Cy Twombly Fifty Days at Iliam: Like a Fire that Consumes All before It 1978

Might as well call it a social experiment. Any other name, like “coup” or “fishing expedition” or “hookers peeing on a bed” or “justice being done” would just inflame “passions” and lead away from what should be the actual topic.

Whatever you call it, the fact remains that Donald Trump has been the first US president to be under continued investigation for the entire 4 years of his first term, and for about a year before it as well. And that should be a cause for alarm for anyone who cares even a little bit about the American political system, including those who abhor Trump. Because once you do that, it’s no longer about just one president, it’s about all who will follow him, and inevitably about the integrity and validity of the system as a whole.

In principle, there should be no investigations of a sitting president, and not even of a presidential candidate, because this risks endangering 1) the entire electoral process, and 2) the Office of the President (not for once, but for ever). In principle. If there must be an investigation, it must be based on solid evidence available beforehand, it must be short, and the President must be removed. If all of these three things are not guaranteed, no investigation is warranted, and the accusing parties should be “liberated” from the positions they held when they initiated the investigation regardless. Skin in the game.

It gets increasingly harder to write about American politics, or express an opinion in any other way, without being dumped into one of two camps, never to be heard from again in the other (except for ridicule or slander). There is no such thing as a neutral or objective viewpoint anymore. You’re either with us or you’re against us – or them.

Seeing -and projecting- the world in black and white is a tempting proposal for anyone afraid of being confused; it should, however, never be an excuse for the media to not present its viewers and readers with a full color palette. But we can see every single day how that went. Black and white it is. And in that environment, too claustrophobic to be put in a box, I might as well paint the picture as I see it. Yes, in color.

The “social experiment” I see progressing has two parts:

1) can a political party, aided and abetted by the media and intelligence services, unseat an elected president it has just lost an election to?

2) can a presidential candidate be elected while shunning the media, debates, etc., and only appear at times and in forms that have been pre-selected by her/his handlers for maximum effect, while hiding his/her weaknesses?

As for no. 1, it has evidently not succeeded, but that is certainly not for lack of trying. One investigation has followed the other non-stop since 2016, in public and behind the scenes, and they have all come up empty. Of course one side would contest that and still say there was lots of evidence, but if so, it obviously wasn’t very strong, or Trump would have been gone.

People may also claim that the mandate of the Mueller investigation was too narrow, but really, go back and watch the man’s pathetic (sorry, but it was) testimony in Congress after the fact, that should be enough. Adam Schiff and Jerry Nadler and others have promised solid and inconvertible evidence many times, but we never saw any. Rest assured, whatever Trump may have done wrong, you would have heard about it by now.

Or to put it another way: he probably did many things wrong, but not the things he was accused of. In fact, the entire Putin puppet narrative is so idiotic it’s impossible not to ponder from time to time that it was designed from the get-go to support Trump, not hurt him.

As for no. 2, that looks even more experimental. The approach is helped along “wonderfully” by the pandemic, which provides plenty excuses to keep Biden hidden, but it goes against everything presidential campaigns have been built upon throughout American history: contact with voters. That very few people would believe Biden is his own man, and not a sock puppet, can’t help.

But there is more at stake. Presidential campaigns are one element of a much bigger process, and you can’t separate the two. Both parts of the “social experiment” seem to run afoul of the respect that bigger process, and ultimately the entire political system, necessarily demands from all participants, from an individual voter to a President. And that is much more important than either candidate. You can’t temporarily switch off that respect if and when that might suit your purpose, because you risk for it never to be switched on again.

You may dislike a presidential candidate, perhaps even intensely so, but that should never make you lose sight of the integrity, if not the sacredness, of the election process, of the political system, of the institutions, of the Constitution, and certainly not of the Office of the President of the United States. Because once you do that, you open the door for everyone to do the same in the future. And no, you can’t blame that on the candidate you don’t like, you do it.

When a candidate is selected through the primaries of his/her party, you must respect that, because if you don’t respect the process, you are lost, the system is lost, and there’s no telling when you’ll see it back, if ever. If that candidate is then elected President, a lot of doors that before allowed you to question and criticize him/her, should be closed. The country at that point has either a new President, or a second-term one. A different phase of the political process starts.

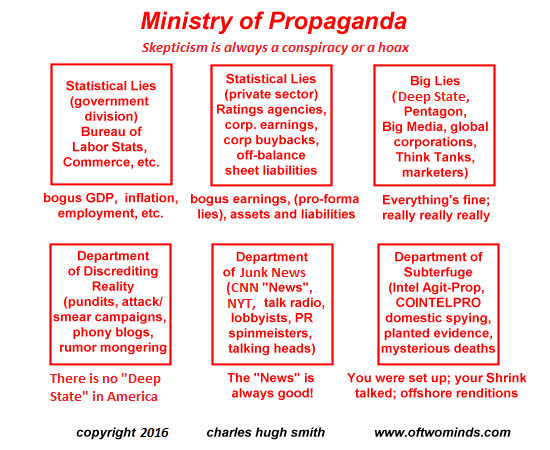

The House and the Senate become the critics, empowered by the system to hold the President accountable. But only the House and the Senate. Not the media, whose role it is, other than in the occasional opinion piece, to report on decisions made; not intelligence services, whose role it is to serve the country, and the new President it just elected; and not the opposition party, whose role it is to prepare for the next election, and to provide a degree of counterbalance, depending on how bad their loss was, on Capitol Hill.

The entire picture is crystal clear. So is everybody’s role in it. But now and then people -try to- refuse to accept their roles, obviously believing that they are more important than the integrity of the political system, and ignoring that in doing so they put the whole system at risk.

What was happening first became apparent in late 2015 – early 2016, when the New York Times began running multiple stories every day directed against Donald Trump. Mostly small bits, based on innuendo about his past, with a whiff of truth perhaps, but not more. The word “gratuitous” comes to mind. At a certain point, they did a dozen per day of the stories, it became assembly line work for the writers and editors..

The Washington Post chimed in, and so did CNN, MSNBC and others, including international press. It turned into a feeding frenzy, with all of them completely losing sight, voluntarily or not, of their roles as news providers. They all shape-shifted into opinion-only-makers, confident that their audience would not notice the difference, at least not at first. At that point it became a very Pavlovian thing.

Which is why I was initially going to name this essay “Trump vs Pavlov”. 100+ years ago, Ivan Pavlov “found” that if he rang a bell in front of a dog, and then gave her food, she would start to associate the two. When he increased the time-lapse between first, the bell, and then, the food, the dog would salivate in expectation of food at just the sound of the bell. In the end, all he had to do was ring the bell, with no food around, and the dog would salivate. So he had nothing to offer, no food, no substance, but the reaction was the same.

That is a very accurate description of what a large part of the US media have done -and become-. All they have to do at this point is mention Trump, or just show his picture, and their public will react the same every single time: Orange Man Bad. There doesn’t have to be any substance, any factual journalistic reports of wrongdoing. The “conditioned reflex” as Pavlov described it, has set in.

And their readers and viewers have become addicted to this. How could they not? They’ve been bombarded with 1000s of these bells ringing, and the substance may not be there, but the expectation of it is. If you’re a regular viewer of Rachel Maddow, what are the odds that your opinion is still your own after hearing RussiaRussia a million times? The only way it could be yours is if you switch her off.

I’ve written before that I don’t even think they really set out to do this. Initially, there were probably just some CEOs and owners and editors who didn’t like Trump and/or were affiliated in one way or another with the other party -and later candidate-. Who was counted on to win big anyway, so why not (well, because of the integrity of the political system!).

It was only later that they found out 24/7 anti-Trump “reporting” was a great business model for them. CNN was dying in early 2016, the New York Times was nor far behind, and all of a sudden numbers of viewers and readers and subscribers went through the roof.

Their problem is that if they succeed in making Trump lose in November, they will be back to where they came from before he appeared on the political scene. All of their “reporting” on US politics has devolved into a scheme based on ringing a bell, and on the scandal and anger their non-stop salivating audience have become addicted to, and mistake for substance.

If Joe Biden should win, that scheme is dead. They may hope to last a bit longer on the angry scandal of a possible persecution of Trump if he leaves office, but that would be it, and that’s not a business model. They can’t very well now turn on Biden and his puppeteers.

New York Times writer and editor Bari Weiss said it very well when she left the paper a few weeks ago, she summarized the essence of the MSM problem in just a few words:

“[..] the lessons that ought to have followed the election – lessons about the importance of understanding other Americans, the necessity of resisting tribalism, and the centrality of the free exchange of ideas to a democratic society—have not been learned. Instead, a new consensus has emerged in the press, but perhaps especially at this paper: that truth isn’t a process of collective discovery, but an orthodoxy already known to an enlightened few whose job is to inform everyone else”.

Why edit something challenging to our readers, or write something bold only to go through the numbing process of making it ideologically kosher, when we can assure ourselves of job security (and clicks) by publishing our 4000th op-ed arguing that Donald Trump is a unique danger to the country and the world?

That’s the media. Second in line is US intelligence. Which, there’s no other way to put it, conspired against a presidential candidate and, when he was elected, a sitting president. The Strzok-Page “insurance policy”, the Obama Oval Office conversations where Comey, Brennan, Clapper, Susan Rice were present, plus 1,000 other things, the overall picture doesn’t exactly point to that famous seamless transition, and US Intel played a pivotal, because accommodating, role in that.

The best way to show this is perhaps that US intelligence themselves did not (could not) come up with a report on alleged links between the -prospective- president’s team and Russia, but took a dossier paid for by the president’s opposition and used it to discredit and persecute him and people in his team. The dossier was written by a two-bit MI6 hustler who hadn’t set foot in Russia in at least a decade, and whose main ‘Russian source’ wasn’t there either, but sitting in an office in the US.

That source in turn had contacts with a group of Russians whose very business model it was to make up and embellish whatever stories the highest bidder required, while failing to deal with their own severe drinking problems. That dossier was the entire foundation (or 99% of it) behind Rod Rosenstein appointing Bob Mueller as a Special Counsel. The appointment would never have been made, never have been possible, without the Steele dossier.

How was the dossier vetted by US intelligence, if at all? It’s very clear now what was wrong with it, but the all knowing and very clever intelligence people could not have figured that out 4 years ago, and instead cleared it for Mueller, for further FBI use, for FISA applications? How about their treatment of Michael Flynn, who they had already cleared only to resurrect the dead corpse of their investigation into his talks with Russian ambassador Kislyak? How would you, personally, spell “in good faith”?

We will see in the near future what the Durham investigation into all Russiagate players will come to. Apparently, Durham has just another three weeks to present at least something, because there is a two-month “no-go-zone” before the election, during which he would be accused of tampering with the election. And the premise for the Democrats and their sympathizers is that if Biden wins, all slates will be wiped clean.

They won’t, by the way. America still has a justice system, even if it is oftentimes crippled and grinding(ly) slow. Just watch Michael Flynn attorney Sidney Powell and her team. They have vowed to not only have their client be exonerated, but to fully clear his name, which according to their view has been besmirched by everyone up to and including Joe Biden and Barack Obama.

The third leg of the “creature” is the Democratic party. Who have stepped so far over their boundaries, nobody recognizes anymore that there were any. Or that the political system they are an integral part of, dictates that there are things they cannot do, lest they corrupt that system to the core.

Once you lose a presidential election, you prepare for the next one. You don’t use the next 4 years to try and frustrate the president you just lost to with all you got. The system should not allow it and can not tolerate it. There should be skin in the game for opposition politicians, who when they come with accusations of gross misconduct serious enough to remove a president, should be forced to step down when the accusations don’t lead to the intended result.

It should never be a free for all, in which you can simply try again the next morning. Because the system cannot work if that is possible. It can’t be that if you win a midterm election and get a majority in the House, you can then use that majority to make it impossible for a president to work on the agenda that made millions vote for him/her. That would cause the system to grind to a halt, and the system must always be more important than its temporary participants (even those who “sit” for 40-50 years).

When you look at the speaker’s list for the Democrat -non- convention next week where Joe Biden will be confirmed as their -virtual- candidate, you see that other than AOC, it’s just a long list of the same old people who were already there when they lost in 2016, and co-losers Hillary and Obama still have a very tight grip on the power and the purse strings.

Why they stick with Joe Biden, g-d only knows, and the same goes for whichever highly unpopular black woman they pick as VP who could soon be president. And sorry, but they all are. Kamala Harris was among the first to step down during the primaries because she didn’t get any votes. Susan Rice is not exactly “loved by the people” either, and the rest are no-names, except for Warren, but she’s both too left and much too white.

So you’re thinking: what’s going on there? That’s really the best you can do? But it does seem to be, likely because Barackillary have a small group of confidantes to choose from who they themselves are confident will be willing to cede all actual power to them once elected. And if Harris and Rice don’t get picked as VP, they’ll still exert a lot of power.

As will Pelosi, Schiff, Nadler, there’s more new blood at Madame Tussaud’s than at the upper echelons of the Democratic party. Yes, AOC can come in to represent the squad in a cynical move (no power but brings in lots of votes), but that’s it. For the rest it’s still just the broken left wing of the war party. But you’re right, they’re none of them, Trump. And that at the same time is the sole identity they possess.

Anti-Trumpism has become a political religion. Because Trump is the only topic that attracts clickbait and viewers. The only topic that rings a bell. Joe Biden rings no bells whatsoever. A while back Donald Trump jr tweeted:

Trump is really running against the media, Silicon Valley, the establishment, the swamp, Hollywood and maybe Joe Biden.

While investor GreekFire23 did even better:

Trump is running against himself in this election. The vote will come down to those who love him vs those who hate him. Biden is totally irrelevant and not even campaigning. Biden has no platform, no slogan, no stickers, no signs, no rallies, no followers. It’s Trump vs Trump.

What can still sink Trump is obvious: it’s the economy and the pandemic. America’s problem is that no matter who wins, those will still be its main problems by January 2021. And another problem has been added in the course of 2020: protests and violence in the streets.

Update: I thought I could leave it at that for now, step out for a moment, have a glass of wine, let it all sink in, and write a closing paragraph. But then I was sitting outside in gorgeous Athens and this popped up, which I very obviously can’t leave out:

Senate Chairman Subpoenas FBI Director Wray For Russiagate Records; Puts Bidens On Notice

FBI Director Christopher Wray has been subpoenaed by the Senate Committee on Homeland Security and Governmental Affairs to produce “all documents related to the Crossfire Hurricane Investigation,” which includes “all records provided or made available to the Inspector General” regarding the FISA probe, as well as documents regarding the 2016-2017 presidential transition..

[..] The subpoena was issued by Sen. Ron Johnson (R-WI) as part of his investigation into the origins of Russiagate. It gives Wray until 5 p.m. on Aug. 20 to produce the documents. Johnson also released a lengthy letter on Monday in which he defended his Committee’s investigation and accused Democrats of initiating “a coordinated disinformation campaign and effort to personally attack” himself and Sen. Chuck Grassley (R-IA) in order to distract from evidence his committee has gathered on Joe and Hunter Biden’s Ukraine dealings.

[..] Johnson’s committee has secured testimony from at least one State Department official who worked in Ukraine, and says the Bidens’ conduct created the appearance of a conflict of interest. “The appearance of family profiteering off of Vice President Biden’s official responsibilities is not unique to the circumstances involving Ukraine and Burisma,” wrote Johnson. “Public reporting has also shown Hunter Biden following his father into China and coincidentally landing lucrative business deals and investments there.

“Additionally, the former vice president’s brothers and sister-in-law, Frank, James and Sara Biden, also are reported to have benefited financially from his work as well.

I can’t let that go because it addresses exactly what my closing paragraph would have been about. Which is the risk of the giant divide that has developed in US society, getting even wider, and potentially leading to utter mayhem. Actually, it’s not even ‘potentially’ anymore, there already has been a lot of violence.

The Democrats think they will win easily on November 3, and then push through all of their their policies, after dumping on Trump for 4 years with their media and intelligence friends, but the 63 million Americans who voted for Trump, and most of their family and friends with them, don’t think so. That’s not a threat, it’s an observation.

They feel cheated out of their 2016 victory. They realize (or should I say “suspect”) that Russiagate and the Mueller probe and the Zelensky-linked impeachment “hearings” were empty vessels directed against the election outcome that they won fair and square, and I guarantee you they won’t take it sitting down.

Which means that no matter who wins, polarization will reach levels America has never seen, and, frankly, should never wish to. Because all of the people involved, bar just a precious few, will have to live together in the same country, and share the same society, streets, highways, stores and resources.

And sometimes I wonder: how are they going to do that? If Trump should win, how will the entire so-called left react, from the Democrats through the MSM to BLM? Will they just increase the protests and the violence in the streets?

Alternatively, if Joe Biden wins, how will the Conservative side of America react? Will they all go home and wait for what the DNC has in store for them, or will their reaction be pro-active? I know which reaction I would see them lean towards.

You have these two sides in society who appear further apart than even Moses could have hoped to bring back together again, you have the media who thrive on widening that divide even further, it’s a scary picture.

And in the meantime, while everyone’s busy blaming each other, who’s going to take care of the country?

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the publishing process. Which seems only fair and just.

Thank you.

Support the Automatic Earth in virustime.