensky took to the X (formerly Twitter) social media platform Sunday to remind Western lawmakers not to forget about Ukraine as the world responds to Iran’s retaliatory strike against Israel. “Ukraine condemns Iran’s attack on Israel using ‘Shahed’ drones and missiles,” the leader wrote, claiming Moscow and Tehran utilize the same kinds of armaments. “The world cannot wait for discussions to go on,” he added. “Words do not stop drones and do not intercept missiles. Only tangible assistance does. The assistance we are anticipating… It is critical that the United States Congress make the necessary decisions to strengthen America’s allies at this critical time.” Former Ukrainian minister Volodymyr Omelyan was even more forceful, slamming former US President Donald Trump whose “America First” brand of conservatism has questioned US military spending.

“I hope that Iran’s attack on Israel will send a powerful message to Republicans, namely to Mr. Trump – you cannot wait aside any more and think that those are small separate regional conflicts happening somewhere in Europe, Middle East, [or] Asia,” Omelyan said in an interview with a US-based tabloid media outlet. “China, Russia, Iran and North Korea persistently attack the West,” he said, without clarifying when they have done so. China, Iran and North Korea have historically been subject to deadly US-backed economic sanctions. The United States invaded Russia in 1918 in an attempt to thwart the country’s unfolding revolution, and invaded China to help put down the Boxer Rebellion. Zelensky has occasionally compared Ukraine’s plight to that of Israel. In 2022 the Ukrainian leader claimed he saw the country as a model for Ukraine’s future, saying Ukraine should become a “big Israel.”

The president said he was referring to Israel’s model of hardened internal security, but critics may instead draw comparisons between the two countries’ strident nationalism and treatment of minorities. The Kiev regime has launched attacks on its Russian-speaking eastern regions for more than a decade, often killing civilians. A 2014 massacre of trade unionists in Odessa drew particular condemnation. Paramilitary groups attacked a peaceful rally in the coastal city, forcing people to take refuge in the Odessa Trade Union House. The neo-Nazi gangs then set fire to the building, killing some 50 people and bludgeoning to death those who attempted to escape. Anti-Russian Ukrainian nationalists have continued to constitute an important faction of the country’s armed forces, with Kiev officially integrating the neo-Nazi Azov Battalion into its military later that year.

Israel has also received criticism for its increasingly extremist trajectory in recent years. Neo-Nazi activist Richard Spencer publicly praised the country’s so-called “Jewish Nation State” law in 2018, viewing it as a model for his desired white ethnostate. Israeli human rights group B’tselem has called Israel an “apartheid” and ethnic supremacist regime. Ukraine has become more coercive in recent months as US aid has been stalled amidst political infighting. “Give us the damn Patriots,” demanded the country’s foreign minister Dmytro Kuleba last month, referring to the US-developed surface-to-air missile system Ukraine sees as crucial to its fight against Russia. Kuleba appeared to economically blackmail Western countries in recent comments, suggesting Ukraine would drive up global oil prices with attacks on Russian refineries if US aid were not forthcoming.

“Everyone survives as best they can..”

• Ukrainian FM Publicly Blackmails West Over Oil Prices (RT)

Kiev would be more receptive to appeals from the US and other Western allies to quit attacking Russian oil infrastructure if those benefactors would boost their military aid, Ukraine’s top diplomat has revealed. Foreign Minister Dmitry Kuleba offered his suggestion for how the West can earn Ukraine’s cooperation in a local broadcast interview on Sunday. His comments came after US defense chief Lloyd Austin expressed concern earlier this month that Ukrainian drone strikes against Russian refineries and oil storage facilities could trigger a jump in international energy prices. “You need to think in your own interests,” Kuleba told Rada TV. “If your partners are saying: ‘We are giving you seven Patriot batteries, but we have a request for you, please don’t do this and that’ – then there is something to talk about.”

On the other hand, if “no batteries, no aid package” are being offered in connection with the entreaty – then there is nothing to talk about. “Everyone survives as best they can,” he added. Weapons shipments from Washington, the biggest sponsor of Kiev’s war effort against Russia, have slowed in recent months amid struggles by US President Joe Biden to secure congressional approval for more Ukraine aid. Republican lawmakers have balked at Biden’s request for more than $60 billion in additional spending after his administration burned through $113 billion in previously approved funding. Kiev’s donors had previously expressed worries that Ukrainian strikes deep into Russian territory with weapons that NATO members provided could trigger a wider conflict. US Secretary of State Antony Blinken said earlier this month that Washington does not support Ukrainian attacks on Russian soil.

Austin later suggested that Kiev could focus on military targets because hitting petroleum infrastructure could roil international markets. Kuleba said he listened to Austin, but he sees no “cause-and-effect relationship in this matter.” When a refinery in Russia “explodes,” the resulting problems are confined to the Russian energy market, he claimed, and in any case, Ukraine has to prioritize its own interests. Ukrainian drone attacks have targeted several Russian refineries since early March. Russian Defense Minister Sergey Shoigu suggested that Kiev has resorted to terrorism and long-range strikes against Russia’s civilian population in an attempt to “convince its Western sponsors of its ability to resist the Russian Army.” That’s despite the fact that Kiev has not had any actual success on the battlefield, the minister added.

“The country faces a particular shortage of young men and women..”

• Germany Escalates Donbass Conflict, Kiev Says Frontline is Deteriorating (Sp.)

Germany offered to provide Kiev with another US Patriot air defense system Saturday as Ukraine’s military chief admitted the country’s position on its eastern front is rapidly deteriorating. “The situation on the eastern front has significantly worsened in recent days,” said Ukraine armed forces commander-in-chief Oleksandr Syrsky, confirming recent media reports. Syrsky made the assessment in a post on Telegram after a visit to a part of territory of the Donetsk People’s Republic under Ukrainian control, which is now a Russian territory. “The enemy is actively attacking our positions in the Lyman [and] Bakhmut [Artemovsk] directions with assault groups and the support of armored vehicles,” he added. “In the Pokrovsk direction, it is trying to break through our defenses using dozens of tanks.”

Syrsky attributed Ukraine’s struggles to Russia’s greater supply of weapons and military technology. Russia’s defense industry has risen to the occasion during the conflict by churning out significant supplies of ammunition. Observers have praised the quality of Russian armaments, particularly its well-respected tank building tradition. Material support for the Kiev regime has meanwhile stalled as Europe’s defense industry fails to meet demand and US backing is stymied by domestic politics. Syrsky also acknowledged a lack of effective manpower. Ukraine’s population, less than a third of Russia’s, has declined by some 30% amidst a demographic crisis after the country’s independence. The country faces a particular shortage of young men and women; the age of the average Ukrainian soldier is estimated to be 43 years old.

“The second serious problem is to improve the quality of training of military personnel, primarily infantry units, so that they can make maximum use of all the capabilities of military equipment and western weapons,” said the military chief. Reports have emerged of Ukrainian troops being provided with only a few weeks of instruction after often being forcibly conscripted. Dry weather has granted Russian tanks easy passage over Ukraine’s terrain according to Syrsky. From the air, Moscow has made extensive use of retrofitted glide bombs and drone strikes. Ukrainian President Volodymyr Zelensky has pleaded with Western partners to help augment the country’s air defense capacity.

Germany obliged Saturday, promising to provide Kiev with a third US Patriot surface-to-air missile system after previously having rejected the request. The pledge follows a familiar pattern of Western countries eventually conceding to Ukrainian requests for armaments after publicly agonizing over the threat of escalation. “We are supporting Ukraine as much as our own operational readiness will allow,” said German Minister of Defense Boris Pistorius Saturday. Observers have questioned the consequences of Western countries depleting their weapons stocks after more than two years of arming Kiev.

“Western imperialism and fascism have come full circle in a staggeringly short span of history..”

• Germany Joins Israel In Dock For Genocide (SCF)

Eight decades ago, Nazi Germany deployed Ukrainian fascists to exterminate Jews and Slavs with a death toll of up to 30 million Soviet citizens. The contemporary Ukrainian regime glorifies these Nazi collaborators. The United States deployed the same Ukrainian fascists after the Second World War to wage covert war against the Soviet Union during the Cold War. Thus, Germany and the United States along with other Western powers are continuing deep-seated historical crimes by way of their proxy war against Russia. The same imperialist rogue states are enabling Israeli aggression against Iran, Syria and Lebanon. Israel’s deadly bombing of the Iranian embassy in Damascus earlier this month was a particularly brazen violation of international law. The barbarity of the Israeli fascist regime is fully enabled and incentivized by its Western patrons.

The bitter irony is Washington and Berlin remonstrating with Iran to exercise “maximum restraint” while Israel openly attacks its sovereignty and assassinates its citizens. Meanwhile, the United States, Australia and Britain are cajoling Japan to join their military alliance to provoke China. Japan’s Prime Minister Fumio Kishida was feted in Washington this week where he signed bellicose new military measures aimed at China and Russia. Kishida linked Ukraine with Asia, claiming that if Russia were to win the war in Ukraine, then China would take over East Asia. The Japanese minion gets its half right. The regions are indeed linked, not by alleged Russian and Chinese misconduct, but by the U.S.-led imperialism that Japan is cravenly serving.

Western imperialism and fascism have come full circle in a staggeringly short span of history. Nearly 80 years after Japan was defeated in the Pacific War in which it was responsible for up to 20 million deaths in China, Tokyo is at the forefront of new plans to wage a potential nuclear war on China. The perversion of Japan joining with the United States in this venture after the latter dropped two atomic bombs on its people in 1945 is yet another sickening twist in history. The monstrous crimes of Nazi Germany and fascist Japan are today rehabilitated because the same forces serve the imperialist geopolitical interests of today. The twists and contradictions of history are, however, crystallized in one historical force. All the crimes, barbarity, bloodshed and danger of catastrophic world war are the cause of imperialist powers – chief among them the United States and its insatiable quest for hegemonic domination.

Historic failure and systemic collapse of Western capitalism is the motive engine driving the world to war again, as it was in previous periods of the modern age. Colonialist genocide, World War One, World War Two, and now the abyss of World War Three. Germany in the dock for genocide with Israel is not as incongruous as it might seem. Because imperialism and fascism are on the rampage again across the world. Both Germany and Israel are gang members in the crime syndicate, each with their specific justifying myths and alibis. Russia and China are arguably the two nations that suffered the most in history from fascism. It is entirely consistent – if not lamentable – that Russia and China today are once again confronted by the same forces. Germany is once again on the wrong side of history. And so too are the United States and all its Western vassals. Eternal shame on them.

“The evacuation plans, codenamed Operation Meteoric..”

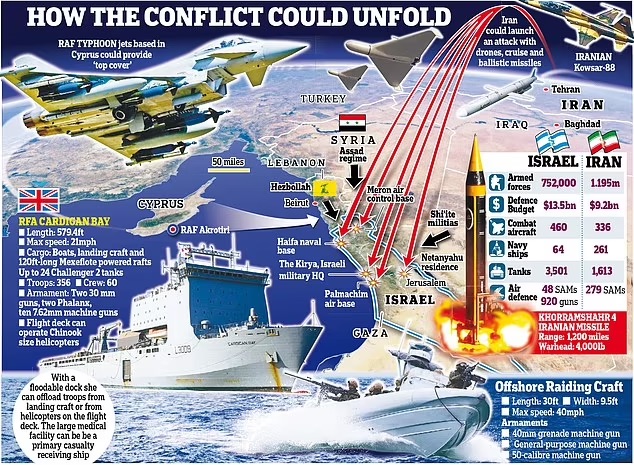

• Royal Marines To Lead ‘Dunkirk-style’ Evacuation Of Britons In Middle East (DM)

Royal Marines are poised to lead a ‘Dunkirk-style’ evacuation of thousands of UK nationals from the Middle East after Iran launched a huge drone and missile attack against Israel last night. Commandos have already conducted reconnaissance along the Lebanese coastline ahead of a potential maritime rescue mission. The daring mission – reminiscent of the huge effort to evacuate 338,000 British troops stranded in France by the Germans during the opening salvo of the Second World War in 1940 – was exclusively revealed by the Mail on Friday. It came a day before Tehran launched a huge aerial bombardment on Saturday evening, which was in retaliation of a deadly consul blast an an Iranian embassy in Syria that killed 13 people Speaking exclusively to the Mail earlier this week, Defence Secretary Grant Shapps confirmed he ‘stands ready’ to assist any Britons trapped in the region. The Foreign Office has already advised all UK citizens to leave Lebanon.

US National Security Council spokesman John Kirby said there remained a ‘serious threat’ of attack while it was reported that Iran had sent a message to Washington warning them against the involvement of US troops in the region. The evacuation plans, codenamed Operation Meteoric, will be spearheaded by the UK’s ‘Green Berets’ and supported by the Royal Navy and Royal Air Force. The Mail has been told a party of Marines from 30 Commando arrived in the region in recent days. Operation Meteoric has been likened to Operation Dynamo, the evacuation of hundreds of thousands of allied soldiers from Dunkirk in 1940 when they were surrounded by German forces. Israel and its allies remain braced for a huge Iranian response to the attack on its Syrian consulate earlier this month, which left 13 dead, including a senior Iranian commander.

While Israel has not claimed responsibility for the blast it is widely considered to have been behind it. Iran’s response may also involve the heavily armed military group Hezbollah, which is based in Lebanon. Tonight, intelligence reports suggested the retaliation could include more than 100 drones, dozens of cruise missiles and ballistic missiles. Such a scenario would likely lead to civilian ‘air bridges’ shutting down – hence the need for a maritime solution. The Mail has been told how the preparatory work behind Operation Meteoric was conducted by the Royal Marines’ Surveillance and Reconnaissance Squadron (SRS). They studied stretches of the Lebanese coastline and selected potential locations for such a rescue mission.

Stranded civilians would be ferried from beaches in raiding craft to Royal Fleet Auxiliary (RFA) ships in the eastern Mediterranean. While it is understood Iran is eager to avoid direct engagement with UK forces, RAF Typhoon jets based in Cyprus could provide ‘top cover’. Earlier this week, Mr Shapps told the Mail: ‘UK nationals in the region will be concerned by what Iran is threatening to do. So we stand ready to assist them. ‘There are plans, but they cannot be discussed for security reasons.’

McCullough childhood vaccines

Dr. McCullough Delivers Message All Parents Need to Hear

“This childhood vaccine schedule is not what we thought… I’m telling you, in total, it doesn’t look good.”

The 1986 Vaccine Injury Act even admits vaccines come with “unavoidable harms.”

Five separate studies now show… pic.twitter.com/CLt2nitJKL

— Vigilant News (@VigilantNews) April 12, 2024

Elephant mom

Elephant mom kicks a crocodile out of her poolpic.twitter.com/aEZ6meolZU

— Massimo (@Rainmaker1973) April 14, 2024

Baby elephant

In the Seoul Grand Park, two elephants rescued baby elephant drowned in the pool pic.twitter.com/SUhCW6SOGO

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 14, 2024

Elephant transport

Transporting elephants. This just looks insane. pic.twitter.com/1mbHbms0f8

— H0W_THlNGS_W0RK (@HowThingsWork_) April 13, 2024

Movement Act

Graduating art student Shun Onozawa has created this mesmerizing device named “Movement Act” where a golden formula allow all 16 balls to continuously move through it without ever colliding.pic.twitter.com/P24UJVw4Yx

— Massimo (@Rainmaker1973) April 14, 2024

Kittens

Why mother cats bring their kittens to you pic.twitter.com/DUc8k0Rcsj

— Cats That Heal Your Depression (@Catshealdeprsn) April 14, 2024

Shark

Diver intimidates a shark to avoid being attacked

[📹 mermaid.kayleigh]

[📍 Oahu, Hawaii]pic.twitter.com/AqjQqdULi6— Massimo (@Rainmaker1973) April 14, 2024

10,000 ducks

Around 10,000 ducks are sent to eat insects in a rice paddy after harvest in Thailand… pic.twitter.com/gjUIw2fXgh

— Nature is Amazing ☘️ (@AMAZlNGNATURE) April 13, 2024

Horse friend

Best friends relaxing

pic.twitter.com/expLMprxYf— Science girl (@gunsnrosesgirl3) April 14, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.