DPC Launch of freighter Howard L. Shaw, Wyandotte, Michigan 1900

I think I should accept that I will never in my life cease to be amazed at the capacity of the human being to spin a story to his/her own preferences, rather than take it simply for what it is. Your run of the mill journalist is even better at this than the average person – which may be why (s)he became a journalist in the first place -, and financial journalists are by far the best spinners among their peers. That’s what I was thinking when I saw another Bloomberg headline that appealed to my more base instincts, which I blame on the fact that it shows a blatant lack of any and all brain activity (well, other than spin, that is).

Here’s what Bloomberg’s Craig Torres and Michelle Jamrisko write: “American Mystery Story: Consumers Aren’t Spending Even In a Booming Job Market”. Yes, it is a great mystery to 95% of journalists and economists. Because they have never learned to even contemplate that perhaps people can be so deep in debt that they have nothing left to spend. Instead, their knowledge base states that if people don’t spend, they must be saving. Those are the sole two options. And so if the US government reports that 863,000 underpaid new waiters have been hired, these waiters have to go out and spend all that underpayment, they must consume. And if they don’t, that becomes The American Mystery Story.

For me, the mystery lies elsewhere. I’m wondering how it ever got to this. How did the capacity for critical thinking disappear from the field of economics? And from journalism?

American Mystery Story: Consumers Aren’t Spending Even In a Booming Job Market

It’s an American mystery story: More people have jobs and extra pocket money from lower gas prices, but they aren’t buying as much as economists expected. The government’s count of how much people shelled out at retailers fell in February for a third consecutive month. Payrolls are up 863,000 over the same period. The chart below shows retail sales and payrolls generally move in the same direction, until now. The divergence could portend lower levels of economic growth if Americans’ usually reliable penchant to spend is less than what it once was.

YoY growth in U.S. retail and food services sales (red) against year-over-year change in non-farm payrolls (blue).

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics

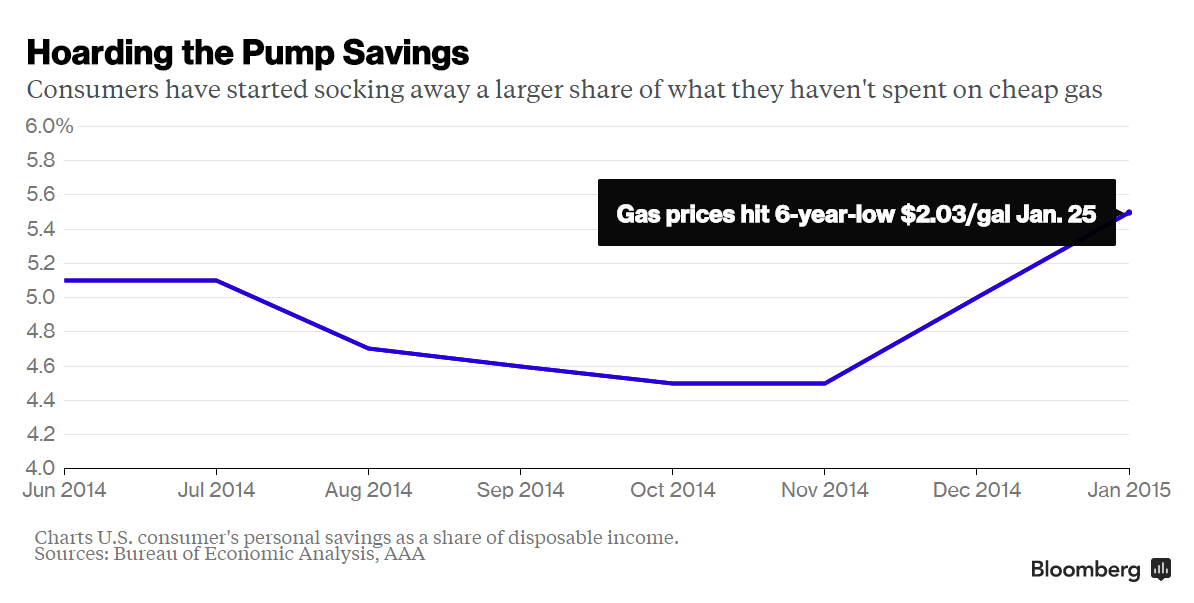

Inevitably, when faced with such a mystery, Bloomberg’s scribblers dig up a household savings graph. Et voilà, problem solved:

“The expenditures that add up to gross domestic product are coming in a lot softer than employment,” said Neil Dutta at Renaissance Macro Research. “Why would retailers be hiring if sales are falling? Why would they be boosting hours if sales are falling and why would they be paying more?” Also, take a look at the household saving rate. It’s gone up as gas prices fell:

And why are all those crazy American waiters hoarding all that cash they, as per economists, just got to have lying around somewhere? You knew it before I said it: it was cold! Crazy cold!

Ben Herzon at Macroeconomic Advisers isn’t that worried yet. As usual, the data is quirky. First, he notes, “it was crazy cold in February.” Aside from stocking up on milk in the snowstorm, staying indoors was probably a more attractive option for most shoppers.

And it gets better. How about this for a whopper?

Herzon notes that lower gas prices also depressed the count in prior months. The government is adding up dollars spent, so fewer dollars to fill a gas tank results in lower sales.

Let’s see. Gas was cheaper, so people spent less on that. And that drove down retail sales. But wasn’t it supposed to drive them up? Wasn’t that the boost the economy was predicted to get? You mean to tell me that lower gas prices actually function to drive spending down? That our newfound platoon of waiters took all that newfound money and spent it on .. nothing at all? Not to worry. March will be much better or “Our story would be wrong…” And how likely is that, right?

That even bleeds into narrower measures of retail sales because grocery stores such as Safeway, Wal-Mart and Sam’s Club also sell gasoline. Herzon is counting on a March rebound. There won’t be the weather to blame anymore, and gas prices have rebounded off their lows of late January and early February. “Payroll employment has been great, and it is generating a lot of labor income that you think would be spent,” Herzon said. “March should be a rebound. Our story would be wrong if it doesn’t happen.”

Halle-bleeping-lujah. Is this creativity on the part of the writer and interviewee, or is it just a knee-jerk reaction? Don’t they understand because they don’t have the appropriate grey matter, or don’t they simply want to?

And Bloomberg takes us from mystery to surprise (I’m guessing that’s one level lower on the What? scale), The surprise is that the US has not lived up to what Bloomberg and its economists had dreamt up all by themselves.

Surprise: US Economic Data Have Been the World’s Most Disappointing

It’s not only the just-released University of Michigan consumer confidence report and February retail sales on Thursday that surprised economists and investors with another dose of underwhelming news. Overall, U.S. economic data have been falling short of prognosticators’ expectations by the most in six years. The Bloomberg ECO U.S. Surprise Index, which measures whether data beat or miss forecasts, fell to the lowest since 2009, when the nation was in the deepest recession since the Great Depression. There’s been one notable exception to the gloom, and it’s a big one: payrolls. The economy added 295,000 jobs in February and 1.3 million over four months, a reflection of a healthier labor market in which the unemployment rate has fallen to the lowest in almost seven years.

Most everything else? Blah. This month alone, personal income and spending, manufacturing as measured by the Institute for Supply Management, auto sales, factory orders, and retail sales have all come in a bit weak. Citigroup keeps economic surprise indexes for the world, and its scoreboard shows the U.S. is most disappointing relative to consensus forecasts, with Latin America and Canada next, as of March 12. Emerging markets were supposed to be hurt by falling oil prices but are now delivering positive surprises. U.S. policymakers frequently talk about weakness in Europe and China, though both are exceeding expectations.

In short, Bloomberg and its economists were once again embarrassingly off target. Though they prefer to use different terminology:

And there’s one rub. The surprise shortfall in the U.S. doesn’t necessarily mean the world’s largest economy is in dire straights. It’s just falling short of some perhaps overly elevated expectations.

Perhaps? What do you mean perhaps? US data are the biggest disappointment of all of your numbers. There’s no perhaps about it. Just admit you get it wrong all the time.

Maybe they are mystified because of data like the following, coming from the Fed, no less.

Fed: US Household Net Worth Hits Record $83 Trillion In Q4 2014

Household net worth rose by $1.5 trillion in the fourth quarter of last year to a record $83 trillion, the Federal Reserve said on Thursday. The gains were driven by a surging real estate market. Household real estate holdings rose to their highest level since 2007. Real estate equity levels also hit a 2007 high. Household stock holdings also rose with the broader markets.

Since those 683,000 waiters would only qualify for subprime loans, you can bet that only a few of them profited from this ‘surging real estate market’. Household net worth may have hit a record, but that has nothing to do with the lower rungs of society. Which we can prove by looking at the second part of the piece:

But at the same time, the central bank reported debt was on the rise. Total debt – including households, governments and corporations – rose 4.7% , the most since 2012.

No doubt that this additional debt can be made to show up somewhere as a positive thing. How about: look, consumers feel confident enough to take on more debt again.

Nomura’s Richard Koo elegantly lays bare the global – and American – economic conundrum in just a few words: “When no one is borrowing money, monetary policy is largely useless..”

Why We’re At Risk Of A QE Trap: Koo (CNBC)

The problem with central banks’ massive bond-buying programs is that if consumers and businesses fail to borrow money to stimulate economic growth, the policy is rendered mostly “useless,” one Nomura economist said Friday. The U.S. and U.K. embarked on asset-purchase, or QE programs, following the 2007-2008 global financial crisis. Japan joined the QE club in 2013 and the ECB began its €1 trillion bond-buying stimulus this week. “Both the U.S. and Europe are facing the same problem– which is that we are in a situation where the private sector in any of these economies is not borrowing money at zero interest rates or repairing balance sheets following what happened in the crisis,” Richard Koo, Chief Economist at Nomura, told CNBC on the side lines of the Ambrosetti Spring Workshop in Italy.

“When no one is borrowing money, monetary policy is largely useless,” he added. In the run-up to the launch of QE in the euro zone, loans to the private sector, which are a gauge of economic health, contracted. Data published late last month showed that the volume of loans to private firms and households fell by 0.1% on year in January, compared with a 0.5% drop in December. According to Koo, major central banks are holding reserves far in excess of levels they need because of the monetary stimulus. This has not led to a rise in private sector spending because big economies are struggling with a balance sheet recession – a situation where companies are focused on paying down debt rather than spending or investing – increasing the risk of QE trap.

“In a national economy if someone is saving money, you need someone to borrow money and this is the part that is missing. They [central banks] are pumping money but no one is borrowing, so you get negative interest rates and all sorts of distortions,” Koo said. He added that instead of looking to raise interest rates, the U.S. Federal Reserve should first focus on reducing its balance sheet which stands at over $4 trillion. The Fed, which meets next week, is widely expected to raise rates this year against a backdrop of improving economic data. “They [Fed policy makers] should not rush into a rate rise; they should reduce the balance sheet when people are not worried about inflation,” Koo said.

That’s all you need to know, really. Americans don’t spend, and they don’t borrow. That makes all QE measures useless for the larger economy, and a huge windfall for the upper echelons of society.

You could also say QE is a criminal racket, but I’m pretty sure journalists, economists, central bankers and politicians alike will only admit to stupidity, not to being accomplices in such a racket. Or perhaps not even stupidity; they’ll just claim nobody could have foreseen this, like they always do when they run into room size elephants.

Still, you have to love a piece like the following by Thad Beversdorf:

The Fed Gives A Giant F##k You to Working Class Americans

I was shocked today by the absolute gaul of the Fed releasing a statement about Net Worth in America reaching record levels. Now I get that they are under extreme pressure to sell the story that everything is rainbows and butterflies. But surely they understand that working class Americans are going along with the story because they really don’t have any say in our nation’s policies anymore. That doesn’t mean they want it thrown in their faces that the Fed has spent 6 years now inflating the wealth of the top 10% so much that it actually lifts the total wealth of the nation’s citizens to record highs. The ugly reality is that the bottom 80% of Americans experienced none of that gain. That’s right: a big ole goose egg.

And so when the Fed via its ass pamper boy, Steve Liesman, start banging on about the fact that some sliver of society is being handed extraordinary wealth while the working class has lost 40% of their net worth since 2007, well a big fuck you right back at ya bub! The Fed is very aware that the bottom 80% of Americans own less than 5% of US equity markets. And so the Fed is very aware that its manipulation of stock prices such that it creates immense unearned wealth to those in the markets doesn’t reach the bottom 80%. So why celebrate the results of the stock market price manipulation?? It is embarrassing that our policymakers are either that inconsiderate or that stupid to celebrate such a brutal dislocation between the haves and have nots.

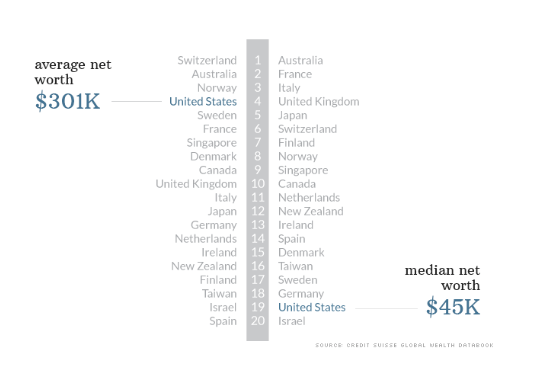

I don’t know what one can even say about the Fed making a celebratory statement like that today. It is somewhat beyond words. And really paints the picture as to how little thought goes into the lives and well being of the bottom 80%. Just to give you something to compare and contrast the situation of the bottom 80% here in the US to counter the Fed’s celebration today. I want you to think about how lucky we are not being in one of the PIIGS nations of Europe. These are the nations that are essentially bankrupt and just hanging on by the kindness of the Troika.

So there it is. While the average net worth of Americans is 4th in the world pulled up by the top 10%, the median net worth of Americans comes in the 19th spot. Yep, behind Spain, Italy and Ireland so 3 of the 5 PIIGS nations. Meaning the bottom 80% in these broke ass barely hanging on nations have more wealth than the bottom 80% of us here in America. So I’d like to ask the Fed, is it that you just hate the working class here in America and thus like to torment them or are you truly that stuck up your own asses that you just cannot see the light?

Rest assured, Thad, the Fed has seen the light. And they don’t actually hate working class America, they just don’t give a flying f#ck about them.

Imagine the founding fathers looking down on all of this. Hell imagine those who fought on the beaches of Normandy looking down at what America has become. Knowing that they sacrificed everything just to hand the nation over to a group of foreign sociopaths. Imagine those men having to see that Americans no longer have any sense of dignity other than to yell loudly that “we are still great”[..]. How incredibly disheartening it would be for those WWII soldiers to see us now.

Plenty of those guys are still alive. So we could ask them. But the gist is clear, and all those who died on those beaches can no longer speak for themselves, so we need to do it for them. Is this the world they died for? Is this the freedom they gave their lives for, the freedom to turn America into a nation of debt slaves?

There is no mystery anywhere to be found in the fact that US retail sales don’t follow the jobs trend. Not if you look at what kind of jobs they are, let alone at all the other made up and manipulated numbers that are being thrown around about the US economy.

The only mystery is why everyone persists in talking about a recovery. That recovery will never come, simply because all 90% of Americans do is pay for the other 10% to get richer. There are many other factors, but that all by itself makes a recovery a mathematical mirage.

Home › Forums › The American Story Is A Mystery Only to Economists