Edward Hopper Burly Cobb’s House, South Truro 1930-33

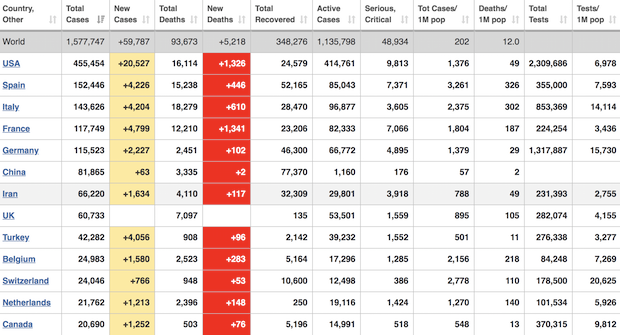

US records 1,783 virus deaths in past 24 hours: Johns Hopkins

April 7: 1,939, April 8: 1.973

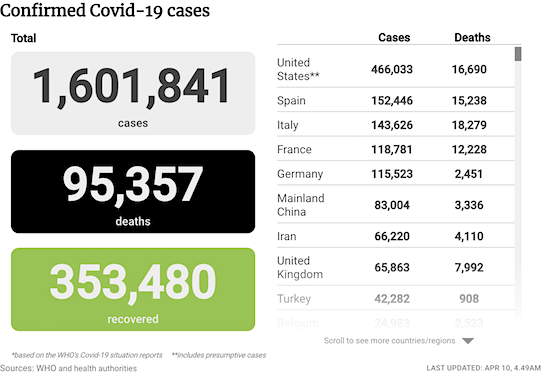

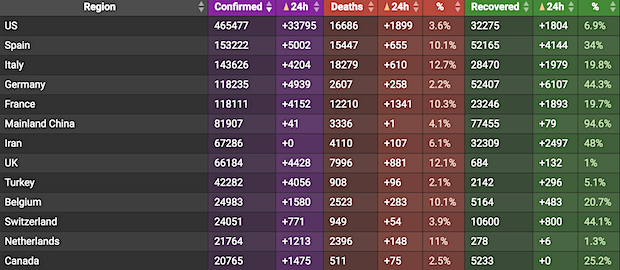

• Cases 1,615,049 (+ 85,971 from yesterday’s 1,529,078)

• Deaths 96,791 (+ 7,380 from yesterday’s 89,411)

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: mortality rate for closed cases is at 21% !– NOTE 2: the number of active cases that are critical or severe is going down. 4% now.

From SCMP:

From COVID2019Info.live:

We keep seeing articles that depict how poor our understanding of the virus is. Sometimes I even wonder how many people died from that, instead of the virus itself.

• Doctors Alarmed After Some COVID19 Patients Test Positive After Recovering (RT)

Troublesome results from South Korea and China, showing some of the patients who recovered from the coronavirus test positive again, could throw off widely accepted strategies for battling the virus, from shutdowns to vaccines. After about 50 recovered patients in the city of Daegu tested positive for Covid-19 again, the Korea Centers for Disease Control and Prevention (KCDC) launched an investigation into whether they were somehow reinfected, or if the virus had made a comeback. “While we are putting more weight on reactivation as the possible cause, we are conducting a comprehensive study on this,” said KCDC Director-General Jeong Eun-kyeong, as quoted by Bloomberg.

While reinfection would be problematic, reactivation is a more troubling prospect. In addition to raising questions about post-recovery immunity to the virus, it would pose a major challenge to mitigation strategies adopted around the world. If there is a high risk of Covid-19 reactivating among the people considered cured, that would mean longer quarantines and delays in reopening businesses and public spaces. Other possibilities include false positives, if the tests pick up residue from the initial infection, or prolonged “shedding” of the virus load missed by the tests at discharge because the levels were just under the limit.

South Korea has often been cited as one of the success stories of the pandemic, keeping the total number of infections to 10,400 and the death toll to 204, through strict quarantine, widespread testing and contact tracing measures. Further troubling news comes from China, where the novel coronavirus was first detected in December last year. A team of scientists at Fudan University analyzed blood samples from 175 patients discharged from a hospital in Shanghai and found that almost a third had “unexpectedly low” levels of antibodies, and in at least ten cases, no antibodies at all.

“Whether these patients were at high risk of rebound or reinfection should be explored in further studies,” the team said in a preliminary research paper released on Monday. While it has not been peer-reviewed or evaluated, the authors say they did the world’s first systematic examination of antibody levels in recovered Covid-19 patients. All of the people examined had recovered from mild symptoms, and most of those with low antibody levels were young, in the 15-39 age group. By contrast, the 60-85 age group had three times the amount of antibodies, the scientists said. If some patients do not develop antibodies, this could have serious implications for both vaccinations and “herd immunity.”

#SARS2019p Reactivation?

51 recovered patients test positive: reinfection, reactivation, or simple prolonged shedding at limit of detection missed by discharge testing? Critical question about immunity since countries proposing to let sero + roam free.https://t.co/At5UHQWOCh— Dr. Ali Khan (@UNMC_DrKhan) April 7, 2020

More poor understanding.

• Doctors Say Ventilators Are Overused For COVID19 (Stat)

Even as hospitals and governors raise the alarm about a shortage of ventilators, some critical care physicians are questioning the widespread use of the breathing machines for Covid-19 patients, saying that large numbers of patients could instead be treated with less intensive respiratory support. If the iconoclasts are right, putting coronavirus patients on ventilators could be of little benefit to many and even harmful to some. What’s driving this reassessment is a baffling observation about Covid-19: Many patients have blood oxygen levels so low they should be dead. But they’re not gasping for air, their hearts aren’t racing, and their brains show no signs of blinking off from lack of oxygen.

That is making critical care physicians suspect that blood levels of oxygen, which for decades have driven decisions about breathing support for patients with pneumonia and acute respiratory distress, might be misleading them about how to care for those with Covid-19. In particular, more and more are concerned about the use of intubation and mechanical ventilators. They argue that more patients could receive simpler, noninvasive respiratory support, such as the breathing masks used in sleep apnea, at least to start with and maybe for the duration of the illness. “I think we may indeed be able to support a subset of these patients” with less invasive breathing support, said Sohan Japa, an internal medicine physician at Boston’s Brigham and Women’s Hospital. “I think we have to be more nuanced about who we intubate.”

That would help relieve a shortage of ventilators so critical that states are scrambling to procure them and some hospitals are taking the unprecedented (and largely untested) step of using a single ventilator for more than one patient. And it would mean fewer Covid-19 patients, particularly elderly ones, would be at risk of suffering the long-term cognitive and physical effects of sedation and intubation while being on a ventilator. None of this means that ventilators are not necessary in the Covid-19 crisis, or that hospitals are wrong to fear running out. But as doctors learn more about treating Covid-19, and question old dogma about blood oxygen and the need for ventilators, they might be able to substitute simpler and more widely available devices.

An oxygen saturation rate below 93% (normal is 95% to 100%) has long been taken as a sign of potential hypoxia and impending organ damage. Before Covid-19, when the oxygen level dropped below this threshold, physicians supported their patients’ breathing with noninvasive devices such as continuous positive airway pressure (CPAP, the sleep apnea device) and bilevel positive airway pressure ventilators (BiPAP). Both work via a tube into a face mask. [..] because in some patients with Covid-19, blood-oxygen levels fall to hardly-ever-seen levels, into the 70s and even lower, physicians are intubating them sooner. “Data from China suggested that early intubation would keep Covid-19 patients’ heart, liver, and kidneys from failing due to hypoxia,” said a veteran emergency medicine physician. “This has been the whole thing driving decisions about breathing support: Knock them out and put them on a ventilator.”

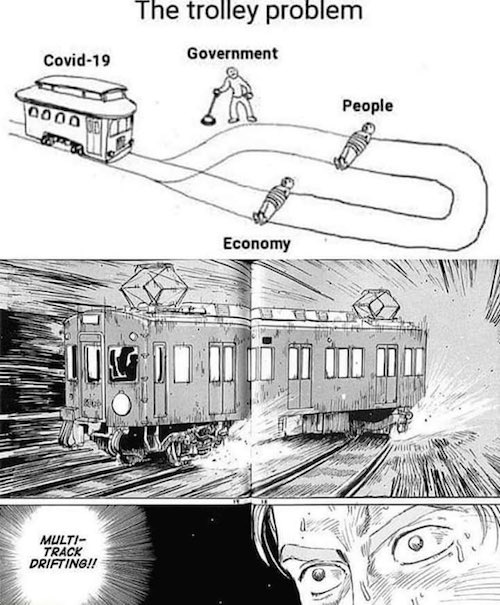

Obvious no. 1 for the government to prevent.

• Pay Cuts, Furloughs, Layoffs For Doctors, Nurses, Healthcare Workers (BI)

Medical University of South Carolina in Charleston started temporarily laying off 900 workers this week, a move it expects will last through June. Salaried employees are facing a 15% cut, and hourly workers who don’t care for patients will be working fewer hours. The hospital confirmed that workers won’t face cuts if they are treating patients with COVID-19,. Though some hourly workers already had reduced hours due to lower volume, they won’t see more cuts if they’re moved onto the COVID-19 response team, said hospital spokeswoman Heather Woolwine. The cuts at MUSC came as the hospital saw a 75% drop in surgeries, 30% fewer patients arriving at the hospital, and 70% fewer patients arriving there by ambulance. Without staffing changes, it projected a $100 million loss through June 30.

In Oklahoma, Hillcrest HealthCare System announced it is putting about 600 employees on an estimated 90-day furlough, which is a temporary layoff without pay, though some might be called back sooner if they’re needed. The furloughs affect workers in administration, surgery, and outpatient care, where patient visits have gone down, said Rachel Weaver Smith, spokeswoman for Hillcrest. About 20% of staff are facing furloughs, reassignments, or reduced hours or pay, but the changes don’t extend to staff treating people with COVID-19, Weaver Smith said.

[..] There’s no central place where hospitals are reporting all of their layoffs or how much money they’re losing. The American Hospital Association, which represents more than 5,000 hospitals, has sounded the alarm about the industry’s financial difficulties and said that quickly distributing funding from the CARES Act would help facilities keep their doors open. About $30 billion will go out in the coming days, according to Seema Verma, administrator of the Centers for Medicare and Medicaid Services, but it’s not clear when or how the rest will be distributed.

There are some 20 million people in NY State. Much less than in Spain, Italy etc.

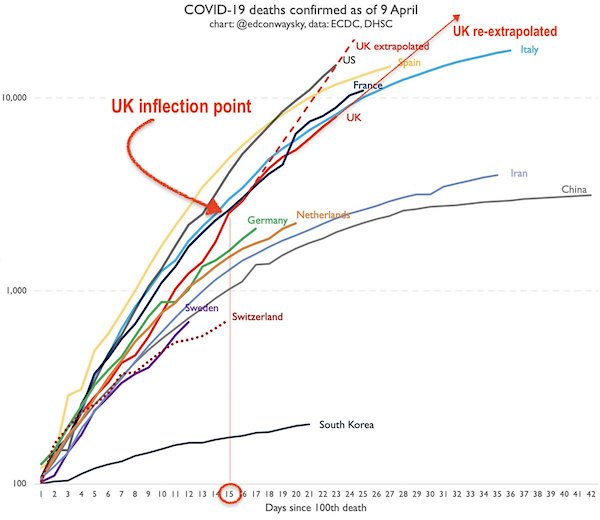

• New York Has More Cases Than Any Country (BBC)

New York state now has more coronavirus cases than any other country outside the US, according to latest figures. The state’s confirmed caseload of Covid-19 jumped by 10,000 on Thursday to 159,937, placing it ahead of Spain (153,000 cases) and Italy (143,000). China, where the virus emerged last year, has reported 82,000 cases. The US as a whole has recorded 462,000 cases and nearly 16,500 deaths. Globally there are 1.6 million cases and 95,000 deaths. While New York state leads the world in coronavirus cases, its death toll (7,000) lags behind Spain (15,500) and Italy (18,000), though it is more than double the official figure from China (3,300).

Photo: Reuters- Lucas Jackson

Photos have emerged of workers in hazmat outfits burying coffins in a mass grave in New York City. Drone footage showed workers using a ladder to descend into the huge pit where the caskets were stacked. The images were taken at Hart Island, off the Bronx, which has been used for more than 150 years by city officials as a mass burial site for those with no next-of-kin, or families who cannot afford funerals. Burial operations at the site have ramped up amid the pandemic from one day a week to five days a week, according to the Department of Corrections. Prisoners from Rikers Island usually do the job, but the rising workload has recently been taken over by contractors.

This drone footage captures NYC workers burying bodies in a mass grave on Hart Island, just off the coast of the Bronx. For over a century, the island has served as a potter’s field for deceased with no known next of kin or families unable to pay for funerals. pic.twitter.com/wBVIGlX6aK

— NowThis (@nowthisnews) April 9, 2020

Imagine you’re a country that has imposed a 2-3 month lockdown on its people, and you’re slowly getting out. Would you then invite mass numbers of untested Americans?

• Trump: Widespread Testing ‘Would Never Happen’, Not Needed To Reopen US (NW)

President Donald Trump on Thursday said a widespread COVID-19 testing program to assess whether workers can safely return to their workplaces is “never going to happen” in the United States. As he addressed reporters during the daily White House Coronavirus Task Force briefing, Trump touted the fact that 2 million Americans had been tested for the virus as a “milestone” in the U.S. fight against the global pandemic caused by SARS-Cov-2. The 2 million tests that have been administered so far represents a high water mark after weeks of problems in obtaining and administering tests caused by the Trump administration’s rejection of a test developed by the World Health Organization. However, that number means only .61 percent of the 330 million U.S. population has been tested for COVID-19.

That’s a paltry number compared to many other countries which have implemented testing programs. Italy, for example, has administered tests to approximately 1.4 percent of its population, and South Korea, which flattened its infection curve with widespread testing, has reached .9 percent of its population. Most public health experts have stressed the need for the U.S. to significantly expand its testing program, both with currently available tests to determine whether a given person is infected with SARS-Cov-2, and with so-called “antibody tests” to determine whether a person has successfully fought off the virus and is therefore immune to it.

Both varieties of test, experts say, must be administered in far greater quantities than currently being done in order to allow Americans to return to work without fear of infection, though Trump has repeatedly suggested that the U.S. could begin to emerge from social distancing measures within a few weeks. But when asked how his administration could discuss “reopening” the U.S. economy without an adequate testing program in place, Trump claimed that such a program was not just unnecessary, but was something that was simply not in the cards. “Do you need it? No. Is it a nice thing to do? Yes,” Trump said.

Social distancing works. We are all #InThisTogetherOhio. https://t.co/jU4ZAkm3Py pic.twitter.com/uKJtfi4cuP

— Ohio Dept of Health (@OHdeptofhealth) April 9, 2020

Long piece by Nafeez. I don’t know, when people spell Government with a capital G, I scratch my head.

• UK Gov’t: Keep Economy Running, We Will All Get COVID-19 Anyway (Nafeez Ahmed)

Leaked recordings of a Home Office conference call on Tuesday, exclusively obtained by Byline Times, reveal that the Government has all but given up in its fight against the Coronavirus and is intent on simply finding “a method of managing it within the population”. The recordings show Home Office Deputy Science Advisor Rupert Shute stating repeatedly that the Government believes “we will all get” COVID-19 eventually. The call further implied that the Government now considers hundreds of thousands of deaths unavoidable over a long-term period consisting of multiple peaks of the disease. While urging the importance of reducing the burden on the NHS by staying at home, Shute downplayed the risk of people contracting the virus at work.

He said: “It’s perfectly okay to carry on around your business. And it’s vitally important that you do as there’s a whole bunch of supply chains and the economy that needs to continue running… So carrying on with your normal work is not putting you in harms way anymore so than staying at home or going out shopping. So I keep coming back to this point that we are all going to get this at some point. And it’s about making sure that we have a really strong NHS there to support us when we do get sick.” The policy being communicated by the Home Office privately among Government staffers is at odds with Prime Minister Boris Johnson’s statement at a press conference three weeks ago that the next 12 weeks could “turn the tide of this disease”.

[..] A fuller analysis of leaked recordings obtained by Byline Times reveals that the Government remains committed to the idea that the vast majority of the UK population will contract COVID-19, making a minimum number of deaths inevitable, albeit over a longer period of time. Using the Government’s own lowest estimate of a fatality rate at around 0.5%, this confirms that it has resigned itself to the expectation that some 264,000 Britons will inevitably die in ensuing months and years from the disease. The recordings provide a sobering insight into how the scientific advice feeding into Government policy is evolving – without, however, being meaningfully communicated to the British public or being subjected to external scientific scrutiny.

American leaders: C’mon everybody, please stay inside. It’s important.

The Caribbean: pic.twitter.com/oopMyRT0lG

— Jemele Hill (@jemelehill) April 9, 2020

Western politicians focus on the economy, and only miles after that see anything else.

• Ex-IMF Head Economist: Western Economies Slow To React (BBC)

The coronavirus was “taken a little more lightly” by western economies compared to those in Asia, says a former IMF chief economist. Raghuram Rajan said western economies are facing a drop in economic growth by as much as 6% this year. The widespread closure of businesses is having a huge financial impact as governments prevent the virus spread. His comments come as the IMF warns the global economy faces its worst crisis since the 1930s depression. “I think in the west, partly because there hadn’t been a direct experience of a serious epidemic, it was taken a little more lightly,” Mr Rajan told the BBC’s Asia Business Report on Friday. “This is something happening in faraway lands, it’s not going to be serious here.

“It’s all too easy to point fingers after the fact but what I’m saying is that the countries in East Asia that had the experience of previous pandemics, which didn’t quite rise to the level of pandemics I should say… but previous epidemics, they took this seriously right from the get-go.” Mr Rajan, a former governor of India’s central bank, praised South Korea and Singapore as two Asian economies that have handled the virus outbreak well. For his native India, he warned that it had “limited tools” given how densely populated the country is. “It’s hard to do social distancing anywhere in the normal course. Your markets are chock-full of people. Your dwellings are chock-full of people. And so I think the government is trying to attempt to reduce the pace of increase with this lockdown.”

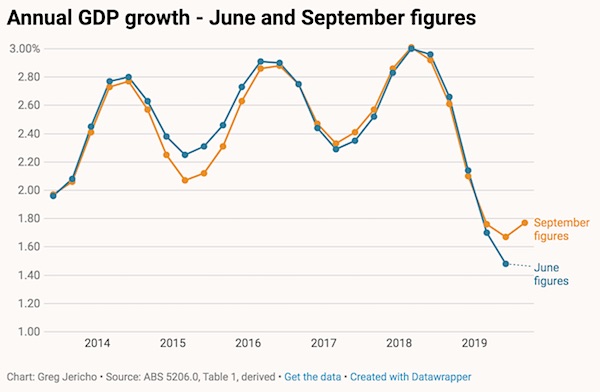

His said it was necessary to send the message to people to take this pandemic seriously. “This is not fun and games, this is really about life and death, and if it really explodes in India, we really don’t have the resources to deal with that.” The economist, who is a finance professor at the University of Chicago Booth School of Business, gave a bleak forecast for western economies as he expects them to shift from expansion to contraction. “At this point, we’re probably thinking of western countries seeing a shift in GDP growth from about 2 percentage to 3 percentage points, to negative 4 or 5 percentage points. “Each country is going to lose 5 to 6 percentage points of GDP at the very least over this year. So cumulate that, that’s significantly more than $2 trillion”.

When Iran became a major case, there were fears for Lebanon as well. But so far it’s done well.

• Americans In Lebanon Decline Repatriation Offer: ‘It’s Safer In Beirut’ (CNN)

Carly Fuglei was with a group of Danish friends in Beirut last month when she first considered moving back to the United States. They were preparing to leave Lebanon amid fears of a major coronavirus outbreak there, and tried to convince her to do the same. But the 28-year-old humanitarian consultant from Montana decided to stay. After Lebanon closed its borders on March 19 to stem the spread of the global pandemic, she began furnishing her rooftop terrace. Her time in Beirut, she realized, would be indefinite. “I made that decision for a combination of personal reasons and calculations about the virus that we’re all making,” says Fuglei. “I think that I am probably safer here.”

It’s a decision that several US citizens in Beirut who CNN spoke to have echoed, citing skyrocketing cases in the US. When the US government last week said it would fly its citizens and permanent residents to the US on a chartered flight for $2,500 per person, some Americans took to Twitter to publicly decline the offer. “And no, Mom, I’m not going,” Beirut-based freelance journalist Abby Sewell wrote in a tweet about the US embassy announcement. Responding to her tweet, a Lebanese journalist said: “For once I’m like no America is not safer than here.” Sewell’s mother, Meg Sewell, replied: “Actually, for the moment I might have to agree.” Sewell tells CNN she never considered taking the US embassy’s offer.

“From everything I’m reading, the situation is worse in the US, in terms of the number of cases, prevention measures or lack thereof, and how overburdened the health system is,” she says. “Also, since I’ve been living overseas for years, I don’t have health insurance in the US now, so if I did go back and then got sick, I would be looking at paying thousands of dollars out of pocket.” [..] Just under 12,000 tests for coronavirus have been carried out so far in Lebanon. That equates to around 0.1% of the population (by contrast, roughly 0.3% of the population in Britain, and 1.1% of the population of Germany have been tested). As a result, the ministry of public health believes it is underestimating the scale of its outbreak. It has urged more people to get tested. Lebanon’s ministry of public health has vowed to boost the number of screenings to as many as 2,000 a day. It says anyone with mild to severe symptoms is entitled to be tested.

It will take pitchforks to change this.

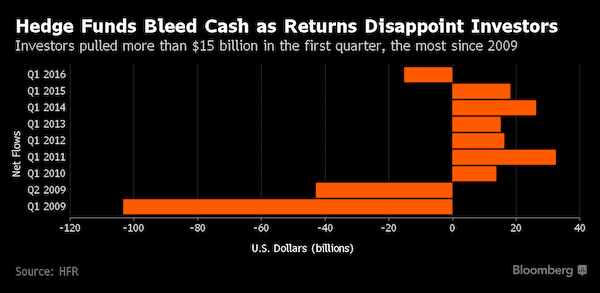

• US Shouldn’t Bail Out Hedge Funds, Billionaires – Chamath Palihapitiya (CNBC)

Chamath Palihapitiya, founder and CEO of investment firm Social Capital, told CNBC on Thursday that the U.S. shouldn’t be bailing out billionaires and hedge funds during the coronavirus pandemic. “On Main Street today, people are getting wiped out. Right now, rich CEOs are not, boards that have horrible governance are not. People are,” Palihapitiya, an early Facebook executive, said on CNBC’s “Fast Money Halftime Report.” “What we’ve done is disproportionately prop up poor-performing CEOs and boards, and you have to wash these people out.” “Just to be clear on who we are talking about. We’re talking about a hedge fund that serves a bunch of billionaire family offices, who cares? They don’t get the summer in the Hamptons?” he said.

“These are the people that purport to be the most sophisticated investors in the world.” Palihapitiya also said he was concerned that the Federal Reserve’s plans to support to economy during the COVID-19 crisis are going to have consequences. The Fed earlier in the day announced a slew of new moves aimed at getting another $2.3 trillion of financing into businesses and governments, including its Main Street business lending program and market interventions. The central bank said its loans will be geared toward businesses with up to 10,000 employees and less than $2.5 billion in revenues for 2019. Programs would total up to $2.3 trillion and include the Payroll Protection Program and other measures aimed at getting money to small businesses and bolstering municipal finances with a $500 billion lending program, it added.

But Palihapitiya said it would have been better to just give more money to Americans. “I’m not disagreeing with what the Fed has to do. What I’m saying is it’s creating a land mine, and it’s creating a bill that will have to come due,” he said. “It would be better for the Fed to have given half a million to every man, woman and child in the United States,” he added.

The U.S. shouldn’t bail out billionaires and hedge funds during the coronavirus pandemic, Social Capital CEO Chamath Palihapitiya says. “Who cares? Let them get wiped out.” https://t.co/dIbizumtqG pic.twitter.com/u8BSVvr0B1

— CNBC (@CNBC) April 9, 2020

“For years, we have been excluded from international organisations, and we know better than anyone else what it feels like to be discriminated against and isolated..”

• WHO Chief And Taiwan In Row Over ‘Racist’ Comments (BBC)

A row has erupted after the chief of the World Health Organization (WHO) accused Taiwan’s leaders of spearheading personal attacks on him. WHO chief Tedros Adhanom Ghebreyesus said he had been subjected to racist comments and death threats for months. But President Tsai Ing-wen said Taiwan opposed any form of discrimination, and invited Dr Tedros to visit the island. Taiwan said it had been denied access to vital information as the coronavirus spread. The WHO rejects this. Taiwan is excluded from the WHO, the United Nations health agency, because of China’s objections to its membership. The Chinese Communist Party regards Taiwan as a breakaway province and claims the right to take it by force if necessary. The WHO has also been criticised by US President Donald Trump, who has threatened to withdraw US funding to the agency.

Dr Tedros said he had been at the receiving end of racist comments for the past two to three months. “Giving me names, black or negro,” he said. “I’m proud of being black, or proud of being negro.” He then said he had received death threats, adding: “I don’t give a damn.” The WHO chief said the abuse had originated from Taiwan, “and the foreign ministry didn’t disassociate” itself from it. But Ms Tsai said Taiwan was opposed to discrimination. “For years, we have been excluded from international organisations, and we know better than anyone else what it feels like to be discriminated against and isolated,” Reuters news agency quoted her as saying. “If Director-General Tedros could withstand pressure from China and come to Taiwan to see Taiwan’s efforts to fight Covid-19 for himself, he would be able to see that the Taiwanese people are the true victims of unfair treatment.”

Many countries will follow. Big shift.

• Japan Will Pay Its Firms to Leave China, Relocate Production (N18)

Japan is willing to fund its companies to shift manufacturing operations out of China, Bloomberg has reported as the disruptions caused to production by the coronavirus pandemic has forced a rethink of supply chains between the major trading partners. As part of its economic stimulus package, Japan has earmarked $2.2 billion to help its manufacturers shift production out of China. Of this amount, 220 billion yen ($2 billion)is for companies shifting production back to Japan and 23.5 billion yen for those seeking to move production to other countries. China is Japan’s biggest trading partner under normal circumstances, but imports from China have slumped by almost half in February due to lockdowns to curb the spread of the virus hitting manufacturing and the supply chain.

Shinichi Seki, an economist at the Japan Research Institute, predicted that there would be a shift in the coming days as there already was renewed talk of Japanese firms reducing their reliance on China as a manufacturing base. “Having this in the budget will definitely provide an impetus,” he told Bloomberg. Companies, such as car makers, which are manufacturing for the Chinese domestic market, will likely stay put, he said. The Japanese government’s panel on future investment had last month discussed the need for manufacturing of high-added value products to be shifted back to Japan, and for production of other goods to be diversified across Southeast Asia. More than 37 per cent of the 2,600 companies surveyed by Tokyo Shoko Research Ltd. in February had also said they were diversifying procurement to places other than China amid the coronavirus crisis.

Someone mentions the D word!.

• China Factory Gate Deflation Deepens (R.)

China’s factory gate prices fell the most in five months in March, with deflation deepening and set to worsen in coming months as the economic damage wrought by the coroanvirus outbreak at home and worldwide shuts down many countries. The world’s second-largest economy is trying to restart its engines after weeks of near paralysis to contain the pandemic that had severely restricted business activity, flow of goods and the daily life of people. Friday’s data from the National Bureau of Statistics suggested a durable recovery was some way off, with China’s producer price index (PPI) falling 1.5% from a year earlier, the biggest decline since October last year. It compared with a median forecast of a 1.1% fall tipped by a Reuters poll of analysts and a 0.4% drop in February.

Headline consumer inflation also eased somewhat last month, partly led by government control measures, while core prices remained benign, leaving more room for monetary easing, some analysts said. The overall decline in the factory gate gauge was exacerbated by a slump in global oil and commodities prices, which filtered through to crude oil, steel and non-ferrous metal industries, the statistics bureau said in a statement accompanying the data. “The issue of having more supply than demand, and persistently low oil prices, will intensify deflationary pressures,” said Yang Yewei, a Beijing-based analyst with Southwest Securities.

3 different articles on “How Greece Did It” today, This one from Al Jazeera, others are the Independent and an op-ed at Bloomberg.

• How Greece Flattened The Coronavirus Curve (AlJ)

When Greece cancelled carnival celebrations in late February, many people thought the measure excessive. In the western city of Patra, which hosts Greece’s most flamboyant carnival parade, thousands defied the ban and took to the streets. “The government has ordered an end to all municipal activities … but this is a private enterprise. No one can shut it down,” said a jubilant reporter for the local Ionian TV in front of a crew dressed up as 17th-century French courtiers. “They’re gathering here on St George’s Square, where the [Greek] revolution began in 1821, and that’s symbolic,” he said. Greeks quickly put their revolutionary spirit aside, however, and largely heeded government advice to remain indoors. The result has been a remarkably low number of deaths – 81 by Tuesday, compared to more than 17,000 in neighbouring Italy.

Even adjusted for population sizes, Italy’s fatality rate is almost 40 times greater. Compared with other European Union members, too, Greece has fared better. Its fatalities are far lower than in Belgium (2,035) or the Netherlands (1,867), which have similar populations, but a much higher GDP. “State sensitivity, co-ordination, resolve, swiftness, seem not to be matters of economic magnitude,” Prime Minister Kyriakos Mitsotakis recently told a pared-down session of parliament. “Our schools closed before we had the first fatality. Most countries followed a week or two later, after they had mourned the loss of dozens,” he said.

George Pagoulatos, a political economist who heads the Hellenic Foundation for European and Foreign Policy (ELIAMEP), a think-tank, agrees that the government displayed “a very professional, managerial approach early on”, albeit largely dictated by inherent national weaknesses. Greece had very shallow resources with which to tackle a large outbreak. A decade of austerity saw its national healthcare expenses cut by three-quarters. Its intensive care beds numbered just 560 last month, though the government has now raised that to 910, and hired more than 4,000 extra doctors and nurses. Another weakness is that at least a quarter of Greece’s population is over 60, and elderly patients have been deemed particularly at risk from coronavirus.

All this has meant that a forward line of defence was Greece’s only real defence – but it has paid off. Greece is using only a tenth of its ICU beds, and has plenty of capacity left over.

Put pressure on Mexico but not the US. BAU.

• Saudi Energy Minister Says OPEC+ Oil Pact Hinges On Mexico Joining (R.)

Saudi Arabia’s energy minister said on Friday that a final OPEC+ oil supply pact to reduce 10 million barrels per day (bpd), which was agreed on Thursday, hinges on Mexico joining in the cuts. OPEC, Russia and other allies, a group known as OPEC+, outlined plans on Thursday to cut their oil output by more than a fifth, but said a final agreement was dependent on Mexico signing up to the pact after it balked at the production cuts it was asked to make. Discussions among top global energy ministers will resume on Friday. “I hope (Mexico) comes to see the benefit of this agreement not only for Mexico but for the whole world. This whole agreement is hinging on Mexico agreeing to it,” Prince Abdulaziz bin Salman told Reuters by telephone.

Global fuel demand has plunged by around 30 million bpd, or 30% of global supplies, as steps to fight the coronavirus have grounded planes, cut vehicle usage and curbed economic activity. The kingdom will host an extraordinary meeting by video conference at 12.00 GMT on Friday for energy ministers from the Group of 20 major economies. Asked about other countries such as the United States, Canada and Brazil joining the OPEC+ cut pact, Prince Abdulaziz said: “They will do it in their own way, using their own approaches, and it is not our job to dictate to others what they could do based on their national circumstances.” [..] The planned output curbs by OPEC+ amount to 10 million bpd, or 10% of global supplies, with another 5 million bpd expected to come from other nations, according to sources, to help deal with the deepest oil crisis in decades.

Shale outdid subprime in sheer craziness.

• US Banks Prepare To Seize Energy Assets As Shale Boom Goes Bust (R.)

Major U.S. lenders are preparing to become operators of oil and gas fields across the country for the first time in a generation to avoid losses on loans to energy companies that may go bankrupt, sources aware of the plans told Reuters. JPMorgan Chase, Wells Fargo, Bank of America and Citigroup are each in the process of setting up independent companies to own oil and gas assets, said three people who were not authorized to discuss the matter publicly. The banks are also looking to hire executives with relevant expertise to manage them, the sources said. The banks did not provide comment in time for publication. Energy companies are suffering through a plunge in oil prices caused by the coronavirus pandemic and a supply glut, with crude prices down more than 60% this year.

Although oil prices may gain support from a potential agreement Thursday between Saudi Arabia and Russia to cut production, few believe the curtailment can offset a 30% drop in global fuel demand, as the coronavirus has grounded aircraft, reduced vehicle use and curbed economic activity more broadly. Oil and gas companies working in shale basins from Texas to Wyoming are saddled with debt. The industry is estimated to owe more than $200 billion to lenders through loans backed by oil and gas reserves. As revenue has plummeted and assets have declined in value, some companies are saying they may be unable to repay.

Whiting Petroleum Corp became the first producer to file for Chapter 11 bankruptcy on April 1. Others, including Chesapeake Energy Corp, Denbury Resources Inc and Callon Petroleum Co, have also hired debt advisers. If banks do not retain bankrupt assets, they might be forced to sell them for pennies on the dollar at current prices. The companies they are setting up could manage oil and gas assets until conditions improve enough to sell at a meaningful value.

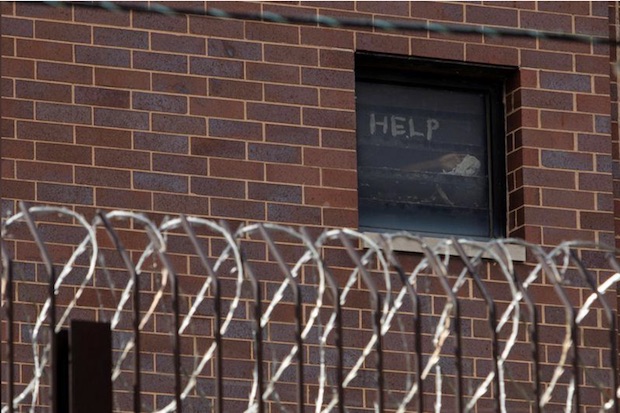

A whole bunch of scared people together in not very much space.

• Chicago Jail Reports 450 Coronavirus Cases Among Staff, Inmates (R.)

Some 450 inmates and staff have tested positive for coronavirus at Chicago’s largest jail, county corrections officials said on Thursday, representing one of the nation’s largest outbreaks of the respiratory illness at a single site so far in the pandemic. The surge of cases at Cook County Jail marks the latest flare-up of COVID-19 at jails and prisons in major cities across the United States, where detainees often live in close quarters. The situation gained national attention earlier this week when inmates posted handmade signs pleading for help in the windows of their cells overlooking a public street. “Sheriff’s officers and county medical professionals are aggressively working round-the-clock to combat the unprecedented global coronavirus pandemic,” the Cook County Sheriff’s Office said in a written statement on Thursday.

Those measures include opening an off-site 500-bed “quarantine and care facility” for prisoners, an effort to move as many inmates as possible from double to single cells, and the opening of a testing site at the jail. “Front line” staff members were being checked for fever at the start of each shift and issued protective equipment if they interact with inmates, according to the sheriff’s department.[..] In Monroe, Washington, inmates at a minimum-security prison vandalized the facility in a protest on Wednesday evening after officials announced that six prisoners had tested positive for COVID-19, according to Washington state’s Department of Corrections. State and local police and corrections officers quelled the disturbance at the prison 24 miles northeast of Seattle using pepper spray, sting balls and rubber pellets, the corrections department said.

Signs made by prisoners pleading for help in a window of Cook County Jail in Chicago, Illinois, U.S., April 9, 2020 REUTERS/Jim Vondruska

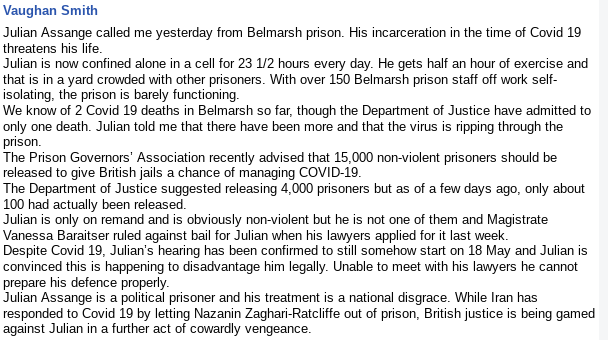

“More than 150 Belmarsh guards are in self-isolation and the prison is barely functioning..”

• Assange Not Infected But Says Many in Belmarsh Are (CN)

Julian Assange has told a friend in a telephone conversation on Wednesday that he is living in a prison in which the coronavirus is “ripping through” the population. He told photojournalist Vaughan Smith, founder of London’s Frontline Club, that he is isolated 23 1/2 hours a day and spends 30 minutes in a prison yard packed with other inmates. More than 150 Belmarsh guards are in self-isolation and the prison is barely functioning, Smith said. Assange did not show up for a video link to his case management hearing at Westminster Magistrate’s Court on Tuesday. A court official was overheard by three people present in the courtroom saying that Assange was “unwell.” He is not infected with Covid-19, but Vaughan says his life is threatened by it in prison.

“Nearly every war that has started in the past 50 years has been a result of media lies.”

Julian Assange, who’s suffering from a chronic lung condition, is in grave danger as the #COVIDー19 is raging in Belmarsh prison. And corporate media is silent.pic.twitter.com/v11ltYTaJv

— Sarah Abdallah (@sahouraxo) April 9, 2020

It must be possible to run the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of the process.

Thanks everyone for your generous donations.

Sound on.

Some sports are slower. More about the strategy. pic.twitter.com/JMBaGJ1tSd

— Andrew Cotter (@MrAndrewCotter) April 9, 2020

Support the Automatic Earth. It’s good for your mental health.