Albert Kahn Paris, Autochrome Lumière color photo 1914

Obama’s PR fiasco widens.

• Turkey and Russia Agree on Syria Ceasefire, Into Effect by Midnight (R.)

Turkey and Russia have agreed on a proposal toward a general ceasefire in Syria, Turkey’s state-run Anadolu Agency said on Wednesday, and will aim to put it into effect by midnight. Anadolu, citing sources, said the two countries have reached a consensus that will be presented to participants in the conflict on expanding the ceasefire that was established in Aleppo earlier this month. Russia, Iran and Turkey said last week they were ready to help broker a peace deal after holding talks in Moscow where they adopted a declaration setting out the principles any agreement should adhere to. Arrangements for the talks, which would not include the United States and be distinct from separate intermittent U.N.-brokered negotiations, remain hazy, but Moscow has said they would take place in Kazakhstan, a close ally. Russia’s foreign minister on Tuesday said the Syrian government was consulting with the opposition ahead of possible peace talks, while a Saudi-backed opposition group said it knew nothing of the negotiations but supported a ceasefire.

Accuse the accuser.

• Erdogan Says He Has Evidence US-Led Coalition Has Given Support To ISIS (Ind.)

The Turkish President Recep Tayyip Erdogan says he has uncovered evidence that US-led coalition forces have helped support terrorists in Syria – including Isis. American-led forces have been working alongside Syrian rebels fighting President Bashar al-Assad but have attempted to avoid helping Isis and other Islamist militant groups. However, speaking on Tuesday in the Turkish capital, Ankara, he said he believed they had given support to a variety of militant groups, including Isis Kurdish outfits YPG and PYD. “They were accusing us of supporting Daesh [Islamic State],” he told a press conference, according to Reuters. “Now they give support to terrorist groups including Daesh, YPG, PYD. It’s very clear. We have confirmed evidence, with pictures, photos and videos.”

So Turkey is accused of aiding ISIS, now accuses the US of doing just that, and wants known ISIS backers to join peace talks. Enter Putin stage left.

• Turkey Says Saudis, Qatar Should Attend Syria Peace Talks (AP)

Turkish President Recep Tayyip Erdogan says Saudi Arabia and Qatar should join its meeting with Russia and Iran to discuss Syrian peace efforts. Russia, Turkey and Iran, which helped broker the withdrawal of civilians and militants from the Syrian city of Aleppo, have agreed to hold talks on Syria in Kazakhstan next month. Erdogan said Tuesday the meeting of foreign ministers should include Saudi Arabia and Qatar, saying they had “shown goodwill and given support” to Syria. Turkey, Saudi Arabia and Qatar are the main backers of rebels seeking to topple Syrian President Bashar Assad, who is closely allied with Moscow and Tehran. Erdogan added, however, that Turkey would not take part if any “terror organizations” are also invited, referring to Syrian Kurdish groups affiliated with Kurdish insurgents in Turkey.

All the US has ever bet on is chaos.

• ‘US Raised Middle East Terrorists & Wants Them To Stay’ – Iran Def Min (RT)

Washington appears unready to play a serious role in fighting Islamic State (IS, formerly ISIS/ISIL), as it has fostered terrorists itself and now wants them to remain in the Middle East, Iranian Defense Minister Hossein Dehghan told RT. “The Western coalition is of a formal nature, they have no real intention to fight neither in Syria nor in Iraq. We don’t see any readiness on their part to play a truly useful and meaningful role in fighting IS, because it’s them who have raised terrorists and they are interested in keeping them there,” Dehghan said. According to the Iranian defense minister, Tehran has never coordinated its operations with the Americans and “will never collaborate with them.”

“Maybe the coalition forces would like to see terrorists weakened, but certainly not destroyed, because those terrorists are their tool for destabilizing this region and some other parts of the world.” He also mentioned Al-Nusra Front (also known as Jabhat Fateh al-Sham) and said that terrorists in Syria receive support from the US, Saudi Arabia and Qatar. He also accused Turkey of supporting terrorists on the ground. “If Iran, Russia and Syria were to reach an agreement with Turkey to end Turkish support for those terrorist groups, particularly IS and Jabhat al-Nusra, and start fighting them, then I think we would see the situation in Syria improve,” he added. According to the minister, any ceasefire in Syria demands guarantees and all parties should agree to fulfill the conditions for a truce.

“We shouldn’t let Islamic State or Al-Nusra groups take part in the ceasefire. All other groups should start a political process and negotiations with the Syrian government.” He added that after the truce comes into force, it is important to separate terrorists and opposition groups ready to negotiate with the Syrian government. All sides should fight IS and Al-Nusra Front, Dehghan stated, adding that everyone should stop supporting terrorists in political, financial and military areas.

That’s a big company to have this happen to.

• Toshiba Shares Fall 20%, Hit Limit, As US Nuclear Writedown Sinks In (AFP)

Toshiba shares dived more than 20% on Wednesday in their second straight double-digit plunge as the company said it may book a one-time loss of several billion dollars over its US nuclear business. Toshiba’s stock price dropped by 20.42% to 311.60 yen, the largest fall allowed for a single day, about 30 minutes after the opening bell, as the company failed to remove investor worries over the potential risk. On Tuesday the Tokyo-based conglomerate said costs linked to the acquisition in 2015 by its US subsidiary of a nuclear service company would possibly come to “several billion US dollars, resulting in a negative impact on Toshiba’s financial results”. The exact figure of the potential writedown was still being worked out, Toshiba president Satoshi Tsunakawa said after the announcement, apologising for “causing concern”.

The company statement suggested the figure would be released soon, citing an end-of-year deadline. Toshiba shares had closed nearly 12% lower on Tuesday on media reports about the potential loss. Analysts said uncertainty was fuelling investor anxiety. “Concerns have yet to be cleared away as they said they didn’t know the figure,” Yukihiko Shimada, senior analyst at SMBC Nikko Securities, told AFP. SMBC Nikko credit analysts Yutaka Ban and Kentaro Harada said in a report that investors “can’t be optimistic about the situation” even though the total writedown may not end up as big as the 500 billion yen (US$4.3bn) reported by local media. Nomura Securities analyst Masaya Yamasaki said in a report issued late on Tuesday that the expected loss “is negative for the company as its financial standing is fragile”.

Tsunakawa answered in the affirmative when asked if Toshiba was considering boosting capital. Its chief financial officer, Masayoshi Hirata, said that after the figure was confirmed the company would “explain and seek support” from financial institutions. Toshiba said the possible loss was related to the valuation of the purchase by subsidiary Westinghouse Electric of the nuclear construction and services business of Chicago Bridge and Iron.

Something’s not right.

• China To Rein In Outward Investment As Domestic Growth Stalls (G.)

Beijing has signalled plans to curb Chinese firms’ investment in foreign assets, after revealing that companies from China are on course to spend 1.12 trillion yuan (£130bn) on everything from British football clubs to a Hollywood film producer in 2016. Companies from China ramped up their spending on overseas assets during the year, as a weakening domestic economy saw investors turn their attention overseas. A diverse array of targets included the maker of Godzilla, Aston Villa Football Club and the pub in which former prime minister David Cameron and Chinese premier Xi Jinping once shared a pint. The spending spree boosted non-financial overseas investment 55% in the first 11 months of 2016, putting Chinese companies on course to spend £130bn this year, compared with £86bn in 2015, said commerce minister Gao Hucheng.

While foreign investment has soared, the amount of money flowing into the country is set to remain broadly flat at £92bn. This means the difference between investments abroad and those coming into China has reached an unprecedented £39bn. The widening gap has triggered concerns about capital flight, where investors send their money out of the country rather than investing it to spur domestic growth. Gao signalled that Beijing would move to address the investment gap by reining in Chinese firms’ overseas spending and making it easier for firms from abroad to access the Chinese economy.

He said the government would “promote the healthy and orderly development of outbound investment and cooperation in 2017”, in remarks at a conference that were published on the commerce ministry’s website. In November it was reported that China was preparing a clampdown on non-Chinese mergers and acquisitions. Separately, the ministry said on its blog that China would sharply reduce restrictions on foreign investment access in 2017 to make it easier for overseas firms to spend their cash in the People’s Republic. No details were given on what restrictions would be changed.

Even worse than in other years, and there’s a reason for that.

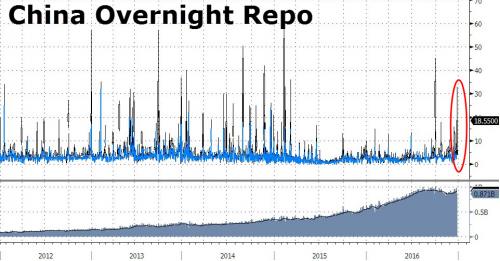

• Chinese Interbank Funding Freezes Again As Overnight Repo Hits 33% (ZH)

… when it comes to more traditional unsecured short-term funding markets, like the simple overnight repo, these reflect overall levels of liquidity in the interbank market, or as the case may be, complete absence thereof. And while China is notorious for suffering major liquidity shortages heading into a new year (including the non-lunar variety), what happened overnight in China is worth pointing out because according to Bloomberg data, the overnight repo rate traded on Shanghai Stock Exchange soared as much as 30.87% to 33%, the highest since September 29, before closing at 18.55%.

And while some of the liquidity squeeze was certainly calendar driven, what is more concerning for Chinese markets, where as we reported recently the local authorities, regulators and even press are confirming that the government crackdown on the credit and housing bubble may be serious for once due to fears about “rising social tensions”, much of the overnight repo rate spike was driven by the PBOC which pulled a net 150 billion yuan of funds in open-market operations today, the most since December 7. The result was another brief, but painful, freeze of the interbank lending market. Should the PBOC continue to not only not inject liquidity among banks, but aggressively withdraw it, it is possible that a repeat of the 2013 bank crisis when as a result of the government’s eagerness to delever the economy it almost crushed its financial sector (it ultimately gave up, with Chinese debt/GDP subsequently rising to 300% according to the IIF), should be one of the more notable risk factors for 2017.

How can Beijing NOT devalue?

• No Happy New Year in China as Currency, Liquidity Fears Loom (BBG)

China bulls could be facing a grim New Year’s eve. The first day of 2017 is when an annual $50,000 quota to convert the yuan into foreign exchange resets, stoking concern there will be a rush to sell the local currency. With tax payments and a regulatory assessment also tightening liquidity in the money market toward year-end, January may bring scant relief as lenders prepare for stronger cash demand before Lunar New Year holidays, which are only a month away. China’s markets are seeing renewed pressure this month as the Federal Reserve projects a faster pace of rate increases for 2017 and its Chinese counterpart tightens monetary conditions to spur deleveraging and defend the exchange rate. The declines are capping off a tough year for investors during which bonds, shares and currency all slumped.

“You have Chinese New Year quite early, and because of that one-month window, most of the banks will try to lock the money in a three-month cycle,” said Arthur Lau, Hong Kong-based head of Asia ex-Japan fixed income at PineBridge Investments. “The current situation in the bond market is partly because of year-end and because of Chinese New Year.” The week-long Lunar New Year holidays are traditionally a time when people give out cash gifts and companies pay employee bonuses. China’s 10-year government bond yield has surged 21 basis points in December, poised for its biggest monthly increase since August 2013, and its first annual gain since that same year. The yuan’s 6.6% decline in 2016 puts it on course for its worst year since 1994, while the Shanghai Composite Index is headed for its largest drop in five years.

The three-month interbank rate known as Shibor rose for a 50th day, its longest streak since 2010, to an 18-month high on Wednesday. The overnight repurchase rate on the Shanghai Stock Exchange jumped to as high as 33% the day before, the highest since Sept. 29. As banks become more reluctant to offer cash to other types of institutions, the latter have to turn to the exchange for money, said Xu Hanfei at Guotai Junan Securities in Shanghai. Bond and money markets may stabilize after Lunar New Year holidays – which start Jan. 27 and end Feb. 2 – though they’re unlikely to return to levels before the latest rout owing to yuan weakness and tighter monetary policy, said Lau. The People Bank of China’s yuan position – a gauge of capital flows – dropped the most in 10 months in November amid expectations for faster U.S. rate increases.

The onshore yuan’s surging trading volume suggests outflows are quickening, according to Harrison Hu, chief greater China economist at RBS. The daily average value of transactions in Shanghai climbed to $34 billion in December as of Monday, the highest since at least April 2014, according to data from China Foreign Exchange Trade System. “In the new year, the new foreign-exchange purchase quota starts, so we expect yuan positions in January to drop significantly,” Liu Dongliang at China Merchants Bank wrote in a note this month. “Within the foreseeable future, the market will be pessimistic about funding conditions. It happens to be near year-end now, where money markets are tight, and after New Year’s Day it’s almost Chinese New Year.”

“Happy New Year with fewer taxes!”

• Greek Taxpayers Face €4 Billion Tax Bill By New Year’s Eve (Xinhua)

Greek taxpayers are obliged to pay some €4 billion in taxes by New Year Eve, as outstanding debts to the state have soared to more than €94 billion by November, according to Finance Ministry data. However, some recession-hit taxpayers seem unable to pay the full taxes within deadlines and apply for settlements to pay their debts in more installments. To collect as much as possible to reach bailout targets, the Greek state has launched confiscation procedures for debtors. According to official data, in the first 10 months of 2016, the procedures had been applied onto 108,729 debtors. And another 1.6 million debtors are facing confiscation in early 2017 should they do not immediately settle their debts to the Tax office.

However, some debtors complained about the levies, saying they can not afford any more as they have been struggling to make ends meet amid seven-year austerity. Many financial analysts also warned that Greek society has reached a breaking point due to over-taxation combined with salary, pension cuts and high unemployment rates. Despite the levies, the country’s tax evasion still exists. According to a recent study conducted by the independent Greek research organization diaNEOsis, tax evasion in Greece is estimated range between 6% and 9% of the country’s GDP, which means a loss of some €16 billion in taxes a year. Experts as well as ordinary citizens urge the government to do more to address widespread tax evasion instead of adding more burdens on those who are trying to pay their share.

While mentioning the tax obligations due by Friday, the Hellenic Confederation of Commerce and Entrepreneurship (ESEE), which represents small and medium-sized companies in Greece, wishes in an e-mailed card to its members on Tuesday “Happy New Year with fewer taxes!”

is this just a stunt to get rid of the president, proposing a female Muslim for PM?

• Clash Over New Government Sends Romania Spiraling Toward Crisis (BBG)

Romania tumbled toward a new political crisis after President Klaus Iohannis rejected a prime minister nominee from the Social Democratic Party, which threatened to suspend him after winning a landslide election victory this month. Iohannis called on the party to pick someone else to lead a government after Sevil Shhaideh, a former development minister with little previous political influence, was picked by Social Democrat leader Liviu Dragnea last week. Dragnea, who can’t take the post himself because he was previously convicted of rigging a referendum, called the decision unjustified. He said he’ll consider his options, including potentially starting the procedure to suspend Iohannis, and will announce a decision by Dec. 29.

“It seems the president clearly wants to be suspended,” Dragnea said in a speech in Bucharest on Tuesday. “We’ll weigh our options very carefully, because we don’t want to take emotional decisions. We don’t want to trigger a political crisis for nothing, but if we come to the conclusion that the president must be suspended, I won’t hesitate.” The standoff in the European Union’s second-poorest country raises the risk of returning to the type of crisis that led to months of bickering between top leaders and culminated in Traian Basescu’s suspension from the presidency in 2012. It may also undermine one of the fastest paces of growth in the EU by delaying investment and the tapping of development funds, an area where Romania has ranked last in the 28-member club.

Iohannis has the constitutional right to reject any premier candidate that he doesn’t consider fit for the job. He didn’t give a reason for his decision. The choice of Shhaideh, a member of the mainly Orthodox country’s tiny Muslim minority, had fueled speculation that Dragnea may try to run the government himself from the sidelines.

“..the detractors of Donald Trump, when he was a candidate, failed to realize that [..] there is something respectable in losing a billion dollars, provided it is your own money.

• Inequality and Skin in the Game (Taleb)

There is inequality and inequality. The first is the inequality people tolerate, such as one’s understanding compared to that of people deemed heroes, say Einstein, Michelangelo, or the recluse mathematician Grisha Perelman, in comparison to whom one has no difficulty acknowledging a large surplus. This applies to entrepreneurs, artists, soldiers, heroes, the singer Bob Dylan, Socrates, the current local celebrity chef, some Roman Emperor of good repute, say Marcus Aurelius; in short those for whom one can naturally be a “fan”. You may like to imitate them, you may aspire to be like them; but you don’t resent them.

The second is the inequality people find intolerable because the subject appears to be just a person like you, except that he has been playing the system, and getting himself into rent seeking, acquiring privileges that are not warranted –and although he has something you would not mind having (which may include his Russian girlfriend), he is exactly the type of whom you cannot possibly become a fan. The latter category includes bankers, bureaucrats who get rich, former senators shilling for the evil firm Monsanto, clean-shaven chief executives who wear ties, and talking heads on television making outsized bonuses. You don’t just envy them; you take umbrage at their fame, and the sight of their expensive or even semi-expensive car trigger some feeling of bitterness. They make you feel smaller.

There may be something dissonant in the spectacle of a rich slave. The author Joan Williams, in an insightful article, explains that the working class is impressed by the rich, as role models. Michèle Lamont, the author of The Dignity of Working Men, whom she cites, did a systematic interview of blue collar Americans and found present a resentment of professionals but, unexpectedly, not of the rich. It is safe to accept that the American public –actually all public –despise people who make a lot of money on a salary, or, rather, salarymen who make a lot of money. This is indeed generalized to other countries: a few years ago the Swiss, of all people almost voted a law capping salaries of managers . But the same Swiss hold rich entrepreneurs, and people who have derived their celebrity by other means, in some respect.

In this chapter I will propose that effectively what people resent –or should resent –is the person at the top who has no skin in the game, that is, because he doesn’t bear his allotted risk, is immune to the possibility of falling from his pedestal, exiting the income or wealth bracket, and getting to the soup kitchen. Again, on that account, the detractors of Donald Trump, when he was a candidate, failed to realize that, by advertising his episode of bankruptcy and his personal losses of close to a billion dollars, they removed the resentment (the second type of inequality) one may have towards him. There is something respectable in losing a billion dollars, provided it is your own money.

Many countries use these ‘outlets’, pushing people into programs not intended for them.

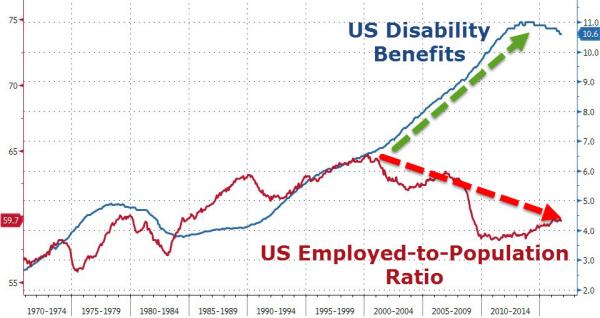

• The New Normal ‘Safety Net’: Surging Disability Benefits Claims (ZH)

If you’ve paid into Social Security, become injured or sick, and can no longer earn more than $1,130 a month, you can get a monthly subsidy from the Disability Insurance Trust Fund. As Bloomberg notes, in 1990 fewer than 2.5% of working-age Americans were “on the check;” by 2015 the number stood at 5.2%, with geographical “disability belts” appearing across America. That growth has left the fund in periodic need of rescues by Congress – most recently in 2015, when the Bipartisan Budget Act shifted money from Social Security’s old-age survivors’ fund to extend the solvency of the disability fund to 2023. Something changed in 2000…

“None of us should be surprised that the cost of the program was rising,” says Stephen Goss, Social Security’s chief actuary. He says the program’s growth is mostly a consequence of demographic change. Older workers are more likely to get sick, and as women have entered the workforce, they too have become eligible for benefits.”

In 1956, when the disability insurance fund was created, qualification was based on a list of accepted medical conditions. In 1984, Congress broadened the criteria, giving more weight to chronic pain and mental disorders. The qualification process also became more subjective. Now, rather than check diagnostic conditions against a list, the process determines whether applicants are able to perform work that’s available. It’s not as if you go to the doctor, the doctor says, “I’m sorry, son, you’ve got disability, Autor says. “It’s a social construct, because it’s about whether you can work.”

I’m prety sure it’s worse than this: “..more than 70% of the antibiotics considered medically important for human health sold in the U.S. are actually used in livestock.”

But also: “..half of antibiotic use in humans is unnecessary.”

• The Battle Against The ‘Superbugs’: Transplants, Chemotherapy At Risk (CNBC)

Headlines about antibiotic resistance – the increase in so-called “superbugs” – have been persistent in 2016. The issue of infection-causing bacteria becoming increasingly resistant to the drugs used to fight them poses a pressing risk to public health worldwide, and according to a 2014 report from the World Health Organization, “threatens the achievements of modern medicine.” The Review on Antimicrobial Resistance, commissioned by the U.K. government, estimated that “by 2050, 10 million lives a year and a cumulative $100 trillion of economic output are at risk due to the rise of drug resistant infections.” For perspective, cancer currently kills 8.2 million people annually. In September of this year, the United Nations agreed on a declaration to fight antibiotic resistance.

This was only the fourth time in the organisation’s 71-year history that a health issue has been treated with such gravity, putting antibiotic resistance on par with HIV and ebola. “It’s hard to be too dramatic,” Prof. Michael Gardam, associate professor of medicine at the University of Toronto, told CNBC via telephone. Echoing this severity, Prof. Toby Jenkins, a biophysical chemist at the University of Bath, said that “a Doomsday scenario is that transplant surgery will be impossible, chemotherapy likewise.” “Even a dental abscess could become deadly, or at least very painful,” he added. The overprescription of antibiotics is one cause of the problem, with Gardam saying that it is “becoming the norm to use last line drugs” in treating bacterial infections, and that “just in case” prescriptions should be handled with care. The U.S.-based Centers for Disease Control and Prevention estimates that half of antibiotic use in humans is unnecessary.

But, other contributing factors well integrated into daily life are also to blame. Gardam also criticized antibacterial soap and toothpaste, particularly prevalent in North America. Deeming such products unnecessary, Gardam warned that “your mouth is not meant to be a sterile zone.” He also stressed the importance of “not messing around with the natural flora of the body,” as such consumer products are wont to do. The food industry also plays a significant part in the antibiotic resistance dilemma, with healthy food-producing animals fed drugs to both prevent disease and promote growth. According to 2012 data from the U.S. Food and Drug Administration and research firm IMS Health, more than 70% of the antibiotics considered medically important for human health sold in the U.S. are actually used in livestock.