Jack Delano Union Station, Chicago, Illinois 1943

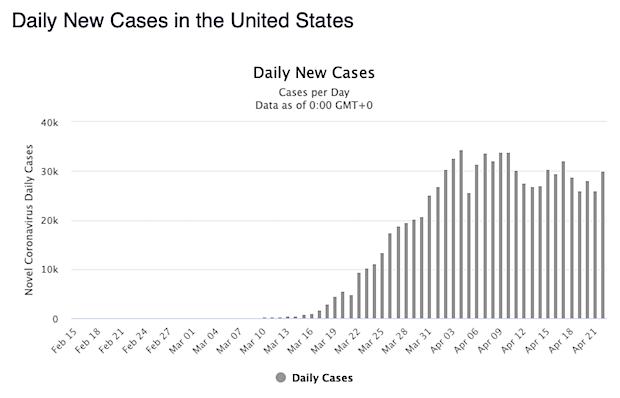

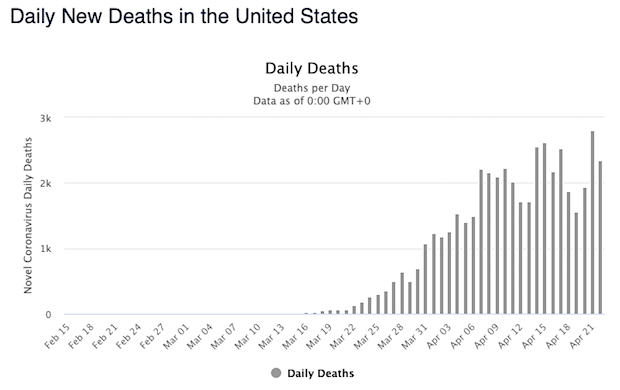

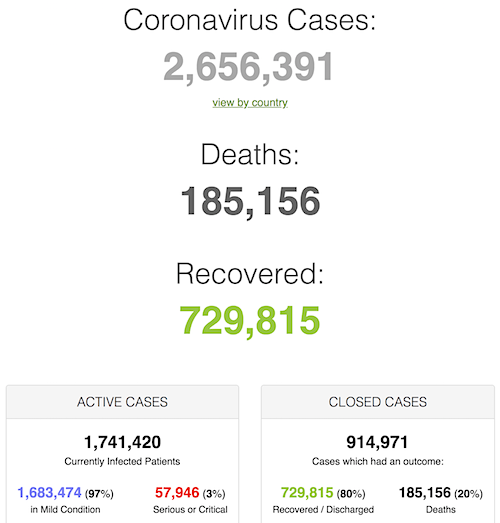

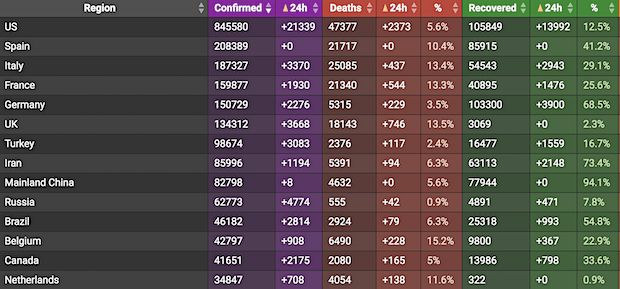

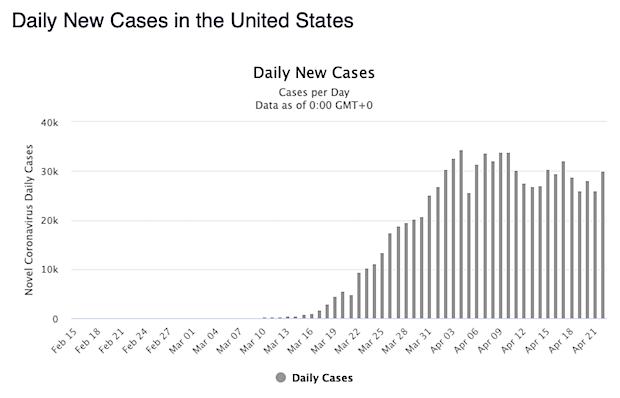

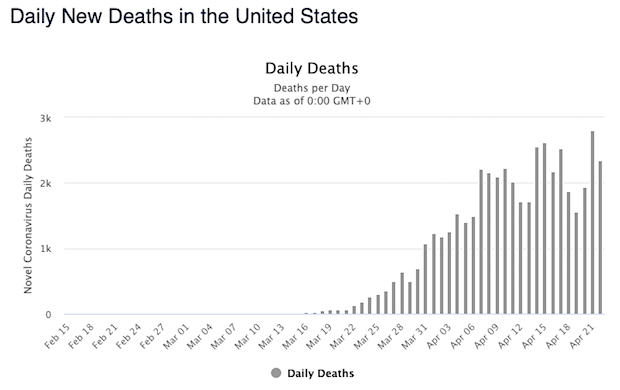

• The US had +2,341 new deaths from coronavirus today, down from its record high yesterday, bringing the total US death toll to 47,659.

• New York had +661 new deaths, while New Jersey had +310, Massachusetts had +221, and three other states (CA, MI, CT) had over 100 new deaths. Only five states did not have a coronavirus death today.

• The US had nearly +30k new confirmed cases today, bringing the total to over 848k, with over 717k active cases.

• US total cases currently at 848,735, with death totals at 47,663.

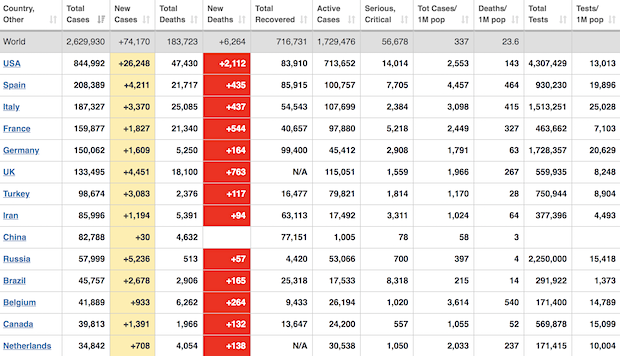

• Globally, total cases have hit 2,637,414, with death totals at 184,204.

• US yesterday new 25,985, today now 27,948.

• IL, CT today exceed 2,000

• Spain yesterday 3,968, today 4,211. Fluctuating. No daily testing data

• 4/22/20 – Top 12 State Cases

New York: 257,216

New Jersey: 95,865

Massachusetts: 42,944

California: 35,396

Illinois: 35,108

Pennsylvania: 35,045

Michigan: 33,966

Florida: 28,309

Louisiana: 25,258

Connecticut: 22,469

Texas: 21,069

Georgia: 20,740

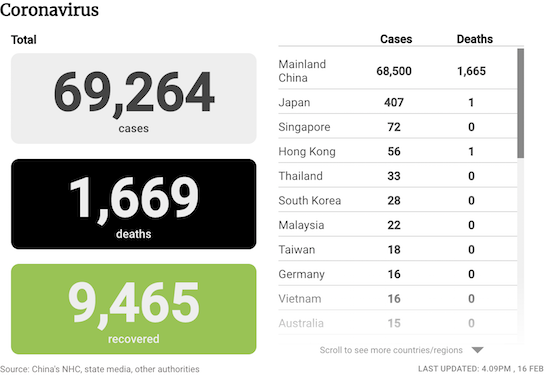

#Coronavirus: Global #Covid19 Deaths By Week

01/22: 17

01/29: 133

02/05: 564

02/12: 1,118

02/19: 2,122

02/26: 2,770

03/04: 3,254

03/11: 4,615

03/18: 8,733

03/25: 21,181

04/01: 46,809

04/08: 88,338

04/15: 134,177

04/22: 183,027

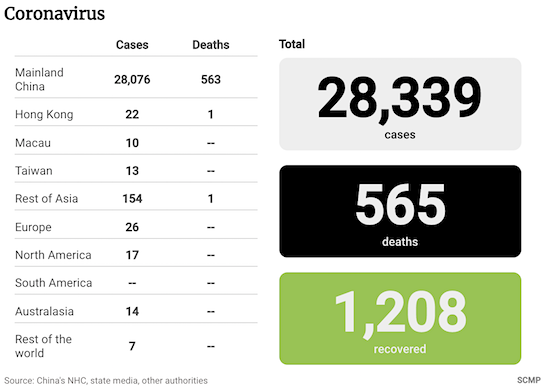

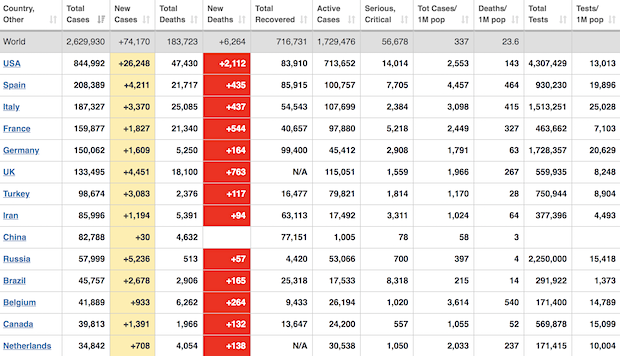

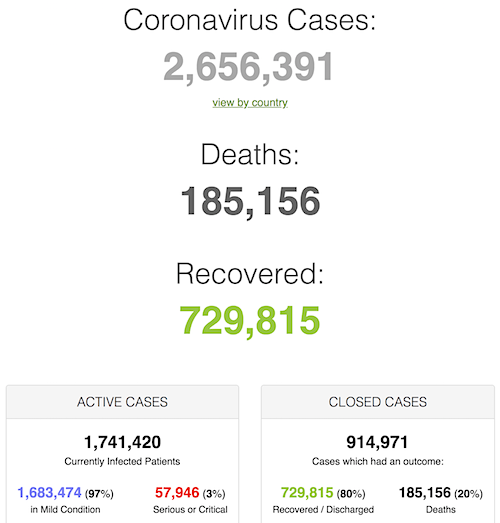

• Cases 2,656,391 (+ 82,920 from yesterday’s 2,573,471)

• Deaths 185,156 (+ 6,598 from yesterday’s 178,558)

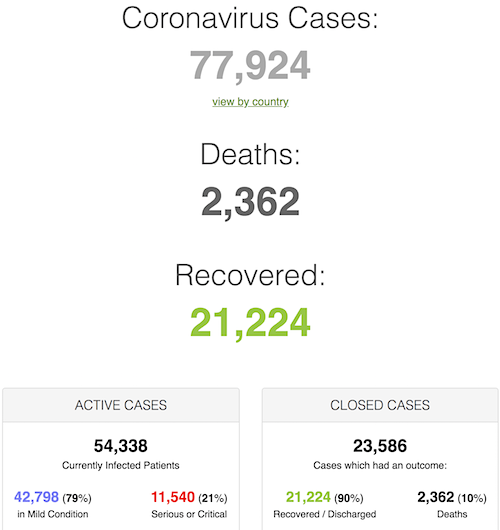

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: among Active Cases, Serious or Critical fell to 3%. Among Closed Cases, Deaths have fallen to 20%

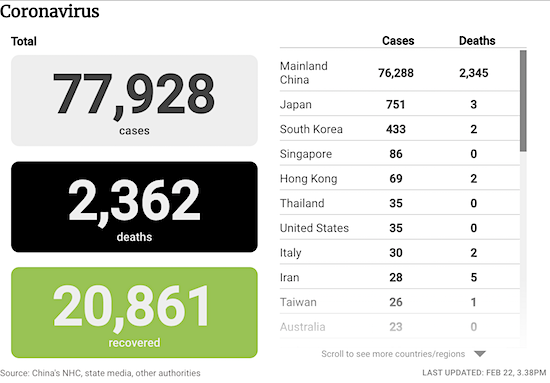

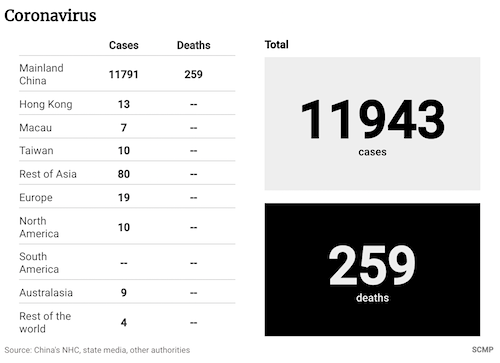

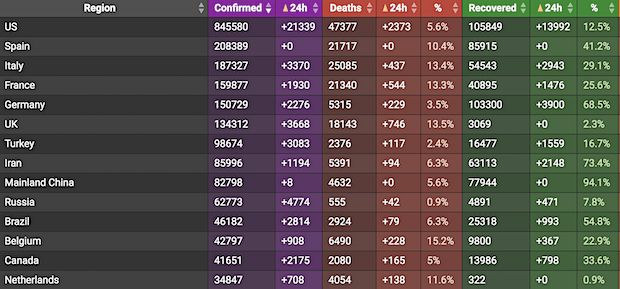

From SCMP:

From COVID19Info.live: Note: Turkey, Russia, UK are the biggest risers

“The state,” he told me, “should not smooth out your life, like a Lebanese mother, but should be there for intervention in negative times, like a rich Lebanese uncle.”

• Not a Black Swan but a Portent of a More Fragile Global System – Taleb (NYer)

COVID19 has initiated ordinary citizens into the esoteric “mayhem” that Taleb’s writings portend. Who knows what will change for countries when the pandemic ends? What we do know, Taleb says, is what cannot remain the same. He is “too much a cosmopolitan” to want global networks undone, even if they could be. But he does want the institutional equivalent of “circuit breakers, fail-safe protocols, and backup systems,” many of which he summarizes in his fourth, and favorite, book, “Antifragile,” published in 2012. For countries, he envisions political and economic principles that amount to an analogue of his investment strategy: government officials and corporate executives accepting what may seem like too-small gains from their investment dollars, while protecting themselves from catastrophic loss.

For Taleb, an antifragile country would encourage the distribution of power among smaller, more local, experimental, and self-sufficient entities—in short, build a system that could survive random stresses, rather than break under any particular one. (His word for this beneficial distribution is “fractal.”) We should discourage the concentration of power in big corporations, “including a severe restriction of lobbying,” Taleb told me. “When one per cent of the people have fifty per cent of the income, that is a fat tail.” Companies shouldn’t be able to make money from monopoly power, “from rent-seeking”—using that power not to build something but to extract an ever-larger part of the surplus.

There should be an expansion of the powers of state and even county governments, where there is “bottom-up” control and accountability. This could incubate new businesses and foster new education methods that emphasize “action learning and apprenticeship” over purely academic certification. He thinks that “we should have a national Entrepreneurship Day.” But Taleb doesn’t believe that the government should abandon citizens buffeted by events they can’t possibly anticipate or control. (He dedicated his book “Skin in the Game,” published in 2018, to Ron Paul and Ralph Nader.) “The state,” he told me, “should not smooth out your life, like a Lebanese mother, but should be there for intervention in negative times, like a rich Lebanese uncle.”

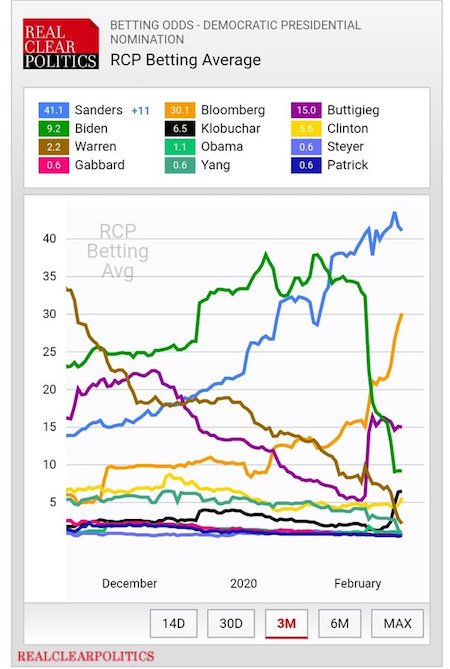

Right now, for example, the government should, indeed, be sending out checks to unemployed and gig workers. (“You don’t bail out companies, you bail out individuals.”) He would also consider a guaranteed basic income, much as Andrew Yang, whom he admires, has advocated. Crucially, the government should be an insurer of health care, though Taleb prefers not a centrally run Medicare-for-all system but one such as Canada’s, which is controlled by the provinces. And, like responsible supply-chain managers, the federal government should create buffers against public-health disasters: “If it can spend trillions stockpiling nuclear weapons, it ought to spend tens of billions stockpiling ventilators and testing kits.”

Read more …

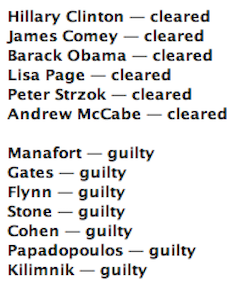

This was a given.

• Coronavirus Started Spreading In US Much Earlier Than Thought (CoD)

Experts have released new information about just how long the coronavirus (COVID-19) might have been silently spreading in the United States. Health officials in California said the first U.S. coronavirus deaths actually occurred weeks before they previously believed. This comes as no surprise to doctors. Many doctors had patients earlier on that they now believe were COVID-19 cases. But they didn’t qualify for testing at the time because they either didn’t have a history of travel to China or the didn’t have the initially reported symptoms of fever, cough and shortness of breath. But now there’s concrete proof that the timeline of cases started much earlier.

The first confirmed case of the coronavirus in the U.S. came Jan. 21 in a man from Washington state who developed symptoms after returning from a trip to Wuhan, China. But the first confirmed death was thought to be more than a month later, on Feb. 29, in Kirkland, Washington. Health officials there later found two deaths on Feb. 26 were due to the virus, pushing the timeline back three days. But coroners across the country are now looking back at other deaths. The medial examiner in Santa Clara County, California, sent tissue samples collected during autopsies performed in February to the Centers for Disease Control and Prevention for testing.

Samples taken from patients who died at home on Feb. 6 and Feb. 17 both tested positive for the coronavirus. That pushes the fatality timeline back 20 days. Health officials believe the patients were infected in the community. Neither is known to have a travel history. Given that deaths tend to lag infections by about two weeks, the first patient could have been infected in mid-January. It’s likely the coronavirus was already spreading in the U.S. far earlier than initially reported — hidden in a bad flu season and undetected by rigid testing rules.

Read more …

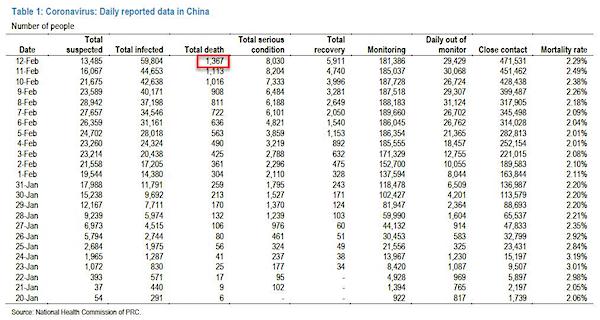

So people will say: see, infection rate is much lower! Well, not if the death rate is also much higher. Which certainly in China is possible.

• Coronavirus Study Points To Vast Number Of Cases Under Radar In China (SCMP)

China’s official tally of coronavirus cases could have quadrupled in mid-February if one broader system for classifying confirmed patients had been used from the outset of the pandemic, according to researchers at the University of Hong Kong. In a study published in the medical journal The Lancet on Tuesday, the researchers said China might have had 232,000 confirmed cases – rather than the official total of about 55,000 – by February 20 if a revised definition adopted earlier in the month had been applied throughout. “We estimated that there were at least 232,000 infections in the first epidemic wave of Covid-19 in mainland China,” they said, referring to the disease caused by the coronavirus.

“The true number of infections could still be higher than that currently estimated considering the possibility of under-detection of some infections, particularly those that were mild and asymptomatic, even under the broadest case definitions.” The researchers – led by Peng Wu from the University of Hong Kong’s school of public health – looked at the various classification systems used by the government after the epidemic erupted in the central Chinese city of Wuhan in late December. China has published seven editions of diagnosis and treatment guidelines, changing the classification system as understanding of the disease developed. The Hong Kong team found that different definitions made a big difference to the number of cases.

“We estimated that when the case definitions were changed from version 1 to 2, version 2 to 4, and version 4 to 5, the proportion of infections being identified as Covid-19 cases was increased by 7.1 times from version 1 to 2, 2.8 times from version 2 to 4, and 4.2 times from version 4 to 5,” the paper, co-authored by Peng’s HKU colleagues epidemiologist Benjamin Cowling and medical faculty dean Gabriel Leung, said.

Read more …

Thorough report on how and why. But even then a lack of understanding of what the virus is, remains.

• How Does Coronavirus Kill? (ScienceMag)

When an infected person expels virus-laden droplets and someone else inhales them, the novel coronavirus, called SARS-CoV-2, enters the nose and throat. It finds a welcome home in the lining of the nose, according to a preprint from scientists at the Wellcome Sanger Institute and elsewhere. They found that cells there are rich in a cell-surface receptor called angiotensin-converting enzyme 2 (ACE2). Throughout the body, the presence of ACE2, which normally helps regulate blood pressure, marks tissues vulnerable to infection, because the virus requires that receptor to enter a cell. Once inside, the virus hijacks the cell’s machinery, making myriad copies of itself and invading new cells.

As the virus multiplies, an infected person may shed copious amounts of it, especially during the first week or so. Symptoms may be absent at this point. Or the virus’ new victim may develop a fever, dry cough, sore throat, loss of smell and taste, or head and body aches. If the immune system doesn’t beat back SARS-CoV-2 during this initial phase, the virus then marches down the windpipe to attack the lungs, where it can turn deadly. The thinner, distant branches of the lung’s respiratory tree end in tiny air sacs called alveoli, each lined by a single layer of cells that are also rich in ACE2 receptors.

Normally, oxygen crosses the alveoli into the capillaries, tiny blood vessels that lie beside the air sacs; the oxygen is then carried to the rest of the body. But as the immune system wars with the invader, the battle itself disrupts this healthy oxygen transfer. Front-line white blood cells release inflammatory molecules called chemokines, which in turn summon more immune cells that target and kill virus-infected cells, leaving a stew of fluid and dead cells—pus—behind. This is the underlying pathology of pneumonia, with its corresponding symptoms: coughing; fever; and rapid, shallow respiration. Some COVID-19 patients recover, sometimes with no more support than oxygen breathed in through nasal prongs.

But others deteriorate, often quite suddenly, developing a condition called acute respiratory distress syndrome (ARDS). Oxygen levels in their blood plummet and they struggle ever harder to breathe. On x-rays and computed tomography scans, their lungs are riddled with white opacities where black space—air—should be. Commonly, these patients end up on ventilators. Many die. Autopsies show their alveoli became stuffed with fluid, white blood cells, mucus, and the detritus of destroyed lung cells.

Read more …

All the big money’s already been handed out.

• Many Small Businesses Say Loans Won’t Get Them To Rehire (AP)

Some small businesses that obtained a highly-coveted government loan say they won’t be able to use it to bring all their laid-off workers back, even though that is what the program was designed to do. The Paycheck Protection Program promises a business owner loan forgiveness if they retain or rehire all the workers they had in late February. But owners say the equation isn’t so simple, in part because of current economic conditions and partly due to the terms of the loans. As a result, the lending may not reduce unemployment as much as the Trump administration and Congress hope. The government’s $2 trillion relief package included $349 billion for the small business loan program, which was besieged with applications and ran out of money Thursday.

Congress and the White House reached a deal Tuesday that would provide another $310 billion. To get the loans forgiven, companies need to spend 75% on payroll within eight weeks of receiving the money. The other 25% can be spent on rent, utilities, and mortgage payments. Otherwise, the loan has generous terms: Only a 1% interest rate and six months before any principal is due. Many of the small companies that were able to obtain a loan are having second thoughts about rehiring all their workers and a few plan to return the money. Others will use what they can on rent and utilities, and will use some to rehire a portion of their laid-off staff. But most are unsure they will be able to reopen eight weeks from now.

They see little point in rehiring all their workers, paying them to do little or nothing, and then potentially laying them off again if business remains weak two months from now. “You’re turning the business into a pass through for the federal government,” said Joe Walsh, who owns Clean Green Maine, a cleaning service in Portland, Maine with 35 employees. “You’re doing very little to actually help the business.” [..] Also, the generous unemployment aid that was also included in the government’s relief package has made it more difficult to rehire. Many workers are making more with unemployment checks, which now include a $600 weekly benefit from the federal government.

Walsh, who received a $280,000 loan from the SBA, said that he is reluctant to push his employees to return to work because, under unemployment benefit rules, they could lose their weekly checks if they turn down potential jobs. “That’s just putting me as the employer in a really difficult position,” Walsh said. He pays at least $17 an hour, with benefits, but his former employees are getting the equivalent of roughly $25 an hour from unemployment.

Read more …

They all have the same campaign contributors. And they’re not small businesses.

• Congressional Democrats Do Little To Improve ‘Pathetic’ Coronavirus Deal (IC)

PROGRESSIVE GROUPS are outraged with the nearly $500 billion interim coronavirus rescue package the Senate passed on Tuesday, urging House Democrats to oppose the “pathetic” deal they say doesn’t come close to providing the relief vulnerable people need while giving away all Democratic leverage for future legislation. The “Phase 3.5” bill, which is expected to sail through the House this week, left out almost everything Democratic leaders were advocating for. There’s no additional funding for state and local governments, no expanded food stamp benefits, no hazard pay for front-line workers, nor money for the U.S. Postal Service, which had all been basic Democratic priorities.

The lack of progressive opposition in Congress has been especially noteworthy, after members of the progressive caucus promised to help make future legislation more comprehensive following the hastily passed Phase 3 bill. While some progressive advocates argue that Democrats didn’t have much leverage on the package to begin with, others note that Democrats control the House and House Speaker Nancy Pelosi could have led the party to pass its own bill. “Just as importantly as the inadequate policy provisions, this bill gives away all Democratic leverage,” Ezra Levin, co-executive director of Indivisible, said in an emailed statement.

“We fought so hard to win back the House in 2018 — to make sure that we had a voice in negotiations like this. So far we’ve heard silence from the House. This bill may be our last chance to get the things we need. [Republican Senate Majority Leader] Mitch McConnell has already said he doesn’t want to push through another bill, and if he does, it won’t be for weeks.” [..] The interim package, which would replenish funds for an emergency small business lending program, also includes an additional $75 billion for hospitals and $25 billion for coronavirus testing — two necessities that have been framed as GOP concessions. House Majority Leader Steny Hoyer said the legislation is everything they were expecting. “When you look at the package that is going to be passed, it’s almost exactly like the one we asked for two weeks ago, or 12 days ago,” he told reporters on Tuesday.

Read more …

It takes 2 weeks for new infections to occur. By then, most of the US will have reopened.

• Trump Disagrees ‘Strongly’ With Georgia Reopening Shops (JTN)

President Trump said he disagreed with Georgia’s decision to allow some shops to re-open as early as Friday after shuttering due to the coronavirus pandemic. “I told the governor of Georgia, Brian Kemp, that I disagree strongly with his decision to open certain facilities which are in violation of the Phase 1 guidelines for the incredible people of Georgia,” Trump said Wednesday during a press conference of the White House Coronavirus Task Force. “But at the same time, he must do what he thinks is right. I want him to do what he thinks is right. But I disagree with him on what he’s doing.” Trump said he wanted to give governors discretion, although he would step in if he sees something “totally egregious, totally out of line.”

Trump’s administration last week released a 3-phase set of guidelines to re-open following the worst of the pandemic. Trump said that these Georgia shops shouldn’t be re-opening during the federal phase 1 guidelines and should instead wait for phase 2. “We’re going to have phase 2 very soon,” Trump said. “It’s just too soon. I think it’s too soon. And I love the people. I love those people that use all of those things, the spas, and the beauty parlors, barber shops, tattoo parlors. I love ’em. But they can wait a little bit longer, just a little bit. Not much. Because safety has to predominate. We have to have that. So I told the governor very simply that I disagree with his decision, but he has to do what he thinks is right.”

[..] 46% of registered U.S. voters want decisions about re-opening the country after the coronavirus to be made by state and local officials. Only 15% think it should be a federal decision, according to the Just the News Daily Poll with Scott Rasmussen. Trump praised Gov. Gavin Newsom (D-Calif.) for his re-opening strategy. “Some of the governors have done a fantastic job working with us,” Trump said.

Read more …

Sidelined a little too late perhaps?

• HHS Secretary Alex Azar Waited For Weeks To Brief Trump (WSJ)

On Jan. 29, Health and Human Services Secretary Alex Azar told President Trump the coronavirus epidemic was under control. The U.S. government had never mounted a better interagency response to a crisis, Mr. Azar told the president in a meeting held eight days after the U.S. announced its first case, according to administration officials. At the time, the administration’s focus was on containing the virus. When other officials asked about diagnostic testing, Dr. Robert Redfield, director of the Centers for Disease Control and Prevention, began to answer. Mr. Azar cut him off, telling the president it was “the fastest we’ve ever created a test,” the officials recalled, and that more than one million tests would be available within weeks.

That didn’t happen. The CDC began shipping tests the following week, only to discover a flaw that forced it to recall the test from state public-health laboratories. When White House advisers later in February criticized Mr. Azar for the delays caused by the recall, he lashed out at Dr. Redfield, accusing the CDC director of misleading him on the timing of a fix. “Did you lie to me?” one of the officials recalled him yelling. Six weeks after that Jan. 29 meeting, the federal government declared a national emergency and issued guidelines that effectively closed down the country. Mr. Azar, who had been at the center of the decision-making from the outset, was eventually sidelined.

Many factors muddled the administration’s early response to the coronavirus as officials debated the severity of the threat, including comments from Mr. Trump that minimized the risk. But interviews with more than two dozen administration officials and others involved in the government’s coronavirus effort show that Mr. Azar waited for weeks to brief the president on the threat, oversold his agency’s progress in the early days and didn’t coordinate effectively across the health-care divisions under his purview.

[..] White House officials say there is no plan to replace Mr. Azar during a pandemic. Still, the president last week installed a former campaign aide, Michael Caputo, to serve as assistant secretary for public affairs at HHS. The White House also appointed policy adviser Emily Newman as a liaison to HHS who will oversee the agency’s political hires. Mr. Azar has largely been sidelined over the past several weeks from discussions with the president and with the White House task force, administration officials said. He hasn’t attended the daily briefing since April 3.

Read more …

The headline is just too good.

• Azar Tapped Former Labradoodle Breeder To Lead US Pandemic Task Force (R.)

On January 21, the day the first U.S. case of coronavirus was reported, the secretary of the Department of Health and Human Services appeared on Fox News to report the latest on the disease as it ravaged China. Alex Azar, a 52-year-old lawyer and former drug industry executive, assured Americans the U.S. government was prepared. “We developed a diagnostic test at the CDC, so we can confirm if somebody has this,” Azar said. “We will be spreading that diagnostic around the country so that we are able to do rapid testing on site.” While coronavirus in Wuhan, China, was “potentially serious,” Azar assured viewers in America, it “was one for which we have a playbook.”

Azar’s initial comments misfired on two fronts. Like many U.S. officials, from President Donald Trump on down, he underestimated the pandemic’s severity. He also overestimated his agency’s preparedness. As is now widely known, two agencies Azar oversaw as HHS secretary, the Centers for Disease Control and Prevention and the Food and Drug Administration, wouldn’t come up with viable tests for five and half weeks, even as other countries and the World Health Organization had already prepared their own. Shortly after his televised comments, Azar tapped a trusted aide with minimal public health experience to lead the agency’s day-to-day response to COVID-19.

The aide, Brian Harrison, had joined the department after running a dog-breeding business for six years. Five sources say some officials in the White House derisively called him “the dog breeder.” Azar’s optimistic public pronouncement and choice of an inexperienced manager are emblematic of his agency’s oft-troubled response to the crisis. His HHS is a behemoth department, overseeing almost every federal public health agency in the country, with a $1.3 trillion budget that exceeds the GDP of most countries. [..[ Azar and his top deputies oversaw health agencies that were slow to alert the public to the magnitude of the crisis, to produce a test to tell patients if they were sick, and to provide protective masks to hospitals even as physicians pleaded for them.

The first test created by the CDC, meant to be used by other labs, was plagued by a glitch that rendered it useless and wasn’t fixed for weeks. It wasn’t until March that tests by other labs went into production. The lack of tests “limited hospitals’ ability to monitor the health of patients and staff,” the HHS Inspector General said in a report this month. The equipment shortage “put staff and patients at risk.” A promised virus surveillance program failed to take root, despite assurances Azar gave to Congress. Rather than share information, three current and three former government officials told Reuters, Azar and top staff sidelined key agencies that could have played a higher-profile role in addressing the pandemic. “It was a mess,” said a White House official who worked with HHS.

Read more …

Little Mike mighty actually pull it off. But he doesn’t care too much about privacy.

• Cuomo Taps Bloomberg To Lead COVID-19 Contact “Tracing Army” (Gothamist)

Michael Bloomberg has been charged with amassing and leading a “tracing army” to track the spread of COVID-19 in the Tri-State area, according to Governor Andrew Cuomo. The goal will be to aggressively test and isolate contacts of all those who tested positive for the virus — a major undertaking that experts say is necessary before officials can consider relaxing social distancing measures. After previewing this push in recent weeks, Cuomo revealed during a press conference on Wednesday that Bloomberg will “coordinate the entire effort,” including developing the program and designing the training for thousands of newly-hired tracers.

The multibillionaire former mayor, who does not have a public health background, has also agreed to contribute $10 million to the initiative. By comparison, he spent $1 billion on his failed presidential bid. The announcement came hours after Mayor Bill de Blasio unveiled his own plans for a citywide contact tracing apparatus. The mayor was not informed by the Governor’s Office that Bloomberg, his predecessor and political rival, would be heading up the statewide effort until Wednesday morning, as de Blasio was announcing his own initiative, mayoral spokesperson Freddi Goldstein told Gothamist. While the city will still be responsible for hiring some of the field workers, Cuomo stressed that the initiative had to be regionally focused.

“You cannot trace someone within the boundaries of New York City,” he said. The state will also partner with Johns Hopkins University and the non-profit Vital Strategies to roll out the program. Some of the roughly 35,000 CUNY and SUNY students in medical fields will also be tapped for the effort, Cuomo said. The federal government has made available $1.3 billion for New York to begin contact tracing. Cuomo did not immediately have an estimate for how much it would cost. “You don’t have months to get this up and running,” he added. “You have weeks.”

Read more …

Turkey is one of the exploding countries. Is it a good ide to export their supplies?

• Turkey PPE Supplier Doesn’t Have Enough Stock To Meet UK Order (Sky)

A commercial supplier in Turkey did not have enough stock to fulfil an order for 84 tonnes of protective equipment supposed to be bound for the UK, Turkish officials have said. British sources said the UK government was working with the company and the Turkish authorities to secure the shipment “as soon as possible” – though no time frame was given. It comes as a flight carrying PPE – urgently needed by front line health workers as they treat COVID-19 patients in the UK – arrived from Turkey, following days of delays. The Royal Air Force plane arrived at Brize Norton in Oxfordshire from Istanbul just after 3am.

The total consignment of 84 tonnes includes 400,000 clinical gowns, but it is not clear how much of this is on today’s flight. An initial batch of just 2,500 gowns was sent to the airport in Istanbul for quality control checks on Tuesday. Turkish officials said Britain’s attempt to buy the protective equipment from a Turkish firm ran into trouble because the supplier did not have enough stock. Turkey’s ambassador to the UK, Umit Yalcin, told Sky News: “As far as I understand there have been problems with the private supplier company. “Now Turkey is cooperating with the UK authorities to find a quick solution for the UK’s urgent needs.

Read more …

Support your local dealer.

• Coronavirus Upends Global Narcotics Trade (R.)

Countries around the world have spent billions of dollars bailing out businesses affected by the coronavirus outbreak. Peru’s coca farmers, who grow the bushy plant used to make cocaine, say they want help, too. Prices for coca leaves sold to drug gangs have slumped 70% since Peru went on lockdown last month, according to Julián Pérez Mallqui, the head of a local growers’ organization. He said his members cater to Peru’s tightly regulated legal coca market, but acknowledged some growers sell on the black market. Peruvian officials say more than 90% of the country’s coca crop goes to traffickers who are now struggling to move product. With the sector in turmoil, Pérez’s group is crafting a plan to ask the government to buy up excess coca inventory.

Peru “has to design clear intervention strategies for coca,” Pérez said. “We’re screwed, just like everyone else in the world.” A spokesman for Peru’s anti-drugs agency said it may funnel more development aid to hard-hit areas. The coronavirus outbreak has upended industries across the globe. The international narcotics trade has not been spared. From the cartel badlands along the U.S.-Mexico border and verdant coca fields of the Andes, to street dealers in London and Paris, traffickers are grappling with many of the same woes as legitimate businesses, Reuters has found. On three continents, Reuters spoke with more than two dozen law enforcement officials, narcotics experts, diplomats and people involved in the illicit trade.

They described a business experiencing busted supply chains, delivery delays, disgruntled workers and millions of customers on lockdown. They also gave a window into the innovation – and opportunism – that are hallmarks of the underworld. [..] coronavirus has managed to do what authorities worldwide have not: slow the global narcotics juggernaut almost overnight and inflict a measure of pain on all who participate. In Mexico, the Sinaloa Cartel has faced many threats over the years, including the jailing of former leader Joaquin “El Chapo” Guzman. But never one like the coronavirus pandemic.

Read more …

“The task for now is income maintenance — targeting public support at the unemployed so that parents can feed their children.”

• The Analogy Trap in Economic Policy (Eichengreen)

Where comparisons with past crises have value is precisely in highlighting how this crisis is different, and therefore how the policy response should vary. First, this crisis did not originate in the financial system, in contrast to 1929 and 2008. Flooding financial markets with liquidity, as central banks have done, may prevent problems on the real side of the economy from destabilising financial institutions and markets. But doing so will not mend the economy or even halt its downward spiral. Achieving this requires first containing the pandemic. Second, in contrast to these earlier episodes, major fiscal stimulus packages are not the right policy focus. Unlike in the past, we have also experienced an unprecedented supply shock.

It makes no sense to try to sustain demand at earlier levels at a time when production can’t keep up, since it is not yet safe — and won’t be safe for some time — for people to return to work. The time for demand stimulus is later. The task for now is income maintenance — targeting public support at the unemployed so that parents can feed their children. Third, this crisis will be most acute in low-income countries. These countries have weak health systems. They are being hit by weak commodity prices, falling remittances, capital flight, a shortage of trade credit and collapsing currencies all at once. They were not the focus in 1929 or 2008 because those crises centred on the global financial system, and because low-income countries had only rudimentary financial systems and were not integrated financially.

This time, low-income countries are at risk of a crisis that will dwarf anything in the advanced-country world. Addressing their plight should be priority number one on humanitarian grounds, but also because what happens there will spill back onto the rest of the world through both economic and epidemiological channels. With the IMF and World Bank meetings coming up next week, one wonders whether advanced countries will look beyond their domestic concerns. One worries that their preoccupation with the questions ‘is this downturn more serious than the Global Financial Crisis?’ and ‘could unemployment rise as high as in the Great Depression?’ will cause them to lose sight of what is about to become the most serious crisis of all.

Read more …

Yeah, before you know it you’re trapped with the NYT in your corner.

• New York Times Revives its Role in Chinagate (Lauria)

During the saga of Russiagate The New York Times was the main vehicle for unnamed U.S. intelligence officials to filter uncorroborated allegations about Russia, presenting them as proven fact. Just as the Democratic Party attempted to shift the blame from its disastrous 2016 loss to Donald Trump onto Russia, the Trump administration is now trying to shift the blame from Trump’s disastrous handling of the Coronavirus crisis onto China. And The New York Times is once again the vehicle. In a front-page story on Wednesday, the Times reports as flat fact that “Chinese agents helped spread messages to millions of Americans about a fake lockdown last month, sowing virus panic in the U.S., officials said.” One of the messages said Trump would lock down the entire nation. “They will announce this as soon as they have troops in place to help prevent looters and rioters.”

But as in the Times‘ sordid history of numerous Russiagate stories, you have to read deep into the piece, in this case to paragraph seven, before you are told: “The origin of the messages remains murky. American officials declined to reveal details of the intelligence linking Chinese agents to the dissemination of the disinformation, citing the need to protect their sources and methods for monitoring Beijing’s activities.” Any reputable journalism school will teach its students that you hold off publishing until you see the evidence underlying an assertion. This is especially true when quoting anonymous sources. And it is doubly true when these sources are intelligence agents, who have a long history of deception. It is part of their job description.

Reporters should by now be wary and demand proof after they had allowed intelligence officials to misuse them in misleading the public about the reasons to invade Iraq, and indeed about the later proven lies about collusion between the Trump campaign and Russia. The Times story on Wednesday rather shamelessly revives and links China’s alleged misdeeds to Russiagate. “American officials said China, borrowing from Russia’s strategies, has been trying to widen political divisions in the United States. As public dissent simmers over lockdown policies in several states, officials worry it will be easy for China and Russia to amplify the partisan disagreements.”

Read more …

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks for your generousl donations to date.

https://twitter.com/i/status/1252733979544993794

Support the Automatic Earth. It’s good for your mental health.