Frances Benjamin Johnston Edgar Allan Poe’s mother’s house, Richmond, VA 1930

Getting ugly. Just getting started.

• Commodities Tumble to 12-Year Low as US Futures Slide (Bloomberg)

Commodities (BCOM) tumbled to a 12-year low, led by copper’s biggest decline in almost six years, as slowing global growth curbs demand. Stocks fell around the world, while the yen rose with Treasuries. The Bloomberg Commodities Index slid 1% by 8:24 a.m. in London as copper tumbled 6%. Nickel fell to an 11-month low as crude oil declined. The MSCI All Country World Index fell 0.4% as benchmark gauges in Europe and Asia declined and Standard & Poor’s 500 Index futures lost 0.6%. The yield on 10-year Treasuries matched a 20-month low and German and U.K. bonds rallied. The yen rose a fourth day.

Commodity prices are tumbling as a supply glut collides with waning demand, reducing earnings prospects for producers and increasing the appeal of government bonds as inflation slows. The World Bank cut its global growth outlook, citing weak expansions in Europe and China, the world’s biggest consumer of raw materials. Data today is projected to show a gain in U.S. oil inventories. “Oversupply and falling demand are dragging down commodities beyond oil,” said Ayako Sera, market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo, which oversees $325 billion. “There are a lot of uncertainties and it’s hard to see a reversal in sentiment for the time being. As an investor it’s hard to proactively take on risk at the moment.” [..] “The news everywhere is doom and gloom,” said David Lennox, a resource analyst at Fat Prophets in Sydney. “Prices are going to keep sinking.”

Now they tell us 😉

• Oil at $40, and Below, Gaining Traction on Wall Street (Bloomberg)

Brace for $40-a-barrel oil. The U.S. benchmark crude price, down more than $60 since June to below $45 yesterday, is on the way to this next threshold, said Societe Generale and Bank of America. And Goldman Sachs says that West Texas Intermediate needs to remain near $40 during the first half to deter investment in new supplies that would add to the glut. “The markets are continuing to price in huge oversupply in the first half of 2015,” Mike Wittner, head of research at SocGen, said. “We’re going to go below $40.” Oil is seeking a “new equilibrium” as OPEC abandons its role of keeping supply and demand aligned, according to Goldman. Prices are poised to drop further, testing the ability of U.S. shale drillers to keep pumping.

WTI has dropped 14% this month, extending a 46% plunge last year that was the worst since the 2008 financial crisis. OPEC is trying to maintain its share of the global oil market against the rise of U.S. output. United Arab Emirates Energy Minister Suhail Al Mazrouei reiterated yesterday that shale producers will capitulate before OPEC to lower prices, the latest in more than a dozen comments from Gulf members aimed at hastening oil’s slide and lowering non-OPEC supply. The rout may continue to $35 a barrel in the “near term” because both oil supply and demand will have a delayed reaction to falling prices, Francisco Blanch at Bank of America said in a report on Jan. 6.

The U.S. is pumping oil at the fastest pace in more than three decades, helped by a drilling boom that’s unlocked supplies from shale formations including the Eagle Ford in Texas and the Bakken in North Dakota. U.S. output expanded to 9.14 million barrels a day in the week ended Dec. 12, the most since at least 1983, according to the U.S. Energy Information Administration. With Saudi Arabia and other OPEC nations no longer fine-tuning supply, reductions in investment in new production will be the instrument for removing excess output, Jeffrey Currie at Goldman said. This means the collapse will be deeper and the recovery slower than in previous slumps, he said.

“.. there is a possibility of a “true collapse” in U.S. capital expenditures and hiring if the price of oil stays at its current level.”

• Oil Fall Could Lead To US Capex Collapse: Jeff Gundlach (Reuters)

DoubleLine Capital’s Jeffrey Gundlach said on Tuesday there is a possibility of a “true collapse” in U.S. capital expenditures and hiring if the price of oil stays at its current level. Gundlach, who correctly predicted government bond yields would plunge in 2014, said on his annual outlook webcast that 35% of Standard & Poor’s capital expenditures comes from the energy sector and if oil remains around the $45-plus level or drops further, growth in capital expenditures could likely “fall to zero.” Gundlach, the co-founder of Los Angeles-based DoubleLine, which oversees $64 billion in assets, noted that “all of the job growth in the (economic) recovery can be attributed to the shale renaissance.” He added that if low oil prices remain, the U.S. could see a wave of bankruptcies from some leveraged energy companies.

Brent has fallen as low as just above $45 a barrel, near a six-year low, having averaged $110 between 2011 and 2013. Gundlach said oil prices have to stop going down so “don’t be bottom-fishing in oil” stocks and bonds. “There is no hurry here.” Energy bonds, for example, have been beaten up and appear attractive on a risk-reward basis, but investors need to hedge them by purchasing “a lot, lot of long-term Treasuries. I’m in no hurry to do it.” High-yield junk bonds have also been under severe selling pressure. Gundlach said his firm bought some junk in November but warned that investors need to “go slow” and pointed out “we are still underweight.”

Everything is overvalued.

• The Stock Market Is Overvalued Any Way You Look At It (MarketWatch)

No matter how you slice it, the stock market is overvalued. In fact, based on six well-known and time-tested indicators, equities are more overvalued today than they’ve been between 69% and 89% of the past century’s bull-market tops. To be sure, overvaluation doesn’t immediately doom a market. A year ago, the stock market was almost as overvalued as it is now, and it nevertheless turned in a decent year. But valuation indicators’ inability to forecast the market’s short-term direction doesn’t justify ignoring them altogether. Their longer-term forecasting record is impressive, which means that — sooner or later — the market will succumb to their gravitational force. Consider six widely used valuation indicators. To put their current readings into context, I compared them to where they stood at all bull-market tops since 1900 (using the definition employed by Ned Davis Research). Five of the six indicators show today’s market to be more overvalued than at between 82% and 89% of those previous peaks.

• The price/book ratio, which stands at an estimated 2.6 to 1. The book value dataset I was able to obtain extends only back to the 1920s rather than to the beginning of the century, but at 23 of the 28 major market tops since then, the price/book ratio was lower than it is today.

• The price/sales ratio, which stands at an estimated 1.1 to 1. I was able to put my hands on per-share sales data back to the mid 1950s; at 16 of the 18 market tops since, the price/sales ratio was lower than where it stands now.

• The dividend yield, which currently is 2.0% for the S&P 500. At 30 of the 35 bull-market peaks since 1900, the dividend yield was higher.

• The cyclically adjusted price/earnings ratio, which currently stands at 26.8. This is the ratio championed by Yale University’s Robert Shiller. It was lower than where it is today at 30 of the 35 bull-market highs since 1900.

• The so-called “q” ratio. Based on research conducted by the late James Tobin, the 1981 Nobel laureate in economics, the ratio is calculated by dividing market value by the replacement cost of assets. According to data compiled by Stephen Wright, an economics professor at the University of London, and Andrew Smithers, founder of the U.K.-based economics-consulting firm Smithers & Co., the market currently is more overvalued than it was at 31 of the 35 bull-market tops since 1900.

• The sixth valuation indicator is the one that is least bearish: The traditional price/earnings ratio. According to data on as-reported earnings compiled by Yale’s Shiller, and based on S&P estimates for the fourth quarter, this ratio currently stands at 18.7 to 1. It is higher than it was at 69% of past bull-market peaks.

Timebombs.

• Slide in Oil Means Tighter Budgets and Fewer Perks for Gulf Arabs (Bloomberg)

Gulf Arabs are gradually losing perks from free water to cheap fuel as governments hit by the slump in crude prices seek to trim their budgets. Kuwait, Oman and Abu Dhabi reduced subsidies on diesel, natural gas and utilities this month. The plunge on oil markets has added to pressure on the region’s rulers to implement spending cuts that were under discussion before the drop. Countries in the six-member Gulf Cooperation Council have used subsidies to mollify citizens and keep unrest at bay. The subsidies will be gradually removed “as long as there is no major blowback from citizens,” said Jim Krane at Rice University’s Baker Institute for Public Policy in Houston. “Governments have genuine fiscal pressure that adds punch to their call for everyone to tighten their belts.” Spending on subsidies in the GCC surged in the past four decades to reach as much as 10% of economic output in Saudi Arabia, the world’s biggest oil exporter, according to the World Bank.

Gasoline sells at 45 cents a gallon (12 cents a liter) in the kingdom, the cheapest after Venezuela among 61 countries tracked by Bloomberg. Cheap energy has led to a surge in consumption, which risks reducing the oil available for export. State-run Saudi Arabian Oil Co. warned in May that it will have “unacceptably low levels” of oil to sell in the next two decades if domestic power use keeps rising at 8% a year. “With energy demand in the GCC doubling every seven years, these countries can no longer afford to keep subsidizing domestic consumption of their chief export,” Krane said. The Middle East and North Africa accounted for about 50% of global energy subsidies in 2011, according to the IMF, a year when Brent crude averaged $111 a barrel. It was trading at below $47 yesterday. Even if oil recovers to average $65 a barrel this year, the GCC nations will post a combined budget deficit of 6% of gross domestic product, according to Arqaam Capital, a Dubai-based investment bank.

“OPEC, the industry cartel through which Saudi Arabia traditionally exerts its influence, is in decline. OPEC’s market share has fallen from more than 50% in 1974 to around 40% currently. ”

• OPEC’s Squeeze On US Oil Independence Could Succeed (Satyajit Das)

The price of crude oil, adjusted for inflation, is at 1979 levels, having fallen by more than 50% since June 2014. Weak demand contributes perhaps 30%-40% of the fall. In 2014, oil demand grew by around 500,000 barrels per day, below the 1.3 million barrels of growth projected earlier, reflecting slack economic activity in Europe, Japan, and emerging markets, especially China. Increased supply accounts for 60%-70% of the decline. High prices and strong demand encouraged new sources of oil to be brought on stream. The U.S. alone has added 3 million barrels a day of new supply in just the past three years, the equivalent of adding another Kuwait to the world oil market. The increased supply has been exacerbated by the refusal of OPEC, led by Saudi Arabia, to cut output for strategic and geopolitical reasons.

OPEC, the industry cartel through which Saudi Arabia traditionally exerts its influence, is in decline. OPEC’s market share has fallen from more than 50% in 1974 to around 40% currently. Compounding OPEC’s problems are efforts to diminish the role of oil as a transport fuel. The poor financial condition of some OPEC members makes it hard for them to reduce production, exacerbating the decline of the cartel’s power and its ability to dictate prices. From the Saudi perspective, the primary benefit of high oil prices has accrued to non-OPEC members. A cut in Saudi or OPEC production to support prices would only further benefit these oil producers. The Saudis are mindful of history. In the mid-1980s, Saudi Arabia cut its output by close to 75% to support weak prices. The Saudis suffered a loss of both revenues and market share.

Other OPEC members and non-OPEC producers benefitted from higher prices. In recent years, Saudi Arabia has regained market share, benefitting from the disruption to suppliers such as Iran, Iraq and Libya. The Saudis are reluctant to cut production, preferring to maintain market share rather than prices. The strategy is to allow oil prices to fall to levels below production costs of high-cost producers and non-traditional oil sources. The average breakeven cost currently is probably between $60 and $70 per barrel. Importantly, U.S. shale oil may not be economically viable below those levels. Perhaps as much as 80% of shale reserves are uneconomic at prices below $80 per barrel, at least based on current technology. In the short run, producers may continue to produce and sell at below breakeven prices. If oil prices stay low for a sustained period, then producers will cut production, with marginal- or higher-cost firms forced to close or declare bankruptcy.

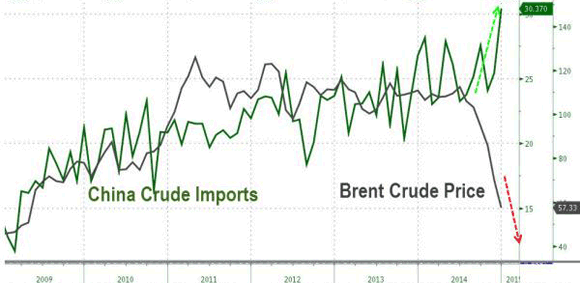

China has actually kept oil prices up.

• Low Prices Spark Biggest Surge In Chinese Crude Imports Ever (Zero Hedge)

Despite the collapse of several key industries (cough Steel & Construction cough), Chinese crude oil imports surged by almost 5 million barrels in December – the most on record. This 19.5% surge MoM (and 13.4% YoY) indicates significant efforts to fill the nation’s strategic reserve but – absent this ‘artificial’ demand – spells problems for an already over-supplied global oil market (and its near record contango). A record surge in crude imports in December…

Back to the German courts.

• EU Top Court Finds ECB’s Bond Buying Plan ‘May Be Legal’ (Zero Hedge)

Almost a year ago, the German top court found that ECB’s OMT is “illegal”, then promptly washed its hands of the final decision, kicking the ball in the court of the European Court of Justice. Moments ago, the Advocate General Pedro Cruz Villalon of the EU Court of Justice in Luxembourg delivered the non-binding opinion on issue of Mario Draghi’s “unconditional” OMT. Here are the details from Reuters and Bloomberg:

• EU COURT ADVISER SAYS OMT PROGRAMME IN LINE WITH EU LAW SO LONG AS CERTAIN CONDITIONS MET

The conditions:

• EU COURT ADVISER SAYS OMT LEGITIMATE SO LONG AS THERE IS NO DIRECT INVOLVEMENT IN FINANCIAL ASSISTANCE PROGRAMME THAT APPLIES TO STATE IN QUESTION

• EU COURT ADVISER SAYS ECB MUST OUTLINE REASONS FOR ADOPTING UNCONVENTIONAL MEASURES SUCH AS OMT PROGRAMME[..] Basically, the court has allowed the ECB to drive down borrowing costs using the OMT but it can’t fund bailouts. How the two will be “separated” in a world of fungible money is unclear and will likely be the basis for another court appeal. Bottom line: Draghi’s “unconditional” bazooka just became conditional, but it is still a bazooka, albeit one that will never actually be used since well over two years after it was revealed following Draghi’s famous “whatever it takes” speech, it still has no legal termsheet or basis, and no definition on its pari passu or burden-sharing status. And it never will: after all it was merely meant as a precautionary device designed to scare away the bond vigilantes, and never to be actually implemented.

“..the burden for part of the losses could fall on national central banks. That would land quantitative easing in the same murky waters as its emergency liquidity assistance for crisis-riddled banks — a policy that lies far beyond the realms of standard monetary policy.”

• Court Decision Could Narrow ECB’s Quantitative Easing Options (FT)

Splits on the European Central Bank’s governing council had already left Mario Draghi facing tough choices on how to design a quantitative easing package for the eurozone. The European Court of Justice may impose more limits on the ECB president’s options on Wednesday. One of the ECJ’s advocates-general, Pedro Cruz Villalón, will issue an interim ruling on whether an earlier promise to save the region from economic ruin by buying government bonds in potentially unlimited quantities overstepped the ECB’s mandate. Any suggestion that elements of the Outright Monetary Transactions programme, unveiled at the height of the region’s crisis in the summer of 2012, contravene EU law may raise the risk that the ECB’s forthcoming QE package will underwhelm markets.

The chasm between the pro- and anti-QE camps, as well as resistance towards more monetary easing in Germany, are clearly weighing on Mr Draghi’s thinking. He has championed quantitative easing as a way to prevent the eurozone from falling into a damaging spell of deflation. But of the governing council’s 24 members, six last month voted against a decision to increase the ECB’s balance sheet by €1,000bn — a key step to prepare the bank for bond buying. Half the opposition came from the ECB’s internal executive board. The council’s two Germans, Bundesbank president Jens Weidmann and board member Sabine Lautenschläger, remain opposed to the policy.

For the ECB to embark on a policy as controversial as government bond buying, it could not tolerate such a high level of dissent. The issue is all the more charged because of Greece, and the growing fears that its bonds may ultimately be subjected to some form of restructuring, implying losses for whoever ends up holding them. The ECB is already considering breaking one of the most sacrosanct principles of monetary union to appease the hawks. Its chief economist, Peter Praet, has raised the prospect that the burden for part of the losses could fall on national central banks. That would land quantitative easing in the same murky waters as its emergency liquidity assistance for crisis-riddled banks — a policy that lies far beyond the realms of standard monetary policy.

All that matters: “.. there is no demand in Europe”

• QE In Europe Will Be Even More Inefficient Than It Was In The US (CNBC)

The market is expecting confirmation of a quantitative easing (QE) plan from European Central Bank (ECB) president Mario Draghi very soon. Indeed, CNBC learned yesterday that the ECB will more than likely base its highly-anticipated sovereign bond buying on the size of contributions made by national central banks. But whatever form it takes, it will almost certainly be the most inefficient bout of QE seen by global markets since the onset of the financial crisis. We already know that yields in Europe are extraordinarily low, and that these have not yet fed through to the broader economy. Further, whether based on gross domestic product (GDP), bond market size, central bank contribution, or sovereign rating, bond buying will be focused towards the core of Germany, Italy and France.

This will likely have little incremental effect in spurring consumers and firms to borrow. We won’t know if U.S. QE worked for at least another few years. If – and I stress if – it did, it will have been because it Fed through to companies due to a well-developed bond market, and because the U.S.’s consumption-led economy has strong multiplier effects. It is unlikely that the ECB’s bond-buying program will be so lucky. Why does the average investor or business borrow money? It is either to increase capital spending to expand, or for financial engineering in order to purchase an existing cash flow (where its value is higher than the cost of debt required to own it). The former increases capital stock, the latter just transfers its ownership.

There is no doubt that U.S. QE has led to both taking place – arguably far more financial engineering than capital generation. The same will be true in Europe, but the balance will be even further towards the financial engineering side. The process by which QE (may have) worked in the U.S. saw banks sell bonds in exchange for “cash” held at the Fed paying minimal interest rates. Essentially, their net interest income (NII) was diluted in return for more profitable core lending. But which euro zone bank, most of which are already struggling for any level of meaningful profitability, is going to sacrifice NII for a negative deposit rate at the ECB when they won’t be able to lend the released capital as there is no demand in Europe?

Great metaphor.

• Tsipras Says ’Fiscal Waterboarding’ Holding Greece Back (BW)

Anti-austerity leader Alexis Tsipras said Greece can’t repay its debt as long as its creditors enforce “fiscal waterboarding” and signaled he’ll boost government spending if his Syriza alliance wins power. In an op-ed article in Germany’s Handelsblatt newspaper today, Tsipras said the notion that Greece’s economy has stabilized is an “arbitrary distortion of the facts.” He said that while the economy grew 0.7% in the third quarter, the recession isn’t over because inflation was a negative 1.8%. “We’re facing a shameful embellishment of the statistics to justify the effectiveness of troika policies,” said Tsipras, whose alliance leads Prime Minister Antonis Samaras’s party in polls for parliamentary elections on Jan. 25. Tsipras’s comments addressed audiences in Germany, where Chancellor Angela Merkel has led Europe’s austerity-first response to the debt crisis that spread from Greece in 2010.

The German Finance Ministry declined to comment yesterday on the possibility of a Greek debt cut, one of Tsipras’s demands. “German taxpayers have nothing to fear from a Syriza government,” Tsipras said. “Our goal is not to seek confrontation with our partners, more credits or a blank check for new deficits.” Instead, Syriza would seek a “new deal within the framework of the euro zone” that allows the Greek government to finance growth and restore the nation’s debt sustainability,’’ Tsipras said. Greece’s election hinges on whether voters are willing to accept an extension of the conditions attached to the country’s international bailouts. Greek bond yields declined yesterday by the most since October as concern eased that a Syriza election victory would result in Greece leaving the euro. “The truth is that Greece’s debt cannot be repaid as long as our economy is subjected to constant fiscal waterboarding,” Tsipras said in Handelsblatt.

Bad news for Oz.

• Cheap Gas Makes US Only Place Where Export Makes Sense (Bloomberg)

While plunging prices tied to oil have derailed natural gas export projects from Australia to Africa, U.S. plans to build new terminals are getting a boost from a pricing system that charges a set fee to liquefy and ship the gas. The U.S. model is based on how much gas is bought, not on the price of Brent, the global crude oil benchmark. Linking the price of liquefied gas, or LNG, made sense when Brent was above $100 a barrel. Now, it’s priced at less than $50 after losing more than half its value in six months. That means new LNG facilities whose output remains tied to crude prices will struggle to make money even as more capacity comes online.

U.S. suppliers, meanwhile, can be expected to deliver deliver some profits even as energy markets slump, said Chris McDougall at Westlake Securities in Austin, Texas. “Oil prices have dropped but U.S. LNG still looks good,” McDougall said in a telephone interview. “There are enough buyers that are willing to commit to paying some fee for the ability to access U.S. gas pricing.” The deals that link crude and LNG prices are widely used in Asia, at a cost of about 14% of the value of a barrel of Brent for every million British thermal units of gas. Falling oil prices mean cheaper LNG, making the fuel from the region more competitive with U.S. exports and more attractive to buyers. For sellers, sliding prices threaten profit for LNG terminals.

Projects in Australia, for example, would get less than $7 per million Btu of LNG; they need at least $14 to make a profit, according to a study from Harvard University’s Belfer Center for Science & International Affairs. Those figures put U.S.-based suppliers in a winning position, said Leonardo Maugeri at the Belfer Center. At the same time, the U.S. has lower labor and capital costs than Australia, where LNG construction has strained a limited workforce and sent salaries soaring. LNG plants in the U.S. “have the best economics,” said Mauger, a former executive at Italian oil producer Eni SpA, in a telephone interview. “Projects still on paper in Australia for sure will be postponed or will die, and that’s it.”

Not sure such comparisons are overly useful.

• Oil Collapse of 1986 Shows Rebound Could Be Years Away (Bloomberg)

The last time excess supply caused a plunge in oil, it took almost five years for prices to recover. The CHART OF THE DAY shows how West Texas Intermediate, the U.S. oil benchmark, tumbled 69% from $31.82 a barrel in November 1985 to $9.75 in April 1986 when Saudi Arabia, tiring of cutting output to support prices, flooded the market. Prices didn’t claw back the losses until 1990. Oil has dropped 57% since June and OPEC members say they’re willing to let prices sink further. Surging prices in the 1970s led to the development of the North Sea and Alaska oil fields. OPEC members also increased capacity, leaving the Saudis to trim output when demand softened. In the 1980s, Saudi Arabia “was tired of the other members cheating and just opened the spigots,” Walter Zimmerman at United-ICAP who predicted last year’s drop, said.

After the plunge in prices “the Saudis lost their nerve and they resumed the role of swing producer. If they hadn’t lost their nerve, we wouldn’t be seeing the shale oil boom today and North Sea production would be substantially lower because investment would have been less,” he said. Investment in new production surged as futures averaged $95.77 a barrel in 2011 through 2013. The combination of horizontal drilling and hydraulic fracturing has unlocked supplies from shale formations, sending U.S. oil output to the highest level in three decades. Russian oil production rose to a post-Soviet record last month and Iraq exported the most oil since the 1980s in December. “If they had allowed prices to stay lower they would have saved themselves many problems in the long run,” Zimmerman said. “Many reserves we take for granted would have never been developed.”

Who do they think they’re fooling?

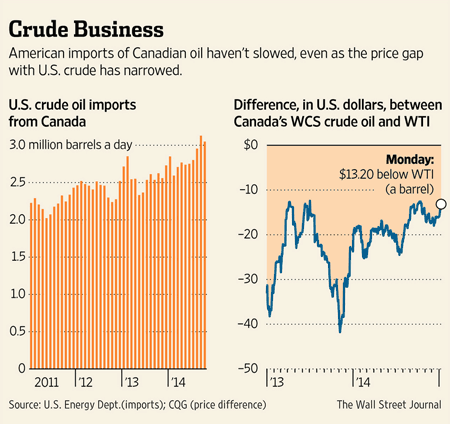

• As Oil Slips Below $50, Canada Digs In for Long Haul (WSJ)

In the escalating war of attrition among top oil-producing nations, Canada’s biggest oil-sands mines have a message for the market: Don’t look to us to cut production. Long the unloved stepchild of so-called unconventional crude production, the oil sands have lured some of the world’s top energy producers to a remote corner of Northern Alberta where the heavy oil deposits are richest. There, they have plowed billions of dollars into building up a sprawling industrial complex amid the surrounding forests. And even as oil prices settled below $50 a barrel Monday for the first time in nearly six years, those companies are unlikely to shut off the tap anytime soon thanks to those huge upfront costs, combined with long-term break-even points and lengthy production lives.

Unlike shale oil, which requires constant drilling of new wells to maintain output levels, once an oil-sands site is developed it will produce tens or hundreds of thousands of barrels a day, steadily, for up to three decades. On Monday, major producer Canadian Natural became the latest to underscore the resilience of oil-sands growth. The company said lower oil prices will force it to trim investment on new projects and curtail its growth forecast—but it still expects overall output to grow about 7% over 2014 levels, and it vowed to keep spending on expanding output at its biggest oil-sands mine over the next two years. Oil prices tumbled to fresh lows Monday as two major banks slashed their price forecasts for crude amid a global supply glut. U.S. oil for February delivery fell 4.7% to $46.07 a barrel.

Brent, the global benchmark, dropped 5.3% to $47.43 a barrel on ICE Futures Europe. Both are at their lowest point in almost six years. Canadian Natural will continue expanding production because it expects higher volume will cut operating expenses at its mainstay Horizon mine, currently at 37.13 Canadian dollars a barrel, by at least another CAN$10 dollars a barrel. “A lot of the costs are fixed in nature,” Chief Financial Officer Corey Bieber said in an interview Monday. “You don’t necessarily increase your workforce in a corresponding ratio [with production]. If you can increase your denominator and manage your numerator effectively, you wind up with a lower cost per barrel.”

Canadian crude exports to the U.S. exceeded 3 million barrels a day in 2014, according to the U.S. Energy Information Administration, a record volume that helped displace other imports, and producers here are looking to tap European and Asian markets. Moves such as those by Canadian Natural ensure the oil sands will continue adding to the global oil glut for a long time to come, regardless of the price of crude. That has implications for spot prices, other major oil producers around the world and the future of key infrastructure plays like the Keystone XL pipeline.

Dead in the water.

• Arctic Explorers Retreat From Hostile Waters With Oil Prices Low (Bloomberg)

When Statoil acquired the last of three licenses off Greenland’s west coast in January 2012, oil at more than $110 a barrel made exploring the iceberg-ridden waters an attractive proposition. Less than two years later, the price of oil had been cut by almost half and Norway’s Statoil, the world’s most active offshore Arctic explorer in 2014, relinquished its interest in all three licenses in December without drilling a single well, Knut Rostad, a spokesman, said. Statoil’s decision shows how the plunge in oil, with Brent crude trading at about $45 a barrel, has dealt another blow to companies and governments hoping to tap the largely unexplored Arctic. That threatens to demote the importance of a region already challenged by high costs, environmental concerns, technological obstacles and, in the case of Russia, international sanctions.

“At $50, it just doesn’t make sense,” James Henderson at the Oxford Institute for Energy Studies, said. “Arctic exploration has almost certainly been significantly undermined for the rest of this decade.” The Arctic – spanning Russia, Norway, Greenland, the U.S. and Canada – accounts for more than 20% of the world’s undiscovered oil and gas resources, including an estimated 134 billion barrels of crude and other liquids and 1,669 trillion cubic feet of natural gas, according to the U.S. Geological Survey. That’s almost as much oil as Iraq’s proved reserves at the end of 2013 and 50% more gas than Russia had booked, BP’s Statistical Review of World Energy shows. Yet, explorers seeking a piece of the Arctic prize have been tripped up for years.

After spending $6 billion searching for oil off Alaska over the past eight years, Royal Dutch Shell in October asked for an extension of licenses as setbacks including a stranded oil rig and lawsuits risk delaying drilling further. Cairn Energy spent $1 billion exploring Greenland’s west coast in 2010 and 2011 without making commercial discoveries, and Gazprom has shelved its Shtokman gas field in the Barents Sea indefinitely on cost challenges. Environmental group Greenpeace has occupied oil rigs from Norway to Russia, arguing a spill would cause irreparable damage to ecosystems that sustain animals from polar bears to birds and fish. The possibility that economically marginal fields such as Arctic deposits might be stranded as governments adopt stricter climate policies has also shaken some investors.

“The expectation has been that every generation will do better than the last, but this may not be the case with those who bought homes during the economic boom.”

• Prepare For The Largest Wealth Transfer In History (MarketWatch)

While most of us are struggling to regain our net worth after the Great Recession, the richest Americans are preparing to transfer $6 trillion in assets over the next three decades. According to a new report by global wealth consultancy Wealth-X, $16 trillion of global wealth will be transferred over that time — mostly to family members — and 40% of that, or $6 trillion, will be transferred within the U.S. Of that $16 trillion, $6 trillion will be liquid assets and philanthropic bequests comprise $300 billion of this upcoming wealth transfer, Wealth-X found. Ultra-high net worth individuals who are 80 years old or above are on average five times wealthier than those under 40. “This will be the largest wealth transfer in history from one generation to the next,” says Wealth-X President David Friedman.

And many of those passing on their wealth are self-made individuals. Only 25% of those on the Forbes list of the 400 richest Americans were self-made billionaires in 1984, compared with 43% last year. The wealth of the Forbes 400 has soared 1,832% since 1984, from $125 billion to $2.29 trillion last year. Upper-income Americans have also fared well over the last three decades. The wealth gap between America’s upper-income and middle-income families has reached its highest level on record, according to the Pew Research Center. In 2013, the median wealth of the nation’s upper-income families ($639,400) was nearly 7 times the median wealth of middle-income families ($96,500), the widest wealth gap seen in 30 years.

Middle-class Americans won’t be so fortunate when it comes to transferring wealth, however. The expectation has been that every generation will do better than the last, but this may not be the case with those who bought homes during the economic boom. All American households since the recovery have started to reduce their ownership of key assets, such as homes, stocks and business equity, according to a recent survey by the Pew Research Center. From 2007 to 2010, the median net worth of American families decreased by 40%, from $135,700 to $82,300. Rapidly plunging house prices and a stock market crash were the immediate contributors to this shellacking. “Such a large transfer of wealth [among the ultra-wealthy] will exacerbate wealth inequality,” says Signe-Mary McKernan at the Urban Institute. “African-American and Hispanic families are about five times less likely than white families to inherit money and when they do inherit money they inherit less than white families.”

“The underlying lack of confidence in the eurozone remained “and that really doesn’t depend very much on whether Germany digs a few more holes and fills them in afterwards again”

• Germany Balances Budget For First Time Since 1969 (Guardian)

Germany has balanced the federal budget for the first time in more than 40 years, helped by strong tax revenues and rock-bottom interest rates, but the extra leeway is unlikely to translate into spending that could boost weak eurozone growth. Berlin had been aiming to achieve a schwarze Null – a balanced budget or one in the black – this year but the finance ministry announced on Tuesday it had got there in 2014, a year ahead of schedule. It is the first time since 1969 that Germany has achieved the feat and is a domestic and European political fillip for Chancellor Angela Merkel’s government, which wrote the goal into a coalition agreement in late 2013 and has preached budget discipline to Greece and other indebted eurozone countries.

Peter Tauber, general secretary of Merkel’s Christian Democratic Union party (CDU), said the budget was a historic success and sent a clear signal to the rest of Europe that Berlin was leading by example and only spending money in its coffers. “This marks a turning point in financial policy: We’ve finally put an end to living beyond our means on credit,” he said. But while Europe’s biggest economy is under pressure from European partners to spend more, some Germans have harboured deep-seated fears of inflation since the hyperinflation of the 1920s that wiped out an entire generation’s savings and many have an aversion to debt.

Christian Schulz, economist at Berenberg Bank, said the government had staked a lot of credibility on balancing the budget and would reap a political dividend from voters “who are very keen on the German government not borrowing more”. But although more spending could boost domestic demand in Germany and imports from the rest of Europe, Schulz said it was unlikely to be at levels that could significantly affect euro zone growth. The underlying lack of confidence in the eurozone remained “and that really doesn’t depend very much on whether Germany digs a few more holes and fills them in afterwards again”, he said.

According to Ambrose, all Brits are geniuses. I doubt that.

• Half The World Covets The UK’s Precious Inflation (AEP)

Inflation is now the most precious commodity in the developed world. The great economic powers are almost all trying to steal a little from each other by currency warfare. Perfidious Albion got there first. We are good at the game. Britain still has an emergency reserve, thanks to the good judgement of the Bank of England. The Monetary Policy Committee ignored the howling commentariat and the hard money populists when headline inflation spiked above 5pc. “The MPC should not be obsessive about bringing inflation back to target as rapidly as possible,” was how they nonchalantly put it in the minutes from January 2008. The Bank of England ploughed on with full-blown quantitative easing even through the inflation scare of 2011. That showed courage. Historians will judge this to have been a masterful decision.

The effect was to erode the real debt stock, slash the ratio of household debt to disposable income from 170pc to 147pc, and broadly stabilize the overall debt trajectory. It ensured that the recovery reached “escape velocity” despite the headwinds of fiscal tightening. The UK revived the successful reflation formula of the mid-1930s. It eschewed the failed deflationary formula of the 1920s, which merely pushed debt ratios even higher. The shock fall in CPI inflation to 0.5pc does not yet put Britain at risk. Inflation expectations remain at safe levels. They are not close to becoming “unhinged” – with all kinds of nasty self-fulfilling consequences – though the experience of Japan and now the eurozone tells us how suddenly if can happen if you let your guard down.

The beauty of having a safety buffer is that you can enjoy the benefits of an oil-price crash – a “positive supply shock” in the jargon – without sliding into a debt-deflation trap. It acts as a tax cut. Enjoy it. It is no great mystery why the world is edging from “lowflation” to deflation. It lies in the structure of globalisation over the last quarter century. Above all it lies in China. Chinese factory gate prices are falling at a rate of 3.3pc. There is massive spare capacity. The country’s fixed investment was $8 trillion last year, more than in Europe and North America combined. The country is exporting deflation worldwide. And so is Japan. As I wrote in last week’s column, there is an excess of global capital. The world’s savings rate keeps rising and has hit a record 26pc of GDP. One culprit is the $12 trillion accumulation of foreign reserves by central banks, money that is pulled out of consumption and instead floods the bond market. Large parts of Pacific Rim and central Europe have reached a demographic tipping point. Call it worldwide “secular stagnation” if you want.

“Debt to GDP ratio in the region excluding Japan rose to 203% in 2013 from 147% in 2007, with most of the increase coming from companies ..”

• Plunging Oil Prices, Rising Debt Leaves Asia Staring at Deflation (Bloomberg)

Asia’s rapid accumulation of debt in recent years is holding back central banks from easing monetary policy to fight the risk of deflation, endangering private investment needed to boost faltering growth, according to Morgan Stanley. Debt to GDP ratio in the region excluding Japan rose to 203% in 2013 from 147% in 2007, with most of the increase coming from companies, analysts led by Chetan Ahya wrote in a report yesterday. The ratio is close to or has exceeded 200% in seven of 10 nations including China and South Korea, they said. Deflation risk is spreading from Europe to Asia as oil prices plunge, raising the specter of companies and consumers postponing spending and threatening a recovery in the global economy.

Asia could take its cue from the U.S. where a policy of keeping real rates low after the 2008-2009 global financial crisis encouraged private-sector investment and boosted productive growth, the analysts said. “When real rates are high, only the public sector or government-linked companies will take on leverage,” the Morgan Stanley economists wrote in the report. The key concern with an approach of keeping real rates at elevated levels is that the private sector will remain hesitant to take up new investment, which is critical for reviving productivity, the report said. Asia’s policy makers are balancing the need to support domestic demand and curbing debt and asset bubbles. While China cut its one-year lending rate in November, officials have held off on broader easing measures as they sought to avoid exacerbating a build-up in nonperforming loans.

“We’ve got the biggest debt bubble that the world has ever seen and credit is continuing to grow twice as fast” as output ..”

• For China, Even Good Numbers Don’t Add Up (Bloomberg)

The improving U.S. economy has brought some welcome cheer to officials in Beijing, which reported an unexpectedly high 9.7% jump in December exports on Tuesday. If those numbers continued in months ahead, they’d also be good news for a global economy that’s running short on viable growth engines. Not all analysts are convinced they will; many predict that China will have to loosen monetary policy soon in order to ensure that GDP growth stays above last year’s target of 7.5% (it’s currently around 7.3%). That’s worrisome because of a different number entirely: 251. That, in percentage terms, is Standard Chartered’s working estimate for China’s debt-to-GDP ratio. Already worryingly high compared to where Japan was 25 years ago when its own bubble burst, the number will only rise further with additional stimulus.

The more China gins up growth in 2015, the more irresponsible lending it will have to service in the decade ahead. The math simply doesn’t work out. Even if China could somehow return to the heady days of 10%-plus GDP growth, its debt mountain would by then be nearly unmanageable. “We’ve got the biggest debt bubble that the world has ever seen and credit is continuing to grow twice as fast” as output, Charlene Chu, a former Fitch Ratings analyst, said. Those who believe China can somehow grow its way out of this problem are fooling themselves. “Mathematically, that’s impossible when something is twice as big as something else and growing twice as fast,” as Chu noted. From Japan to Argentina to Greece, recent decades offer many examples of governments thinking 1+1=3.

It took Japan more than a decade after its bubble burst in 1990 to create the Resolution and Collection Corporation, modeled after America’s Resolution Trust Corporation, to dispose of bad loans. China can’t afford to wait that long to head off a full-blown crisis. It’s one thing for a $24 billion economy like Argentina to blow up; it would be quite another if the world’s second-biggest plunged into turmoil. Yet for all the official talk about curbing borrowing and adjusting to a “new normal” of lower growth, Xi’s government still hasn’t shown the stomach necessary to bring China’s debt problems out into the open and deal with them. Even one of the first defaults on an offshore bond by a Chinese developer last week ended happily. Kaisa Group missed a $23 million interest payment, but quickly received a waiver from HSBC. Since all property companies won’t get last-minute reprieves, these kind of maneuvers just delay a reckoning.

Much of this is Communist Party members and their families.

• China’s $300 Billion Errors May Mask Illicit Outflows (Bloomberg)

China’s balance of payments figures are suggesting a pickup in covert fund outflows, which may spur the central bank to keep the yuan stable, according to Goldman Sachs. Errors and omissions, an accounting practice used by nations to balance numbers when official records of cross-border flows don’t match, were equivalent to net outflows of more than $300 billion since 2010, Goldman Sachs economists MK Tang and Maggie Wei wrote. That included a record $63 billion in the third quarter of 2014, a year in which yuan sentiment soured and President Xi Jinping’s anti-corruption drive widened. “Such outflows probably have an illicit nature, occurring through opaque channels and falling outside of effective regulatory oversight,’” Tang and Wei wrote.

“Illicit flows are probably harder to control and hence could represent a more worrying source of risk to financial stability.” President Xi’s campaign to rein in corruption has ensnared more than 480 officials spanning all of China’s provinces and largest cities. Cash outflows may tighten funding conditions at a time when the government is attempting to lower borrowing costs to boost an economy estimated to have grown at the slowest pace since 1990 last year. One-year interest-rate swaps, the fixed payment to receive the floating seven-day repurchase rate, have risen 18 basis points to 3.32% since the People’s Bank of China cut interest rates in November for the first time since 2012. The yield on the five-year government bond has risen four basis points, or 0.04 percentage point, to 3.52%.

As falling confidence in the yuan will exacerbate any hidden outflows, the PBOC may aim to maintain a stable exchange rate, according to the Goldman Sachs economists. The U.S. lender expects the authority to weaken its daily fixing for the yuan only slightly to 6.16 a dollar in three months and to 6.20 in a year, compared with 6.1195 today. It is not in the authority’s interest to allow the yuan to decline because that could lead to capital outflows and increase financial risk, Australia & New Zealand Banking economists Liu Li-Gang and Zhou Hao said. The currency is unlikely to drop sharply in 2015, they wrote.

Carnage awaits. Everything is overvalued thanks to QE.

• Standard Chartered Loses $4.4 Billion On Commodities, Must Raise Cash (Reuters)

Asia-focused bank Standard Chartered could need $4.4 billion of extra provisions to cover losses from commodities loans, potentially forcing it to raise billions of dollars from investors, analysts said on Monday. Credit Suisse analysts said the losses could force Standard Chartered to raise $6.9 billion to improve its core capital ratio to 11% by the end of the year. “We think the needed provisioning could be large enough to require further capital measures, such as further equity raisin, and/or dividend reductions,” analyst Carla Antunes-Silva said in a note. A jump in Standard Chartered’s bad debts in the third quarter has prompted concern that it could face heavy losses from commodities loans after the fall in the price of oil and commodities.

Credit Suisse’s estimate was based on an “adverse” scenario that would see the bank need $4.4 billion to maintain its capital ratio, based on a potential $2.6 billion of pretax provisioning for commodities loans that sour and a higher risk-weighting on the loans. It said the bank could announce a rights issue or cut the dividend at its 2014 results, due on March 4. “We believe the last two years of de-rating have been driven largely by weaker revenue and that the asset quality deterioration leg is now setting in,” said Credit Suisse, maintaining its “underperform” rating on the stock.

Analysts at JPMorgan and Jefferies also cut their target prices on the stock on Monday, saying that credit quality could deteriorate. Standard Chartered CEO Peter Sands is under pressure after a troubled two years in which profits have fallen, halting a decade of record earnings. Some investors have said that Sands should go or the bank should set out succession plans. Sands last week announced plans to close the bulk of the bank’s equities business and axe 4,000 jobs in retail banking as part of a turnaround plan to cut costs and sharpen its focus.

Here’s your democracy, America.

• Middle Eastern Governments Are on Shopping Spree for Former Congressmen (Vice)

For ex-congressman and GOP strategist Vin Weber, Christmas came a few days early and from an unlikely source: the Qatari government. In December, three days before the holiday, the former Minnesota lawmaker and his lobbying firm, Mercury, signed a lucrative lobbying contract with the Gulf State,receiving a $465,000 advance for the first few months of work. Weber isn’t alone. Over the past year and a half, regimes throughout the Middle East, from Turkey to the United Arab Emirates, have gone on what appears to be a shopping spree for former members of Congress. Compared to the rest of the world, Middle East governments have accounted for more than 50% of the latest revolving door hires for former lawmakers during this time period, according to a review of disclosures by VICE. It’s not out of the ordinary for special interest groups to enlist retired lawmakers-turned-lobbyists to peddle influence in the U.S. Capitol.

What’s unique here is that most special interests aren’t countries home to investors accused of providing support to anti-American militants in Syria or engaged in multi-billion dollar arms deals that require American military approval, as is the case with Qatar and some of its regional neighbors. What’s also striking about the latest surge in foreign lobbying is that many of these former lawmakers maintain influence that extends well beyond the halls of Congress. Former Michigan Representative Pete Hoekstra, who used to chair the House Intelligence Committee, appears regularly in the media to demand that the US increase its arms assistance to the Kurds in northern Iraq. Writing for the conservative news outlet National Review, Hoekstra argued that, “the United States needs to immediately provide [the Peshmerga] with more than light arms and artillery to tip the scales in their favor and overcome the firepower of the Islamists.”

In that instance and in others, Hoekstra has often not disclosed that since August 12th, he has worked as a paid representative of the Kurdistan Regional Government, which relies on the beleaguered Peshmerga militia for safety against ISIS. The same goes for former US Senator Norm Coleman, a lobbyist who serves on the board of the influential Republican Jewish Coalition, and whose Super PAC, American Action Network, spent over $12.3 million to help elect Republicans last year. Since July, Coleman has been a registered lobbyist for the Kingdom of Saudi Arabia, hired in part to work on sanctions against Iran, a key priority of Saudi Arabia’s ruling family. Shortly after signing up as a lobbyist for the Saudis, Coleman, introduced only as a former Senator, gave a speech on Capitol Hill imploring his congressional allies to realize that Israel and Saudi Arabia have many shared policy priorities, and that the United States “should be hand in glove with our allies in the region.”.

Throw it out already!

• EU-US TTIP Trade Talks Hit Investor Protection Snag (BBC)

EU-US talks aimed at clinching a comprehensive free trade deal have run up against “huge scepticism” in Europe, the European Commission says. The Commission has published the results of a public consultation on investor protection – one of the most contentious areas under discussion. There were many objections to the idea of using independent tribunals with power to overrule national policies. A lot of work is needed on future investment rules, the Commission says. The talks on a Transatlantic Trade and Investment Partnership Agreement (TTIP) are continuing, but the important area of investor protection has been suspended for now. There are widespread fears in Europe that EU standards might be weakened in some areas, in a trade-off to satisfy powerful business lobbies and revive Europe’s struggling economies.

A Commission study estimates that a TTIP deal could boost the size of the EU economy by €120bn (£94bn; $152bn) – equal to 0.5% of the 28-member bloc’s total GDP – and the US economy by €95bn (0.4% of GDP). But the Commission acknowledges public concern about court cases in which powerful companies have sued governments over public policy. Swedish energy giant Vattenfall brought a claim against the German government over its move to decommission nuclear power plants. And US tobacco giant Philip Morris sued the Australian government over the introduction of plain packaging for cigarettes. In the UK concern has focused on the National Health Service and the possible involvement of US firms in healthcare services. Of the total responses in the consultation 35% came from the UK – the largest share – and Austria was second.

“Under the new law, the grounds for a ban on any GM variety will be expanded. National governments will in future be able to cite factors such as protection of a particular ecosystem or the high cost of GM contamination for conventional farmers.”

• EU Changes Rules On GMO Crop Cultivation (BBC)

The EU has given governments more power to decide whether to plant genetically modified (GM) crops, which are highly restricted in Europe. The European Parliament has passed a new law giving states more flexibility by a big majority. A type of maize – MON 810 – is the only GM crop grown commercially in the EU. Although Euro MPs and ministers have agreed to give states more flexibility, EU scientists will still play a key role in authorisations. GM crops are used widely in the US and Asia, but many Europeans are wary of their impact on health and wildlife. It is one of the toughest issues at the EU-US talks on a free trade deal, as farming patterns in Europe – including GM use – differ greatly from North America. The new law only applies to crops and does not cover GM used in animal feed, which can still enter the human food chain indirectly.

Last July the new EU Commission President, Jean-Claude Juncker, said the legal changes were necessary because under current rules “the Commission is legally obliged to authorise the import and processing of new GMOs [genetically modified organisms], even in cases where a clear majority of member states are opposed to their use”. Spain is by far the biggest grower of MON 810 in Europe, with 137,000 hectares (338,000 acres), the European Commission says. Yet the EU total for MON 810 is just 1.56% of the EU’s total maize-growing area. MON 810 is marketed by US biotech giant Monsanto and is modified to be resistant to the European corn borer, a damaging insect pest. The maize variety is banned in Austria, Bulgaria, France, Germany, Greece, Hungary and Luxembourg. Under the new law, the grounds for a ban on any GM variety will be expanded. National governments will in future be able to cite factors such as protection of a particular ecosystem or the high cost of GM contamination for conventional farmers.

“Diesel vehicles that would have been phased out in Europe years ago choke its narrow lanes, making cloth face masks indispensable.”

• Melting Glaciers Imperil Kathmandu, Perched High Above Rising Seas (Bloomberg)

A month’s walk from the nearest sea, Kathmandu – elevation almost a mile – is as vulnerable to climate change as the world’s coastal megacities. The capital of the poorest Asian country after Afghanistan already is feeling the effect: Rising temperatures are crimping power and food supplies as rural migrants stream to a city of 1 million that’s among the world’s most crowded. “Kathmandu is the country’s production and consumption center,” said Mahfuzuddin Ahmed, an adviser in the Manila-based Asian Development Bank’s regional and sustainable development department. “Any climate-related hazards that spill into the national economy will be amplified there.” The mountainous Himalayan nation may have crossed a tipping point of irreversible damage. Its glaciers have lost about a third of their ice reserves since 1977.

Just like giant icebergs in the ocean, those glaciers play a critical role in the high-altitude jet streams that can delay monsoons, prolong droughts or spawn storms. “It’s affecting daily life,” says Ram Sharan Mahat, Nepal’s finance minister. He calculates the economy will grow half a percentage point slower this fiscal year because of an erratic monsoon that hit crops, the mainstay of the economy. “I’m sure that’s largely attributable to climate change.” Ahmed led a June study projecting Nepal could lose 10% of its annual gross domestic product by 2100 because of climate change. That makes it the second-most vulnerable in the region after the Maldives. There’s something a mountain city like Kathmandu – some 600 miles (966 kilometers) from the Indian Ocean – shares with an atoll threatened with extinction from rising seas: a spectacular incapacity to do much about it.

An acrid brown smog shrouds the metropolis, obscuring the snow-capped Himalayan peaks in the distance that beckon trekkers worldwide. Diesel vehicles that would have been phased out in Europe years ago choke its narrow lanes, making cloth face masks indispensable. Residents shop for vegetables and spices by candlelight amid blackouts lasting most of the day in the winter, when hydropower plants sputter as snow-fed rivers dry up. Garbage has turned the city’s sacred Bagmati River into a sewer, too filthy for fish to survive, though Hindu worshipers still bathe in its waters.Economists and environmental experts warn that climate change will hurt those who have the least because they don’t have the resources or capacity to minimize the threats.

Home › Forums › Debt Rattle January 14 2015