Paul Gauguin We hail thee Mary 1891

“..the “Walmartization” of America.”

• If The US Middle Class Disappears So Will The US Economy (Hutch)

Economies have ebbs and flows. In spite of what they teach you in economics 101 nothing is ever in equilibrium. There are just too many parts as well as internal and external influences although there are times when activity is stronger than others. The US built one of the greatest economic powerhouses on earth after World War II, however it was already well on its way from the 1800s as it built out its infrastructure and put many to work. There was a time when the US consumed the majority of what it produced as a nation and then exported the remainder. Who was responsible for the consumption? It was the middle class. The middle class made up the majority of the population. They had jobs and respectable salaries. So what happened?

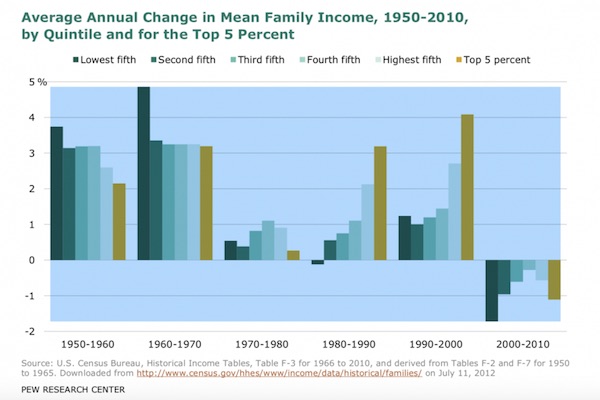

According to a research report by the Pew Research Center in 2012, “The Lost Decade of the Middle Class” they state: “For the half century following World War II, American families enjoyed rising prosperity in every decade—a streak that ended in the decade from 2000 to 2010, when inflation-adjusted family income fell for the middle income as well as for all other income groups, according to U.S. Census Bureau data.” The above graph shows that the 50s and 60s had the strongest middle class. In 1950 and 1951 the US had successive years of 8% GDP growth. The report also highlights how the net worth of middle income families—that is, the sum of assets minus debts— took a hit from 2001 to 2010 from the Federal Reserve’s Survey of Consumer Finances. Median net worth fell 28%, to $93,150, erasing two decades of gains.

So we have a situation where consumer debt has increased over the years and incomes have fallen. There are a large number of reasons for this. The manufacturing base has shrunk as companies chose to produce goods in other countries in order to take advantage of cheap labour so they could give themselves pricing advantages. There is, what has become to be known as the “Walmartization” of America. Author John Atcheson writes, “If you want to know why the middle class disappeared and where they went, look no further than your local Walmart. People walked in for the low prices, and walked out with a pile of cheap stuff, but in a figurative sense, they left their wages, jobs, and dignity on the cutting room floor of the House of Cheap.” Driving prices lower and lower is just a race to the bottom that erodes everyone’s quality of life.

Safety.

• Nervous Investors Exiting US Stocks At Near-Record Pace (CNBC)

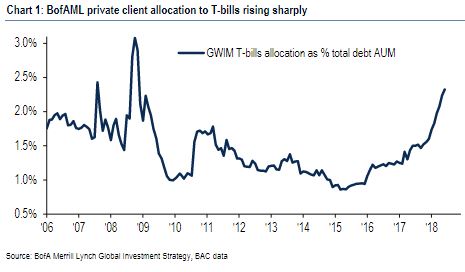

Investors bailed out of U.S. stocks at a near-record pace in the last week, as money flowing into Treasury bills surged to a 10-year high. Outflows from U.S. stock funds and ETFs totaled $24.2 billion, the third-highest ever, and the $30 billion that came out of global stock funds in total in the past week was the second-highest ever and largest since the financial crisis, according to Bank of America Merrill Lynch strategists. The outflows from U.S. stocks were the highest since the stock market correction in February. Bonds, at the same time, saw small inflows of $700 million. “That nervousness, the losses people were experiencing in non-U.S. markets with the trade wars has probably led to what you’re seeing in the markets in the last week or so — a big unwind of positioning, a flight to quality,” said Michael Hartnett, BofAML chief investment strategist.

Hartnett said there was a “pervasive euphoria” about the U.S. at the beginning of the year and that has faded. Now, investors are adjusting positions, not panicking, though T-bills, considered the safest of safe haven bets, continued to pull in funds at a rapid pace. “It’s not like it’s February 2016. It’s not like we’re staring recession in the face, and everyone is cashed up to the eyeballs and policymakers are panicking. That’s not what’s happening. It’s just that people were pricing in Goldilocks forever earlier on in the year, and that was wrong. They’re probably unwinding that positioning,” he said. “It helps explain why the markets have firmed up in the last couple of days. You want to buy fear and sell greed.” Hartnett said July could be a month where investors sell volatility, but then the market could get rockier in August and September, ahead of the midterm elections.

Prone to get a whole lot worse.

• Emerging Markets Are In A Death Cross (CNBC)

Emerging markets are feeling the heat. China is in a bear market, Brazil is closing in on one, and the EEM emerging markets ETF could close out its worst quarter in nearly three years on Friday. Brace for more pain, says one technical analyst. “There’s really a time to own EEM and it’s time not to own EEM,” Piper Jaffray’s chief market technician Craig Johnson told CNBC’s “Trading Nation” on Thursday. “Our rising dollar is going to be an issue for EEM in here and it looks like to me you got probably another 12 percent downside before you get down to a material support area.”

A 12 percent decline from Thursday’s close would put the EEM ETF at around $37.50, its lowest level since March 2017. On Friday afternoon it had risen 1.5 percent to $43.35. The EEM ETF has also entered a death cross, a technical red flag for Johnson. A death cross marks the point on a chart where a longer-term moving average, such as the 200-day, breaks above a shorter-term moving average, such as the 50-day. The technical indicator demonstrates a sharp breakdown in a security’s price and often prefaces further downside.

How is that a question?

• Are Central Banks Embracing Too Much Risk? (R.)

Central banks are usually thought of as very conservative institutions; if they were cars they would be safe, family sedans. Lately, though, some central banks have been doing the market equivalent of zipping around in a sporty convertible. In recent years, at least two large central banks have been snapping up large quantities of equities, typically considered a risky investment. The Swiss National Bank now has about 20% of its reserves in equities, up from about 7 percent a decade ago. More than half of that is in U.S. equities. And to say that the Bank of Japan has become a player in that country’s equity market is an understatement; BOJ currently owns nearly 75% of the Japanese exchange-traded fund (ETF) market, again up sharply from just a few years ago.

Other central banks, including the European Central Bank and South African Reserve Bank, also make similar purchases, although Japan and Switzerland are the most aggressive buyers of equities. If the idea of a central bank owning a significant amount of stock in a company sounds strange to you, that’s hardly surprising. In the United States, for example, the Federal Reserve Bank is legally prohibited from owning equities, and instead invests its reserves in bonds and other government-backed securities. Some other countries, obviously, have different rules in their bank charters, and modest equity holdings have been a central bank strategy for years. Even so, the practice of central banks owning significant shares of equities is a very recent phenomenon. So why is it happening now, and what kind of risks does this unprecedented trend carry?

In the case of Japan, the motive is clear: for decades the country has had difficulty sustaining economic growth, and the Bank of Japan has already exhausted more traditional forms of stimulus, such as interest rate cuts and bond purchases. Both Prime Minister Shinzo Abe and BOJ Governor Haruhiko Kuroda have been at pain to stimulate growth and defy expectations of deflation. Switzerland’s bank, by contrast, seems to be acting more like an aggressive individual investor: it has been buying stocks because that is where money is to be made. Unbeknownst to many American investors, the Swiss National Bank is a significant shareholder in well-known American firms like Amazon, Apple, Facebook and Microsoft.

All in for Wall Street.

• Stress Test Results Signal More Flexible New-Look Fed (R.)

This year’s Federal Reserve stress test results suggested a more flexible approach, a further sign the regulator’s new leadership is responding positively to a Wall Street push for pragmatic bank supervision, analysts and lawyers said. Banks that took a one-off capital hit due to the 2017 U.S. tax overhaul got a conditional pass, a departure from the Fed’s traditional strict pass-fail approach to quantitative capital issues, while scandal-plagued Wells Fargo was able to double share buyback plans. Goldman Sachs and Morgan Stanley were dinged since their capital fell below the Fed’s minimum, but the regulator’s response this year sounded a more industry-friendly tone under Chairman Jerome Powell and Vice Chairman Randal Quarles, President Donald Trump appointees, analysts and lawyers said.

“They have allowed firms to pass on the basis there were special circumstances and applied a level of pragmatism in the way they haven’t in the past. This is the new Fed and it signals to me an early retirement of this super-strict quantitative test,” said Mike Alix, financial services risk leader at PwC. The Fed on Thursday approved the capital plans of 34 lenders following the second leg of its annual tests, a process introduced after the 2007-2009 financial crisis to assess banks’ capacity to withstand a severe recession. The U.S. central bank has ramped up its worst-case scenarios each year.

The U.S. tax code rewrite signed into law in December meant Goldman and Morgan Stanley’s Thursday results were weighed, in part, by changes to the treatment of past losses on hypothetical tax bills under the Fed’s scenarios. But since the tax issue was a one-off and capital levels in the system are high, the Fed felt it was unnecessary to fail the two banks, senior Fed officials said.

“Asked about Ms May’s dinner speech on Friday morning, Leo Varadkar, the Irish prime minister, looked confused, and said: “There was a speech? Haha.”

• EU Warns Deep Disputes With UK Threaten No-Deal Brexit (Ind.)

The European Union has warned that “serious divergence” between itself and Britain in Brexit talks risks the possibility of a no deal, following a meeting by the 27 national leaders in Brussels on Friday. After roughly an hour of discussion, leaders signed off a joint statement pledging to prepare for the possibility of a no-deal situation and highlighting their “concern” at the lack of progress on the Irish border issue. Speaking ahead of the meeting, Michel Barnier, the European Commission’s chief negotiator, warned: “On Brexit, we have made progress, but huge and serious divergence remains, in particular on Ireland and Northern Ireland.”

Mr Barnier called for “workable and realistic proposals” to be included in a UK government white paper scheduled for release next month. He added that “time is very short” and said UK negotiators should return to Brussels on Monday to intensify talks. The EU says a deal must be struck before October to stop Britain crashing out of the bloc in March without a transition period – a scenario that would be expected to cause economic chaos. Theresa May on Thursday night addressed leaders over dinner about Brexit for 10 minutes but her speech was apparently overshadowed by hours of discussions about the EU migration crisis, the main focus of the summit. Asked about Ms May’s dinner speech on Friday morning, Leo Varadkar, the Irish prime minister, looked confused, and said: “There was a speech? Haha.”

One long litany of nonstarters.

• EU Leaders Say Post-Brexit Single-Market Access For Goods A Nonstarter (G.)

Theresa May has been told by European leaders that an attempt to protect the UK’s industrial base by gaining single market access for goods alone after Brexit is a nonstarter, as the Irish prime minister warned: “We are not going to let them destroy the European Union.” After being given a “broad brush approach” presentation at a Brussels summit of May’s long-awaited paper, yet to be signed off by her warring British cabinet, the taoiseach, Leo Varadkar, told her that unless the final document presented a departure from the UK government’s thinking over the last two years, it would be dead on arrival. The British government is continuing to push the idea of keeping frictionless trade on goods, claiming that it would be a good deal for Europe, given the large trade surplus it enjoys.

May has promised to publish her vision for the future trading relationship after a cabinet meeting at Chequers on Friday. Speaking at the end of a summit dominated by a row over migration, Donald Tusk, the European council president, said that “quick progress” in the Brexit negotiations was needed for there to be any hope of an agreement in October, at what is increasingly being billed as a make-or-break summit. “This is the last call to lay the cards on the table,” Tusk said, of the EU’s call for a workable plan. The French president, Emmanuel Macron, said: “There is a clear message in this respect – we can no longer wait”.

Anyone seen Jeff Sessions lately?

• Hidden Figures (Jim Kunstler)

Now, Mr. Trey Gowdy (R – SC) is a different breed of porpoise among congressmen, kind of legal man-eating orca. In look and demeanor, he comes off as a cross between Atticus Finch and the young feller who played the banjo so well in the opening scenes of Deliverance. Mr. Rosenstein didn’t dare lay any mirthful smirky trips on Mr. Gowdy, who radiated the consolidated wrath of the legislative branch at this flock of executive branch popinjays. Mr. Gowdy, who is declining to run for his seat this year, may be bound for bigger things. Some say he may be the next Attorney General. In case you’ve forgotten, Rod Rosenstein is not the Attorney General, he’s the Deputy AG.

His boss is Mr. Jeff Sessions, an elusive figure for months now in the malarial DC backwaters, like that Louisiana Swamp Thang that turns up in the fake Bigfoot documentaries, looming hairily through the night-vision goggles in a cypress slough. Maybe three or four people have laid eyes on him since sometime back in April. Better check his office, make sure he isn’t hunched over face-down in a take-out order of tonkatsu ramen. It’s rumored that our president, the Golden Golem of Greatness, can, shall we say, put the Department of Justice and its subsidiary, the FBI, out of their current misery by finally firing a few of these conniving top dawgs. Order Rosenstein to release un-redacted files he’s been sitting on for a year, and fire his ass for cause when he refuses. In the case of Mr. Sessions, for Godsake, call the undertaker.

Yogurt and whiskey.

• Canada Hits US With Retaliatory Tariffs: ‘We Will Not Back Down’ (G.)

Canada has announced billions of dollars in retaliatory tariffs against the US in a tit-for-tat response to the Trump administration’s duties on Canadian steel and aluminum. Justin Trudeau’s government released the final list of items that will be targeted beginning 1 July. Some items will be subject to taxes of 10 or 25%. “We will not escalate and we will not back down,” the Canadian foreign minister, Chrystia Freeland, said. The taxes on items including ketchup, lawnmowers and motorboats amount to $12.6bn. “This is a perfectly reciprocal action,” Freeland said. “It is a dollar-for-dollar response.” Freeland said they had no other choice and called the tariffs regrettable.

Many of the US products were chosen for their political rather than economic impact. For example, imports just $3m worth of yoghurt from the US annually and most of it comes from one plant in Wisconsin, the home state of the House speaker, Paul Ryan. The product will now be hit with a 10% duty. Another product on the list is whiskey, which comes from Tennessee and Kentucky, the latter of which is the home state of the Republican Senate leader, Mitch McConnell. Freeland also said they are prepared if Donald Trump, the US president, escalates the trade war. “It is absolutely imperative that common sense should prevail,” she said. “Having said that, our approach from day one of the Nafta negotiations has been to hope for the best but prepare for the worst.”

How much money is on the line, Angela?

• Merkel Confirms Bilateral Migrant Agreements With Spain And Greece (DW)

Spain and Greece have agreed to take back asylum seekers already registered in those countries who are intercepted at the Austria-German border, Chancellor Angela Merkel confirmed on Friday. However she said no bilateral agreement had been made with Italy. The agreements are temporary measures to stem secondary migration until EU-wide policies take effect. “What we achieved here together is perhaps more than I had expected,” Merkel told reporters at the end of the summit. Merkel is to inform her coalition allies about the agreement on Friday evening.

Merkel was asked if the agreements with Athens and Madrid met demands from her German conservative CSU coalition partners. Merkel told reporters she believed they even surpassed them: “They are more than equivalent in their effect,” she said. “We are not at the end of the road. I always said that we would never be able to agree a common European asylum system here. But the more we agree among ourselves, the closer we get to a possible European solution. I’m convinced of that.” The tentative agreement with Greece and Spain came on the sidelines of an EU leaders’ summit that reached a breakthrough on migration. It will go into effect once operational details are worked out in the next four weeks, the Chancellery said.

Does Ecuador have a spine?

• Not Up To US To Decide On Assange Asylum, Ecuador Says (AFP)

It’s not up to Washington to decide the fate of WikiLeaks founder Julian Assange, Ecuador’s top diplomat said Friday, following the visit of US Vice President Mike Pence. Pence “raised the issue” of the Australian anti-secrecy activist – holed up at Ecuador’s embassy in London since 2012 – when he met with Lenin Moreno on Thursday, an official with the US vice president’s office confirmed. “Ecuador and the United Kingdom, and of course Mr Assange as a person who is currently staying, on asylum, at our embassy” will decide the next steps, Foreign Minister Jose Valencia told reporters. “It does not enter, therefore, on an agenda with the United States.” Pence and Moreno “agreed to remain in close coordination on potential next steps going forward,” the US official told reporters traveling with Pence.

Snowden sure has a spine.

• Edward Snowden Calls Russian Government ‘Corrupt’ (Ind.)

Edward Snowden, who fled to Russia after releasing thousands of documents from the US National Security Agency, has suggested his current homeland’s government is “corrupt in many ways”. The ex-IT contractor and Central Intelligence Agency (CIA) worker, said the country’s citizen’s were warm and clever but he “strongly” disagreed with the policies of Russian president Vladimir Putin. “I think the public feels disempowered. Russians are not naive, they know that state TV is unreliable. The Russian government is corrupt in many ways, that’s something the Russian people realise,” the 35-year-old told German newspaper Suddeutsche Zeitung. “Russian people are warm, they are clever. It’s a beautiful country. Their government is the problem not the people.”

Mr Snowden was granted asylum in Russia after his flight from the US when he made public the NSA’s widespread undeclared surveillance in 2013. He faces three charges under the Espionage Act in his homeland, each of which carry a minimum of 10 years in jail. He has been granted permission to stay in Russia until 2020. Asked by the Suddeutsche Zeitung whether his comments could put him in danger by angering Mr Putin, Mr Snowden said: “There’s no question, it’s a risk. Maybe they don’t care, right? Because I don’t speak Russian. “And I am literally a former CIA agent, so it’s very easy for them to discredit my political opinions as those of an American CIA agent in Russia.”

Thought control.

• The Great Firewall Of China (G.)

In December 2015, thousands of tech entrepreneurs and analysts, along with a few international heads of state, gathered in Wuzhen, in southern China, for the country’s second World Internet Conference. At the opening ceremony the Chinese president, Xi Jinping, set out his vision for the future of China’s internet. “We should respect the right of individual countries to independently choose their own path of cyber-development,” said Xi, warning against foreign interference “in other countries’ internal affairs”. No one was surprised by what they heard. Xi had already established that the Chinese internet would be a world unto itself, with its content closely monitored and managed by the Communist party.

In recent years, the Chinese leadership has devoted more and more resources to controlling content online. Government policies have contributed to a dramatic fall in the number of postings on the Chinese blogging platform Sina Weibo (similar to Twitter), and have silenced many of China’s most important voices advocating reform and opening up the internet. It wasn’t always like this. In the years before Xi became president in 2012, the internet had begun to afford the Chinese people an unprecedented level of transparency and power to communicate. Popular bloggers, some of whom advocated bold social and political reforms, commanded tens of millions of followers.

Chinese citizens used virtual private networks (VPNs) to access blocked websites. Citizens banded together online to hold authorities accountable for their actions, through virtual petitions and organising physical protests. In 2010, a survey of 300 Chinese officials revealed that 70% were anxious about whether mistakes or details about their private life might be leaked online. Of the almost 6,000 Chinese citizens also surveyed, 88% believed it was good for officials to feel this anxiety.