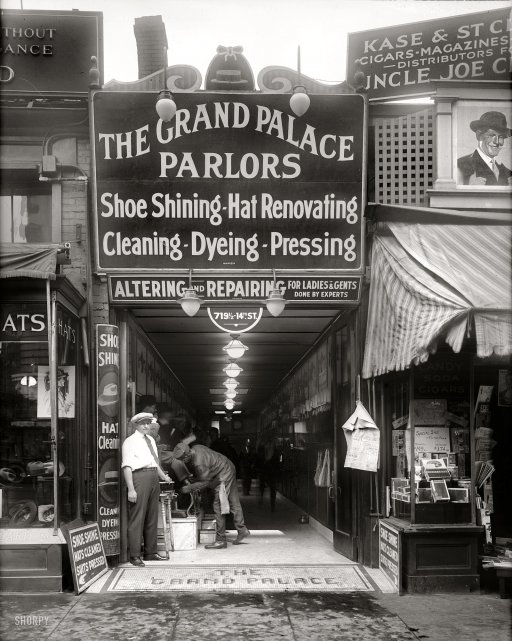

NPC Grand Palace shoe shining parlor, Washington DC 1921

After losing 11% last week, Shanghai this morning was down almost -9% at one point, after lunch went back up to -6.5%, and ended its day at -8.49%. A Black Monday for sure, but is this the BIG ONE? It really doesn’t matter one bit. Unless perhaps you persist in calling your self an investor, in which case we pity you, but not for losing your shirt. Because God knows we’ve said enough times now that there are no functioning markets anymore, and therefore no-one who can rightfully lay claim to the title ‘investor’.

Plenty amongst you will be talking about economic cycles, and opportunities, and debate how to ‘play’ the crash, but all this is useless if and when a market doesn’t function. And just about all markets in the richer part of the world stopped functioning when central banks started buying assets. That’s when you stopped being investors. And when market strategies stopped making sense.

Central banks will come up with more, much more, ‘stimulus’, but what China teaches us today is that we’re woefully close to the moment when central banks will lose the faith and trust of everyone. After injecting tens of billions of dollars in markets, which thereby ceased to function, the global economy is in a bigger mess then it was prior to QE. The whole thing is one big bubble now, and we know what invariably happens to those.

More QE is not an answer. And there is no other answer left either. Those tens of trillions will need to vanish from the global economy before any market can be returned to a functioning one, and by that time of course asset prices will be fraction of what they are now. It may not happen today, but that doesn’t matter: what’s important to know is that it WILL happen.

And if you keep being out there trying to outsmart a non-functioning market, you’ll get burned as badly as the millions of Chinese grandmas who already lost 20%+ so far just this month. And that’s just on their share holdings; Chinese property ‘markets’ will be at least as badly burned.

China’s leaders, and its people, have walked eyes wide open into an ugly albeit nigh perfect trap. They’ve all started to believe that borrowing more could make them richer. Outstanding credit across the entire society has reached idiotic proportions. We can get somewhat of a glance at what levels debt have reached in Steve Keen’s Is This The Great Crash Of China?, in which he argues that a crash is inevitable, simply given those levels.

But we can at the same time be sure that this doesn’t tell the whole story. Much of what has gone on in the shadow banking sector remains unknown and carefully hidden. Thousands of local governments have plunged themselves into the deep end borrowing from trusts and other often shady instruments, at interest levels much higher than the ‘official’ ones. Even these shadow trusts last week have begun asking for bailouts, a development that can only make one think of a Godfather episode of one’s choice.

China’s first big mistake is that Xi and Li and their ilk think they can control housing and stock markets. Which basically means they think they can stop people from selling property and assets when they feel these might go down in ‘value’.

China’s second big mistake is that so many people believe that Xi and Li actually have any such control. Which means the people don’t sell nearly soon enough, and will be saddled with the losses. From an economic perspective, it’s an exercise in stupid futility, or, if you prefer, futile stupidity.

Add to this that the credit that allowed the Chinese to purchase all these alleged assets came from nowhere, and will therefore of necessity have to go back to nowhere, and you have a recipe for deflationary debt deleveraging the likes of which the world may never have seen before in history, unless perhaps you count the tulip- or South Sea bubbles, but they are just small scale anecdotes compared to today.

This deleveraging will be global. We pity the many millions of poor souls who think that countries like the US and Britain will be spared the worst because their economies are doing ‘so well’. Doing well in a global Ponzi is not a recommendation.

China’s fall is being exacerbated by the fact that it has two -heavily intertwined- parties who believe in their own omnipotence, the government (Politburo) and the central bank. Both are being found out at the same moment. And both will resist this discovery. As will all central banks in the west, where at least any idea of omnipotence of governments has long been eradicated.

But the entire west has become so addicted to China’s debt, and the illusion of prosperity and economic recovery it has brought, that all prices everywhere must come down, as noted above, until the tens of trillions of dollars in stimulus measures have vanished into the thin air they were fabricated in. Until value becomes real value again, not this virtual zombie Ponzi pricing.

Today may be just a warning sign, and it may take a while longer before the deluge, but it will come. And since China has nothing left to fall back on but even higher private and public debt levels, make that sooner rather than later.

The main advice we’ve always given with regards to debt deleveraging stands: get out of debt.

Meanwhile, the western financial press, which has been reporting on non-functioning markets for years as if they actually were still functioning, is worrying about a potential Fed rate hike, telling its readers and listeners that the US central bank ‘looks set to make a dangerous mistake’. But the real ‘mistake’ was made a long time ago.

Home › Forums › Is This Black Monday Crash The BIG ONE? It Doesn’t Matter