Dorothea Lange “Men on ‘Skid Row’, Modesto, California” 1937

Before we get news in a few hours on the new proposals Greece is required to hand to its slavemasters today, Monday Feb 23, it seems relevant to point out one more time that what is happening to Greece is the result of political, not economic, decisions and points of view. One could argue that Greece is being thrown under the bus because it’s not – yet – deeply enough entangled and enmeshed in the global financial matrix. Just think back to a point Gordon Kerr of Cobden Partners made a few days ago on Bloomberg:

They [Greece] don’t have systemically important financial institutions dragging down their economy ..

In other words, Greek banks are not too big to fail. They could therefore be restructured – by the Greek government itself – without global contagion, certainly theoretically (it’s hard to pinpoint how this would turn out in practice, there are too many variables involved). And that is a major potential threat to other – European -banks, who A) could then also face calls for restructuring, and B) still have money invested in Greece. Just not that much anymore…

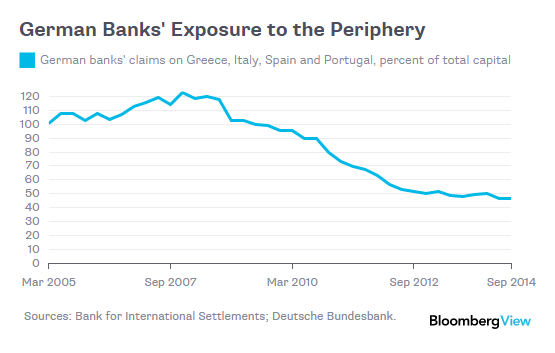

Bloomberg’s Mark Whitehouse showed in a piece over the weekend to what extent Germany’s banks pulled out of Greece since 2010. Thanks to the same bailouts that are now being used to try and force Greece into ever more austerity, budget cuts, depleted services and shy high unemployment.

I said it before: the decision to not restructure banks is purely political. It’s not an economic decision, though you will see everyone pretend it is, and claim the banking system(s) would collapse in case of debt restructuring and defaults on wagers. It was decided early on, 2007, that bank debts would, instead of being restructured, be transferred to public coffers. But that’s just a choice, not a necessity.

Moreover, it’s the by far worst choice, if only because it rewards gambling addicts for their behavior, at the cost of everyday people simply trying to make ends meet – and failing -. And this is self-reinforcing: the world today is firmly ruled by gambling addicts and their enablers, because they have managed to get their hands in the till. And they’re not just not planning to let go, they want more.

Here’s what happened to German bank debt in Greece:

Why Germany Might Not Be Bluffing in Greece

As Europe’s high-stakes debt negotiations with Greece reach an impasse, Germany has appeared surprisingly willing to drive the country out of the euro, regardless of the potentially dire repercussions for Italy, Portugal, Spain and the entire currency union. One possible explanation for Germany’s brinkmanship: Its banks have a lot less to lose than they once did. When the European debt crisis first flared up in 2010, Germany’s finances were closely linked to those of the euro area’s more economically fragile members. Its banks’ claims on Greece, Italy, Portugal and Spain – including money lent to governments and companies – amounted to more than €350 billion, about equal to all the capital in the German banking system.

If the periphery countries had forced losses on private creditors, which they arguably should have done, Germany would have had to recapitalize its banks or face an immediate meltdown.

The picture is very different now. The ECB, the IMF and other taxpayer-backed creditors have pumped hundreds of billions of euros of loans into the periphery countries, making it possible for German banks to extract themselves with minimal damage.

Thanks in part to this back-door rescue, the banks have also been able to raise some capital. As a result, they are in much better shape to withstand a Greek disaster. As of September 2014, their claims on Greece, Italy, Portugal and Spain had declined to about €216 billion, or 46% of capital. The upshot: Greece is left with more debt than it can pay, and Germany – with its banks effectively bailed out – has one less pressing reason to give Greece a break. Hardly the right incentives for a happy ending.

Merkel and Schäuble decided to save Wall Street mogul and derivatives behemoth Deutsche Bank at the cost of the Greek people. Not for economic reasons, but because Deutsche has much more political power inside the European Union than the entire Greek nation. Now you know what’s so inherently wrong in that union. Same story for France, where BNP, SocGen and Crédit Agricole had humongous amounts of debt outstanding in Athens. Where’s all that debt now, where’s it gone? Well, check your wallet.

When the decision came to throw either their own biggest banks, or the grandmas of a co-member nation of the currency union under the bus, I don’t think they even hesitated; they probably only went looking for the most efficient way to do it. And they have control over the perfect vehicle for such tasks: the ECB. A allegedly neutral institution that in reality peddles political influence in a way that guarantees the poorer countries will always wind up footing the bill.

And now that the systemic risk that Greece still might have been is effectively gone, and the debt has been transferred to the union’s bottom dwellers, Merkel and Schäuble can talk tough to Greece. Even if it wasn’t the Greeks that created this mess, it was Merkel and the Frankfurt bank CEO’s she confers with on a daily basis.

Banks are more important than people, certainly grandmas. That’s true on Wall Street, and it‘s true all over Europe. But it’s still just a political decision. And one that could be reversed as easily as it was taken. Which it what the paymasters find so scary about Syriza.

For those of you who don’t want to wake up one day to find their own grandmas crushed under the same bus the Greek yiayia’s are under as we speak, it would be beneficial to ponder how perverse this all is, not just the isolated events but the entire underlying system that produces them. And you support this perversity. And don’t fool yourself into thinking that the system won’t come for your grandma too. If you think that, you simply don’t understand how it works.

Home › Forums › Throw Your Grandma Under The Bus