Salvador Dalí Cadaques 1923

“More than a dead cat bounce?!”

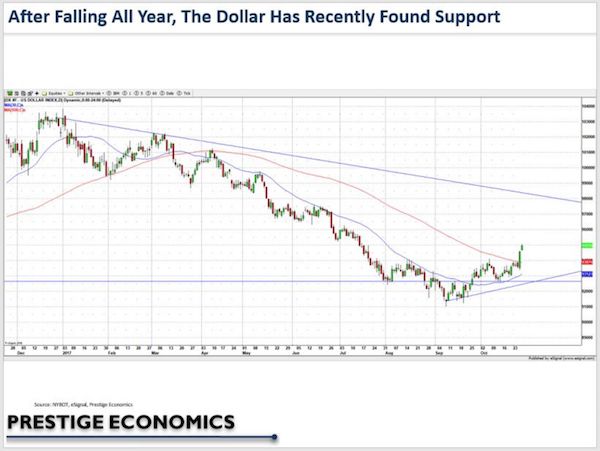

• The Dollar’s Enjoying a Renaissance (BBG)

After getting pummeled all year by the euro, the dollar is having a moment. In Wall Street parlance, it may be more than just a dead-cat bounce, as politics, economic fundamentals and technicals have converged to give the greenback a boost. The U.S. currency surged in the immediate aftermath of Donald Trump’s election victory before suffering a long descent that lasted from December until last month. That’s when the political viability of U.S. fiscal policy reform in the shape of – as yet to be detailed – tax cuts (and maybe even tax reform) became increasingly likely. Although equity markets have reflected optimism all year that tax cuts would come, the dollar has conveyed doubt along with gold and bonds. The Bloomberg Dollar Index is up more than 4% from its low for the year on Sept. 8, partially rebounding from the more than 10% drop since the end of December.

There could be more to come in the short term if tax cuts happen, because the legislation is likely to contain a provision that would allow U.S. companies to repatriate significant foreign profits and further bolster the economy. That could spark more inflation and put U.S. monetary policy on a more aggressive path. In terms of the euro, the political situation in Europe has been a distraction. After the election of the far-right Alternative for Germany party to the Bundestag on Sept. 24, the independence movement in the Spanish autonomous region of Catalonia has devolved into a political rat’s nest. Uncertainty, regionalism and the risk of escalating discord in Spain are adding to the political dissonance – a stark contrast to the apparent acceptance of U.S. Senate Republicans of higher national debt levels in exchange for tax cuts.

Lots of Bloomberg today. After the Party Congress, things start to look very different. Stocks and bonds both under a lot of pressure.

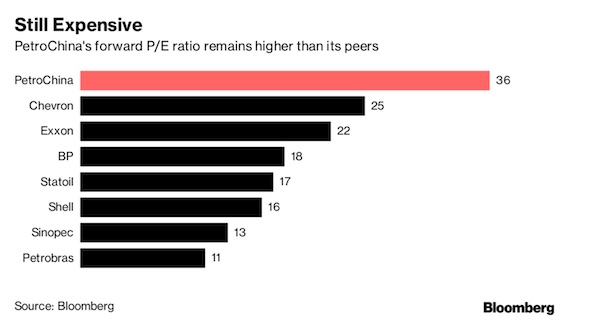

• Biggest Stock Collapse in World History Has No End in Sight (BBG)

It’s going to take more than the biggest stock slump in world history to convince analysts that PetroChina has finally hit bottom. Ten years after PetroChina peaked on its first day of trading in Shanghai, the state-owned energy producer has lost about $800 billion of market value – a sum large enough to buy every listed company in Italy, or circle the Earth 31 times with $100 bills. In current dollar terms, it’s the world’s biggest-ever wipeout of shareholder wealth. And it may only get worse. If the average analyst estimate compiled by Bloomberg proves right, PetroChina’s Shanghai shares will sink 16% to an all-time low in the next 12 months.

The stock has been pummeled by some of China’s biggest economic policy shifts of the past decade, including the government’s move away from a commodity-intensive development model and its attempts to clamp down on speculative manias of the sort that turned PetroChina into the world’s first trillion-dollar company in 2007. Throw in oil’s 44% drop over the last 10 years and Chinese President Xi Jinping’s ambitious plans to promote electric vehicles, and it’s easy to see why analysts are still bearish. It doesn’t help that PetroChina shares trade at 36 times estimated 12-month earnings, a 53% premium versus global peers. “It’s going to be tough times ahead for PetroChina,” said Toshihiko Takamoto, a Singapore-based money manager at Asset Management One, which oversees about $800 million in Asia. “Why would anyone want to buy the stock when it’s trading for more than 30 times earnings?”

No mincing words.

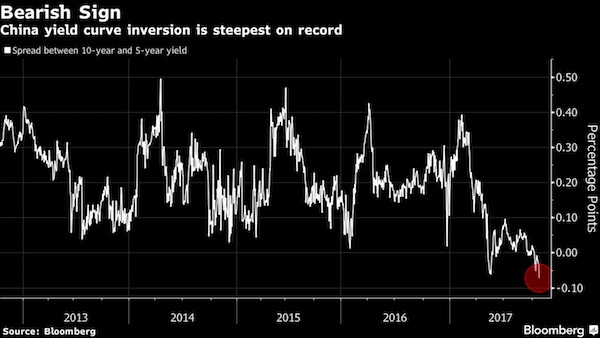

• China’s Bonds Spell Disaster (BBG)

Qin Han, chief fixed-income analyst at Guotai Junan Securities, doesn’t mince his words when it comes to the rout in Chinese bonds. “Considering the pace of the slump, which is very fast, it’s fair to say we are likely in a bond disaster,” Qin said. Shorter-tenor notes led the selloff in government debt on Monday, making the yield curve inversion the steepest since at least 2006, according to data compiled by Bloomberg. Concern that rising borrowing costs and inflation will erode returns have weighed on the debt market in the past month, with one top-performing macro fund manager saying he was shorting Chinese bonds.

The yield on five-year government bonds surged nine basis points to 3.97% as of 1:29 p.m. in Shanghai, while the cost on 10-year notes jumped six basis points to 3.9%, with the spread reaching eight basis points earlier Monday. The yield gap will widen further, and the cost on debt due in a decade will likely reach 4% “very soon,” said Qin. “The yield will become even more inverted as fragile sentiment prevails,” he said. “Yes, this is overselling, but it’s not the time to buy yet as the overselling could last longer.”

It’s not just China that’s affected.

• China’s Debt Battle Has Global Growth at Stake (BBG)

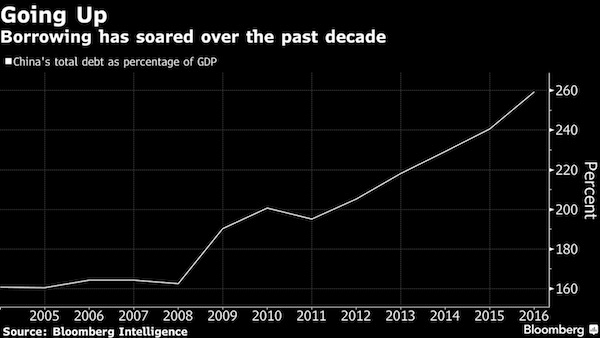

It used to be that when America sneezed, the world caught a cold. This time around, it’s the risk of a sickly China that poses a bigger threat. The world’s second-largest economy is now trying to ward off the sniffles. While output is still growing at a pace that sees GDP double every decade, the problem remains that much of that has been fueled by a massive buildup of credit. Total borrowing climbed to about 260% of the economy’s size by the end of 2016, up from 162% in 2008, and will hit close to 320% by 2021 according to Bloomberg Intelligence estimates. Economy-wide debt levels are on track to rank among “the highest in the world,” according to Tom Orlik, BI’s Chief Asia Economist. That path may be what prompted outgoing People’s Bank of China Governor Zhou Xiaochuan to warn of the risk of a plunge in asset values following a debt binge, or a “Minsky Moment,” earlier this month.

Given that China is forecast by the International Monetary Fund to contribute more than a third of global growth this year, controlling China’s debt matters far beyond its borders. There are two key components of China’s credit clampdown, each posing challenges to policy makers. First is wringing out bets on property prices. As President Xi Jinping put it in a keynote policy speech to the Communist Party leadership on Oct. 18: Housing is for living in, not for speculation. The latest data show that in some areas, prices are still surging in many cities despite a raft of measures to make it harder for investors to buy real estate with borrowed money. Xi’an, China’s ancient capital, saw home values soar almost 15% in September from a year before. It will be up to regulators to come up with measures that deliver on Xi’s mandate without tipping housing into a downward spiral.

Property crashes in the U.S., Japan and U.K. over the past three decades amply illustrated how damaging they can be to economies. The second key challenge is progress in aligning borrowing costs with borrowers’ ability to repay — rather than with their relationship with the state. China’s financial system has long let companies that are state owned or are seen to be implementing state initiatives get funding more cheaply than others. That’s thanks to the assumption the government would step in if needed to back them up. To help encourage capital to be deployed more efficiently – and to prevent firms that are effectively insolvent keep going thanks to continued funding – policy makers have begun to gradually take away implicit support.

“A majority of non-bank financial institutions’ debt holdings are corporate bonds, so their selloff can lead to severe consequences..”

• China Corporate Bond Investors’ Luck May Be About to Run Out (BBG)

Investors in Chinese company bonds have so far avoided the brunt of a debt selloff that’s driven 10-year sovereign yields to the highest in three years. Their luck may be about to run out. Now that the Communist Party Congress is over, China’s bond holders may be about to get hit by “daggers falling from the sky,” said Huachuang Securities Co., referring to aggressive deleveraging policies. Plus, accelerating inflation and the risk that China’s central bank may follow the Federal Reserve in raising borrowing costs are casting a shadow over the entire bond market. That all means that the situation that’s existed for most of 2017 – sovereign yields rising, and corporate debt remaining relatively resilient – is at risk of cracking. As appetite for bonds of any kind dwindles and authorities roll out measures that target higher-risk investments, company securities are in the line of fire.

“It’s very likely we will see a significant increase in corporate yields in the coming year,” said David Qu, a market economist at Australia & New Zealand Banking in Shanghai. “The trigger could be tougher regulations or a default. A majority of non-bank financial institutions’ debt holdings are corporate bonds, so their selloff can lead to severe consequences. Banks are underestimating authorities’ intentions to tighten regulations.” Signs of a turnaround are already beginning to show, with the yield on three-year AAA notes – the most common grading for Chinese corporate debt – rising 21 basis points this month to the highest level since early June. The spread between those notes and government debt has climbed in October and was last at 116 basis points, though it’s still a long way from this year’s peak of 150 basis points in April.

Losses accelerated earlier this month after People’s Bank of China Governor Zhou Xiaochuan voiced concern about high borrowing levels and signaled that growth could beat expectations. If concerns on regulation intensify and risks of a debt repayment failure appear, the market may go through a major correction in the near term, Huachuang analysts including Qu Qing wrote in a note last week.

How far will Xi go? Is that big yuan devaluation still in play?

• China Bond Selloff Spreads to Stocks as Deleveraging Risks Mount (BBG)

Chinese stocks fell the most since early August, breaking the calm that persisted through the recent Communist Party Congress, as government bonds extended a monthly rout amid concern the government will step up efforts to reduce leverage in the financial sector. The Shanghai Composite Index dropped as much as 1.7% on Monday, and was 0.8% lower at 11:27 a.m. local time. Small-cap shares bore the brunt of the selling, with the ChiNext gauge tumbling as much as 2.5%. Equity indexes in Hong Kong pared gains. The 10-year yield climbed five basis points to 3.90%, a three-year high. While China’s equity market was subdued for most of this month amid state efforts to limit volatility during the twice-a-decade Party gathering, sovereign yields have been climbing.

There’s more than 1 trillion yuan ($150 billion) of funding provided by the central bank that matures this week, the most since February. “Pessimism in the bond market is spilling over to the stocks,” said Hao Hong, chief China strategist at Bocom International Holdings Co. in Hong Kong. “Surging yields of the government bonds are resulting in worsened sentiment and higher funding costs for companies, of which smaller ones will suffer most as they rely more heavily on the market rather than bank loans for financing.” There are also early signs economic data may weaken, after solid figures for most of this year buoyed equities. Chinese shares held steady during the week-long Congress amid speculation the “National Team,” as state-backed funds are referred to, would step in to avoid any large swings.

Yeah, that sounds great. Wells Fargo should be shut down and its execs put on trial.

• US Regulator Wants To Loosen Leash On Wells Fargo (R.)

A leading U.S. regulator wants to make it easier for Wells Fargo to pay employees when they leave, loosening a restriction in place since a phony accounts scandal hit the bank last year, according to people familiar with the matter. The initiative comes as President Donald Trump is trying to lighten rules on Wall Street and the bank regulator, Keith Noreika, acting Comptroller of the Currency (OCC), must weigh whether to vet new Wells Fargo executives. If Noreika’s approach prevails, the OCC could go easier on Wells Fargo and any other large banks sanctioned in the future. Since Noreika took control of the OCC in May, he has advocated easing up on sanctions imposed on Wells Fargo in the wake of the scandal over abusive sales practices, according to current and former officials.

Wells Fargo reached a $190 million settlement in September 2016 after admitting that its sales staff opened as many as 2.1 million accounts without customers’ consent. Since then the estimate has climbed to as many as 3.5 million. As part of the deal with regulators, incoming Wells Fargo executives can face a vetting from the OCC while severance payouts must be cleared by the OCC and a sister agency, the Federal Deposit Insurance Corporation. But Noreika wants officials to work faster when they review severance pay and the agency can choose to waive its check on incoming executives. Hundreds of Wells Fargo employees have had their severance payouts frozen when they left as regulators tried to determine what role those employees might have had in the scandal.

High time for the Tories to leave.

• Damning Verdict On UK Austerity In Major Report (Ind.)

Despite years of painful austerity, the UK’s level of public spending is today no lower as a share of national income than it was after 11 years of a Labour government in 2008, according to a report by the Institute for Fiscal Studies. The major report from the UK’s leading economic think tank shows that deep cuts have left the NHS, schools and prisons in a “fragile state”, and have merely returned public spending to pre-financial crisis levels. The document presents a challenge to claims that Conservative-driven austerity saved the public finances following years of Labour overspending. The think tank’s report goes on to conclude that in the light of the data, Chancellor Philip Hammond’s plan to abolish the UK’s deficit by the mid-2020s is “no longer sensible”.

With his critical Budget approaching in November, it challenges him to admit the target looks “increasingly unlikely” in the light of a worsening economic outlook, exacerbated by Britain’s “terrible” productivity and uncertainty over Brexit. The IFS analysis of public spending levels appears in its pre-Budget look at the Chancellor’s options published on Monday. It found public spending as a share of national income was at a similar level both now and shortly before the financial crash, an event David Cameron and George Osborne claimed Labour overspending left the country ill-prepared for. In 2007-08, public spending as a share of GDP was 39%, it peaked in 2009-10 at 45.1% and is forecast to be 39.6% this year, according to the IFS.

The main justification for austerity has been the need to reduce and eventually abolish the deficit, a target that the IFS refers to as “ever-receding”. The IFS argues Mr Hammond’s critical budget speech next month, will be given against a backdrop of a worsening economic outlook that demands austerity goals are rethought. [..] The IFS report said: “It looks like [Mr Hammond] will face a substantial deterioration in the projected state of the public finances. “He will know that seven years of ‘austerity’ have left many public services in a fragile state. And, in the known unknowns surrounding both the shape and impact of Brexit, he faces even greater than usual levels of economic uncertainty.”

Armies. The only answer we have.

• Plan To Create $400 Million Army in Sahel Faces UN Moment Of Truth (G.)

Unprecedented plans to combat human trafficking and terrorism across the Sahel and into Libya will face a major credibility test on Monday when the UN decides whether to back a new proposed five-nation joint security force across the region. The 5,000-strong army costing $400m in the first year is designed to end growing insecurity, a driving force of migration, and combat endemic people-smuggling that has since 2014 seen 30,000 killed in the Sahara and an estimated 10,000 drowned in the central Mediterranean. The joint G5 force, due to be fully operational next spring and working across five Sahel states, has the strong backing of France and Italy, but is suffering a massive shortfall in funds, doubts about its mandate and claims that the Sahel region needs better coordinated development aid, and fewer security responses, to combat migration.

The Trump administration, opposed to multilateral initiatives, has so far refused to let the UN back the G5 Sahel force with cash. The force commanders claim they need €423m in its first year, but so far only €108m has been raised, almost half from the EU. The British say they support the force in principle, but have offered no funds as yet. Western diplomats hope the US will provide substantial bilateral funding for the operation, even if they refuse to channel their contribution multilaterally through the UN. France, with the support of the UN secretary general, António Guterres, and regional African leaders, has been pouring diplomatic resources into persuading a sceptical Trump administration that the UN should financially back the force.

With a straight face. But the refugees must stay on the islands, even if there’s no place for them.

• Greek Islanders Are ‘Heroes,’ Says European Commission VP (K.)

The Greek islanders in the eastern Aegean who have helped thousands of refugees under adverse conditions are “heroes,” according to the European Commission’s First Vice President Frans Timmermans. In an interview with Sunday’s Kathimerini ahead of his visit to Greece on Monday, Timmermans said that, despite being under immense pressure, the mayors and residents of the islands are doing everything in their power to help refugees.Timmermans, who has described the situation on the islands as “unacceptable,” expressed concern over the difficulty the Greek government has in absorbing EU funds – around €1 billion – for infrastructure to shelter some 50,000 refugees.

“We are faced with a series of problems,” he said, adding that that the Commission’s experience “has shown that it’s hard to get the support we provide in the spot where it is needed most.” Timmermans, who was one of the main architects of last year’s deal between the EU and Turkey to stem the flow of migrants into Europe, said that people whose asylum applications have been processed should be returned to Turkey as stipulated in the agreement. But with just 1,600 returns having taken place since 2016, Timmermans said that “this doesn’t happen enough.” He refrained from placing blame on either Greece or Turkey but insisted that the system must not be changed. Migrants, he said, must stay on the islands, despite the difficulties, because their transfer to the mainland would send a wrong message and create a new wave of arrivals.

” If the success of a civilisation is judged by its endurance over time, this means the Khoisan are by far the most successful, stable and sustainable civilisation in human history.”

• Bushman Banter’ Was Crucial To Hunter-Gatherers’ Evolutionary Success (G.)

Barely a day goes by when proponents of greater taxation, universal income and other initiatives aimed at addressing systematic inequality are not accused of inciting the “politics of envy”. Doing so is an effective way of closing down debate; envy is, after all, among the deadliest of the “deadly sins”. Yet politicians inclined to dismiss inequality in this way may do so at their peril. For the evidence of our hunting and gathering ancestors suggests we are hard-wired to respond viscerally to inequality. In the 1960s, the Ju/’hoansi “Bushmen” of the Kalahari desert became famous for turning established views of social evolution on their head. But their contribution to our understanding of the human story is far more important than simply making us rethink our past.

Until then, it had been widely believed that hunter gatherers endured a near-constant battle against starvation. But when a young Canadian anthropologist, Richard B Lee, conducted a series of simple economic input-output analyses of the Ju/’hoansi as they went about their daily lives, he found not only did they make a good living from hunting and gathering, but they did so on the basis of only 15 hours’ work per week. On the strength of this, anthropologists redubbed hunter-gatherers “the original affluent society”. I started working with Ju/’hoansi in the early 1990s. By then, more than a half-century of land dispossession meant that, other than in a few remote areas, they formed a highly marginalised underclass eking out a living on the dismal fringes of an ever-expanding global economy. I have been documenting their often traumatic encounters with modernity ever since.

The importance of understanding how hunter-gatherers made such a good living has only recently come to light, thanks to a sequence of genomic studies and archaeological discoveries. These show that the broader Bushmen population (referred to collectively as Khoisan) are far older than we had ever imagined, and have been hunting and gathering continuously in southern Africa for well over 150,000 years. If the success of a civilisation is judged by its endurance over time, this means the Khoisan are by far the most successful, stable and sustainable civilisation in human history.