Albert Kahn Paris, Autochrome Lumière color photo 1914

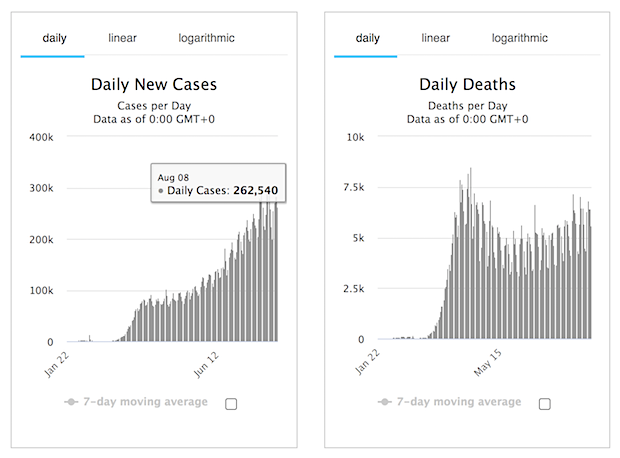

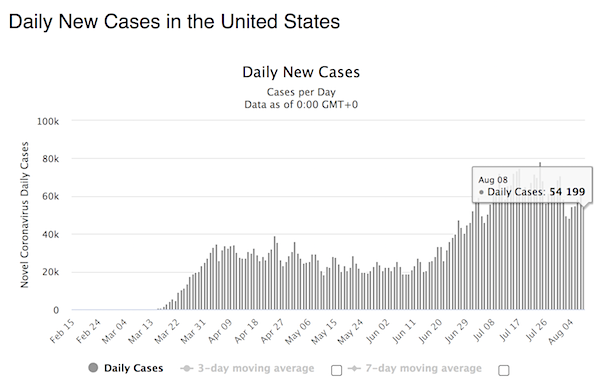

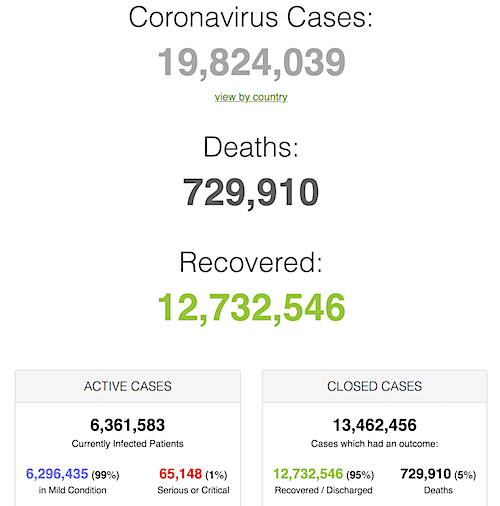

Weekend, so lower numbers. US new deaths were below 1,000 (976), so I lost that grpah.

Hedge funds dollar

Hedge Funds ramped-up their bearish Dollar bets. The aggregate USD short position reached $28.9bn, an increase of whopping $4.455bn, effectively back to peak USD bearish levels seen in 2018 and 2012, Scotia says. Euro is primary vehicle being used to express negative Dollar view. pic.twitter.com/nI3zLZtNrM

— Holger Zschaepitz (@Schuldensuehner) August 8, 2020

Who would have thought that the first socialist president of the United States would be Donald Trump?

• COVID19 Pandemic To ‘Bring Socialism To US’, Transform The World – Taleb (RT)

In a remarkable twist, the raging coronavirus pandemic has forced even countries like the US to adopt “socialist” welfare programs, acclaimed author and risk analyst Nassim Taleb has told RT. While people spend days worrying about global wars, our biggest threats have always been the pandemics, the author of ‘The Black Swan’ and ‘Skin in the Game’ told RT’s Sophie Shevardnadze on her show SophieCo. Visionaries. The advent of the novel coronavirus will tremendously change societies in many ways, making them better ready for future crises, he said. “So the world will be different, wiser. But, hopefully, it will be good for peace, because people will understand tomorrow that the enemy is not some person with weapons. The enemy is that thing you don’t see: a tiny little germ you can have on top of a pencil,” the writer added.

What I think is going to happen is a transformation of economic structures to accommodate potential pandemics. Even if they never happen again, people will be prepared for them. He cited the boom of teleworking, Zoom conference calls, and online shopping as examples of people adapting to the new reality. According to Taleb, globalization would become more “guarded,” rather than disappear entirely. “The physical movement of population… would be reduced, and business travel will not be as active as we saw in the past,” he said. One of the most remarkable changes the pandemic has brought, the writer noted, was how some governments have been “extremely helpful” to citizens trapped in quarantines and lockdowns.

This touched the US as well, where a $2 trillion stimulus package was adopted in May, the largest in the nation’s history. Who would have thought that the first socialist president of the United States would be Donald Trump? He gave people universal basic income for a few months, and they took possession of companies. If that’s not socialism, I don’t know what is. So, the individuals got a protective net that they didn’t have before. “Mark my words, if you want a headline done – ‘Who would have expected the Covid to run both domestic and foreign policy?’, ‘Covid to bring socialism to countries like the United States,’” Taleb said.

Yeah. No. Everyone may get this wrong or confused, but from what I can see he signed just one executive order (on payroll tax), the other three are memoranda. Details on that:

The hierarchy is: Proclamations, executive orders, presidential memoranda, presidential notices, and presidential determinations. Notices and determinations are usually required by Congress on specific issues. Authority: Under an executive order signed by President John F. Kennedy, an executive order must cite the authority the president has to issue it. That could be the constitution, or a specific statute. Presidential memoranda have no such requirement.

• What’s In Trump’s Coronavirus Executive Orders (R.)

After failing to reach a deal with the U.S. Congress for a fresh round of coronavirus pandemic relief, President Donald Trump signed a series of executive orders aimed at pumping up America’s pandemic-hit economy. The orders are likely to face some legal challenges. Trump’s order cuts enhanced federal unemployment benefits – a lifeline for the tens of millions of Americans thrown out of work during the pandemic – from $600 to $400 per week. Democrats had been lobbying to extend the original $600 a week enhanced benefits, which expired on July 31. Trump proposes taking most of the money from the coffers of the Federal Emergency Management Agency – $44 billion, according to the order – with 25% of the money coming from states.

It’s not clear how Trump will convince state governments, whose revenues have been hard hit by the crisis, to pony up their proposed share. Trump called the reduced payments “generous.” Trump’s first order waives the payroll tax that funds Social Security in a bid to inject extra money directly into salaried employees’ pockets. Trump has been pushing the idea for a while but it has found little support in Congress from Democrats or his fellow Republicans. The executive order says the cut comes into effect on Sept. 1, but Trump said it “most likely” would be retroactive to Aug. 1 and translate into “bigger paychecks for working families.”

Trump’s order protecting homeowners and renters from evictions is unlikely to face a challenge from Democrats; indeed, House of Representatives Speaker Nancy Pelosi this week encouraged the move. But it isn’t clear how it will be executed. The order directs authorities to provide “temporary financial assistance” to renters and homeowners “struggling to meet their monthly rental or mortgage obligations.” Even Trump seemed a little hazy on the order’s ultimate effects, saying “we don’t want people being evicted and the act that I am signing will solve that problem – largely, hopefully, completely.” Trump said that interest on student loan payments – frozen since March – would be suspended until the end of the year.

“Americans were surprised when they heard Sputnik’s beeping, it’s the same with this vaccine. Russia will have got there first..”

• Russia COVID19 Vaccine Registration Expected August 12 (RT)

Moscow’s Gamelei Center could register the world’s first coronavirus vaccine on August 12, Russia’s deputy health minister has revealed. Oleg Gridnev says medical workers and the elderly will be given priority for immunization. The senior minister at the department, Mikhail Murashko, announced last week that a nationwide mass vaccination program is planned to begin in October. Murashko added that all expenses will be covered by the government. “The registration of the vaccine developed at the Gamelei Center will take place on August 12,” Gridnev told journalists in Ufa on Friday morning, as cited by RIA Novosti. “Now the last stage, the third, is underway. This is the testing part and is extremely important. We have to understand that the vaccine itself must be safe.”

The Health Ministry, in an official statement, clarified that “the documents required for registration of the vaccine developed by the Gamelei Center, including data from clinical trials, are under examination. The issue of its registration will be decided upon the results of the examination.” Clinical trials of the formula began at Moscow’s Sechenov University on June 18. In a study involving 38 volunteers, it passed safety protocols. It was observed that all those who took part developed immunity to the infection. The speed with which Russia has managed to research and approve a formula has raised some eyebrows in the West, but Vadim Tarasov, a top scientist at Sechenov, said the country had a head start as it has spent the last 20 years developing skills in this field and trying to understand how viruses transmit.

The haste is fairly easy to grasp when you consider the effect Covid-19 has had on the world’s largest country. With more than 870,000 cases, it is among the four countries worst affected by the epidemic, along with the US, Brazil, and India. Russia’s 14,725 fatalities is the 11th highest in the world, although when measured per capita, the death rate ranks 47th, below Germany, but above Austria. The technology behind the Russian vaccine is based on adenovirus, the common cold. Created artificially, the vaccine proteins replicate those of Covid-19, triggering “an immune response similar to that caused by the coronavirus itself,” Tarasov said. In other words, immunization is similar to having survived the virus, but without its life-threatening risks.

Kirill Dmitriev, the head of Russia’s sovereign wealth fund, which has bankrolled the research, last week compared the vaccine discovery process to the Space Race. “Americans were surprised when they heard Sputnik’s beeping, it’s the same with this vaccine. Russia will have got there first,” he told US TV.

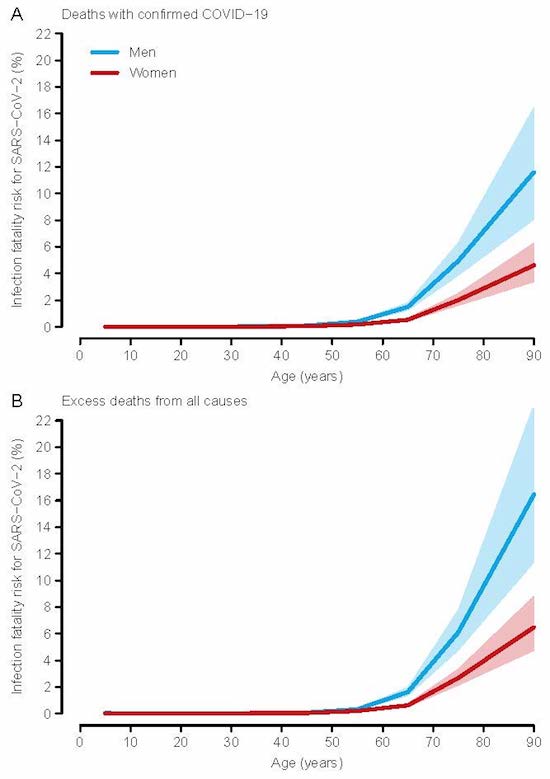

Much deadlier in men. Much deadlier than the seasonal flu.

• SARS-CoV-2 Fatality Risk In A Nationwide Seroepidemiological Study (Medrxiv)

The magnitude of the infection fatality risk (IFR) of SARS-CoV-2 remains under debate. Because the IFR is the number of deaths divided by the number of infected, serological studies are needed to identify asymptomatic and mild cases. Also, because ascertainment of deaths attributable to COVID-19 is often incomplete, the calculation of the IFR needs to be complemented with data on excess mortality. We used data from a nation-wide seroepidemiological study and two sources of mortality information -deaths among laboratory-confirmed COVID-19 cases and excess deaths- to estimate the range of IFR, both overall and by age and sex, in Spain.

The overall IFR ranged between 1.1% and 1.4% in men and 0.58% to 0.77% in women. The IFR increased sharply after age 50, ranging between 11.6% and 16.4% in men ≥80 years and between 4.6% and 6.5% in women ≥80 years. Our IFR estimates for SARS-CoV-2 are substantially greater than IFR estimators for seasonal influenza, justifying the implementation of special public health measures.

Not the first time that the Dems cry murder over something Trump says, only to make it look like they invented it mere weeks later.

• Chuck Schumer Says Schools Must Reopen Or Economy Suffers (RT)

Republicans and Democrats failed to reach a compromise on a Covid-19 economic relief bill, but one comment from Sen. Chuck Schumer (D-New York) about schools needing to reopen has some seeing hypocrisy on the left. Rep. Nancy Pelosi (D-California) and Schumer addressed the press after failed negotiations with Republicans on a potential relief bill. While many of their complaints about Republicans refusing to continue robust unemployment and other government programs was to be expected, one comment from Schumer went viral as it didn’t seem to match the outrage shown to President Donald Trump when he mentioned the same thing. “If you don’t open up the schools, you’re going to hurt the economy significantly,” Schumer said, “because lots of people can’t go to work.”

The president has floated the idea of fully reopening most schools in the fall despite the coronavirus pandemic, but he has found pushback with liberal critics each and every time. Schumer’s admission that not reopening schools will hurt the economy, which the president has argued, was seen as a surprising “moment of clarity” by critics on social media who latched onto the comment. The disagreement on reopening schools comes down to federal funding. Schumer and Pelosi have argued the only way to safely let kids back into the in-person education system is through major federal funding. Trump has argued that schools in hotspots for the coronavirus should be taking precautions when reopening, but the failure to add federal funding into a Covid-19 economic package has the left and right at a standstill on the issue.

Already a heated debate, it is only bound to get more heated as the country draws nearer to the dates schools would normally open their doors again. Experts have argued since schooling is a childcare issue, keeping them closed affects not only children and employees of the education system, but also parents who cannot return to work. “Because children and parents are dying from that trauma, too. They’re dying because they can’t do what they’re doing. Mothers can’t go to work because all of a sudden they have to stay home and watch their child, and fathers,” the president told CBS News last month when asked why he considered not reopening schools a “terrible decision.”

Pelosi has argued the president is “messing” with childrens’ health and risking another outbreak of the virus with his support for reopening schools. “Going back to school presents the biggest risk for the spread of the coronavirus,” she told CNN. “If there are CDC guidelines, they should be requirements.”

Why does Chuck Schumer literally want to kill our children https://t.co/YnLYkTz1D5

— Greg Price (@greg_price11) August 7, 2020

Oh, we’re going to have so much fun over the nest three months. And then there may be another three months needed to count the votes. Solid entertainment into Spring 2021. And Pelosi as President.

• Trump Aides Exploring Executive Actions To Curb Voting By Mail (Pol.)

Just because Trump’s claims of rampant mail-in voting fraud aren’t supported by evidence doesn’t mean election experts aren’t concerned about problems holding a presidential election during a pandemic. It’s unknown whether the United States Postal Service can handle a surge of mail-in ballots in a timely fashion, and other officials have cautioned about long lines and a shortage of workers at in-person polling stations, which have been limited during the coronavirus outbreak. Some have predicted the crush of remote voting could mean a final winner in the presidential race between Trump and Democrat Joe Biden won’t be known for days or even weeks.

Democrats are pushing for $25 billion for USPS in the next coronavirus recovery bill to help address those concerns, but it remains a source of disagreement with Republicans. There have already been some some notable delays in down-ballot elections during the pandemic, including one New York race this summer. Six weeks after a Democratic primary for a U.S. House seat, all of the ballots have yet to be counted. “This is a rare case where the president is not overstating the case,” argued Tom Fitton, president of Judicial Watch, a conservative group that has sued in North Carolina and Pennsylvania over the accuracy of voting rolls. “Frankly he’s understating the problem that I think we are going to face on Election Day. The system is going to break.”

The Trump campaign is holding events touting its legal actions on voting rules. And privately, the White House is debating possible further action, according to two people familiar with the situation. The White House declined to comment on whether Trump would be signing an executive order on the issue. “All Americans deserve an election system that is secure and President Trump is highlighting that Democrats’ plan for universal mail-in voting would lead to fraud,” said White House spokeswoman Sarah Matthews. “While Democrats continue to call for a radical overhaul of our nation’s voting system, President Trump will continue to work to ensure the security and integrity of our elections.”

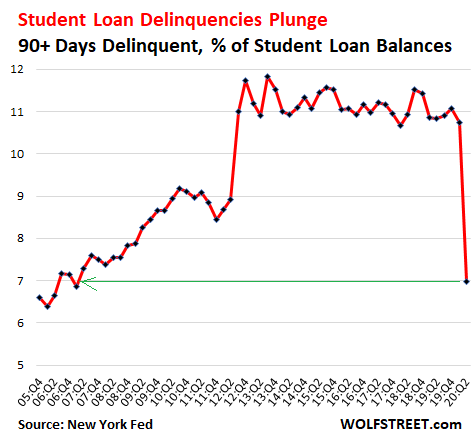

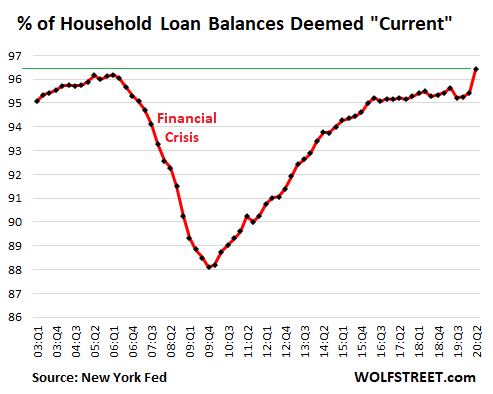

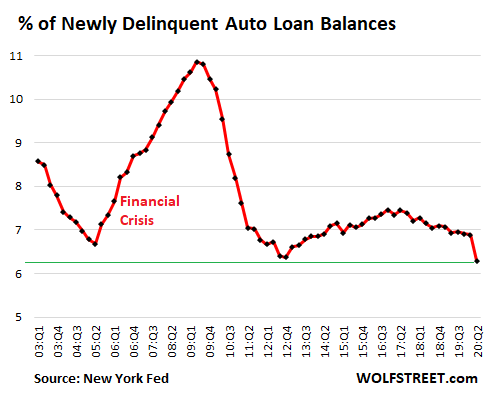

It’s just like a biblical jubilee.

• No Payment, No Problem: Bizarre New World of Consumer Debt (WS)

The New York Fed released a doozie of a household credit report. It summarized what individual lenders have been reporting about their own practices: If you can’t make the payments on your mortgage, auto loan, credit card debt, or student loan, just ask for a deferral or forbearance, and you won’t have to make the payments, and the loan won’t count as delinquent if it wasn’t delinquent before. And even if it was delinquent before, you can “cure” a delinquency by getting the loan deferred and modified. No payment, no problem. Student loan borrowers were automatically rolled into forbearance under the CARES Act, and even though many students had stopped making payments, delinquency rates plunged because the Department of Education had decided to report as “current” all those loans that are in forbearance, even if they were delinquent. Yup, according to New York Fed data, the delinquency rate of student loan borrowers, though many had stopped making payments, plunged from 10.75% in Q1, to 6.97% in Q2, the lowest since 2007:

Student loan forbearance is available until September 30, and interest is waived until then, instead of being added to the loan. In a blog post, the New York Fed said that 88% of the student-loan borrowers, including private-loan borrowers and Federal Family Education Loan borrowers, had a “scheduled payment of $0,” meaning that at least 88% of the student loans were in some form of forbearance. Until September 30. And then what? And because delinquencies in student loans, auto loans, credit card debt, and mortgages are being “cured” by putting the loans in deferral programs and modifying the delinquent loans, they become “current” loans even though no catch-up payments have been made.

Still, about 32 million people are claiming unemployment insurance. A much smaller employment shock during the Financial Crisis caused the percentage of delinquent loan balances to soar, and the percentage of “current” loan balances to plunge, to bottom out at 88% in Q4 2009. Not this time. As the percentage of delinquent loan balances fell, the percentage of “current” loan balances jumped to 96.4%, a record high in the New York Fed’s data going back to 2003. Yup, crazy world. Ally Financial reported in its 10-Q filing with the SEC for the second quarter that about 21% of its auto-loan customers were enrolled in its deferral program where they don’t have to make payments for 120 days. “The vast majority of our loan deferrals for customers in the program are scheduled to expire by the end of August 2020,” it said. And then what?

Lenders like these types of programs because they can kick the can of delinquencies down the road, and instead they have “performing loans” for which they can accrue interest which makes their investors happy, even though the customers don’t make any interest or principal payments. Bank regulators normally get nervous about deferral programs. But it appears that bank regulators have been told the shelter at home until further notice. Across all lenders, about 5.9% of the $1.34 trillion in auto loans – so close to $80 billion – are in forbearance, according to the New York Fed. And as a result, borrowers who cannot make the payment, don’t have to make it, and their loans are still deemed “current,” and the percentage of auto loans that are newly delinquent dropped to 6.29%, a record low in the data – while during the last crisis, the delinquent balances were above 10% for nearly two years:

Yes, they’re censoring TV networks now. Scary. So is this: when Elon Musk tweeted in March that “kids are essentially immune,” Twitter clarified that his tweet did not violate its COVID-19 rules.

• Social Media Imposing Modern-Day ‘Hays Code’ On Political Speech (RCP)

Social media companies continued to assert their power over the political sphere this week, with Twitter temporarily suspending the Trump campaign’s ability to post until it removed a clip of a Fox News interview with the president regarding COVID-19. When the Democratic National Committee reposted the video to debunk it, Twitter similarly banned the DNC from tweeting until it too deleted the footage. With Twitter seemingly unbothered by the implications of suspending a presidential campaign’s account just 12 weeks before the election, what might the future hold as control of our public squares is increasingly centralized?

Twitch became the first social media platform to formally suspend a presidential candidate’s account this past June when it deleted two of President Trump’s campaign rally videos for violations of its “hateful conduct” rules. In doing so, it emphasized the divide between physical and virtual campaigning. At an in-person rally a candidate can present the policy proposals he or she believes supporters want. Virtual rallies, however, are policed by an army of moderators enforcing ever-changing acceptable speech policies, forcing politicians to self-censor or risk deletion from the online world that increasingly shapes elections.

In the case of this week’s ban, the story is all the more remarkable because the video in question was actually a cable TV interview with the nation’s leader, meaning that social platforms were in effect banning a major news organization’s reporting. As news is increasingly consumed through social media, the upshot is that the online platform’s acceptable speech rules are being applied to traditional news outlets. Additionally, rather than link the video to an outside fact check, Facebook simply deleted it as “a violation of our policies around harmful COVID misinformation” while Twitter forced the campaign to delete the post as a “violation of the Twitter Rules on COVID-19 misinformation.” Both companies cited as the offending statement Trump’s claim that children have “much stronger immune systems” than adults and thus “they don’t have a problem” when infected.

While oversimplifying, Trump’s claims are not that far removed from those of CDC Director Robert Redfield and infectious disease expert Dr. Anthony Fauci, who have cited the pathogen’s significantly reduced severity in children in their calls to safely reopen schools this fall. While more measured than the “immunity” claimed by Trump, the gist of his statement — that COVID-19’s impact on children appears to be less severe than its effect on older Americans — aligns with the public statements of his medical advisers. Moreover, when Elon Musk tweeted in March that “kids are essentially immune,” Twitter clarified that his tweet did not violate its COVID-19 rules. To this date, Musk’s tweet carries no warnings or fact-checking statements from Twitter refuting it or adding additional context to his claims.

In many ways, social media platforms have become modern-day incarnations of the Hays Code that governed Hollywood from the 1930s to 1960s, establishing “morality” standards and enforcing them with an army of censors. By shaping popular culture through its control of movies, the Hays Code ensured that generations of Americans were presented an idealized world of benevolent public institutions, including police and politicians whose good works were spotlighted and any wrongdoing was punished. Moreover, as an extrajudicial speech regulation, studios could modify the rules and exempt content at will, much as social platforms do today.

And the censoring power will only get more centralized, unless politics calls a halt to it. But then there’s always the strong links to intelligence services.

• Twitter Reportedly Joins Growing List Of Potential TikTok Suitors (ZH)

The ideological battle over the fate of TikTok is provoking fist fights in the Oval Office, and a scramble among the country’s biggest tech firms to see if they might be able to come up with a workable pitch that would allow them to win approval to buy the US operations (along with New Zealand, Australia and Canada, and possibly more) of the popular Chinese-owned social media platform – the only real obstacle to a deal at a time when corporate credit is essentially free. It’s becoming increasingly obvious that the app, which the Trump Administration is threatening to shut down in the US over fears of a “national security threat” (Chinese law forces all Chinese companies to cooperate with state security forces, provoking fears that ByteDance, TikTok’s owner, might be compelled to set up a pipeline of Americans’ private information straight to Beijing), has become perhaps the biggest political football at a time of intense strain in the bilateral relationship.

But amid the chaos and the geopolitical posturing of the leaders of the world’s two largest economies, America’s tech giants apparently see an opportunity, however unlikely, to circumvent opposition to further tech-industry mergers and seal what very well might be the last major merger in the industry for quite some time. And with the world headed into a period of protracted slowdown, companies might as well take advantage of the free money, and lock in that future EPS growth while they can. Since anti-trust scrutiny is such a hot issue in the world of big tech right now, it seems every company that has reportedly engaged in “talks” about the prospects for a deal has a reason for why it might assuage regulators and lawmakers and convince both Congress and the White House to agree to the deal.

Being the smallest of the three major companies rumored to be potential suitors, Twitter obviously has the best case from a purely anti-trust standpoint (although it seems reporters keep coming up with excuses for why Microsoft or Facebook could still make it work). Plus, Twitter’s comparatively tiny $29 billion market cap means it would likely need help from outside investors – a great opportunity for Sequoia and the other big VC firms who backed ByteDance who reportedly were in talks about a deal to bring TikTok into the US under their purview. The deal would have valued TikTok at $50 billion, according to unconfirmed reports.

How awful! Let’s do something!

• US To Cut Troop Levels In Afghanistan To ‘Less Than 5,000’ – Esper (R.)

The United States plans to cut its troop levels in Afghanistan to “a number less than 5,000” by the end of November, Defense Secretary Mark Esper said in an interview broadcast on Saturday, adding detail to drawdown plans U.S. President Donald Trump announced earlier this week. The United States currently has about 8,600 troops in Afghanistan. Trump said in an interview released Monday by Axios that the United States planned to lower that number to about 4,000.

Hey! You’re not driving enough! Want to collapse the economy or something?

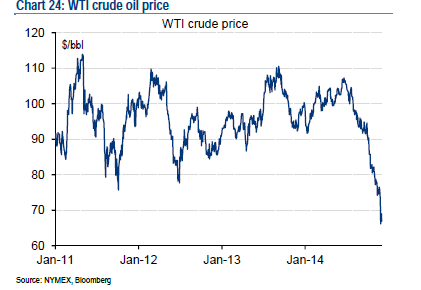

• Oil Giants Cut Production By 1 Million bpd Amid Massive Writedowns (R.)

The world’s five largest oil companies collectively cut the value of their assets by nearly $50 billion in the second quarter, and slashed production rates as the coronavirus pandemic caused a drastic fall in fuel prices and demand. The dramatic reductions in asset valuations and decline in output show the depth of the pain in the second quarter. Fuel demand at one point was down by more than 30% worldwide, and still remains below pre-pandemic levels. Several executives said they took massive writedowns because they expect demand to remain impaired for several more quarters as people travel less and use less fuel due to the ongoing global pandemic that has killed more than 700,000 people.

Of those five companies, only Exxon Mobil did not book sizeable impairments. But an ongoing re-evaluation of its plans could lead to a “significant portion” of its assets being impaired, it reported, and signal the elimination of 20% or 4.4 billion barrels of its oil and gas reserves. By contrast, BP took a $17 billion hit. It said it plans to re-center its spending in coming years around renewables and less on oil and natural gas. Weak demand means oil producers must revisit business plans, said Lee Maginniss, managing director at consultants Alarez & Marsal. He said the goal should be to pump only what generates cash in excess of overhead costs. “It’s low-cost production mode through the end of 2021 for sure, and to 2022 to the extent there are new development plans being contemplated,” Maginniss said.

Isn’t he also interfering by NOT investigating Burisma, Hunter and the clip where Joe Biden brags about blackmailing Poroshenko into firing a prosecutor?

• Zelensky Says Ukraine Staying Out Of US Internal Politics, Elections (R.)

Ukrainian President Volodymyr Zelenskiy said on Saturday that it was a matter of Ukraine’s national security to stay out of U.S. internal politics, particularly its election. “#Ukraine did not and will not allow itself to interfere in the elections and thus harm our trusting and sincere partnership with the #USA,” he wrote on Twitter late on Saturday. Zelenskiy, 42, was a comic actor when he won a landslide election last year. But the first year of his presidency was overshadowed by Ukraine’s unwitting involvement in events that led to the impeachment of Republican U.S. President Donald Trump. Trump had unsuccessfully pressed Ukraine to launch an investigation into his Democratic rival in the 2020 presidential race, former Vice President Joe Biden.

“Never, under any circumstances, it’s acceptable to meddle in another country’s sovereign elections,” Zelenskiy wrote. Zelenskiy appealed to Ukrainian politicians to avoid any actions that could be linked to U.S. elections, nor allow themselves to try to solve any of their personal, political or business problems that way. “Ukraine’s reputation is worth much more than the reputation of any of our politicians,” the president said.

“It is perhaps the most American of issues, and it should be one that unites us..”

Hard to read that with a straight face, let alone for him to say it.

• George W. Bush Laid the Groundwork for Today’s Immigration Nightmare (MPN)

George W. Bush, the 43rd president of the United States, has announced he is releasing a new book called “Out of Many, One” which will celebrate America’s diversity and immigrant populations. “Our immigrant heritage has enriched America’s history. It continues to shape our society. Each generation of Americans — of immigrants — brings a renewal to our national character and adds vitality to our culture. Newcomers have a special way of appreciating the opportunities of America, and when they seize those opportunities, our whole nation benefits,” the former president said. The book, scheduled for release in March 2021 will feature 43 images of immigrants, painted by Bush himself [..]

“While I recognize that immigration can be an emotional issue, I reject the premise that it is a partisan issue. It is perhaps the most American of issues, and it should be one that unites us,” he said in a press release. “My hope is that this book will help focus our collective attention on the positive impacts that immigrants are making on our country.” With immigration becoming an increasingly hot partisan issue, the move celebrating the practice is the latest in a series of actions that Bush has taken to distance himself from the current Republican president. Both Bush and his father claimed they did not vote for Trump in 2016, leading to delight from many Democrats. Speaker of the House Nancy Pelosi, for example, yearned for a by-gone age, admitting to wishing Bush were still president, even though at the time she described him as a “total failure” in every aspect of governing.

[..] Bush bragged about greatly increasing the U.S.’ detention capacity for immigrants, using drones to patrol the area, and building 700 hundred miles of fencing and wall, which served as a stepping stone to Trump’s border plans. The increasingly militarized border mirrored the increasingly hostile rhetoric towards immigrants that dominated the Republican Party today. Bush is no stranger to covering controversial topics in his art. In 2017, he released a similar bestselling book called “Portraits of Courage: A Commander in Chief’s Tribute to America’s Warriors.” In it, he painted dozens of fallen American servicemen, all of whom died fighting in wars he started under false pretenses and has expressed no remorse for doing so. Neither Bush nor the great number of outlets who praised the book appeared at all interested in Middle Eastern victims of his policy.

Man this George Bush rebranding is amazing. It’s almost like he wasn’t the Donald Trump of his days https://t.co/aAucRzDJeA

— Maximilien Robespierre (@Imperator_Faora) August 7, 2020

A Trojan horse in the 2020’s.

• West’s Favorite Hong Kong ‘Freedom Writer’ Is American In Yellowface (GZ)

An American man with ties to Amnesty International and key Hong Kong separatist figures has been posing online as a Hong Kong native named Kong Tsung-gan. Routinely cited as a grassroots activist and writer by major media organizations and published in English-language media, the fictitious character Kong appears to have been concocted to disseminate anti-China propaganda behind the cover of yellowface. Through Kong Tsung-gan’s prolific digital presence and uninterrogated reputation in mainstream Western media, he disseminates a constant stream of content hyping up the Hong Kong “freedom struggle” while clamoring for the US to turn up the heat on China.

Whispers about Kong’s true identity have been circulating on social media among Hong Kong residents, and was even mentioned in a brief account last December by The Standard. The Grayzone spoke to several locals outraged by a deceptive stunt they considered not only unethical, but racist. They said they have kept their views to themselves due to the atmosphere of intimidation looming over the city, where self-styled “freedom fighters” harass and target seemingly anyone who speaks out publicly against them.

The Twitter user Kong Tsung-gan (@KongTsungGan) first appeared in March 2015. Kong Tsung-gan’s earliest tweets featured commentary about Tibet and the Hong Kong Umbrella Movement. At some point, Kong changed his Twitter avatar to a black-and-white headshot of an unknown Asian person. A search of the Wayback Machine internet archive shows that this photo remained up until sometime in late 2019. Later, Kong changed his Twitter avatar to an image depicting Liu Xia, the wife of the late Nobel Prize-winning dissident Liu Xiaobo. Liu Xiaobo was a right-wing ideologue who celebrated the US wars on Vietnam, Afghanistan, and Iraq, and was rewarded with the 2014 Democracy Award by the National Endowment for Democracy – the favorite meddling machine of the US government.

[..] At around the time he created his Twitter account, Kong Tsung-gan published his first Medium post. He has since filled his Medium feed with protest timelines, lists of recommended human rights books and journalism (including a link to the questionable China “expert” Adrian Zenz), and “first-hand accounts” of his protest experiences on the ground. In one account, Kong Tsung-gan claimed he attended a Band 1 government school, implying he was a native Hong Kong resident. Kong’s work has been amplified by Joshua Wong, the Hong Kong protest poster-boy who has enjoyed photo-ops with neoconservative Republican senators like Marco Rubio and Tom Cotton.

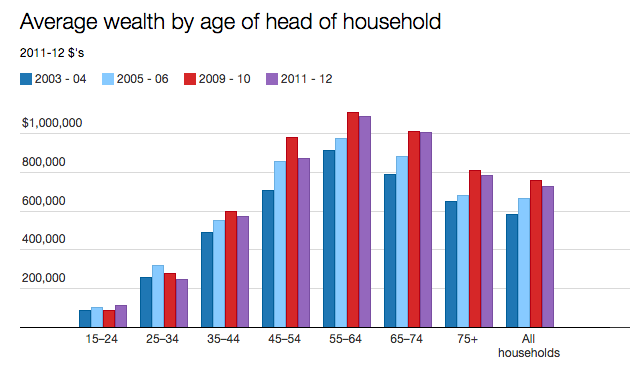

Rich eat poor everywhere.

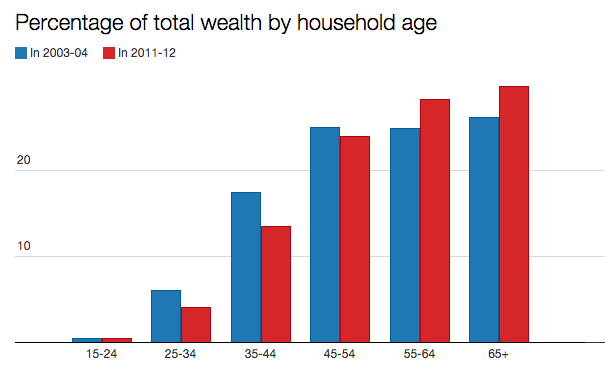

• Solidarity with the Germans (Varoufakis)

A recent study has confirmed that half of Germany’s population owns just 1.5% of the country’s wealth, while the top 0.1% own 20%. And inequality is getting worse. During the last two decades, the real disposable income of the poorest 50% has been falling while that of the top 1% has been rising fast, along with house and share prices. It is against this background of high and rising inequality that the mood of the German public must be understood, in particular popular resistance to the idea of a eurozone fiscal union. German workers, who are increasingly struggling to make ends meet, understandably refuse to endorse the idea of huge amounts of money being constantly channeled to citizens of other countries. The fact that Germany is getting richer overall is irrelevant to them.

From experience, they know that any money sent to Italy or Greece will probably come from them, not the top 0.1% – not to mention that it will probably end up in the pockets of vile Greek oligarchs, or of private German companies that have purchased Greek assets for next to nothing. As a result, the European Union’s recently agreed €750 billion ($880 billion) pandemic recovery fund, dubbed Next Generation EU, threatens to deepen divisions across Europe, rather than being the unifying balm of many commentators’ dreams. Setting aside the scheme’s macroeconomic insignificance, it is important to take a fresh look at it from the perspective of a typical German worker languishing among the bottom 50% of the country’s wealth distribution.

Her government, a typical German worker is told, will be liable for €100 billion of new debt that the EU will use to help foreigners recover from the pandemic’s economic fallout. “Italians will receive €80 billion from Europe’s Recovery Fund,” she hears. “Spaniards will collect €78 billion, and even the Greeks will pocket €23 billion.” And what will she get? Less than nothing. Because her government is already in fiscal consolidation mode, trying to return its budget to a small surplus by 2021, she can expect only stagnant wages and more austerity for her local hospitals, schools, roads, and other infrastructure.1 While she may well feel compassion to the Italians and Spaniards, who lost so many people to COVID-19, she will never accept repeating this exercise in debt mutualization on behalf of southern or East Europeans. The solidarity of German workers, toward whom no one shows any solidarity, has its limits – as it should.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you.

Support the Automatic Earth in virustime.