Jack Delano Information desk, Union Station, Chicago January 1943

This morning I saw an article by Barry Ritholtz on Bloomberg that got my few remaining active neurons going (or I think it was them). The title alone, The Parasites of Finance, did that, actually. I sort of knew, since I’ve known Barry’s work at the Big Picture site for quite some time, what he would talk about, and I knew I wouldn’t – fully – agree.

Or rather, it’s like this: I have nothing against Barry, and he does make some valid points in the article, but in my view his focus is too narrow for the title he’s chosen, willingly or not. But then Barry works in finance, and I don’t. For me the parasites of finance form a much larger group than for him. And that is the direct result of government policies, such as the promotion of creative fantasy accounting and the refusal to restructure debt, multiplied by the tens of trillions of dollars of future wealth that have been pumped into the financial system in the form of QE and other stimuli, lest the system collapse on the spot.

We all understand today, from the world of biology, why and how a body, a system, gets more susceptible to parasites when it becomes weaker. Well, financial stimulus of all shapes and forms, as executed over the past decade and more by governments and central banks, does just that: it makes the system weaker. This – temporarily – makes it possible for a large number of people to feed on the system (just like parasites do), and declare that from where they’re sitting, everything seems fine. But everything is not fine. The system, in this analogy, has turned into a body addicted to drugs to such an extent that without them it would risk … collapsing on the spot. The undead body of a zombie, essentially.

In short, this makes just about every investor today a parasite, if not of finance, then certainly of the financial system. Or even of society as a whole. In most cases this is not intentional, but for the end result that makes little or no difference. Everyone who owns assets of any kind at all today profits up to a point, at least on paper, from the gigantic asset bubble blown by “authorities” and their accommodative policies. That part is easy to see, so much so that it’s the only part most see. The shadow side largely remains hidden, until it will be too late. Because the shadow side lies in the future, and we live in the present. But before I stomp over him entirely, which is not at all what I want, let’s turn to Barry:

[..] … I am always amazed at how some business models manage to hang on despite overwhelming proof of their lack of purpose or value added. Some parts of the investment world exist simply because people don’t know better. The information is out there, but it is obscured by a relentless parade of advertising, promotion and marketing. The truth gets lost behind a smokescreen of noise and deception. Indeed, there are increasing numbers of people who are employed for just that purpose. Ignorance: It’s a job creator.

This first paragraph had me smile, because what Ritholtz says here about the (his) world of finance, for me describes our entire society. Or to put it in starker terms: to me, the entire world of finance today only exists, or continues to exist, because of a relentless parade of advertising, promotion and marketing, PR. Which makes that people don’t know better. For me it takes on the meaning that there is a relentless parade of journalists and government officials and central bankers and investors and hedge funders, etc., all hell bent on blowing such quantities of smoke up the public’s asses that the latter don’t think, or figure out, that the whole thing has become a parade of parasitical zombies, who suck the lifeblood out of society instead of creating value, something they will insist they do until their bodies crumble to ashes and evaporate.

That may sound harsh for everyone invested in something, and particularly unwelcome for finance professionals, but we can all imagine, though perhaps not all equally, what the world of finance, and society at large, would have looked like without such lovely though grossly expensive concepts as creative accounting, QE 1-1001, artificially and absurdly low interest rates, home purchase assistance plans that skirt on subprime, and with debt restructuring, defaults, bankruptcies and the like that until recently were considered normal, nay necessary. What it all would have looked like would be, to put it succinctly, more ‘normal’. More like a free market.

Not that things wouldn’t have been chaotic for a while, maybe quite a while. But does that warrant turning an entire society into a parade of zombies? Because that’s what we’re looking at now. It might be good to acknowledge who has benefited most from the entire set of extreme measures. And no matter how you look at that, you will always come back to the same group of people: those who benefit most would have risked losing most if ‘normal’ would have been the norm. That means politicians, bankers, finance professionals.

Everyone who profited most from the bubble had most to lose from it bursting. So a huge layer of virtual credit, for which your blood and sweat and tears is the collateral, was laid out on top of the imploding world of finance. That way they could all hang on and pretend everything was just hunky dory. But that won’t last, simply because it can’t. You can use creative accounting for your unemployment numbers too, but the fact remains that some 90 million working age Americans don’t work. And 60% of southern European young people don’t either.

And you need all those people to work, not just to keep them from rising up, but to make sure your society and economy produce things of actual value. That’s where the real crisis is, not in bank profits going down. But it’s not what all the measures have been aimed at, they have all been about propping up “finance” to the point where society at large could be made to believe it’s actually still standing while it’s as dead as King Tut.

It’s a policy that carries its own demise on its back. Then again, it also carries its own advertising, promotion and marketing parade. Because it makes everyone – except perhaps for the unemployed – think they are richer than they actually are. Temporarily. Not just investors, but really everybody. Because proper financial policy, the kind where the bankrupt actually go bankrupt, would cause a giant reset of the entire economy. Pensions funds are all invested up to their necks in assets that would have lost a lot of value if Bernanke and his ilk would not have taken their grandchildren’s money to spend it today on propping up their undead friends. Home prices would have fallen so much that over half the nation would have been underwater much faster than an Antarctic melt could have put them.

So why not just go for the Lord Keynes stimulus parade? Because it’s all fake. It’s virtual. It’s zombie. And it’s a way for the financial industry to transfer its debts to the rest of us. That way when the zombies start exploding and spewing around the gory green slimy juices that run in their veins, they’ll land on us, not them. Keynesian stimulus policies are utterly destructive to a society if they are not accompanied by debt restructuring, they become nothing but a free for all for the few. Because if that happens, stimulus only serves to keep the undead alive. And no matter how much it may hurt in the short term, the undead are not a good foundation to build a healthy society on. They’re too squishy.

Today, we are all zombies, to one degree or another. And we’re all parasites, feeding on the temporary feel-good effects of the stimulus that in turn sucks the (life)blood and tears out of our children. The question then becomes: would you prefer to have less spending money today, or to leave your kids in utter misery? And no, you can’t have both. That’s just PR.

It stops somewhere sometime.

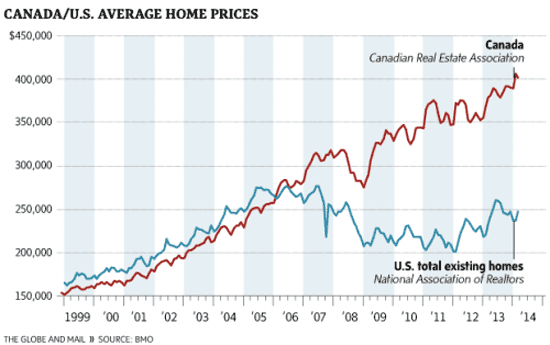

• Yellen’s Housing Wand Is Running Low On Magic (Doug French)

How important is housing to the American economy? If a 2011 SMU paper entitled “Housing’s Contribution to Gross Domestic Product (GDP)” is right, nothing moves the economic needle like housing. It accounts for 17% to 18% of GDP. And don’t forget that home buyers fill their homes with all manner of stuff—and that homeowners have more skin in insurance on what’s likely to be their family’s most important asset. All claims to the contrary, the disappointing first-quarter housing numbers expose the Federal Reserve as impotent at influencing GDP’s most important component. No wonder every modern Fed chairman has lowered rates to try to crank up housing activity, rationalizing that low rates make mortgage payments more affordable.

Back when he was chair, Ben Bernanke wrote in the Washington Post, “Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance.” In her first public speech, new Fed Chair Janet Yellen said one of the benefits to keeping interest rates low is to “make homes more affordable and revive the housing market.” As quick as they are to lower rates and increase prices, Fed chairs are notoriously slow at spotting their own bubble creation. In 2002, Alan Greenspan viewed the comparison of rising home prices to a stock market bubble as “imperfect.” The Maestro concluded, “Even if a bubble were to develop in a local market, it would not necessarily have implications for the nation as a whole.”

Three years later—in 2005—Ben Bernanke was asked about housing prices being out of control. “Well, I guess I don’t buy your premise,” he said. “It’s a pretty unlikely possibility. We’ve never had a decline in home prices on a nationwide basis.” With never a bubble in sight, the Fed constantly supports housing while analysts and economists count on the housing stimulus trick to work. “There’s more expansion ahead for the housing market in 2014, with starts and new-home sales continuing to rise at double-digit rates, thanks to tight inventory,” writes Gillian B. White for Kiplinger. The “Timely, Trusted Personal Finance Advice and Business Forecast(er)” says GDP will bounce back. Fannie Mae Chief Economist Doug Duncan says, “Our full-year 2014 economic forecast accounts for three key growth drivers: an acceleration in spending activity from private-sector forces, waning fiscal drag from the federal government, and continued improvement in the housing market.” We’ll see about that last one.

With the central bank flooding the markets with liquidity, holding short rates low, and buying long-term debt, mortgage rates have been consistently below 5% since the start of 2009. For all of 2012, the 30-year fixed mortgage rate stayed below 4%. In the post-gold-standard era (after 1971), rates have never been this low for this long. The Fed’s unprecedented mortgage subsidy has helped the market make a dead-cat bounce since the crash of 2008. After peaking in July 2006 at 206.52, the Case-Shiller 20-City composite index bottomed in February 2012 at 134.06. It had recovered to 165.50 as of January. However, while low rates have propped up prices, sales of existing homes have fallen in seven of the last eight months. In March re-sales were down 7.5% from a year earlier. That’s the fifth month in a row in which sales fell below the year-earlier level.

Lovely.

• German Investor Sentiment Falls Sharply In May (Reuters)

German analyst and investor sentiment declined for a fifth consecutive month in May to its lowest level in nearly 1-1/2 years as concerns intensified that economic growth in Europe’s largest economy would slow in the second quarter. Mannheim-based think tank ZEW’s monthly survey of economic sentiment, released on Tuesday, dropped to 33.1 from 43.2 in April, missing the Reuters consensus forecast for a reading of 41.0 and undershooting even the lowest estimate for 37.1. That sent the euro down to a one-month low against the dollar.

“The fifth consecutive decline in ZEW investor sentiment in May suggests that the German recovery might not gain much pace from here,” said Jessica Hinds, economist at Capital Economics. “Data later this week are likely to reveal that the German economy made a strong start to the year, perhaps expanding by a quarterly 0.7 percent or so. But today’s survey broadly supports our view that this pace of growth is unlikely to be sustained.” Recent hard data has shown German exports posting their biggest fall in nearly a year, while industry output, orders and retail sales have all fallen.

Excellent read.

• The Writing Is On The Wall. And We Should All Read It (Zero Hedge)

The “Shiller P/E” is much in the news of late, and, as ConvergEx’s Nick Colas suggests, with good reason. It shows that U.S. equity valuations are pushing towards crash-worthy levels. This measure of long term earnings power to current price is currently at 25.3x, or close to 2 standard deviations away from its long run median of 15.9x. As Colas concludes, the writing is on the wall and we must all read it. Future returns are likely going to be lower. Competition for investor capital will get even tougher. That’s what the Shiller P/E says, and it is worth listening. Via ConvergEx’s Nick Colas:

With all the investor attention on this measure, you don’t hear much about how it should inform corporate capital allocation and investor relations. Since stock prices are essentially a conversation between the owners and managers of capital, the Shiller P/E should have a place in the boardroom as well. For example, should companies engaged in buybacks be more careful at these levels, and how do they explain that caution? And what about managing investor expectations for future returns on the business, and therefore its underlying equity? After all, the higher the Shiller P/E, the more likely that future returns will run below historical averages. In short, this is not just a useful tool for investors – it should also inform corporate capital planning and communication.

On the table in my den I have a plaque with Mercedes-Benz and Chrysler hood ornaments glued to the top. It is a deal toy – those commemorations that investment banks give out to the people who work on a specific transaction. You see them littering the officers of corporate treasurers and chief financial officers, bankers, and private equity professionals. The more toys, in theory, the more experience the person has. And the more elaborate the toy, the more creative the 28 year old investment banking associate who really did all the work getting that deal across the finish line.

You could tell that the merger of Daimler and Chrysler was going to fail by just looking at those hood ornaments on the deal toy. Daimler-Benz mounts its famous three pointed star (for land, sea and air transport) on a spring, so that in the case of an inadvertent knock it pops back up unharmed. The corporate name and laurel wreath on the base is done in a lovely blue lacquer worthy of a piece of jewelry. In contrast, the Chrysler hood ornament feels flimsier, has no spring mount and no lettering. One sharp blow and you just know the thing would snap two. And there’s really nothing wrong with either engineering ethos – they are just different approaches for different markets. But culturally, they are like oil and water.

Of course, it didn’t help matter that the merger occurred in 1998, right at the peak of the North American auto profit cycle. Chrysler got over $40 billion for the company in Daimler stock. Nine years and one forced CEO (the architect of the deal) departure later, Daimler sold Chrysler to private equity firm Cerberus for $6 billion. And two years after that the company filed bankruptcy. You could, in essence, time the tops of every market for the last two decades on when Chrysler changed hands. The U.S. stock market has its own “Chrysler Indicator” in the form of the Shiller Price/Earnings ratio. First developed by Nobel Prize winner Robert Shiller for his book “Irrational Exuberance” in 2000, it measures the current price of the S&P 500 as a multiple of 10 year average corporate earnings. It is essentially what old-school analysts would call an earnings power ratio, since it incorporates good and bad years into one across-the-cycle measurement.

Do read the entire piece. Bill Black knows the topic better than anyone.

• Geithner’s Single Most Revealing Sentence (Bill Black)

Timothy Geithner has a great deal of competition for the title of worst Treasury Secretary of the United States, but he has swept the field as worst President of Federal Reserve Bank of New York (NY Fed). Geithner is a target rich environment for critics and he has a gift for saying things that are obviously depraved, but which he thinks are worthy of a public servant. He did vastly more harm to the Nation as the President of the New York Fed than he did as Treasury Secretary. He was supposed to regulate most of the largest (and most criminal) bank holding companies – and failed so completely that he testified to Congress that he had never been a regulator and that the problem in banking leading up to the crisis was excessive regulation.

His statement that he was never a regulator was truthful – but you’re not supposed to admit it, and you’re certainly not supposed to be proud of it. Geithner, Greenspan, and Bernanke are the three Fed leaders who could have prevented the entire crisis by being even modestly effective regulators. Instead of regulating the banks, Geithner relied on the banks self-regulating through “stress tests.” The stress tests were (and remain) farcical. AIG, Fannie, Freddie, Lehman, the Irish banks, and the big three Icelandic banks all passed stress tests shortly before they collapsed. It is a measure of Geithner’s goofiness that he has entitled his book “Stress Test.”

As Treasury Secretary, Geithner made his infamous “foam the runways” comment. He admitted that while the way he ran the programs putatively designed to help distressed homeowners was causing them to fail frequently to help homeowners it was succeeding in easing the bank crashes. Geithner repeatedly claimed as Treasury Secretary that he never worked for Wall Street (and as he left congratulated himself on not joining Wall Street – a few months before he did). As New York Fed President Geithner worked for Wall Street for five years and was handsomely rewarded for that service. As he has admitted, virtually bragged, he did not work for the American people as a regulator though that is what he was supposed to do.

Iron ore has been used as money, collateral, credit. That use is largely gone.

• Price Destruction From Massive Iron Ore Glut Gains Momentum (Stockman)

At the heart of the global boom of the last two decades, of course, was a fantastic leap in credit expansion that has no historical antecedents. Around 1994 the combined credit market debt—public and private—of the US, EU, Japan and China amounted to about $35 trillion or 200% of GDP. By the turn of the century debt outstanding among these four major economies had doubled to $70 trillion, and then the central bank printing presses turned white hot. Combined debt outstanding at present is in the order of $175 trillion, meaning that it towers 4X above levels of only 20 years ago, and weighs in a nearly 400% of GDP among the big four economies. And what happened to this $140 trillion of tsunami of new debt since 1994?

In the DM world it ended up on the balance sheets of households and governments which have now reached “peak debt” ratios, meaning that the credit fueled consumption party is over. Accordingly, what had been double digit growth for EM exports of manufactured goods to consumers in the DM markets has hit the flat line since the 2008 peak. And in the EM world it ended up funding the most spectacular increase in mining, manufacturing, shipping, real estate and public infrastructure assets ever imagined by any economic scribbler prior to the turn of the century. Moreover, the artificial consumption boom in the DM world fueled the fixed asset boom in the EM based on the kind of mathematically impossible bullish extrapolations which always accompany a credit-fueled crack-up boom.

Yet when the housing and credit booms crashed in the DM world in 2009, the deep retrenchment of capital spending that was warranted in the EM supplier markets didn’t happen—except during a few brief months of panic and inventory liquidation in the winter of 2008-2009. Instead, the EM governments stepped into the breach, and launched a Keynesian pyramid building spree that surpassed by orders of magnitude any “stimulus” program ever conceived or imagined in the Harvard economics department. Accordingly, global demand for the building blocks of fixed assets and infrastructure—that is, copper, iron ore, bauxite, nickel, hydrocarbons etc.——took another giant leap upward after the financial crisis. Indeed, CapEx by the big three surviving mining companies—BHP, Rio Tinto And Vale—soared by 10X during the decade ending in 2012.

For now, it’s growth that goes down. But how long till the underlying data itself does?

• China Slowdown Deepens (Bloomberg)

China’s economic slowdown deepened with unexpected decelerations in industrial output, investment and retail sales, testing policy makers’ reluctance to step up monetary stimulus. Factory production rose 8.7% in April from a year earlier, the National Bureau of Statistics said today in Beijing, compared with the 8.9% median estimate of analysts surveyed by Bloomberg News. Fixed-asset investment increased 17.3% in the first four months of the year, and retail sales advanced 11.9% in April. The figures signal risks are increasing that China will miss the year’s expansion goal of about 7.5%, as the government’s efforts to counter the slowdown, including tax breaks and spending on railways and housing, have yet to gain traction.

Leaders are trying to rein in a credit boom and curb pollution, and President Xi Jinping said last week that the nation needs to adapt to a “new normal” of slower growth. “The economy is still slowing,” Wang Tao, chief China economist at UBS AG in Hong Kong, said in an e-mail. The government’s “mini-stimulus has not yet turned around the growth momentum,” and the government may ease credit by loosening restrictions on lending to homebuyers and local-government financing vehicles, Wang said. The Shanghai Composite Index fell 0.3% as of 2:05 p.m. local time. The yuan weakened 0.05% to 6.2407 per dollar. Factory-production growth compared with an 8.8% increase in March. The advance in retail sales compared with the 12.2% median projection of analysts, and the same gain in March.

But is that also true for the shadow banks?

• China’s New Credit Declines (Bloomberg)

China’s broadest measure of new credit fell last month as authorities extended their campaign to tame financial dangers even as construction and manufacturing data point to risks that the economy’s slowdown will worsen. Aggregate financing was 1.55 trillion yuan ($249 billion) in April, the People’s Bank of China said yesterday in Beijing, compared with 2.07 trillion yuan in March. New local-currency bank loans were 774.7 billion yuan, down from 1.05 trillion yuan the previous month. The figures add to signs that officials are reluctant to heed calls for monetary stimulus, with President Xi Jinping saying in remarks published May 10 that the nation needs to stay “cool-minded” amid what analysts forecast will be the weakest annual growth since 1990.

PBOC Deputy Governor Liu Shiyu said the same day that shadow banking threatens to undermine the financial system, as policy makers try to rein in credit. “In the face of calls for stimulus, China’s government appears comfortable with a continued slowdown in credit growth,” Mark Williams, chief Asia economist at Capital Economics Ltd. in London, said in a note. “The government’s composure so far is an encouraging sign that policy makers are still giving priority to bringing credit risks under control,” said Williams, a former U.K. Treasury adviser on China.

China worries go mainstream.

• Chinese Leaders Face Mounting Pressure As Slowdown Concerns Grow (Forbes)

Will China’s economy have a hard or a soft landing? That was a question I was often asked when I was in New York, but struggled to answer. On one hand, I knew full well that theories, like the Solow Model, tell us an economy can’t keep growing forever. On the other hand, I also understand that a crash – a.k.a. hard landing – may not arrive in a form that many expect because the Chinese government is so proactive in cushioning the economy from negative shocks. Xinhua News Agency reported today China’s urban fixed asset investment reached $1.74 trillion in the first fourth months. The growth rate was 0.3%age points slower than the first quarter although it was up 17.3% on the yearly basis. On the same token, the country’s growth of factory output and retail sales have both missed estimates.

China’s PMI (Purchasing Managers’ Index) announcements have been grabbing lots of attention too these past few years. The latest figure released by the end of April showed that the country’s manufacturing sector recorded a contraction for the fourth straight month. As a more reliable indicator of the economy’s health than GDP, the PMI indicates a slowdown in activity in the world’s workshop, while other indicators, such as private investment in fixed assets and power consumption, are also reflecting a softening trend. The numbers have become the story. Private investment in fixed assets in China grew 20.9% to 4.43 trillion yuan in the first quarter. But that was a slowdown from growth of 24.1% in the same period a year earlier.

Moreoever, Xinhua quoted official figures stating that power use by Primary Industry, i.e. business related to natural resources and the manufacturing of certain products, Moreoever, Xinhua quoted official figures stating that power use by Primary Industry, i.e. business related to natural resources and the manufacturing of certain products, fell 7 % to 17.4 billion kwh in the first three months. Beijing’s technocrats say the phlegmatic scenario was brought on by a listless rebound in the U.S. and Europe , along with slack demand in emerging markets. In response to the slowdown, the government unveiled some measures, dubbed “mini stimulus,” which mainly focuses on raising funds for railways and social housing by early April.

Japanese nuts, anyone?

• Japan to Sell Inflation-Linked Bonds to Individuals (WSJ)

Japan will allow individuals to own inflation-linked bonds from next year in response to growing demand for protection against rising prices as the Bank of Japan continues its ultra-easy monetary policy, the government said Tuesday. The move is also meant to complement the government’s policy of encouraging individual ownership of Japanese government bonds amid concerns that domestic institutional investors alone may not be able to carry Japan’s massive debt, the largest among industrialized countries. The Finance Ministry said bonds reaching maturity in 2016 or later will be eligible for individual ownership.

Inflation-linked bond issuance was resumed last year after a five-year hiatus, as appetite revived for inflation protection following the BOJ’s introduction of an inflation target. The outstanding balance of such bonds is expected to reach Y3.6 trillion in the year ending March 2015, including Y1.6 trillion to be issued during the year. Individuals currently own only 2.2% of outstanding JGBs totaling Y744 trillion. The government expects that greater individual ownership will help stabilize the JGB market.

“Japan’s gross public debt is 240% of GDP compared to 100% in the US”. Any questions?

• Abenomics: Live Fire Test Of Keynesian Central Banking Is A Disaster (Stockman)

You would think that Japan would be a blinding object lesson in the folly of Keynesian economics. After all, Japan has gone all-out on both fiscal stimulus and massive central bank balance sheet expansion and interest rate repression. Indeed, the US incursions into that fantasy world are somewhat modest by comparison: Japan’s gross public debt is 240% of GDP compared to 100% in the US; and its central bank balance sheet of nearly $3 trillion amounts to more than 40% of GDP. That vastly exceeds the 25% of GDP balance sheet generated by the mad money printers in the Eccles Building to date.

But the lessons go far beyond balance sheet ratios. Japan’s rapidly aging demographic profile—-its population is now actually declining— is only an advanced case of the US path over the next several decades. Likewise, its inability to close its yawning fiscal gap—last year it borrowed nearly 50 cents on every dollar of government spending—is a function of the same malady of governance that afflicts the Washington beltway. Namely, the domination of a nominal democratic process by crony capitalist gangs which resist all efforts to curtail privileges, subsidies and entitlements.

In truth, Japan is rapidly becoming a vast old age home buckling under the weight of a monumental accumulation of public, household, business and financial debt. Current estimates for total debt outstanding amount to nearly 500% of GDP—-a figure which would be equivalent of $85 trillion on a US economic scale. Needless to say, these staggering debt burdens have prevented Japan from returning to normal economic growth—ever since its giant financial bubble collapsed 25 years ago after the Nikkei average had hit 50,000 (vs. 15,000 today). The aftermath has been described as chronic “deflation”, but the true meaning of that term has been badly twisted and distorted.

What actually happened during the final stages of Japan’s 1980s bubble is that ultra-cheap interest rates caused financial and real estate values to become drastically inflated. Similarly, cheap capital resulted in a massive over-investments in long-lived industrial assets like auto plants, steel mills and electronics plants. So the deflationary aftermath of its bubble was an unavoidable and inexorable economic process. That is, real estate got marked down by upwards of 80%; stocks fell by even more; excess industrial capacity was steadily eliminated; and massive bad debts have been liquidated by Japan’s unique slow-motion process.

The renewed housing bubble and ongoing crisis change society in profound ways.

• America On The Move Becomes Stay-Home Nation For Young (Bloomberg)

Ryan Yang could have taken a job in a New Jersey DNA sequencing laboratory after graduating from college last year. Instead, the 23-year-old lives with his family in Queens, New York, still unemployed and searching. With the expense of commuting or relocating, “I thought about it and it just didn’t seem right,” said Yang, a biology major who rejected the job 50 miles away in Piscataway to look for opportunities closer to home. “If I was previously living in New Jersey, I think I would have taken that job in a heartbeat.”

Yang belongs to the age group, adults under 35, that’s traditionally the most mobile part of an American work force constantly on the move since the 19th century. Now, that’s changing as members of the millennial generation, the estimated 85 million born from 1981 through 2000, prove less restless than their forebears. The standstill may be holding back recovery in the labor and housing markets. “They remain stuck in place,” said William Frey, a senior fellow at the Brookings Institution in Washington who specializes in migration issues. “The recent slowdown is really an interaction of demographics and a continued housing- and labor-market freeze. Millennials are mired down, very cautious about buying a home or moving to new areas.”

While Frey’s analysis of U.S. Census Bureau data shows Americans under 35 move almost twice as often as other age groups, the pace is slowing. In the year ended March 2013, just 20.2% of those aged 25 to 34 relocated, the lowest rate for that age group in data going back to 1947, down from 31% in 1965, Frey said.

We need francs!, Eh, Euros!

• France Refuses To Block Mistral Warship Deal With Russia (RT)

The French government has said that it will go ahead with €1.2 billion ($1.6 billion) contract to supply Russia with two Mistral helicopter carriers because cancelling the deal would harm Paris more than Moscow. In the wake of the crisis in Ukraine, the United States had been pressing France as well as Britain and Germany to take a tougher line against Russia and cancel the Mistral contract. But France refuses to link the helicopter carrier deal to the US/EU debate over tougher sanctions against Russia.

A French government official travelling with President Francoise Hollande in Azerbaijan Sunday, who asked not be named, told reporters that the contract was too big to cancel and that if France didn’t fulfill the order it would be hit with penalties. “The Mistrals are not part of the third level of sanctions. They will be delivered. The contract has been paid and there would be financial penalties for not delivering it. “It would be France that is penalized. It’s too easy to say France has to give up on the sale of the ships. We have done our part,” the official said.

President Hollande also said earlier on Saturday that the contract will go ahead. “This contract was signed in 2011, it will be carried out. For the moment it is not in question,” President Hollande said on Saturday during a visit to German Chancellor Angela Merkel’s electoral district. The Russian defense ministry warned Paris in March that it would have to repay the cost of the contract plus additional penalties if it cancelled the deal. EU foreign ministers met in Brussels Monday and expanded their sanctions over Russia’s stance on the Ukrainian crisis, adding two Crimean companies and 13 people to the bloc’s blacklist, EU diplomats said.

Still the sole voice of reason in the US. Hope you noted that the Telegraph of all places started asking serious questions yesterday, see May 12 Debt Rattle.

• What Does The US Government Want in Ukraine? (Ron Paul)

In several eastern Ukrainian towns over the past week, the military opened fire on its own citizens. Dozens may have been killed in the violence. Although the US government generally condemns a country’s use of military force against its own population, especially if they are unarmed protesters, this time the US administration blamed the victims. After as many as 20 unarmed protesters were killed on the May 9th holiday in Ukraine, the State Department spokesman said “we condemn the outbreak of violence caused by pro-Russia separatists.”

Why are people protesting in eastern Ukraine? Because they do not believe the government that came to power after the US-backed uprising in February is legitimate. They do not recognize the authority of an unelected president and prime minister. The US sees this as a Russian-sponsored destabilization effort, but is it so hard to understand that the people in Ukraine may be annoyed with the US and EU for their involvement in regime change in their country? Would we be so willing to accept an unelected government in Washington put in place with the backing of the Chinese and Iranians?

The US State Department provided much assistance earlier this year to those involved in the effort to overthrow the Ukrainian government. The US warned the Ukrainian government at the time not to take any action against those in the streets, even as they engaged in violence and occupied government buildings. But now that those former protesters have come to power, the US takes a different view of protest. Now they give full support to the bloody crackdown against protesters in the east. The State Department spokesperson said last week: “We continue to call for groups who have jeopardized public order by taking up arms and seizing public buildings in violation of Ukrainian law to disarm and leave the buildings they have seized.” This is the opposite of what they said in February. Do they think the rest of the world does not see this hypocrisy?

The real question is why the US government is involved in Ukraine in the first place. We are broke. We cannot even afford to fix our own economy. Yet we want to run Ukraine? Does it really matter who Ukrainians elect to represent them? Is it really a national security matter worth risking a nuclear war with Russia whether Ukraine votes for more regional autonomy and a weaker central government? Isn’t that how the United States was originally conceived? Has the arrogance of the US administration, thinking they should run the world, driven us to the brink of another major war in Europe? Let us hope they will stop this dangerous game and come to their senses. I say let’s have no war for Ukraine!

As would anyone.

• Russia Tells Ukraine To Pay Gas Debt Or Supplies May Halt June 3 (BBC)

Russia’s state energy giant Gazprom has said it may halt natural gas shipments to Ukraine on 3 June unless the country pays in advance for supplies.Gazprom boss Alexei Miller said the move was because of outstanding debts. If there is no payment by the deadline then “Ukraine will receive zero cubic metres [of gas] in June,” Russian news agency Interfax reported. And Prime Minster Dmitry Medvedev said on Russian TV saying they could no longer “nanny” Ukraine. Mr Miller said Ukraine must pay in advance for its June deliveries because of debts amounting to $3.51bn. His comments were made during a meeting with Mr Medvedev. The Russian president said that Kiev could dip into its IMF aid package and questioned Ukraine’s refusal to do so until now. “According to our information, Ukraine has received money from the first IMF tranche,” he said.

Ukraine has refused to cover its obligations in protest over Moscow’s decision to nearly double the price it charges Kiev for gas imports. Ukraine’s Finance Minister Oleksandr Shlapak had earlier said on Monday that the county was willing to cover its outstanding payment as soon as Russia lowered its price. He said Ukraine was prepared to issue bonds worth $2.16bn to address its gas arrears. “If Russia extends the old price of $268 per 1,000 cubic metres [until] the end of the year, we will immediately cover the debt,” the UNIAN news agency quoted Mr Shlapak as saying. Gazprom now charges Ukraine $485.50 per 1,000 cubic metres – the highest rate of any of its European clients. Close to 15% of all gas consumed in Europe is delivered from Russia through Ukraine. There is a danger for EU nations that Ukraine will start taking the gas Russia had earmarked for its European clients, something it did when it was cut off from Russian gas during previous disputes in 2006 and 2009.

Partly true for sure. NATO is a big one too. US.

• EU Policy To Blame For Ukraine Crisis – Ex-Chancellor Schroeder (RT)

Germany’s former Chancellor Gerhard Schroeder has blamed European Union policy for the current situation in Ukraine and urged the West to stop focusing on new sanctions against Russia. In Schroeder’s opinion, the EU’s fundamental mistake – that subsequently led to the ongoing crisis in Ukraine – was its association policy, he said in an interview with German newspaper Welt am Sonntag published Sunday. Brussels “ignored” Ukraine’s deep cultural division between traditionally pro-European western regions and Russia-leaning regions in the east, the former chancellor said. Kiev, however, had to pick either an association with the EU or a Customs Union with Russia, Schroeder said. He suggested that it could have been more reasonable if the former Soviet republic was offered an alternative when it could do both.

Asked whether it was the corrupt system and government in Ukraine that led to the unrest, Schroeder agreed that that was also true, but, at the same time, Yanukovich came to office through a free election. Initially, protests in Ukraine began in November, after President Viktor Yanukovich put on hold the signing of the association agreement with the EU, because, as he explained, at that moment it would be against national interests. The decision sparked months of fierce protests on Kiev’s Maidan square which ended with a February coup and the ouster of Yanukovich. Since then, the epicenter of bloody unrest has moved to eastern regions where many oppose to the new Kiev government, the republic of Crimea decided to rejoin Russia. Schroeder admitted that the situation with Crimea joining Russia might be controversial in terms of international law, but that has already happened after the republic decided to be part of Russia via a referendum.

Not so sure about this. They tried that one before, last time early 40’s.

• ‘Russia Should Ignore Washington’s New Cold War’ (RT)

Washington desperately needs a new Cold War with Russia to ensure a healthy Military-Security Complex and to maintain global hegemony, former Reagan administration official Paul Craig Roberts told RT in an interview. “The best thing the Russian government could do is just ignore [Washington’s rhetoric] and go on making its relations with China, India, Brazil, and South America, and go on about its business and leave the dollar system, and simply quit trying to be accepted by Washington,” said Roberts, also an economist and columnist on global affairs.

RT: The way that some US officials are speaking, it seems that NATO seriously believes that Russia is set to invade the Baltic states.

PCR: What this is all about is that Washington had hoped to grab Ukraine, especially the Russian naval base in Crimea, in order to cut Russia off from the port and access to the Mediterranean. Now, Washington lost that game. They’re trying to retrieve it by starting a new Cold War, and that’s what all this talk is about. They’re pretending that Russia is going to invade the Baltics or Eastern Europe. This is absurd.

RT: NATO is building up its forces in the Baltic region. Isn’t this a dangerously provocative step in terms of a new Cold War?

PCR: Washington wants a Cold War, they need it. They’ve been defeated in Afghanistan, they were blocked from attacking Syria and Iran, so they’ve got to keep the military-security complex funded, because that’s where an important part of their campaign contributions comes from. When Washington gives the taxpayers’ money to the military sector, it is cycled back in campaign contributions to keep them in office. They have to have conflict. With the wars in the Middle East winding down, apparently, they have to start new conflict, and since they lost their plan to take over Ukraine – which has defected, much of it, back to Russia – they’re going to start a new Cold War.That’s what this means.

Now they haven’t put enough troops or aircraft in these countries to make any difference, but they want to. So what Russia is faced with is a new Cold War, and the best thing the Russian government could do is just ignore it and go on making its relations with China, India, Brazil, and South America, and go on about its business and leave the dollar system, and simply quit trying to be accepted by Washington.

As is everybody’s. Just a little later.

• Ukraine’s Destiny Is To Go Medieval (Jim Kunstler)

I’m not persuaded that Russia and its president, Mr. Putin, are thrilled about the dissolution of Ukraine. Conceivably, they would have been satisfied with a politically stable, independent Ukraine and reliable long-term leases on the Black Sea ports. Russia is barely scraping by financially on an oil, gas, and mineral based economy that allows them to import the bulk of their manufactured goods. They don’t need the aggravation of a basket-case neighbor to support, but it has pretty much come to that. At least, it appears that Russia will support the Russian-speaking region east of the Dnieper.

My guess is that the Kiev-centered western Ukraine can’t support itself as a modern state, that is, with the high living standards of a techno-industrial culture. It just doesn’t have the fossil fuel juice. It’s at the mercies of others for that. In recent years, Ukraine has even maintained an independent space program (which is more than one can say of the USA). It will be looked back on with nostalgic amazement. Like other regions of the world, Ukraine’s destiny is to go medieval, to become a truly post-industrial agriculture-based society with a lower population and lower living standards. It is one the world’s leading grain-growing regions, a huge advantage for the kind of future the whole world faces — if it can avoid becoming a stomping ground in the elephant’s graveyard of collapsing industrial anachronisms.

Ukraine can pretend to be a ward of the West for only a little while longer. The juice and the money just isn’t there, though. Probably sooner than later, the IMF will stop paying its gas bills. Within the same time-frame, the IMF may have to turn its attention to the floundering states of western Europe. That floundering will worsen rapidly if those nations can’t get gas from Russia. You can bet that Europe will think twice before tagging along with America on anymore cockamamie sanctions. Meanwhile, the USA is passing up the chance to care for a more appropriate client state: itself. Why on earth should the USA be lending billions of dollars to Ukraine when we don’t have decent train service between New York City and Chicago?

The new known unknowns…

• Former CIA Director: ‘We Kill People Based On Metadata’ (RT)

At a recent debate concerning the National Security Agency’s bulk surveillance programs, former CIA and NSA director Michael Hayden admitted that metadata is used as the basis for killing people. The comments were made during a debate at Johns Hopkins University, after Georgetown University Law Center professor David Cole detailed the kind of information the government can obtain simply by collecting metadata – who you call, when you call them, how long the call lasts, and how often calls between the two parties are made.

Although NSA supporters often claim such metadata collection is permissible considering the content of the call is not collected, Cole argued that is not the case, since the former general counsel of the NSA, Stewart Baker, has already stated metadata alone is more than enough to reveal vast amounts of an individual’s personal information. Writing in the New York Review of Books, Cole elaborated:

“Of course knowing the content of a call can be crucial to establishing a particular threat. But metadata alone can provide an extremely detailed picture of a person’s most intimate associations and interests, and it’s actually much easier as a technological matter to search huge amounts of metadata than to listen to millions of phone calls. As NSA General Counsel Stewart Baker has said, ‘metadata absolutely tells you everything about somebody’s life. If you have enough metadata, you don’t really need content.’ “When I quoted Baker at a recent debate at Johns Hopkins University, my opponent, General Michael Hayden, former director of the NSA and the CIA, called Baker’s comment ‘absolutely correct,’ and raised him one, asserting, ‘We kill people based on metadata.’”

How to use NZ laws to cheat the entire planet.

• New Zealand Shell Companies And Stooges -and Ukraine- (NC)

In our first post in this series, we reminded readers of the nearly complete demolition, by the New Zealand Company registrar, of the GT Group and Company Net shell company incorporation franchises in New Zealand. In the second post, we highlighted another franchised shell incorporator, Unicredit, incidentally trampled by the NZ Registrar’s giant Monty Python foot as it descended on the shell companies created by GT Group and The Company Net. That was semi-good work by the Registrar, but The Company Net had another deal going, with another incorporator, and the Registrar, despite a frenzy of striking off back in 2011, didn’t clean it all up. This post gives the background to that deal, and should make it pretty obvious why these particular shells matter. Subsequent posts will round out the picture and bring it up to date.

Once again, the stooge directors recorded in the New Zealand register are the indicators. Their names are Juri Vitman (associated with one NZ company), Erik Vanagels (associated with 318 NZ companies), Voldemar Spatz (associated with 360 NZ companies), and Inta Bilder (associated with 897 NZ companies). All the New Zealand companies the stooges purportedly directed were originally incorporated by The Company Net. They all have Latvian addresses; Erik Vanagels (who may be two people of the same name, father and son perhaps; no-one’s quite sure) often has an address in Panama, as well as his Latvian one. Here is their pedigree, from a 2011 article by Graham Stack, then of Business New Europe, fittingly entitled “Massive Ukrainian government money-laundering system surfaces”:

What do Ukrainian tank exports to Kenya, flu vaccine imports from Oregon and oil rig imports from Wales all have in common? They are all deals carried out by the same shell companies that are linked to a small set of Latvian directors. A scandal is unfolding in Ukraine that could be dubbed Vanagels-gate as more details of dodgy and outright illegal deals using a string of shell companies emerges, which can be traced directly back to the upper echelons of the Ukrainian government. … According to an investigation conducted by bne, Vanagels and Gorin – together with Latvian colleagues such as Juri Vitman, Elmar Zallapa and Inta Bilder – preside over a sprawling network of companies with Baltic bank accounts that have extensive dealings with the Ukrainian state, covering everything from arms exports to machinery imports.

The “Ukrainian government” mentioned here is the Yanukovych one, recently turfed out either by neo-Nazis and the CIA, or by concerned freedom-loving citizens, depending on which Manicheism you subscribe to. The back story of the network that shows up in this group of New Zealand shell companies just grows and grows. For a 2012 baseline, try this Swiss summary of the trail left in Ukraine, Russia, Moldavia and Rumania by one of these stooges, Erik Vanagels (I was tempted to make the prose more English, but resisted):

Why am I not surprised?

• Australia Asked Americans For More Help To Spy On Australian Citizens (Guardian)

Australia’s intelligence agency asked for more help from its US counterparts to increase surveillance on Australians suspected of involvement in international extremist activities. Documents from the US National Security Agency, published by Glenn Greenwald on Tuesday in his book No Place to Hide: Edward Snowden, the NSA and the Surveillance State, reveal new details of Australia’s close relationship with the US spy agency. In an extract on 21 February 2011 from the acting deputy director of Australia’s Defence Signals Directorate, which has since been re-named the Australian Signals Directorate (ASD), the director pleads for additional surveillance on Australians.

“We would very much welcome the opportunity to extend that partnership with NSA to cover the increasing number of Australians involved in international extremist activities – in particular Australians involved with AQAP,” the extract said. AQAP stands for Al-Qaida in the Arabian Peninsula, an organisation that is proscribed as a terrorist organisation under Australia’s Commonwealth Criminal Code. The letter says the Australian spy agency has enjoyed a long and very productive partnership with the NSA in obtaining access to “minimised access to United States warranted collection against our highest value terrorist targets in Indonesia”. “This access has been critical to DSD’s efforts to disrupt and contain the operational capabilities of terrorists in our region as highlighted by the recent arrest of fugitive Bali bomber Umar Patek,” the letter said.

It’ll take centuries. Ready to fall back asleep yet?

• Western Antarctic Ice Sheet Collapse Underway, Unstoppable (Guardian)

The collapse of the Western Antarctica ice sheet is already under way and is unstoppable, two separate teams of scientists said on Monday. The glaciers’ retreat is being driven by climate change and is already causing sea-level rise at a much faster rate than scientists had anticipated. The loss of the entire western Antarctica ice sheet could eventually cause up to 4 metres (13ft) of sea-level rise, devastating low-lying and coastal areas around the world. But the researchers said that even though such a rise could not be stopped, it is still several centuries off, and potentially up to 1,000 years away. The two studies, by Nasa and the University of Washington, looked at the ice sheets of western Antarctica over different periods of time.

The Nasa researchers focused on melting over the last 20 years, while the scientists at the University of Washington used computer modelling to look into the future of the western Antarctic ice sheet. But both studies came to broadly similar conclusions – that the thinning and melting of the Antarctic ice sheet has begun and cannot be halted, even with drastic action to cut the greenhouse gas emissions that cause climate change. They also suggest that recent accumulation of ice in Antarctica was temporary. “A large sector of the western Antarctic ice sheet has gone into a state of irreversible retreat. It has passed the point of no return,” Eric Rignot, a glaciologist at Nasa and the University of California, Irvine, told a conference call. “This retreat will have major consequences for sea level rise worldwide.”

Good title.

• This Is What a Holy Shit Moment for Global Warming Looks Like (Mother Jones)

If you truly understand global warming, then you know it’s all about the ice. That’s what matters. Planet Earth has not always had great ice sheets at the poles, of the sort that currently exist atop Greenland and Antarctica. In other periods, much of that water has instead been in liquid form, in the oceans—and the oceans have been much higher. How much? According to the National Academy of Sciences, the globe’s great ice sheets contain enough frozen water to raise sea levels worldwide by more than 60 meters. That’s about 200 feet. And it makes all the sea level rise that we’ve seen so far due to global warming appear piddly and insignificant.

That’s why scientists have long feared a day like this would come. Two new scientific papers, in the journals Science and Geophysical Research Letters, report that major glaciers that are part of the West Antarctic Ice Sheet appear to have become irrevocably destabilized. The whole process may still play out on the scale of centuries, but due to the particular dynamics of this ice sheet, the collapse of these major glaciers now “appears unstoppable,” according to NASA (whose researchers are behind one of the two studies).

The first study, by researchers at NASA and the University of California-Irvine, uses satellite radar to examine an array of large glaciers along the Amundsen Sea in West Antarctica, which collectively contain the equivalent of four feet of sea level rise. The result is the documentation of a “continuous and rapid retreat”—for instance, the Smith and Kohler glaciers have retreated 35 kilometers since 1992—and the researchers say that there is “no [major] obstacle that would prevent the glaciers from further retreat.” In the NASA press release, the researchers are still more vocal, with one of them noting that these glaciers “have passed the point of no return.”

The other group of researchers, based at the University of Washington, reach similar conclusions with their paper in Science. But they do so by using an computer model to study one of these glaciers in particular: The Thwaites Glacier, pictured above, which contains about two feet of sea level rise and is retreating rapidly. “The simulations indicate that early-stage collapse has begun,” notes their paper. What’s more, the Thwaites Glacier is a “linchpin” for the rest of the West Antarctic Ice Sheet; its rapid collapse would “probably spill over to adjacent catchments, undermining much of West Antarctica.” And considering that the entire West Antarctic Ice Sheet contains enough water to raise sea levels by 10 to 13 feet, that’s a really big deal.