Elliott Erwitt Waiting for a Streetcar in Downtown Pittsburgh 1950

Paul’s just guessing on the numbers, but the risks are obvious. And Trump will be blamed anyway.

• Ron Paul: 50% Stock Market Plunge ‘Conceivable,’ But Not Trump’s Fault (CNBC)

Ron Paul’s sell-off prediction just got more severe. The former Republican Congressman from Texas believes escalating dysfunction in Washington will create even more pain for Wall Street. “A 50% pullback is conceivable,” Paul said on “Futures Now” recently. “I don’t believe it’s ten years off. I don’t even believe it’s a year off. ” According to his calculations, it would cut the S&P 500 Index in half, to 1212, and the blue-chip Dow Jones Industrial Average would collapse to 10,837. Paul noted that there’s a lot of chaos in Washington right now, with an “unpredictable president” and those who are inclined to “tear him apart” but if the market takes that big of a tumble, he doesn’t see it as Trump’s fault.

“It’s all man-made. It’s not the fault of Donald Trump in the last week. If the market crashes tomorrow and we have a great depression, he didn’t do it in six months. It took more like six or ten years to cause all these problems that we’re facing,” he said. What’s more, it would come at the expense of businesses who are counting on reforms such as tax cuts and fewer regulations, according to Paul. Paul, who is also known for his presidential runs, originally made his case for a somewhat more benign 25% downturn on June 29 on “Futures Now.” He argued Wall Street is overestimating the strength of the economy, and the Federal Reserve kept interest rates too low for too long. He said the situation for stocks could turn ugly as soon as October. Stocks will try to bounce back on Monday from multiple losing weeks in a row. The Nasdaq just saw its fourth consecutive week of losses. Meanwhile, the Dow & S&P 500’s losing streak now sits at two weeks.

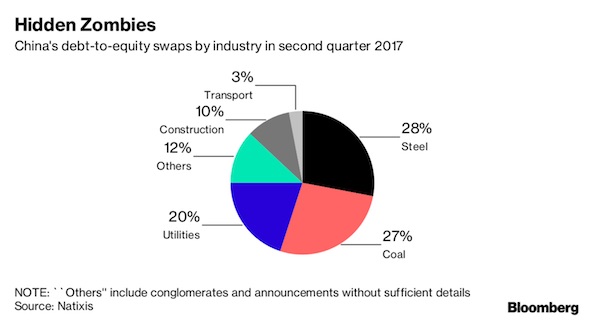

China’s way of propping up coal and steel. Too big to fail.

• Zombies Propped Up As China’s Debt Swaps Surpass $100 Billion (BBG)

Almost a year after China rolled out steps to rein in soaring corporate leverage, concerns are rising that undeserving companies are benefiting while households are getting saddled with risks. China unveiled guidelines for debt-to-equity swaps in October, part of measures to trim the world’s biggest corporate debt loads. The idea was that healthy firms would use the program to cut interest-bearing borrowings, while bloated companies would be shunned. But it hasn’t always worked out that way, even as the total value of swaps reached 776 billion yuan ($116 billion) in the second quarter when volumes jumped to a record, according to Natixis. While China’s State Council said in October that zombie firms may not take part, 55% of the swaps last quarter were in the coal and steel industries, which are plagued by overcapacity, Natixis says.

The stakes are high for lenders and even individual investors, some of whom buy wealth management products repackaged from the swaps. The absence of a clear definition of “zombie” is part of the problem, according to Fitch Ratings. Views vary on whether further guidelines on the program released this month by the banking regulator will help address these issues. The program is attracting bad companies because they see debt-to-equity swaps as a way to get a bailout, said Chi Lo, Greater China senior economist at BNP Paribas Asset Management. “You can imagine the zombie companies will be just like cancer cells that eat into the system.”

The swaps generally work like this: A bank agrees to take over a company’s debt from its original lenders. The bank sets up a unit which has other shareholders that help share risk. The unit assumes the debt and conducts a transaction with the company to convert it into equity. It can then dispose of the stake. In the most recent draft guidelines released earlier this month by the China Banking Regulatory Commission, a bank is required to own no less than a 50% stake in the unit conducting the swaps. The guidelines also say that the units can sell bonds and borrow from the interbank market.

That’s the same claim the Fed and ECB make, just in other words.

• China’s Plunge Protection Team Claims “State Meddling” Stabilizes Markets (ZH)

It was two years ago, in June of 2015, when just as the Shanghai Composite was flirting with 5,000 and when literally the local banana stand guy was trading stocks, that the Chinese stock bubble burst, unleashing an unprecedented selling spree, a 40% drop in just two months, and Beijing’s nationalization of the stock market, courtesy of the domestic plunge protection team, the China Securities Regulatory Commission also known as the “National Team”. The decision by local authorities to effectively shut down price discovery had a huge confidence crushing impact on local investor confidence. As Gavekal Research put it overnight, “the lack of trust was crystallized by the decision in the summer of 2015 to “shut down” the equity markets for a while and stop trading in any stock that looked like it was heading south.

That decision confirmed foreign investors’ apprehension about China and in their eyes set back renminbi internationalization by several years, if not decades.” Understandably, with the realization that China (or any other nation for that matter), no longer has a an efficient, discounting stock market, but merely a policy tool meant to inspire confidence on the way up, and punish short sellers and “speculators” on the way down, the China Securities Regulatory Commission kept a low profile: after all why remind traders and investors that the local market only exists in the imaginations of several Beijing bureaucrats who sit down every day to decide the “fair value” of all market-traded equities. That changed last week, when for the first time in years, the Chinese Plunge Protection Team broke its silence and said that “state meddling has successfully stabilized China’s US$7 trillion stock market by curbing volatility and steering valuations to rational levels.”

For those stunned by the idiocy in the circular statement above, don’t worry it’s not just you: China indeed just said that the local market has become more efficient as a result of more manipulation. What is far more shocking, however, is that most central bankers around the world would agree with this statement.

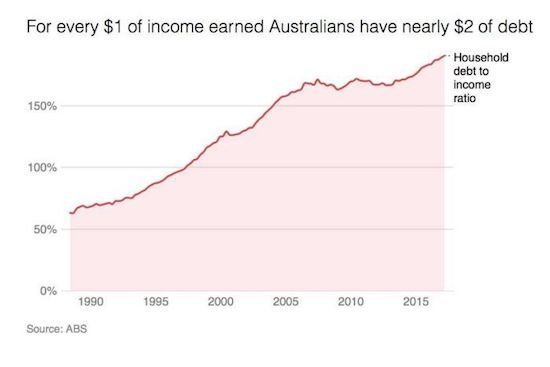

The banking system will fall with real estate, exposure to mortgage debt is 60%. And Australian banks own New Zealand banks.

• House Of Cards: Lending Culture Is Leaving Australians Vulnerable (Abc)

A decade of housing price rises, low interest rates and relatively easy credit has left Australians carrying the second-highest level of household debt in the world. And despite efforts to tighten lending and to address problems in the lending culture, the ABC’s Four Corners program has learnt bank staff and mortgage brokers are still required to meet tough lending targets and some staff are threatened with dismissal if they do not meet the banks’ requirement to sign up more mortgages. The problems in the lending culture were acknowledged by the banks themselves earlier this year in a review conducted by the former public service chief, Stephen Sedgwick. Incentive payments and lending targets are still a primary motivator for bank staff. Internal performance expectations for Westpac bank lenders, obtained by Four Corners, include targets of six-to-nine home-finance requests a week and between two and three home-loan drawdowns a week.

Another economist who has raised the alarm is former banker Satiyajit Das. He said the 60% exposure to mortgage debt in Australia’s banks was “extremely high”. That figure “is at least 20% higher than Norway, and also higher than Canada, which is a very comparable economy to Australia”, he said. Australia’s feverish housing market has contributed but Mr Das said other countries that had experienced rapid house price rises did not have the same potentially dangerous exposure. “One of the biggest housing bubbles in the world is Hong Kong, but the Hong Kong banks have only got exposure to the housing market of around 15%,” he said. Exposure to housing debt at Australian levels, Mr Das said, would leave banks more vulnerable in the case of any housing downturn. “If there is a downturn then obviously the losses will build up quite quickly,” he said.

[..] Gerard Minack, the former head of developed market strategy at Morgan Stanley, said Australia had been led down this path by current tax arrangements and lenders who had been increasingly willing to leverage up borrowers. This, he said, had created “a massive affordability problem” that will exacerbate the pain associated with any downturn. Australia now has a household-debt-to-income ratio of 190%. “For every $1 of household income, there’s [nearly] $2 of debt,” Mr Minack said.

Preparing Germans for a lenient attitude by their government (ahead of the Merkel re-election). Sorry guys, but carmakers are too big to fail. Can’t blame Angela…

• Diesel Scandal Is A Risk To German Economy, Says Ministry (R.)

The emissions scandal ensnaring German carmakers is a risk to Europe’s largest economy, the finance ministry said on Monday. In its monthly report, the ministry named the issue, which broke out almost two years ago after Volkswagen admitted to cheating US diesel emissions tests, as a threat to Germany along with Britain’s decision to leave the European Union and protectionist trade policies by the US government. But it has said it was impossible to put a figure on the potential damage it could cause. The car industry is Germany’s biggest exporter and provides about 800,000 jobs. “Risks linked to how Brexit will shape out and future US trade policies remain,” the ministry said. “In addition, the so-called diesel crisis should be classified as a new risk to the German economy even though its effects are not possible to quantify at the moment.”

Strong household and state spending provided most of the impulse for the German economy in the second quarter when growth was measured at 0.6%. Weaker net foreign trade dampened growth, as exports grew strongly less than imports. The ministry said it expected the industrial sector to continue its upswing also in the third quarter, pointing to robust orders and strong business sentiment indicators. But the diesel crisis could cloud the German growth outlook, it said, adding: “Given the importance of the automotive industry [the diesel crisis) must be classified in the medium term as a risk to the overall economic development.” German politicians and car bosses agreed earlier in August to overhaul engine software on 5.3m diesel cars to cut pollution and try to repair the industry’s battered reputation.

EU antitrust regulators are also investigating allegations of a cartel among a group of German carmakers, a measure that could result in hefty fines for the companies. In April, Volkswagen was ordered to pay a $2.8bn criminal penalty in the United States for cheating on emissions tests. The company is also paying $1.5bn in a civil case brought by the US government and spending $11bn to buy back cars and offer other compensation. Back in Europe, German carmakers VW, Audi, Porsche, Mercedes and BMW face questions over whether they colluded to bring down the cost of components – including some used to control diesel emissions.

How is it possible that just one party does these negotiations?

• Britain and EU Clash Over Brexit Timetable for Trade Deal (BBG)

Britain and the European Union are at odds over how soon the Brexit talks can pivot towards a trade deal just a week before negotiations are set to resume. Adopting a provocative posture, U.K. Prime Minister Theresa May’s government declared at the weekend that it’s “stepping up pressure” on the bloc to shift the discussions away from the terms of separation as soon as October. The use of fighting words in the past has not budged the EU and in a sign the U.K. will be disappointed, Slovenian Prime Minister Miro Cerar told the Guardian that “the process will definitely take more time than we expected.”

Signs of fresh discord may unnerve investors after the pound last week under-performed all of its Group of 10 counterparts. By giving out more details of where it stands and spelling out its demands, the U.K. wants to change the narrative that it’s been too vague, and by doing so jolt the EU into talking trade sooner. With the clock ticking down to the U.K.’s March 2019 departure, and the two sides clashing over many key issues, Brexit Secretary David Davis seems bent on reviving a debate over whether talks should run in parallel rather than in the strict order the EU has laid out.

Such an ambition will draw short shrift from the EU. Its chief negotiator, Michel Barnier, last week reiterated that the other 27 governments won’t allow trade talks to start until “sufficient progress” has been made resolving residency rights, the U.K.’s exit bill and the border with Ireland. The original hope was to reach this milestone in October – in time for a summit of EU leaders – but that is now in doubt amid criticism within the EU of sluggish progress and a lack of detail from the British. “There are so many difficult topics on the table, difficult issues there, that one cannot expect all those issues will be solved according to the schedule made in the first place,” Slovenia’s Cerar told the Guardian. “What is important now is that the three basic issues are solved in reasonable time.”

The NAFTA talks may well end up being as tough as the Brexit ones.

• NAFTA Negotiations Start in Secrecy. Lobbying Heats Up (WS)

The first round of re-negotiating the North American Free Trade Agreement between the US, Canada, and Mexico began on Wednesday and is scheduled to last through Sunday. And the one thing we know about it is this: Despite promises in March by US Trade Representative Robert Lighthizer (USTR) that the negotiations would be transparent, the USTR now considers the documents and negotiations “classified” and they’ll be cloaked in secrecy. But corporate lobbyists have access. And they’re all over it. The Electronic Frontier Foundation put it this way: “Once again, following the failed model of the Trans-Pacific Partnership (TPP), the USTR will be keeping the negotiating texts secret, and in an actual regression from the TPP will be holding no public stakeholder events alongside the first round. This may or may not set a precedent for future rounds, that will rotate between the three countries every few weeks thereafter, with a scheduled end date of mid-2018.”

But during his confirmation hearing in March, Lighthizer had promised to make the negotiations transparent and to listen to more stakeholders and the public. The EFF reported at the time that in response to Senator Ron Wyden question – “What specific steps will you take to improve transparency and consultations with the public?” – Lighthizer replied in writing: “If confirmed, I will ensure that USTR follows the TPA [Trade Promotion Authority, aka. Fast Track] requirements related to transparency in any potential trade agreement negotiation. I will also look forward to discussing with you ways to ensure that USTR fully understands and takes into account the views of a broad cross-section of stakeholders, including labor, environmental organizations, and public health groups, during the course of any trade negotiation.

He said that “we can do more” to ensure that we “have a broad and vigorous dialogue with the full range of stakeholders in our country.” Senator Maria Cantwell tried to have Lighthizer address the skewed Trade Advisory Committees that currently advise the USTR, by asking: “Do you agree that it is problematic for a select group of primarily corporate elites to have special access to shape US trade proposals that are not generally available to American workers and those impacted by our flawed trade deals?” Lighthizer replied: “It is important that USTR’s Trade Advisory Committees represent all types of stakeholders to ensure that USTR benefits fully from a diverse set of viewpoints in considering the positions it takes in negotiations.”

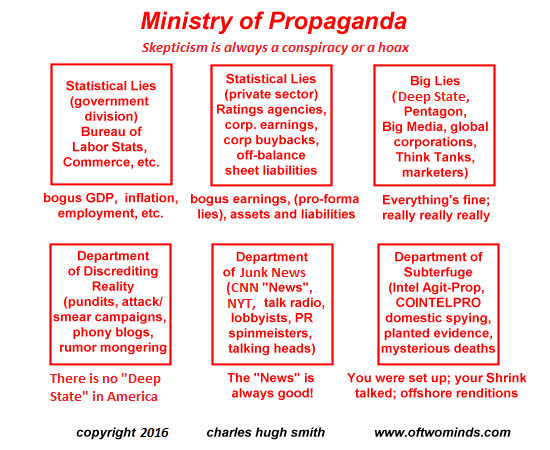

You’re being played.

• Beware the “The Cultural Civil War” Narrative (CHS)

The play is as old as civilization itself: conjure up extremists (paying them when necessary), goad the formation of opposing extremists, then convince the populace that these extremists have been normalized, i.e. your friends and neighbors already belong to one or the other. This normalization then sets up the relentless demands to choose a side – the classic techniques of misdirection and false choice. Just as you’re sold a triple-bacon cheeseburger or a hybrid auto, you’re being sold a completely fabricated cultural civil war. There have always been extremists on every edge of the ideological spectrum, just as there have always been religious zealots. In a healthy society, these fringe pools of self-reinforcing fanaticism are given their proper place: they are outliers, representing self-reinforcing black holes of confirmation bias of a few.

In times of social, political and financial stress, such groups pop up like mushrooms. In times of media saturation, a relative handful can gain enormous exposure and importance because the danger they pose sells adverts and attracts eyeballs/viewers. Add a little fragmentation, virtue-signaling, demands for ideological conformity and voila, you get a deeply fragmented and deranged populace that is incapable of recognizing the dire straits it is in or recognizing the structural sources of its impoverishment and powerlessness. In other words, you get an easily mallable populace at false war with itself.

There is always common ground for those who dare to seek it. The Powers That Be are blowing up the bridges as fast as they can, whipping up fear and hatred of the Other, fanning the flames of extremism and claiming extremists are now normalized and everywhere. All of this is false. Would you buy an entirely manipulated cultural civil war if it was advertised as such? If not, then don’t buy into the false (but oh so useful to the ruling elites) narrative of an “inevitable cultural Civil War.”

Excellent piece by G. Mark Towhey, “a key player on the team that helped elect Rob Ford as mayor of Toronto”.

• Rob Ford, Donald Trump and the New Direction of Political Polarization (Towhey)

You are not a typical American. Not even close. The typical American doesn’t read lengthy articles in policy journals. The typical American gets up far too early in the morning, after too little sleep, works too hard for too long in a job that pays too little, before heading home, feeding the kids, cleaning the house, and collapsing into bed far too late. He or she has precious little time to consume news: a fleeting glimpse of pithy headlines, maybe a two-minute newscast on the radio if they drive to work or a few minutes of local TV news—mostly weather and sports scores. It is through this lens that typical Americans view the world beyond their personal experience and that of friends and family. It’s through this lens that they assess their government and judge their politicians.

These are the typical Americans who elected Donald Trump. They weren’t alone in voting for Trump, and they didn’t cast their ballots by mistake. They chose Trump because, out of the available alternatives, he best represented their view of the world. I am not a typical American, either. In fact, I’m a Canadian. I was a key player on the team that helped elect Rob Ford as mayor of Toronto—North America’s fourth largest city. I helped him craft a campaign platform that resonated with typical Torontonians and, later, helped him translate that platform into an actionable governing agenda. I helped him get things done. Three years later, Ford fired me as his chief of staff when I insisted that he go to rehab to address the personal demons that were destroying both him and his mayoralty. My experience with Ford has given me an unusual perspective on the recent presidential election, the Trump phenomenon, and the rise of a new and powerful political force that favors unorthodox candidates.

No, you and I are not typical at all. We have time to read (and, apparently, to write) long-form articles in policy journals. We can pause our breadwinning labor and child-rearing duties long enough to consider hypotheticals and to ruminate, now and then, on an idea or two. We may not recognize this as a luxury in our modern world, but we should. Amid all that rumination, however, we rarely stop to think that what motivates us does not necessarily excite typical Americans, the people who elected Donald Trump some six years after their northern cousins elected Rob Ford in Toronto. Almost by mistake, this bloc of typical citizens—overstressed, under-informed, concerned more with pragmatic quality of life issues than idealistic social goals—has become a powerful political movement. And we didn’t see them coming. Conventional political leaders seem to completely misunderstand them, and even their own champions often appear to disrespect them. They do so at their peril.

In 2010, Rob Ford was a dark horse candidate in the race to be mayor of Toronto. He later became internationally notorious for his very public battles with drug addiction and frequent appearances as a punch line in late-night television monologues. But his 2010 campaign was based on his understanding of the struggles typical residents endured and their limited time for politics. Ford boiled his campaign down to “Respect for Taxpayers” and “Stop the Gravy Train.” His message was concise and understandable. It fit on a bumper sticker. It could be passed by word of mouth from one person to the next without loss of meaning or impact. That it meant something different to everyone was not a weakness but a strength—no matter what you thought the “gravy train” was, everyone wanted it stopped.

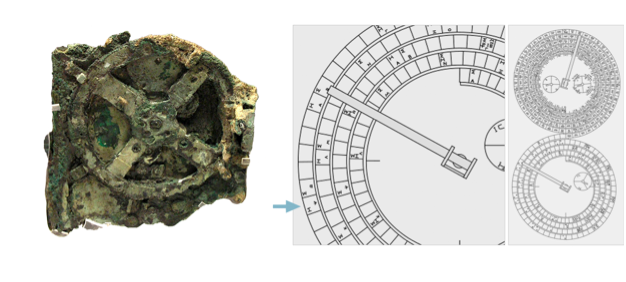

In case you want to know Absolutely Everything about the eclipse, here’s Stephen Wolfram.

• When Exactly Will the Eclipse Happen? (Wolfram)

A total solar eclipse occurs when the Moon gets in front of the Sun from the point of view of a particular location on the Earth. And it so happens that at this point in the Earth’s history the Moon can just block the Sun because it has almost exactly the same angular diameter in the sky as the Sun (about 0.5° or 30 arc-minutes). So when does the Moon get between the Sun and the Earth? Well, basically every time there’s a new moon (i.e. once every lunar month). But we know there isn’t an eclipse every month. So how come? Well, actually, in the analogous situation of Ganymede and Jupiter, there is an eclipse every time Ganymede goes around Jupiter (which happens to be about once per week). Like the Earth, Jupiter’s orbit around the Sun lies in a particular plane (the “Plane of the Ecliptic”).

And it turns out that Ganymede’s orbit around Jupiter also lies in essentially the same plane. So every time Ganymede reaches the “new moon” position (or, in official astronomy parlance, when it’s aligned “in syzygy”—pronounced sizz-ee-gee), it’s in the right place to cast its shadow onto Jupiter, and to eclipse the Sun wherever that shadow lands. (From Jupiter, Ganymede appears about 3 times the size of the Sun.) But our moon is different. Its orbit doesn’t lie in the plane of the ecliptic. Instead, it’s inclined at about 5°. (How it got that way is unknown, but it’s presumably related to how the Moon was formed.) But that 5° is what makes eclipses so comparatively rare: they can only happen when there’s a “new moon configuration” (syzygy) right at a time when the Moon’s orbit passes through the Plane of the Ecliptic.

Home › Forums › Debt Rattle August 21 2017