DPC Cab stand at Madison Square, NY 1900

“This is the death-spiral of empires. They consume all wealth until none is left.”

• All Empires Die By Deflation – Not Inflation (Martin Armstrong)

A lot of people have asked what to do because property taxes keep rising and they can see they are unable to retire under such circumstances. The politicians are wiping out the elderly diminishing their savings and exploiting them in every way. There are no exceptions for taxation when you sell your home as there are in Britain. You pay no tax on the profits from a primary residence there. In the USA, you are taxed until you die. and then they want what is left. Property taxes are the worst of all taxes for they prevent you from really owning your home. Can’t pay the tax – they take it and sell it for pennies on the dollar. You have to pay taxes as if you were still working so all you can do is sell and move south and then pay taxes on your gains. New Jersey even put in an exit tax on the people it has been forcing to leave.

California has been hunting former residents who moved demanding taxes on pensions claiming they earned it when living in that state. It is a wonder why we do not yet have a sea of grey hair people with guns and pitchforks storming Washington yet. This is how empires die. Taxes in Rome kept rising. Its population peaked about 180AD and as corruption began to rise, people began to leave. The higher the taxes, the more people left town. Eventually, people could not afford the taxes and were forced to just abandon their homes. This is the death-spiral of empires. They consume all wealth until none is left. Indeed, Ben Franklin got it right – our fate is always doomed by death and taxes. By the Middle Ages, the Roman Forum, was the grazing grounds for animals. Edward Gibbon wrote the best epitaph:

“Her primeval state, such as she -might–appear in a remote age, when Evander entertained the stranger of Troy, has been delineated by the fancy of Virgil. This Tarpeian rock was then a savage and solitary thicket; in the time of the poet, it was crowned with the golden roofs of a temple, the temple is overthrown, the gold has been pillaged, the wheel of Fortune has accomplished her revolution, and the sacred ground is again disfigured with thorns and brambles. The hill of the Capitol, on which we sit, was formerly the head of the Roman Empire, the citadel of the earth, the terror of kings; illustrated by the footsteps of so many triumphs, enriched with the spoils and tributes of so many nations. This spectacle of the world, how is it fallen! how changed! how defaced!

The path of victory is obliterated by vines, and the benches of the senators are concealed by a dunghill. Cast your eyes on the Palatine hill, and seek among the shapeless and enormous fragments the marble theatre, the obelisks, the colossal statues, the porticos of Nero’s palace: survey the other hills of the city, the vacant space is interrupted only by ruins and gardens. The forum of the Roman people where they assembled to enact their laws and elect their magistrates, is now enclosed for the cultivation of pot-herbs, or thrown open for the reception of swine and buffaloes. The public and private edifices that were founded for eternity lie prostrate, naked, and broken, like the limbs of a mighty giant, and the ruin is the more visible from the stupendous relics that have survived the injuries of time and fortune.”

“..if the trade weighted dollar is appreciating, then this exerts downward pressure on the dollar economy on a near one-to-one basis.”

• Global Dollar Economy Hits ‘Deflationary Vortex’ (Zero Hedge)

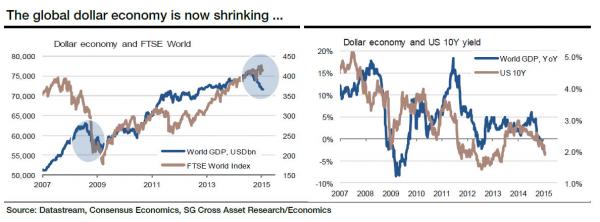

One of the macroeconomic observations that has gotten absolutely no mention in recent months is the curious fact that while global economic growth has not imploded in recent quarters, it is because GDP has been represented, as is customary, in local currency terms. Of course, this comes as a time when local currencies (at least those which are not the USD) have been plunging against the greenback on the back of the expectations that the Fed will hike rates some time in the summer or later in 2015. Which also means that in “dollar economy” terms, i.e., converted in USD, things are not nearly as good.

In fact, as the chart below shows, the global dollar economy is not only shrinking fast, but it is doing so at the fastest pace since the Lehman collapse, having shrunk by $4 trillion, or a whopping 5%, in just the last 6 months! By way of comparison the dollar economy lost $7 trillion, or a 10% contraction, during the Lehman crisis. Should the USD continue to appreciate, the global dollar economy collapse may surpass the plunge observed just as the great financial crisis struck. SocGen calls it “a deflationary vortex”; CNBC would call it a “global recovery.” Here is SocGen on this largely undiscussed topic with “The deflationary vortex of a shrinking dollar economy”:

As the ECB prepares to race faster in a bid to export deflation, the risk is that the dollar economy (world GDP measured in US dollars) will shrink further. The dollar economy is down by just over 5% since July, marking a loss of just over $4tn in nominal terms. The last sharp contraction of the dollar economy took place in 2008. Back then the economy shrank by just over $7tn, marking a loss in excess of 10%. The foreign trade mix of the US fairly closely mirrors the composition of world GDP. As such, if the trade weighted dollar is appreciating, then this exerts downward pressure on the dollar economy on a near one-to-one basis.

Any offset then comes from nominal GDP growth in local currency terms. Since July, the trade weighted dollar has gained just over 10%. Viewing the global economy from the vantage point of the dollar economy, it is hardly surprising that when the trade weighted dollar appreciates, commodity demand is eroded as economies with depreciating currencies lose purchasing power. To the extent that central banks actively seek currency depreciation, this could see further shrinkage of the dollar economy and add further downward pressure to commodity prices.

“This is the year the markets really panic about deflation. You haven’t had that panic yet.”

• Albert Edwards: ‘Markets Will Riot’ On Deflation (Huebscher)

Albert Edwards admits that his “uber bear” reputation is well deserved, at least with respect to equities, an asset class he has dismissed for the last 10 years. His bearishness has not abated, and for the coming year, he fears that “deflation will overwhelm the west.” Markets, he said, will riot. Edwards is the chief global strategist for Societe Generale and he spoke at that firm’s annual global strategy conference in London on January 13. Global markets face three risks, according to Edwards: bearishness in the U.S. government bond market, a flawed confidence that the U.S. is in a self-sustaining recovery and undue faith in the relationship between quantitative easing (QE) and the equity markets. Deflation is the main threat, though, according to Edwards. “This is the year the markets really panic about deflation. You haven’t had that panic yet.”

Edwards said that U.S. equities are “stuck in a secular-valuation bear market” and have been inflated by QE. Though he did not predict a recession, he said stocks would react very negatively if one were to happen. “The market embraces a recession by going to a new lower low on valuations,” he said. He offset that pessimism with a bullish view on the U.S. bond market. He said the 10-year yield could go below 1% and “converge on what is happening in Japan.” “Markets move on extreme surprises,” Edwards said, “and when expectations are so firmly held and they are shown not to be the case, you get these extreme moves.”

“QE is not going to help at all. Europe has far greater reliance than the US on small and medium-sized companies and they get their money from banks, not from the bond market..”

• QE Warfare Pushing World Financial System Out Of Control (AEP)

The economic prophet who foresaw the Lehman crisis with uncanny accuracy is even more worried about the world’s financial system going into 2015. Beggar-thy-neighbour devaluations are spreading to every region. All the major central banks are stoking asset bubbles deliberately to put off the day of reckoning. This time emerging markets have been drawn into the quagmire as well, corrupted by the leakage from quantitative easing (QE) in the West. “We are in a world that is dangerously unanchored,” said William White, the Swiss-based chairman of the OECD’s Review Committee. “We’re seeing true currency wars and everybody is doing it, and I have no idea where this is going to end.” Mr White is a former chief economist to the Bank for International Settlements – the bank of central banks – and currently an advisor to German Chancellor Angela Merkel. He said the global elastic has been stretched even further than it was in 2008 on the eve of the Great Recession.

The excesses have reached almost every corner of the globe, and combined public/private debt is 20% of GDP higher today. “We are holding a tiger by the tail,” he said. He warned that QE in Europe is doomed to failure at this late stage and may instead draw the region into deeper difficulties. “Sovereign bond yields haven’t been so low since the ‘Black Plague’: how much more bang can you get for your buck?” he told The Telegraph before the World Economic Forum in Davos. “QE is not going to help at all. Europe has far greater reliance than the US on small and medium-sized companies (SMEs) and they get their money from banks, not from the bond market,” he said. “Even after the stress tests the banks are still in ‘hunkering down mode’. They are not lending to small firms for a variety of reasons. The interest rate differential is still going up,” he said.

The warnings come just as the ECBprepares a blitz of bond purchases at a crucial meeting on Thursday. Most ECB-watchers expect QE of around €500bn now that the eurozone is already in deflation. Even the Bundesbank is struggling to come with fresh reasons to oppose it. The psychological potency of this largesse will depend on whether the ECB opts for shock-and-awe concentration or trickles out the stimulus slowly. It also depends on the exact mechanism used to conduct QE, a loose term at best. ECB president Mario Draghi hopes that bond purchases will push money out into the broader economy through a “wealth effect”, but critics fear this will be worse than useless if it leads to an asset bubble without gaining traction on the real economy. Classic moneratists say the ECB may end up spinning its wheels should it merely try to expand the money base. Mr White said QE is a disguised form of competitive devaluation. “The Japanese are now doing it as well but nobody can complain because the US started it,” he said.

Jon Hilsenrath is the unofficial Fed bullhorn. So pay attention.

• Fed Officials on Track to Raise Short-Term Rates Later in the Year (WSJ)

Federal Reserve officials are staying on track to start raising short-term interest rates later this year, even though long-term rates are going in the other direction amid new investor worries about weak global growth, falling oil prices and slowing consumer price inflation. The Fed’s stance, as it prepares for a policy meeting later this month, is striking because European Central Bank officials are poised to take the opposite approach later this week. The ECB is nearing a decision on whether to launch a controversial stimulus program known as quantitative easing on Thursday. It is widely expected to announce it will buy hundreds of billions or more of euro-denominated government bonds in an effort to beat back Japan-style deflation.

The world hasn’t seen an economic divergence like this since the mid-1990s, when growth in the U.S., Japan and Europe went in different directions. Back then, Japan was mired in a post-real-estate bubble downturn, Europe was grappling with the consequences of the collapse of the Soviet Union and the U.S. was enjoying a burgeoning technology boom. The looming moves have important implications for markets and growth. Investors have already been driving up the value of the U.S. dollar in anticipation of the moves and driving down long-term interest rates across the globe. “I think it is important to get started and to start normalizing policy,” St. Louis Fed President James Bullard said in an interview with The Wall Street Journal on Monday. “Even once we start to normalize, interest rates would be extraordinarily low.” [..]

“The level of inflation is not so low that it can alone justify a policy rate of zero,” Mr. Bullard said in a speech Friday. He wants the Fed to start raising rates by March, earlier than most other officials. San Francisco Fed President John Williams said in a speech Friday the middle of the year may still be the best time for the U.S. central bank to increase rates. Given the health of the broader economy, “what I’m really watching for is underlying inflation—wage growth, prices [..] My forecast is once we get through this slow path in inflation it will start moving back,” he said, adding, “I’m not expecting inflation to be 2% when we raise interest rates.I don’t need to be at the goal when we raise the rates.”

“Monetary methadone..”

• Central Bankers Lurch From ‘Whatever It Takes’ To ‘Whatever Next’ (Reuters)

The Swiss currency shock has raised an awkward question many investors have been fearful of asking – what if central banks become as unpredictable and fallible as they are powerful? The Swiss National Bank’s sudden decision to abandon its three-year-old cap on the franc – the “cornerstone” of its monetary policy just three days before – led to the biggest one-day move in major exchange rates in the post-1973 floating rates era. To some it was a warning sign of other U-turns, mishaps and possible failures by central banks still ahead, outcomes not fully appreciated by long-becalmed markets. For decades the power of currency printing presses has held markets in thrall. “Don’t fight the Fed” and all its international variations has been a devout belief among financial traders.

Even after the failure of Alan Greenspan’s Federal Reserve to spot and headoff one of the biggest credit booms and busts in history, the ability of the Fed, Bank of England, Bank of Japan, European Central Bank and others to flood their money supply to ease the fallout helped anaesthetise fractious markets. The subsequent waves of cheap credit, currency fixes and “quantitative easing” drove down borrowing rates and erased volatility. The demonstrations of central bank might culminated in ECB chief Mario Draghi’s declaration in 2012 that he would do “whatever it takes” to save the euro. In the face of the power of the money printing press, speculation became pointless. So much so that one of the biggest conundrums of recent years became the persistently low implied volatility in markets even in the face of outsized economic, political and policy risks.

Not everyone was pleased by the complacency. “Monetary methadone was the best of no choice but we have become addicted to cheap money everywhere and, somehow, that central bankers are prophetic,” Nigel Wilson, chief executive of UK insurer Legal & General told Reuters. The first cracks appeared last summer, when it became clear the Fed was turning off the printing presses even as counterparts in Europe and Japan were still cranking up theirs. The idea the world’s largest economy was about to suck dollars back out of the world just as others were pumping in euros and yen sent once-steady exchange rates lurching. The power of the central banks was as daunting as ever, but no longer such a reassuring and calming influence.

No.

• Storm Clouds Gather Over US Economy: Can The Miracle Last? (CNBC)

The world just got a bit scarier for risk assets. On Thursday morning, the Swiss National Bank shocked the world by removing its cap on the Swiss franc against the euro, causing its currency to soar and the euro to plunge—and creating fears about more sudden central bank moves. Meanwhile, global growth concerns continue to drive industrial commodities like copper and crude oil to multi-year lows. With the U.S. serving as one of the world’s few bastions of security and growth, the dollar continues to soar and Treasury yields are plummeting in a bid for safe havens. The question now: How long can America continue to shine in an increasingly uncertain and slow-growing world? A key clue could come in the week ahead, as a slate of major companies report their fourth-quarter results and release forward guidance.

Most closely watched will be energy companies like Halliburton and Baker Hughes, consumer discretionary names like Starbucks and McDonald’s, and industrial giants like GE. The overarching questions will be whether the soaring dollar and plunging energy prices are helping or hurting—and just how much the weakening global environment is a concern for corporate managers. “What I’m going to be watching for is some clarity from the companies in terms of the decline in the price of oil, and the decline of interest rates and the rise of the dollar,” said John Conlon, chief investment officer at People’s United Bank. “I’m going to see if there’s some consensus developing in terms of the price of oil and interest rates.”

Thus far, the “blended” estimate for fourth quarter earnings growth (which combines reported earnings with analyst estimates for yet-to-be-reported earnings) stands at a meager 0.6%, according to FactSet. That’s down from 1.7% on December 31st, mostly due to misses from Citigroup, Bank of America and JPMorgan. It’s worth noting that since more companies beat than miss, actual earnings growth tends to be prettier than the estimates. But if the growth rate does stand at 0.6% after the dust has settled, that would mark the slowest earnings growth since the third quarter of 2012, when S&P 500 companies reported an earnings decline of 1%.

“..what they actually are doing is plotting even more wars, interventions, more economic controls, more ‘banksterism’, more benefits to the power elite versus the people”

• Davos Is About More Control And Banksterism, Not Solutions: Lew Rockwell (RT)

The Davos meeting is not looking for world crisis solutions but plotting more controls, ‘banksterism’ and power elite benefits, says economic journalist Lew Rockwell. They are going to tax and rip off their own people to even greater extent, he added.

RT: The main theme of the Davos forum in the past has largely been finding solutions for world economic problems. How about today? Is it still about that?

Lew Rockwell: No, it is actually about control. I think it has always been about control for the US Empire, for the oligarchs associated with it. They may talk about wanting to solve problems, or make people’s lives better, [but] what they actually are doing is plotting even more wars, interventions, more economic controls, more ‘banksterism’, more benefits to the power elite versus the people. We don’t know what is going on there. I’d like to put chest cams on all of them so we can see what they are doing, what they are talking about. It is not good for the cause of freedom, for the cause of prosperity, not good for the cause of human rights what goes on in Davos.

RT: Let’s talk about numbers. For example, this year companies have to pay $20,000 per executive for a ticket. A simple dinner in an average restaurant was $40 last year. A night in a mid-range hotel has gone from roughly $600 to $700. Do the Forum’s participants need all these special arrangements to make an effective decision?

LR: It is a meeting of the very rich and it’s a meeting of the politicians that they own. They all live very well; they are not staying in the middle range hotels and are not eating at the regular restaurants. They are having the times of their lives; they lived the life of riley at the expense of everybody else. I don’t think we need to worry about cost to them. They are happy to spend the money. It is not theirs after all; they are taking it from the rest of us.

“The aftermath is like a black hole that can suck massive amounts of credit from currency trading as we have known it.”

• Brokers Reveal Details Of Damage From Swiss Chaos (Independent)

The UK’s biggest spread-betting firm, IG Group, said yesterday that it would “learn lessons” from last week’s stunning reversal by the Swiss National Bank (SNB), which cost it £30m. IG is nursing £18m in client losses from the SNB’s shock scrapping of the franc’s cap against the euro, as well as £12m in market exposure. IG honoured the loss limits of clients but was unable to close its hedging positions on bets because of the extreme volatility, which saw the euro tumble 30% against the “Swissie” at one stage. The company intends to maintain the dividend at last year’s level. “Although this was because of an unprecedented and unforeseeable degree of movement in a major global currency, and only a few hundred clients were affected, we will seek to learn lessons from this incident which we can incorporate into our risk-management approach,” the company said.

The Swiss blow took the gloss off strong results from the company, which has seen 1,700 clients sign up to a new stockbroking account. IG generated its highest monthly revenue in October, when global markets sank on growth fears, helping half-year profits up 2.8% to £101.4m. Another victim of the SNB’s currency earthquake, the US broker FXCM, also revealed the punishing terms of a $300m (£198m) rescue loan from investment firm Leucadia National, owner of a wide range of companies that includes broker Jefferies. FXCM will pay an eye-watering 10% annual interest on the loan, with the rate increasing by 1.5% a quarter up to a maximum of 17%, to encourage a sale of the business within three years. Leucadia will get half the proceeds on a sale of FXCM after the loan is repaid, although it will claim an even bigger share on a sale above $500m.

Danish investment bank and broker Saxo said it would incur losses from the SNB move but that its capital position was not in peril. The firm gave its clients less leverage to bet on the currency last year, reducing its exposure. Analysts said that the full impact of the scrapping of the Swiss franc-euro ceiling by the Swiss central bank won’t be known for months. “[It is] closer to a nuclear explosion than a 1,000-kilogram conventional bomb” said Javier Paz, senior analyst in wealth management at Aite Group. “The aftermath is like a black hole that can suck massive amounts of credit from currency trading as we have known it.”

“If the oil prices drop to $25 a barrel, there will yet again be no threat posed to Iran’s oil industry..”

• Iran Oil Minister Sees ‘No Threat’ From $25 Oil (MarketWatch)

Do I hear $25-a-barrel oil? Iran’s oil Minister Bijan Namdar Zanganeh hinted at even lower prices for crude as he declared his well positioned for plunging crude oil prices. “If the oil prices drop to $25 a barrel, there will yet again be no threat posed to Iran’s oil industry,” said Zanganeh at a conference in Tehran on Monday. That means the country should be sitting pretty as the OPEC sticks to its guns on production cuts. But Zanganeh also predicted that OPEC and non-OPEC countries will eventually “cooperate to restore balance to the oil market.” Wishful thinking perhaps in a situation where the market only reads: too much supply, not enough demand. On Sunday, his Iraq counterpart, Adel Abdul-Mehdi, said his country pumped out a record four million barrels per day of oil in December

Recently, billionaire Saudi businessman Prince Alwaleed bin Talal, said the market can kiss $100-a-barrel oil goodbye forever. “I said a year ago [that] the price of oil above $100 is artificial,” Alwaleed said. “It’s not correct.” Over at Project Syndicate last week, Anatole Kaletsky, a former Times of London columnist said $50 oil should really be the ceiling for a much lower price range, which could drop all the way down to $20 a barrel. “As it happens, estimates of shale-oil production costs are mostly around $50, while marginal conventional oilfields generally break even at around $20. Thus, the trading range in the brave new world of competitive oil should be roughly $20 to $50,” said Kaletsky, chief economist and co-chairman of Gavekal Dragonomics.

“The announcement that BHP will reduce the number of US onshore oil rigs it operates by the end of this financial year is a pointer to the industry-wide supply response yet to come..”

• BHP Billiton Cuts US Shale Oil Rigs By 40% Amid Sliding Price (AFP)

The world’s biggest miner BHP Billiton is cutting back its operating US shale oil rigs by 40% amid slumping prices. BHP said on Wednesday it would reduce the number of rigs from 26 to 16 by the end of the June in response to weaker oil prices. However, shale volumes were still forecast to grow by approximately 50% during the period. “In petroleum, we have moved quickly in response to lower prices and will reduce the number of rigs we operate in our onshore US business by approximately 40% by the end of this financial year,” chief executive Andrew Mackenzie said. “The revised drilling programme will benefit from significant improvements in drilling and completions efficiency.” Mackenzie said while the firm’s drilling operations would focus on its Black Hawk field in Texas, “we will keep this activity under review and make further changes if we believe deferring development will create more value than near-term production”.

Oil prices slid again Tuesday after the International Monetary Fund slashed its forecast for world economic growth and revived concerns about the strength of crude demand. US benchmark West Texas Intermediate for February sank US$2.30, or 4.7%, to US$46.39 a barrel, not far from its lowest level since March 2009. “The announcement that BHP will reduce the number of US onshore oil rigs it operates by the end of this financial year is a pointer to the industry-wide supply response on lower oil prices that is yet to come,” CMC Markets’ chief market analyst Ric Spooner said in a note. BHP added that its iron ore output had risen by 16% for the three months to December compared to a year earlier, hitting 56.4m tonnes. Prices in iron ore, one of BHP’s core commodities, slumped 47% in 2014 amid a global supply glut and softening demand from China.

“When the tide turns, it’s going to be very ugly, because you will have a forced exit from the market.”

• Chinese Stocks’ Booms and Busts Getting Bigger on Margin Debt (Bloomberg)

The one thing China’s bulls and bears can agree on is that swings in the world’s most-volatile major stock market are only going to get bigger after equity traders took on record amounts of debt. Both Bank of America strategist David Cui, who predicts Chinese shares will fall, and JPMorgans Adrian Mowat, who has an overweight rating, say the surge in margin lending to all-time highs is amplifying price fluctuations in the $4.9 trillion market. Volatility in the benchmark Shanghai Composite Index reached the highest level since 2009 this week after rising more than fourfold since July. While the flood of borrowed money into Chinese stocks added fuel to a 59% rally in the Shanghai Composite during the past 12 months through yesterday, the gauge’s 7.7% tumble on Monday illustrates how leverage can also accelerate declines.

Margin traders unloaded shares at the fastest pace in 19 months during the rout, which was sparked by regulatory efforts to cool the growth of margin debt in a market where individuals drive 80% of equity volumes. “Margin trading will add more up-and-down to the market and increase volatility,” Xie Weiyu at Shenyin & Wanguo in Shanghai, said. “If a correction starts, the magnitude will be bigger than the past few years.” In a margin trade, investors use their own money for just a portion of their stock purchase, borrowing the rest from a brokerage. The loans are backed by the investors’ equity holdings, meaning they may be forced to sell when prices fall to repay their debt.

The Shanghai Composite sank the most in six years on Monday after the China Securities Regulatory Commission suspended the nation’s two biggest brokerages from lending money to new equity-trading clients and said securities firms shouldn’t lend to investors with assets below 500,000 yuan ($80,467). Outstanding margin loans on both the Shanghai and Shenzhen exchanges surged more than tenfold in the past two years to a record 1.1 trillion yuan as of Jan. 16, or about 3.5% of the nation’s market value. On the New York Stock Exchange, margin debt amounts to about 2.1% of market cap on the NYSE Composite Index. Margin lending is a “new phenomenon in China,” said Cui, who anticipates the Shanghai Composite will fall about 5% by year-end. “When the tide turns, it’s going to be very ugly, because you will have a forced exit from the market.”

Again: China is doing far worse than it pretends.

• The Era Of 7% Growth Is Over For China (CNBC)

Brace for growth numbers starting with “6” from China this year, economists say, after data showed the world’s second largest economy expanded at its slowest pace in over two decades in 2014. China’s GDP release on Tuesday showed the economy grew 7.3% in the fourth quarter from the year-ago period, bringing growth in the full year to 7.4% – the weakest performance since 1990. “The challenges facing China’s economy remain as large or even larger compared to a year prior,” Brian Jackson, chief economist at IHS Global Insight wrote in a note, citing the cooling property sector, industrial overcapacity and high debt levels as persistent headwinds for the economy.

IHS predicts growth will moderate to 6.5% in 2015, far short of a 7% official target the government is expected to announce in March, as the government prioritizes economic reform over stimulus While December monthly indicators, including industrial production and retail sales also released Tuesday, pointed to some upward momentum in the economy, economists say this will proved short-lived. “Brief spells of accelerating Chinese growth are taking place within a larger narrative of China’s secular slowdown, a trend which bouts of mini-stimulus and lower commodity prices cannot fully reverse,” Jackson said.

For example, the pickup in industrial output growth to 7.9% on year in December, from 7.2% in November, is a result of the re-opening of factories following a temporary shutdown during the time of the Asia-Pacific Economic Cooperation (APEC) conference, according to Nomura. Of all the headwinds facing the economy, analysts expect the property sector will be the top drag for the economy in the first half of 2015. Real estate is an important pillar of the economy, accounting for approximately 15% of GDP and directly affecting dozens of other sectors from steel to construction. “Chinese growth will continue to face downward pressure because of the slowdown in property investment,” said Tommy Xie, economist at OCBC Bank, who sees growth dipping below 7% in the first-half.

Empty.

• Defiant Obama Pushes ‘Middle-Class Economics’ (Reuters)

President Barack Obama struck a defiant tone for his dealings with the new Republican-led Congress on Tuesday, calling on his opponents to raise taxes on the rich and threatening to veto legislation that would challenge his key decisions. Dogged by an ailing economy since the start of his presidency six years ago, Obama appeared before a joint session of Congress for his State of the Union speech in a confident mood, buoyed by an economic revival that has trimmed the jobless rate to 5.6% and eager to use this as a mandate. It is now time, he told lawmakers and millions watching on television, to “turn the page” from recession and war and work together to boost those middle-class Americans who have been left behind.

But by calling for higher taxes that Republicans are unlikely to approve and chiding those who suggest climate change is not real, Obama set a confrontational tone for his final two years in office. He vowed to veto any Republican effort to roll back his signature healthcare law and his unilateral loosening of immigration policy. Any attempt to increase sanctions on Iran while negotiations with Tehran over its nuclear program are still under way would also be rejected, he said. In sum, Obama appeared liberated: no longer having to face American voters again after his election victories in 2008 and 2012, a point that he reminded Republicans about. “I have no more campaigns to run,” Obama said. When a smattering of applause rose from Republicans at that prospect, he added with a tight smile: “I know because I won both of them.”

Costly.

• Credit Rater S&P to Be Banned for Year From Commercial-Bond Market (Bloomberg)

Standard & Poor’s will be suspended for a year from rating bonds in one of its most lucrative businesses in a $60 million settlement with the U.S. Securities and Exchange Commission, according to a person with knowledge of the matter. The deal, which the person said may be announced as soon as tomorrow, is the agency’s toughest action yet in an industry blamed for fueling the 2008 financial crisis by assigning inflated grades to risky mortgage debt. Instead of securities created during that period, though, the SEC’s investigation has looked at whether S&P bent its criteria to win business on commercial-mortgage bonds issued in 2011.

The suspension will ban S&P from rating debt in the biggest portion of that market, those that bundle multiple loans tied to anything from shopping malls to skyscrapers, into securities that are sold to bond investors, according to the person, who asked not to be identified because the discussions are private. In addition to the SEC fine, the unit of McGraw Hill is also facing a penalty to settle probes of the same ratings by Attorneys General in New York and Massachusetts, said the person and a second with knowledge of the talks. The CMBS probe is separate from a lawsuit by the Justice Department tied to subprime home loans that S&P rated before the credit crisis. S&P is expected to settle that matter as soon as this quarter for about $1 billion in penalties, people familiar with the matter said this month.

” One has a right, for example, to procreative liberty — yet no right to buy a baby. Money would help some people exercise these rights, too. But we don’t treat laws restricting baby selling as if they were restricting procreative liberty.”

• If Money Speaks Louder Than Words, Is It Speech? (Reuters)

Citizens United may have been just what the United States needed — a decision by the U.S. Supreme Court so dramatically wrongheaded that people across the country paid attention to it and said, “Hold on, something is wrong here.” Though the actual ruling simply extended the flawed approach to campaign-finance laws that the court had been following for decades, Citizens United shined a light on the justices’ reasoning and demonstrated its shortcomings by taking that rationale to its logical — if absurd — conclusion. The Supreme Court treats restrictions on both giving and spending money on elections as restrictions on “speech” under the First Amendment. While the case law has been dotted with victories for both advocates and opponents of campaign-finance restrictions over the past 40 years, it is vital to step back and look at the bigger picture.

In the seminal 1976 campaign-finance case, Buckley v. Valeo, the court laid out the line of reasoning relied on ever since. Buckley said that restrictions on giving and spending money in politics should be treated as if they are restrictions on speech. This approach was not obvious or uncontroversial. Campaign-finance laws do not “prohibit” speech — using the word in its ordinary way. Rather, they restrict giving and spending money used on political speech. The decision to treat campaign-finance laws as restrictions on speech was based on the argument that money facilitates speech. “[V]irtually every means of communicating ideas in today’s society requires the expenditure of money,” the court argued. Though that may be somewhat less true today — given the Internet — it is still largely correct.

What this rationale misses is that money facilitates speech not because there is any special connection between the two, but because money is useful stuff. It facilitates the exercise of many other constitutionally protected rights, as well as the fulfillment of many goals and interests. Yet, and here’s the important part, no one — and especially not this Supreme Court — is likely to conclude that restrictions on spending money in connection with the exercise of all other rights would violate these rights. One has a right, for example, to procreative liberty — yet no right to buy a baby. Money would help some people exercise these rights, too. But we don’t treat laws restricting baby selling as if they were restricting procreative liberty.

Here’s how you spell democracy in Europe today: “The EU has said the final wording would, however, remain confidential until an agreement was reached..”

• No Clear Majority Yet In EU For TTIP Trade Deal (Reuters)

No clear majority has so far emerged among EU states for a free-trade agreement between the European Union and the United States and both sides need to explain the benefits of such a deal, the EU’s health chief said. Chancellor Angela Merkel has urged the 28-nation EU to speed up negotiations with the United States on what would be the world’s biggest trade deal. But there is public opposition in Europe based on fears of weaker food and environmental standards. “We have to take people’s concerns seriously,” Vytenis Andriukaitis, European commissioner for health and food safety, told German daily Tagesspiegel, adding that the trade agreement ultimately needed to be ratified by all national parliaments.

“At the moment, I don’t see a safe majority for this yet,” he said in an interview published on Monday, adding the EU Commission had published some negotiating papers to improve transparency. The EU has said the final wording would, however, remain confidential until an agreement was reached on the Transatlantic Trade and Investment Partnership (TTIP). Negotiations for the TTIP were launched in July 2013 and officials are seeking a deal that goes well beyond trade to remove barriers to businesses. There is concern in Europe that U.S. multinationals would use a proposed investment protection clause to bypass national laws in EU countries. In Berlin, more than 25,000 people joined a rally against the TTIP and genetically modified food over the weekend.

Went to Diplomat School: “Russia is interested in stabilizing the situation globally and in Ukraine in particular..”

• Ukraine Crisis ‘Turning Point’ Close: Russian Deputy PM (CNBC)

The conflict over Ukraine’s borders with Russia, which has soured Moscow’s relationship with the West and stirred up new concerns about global unrest, may be close to a “turning point”, according to Arkady Dvorkovich, Russia’s deputy Prime Minister. “Russia is interested in stabilizing the situation globally and in Ukraine in particular,” Dvorkovich told CNBC at the World Economic Forum in Davos, where he is one of Russia’s most senior representatives after both President Vladimir Putin and Prime Minister Dmitry Medvedev declined to make the trip. He extended the possibility of reducing the price of gas to Ukraine, after Russia hiked it earlier in the conflict. This week, military activity in Donetsk and Luhansk, the disputed parts of eastern Ukraine where Russian-backed militants are battling the Ukrainian army, had escalated after falling back over Christmas and New Year.

Petro Poroshenko, the Ukrainian President, who came to power last year, has acknowledged this week that a military solution to the fighting, which has claimed nearly 5,000 lives so far, does not exist. Economic sanctions enacted by Western countries against Russia, following the outbreak of conflict, combined with the falling price of oil and gas, its biggest export, and a tumbling ruble, have helped send the country into economic turmoil. Nonetheless, Dvorkovich argued that thanks to the country’s currency reserves “we have the resources to keep the economy in a relatively normal stance.” “We have resources, we have an anti-crisis plan.” There has also been a lack of external investment in Russia, as Western companies are concerned that they may fall foul of current or future sanctions. But Dvorkovich dismissed this, arguing “CEOs of foreign companies are all saying that they will continue investments in Russia, with the ruble at this low level.”

“Christine Lagarde must be smiling to herself and thinking we are thick Paddies alright.”

• If Christine Lagarde And Her EU Pals Are Our Friends, Who Needs Enemies? (IM)

There is nothing worse than a posh bird arriving into town and insulting the intelligence of the natives. That’s exactly what IMF chief Christine Lagarde did yesterday. She and her friends in Europe robbed around €10,000 a year out of the pocket of every Irish citizen to save the rich on the continent and to ensure no French or German bank would collapse for lending to the bankrupt Irish banks. And then she has the cheek to tell us we are the real heroes of the recovery. What’s even worse, our Taoiseach Enda Kenny stood there applauding her as she praised the victims of brutal austerity. If Lagarde and her cohorts from Europe can be classed as friends, who needs enemies? This country is sick to death of being the best boys and girls in the class in the EU. Let’s tell the truth Brussels couldn’t give a damn about us and never will. They will protect the euro at any cost and we as a nation paid a horrendous price. We have been landed with debt that will take generations to clear, if ever.

The whole crisis set this country back 20 years. Not one treacherous banker has gone to jail. Not one politician or civil servant has been held to account for horrendous decisions taken on the night of the bank guarantee. Europe has been a failure for the Republic of Ireland, they hung this country out to dry. So lets start having the debate about it. There is also no recovery here yet – very few people have any spare cash. The country is taxed to the hilt and the working man and woman is surviving by the skin of the teeth. That’s why the water charge was a tax too far and the people took to the streets. Our politicians are still living in a Leinster House bubble. They may mean well but the majority of them haven’t a clue what’s going on in the real world. They have no vision where Ireland is going it is all a game of retaining power. Christine Lagarde must be smiling to herself and thinking we are thick Paddies alright.

“Respect for the environment means more than simply using cleaner products or recycling what we use.”

• Pope Francis: Failing to Care for Environment Is a Betrayal of God (Slate)

Pope Francis has been wading into environmental issues during his week-long Asian tour, but he issued the strongest words on Sunday, when he said that man was betraying God’s calling by destroying nature. Or at least that’s what he was supposed to say at a rally with young people at a university in Manila. But the pope ended up being moved by the story of an abandoned girl so he improvised a speech. Still, the Vatican has said that when the pope decides to improvise, the prepared text is official, notes Reuters. “As stewards of God’s creation, we are called to make the earth a beautiful garden for the human family,” the pope said in the prepared text. “When we destroy our forests, ravage our soil and pollute our seas, we betray that noble calling.” The pope also pointed out that youth in the Philippines should feel a special obligation to care for the environment.

“This is not only because this country, more than many others, is likely to be seriously affected by climate change,” he said in the prepared text. “You are called to care for creation not only as responsible citizens, but also as followers of Christ!” He also appeared to chastise those who think that simply by buying environmentally friendly products and recycling they are doing enough for the cause. “Respect for the environment means more than simply using cleaner products or recycling what we use. These are important aspects, but not enough,” he said. God “created the world as a beautiful garden and asked us to care for it,” Francis said. “Through sin, man has disfigured that natural beauty. Through sin, man has also destroyed the unity and beauty of our human family, creating social structures that perpetuate poverty, ignorance and corruption.”

Home › Forums › Debt Rattle January 21 2015