Pablo Picasso Femme nue couchée (Marie-Thérèse Walter) 1932

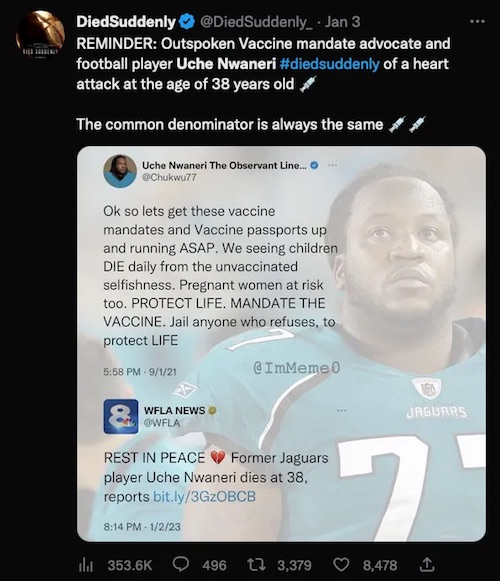

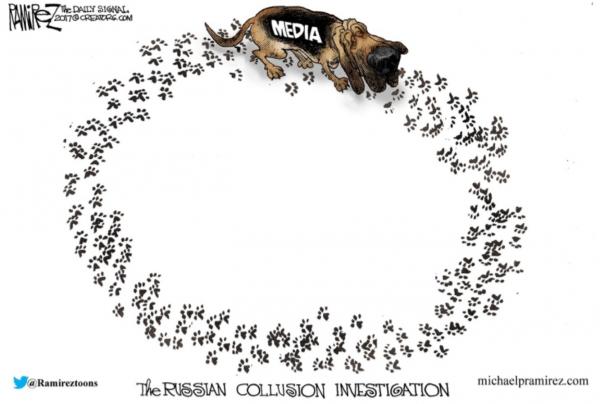

RFK TNI

Robert F. Kennedy Jr on What He Learned Through His Litigation Against the 'Trusted News Initiative'

"The legacy media which traditionally was functioning as guardians of the First Amendment…They've now become the opposite. They've become propagandists for the powerful and… pic.twitter.com/jclCmyIHFt

— Chief Nerd (@TheChiefNerd) July 12, 2023

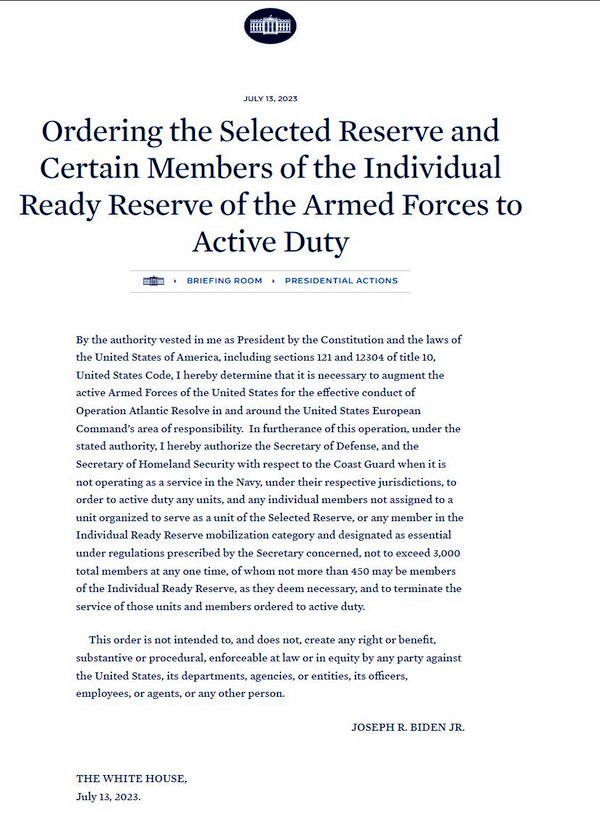

Biden quietly sends 3,000 active US troops to Europe. Ukraine?!

Macgregor

BREAKING REPORT: Col. Douglas Macgregor drops bomb, reveals Washington worked with the CIA to execute a COUP in 2014 to overthrow and install a new Ukrainian government beholden to the United States..

PAYING ATTENTION NOW.. pic.twitter.com/7M8ZmiwUEI

— Chuck Callesto (@ChuckCallesto) July 13, 2023

Caviezel

MILLIONS OF CHILDREN ARE TRAFFICKED EVERY YEAR YET HOLLYWOOD DESPERATELY TRIED TO BLOCK THIS FROM THEATERS! Jim Caviezel's Message From The End of Sound of Freedom is EXTREMELY POWERFUL. No Other Way You Can Spend the Next 2 Minutes is More Important Than This! pic.twitter.com/gOlVdpxGHS

— Matt Wallace (@MattWallace888) July 13, 2023

Agenda 21

— illuminatibot (@iluminatibot) July 14, 2023

EP WHO

The fight back against globalism has begun. #WHO #WEF2030Agenda pic.twitter.com/3JzaqPoR8I

— Jim Ferguson (@JimFergusonUK) July 13, 2023

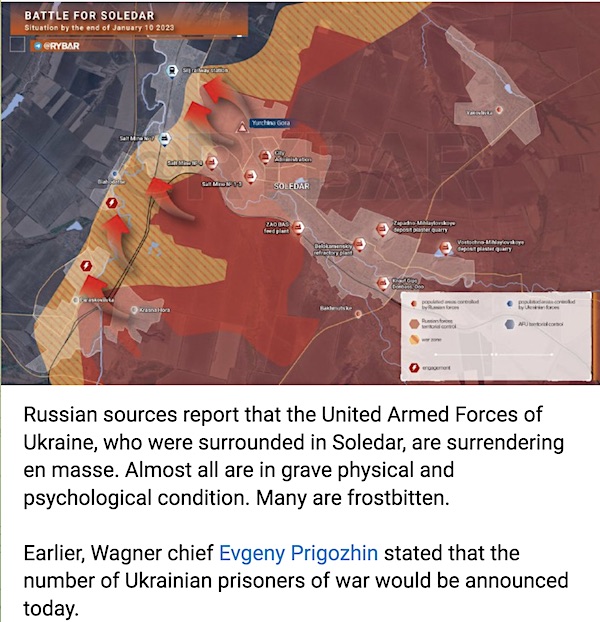

“Whatever is achieved by the end of this year will be the baseline for negotiation..”

• NATO Ultimatum To Ukraine – Win By Winter Or Die (Helmer)

For all its public talk, NATO has agreed on a secret six-month plan for Ukraine. It’s a case of do or die by December. Either the Ukrainian forces, firing everything the NATO allies can give them — from US cluster munitions to Franco-English Storm Shadow missiles and German Leopard tanks — will gain territory and advantage over the Russians; or else the Kiev regime will be destroyed and must fall back on Lvov while NATO beats its own retreat westward from the Polish and Romanian borders — its military capabilities defeated but its Article Five intact. This is hardly a secret. “Whatever is achieved by the end of this year will be the baseline for negotiation”, the Czech President Petr Pavel, former Czech and NATO army general, announced on the first day of the summit meetings in Vilnius. There is no more than a six-month window of opportunity, Pavel added, which will “more or less close by the end of this year”. After that, “we will see another decline of willingness to massively support Ukraine with more weapons.”

The difference between the Czech’s “more or less” was explained to Ukrainian President Vladimir Zelensky by Henry Kissinger on the telephone. But the telephone was rigged, and Kissinger was talking instead to the Stavka in Moscow, in the guise of the pranksters Vovan and Lexus. After justifying himself at length for initially opposing NATO membership of the Ukraine, and then mispronouncing the word “anomalous”, Kissinger acknowledged there is a problem for the Biden Administration to combat European government opposition to NATO membership for the Ukraine. The Ukrainians must fight against that, too, he implied. So long as the US is backing Zelensky, it is necessary for the Ukrainian offensive to demonstrate small territorial advantages; abandon more ambitious ones (like Crimea); and only then agree to ceasefire talks. Although Kissinger told Zelensky he had been speaking with US “military people”, he gave no hint that they had warned him the Ukrainians are facing defeat on the battlefield, and the loss of both territory and European support.

The Russian General Staff calculation is different. At the current rate of battlefield casualties – announced by the Defense Ministry counting conservatively — by December 31 the Ukrainian army will lose between 75,000 and 100,000 dead, and up to 300,000 wounded and out of combat. In parallel, the destruction of NATO weapons will accelerate faster than the NATO states can resupply and deliver them, or replacement parts to keep the surviving stock going at the front. By the time Russia’s General Winter takes control of the battlefield, there will be too few Ukrainian fighting men left, and insufficient weapons and ammunition, to resist the start of the Russian offensive. A demilitarized zone of mines and cluster bomblets will have taken shape over several hundred kilometres west of the surrendering Odessa, Nikolaev, and Kharkov; they will abandon Kiev when Kiev abandons them.

The Russian target then will be to drive what remains of the Ukrainian regime, its flags, tattoos, money, and stay-behind terrorism plans, into an enclave around Lvov. The NATO window, as General Pavel called it, will have been opened, but then will be closed to keep NATO itself from catching cold. One of the unreported outcomes of the Wagner mutiny, and of the June 29 meeting in Moscow between President Vladimir Putin and Yevgeny Prigozhin, is Putin’s commitment to fight for nothing short of the Ukraine’s rout to Lvov, and the NATO retreat westward in the footsteps of the Grande Armée and the Wehrmacht. This too is incomprehensible at NATO headquarters.

How are they going to walk this back in a few months’ time? Blame Zelensky?

• Putin ‘Already Lost’ War In Ukraine, Biden Says (Hill)

President Biden said Thursday there is “no possibility” of Russian President Vladimir Putin winning the war in Ukraine while adding he’s “already lost” the conflict as Biden capped a trip to Lithuania and Finland as a show of strength against Russian aggression. Biden, in a joint press conference with Finnish President Sauli Niinistö, was asked whether his assurance that Ukraine will be able to join the NATO alliance once its war with Russia ends might encourage Putin to drag out the conflict. Biden noted no country can join NATO while in the middle of a war, because it would drag the entire alliance into conflict — a stance Biden and his administration have been stressing this week as Ukrainian President Volodymyr Zelensky criticized the alliance’s resistance to fast-tracking its membership.

“The issue of whether or not this is going to keep Putin from continuing to fight, the answer is Putin’s already lost the war,” Biden continued. “Putin has a real problem. How does he move from here? What does he do?” “And so, the idea that there’s going to be what vehicle is used, he could end the war tomorrow. He could just say, ‘I’m out,’” Biden added. “But what agreement is ultimately reached depends on Putin and what he decides to do. But there is no possibility of him winning the war in Ukraine. He’s already lost that war.” Russia invaded Ukraine in February 2022, and the fighting has dragged on in the 17 months since with no end in sight. The U.S. and its allies have provided billions of dollars in support for Ukraine to defend itself.

Biden has previously argued Putin will not be able to win the war in Ukraine because the Ukrainians have put up a staunch defense in response to the Russian invasion, and his aggression has galvanized the NATO alliance. The president this week attended a NATO Summit in Lithuania, where continued support for Ukraine was at the top of the agenda. The U.S. and its Group of Seven allies announced plans Wednesday for security negotations with Ukraine to ensure it had the military support it needed in the short-term and in the future to defer further Russian aggression.

“..apparently, we are not even allowed now to have a relationship [with China], or so they wish.”

• NATO Suffering Delusions Of Grandeur – Lavrov

The US and its allies are targeting Russia and China because of their strong relationship, Russian Foreign Minister Sergey Lavrov has claimed, citing the final communique from this week’s NATO summit in Lithuania. The NATO document stated that “the deepening strategic partnership between [China] and Russia and their mutually reinforcing attempts to undercut the rules-based international order run counter to our values and interests.” Commenting on Thursday during a trip to Indonesia, Lavrov said that “apparently, we are not even allowed now to have a relationship [with China], or so they wish.” The diplomat noted that the US had previously limited itself to referring to Russia and China as its “rivals.”

The NATO statement further justifies Russia’s efforts to oppose “modern forms of colonialism” and to advocate international relations based on respect, Lavrov insisted. “People in NATO are obviously not prepared for [the same approach]. Delusion of grandeur is expressed in all actions of the NATO leadership, as well as member states, frankly speaking. Everybody sees that,” the Russian minister claimed. Lavrov accused the West of attempting to preserve its hegemony and dress it up as a “rules-based order,” but predicted that multipolarity would ultimately prevail. He also alleged that NATO’s appetite for spreading its influence globally was causing destabilization outside of the North Atlantic region.

“They already have plans to build up NATO military infrastructure in the [Asia-Pacific] region, including in the nations that were invited to the summit in Vilnius… I mean Australia, New Zealand, Japan, [South] Korea,” said the minister. Canberra violated its own commitment to keep the Pacific free from nuclear weapons when it agreed to host “elements of infrastructure” related to nuclear arms under the AUKUS arrangement, Lavrov argued. Tokyo and Seoul “have been signaling that they would not oppose stationing American nuclear weapons or obtaining some of their own,” he added. The Russian foreign minister was speaking in Indonesia after a summit with ASEAN, a regional integration bloc. He claimed the US was pushing for the Southeast Asian organization to be replaced by structures under Washington’s control, so that it could undermine China.

“The very fact of the appearance of such systems within the Ukrainian Armed Forces will be considered by us as a threat from the West in the nuclear domain..”

• Russia Will Treat F-16s In Ukraine As Nuclear Threat – Lavrov (RT)

Moscow can’t ignore the nuclear capability of US-designed F-16 fighter jets that may be supplied to Ukraine by its Western backers, Russian Foreign Minister Sergey Lavrov has said. By continuing to provide more sophisticated arms to Kiev, “the US and its NATO satellites create the risk of a direct armed confrontation with Russia, and this may lead to catastrophic consequences,” Lavrov warned in his interview with Lenta.ru on Wednesday. The plans to supply F-16s to Kiev is yet another example of an escalatory move by the West and in itself is “an extremely dangerous development,” he stated. “We have informed the nuclear powers – the US, UK and France – that Russia can’t ignore the ability of these aircraft to carry nuclear weapons,” the foreign minister continued.

“No assurances [by the West] will help here,” he warned. In the midst of fighting, the Russian military isn’t going to investigate whether any specific jet is equipped to deliver nuclear weapons or not, he added. “The very fact of the appearance of such systems within the Ukrainian Armed Forces will be considered by us as a threat from the West in the nuclear domain,” Lavrov said. In an interview on the sidelines of the NATO summit in Vilnius on Wednesday, White House National Security Advisor Jake Sullivan said “there will be the transfer of F-16s [to Ukraine], likely from European countries that have excess F-16 supplies.” A day earlier, Denmark announced that a “coalition” – which includes the Netherlands, Belgium, Canada, Luxembourg, Norway, Poland, Portugal, Romania, the UK and Sweden – would begin training Ukrainian airmen to fly the US-designed aircraft in August.

Ukrainian Foreign Minister Dmitry Kuleba suggested earlier this week that the first F-16s piloted by Ukrainians could take to the skies“by the end of the first quarter of next year.” Kiev has been pressing its foreign backers for fourth-generation F-16 warplanes for months, arguing that they are crucial in providing air cover for Ukraine’s troops and defending Ukrainian airspace amid a massive Russian missile campaign targeting military facilities and energy infrastructure. The US and its allies initially ruled out deliveries of the jets, saying the F-16 wasn’t the type of hardware that Ukraine needed, but changed their stance on the issue over time. In June, Russian President Vladimir Putin said there was no doubt that the F-16s “will burn”once they’re delivered to Ukraine, just like what has happened to tanks and other Western-supplied weapons.

“I am sure that this will not increase the security of Ukraine itself..”

• Putin: Ukraine in NATO Will Create Security Threat for Russia (Sp.)

In early June, Zelensky said that Kiev hoped to receive a clear invitation to join the bloc at the Vilnius summit. He also said Kiev was disappointed that it had not yet received a clear positive response about joining both the European Union and NATO. Ukraine’s possible membership in NATO will create a security threat for Russia and will not increase security of Ukraine itself, Russian President Vladimir Putin said on Thursday. “As for Ukraine’s membership in NATO, we have repeatedly spoken about this, this creates threats to Russia’s security. Obviously. And as a matter of fact, the reason for the special military operation, one of the reasons, is the threat of Ukraine’s entry into NATO. I am sure that this will not increase the security of Ukraine itself,” Putin said.

Speaking about Western missiles and tanks supplied to Ukraine, Vladimir Putin noted that they ause damage but do not pose a critical threat in the combat zone. “As for the supply of weapons, various weapons, we see how many hopes were placed on the supply of missiles with a sufficiently long range. Well, yes, they cause damage, but nothing critical happens in the combat zone with the use of missiles. The same goes for foreign-made tanks, infantry fighting vehicles,” Putin said on air of the Rossiya 24 broadcaster. The president added that 311 pieces of military equipment used by Ukraine has been destroyed since June 4, and at least one third of those were Western-made. “I can tell you that Ukrainian servicemen often refuse to even get into these tanks, because they are a priority target for our guys,” Putin said, adding that foreign tanks “burn better” than the Soviet-made ones.

“Zelensky confronted his erstwhile allies with the harsh reality that not only would the conflict with Russia not be ending any time soon, but also the growing realization that, when it did end, it would be as a decisive Russian military victory.”

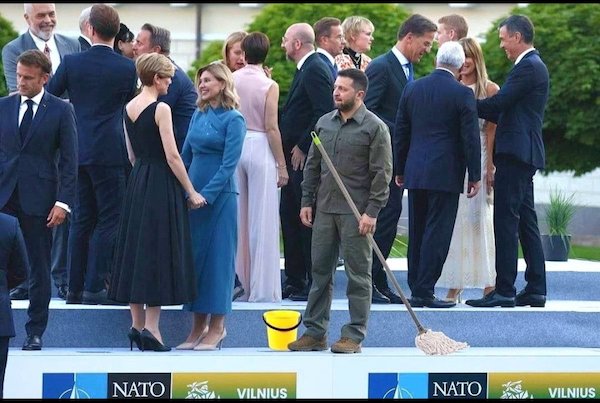

• NATO Summit Serves Up Cringe Nothing-Burger (Scott Ritter)

The Vilnius Summit was intended to showcase the alliance’s unity and resolve in the face of the challenges presented by Russia and the ongoing conflict in Ukraine. There had been a great deal of discussion prior to the summit about the prospects of Ukrainian membership in NATO. It was understood by all parties that, while the conflict between Ukraine and Russia remained in an active phase, Ukrainian membership was impossible, if for no other reason that, under Article 5 of the NATO charter, NATO would immediately find itself in a war with Russia which had a good chance of going nuclear. The working premise going into the Vilnius Summit was that NATO would empower Ukraine to carry out a massive counteroffensive designed to break through the Russian defenses and drive to the Sea of Azov, thereby severing the land bridge between Crimea and Russia, forcing Russia to negotiate an end to the conflict.

At that juncture, having “frozen” the conflict on terms that would be unfavorable to Russia, NATO would extend an invitation to Ukraine for membership, thereby shrouding Ukraine’s gains with Article 5 protections while effectively checking any future Russian offensive operations. In the weeks leading up to the summit, Ukraine was desperately trying to do its part, throwing its newly constituted NATO-trained and equipped assault brigades at prepared Russian defenses in actions which made the infamous “Charge of the Light Brigade” seem like the epitome of military planning and execution by comparison. With much of its NATO-provided weaponry, including the much-touted Leopard tanks and Bradley infantry fighting vehicles, destroyed or damaged without ever reaching the main Russian defensive positions, and some 20,000 Ukrainian casualties, the Ukrainian counteroffensive fizzled out.

Instead of presenting his NATO partners with a decisive Ukrainian victory, Zelensky confronted his erstwhile allies with the harsh reality that not only would the conflict with Russia not be ending any time soon, but also the growing realization that, when it did end, it would be as a decisive Russian military victory. Confronted with this reality, NATO sought to soften expectations about Ukrainian membership. Rather than provide Ukraine with a concrete road map to membership, NATO declared that it would extend an invitation to Ukraine when “conditions are met”, one of which is that the conflict with Russia must be over. NATO offered up as a consolation prize the establishment of a NATO-Ukraine Council “to advance political dialogue, engagement, cooperation, and Ukraine’s Euro-Atlantic aspirations for membership in NATO,” and promised to “continue our support for as long as it takes.”

Scott Ritter

According to Scott Ritter, Russia is on the verge of a strategic military victory by the end of this summer and NATO and the US are aware of their inability to supply Ukraine with enough munitions and equipment to keep them competitive on the battlefield. pic.twitter.com/uAs7vZfu1g

— Highlights (@highlightsnews1) July 13, 2023

“..catastrophic consequences for European security, Ukraine, and the alliance itself.”

• NATO Can’t Exist Without An Enemy – Moscow (RT)

NATO needs enemies so it could justify its existence, Russian Deputy Foreign Minister Aleksandr Grushko said on Thursday, reflecting on the Western bloc’s recent meeting in neighboring Lithuania. “Expansion is one of the instruments used by NATO countries to maintain confrontation,” Grushko told Russia’s Channel One. “Therefore, unfortunately, history has forced us to conclude that NATO cannot exist without an adversary. Otherwise, it would lose all meaning.” Grushko stressed that the admission of Ukraine into the US-led bloc would have “catastrophic consequences for European security, Ukraine, and the alliance itself.” At the same time, Western countries use the prospect of NATO membership as a way to control Ukraine’s domestic politics, the diplomat argued.

Although NATO has refused to grant an immediate membership or a concrete accession timetable to Kiev, the bloc’s members affirmed at the summit in Vilnius on Tuesday that the country would be invited to join in the future. NATO Secretary General Jens Stoltenberg said that Ukraine was “closer to NATO than ever before.” Russia considers NATO’s expansion eastward a threat to its own national security, and has warned that the delivery of heavy weapons and other military aid to Ukraine makes the alliance a de facto participant in the conflict. Western countries insist that NATO is a strictly defensive alliance and claims that it poses no threat to Russia.

“..there is no such legal entity.””The [Wagner] Group exists, but it is judicially non-existent..”

• Wagner PMC Formally Doesn’t Exist – Putin (TASS)

Legalizing private military companies is a complicated issue that should be handled by the government and the parliament, because formally companies such as Wagner PMC are non-existent in Russia at this point, Russian President Vladimir Putin was quoted as saying. Kommersant’s special correspondent Andrey Kolesnikov quoted the Russian president as saying in response to a question about the organization’s future that, from the point of view of the Russian legislation, “Wagner PMC does not exist.” The president explained that Russia has no law on private military companies and, therefore, “there is no such legal entity.””The [Wagner] Group exists, but it is judicially non-existent,” the report quotes Putin as saying.

“The formal legalization is a separate issue that should be addressed by the State Duma [the lower chamber of the Russian parliament] and the government. It’s a complicated issue.” The president believes that the Wagner Group controversy “is very simple and clear for [members of] the Russian society.” “Wagner’s ordinary members were fighting with dignity… so it is very regrettable that they became embroiled into these events,” Putin added. On Thursday, the Russian president took part in the plenary session of the Future Technologies Forum. After the event was over, he had a conversation with Russian journalists. Excerpts of the talk, where the issue of Ukraine, NATO and the grain deal were raised, were published by the Kremlin website and aired by the Rosssiya-24 television channel.

Erdogan is in big financial trouble.

• Biden Offered Erdogan IMF Support To Ratify Sweden NATO Bid – Hersh (RT)

Pulitzer Prize-winning journalist Seymour Hersh claimed on Thursday that US President Joe Biden offered his Turkish counterpart Recep Tayyip Erdogan more than $11 billion in IMF assistance to ratify Sweden’s bid to join the NATO bloc. In an article posted to his Substack account, Hersh wrote that he had been informed by an anonymous source that “Biden promised that a much-needed $11-13 billion line of credit” would be established for Türkiye by the International Monetary Fund (IMF). This was to be in return, Hersh suggested, for Erdogan removing Ankara’s objection to Stockholm joining the US-led military bloc ahead of the NATO summit that took place this week in Lithuania.

Erdogan, who was re-elected as Turkish leader in late May, is currently facing the mammoth task of replacing or repairing hundreds of thousands of buildings damaged or destroyed in February’s earthquakes in which at least 50,000 lost their lives. Türkiye had previously opposed Sweden’s accession to the bloc, largely due to Ankara’s stance that Stockholm has harbored militants from the Kurdistan Workers’ Party (PKK) which was involved in an armed conflict with the Turkish state in the 1980s. The PKK has been designated a terrorist organization by Türkiye, Sweden, Europe and the United States. “What could be better for Erdogan,” Hersh wrote of the American and Turkish presidents’ alleged arrangement, quoting an official familiar with it, than him “finally having seen the light and realizing he is better off with NATO and Western Europe?”

The report also referenced a June financial analysis of Ankara’s coffers by the independent think tank Council on Foreign Relations, which cast a dire economic outlook for Erdogan to navigate in the early stages of his latest term as leader. It said that Türkiye stands on the precipice of an “imminent financial crisis” and if facing a choice “between selling its gold, an avoidable default, or swallowing the bitter pill of a complete policy reversal and possibly an IMF program.” Hersh, 86, generated headlines earlier this year when he claimed he had been informed –also by an anonymous source– that the United States was responsible for last year’s explosions that neutered the Nord Stream natural gas pipelines that supply energy from Russia to Europe. Washington dismissed the claims as “complete fiction.”

To balance out the support for Turkey…

• US to Supply ‘Significant Military Equipment’ Soon – Greek PM (Sp.)

The United States will soon provide Greece with “significant military equipment” for free, announced Greek Prime Minister Kyriakos Mitsotakis. “I mean not only the approval of [the delivery of] F-35 [fighter jets], which is very important, but also the possibility of getting surplus [military] equipment, significant surplus equipment that will be given to us for free. That is what the US is doing and has every reason to do it to a greater extent for a good ally like Greece,” Mitsotakis said in an interview with Greek broadcaster while expressing hope that F-35s would be delivered in 2028. The prime minister noted that Athens was engaged in talks with Washington, having signed “a very strong defense agreement for five years,” adding that he believed Greece hopes for support “regardless of what happens in the negotiations with Turkiye.”

Mitsotakis also said that the construction of French-made Belharra-class frigates for Greece was ahead of schedule, adding that the first frigate would be delivered in September. He noted that Athens are aimed at having “a very strong deterrence capacity,” adding that he believed Greece “has been able to achieve that at a rapid pace.” In 2019 and 2021, Washington and Athens amended the Mutual Defense Cooperation Agreement, which allowed the US to establish new military bases on the territory of Greece and expanded the term of the agreement from one to five years. Until 2019, the US had only one military base in Greece but now has nine. The US was granted access to the port of Alexandroupolis in the north of the country, which is used for the delivery of military equipment to Eastern Europe and Ukraine. Mitsotakis then said that the amended agreement made Greece Washington’s main partner in the region.

Greece is implementing 19 arms procurement programs worth 11.5 billion euros ($12.9 billion). Among them are the purchase of 24 French-made Rafale fighter aircraft, Belharra-class frigates and the modernization of 83 F-16 Block 52+ and 52+ Advanced fighters to the Viper variant — the most advanced variant of F-16. The Greek air force already received two F-16 Viper fighters in September 2022. Moreover, Athens is planning to purchase over 20 F-35 fifth-generation fighters.

Ukraine has never been more corrupt. The enormous influx of money and weapons systems guarantees it.

• Rampant Corruption Is One Reason Behind Ukraine’s Failed NATO Bid (RMX)

Ukraine must implement reforms to fight corruption and strengthen its institutions if it wants to be eligible to join NATO, said Ursula von der Leyen, president of the European Commission, during the second day of the NATO summit in Vilnius. Von der Leyen encouraged Ukraine to implement further reforms and pledged the support of the European Union. According to Hungarian newspaper Magyar Nemzet, von der Leyen’s statement “said in plain language that there was still so much corruption and opacity in Ukraine’s institutions that it could not yet get the green light to join NATO or the European Union.” However, the paper also noted that von der Leyen noted the country’s efforts were appreciated and it had made a lot of progress.

The European Commission already identified systemic corruption in Ukraine in 2021. Although the EU had launched a number of initiatives to reduce the potential for corruption and proposed a wide range of measures, the EU commission’s report at the time found that no progress had been made on this issue in 2021. At that time, there was a significant decline in the judiciary, and anti-corruption institutions were also under threat, according to the report. The authors also noted that oligarchs and vested interests are the biggest problem, as they are an obstacle to the rule of law and economic development in Ukraine.

Brussels is keen to bring Ukraine into the European Union. However, even EU officials do not dare mention in their reports anything concrete or substantial to suggest that Ukraine is ready for integration, and Von der Leyen’s remarks indicate that the situation has still not improved. As Remix News reported last week, the Federation of Employers of Ukraine, representing Ukrainian entrepreneurs, issued an appeal to President Volodymyr Zelensky, demanding action to curb the abuse of power by government officials. The abuse of power by military officials and judges has crossed all lines, according to Ukrainian entrepreneurs, who are calling for the establishment of a public registry to identify corrupt officials. They further argue that corruption on an unprecedented scale is eroding Ukraine’s defensive capabilities.

Anybody’s guess.

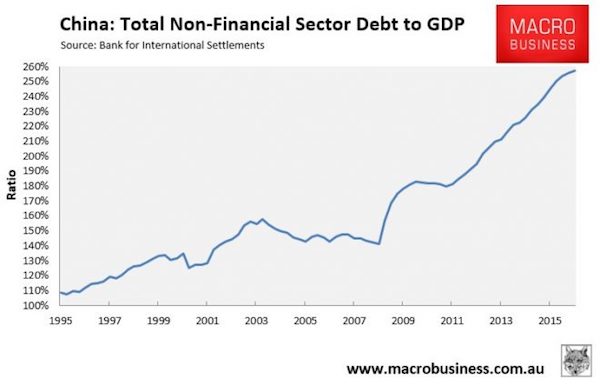

• How The End Of The US Dollar’s Global Dominance Will Play Out (Salikhov)

A more important factor than the nominal share of the US dollar in international reserves is the changing approach to the management and accumulation of foreign assets. The same IMF data shows that the total value of central bank reserves has remained virtually unchanged at $11.5-12 trillion over the past decade, even as the global economy has grown. China’s foreign exchange reserves peaked at $4 trillion in 2014 and have been declining ever since. Their current value is $3.2 trillion, down 20% from 2014. Many other developing countries are not increasing their international reserves, if not reducing them. This does not mean, however, that external assets are not being created.

They can be formed in “non-standard” forms, such as assets of sovereign wealth funds, state banks, development institutions and other structures not directly related to central banks. Foreign direct investment by government structures can also be classified as a type of reserve asset. Such a strategy is not aimed at maximising the availability and liquidity of assets, but at securing one’s own economic interests in foreign markets. To some extent, it provides greater protection against the political risks of asset freezes, as their legal status is less transparent. A similar strategy is being pursued by China, which is seeking to gradually “internationalize” its currency. Formally, the yuan’s share of central banks’ international reserves is small, amounting to no more than 3%. Moreover, between a third and a half of this demand is provided by the Bank of Russia.

China’s strategy is to secure the international status of the RMB through trade rather than investment. In recent years, China has actively sought to motivate and encourage its partners to trade in RMB rather than other currencies. This is being done in a number of ways, including infrastructure development, its own analogue of the SWIFT system, development of clearing, international lending in the currency and so on. Many people have heard of the term “petroyuan” – an analogue of the petrodollar. In essence, it is the signing of long-term contracts for the supply of oil in yuan in return for a flow of goods and equipment. So, trade is already being conducted in yuan rather than US dollars. This creates demand outside the Chinese economy. At the same time, the Chinese authorities maintain restrictions on capital transactions.

***

The de-dollarization of the global financial system will continue. This will be facilitated in particular by progress in financial technology. The development of automated trading platforms will reduce the cost of exchanging one currency for another. Central banks will seek to directly clear each other’s currencies without directly using the currencies of Western countries. In the future, central banks’ digital currencies may also be used for international transactions, reducing costs for economic agents. However, this process will be slow and we should not expect a fundamental change in the global financial system in the foreseeable future.

“..when there’s a glitch, and the accounts remain up, the FBI immediately writes back and says, what’s the deal? We just wrote to you, why is it still up?”

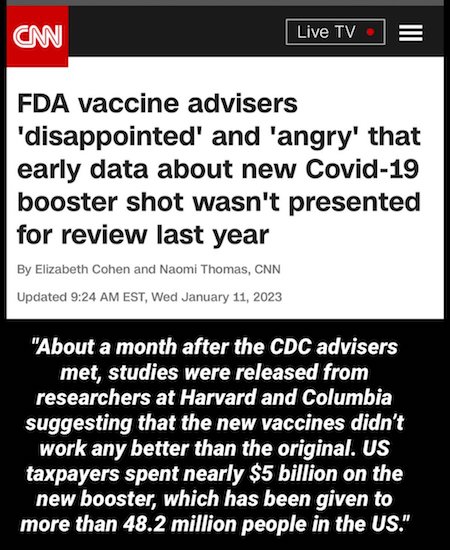

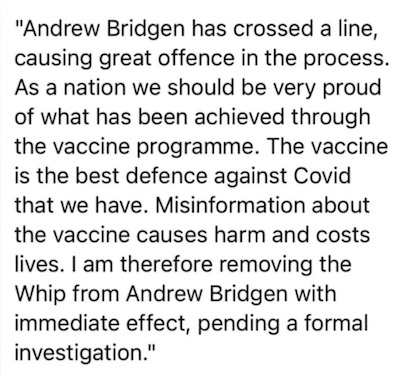

• New Twitter Files Contradict FBI Director’s Testimony (Turley)

Yesterday’s hearing with FBI Director Christopher Wray was another maddening experience of faux contrition and open evasion. Wray apologized for violations that have already been established by courts or Congress (often over the best efforts of the FBI). However, on ample public evidence of new violations, Wray continued to use his favorite testimonial trilogy to dismiss any questions: expressing (1) lack of knowledge, (2) ongoing investigations, and (3) promises of later answers or briefings. He did, however, hold forth in detail after Rep. Eric Swalwell asked him about FBI Family Day. Despite the near total lack of substance, Wray did make one surprising denial. He insisted that the FBI does not engage in censorship efforts, focuses only on “foreign disinformation,” and does not pressure companies to censor others.

Those denials are not only directly contradicted by the recent 155-page opinion of a federal court and the Twitter Files, but a new release from the Twitter Files and journalist Matt Taibbi. Wray said that “…The FBI is not in the business of moderating content, or causing any social media company to suppress or censor.” He then added that these companies are not under any pressure in making their own decisions whether to censor people or groups flagged by the FBI. The statement is obviously false. The FBI maintained a large operation of agents actively seeking the censorship of thousands, as discussed in my prior testimony. Taibbi, however, has released another example of how aggressive the FBI was with social media companies. In the latest Twitter Files release, there is one email exchange where Twitter “immediately” suspended accounts flagged by the FBI without investigation.

Taibbi explained: “In one shot, you can see the FBI asks to remove three accounts, that gets forwarded to Twitter, Twitter immediately suspends them, the accounts. But more importantly, when there’s a glitch, and the accounts remain up, the FBI immediately writes back and says, what’s the deal? We just wrote to you, why is it still up? So, that shows the nature of the relationship basically that it’s not really a collaboration. It’s much more like somebody reporting to an authority. … [W]hat happens in these instances in the ones that I was showing, they’re just forwarding names of accounts that they say are associated with foreign threat actors. It’s very vague. And Twitter is taking them down before they even investigate. In this case, they later determined that they couldn’t find anything connecting them to any bad actors. In fact, one of them was from Canada. And so, that’s the problem. If it’s not connected with a crime, they’re just asking to take accounts down because they don’t like the profile of them.”

”..everything they do is to move along to the next story. They know there will be another Biden crime crisis.”

• Drugs Discovered Three Times At White House Since 2022 (JTN)

Republican Rep. Lauren Boebert said after the Secret Service briefing Thursday on cocaine found July 2 at the White House that drugs have been found two other times since last year in the building. The Colorado lawmaker also confirmed that Secret Service officials said at the briefing the agency likely won’t find a suspect in connection to the cocaine discovery and that the probe will conclude Friday. “There’s a list of more than 500 individuals that they looked into their backgrounds for prior drug records or use, and nothing was determined from from their analysis,” she said. “And the Secret Service is very eager to close this within the next couple of days.”

The cocaine was reportedly found in a cubby near the White House’s West Executive entrance and weighed less than a gram. Republican Rep. Nancy Mace, who like Boebert is a member of the House Oversight Committee and attended the briefing, also confirmed with Just the News the investigation will be closed Friday without a suspect. “The cocaine caper is going to be concluded without any outcome. No suspects, no resolution,” the South Carolina lawmaker said after the briefing, “which is frustrating, because every time there’s something unsavory happening on the president, the White House’s administration, we never get an answer. And it’s just ironic and interesting and frustrating.”

Boebert said the drug found twice before in roughly the past year was marijuana and that she thinks the Secret Service closed the investigation without a suspect “because everything in this administration is about covering up for the Biden crime family.” “This is the third time that drugs have been found on the White House property since 2022, and we did not even hear about the marijuana,” she also said. “I certainly did not hear about the marijuana that was found in 2022, two times, and now there’s cocaine on the property. So everything they do is to move along to the next story. They know there will be another Biden crime crisis.”

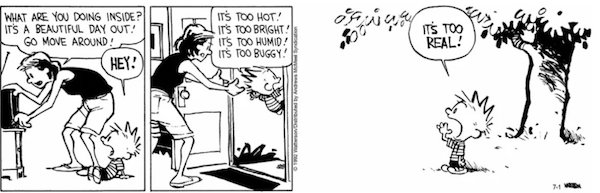

TV vs internet.

• Hollywood Grinds To A Halt As Actors And Writers Go On Strike Together (ZH)

Actors and writers in Hollywood have staged the first joint walkout in six decades, saving the country – if not the world, from the production of crappy, woke entertainment, at least for now. The Screen Actors Guild, which represents approximately 160,000 performers, announced the strike on Thursday after failing to reach a new labor agreement with Alliance of Motion Picture & Television Producers, which represents studios including Walt Disney Co. and Netflix Inc, Bloomberg reports. The Writers Guild of America, meanwhile has been on strike since May 2, shutting down late-night TV programs like The Tonight Show, halting many projects in progress and imperiling the traditional release of new broadcast TV shows starting in September.

In a statement after the strike announcement, the studio alliance said the union “has regrettably chosen a path that will lead to financial hardship for countless thousands of people who depend on the industry.” -Boomberg According to the studios, double-digit percentage increases in salaries and higher pension and health benefits, plus a boost in residuals (the money actors and other receive when shows are rerun), weren’t enough. Also offered were protections against the use of actors’ digital likenesses. A key dispute which remains unresolved is compensation from streaming services as online video entertainment cannibalizes broadcast and cable TV.

“I cannot believe how far apart we are in so many things,” said SAG president Fran Drescher. “The entire business model has been changed by streaming. This is a moment of history. That is a moment of truth.” The move has halted work on shows such as Abbott Elementary and Netflix’s Stranger Things. if the strikes last more than a few days, the impact will be far greater than just the writer’s strike alone. Meanwhile, actors will have to stop promoting upcoming projects and refuse to attend events such as Comi-Con International which is scheduled for next week.

Obesity

8. The Rise Of Obesity In America:

You can only appreciate this epidemic by watching this video… pic.twitter.com/vgN3rEW7zK

— George Mack (@george__mack) July 13, 2023

Bison

These cars stopped for Bison Stampedes to cross the road.pic.twitter.com/MpCtt02OKi

— Epoch Animal Lovers (@EP_AnimalLovers) July 13, 2023

Moth

https://twitter.com/i/status/1679299872401268742

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.