Russell Lee Photo booth at fiesta, Taos, New Mexico Jul 1940

They can’t let go: “..panic equals buying opportunities..”

• Markets Are Back At Panic Levels, Says Credit Suisse (MarketWatch)

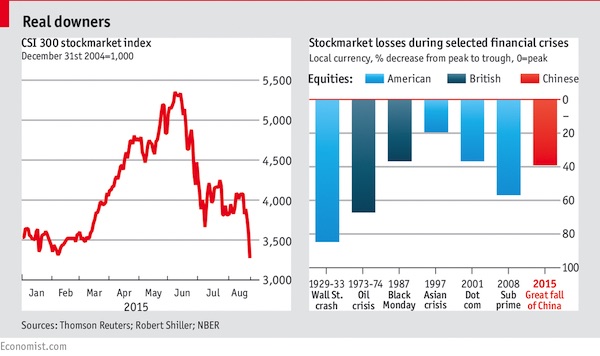

If it feels like you’re reliving the market jitters of the Great Recession and eurozone crisis, it’s probably because you are. During this week, global risk appetite dropped to “panic” levels for the first time since January 2012, according to Credit Suisse’s Global Risk Appetite Index. That was back when investors feared a breakup of the euro bloc, grappled with unsustainably high sovereign borrowing costs and freaking out about the spillover from Greece. Before that, the index reached panic state around the onset of the 2008 financial crisis, after the Sept. 11, 2001 attacks on the U.S., during the dotcom bubble and after Black Monday in 1987. Get the picture?

This time, Credit Suisse’s Global Risk Appetite Index slipped into panic territory just as global equity markets were wrapping up their worst quarter in four years. That came as investors feared a sharp slowdown in China’s economy and a collapse in commodity prices. “Global growth is not a strong supportive factor for risky assets right now,” said the analyst team led by the bank’s chief economist, James Sweeney. “Weak Chinese growth has had very negative effects on general emerging market performance and commodity prices. And a strong dollar has caused many exporters around the world to see declining trade revenues, even if actual activity has not fallen off a cliff,” they added. Indeed, the U.S. economy may not even have grown 1% in the third quarter, according to the Atlanta Fed’s GDPNow tracker.

But here’s for the good news: panic equals buying opportunities. The Credit Suisse analysts said panic usually is an overreaction to short-term events, providing a chance to buy risky assets at a cheaper price. There’s a caveat for the current panic state, however. Because of the murky global growth outlook, investors should only use this as a short-term opportunity, rather than going in for the long haul, the analysts said. “If panic persists, it could alter the global growth outlook for the worse. Ongoing panic and weak global growth would likely influence Fed behavior. But history suggests rebounds often occur when they are least expected,” they said. “That’s why we see the current panic as a tactical opportunity, even if it does not point to a lasting boom in risky assets.”

Define ‘value’.

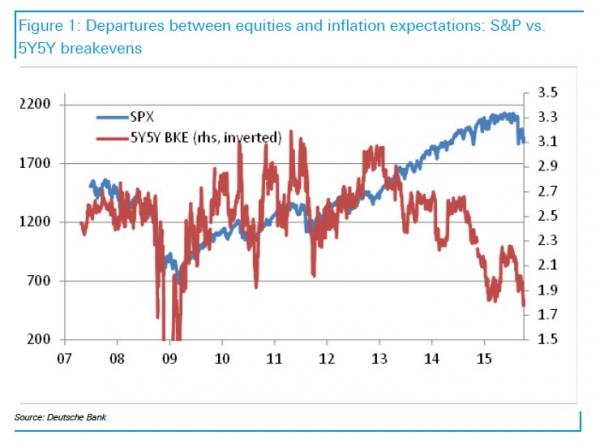

• Post-QE “S&P Should Be Trading At Half Of Its Value”: Deutsche Bank (ZH)

[..] “Since 2013, stocks rallied while disinflationary pressures were reinforced by a strong USD, low commodity prices and a decline in global demand. If pre-2013 coordination between the two is taken as a reference, then based on current stock prices breakevens should trade about 1.5% wider. This means the Fed should be hiking because inflation is above target. Alternatively, given the current level of inflation, S&P should be trading at half of its value.”

Wait, the S&P should be trading at 900… or even less? Yes, according to the following Deutsche Bank chart:

Only one question remains: which breaks first – do inflation expectations surge higher, soaring by some 150 bps to justify equity valuations, or do equities crash?

“Is reconciliation likely – and, if so, in which direction? Are we returning to the pre-crisis world, or we are in a completely new regime?”

The answer will come from none other than the Fed and by now, even Janet Yellen knows that one word out of place, one signal to the market that the QE-inflation trade will converge with stocks crashing instead of inflation rising (which, unless the Fed launched QE4, NIRP of even helicopter money now appears inevitable), and some $10 trillion in market cap could evaporate overnight. Is it any wonder that Yellen is exhibiting “health issues” during her speeches: the realization that the fate of the biggest stock market bubble lies on your shoulders would make anyone “dehydrated.” In retrospect, Ben Bernanke knew exactly what he was doing when he got out of Dodge just as the endgame was set to begin.

The last few sources of funding dry up.

• Oil Slump Plays Havoc With The Junk-Bond Market (MarketWatch)

Low oil prices continued to wreak havoc in the U.S. high-yield bond market in September, and the outlook remains grim, reports from two major rating firms showed Friday. Moody’s said its Liquidity Stress Index, a measure of stress in the high-yield bond market, deteriorated in the month, weighed down once again by a wave of downgrades in the energy sector. The index rose to 5.8% in September from 5.1% in August, placing it at its highest level since October of 2010. The index measures the number of companies that carry Moody’s lowest liquidity rating of SGL-4. The index rises when more issuers are placed in that category, and it falls when liquidity improves.

The U.S. high-yield market is dominated by energy companies, many of them highly leveraged shale producers that had ramped up production while oil prices were soaring. Many are now struggling as the low oil price hammers profits just as debt service costs rise. Crude has lost roughly 59% of its value in the past year, falling from a high close to $107 a barrel in 2014 to about $44 on Friday. Reflecting the pressure on risky borrowers, the energy Liquidity Stress subindex shot up to 16.9% in September from 12.7% in August, its highest level since it reached 19.2% in July of 2009. “The LSI’s rise warns that more companies are becoming dependent on increasingly fickle capital markets to alleviate liquidity pressures, and this is putting upward pressure on defaults,” Moody’s said in a report.

Pumping at full capacity is the only lifeline left.

• Oil Bulls Lose Faith in Recovery as Russia Adds to Global Glut (Bloomberg)

Hedge funds trimmed bullish oil bets for the first time in six weeks, losing faith in a swift recovery as Russia boosted output to the highest since the Soviet Union collapsed. Speculators reduced their net-long position in West Texas Intermediate crude by 9.1% in the week ended Sept. 29, according to data from the Commodity Futures Trading Commission. Longs dropped from a 12-week high while shorts increased. U.S. crude output is down 514,000 barrels a day from a four-decade high reached in June, Energy Information Administration data show. The number of rigs targeting oil in the U.S. dropped to a five year low, Baker Hughes said Oct. 2. WTI traded in the tightest range since June last month as China’s slowing economy and the highest Russian output in two decades signaled the global glut will linger.

“The U.S. producers are the only ones doing their part to reduce the global glut,” John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund, said by phone. “Other countries, such as Russia, are pumping at full tilt. The cutbacks by shale producers here aren’t going to have much impact, especially given the slowing global economy.” WTI decreased 1.3% in the report week to $45.23 a barrel on the New York Mercantile Exchange. It settled at $45.54 Friday. U.S. crude stockpiles, already about 100 million barrels above the five-year average, may swell further. Stockpiles have climbed during October in eight of the last 10 years as refiners slow operations to perform seasonal maintenance.

Russian oil output rose to a post-Soviet record last month as producers took advantage of the weak ruble to push ahead with drilling. The nation’s production of crude and condensate climbed to 10.74 million barrels a day, 1% more than a year earlier and topping a record set in June, according to data from the Energy Ministry’s CDU-TEK unit.

Give ’em a few days…

• Economists Can’t Find the Silver Lining in US Jobs Report (Bloomberg)

When the U.S. jobs report is released each month, there’s typically enough nuance to offer something for everyone — the good and the bad. Today proved to be a feast for the bears. “When you look through all the details of the data, there just isn’t anything good to hang your hat on,” said Thomas Simons at Jefferies in New York. “It’s been years since we’ve seen such an unambiguously bad report. Silver linings were tough to come by in the September jobs data. Payrolls came in at a much-weaker-than-forecast 142,000, while August and July figures were revised down. Wage growth was nonexistent for the month, with average hourly earnings actually falling by a penny on average.

The softness in manufacturing endured, with factory payrolls falling by 9,000 when they were expected to show no change. With dollar appreciation and sluggish overseas growth providing headwinds, it was the biggest back-to-back decline since 2010. Even service industries, which make up the lion’s share of the economy and are more shielded from global weakness, seem to have shifted into a lower gear. Payroll growth there has slowed for four straight months, the longest such streak since 2001. “While it’s always important not to overreact to one single data release, we’ll make an exception in this case,” Paul Ashworth at Capital Economics in Toronto, wrote in a note to clients. “Aside from manufacturing, the slowdown in employment gains is most notable in business services and education and health, which are not the sectors most prone to cyclical swings.”

Even a small positive in today’s report — a sharp decline in the ranks of the underemployed — must be taken with a grain of salt, economists said. The ranks of people working part-time for economic reasons fell by the most since January 2014, which is generally a good sign. However, the number of full-time employees dropped as well. Meanwhile the labor force participation rate decreased to the lowest level since October 1977. At best, the data are murky. “It’s weak through and through,” Simons said. Because such thoroughly disappointing reports are so rare, “we probably won’t see it again next time around.”

Numbered days?!

• US Hedge Funds Brace For Worst Year Since Financial Crisis (Reuters)

U.S. hedge funds are bracing for their worst year since the 2008 financial crisis after a dramatic sell-off in healthcare and biotechnology stocks triggered double-digit losses for some prominent players last month. September’s sucker punch in the biotech sector, on top of a grim August when global markets tumbled due to fears about slowing growth in China, have pushed many hedge fund managers deep into the red. “These are some of the worst numbers we have seen since the crisis,” said Sam Abbas, whose Symmetric IO tracks hedge fund managers’ returns. The average hedge fund lost 19% in 2008 when the credit crunch hit. Since then, hedge funds have had only one down year, when they lost 5.25% in 2011, data from Hedge Fund Research show.

While the biotech sector held up relatively well during the initial market sell-off in August, it cratered in September. “It was the last remaining bastion of alpha and a sector where many hedge funds were hiding. Now it has succumbed,” said Peter Rup at Artemis Wealth Advisors, which invests in hedge funds. Rup said he was expecting some big negative surprises as more hedge funds send September returns to clients. Some of America’s most prominent hedge funds have seen their returns crumble. David Einhorn’s Greenlight Capital, now off 17%, is on track to post its first losses since 2008. And William Ackman’s Pershing Square Capital Management, which has a big bet on Valeant, told investors on Thursday that its Pershing Square Holdings portfolio is now off 12.6% for the year, a big reversal of fortune after 2014’s 40% gain. “Hedge funds are reeling from a relentless rout that has all but killed a year’s worth of alpha in a matter of two weeks,” Stanley Altshuller at research firm Novus wrote in a report.

So.. more bailouts.

• US System Designed To Prevent Financial Crisis ‘Likely To Fail’ (MarketWatch)

The current U.S.regulatory structure designed to prevent another financial crisis is “Balkanized,” a “mess” and likely to fail when needed, experts said. “The current U.S. institutional set-up is likely to fail in a crisis, and will be doing less to prevent a crisis than it should be,” said Adam Posen, president of the Peterson Institute for International Economics, at a two-day conference on financial stability sponsored by the Boston Federal Reserve. Posen said that U.S. regulators, including the Fed, don’t have the tools or the mandates from Congress that they need. Posen was especially critical of the umbrella group of regulators, the Financial Stability Oversight Council, that was set up by Dodd Frank to identify and deal with financial stability risks.

He said FSOC is chaired by the Secretary of Treasury, who is the most political member of the group. “To me, the FSOC is a mess,” Posen said. Mervyn King, the former head of the Bank of England, agreed that the U.S. institutional structure was a problem. He said U.S. regulators had a knack of working well together in a crisis, whatever the institutional structure. “It is before the crisis that the U.S. set-up is to be questioned,” King said. Well before the financial crisis, the U.S. and the Bank of England had a war game to discuss a possible cross-border bank failure, King said. The U.K. regulators had three key participants, while the U.S. had a “mass choir,” he said. Former Fed vice chairman Donald Kohn agreed: “broader and deeper structural deficiencies exist in the U.S. regulatory system for macroprudential regulation.”

Kohn said there is a widespread perception in Washington that the Fed is responsible for financial stability, but said in reality the Fed must work in a “Balkanized” regulatory system. He agreed that FSOC “cannot remedy the underlying flaws of financial regulation in the U.S.” During the conference, regulators and experts echoed concerns with the regulatory structure. Fed Vice Chairman Stanley Fischer said the Fed needed new tools targeted at the real estate sector to prevent another bubble. Boston Fed President Eric Rosengren suggested that Congress needed to give the U.S. central bank a third mandate to foster financial stability.

Central banks’ toolkits should be abolished, not expanded. They create only mayhem.

• Fed’s Fischer Says Financial Stability Toolkit May Need To Grow (Reuters)

The U.S.’s set of tools to limit asset bubbles is neither large nor “battle tested,” Federal Reserve vice chair Stanley Fischer said on Friday in a call for regulators to step up research on how to improve financial stability. Fischer said that compared to other countries the complexity of the U.S. financial system and the diverse number of regulators may make it difficult to develop or deploy so-called “macroprudential” tools – policies that could be used to selectively cool overheated financial markets. As head of the Bank of Israel, Fischer put such tools to work, for example, by hiking loan to value ratios on home mortgages to slow a run-up in real estate values. He has said the U.S. should examine that and other policies before new financial risks emerge, though he acknowledged they may be tough to implement.

“I remain concerned that the U.S. macroprudential toolkit is not large and not yet battle tested,” Fischer said, and it may be difficult to expand because so many agencies have control over different parts of the financial system. In addition, he said, targeting policies at one sector, such as home mortgages, could simply push that sort of lending to less regulated companies. There is concern that the Dodd-Frank regulations put in place after the crisis are already doing that, helping expand the influence of “shadow” banks not covered by the same rules as commercial lenders. Some of those regulations have a macroprudential character, such as the stress testing of banks and the possible imposition of “countercyclical” capital buffers that could require the largest banks to hold more in reserve if markets overheat.

Ultimately Fischer said it may be left to monetary policy to bear responsibility for financial stability. “The limited macroprudential toolkit…leads me to conclude that there may be times when adjustments to monetary policy should be discussed as a means to curb risks to financial stability,” Fischer said. Even though the interest rate is a blunt tool, requiring a potential tradeoff of higher unemployment if it was hiked to control an asset bubble, “we need to consider the potential role of monetary policy in fostering financial stability,” he said. That could include using narrower policy tools, like bank reserve requirements, and not just the interest rate alone, he said.

And then Greece can jump back into crisis mode. No relief till 2017/18.

• IMF’s Mass Debt Relief Call For Greece Set To Be Rejected By Europe (Telegraph)

The IMF is still poised to pull out of Greece’s third international rescue in five years over the sensitive issue of debt relief. The fund is pushing for a restructuring of at least €100bn of Greece’s €320bn debt pile, according to a report in Germany’s Rheinische Post. Such bold measures to extend maturities and reduce interest payments are set to be rejected by its European partners, who are unwilling to impose massive lossess on their taxpayers. The head of Greece’s largest creditor – Klaus Regling of the European Stability Mechanism – told the Financial Times that such radical restructuring was “unnecessary”. Debt relief is also not due to be discussed when eurozone finance ministers gather to meet for talks on Monday, said EU officials.

This intransigence could now see the IMF withdraw its involvement when its programme ends in March 2016. In debt sustainability analysis carried out by body, it has suggested Greece may need a full moratorium on payments for 30 years to finally end its reliance on international rescues. The reports came after a former IMF watchdog urged the world’s “lender of last resort” to be more critical of its involvement in many bail-out countries for the sake of the institution’s credibility. “Few reports probe more fundamental questions – either about alternative policy strategies or the broader rationale for IMF engagement,” said a report from David Goldsbrough, a former deputy director of IMF’s Independent Evaluation Office (IEO). The IMF has come under fire for failing in its duty of care towards Greece by pushing self-defeating austerity measures on the battered economy.

The Washington-based fund has previously admitted it should have eased up on the spending cuts and tax hikes, pushed for an earlier debt restructuring and paid more “attention” to the political costs of its punishing policies during its five-year involvement in Greece. Accounts from 2010 show the IMF was railroaded into a Greek rescue programme on the insistence of European authorities, vetoing the objections of its own board members from the developing world. The IMF is prevented from lending to bankrupt nations by its own rules. But it deployed an “exceptional circumstances” justification to provide part of a €110bn loan package to Athens five years ago. Greece has since become the first ever developed nation to default on the IMF in its 70-year history.

Despite privately urging haircuts for private sector creditors in 2010, the IMF was ignored for fear of triggering a “Lehman” moment in Europe, by then European Central Bank chief Jean-Claude Trichet. Greece later underwent the biggest debt restructuring in history in 2012. The findings of the fund’s research division have largely discredited the notion that harsh austerity will bring debtor nations back to health. However, this stance has been at odds with its negotiators during Greece’s new bail-out talks where officials have continued to demand deep pension reforms and spending cuts for Greece. Diplomatic cables between Greece’s ambassador to Washington have since revealed the White House pressed the fund to make vocal calls for mass debt relief to keep Greece in the eurozone during fraught negotiations in the summer.

All it takes is a straw.

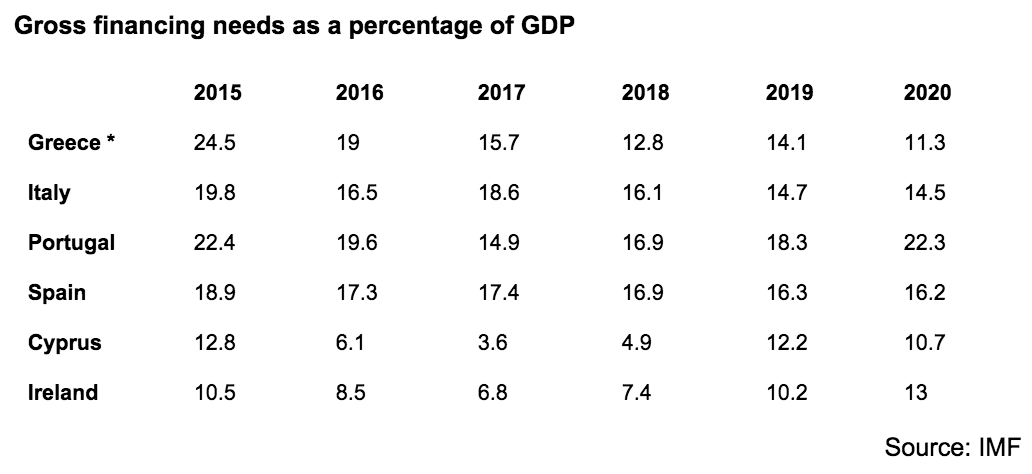

• New Greek Debt Framework Not So Flattering For Italy, Spain, Portugal (WSJ)

When eurozone governments decided to throw Greece another financial lifeline this summer, they also embraced a new way of assessing whether the country will ever be able to repay its debts. But that framework isn’t so flattering for three other highly indebted euro countries. Italy, Portugal and Spain all have gross financing needs—the money a country has to raise to cover its deficit and roll over maturing debt—above 15% of gross domestic product in the coming years. That’s the maximum level the IMF said is manageable for Greece in its preliminary debt-sustainability analysis released this summer. By contrast, Cyprus and Ireland, two other euro countries that were bailed out in recent years, remain below the 15% threshold.

The question of when a country’s debt can be considered sustainable has been central to bailout discussions between the eurozone and the IMF for years. And the answer has been changing regularly—especially in the case of Greece. In the spring of 2012, the International Monetary Fund signed off on a second multibillion bailout, only after a steep writedown on its government bonds promised to bring Greek debt below 120% of gross domestic product by 2020. That, the IMF said at the time, was necessary to make the country’s debt “sustainable in the medium term.” It didn’t take long for that prediction to become outdated. By November 2012 it became clear that the 120% by 2020 was now out of reach. To keep the IMF on board, eurozone governments promised to ensure Greece’s debt would be “substantially lower than 110%” of gross domestic product by 2022.

Fast forward to 2015 and months of back and forth between Greece’s left-wing anti-austerity government and the rest of the eurozone. By the end of June, the IMF was once again ringing the alarm bells over Greek debt. The bigger deficits, lower growth and fewer privatizations expected under the Syriza-led government “render the debt dynamics unsustainable,” the fund warned. In its analysis released in on July 2, three days before Greeks overwhelmingly voted “no” in a referendum on a new bailout deal, the IMF said that Greece’s debt was going to remain at 149.9% in 2020. Even if debt sustainability was going to be judged by gross financing needs rather than the debt-to-GDP ratio, it was still unlikely that Athens would ever be able to regain its financial independence without substantial debt relief, the IMF warned. It was in this report that the IMF first official mentioned 15% as the adequate threshold for determining Greece’s debt sustainability.

“..everything is a mistake and everything is going to be volatile…”

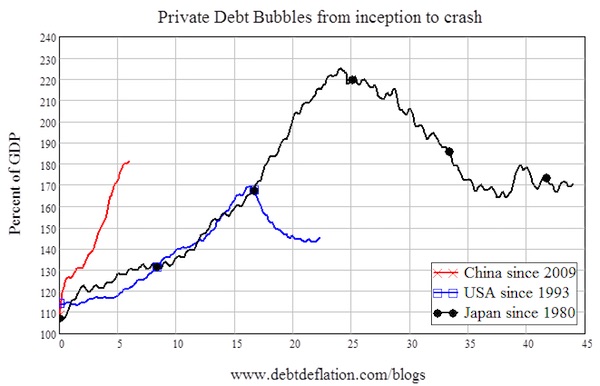

• ‘Bubbles Are All Over The Place’: Ron Paul (RT)

The US economy is set to grow 0.9% in the third quarter after a bigger-than-expected widening of the trade gap for goods in August, according to the Atlanta Federal Reserve’s GDPNow. This appeared to be a much slower rate from the regional Fed bank’s prior estimate of 1.8% last week, the Atlanta Fed noted. “It’s just the beginning of a downturn, nothing’s really happened yet,” Paul said. “Everything is misdirected because of the price of money. There are bubbles every place. You have a stock market bubble, you have still bubblemaking in housing when you see houses selling for $500 million, and you have a bubble in student loans.”

“The bubbles are all over the place. This is the problem. I don’t see an easy way out. I think the markets are going to go down a lot more when you realize how serious this is. Actually we are doing better than the rest of the world but we’re in for trouble too because the world has never had a situation like this where a whole world endorsed a paper currency and had pyramiding of debt around the world by the reserve currency which is the dollar. “It’s the biggest bubble ever, so it’s going to big the biggest crash ever, but it remains to be seen exactly when that’s going to hit. The source of the trouble is the Federal Reserve System, which simply cannot work in a real market economy, Dr Paul said.

“In a true free market economy you have to have people work, use what they need to live on and then save money, and that dictates interest rates and tells businessmen what they should do. Well, that isn’t the way it works any more. The so-called capital comes from the Fed and they create it out of thin air. So everything is a mistake and everything is going to be volatile. You can do this for a while when the country is very very wealthy, and a currency is very very strong.” “But eventually people mistrust the government. They don’t pay interest, they have a huge amount of principal to pay, and corporations are deeply in debt, they borrow a lot of money practically for free and they buy up their stocks. It’s a mess. It’s artificial. It has nothing to do with freedom, has nothing to do with free markets, and the sooner we realize this, the sooner we’ll get rid of central economic planning and especially look into the serious problems we get from the Federal Reserve System.”

Only a few now the new rules.

• History Isn’t A Guide When Market Is Playing By A New Set Of Rules (Ind.)

[..] an unstable global economy is nothing new. David Buik, a City of London veteran and a commentator for the stockbroker Panmure Gordon, has a theory – and it’s one echoed by many who have seen trading evolve over the years. “I think we forget that 40% of trades are programme trades,” Buik explains. “The number of what I call ‘numeric geeks’ that now work in the markets would never have considered being in the markets 50 years ago. “You’ve got a totally different person. He’s incredibly bright and he works out programmes that decide when it’s time to buy and sell. When you’ve got that kind of influence [on the market] you get that level of volatility.” Automated trading has changed the way the stock market works beyond all recognition.

Instead of holding a stock for years, months or days, as was the norm in years gone by, shares can now be owned for a matter of milliseconds. For example, a programme could be created to buy a stock when it reaches £10 and sell it at £10.0001. It might not sound like a big gain, but do it many thousands of times and it can make a tidy profit. High-frequency trading of this nature is also to blame for the “flash crashes” that have happened in recent years. So-called “stop-losses” can be put on trades, meaning that when a share price falls below a level determined by the investor, it is automatically sold, limiting their loss. For investors, it can mean the difference between a small loss and a catastrophic one – as plenty of those Glencore backers would attest to.

But inevitably, automatic stop-loss sales drag share prices down and trigger more selling, causing a dangerous domino effect as investors are automatically bailed out. The stock market is being played or manipulated by financial whiz kids – all completely legally, of course – but it is not what the market was intended for – investing in a company for the benefit of the backer and the recipient. The result is that the market has become increasingly detached from the real world and not a fair reflection of what most see as an improving outlook for the global economy. America, the world’s largest economy, is on the up and an interest rate rise is still expected this year. Yet the US stock market does not reflect that, with its benchmark Dow Jones average falling 8% in the third quarter.

Great history.

• The Failure Of Central Banking: The French Revolution Case Study (Lebowitz)

During the 1700’s France accumulated significant debts under the reigns of King Louis XV and King Louis XVI. The combination of wars, significant financial support of America in the Revolutionary War, and lavish government spending were key drivers of the deficit. Through the latter part of the century, numerous financial reforms were enacted to stem the problem, but none were successful. On a few occasions, politicians supporting fiscal austerity resigned or were fired because belt tightening was not popular and the King certainly didn’t want a revolution on his hands. For example, in 1776 newly anointed Finance Minister Jacques Necker believed France was much better off by taking large loans from other countries instead of increasing taxes as his recently fired predecessor argued.

Necker was ultimately replaced 7 years later when it was discovered France had heavy debt loads, unsustainable deficits, and no means to pay it back. By the late 1780’s, the gravity of France’s fiscal deficit was becoming severe. Widespread concerns helped the General Assembly introduce spending cuts and tax increases. They were somewhat effective but the deficit was very slow to decrease. The problem, however, was the citizens were tired of the economic stagnation that resulted from belt tightening. The medicine of austerity was working but the leaders didn’t have the patience to rule over a stagnant economy for much longer. The following quote from White sums up the situation well:

“Statesmanlike measures, careful watching and wise management would, doubtless, have ere long led to a return of confidence, a reappearance of money and a resumption of business; but these involved patience and self?denial, and, thus far in human history, these are the rarest products of political wisdom. Few nations have ever been able to exercise these virtues; and France was not then one of these few”.

By 1789, commoners, politicians and royalty alike continuously voiced their impatience with the weak economy. This led to the notion that printing money could revive the economy. The idea gained popularity and was widely discussed in public meetings, informal clubs and even the National Assembly. In early 1790, detailed discussions within the Assembly on money printing became more frequent. Within a few short months, chatter and rumor of printing money snowballed into a plan. The quickly evolving proposal was to confiscate church land, which represented more than a quarter of France’s acreage to “back” newly printed Assignats (the word assignat is derived from the Latin word assignatum – something appointed or assigned).

This was a stark departure from the silver and gold backed Livre, the currency of France at the time. Assembly debate was lively, with strong opinions on both sides of the issue. Those against it understood that printing fiat money failed miserably many times in the past. In fact, the John Law/Mississippi bubble crisis of 1720 was caused by an over issue of paper money. That crisis caused, in White’s words, “the most frightful catastrophe France had then experienced”. History was on the side of those opposed to the new plan.

Cosy.

• UK Car Emissions Test Body Receives 70% Of Cash From Motor Industry (Observer)

The body examining the practices of the car industry following the Volkswagen emissions scandal has been accused of a major conflict of interest after it emerged that nearly three quarters of its funding comes from the companies it is investigating. According to its latest annual report, the Vehicle Certification Agency receives 69.91% of its income from car manufacturers, who pay it to certify that their vehicles are meeting emissions and safety standards. The transport secretary, Patrick McLoughlin, said last month that the VCA, which also receives government funding, would be responsible for re-running tests on a variety of makes of diesel cars and investigating their real-world emissions.

The announcement followed the revelation from the US EPA last month that Volkswagen had installed illegal software to cheat emission tests, allowing its diesel cars to produce up to 40 times more pollution than is permitted. However, the apparent conflict of interest raised by VCA’s funding has prompted lawyers to demand a truly independent investigation into the industry, and will raise fresh concerns over the government’s handling of the issue of air pollution. Last week the Observer revealed how the government has been seeking to block EU legislation that would force member states to carry out surprise checks on car emissions. It has also been accused of ignoring a supreme court ruling that the government needed to urgently draw up significant plans to tackle the air pollution problem, which has been in breach of EU limits for years and is linked to thousands of premature deaths each year.

Last days of the empire.

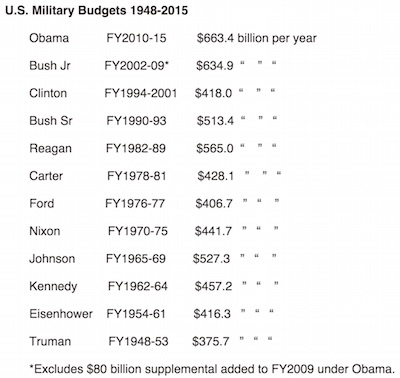

• The Record US Military Budget. Spiralling Growth of America’s War Economy (Davies)

To listen to the Republican candidates’ debate last week, one would think that President Obama had slashed the U.S. military budget and left our country defenseless. Nothing could be farther off the mark. There are real weaknesses in Obama’s foreign policy, but a lack of funding for weapons and war is not one of them. President Obama has in fact been responsible for the largest U.S. military budget since the Second World War, as is well documented in the U.S. Department of Defense’s annual “Green Book.”

The table below compares average annual Pentagon budgets under every president since Truman, using “constant dollar” figures from the FY2016 Green Book. I’ll use these same inflation-adjusted figures throughout this article, to make sure I’m always comparing “apples to apples”. These figures do not include additional military-related spending by the VA, CIA, Homeland Security, Energy, Justice or State Departments, nor interest payments on past military spending, which combine to raise the true cost of U.S. militarism to about $1.3 trillion per year, or one thirteenth of the U.S. economy.

The U.S. military receives more generous funding than the rest of the 10 largest militaries in the world combined (China, Saudi Arabia, Russia, U.K., France, Japan, India, Germany & South Korea). And yet, despite the chaos and violence of the past 15 years, the Republican candidates seem oblivious to the dangers of one country wielding such massive and disproportionate military power. On the Democratic side, even Senator Bernie Sanders has not said how much he would cut military spending. But Sanders regularly votes against the authorization bills for these record military budgets, condemning this wholesale diversion of resources from real human needs and insisting that war should be a “last resort”.

Sanders’ votes to attack Yugoslavia in 1999 and Afghanistan in 2001, while the UN Charter prohibits such unilateral uses of force, do raise troubling questions about exactly what he means by a “last resort.” As his aide Jeremy Brecher asked Sanders in his resignation letter over his Yugoslavia vote, “Is there a moral limit to the military violence that you are willing to participate in or support? Where does that limit lie? And when that limit has been reached, what action will you take?” Many Americans are eager to hear Sanders flesh out a coherent commitment to peace and disarmament to match his commitment to economic justice. When President Obama took office, Congressman Barney Frank immediately called for a 25% cut in military spending.

Instead, the new president obtained an $80 billion supplemental to the FY2009 budget to fund his escalation of the war in Afghanistan, and his first full military budget (FY2010) was $761 billion, within $3.4 billion of the $764.3 billion post-WWII record set by President Bush in FY2008. The Sustainable Defense Task Force, commissioned by Congressman Frank and bipartisan Members of Congress in 2010, called for $960 billion in cuts from the projected military budget over the next 10 years. Jill Stein of the Green Party and Rocky Anderson of the Justice Partycalled for a 50% cut in U.S. military spending in their 2012 presidential campaigns. That seems radical at first glance, but a 50% cut in the FY2012 budget would only have been a 13% cut from what President Clinton spent in FY1998.

They will not stop coming.

• 153,000 Refugees Arrived In Greece In September Alone (UNHCR)

The UN refugee agency said on Friday that refugee and migrant arrivals in Greece are expected to hit the 400,000 mark soon, despite adverse weather conditions. Greece remains by far the largest single entry point for new sea arrivals in the Mediterranean, followed by Italy with 131,000 arrivals so far in 2015. With the new figures from Greece, the total number of refugees and migrants crossing the Mediterranean this year is nearly 530,000. In September, 168,000 people crossed the Mediterranean, the highest monthly figure ever recorded and almost five times the number in September 2014.

UNHCR spokesman Adrian Edwards told journalists in Geneva that the continuing high rate of arrivals underlines the need for a fast implementation of Europe’s relocation programme, jointly with the establishment of robust facilities to receive, assist, register and screen all people arriving by sea. “These are steps needed for stabilizing the crisis,” he said. As of this morning, a total of 396,500 people have entered Greece by sea since the beginning of the year, more than 153,000 of them in September alone. The nine-month 2015 total compares to 43,500 such arrivals in Greece in all of 2014. Ninety-seven% are from the world’s top 10 refugee-producing countries, led by Syria (70%), Afghanistan (18%) and Iraq (4%).

“There was a noticeable drop in sea arrivals this week, along with the change in the weather,” Edwards said, adding that on Sept. 25, for example, there were some 6,600 arrivals. The next day, it dropped to around 2,200. “From an average of around 5,000 arrivals per day recently, it has fallen to some 3,300 over the past six days with just 1,500 yesterday. Nevertheless, any improvement in the weather is likely to bring another surge in sea arrivals.”

Refugees in Berlin face 50-day waits just to register. The system is broken.

• 280,000 Refugees Arrived In Germany In September (AFP)

A record 270,000 to 280,000 refugees arrived in Germany in September, more than the total for 2014, said the interior minister of the southern state of Bavaria Wednesday. “According to current figures… we have to assume that in September 2015 between 270,000 and 280,000 refugees came to Germany,” said Joachim Herrmann. Europe’s biggest economy recorded around 200,000 migrant arrivals for the whole of 2014. The sudden surge this year has left local authorities scrambling to register as well as provide lodgings, food and basic care for the new arrivals. Herrmann highlighted the pressure on the state government of Bavaria – the key gateway for migrants arriving through the western Balkans and Hungary.

“My fellow interior ministers confirm, without exception, that pretty soon we’ll hit our limits in terms of accommodation,” he said. “It’s crucial to immediately reduce the migrant pressure on Germany’s borders,” he said. As Germany expects up to one million refugees this year, Chancellor Angela Merkel’s generosity towards migrants has sparked discord within her coalition. Merkel’s allies, the conservative CSU party governing Bavaria, have been particularly vocal in criticising the policy and warning that resources are overstretched. Berlin is now stepping up action to deter economic migrants from trying to obtain asylum in the country, in a bid to free up resources to deal with applicants from war-torn countries like Syria.