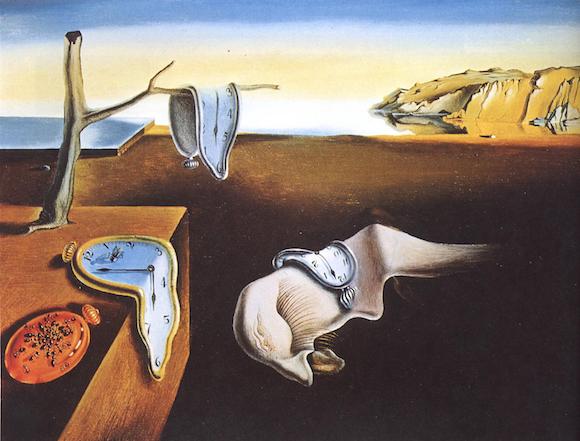

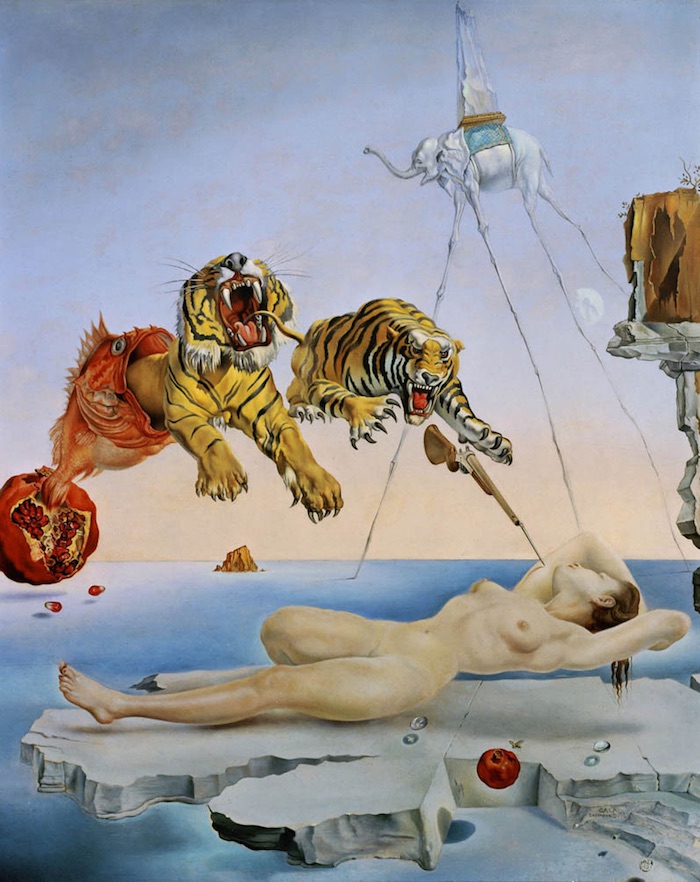

Salvador Dalí Dream, Caused by the Flight of a Bee (Around a Pomegranate, a Second Before Waking Up) 1944

Salvador Dalí on the meaning behind his work pic.twitter.com/jhD9gpIg6k

— Historic Vids (@historyinmemes) January 21, 2024

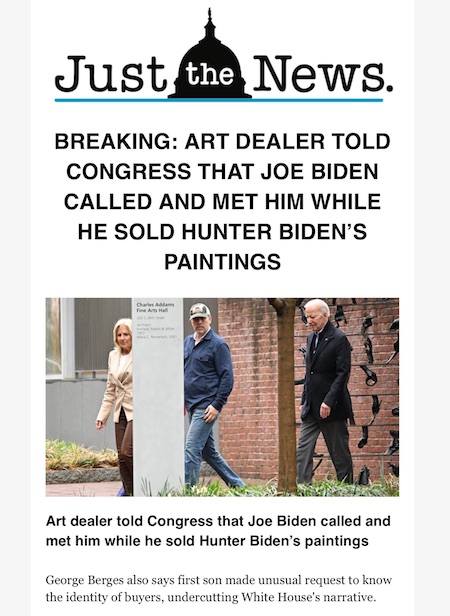

Tucker Hunter

2019. Tucker Carlson lays out how "Middle Class Joe" helped the credit card companies destroy the middle class.

Long before Burisma was paying off Joe Biden through his son Hunter, the credit card company MBNA was doing the same thing.

Now Biden is buying votes by forgiving… pic.twitter.com/CN1ZTSR53B

— MAZE (@mazemoore) January 21, 2024

Biden inflation

Biden's presidency summed up in 18 seconds.

Wrong about everything. Takes responsibility for nothing. pic.twitter.com/ukvipUke5f

— MAZE (@mazemoore) January 22, 2024

RFK autism + allergy

I encourage DeSantis 2024 supporters to hear out RFK Jr’s signature pledge to unravel regulatory capture.

There is a candidate who’s been fighting this fight for 40 years:

“The chronic disease epidemic has now debilitated 60% of our young people. We have the highest chronic… pic.twitter.com/9lwf9kb06K

— Holden Culotta (@Holden_Culotta) January 21, 2024

Tucker Catturd

Ep. 67 Meet the man who made Adam Kinzinger cry. Catturd in the flesh. pic.twitter.com/FBkgJSDsIF

— Tucker Carlson (@TuckerCarlson) January 22, 2024

Stop counting

Imagine Joe Biden was winning a clear +300 electoral college vote victory on election night 2020.

All swing states were tight, but breaking for Biden. Data trending wrong way for Trump.

Then, suddenly the counting STOPS.

Magically, untraceable Trump votes “appear” overnight in… pic.twitter.com/GEqetYoSO0

— Benny Johnson (@bennyjohnson) January 22, 2024

The People’s Pundit: But that’s only half the story. The other half, is that they were lying. They actually continued to add to the totals between midnight and 3AM.

I’m asking honestly, without bias or preconditions:

WHEN in American election history have all 5 swing states *simultaneously* STOPPED counting ballots on election night?

Is there any explanation for this other than centrally organized fraud?

Anyone…?pic.twitter.com/u91RsFMrBT

— Benny Johnson (@bennyjohnson) January 22, 2024

“The failure to confront Russia’s enemies with defeats means the pressure against Russia, the ongoing provocations, and the humiliations inflicted will continue until Russia is forced into war.”

• Will War Result From The Ever Hesitant Putin? (Paul Craig Roberts)

I have often expressed my concern that the lack of proactive action by Putin, Xi, and Iran was maximizing the expansion of Israeli and US aggression in the Middle East and leading to a dangerous confrontation and outbreak of nuclear war. It is the purpose of Israel and Washington to attack Iran. That is what the Israeli-Hamas-Hezbollah-Washington-Houthis conflict is about. It is an entirely simple matter for Russia, China, and Iran to prevent any expansion of Israel’s war against Palestine. All they have to do is to announce a mutual defense treaty: An attack on one is an attack on all. But proactive action does not seem to be in the skill set of Washington’s targeted enemies. With the single exception of Putin’s intervention in Syria to prevent Obama’s invasion, Putin has proved to be ever hesitant about taking control of the situation. It took him eight years to abandon his delusion about the Minsk Agreement. When he finally realized that he had been taken for a ride, the Russian military was not prepared for the level of violence required. Consequently a war that Russia should have won in a few days is two years old and continuing.

From my experience with the liberal Russian intelligentsia, I would say that their program is surrender to Washington. They would rather be invited as visiting professors to Harvard, Yale, and Stanford, and to serve as consultants to American corporations than to be in conflict with the West. As Putin seems to believe toleration of subversion is a sign of democracy, he could have been prevented from required action by pressure to prove that he is not, as the entirety of the West proclaims, a dictator. Putin would have saved many lives by ignoring the propaganda of his enemies and being more forceful in Russia’s defense. But now Putin is showing more awareness of what needs to be done. News reports which I saw in the Indian press, not in the American whore media, a collection of paid liars, say that, according to the Russian Defense Ministry, Russia and Iran are finalizing a pact stressing their commitment to fundamental principles of Russian-Iranian relations, including unconditional respect for each other’s sovereignty and territorial integrity.

In a way this is good news. It indicates that Putin has finally realized that left unprotected, Iran is vulnerable, and if Iran goes, Washington has a direct entry to send “jihadists” into the Russian Federation and the former Soviet central Asian republics. But once again, like with the nonsensical “Minsk Agreement,” Putin has made an error. The pact has been announced before it goes into effect. It is unclear when this acknowledgement of mutual association is to be finalized. So the message to Washington and Israel is to attack Iran now before the agreement goes into effect. There is risk that this will happen. By trying to avoid the expansion of conflict in the Middle East, when conflict is Washington’s and Israel’s intention, Putin by his non-intervention, has given a green light for the expansion of conflict.

Moreover, the Russian-Iranian pact does not seem to be, except, by implication, a mutual defense pact. You can bet that Victoria Nuland and Israel’s American neoconservative agents who control US foreign policy will try to strike Iran before the pact is is in effect or they will argue that it is not a mutual defense agreement. It seems that Russia, China, Iran, and Israel’s Muslim enemies think that words count when nothing but action counts. In the West words are meaningless. Only actions count. And Russia’s are missing. Now, let me back off a bit. There are other indications of progress toward an environment less able to be turned into war by Washington. China had the foresight to broker a peace deal between Iran and Saudi Arabia. This was a fundamental blow to Washington. This rapprochement, if it holds against Washington’s counter offer, has expanded Putin’s organization BRICS to include Iran, Saudi Arabia, Egypt, and the United Arab Emirates. This gives new meaning to Saudi Arabia’s abandonment of the petro-dollar.

There is even a potential good sign on Russia’s part. Russia has announced air patrols over the Syrian Golan border with Israel. Putin prevented Washington’s invasion of Assad’s Syria but then went soft. Putin has left the Syrian oil fields in Washington’s hands. Putin has permitted both Israel and the US to conduct air and missile attacks on Syrian territory, apparently preventing Syria from using the Russian-supplied S-300 air defense system to protect Syrian territory. It remains to be seen if this means anything. The Russians have been sufficiently weakened by Western influence that they now have, associated with the Defense Ministry a “Center for Reconciliation.” This center says the air patrols are just for monitoring. In other words, there will be no military intervention, so it is largely meaningless. The failure to confront Russia’s enemies with defeats means the pressure against Russia, the ongoing provocations, and the humiliations inflicted will continue until Russia is forced into war.

There is a great deal of talk about American over-extension, outmoded weapon systems, excessive debt, inability to recruit for the military, etc., most of which is true. But the neoconservatives in control are still full of confidence, and this confidence is ever encouraged by Putin’s lack of decisive action. The war that is shaping up appears to be unavoidable. I know that it seems arrogant, egocentric, and self-glorifying to appear to be giving advice to Putin. But that is not what I am doing. I am describing a situation. To preclude a US/Israeli attack on Iran, there needs to be a Russia-China-Iran alliance which probably should include Turkey. Right NOW Iran needs the highly effective Russian air defense systems and, if Iran doesn’t have them, the hypersonic Russian long distance offensive missiles. Putin showed a strategic side when he committed the Russian Air Force to Syria’s defense, thus blocking Syria’s invasion by Obama. But he was very late getting into the game, almost too late. The multipolar world that Putin is always talking about cannot materialize without a Russian-Chinese-Iranian mutual defense treaty. Without more strategic vision and action on the part of Russia and China, war is unavoidable.

“Joe Biden’s inner circle of strategists for the Middle East — Antony Blinken, Jake Sullivan and Brett McGurk..”

• The Four Horsemen of Gaza’s Apocalypse (Chris Hedges)

Joe Biden’s inner circle of strategists for the Middle East — Antony Blinken, Jake Sullivan and Brett McGurk — have little understanding of the Muslim world and a deep animus towards Islamic resistance movements. They see Europe, the United States and Israel as involved in a clash of civilizations between the enlightened West and a barbaric Middle East. They believe that violence can bend Palestinians and other Arabs to their will. They champion the overwhelming firepower of the U.S. and Israeli military as the key to regional stability — an illusion that fuels the flames of regional war and perpetuates the genocide in Gaza.

In short, these four men are grossly incompetent. They join the club of other clueless leaders, such as those who waltzed into the suicidal slaughter of World War One, waded into the quagmire of Vietnam or who orchestrated the series of recent military debacles in Iraq, Libya, Syria and Ukraine. They are endowed with the presumptive power vested in the Executive Branch to bypass Congress, to provide weapons to Israel and carry out military strikes in Yemen and Iraq. This inner circle of true believers dismiss the more nuanced and informed counsels in the State Department and the intelligence communities, who view the refusal of the Biden administration to pressure Israel to halt the ongoing genocide as ill-advised and dangerous.

Biden has always been an ardent militarist — he was calling for war with Iraq five years before the U.S. invaded. He built his political career by catering to the distaste of the white middle class for the popular movements, including the anti-war and civil rights movements, that convulsed the country in the 1960s and 1970s. He is a Republican masquerading as a Democrat. He joined Southern segregationists to oppose bringing Black students into Whites-only schools. He opposed federal funding for abortions and supported a constitutional amendment allowing states to restrict abortions. He attacked President George H. W. Bush in 1989 for being too soft in the “war on drugs.” He was one of the architects of the 1994 crime bill and a raft of other draconian laws that more than doubled the U.S. prison population, militarized the police and pushed through drug laws that saw people incarcerated for life without parole. He supported the North American Free Trade Agreement, the greatest betrayal of the working class since the 1947 Taft-Hartley Act. He has always been a strident defender of Israel, bragging that he did more fundraisers for the American Israel Public Affairs Committee (AIPAC) than any other Senator.

“As many of you heard me say before, were there no Israel, America would have to invent one. We’d have to invent one because… you protect our interests like we protect yours,” Biden said in 2015, to an audience that included the Israeli ambassador, at the 67th Annual Israeli Independence Day Celebration in Washington D.C. During the same speech he said, “The truth of the matter is we need you. The world needs you. Imagine what it would say about humanity and the future of the 21st century if Israel were not sustained, vibrant and free.” The year before Biden gave a gushing eulogy for Ariel Sharon, the former Israeli prime minister and general who was implicated in massacres of Palestinians, Lebanese and others in Palestine, Jordan and Lebanon — as well as Egyptian prisoners of war — going back to the 1950s. He described Sharon as “part of one of the most remarkable founding generations in the history not of this nation, but of any nation.”

“Israel’s only answer (to the issue of how to maintain Zionism) was to keep the State’s borders undefined – whilst holding on to scarce water and land resources..”

• Netanyahu’s Shape-Shifting ‘Endgame’ (Alastair Crooke)

The late Ariel Sharon, a long-time Israeli military and political leader, once confided to his close friend Uri Dan that, “the Arabs had never genuinely accepted the presence of Israel … and so, a two-state solution was not possible – nor even desirable”. In the minds of these two – as well as for most Israelis today – is the ‘Gordian Knot’ that sits at the heart of Zionism: How to maintain differential rights over a physical terrain that includes a large Palestinian population. Israeli leaders believed that in Sharon’s unconventional approach of ‘spatial ambiguity’, Israel was close to evolving a solution to the conundrum of managing differential rights within a Zionist majority state, which includes substantial minorities. Palestinians, many Israelis believed (until recently), were being successfully contained in a striated political and physical space – and were even being “disappeared” from significance – only for Hamas, on 7 October, to blow apart that whole elaborate paradigm.

This event has triggered a widespread and existential fear that the Zionist project could possibly implode, were its Zionist exceptionalist foundations to be rejected by a wide resistance ready to take the issue to war. U.S. journalist Steve Inskeep’s recent piece – Israel’s Lack of Strategy is the Strategy – brings into focus the seeming paradox: That whilst Netanyahu is very clear about that which he does not want, he at the same time remains obstinately opaque about what he does want as a future for Palestinians living on a shared terrain. For those who think that Middle East peace might (or should) be Netanyahu’s goal, this opacity appears as a serious ‘flaw’ to resolving the Gaza crisis. However, if Netanyahu (backed by his cabinet, and a majority of Israelis) offers no strategy for peace with the Palestinians, then perhaps its omission is not ‘a bug’, but is its feature.

To understand the underlying oxymoron, you have to grasp why Ariel Sharon and Uri Dan ‘said what they said’, and understand how Sharon’s military experience from the 1973 War effectively has shaped the entire Palestinian paradigm. In 2011, I wrote a piece in Foreign Policy which postulated that Sharon’s notion of Palestinian Permanent Ambiguity was – and has been – the Zionists’ principle answer to how to bypass the paradox inherent within Zionism. Thirty years later, it still lurks in all of Netanyahu’s (and Israeli leaders across the political spectrum’s) recent pronouncements. Even in 2008, Foreign Minister (and lawyer), Tzipi Livni, was spelling out why “Israel’s only answer (to the issue of how to maintain Zionism) was to keep the State’s borders undefined – whilst holding on to scarce water and land resources – leaving Palestinians in a state of permanent uncertainty, dependent on Israeli goodwill”.

And I noted in a separate piece: “Livni was saying that she wanted Israel to be a Zionist state – based on the Law of Return and open to any Jew. However, to secure such a state in a country with very limited territory – means that land and water must be kept under Jewish control, with differential rights for Jews and non-Jews – rights that affect everything, from housing and access to land, to jobs, subsidies, marriages and migration”. A two-state solution inherently therefore, did not solve the problem of how to maintain Zionism; rather, it compounded it. The inevitable demand for full equal rights for Palestinians would bring the end of Jewish ‘special rights’, and of Zionism itself, Livni argued – a threat with which most Zionists concur. Sharon’s answer to this ultimate paradox, however, was different: Sharon had an alternative plan for managing a large non-Jewish ‘out-group’, physically present within a Zionist State of differentiated rights. Sharon’s alternative amounted to frustrating a two-state solution within fixed borders.

“Without the establishment of a Palestinian state, there can be not reliable security for Israel,” Lavrov said.”

• Russia’s Push for Palestinian State Can Stop Endless ‘Loop’ of Violence (Sp.)

A lasting resolution of the Palestinian-Israeli crisis is the keystone to regional stability, Foreign Minister Sergey Lavrov has said. “The main focus of efforts should be the creation of a Palestinian state in full compliance with the resolutions of the United Nations Security Council. The state described in these decisions would be competent and would exist in security and good neighborliness side by side with Israel and other countries in the region,” Lavrov said, speaking at a press conference on the results of Russian diplomacy in 2023 on Thursday. “Without the establishment of a Palestinian state, the Palestinian people will continue to feel disadvantaged and disenfranchised. Generation after generation of young Palestinians will fell this injustice and pass it on to their children. This must end through the creation of a Palestinian state. I hope that the Israeli leadership will eventually come to this conclusion…Without the establishment of a Palestinian state, there can be not reliable security for Israel,” Lavrov said.

The foreign minister announced plans to address the United Nations Security Council next Tuesday to discuss how the crisis in the Middle East can be resolved through “collective efforts,” in place of current attempts by the United States to “advance its agenda around the world.” “Perhaps our Western colleagues should learn some life lessons. And the countries of the region must insist that they are the ones who live here, and that for them, the security of all states [in the region] is of decisive importance to them. No one wants to prohibit advice from the outside, but the final decisions should be made by regional countries themselves,” Lavrov stressed. The creation of a Palestinian state is the “dream” of the Arab and Muslim World, and Russia’s position on the Palestinian-Israeli crisis indicates a very good understanding of the Middle East, says Riyadh-based political analyst Dr. Ahmed Al Ibrahim.

Russia’s position on Palestinian statehood is “going to be very well-received,” Al Ibrahim told Sputnik. “It’s going to cause stability. It’s going to give a lot of ground for the foreign policy of Russia to integrate here in the Muslim-Arab World. If Russia succeeded in that, then Russia has solved the most crucial thing in the history of this region by aligning Israel and Palestine to be together next [to each other]. And they’re going to win the hearts and the minds of the Arab and the Muslim World.” Attempts to resolve the Palestinian-Israeli conflict have been spearheaded by the United States for some seven decades, Al Ibrahim recalled, noting that in all this time “nothing happened except destruction for the Palestinian land, and more expansion, more settlers taking lands.”

“Definitely the whole world would welcome Russia and the BRICS members to be mediating this. But the solution is going to be very hard. Russia and the BRICS members [would] have to coordinate with the United States and with Britain because they are the majority stakeholders of this file, in order to yank it from them and do something on the ground,” the political analyst noted. Otherwise, unless a genuine, multilateral effort is launched to establish Palestinian statehood, the cycle of violence being seen today will continue indefinitely, Al Ibrahim believes. “The real core of the problem is in the deep mind and the deep state of the Israelis,” Al Ibrahim stressed. “Do they want a two-state solution?

We still see at the Knesset, when you enter the building, a big map – a big Israeli state from the [Jordan] River to the Sinai. If this is the creed of the Israelis, then there is no point of anybody mediating and Israel needs to work within themselves in order to come up an evolution to change their mindset and work to have a peaceful neighboring country with the Arab World supporting them. By reaching that, Israel is going to gain a lot by normalizing relationships with many Arab and Muslim countries,” he emphasized. “But if they’re going to play the cat and mouse game, you know, ‘I say something and I do something else on the ground,’ this is not going to work,” Al Ibrahim said, saying Gulf Cooperation Council countries, Arab countries and the Muslim World in general are too smart to be tricked by such deception.

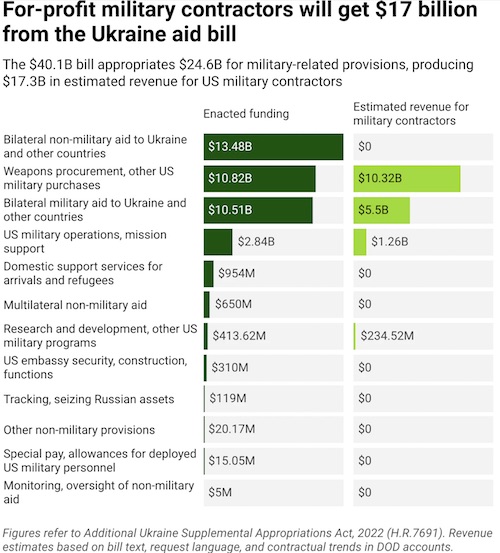

“..not as a war that has already claimed hundreds of thousands of lives … but as a profitable business project.”

• US Sees Ukraine As A ‘Lucrative Business Project’ – Lavrov (RT)

Recent statements from the US suggest it regards Ukraine as nothing but a “lucrative business project,” one that it is profiting from, Russian Foreign Minister Sergey Lavrov told the UN Security Council on Monday. The minister was referring to earlier statements made by US State Secretary Antony Blinken. Last month, the top US diplomat claimed that 90% of the money allocated for Ukrainian aid ends up getting funneled back to the US “to the benefit of American business, local communities, and strengthening the US defense industrial base.” In November 2023, the Washington Post also reported that the majority of these funds were spent on manufacturing new weapons or replacing the equipment sent to Ukraine out of American stockpiles.

The US is essentially “developing its military industrial” complex while “dumping the old junk in Ukraine,” Lavrov said. Russia’s top diplomat also claimed that most major Ukrainian companies, including lithium producers, are being sold to Americans and US companies have been able to get their hands on Ukraine’s fertile land “on the cheap.” Lavrov denounced the statements made by US officials as “cynical” and said that Washington has been treating the ongoing conflict “not as a war that has already claimed hundreds of thousands of lives … but as a profitable business project.” Moscow is waging a military campaign not against Ukraine but against “a criminal regime, presumptuous in its impunity,” he declared.

Kiev has not forgone on the “war against its own citizens in the east and south” despite years-long efforts by Moscow to find a peaceful solution to this crisis, he explained, adding that over 7 million Ukrainians had found refuge in Russia since the 2014 Maidan coup. Kiev’s Western backers have never tried to stop the government from persecuting Russian-speaking Ukrainians, the minister said, accusing the US and its allies of using the past few years to “arm Ukraine and prepare it for war against Russia,” while using the Minsk Agreements as a cover. Russia is ready for talks on Ukraine but it is not willing to discuss ways to keep Kiev’s current government in power, Moscow’s top diplomat concluded.

“Zelensky realizes that the damaging data that the Americans have is capable of destroying him as president. In this situation, he’ll continue to dance to the tune of his American masters..”

• US Forming ‘Colonial Administration’ In Ukraine – Russian Spy Chief (RT)

Washington has begun creating “a colonial administration” in Ukraine consisting of local politicians who have sworn allegiance to the US, the head of the Russian Foreign Intelligence Service (SVR) has said. The US government has demanded that Ukrainian President Vladimir Zelensky “remove” dozens of high-ranking officials, whom Washington no longer trusts, from their posts under various pretexts, Sergey Naryshkin claimed on Monday. Washington wants those jobs to be filled by “Ukrainians trained in the West, who have sworn allegiance to American interests,” he said in comments cited by the SVR press service. “As part of the policy of total vassalization of Ukraine, the US has started forming what is essentially a colonial administration in that country,” the spy chief stated.

According to Naryshkin, the required changes in the Ukrainian government were relayed to Zelensky during his visit to Washington in December. “The Americans are pushing for Ukrainian ambassador to Washington Oksana Markarova, who received her education at Indiana University Bloomington, to take the post of prime minister. The deputy head of the Finance Ministry, Alexander Kava, who studied at Harvard University, is being suggested for the job of finance minister. The current deputy head of the Economy Ministry, Taras Kachka, a graduate of Poland’s National School of Public Administration (KSAP), is recommended for the post of economy minister,” he said. The latest high-profile change in the Ukrainian cabinet follows the pattern described by Naryshkin. Ukraine’s Defense Minister Rustem Umerov, who replaced Zelensky’s ally Aleksey Reznikov in the job last fall, used to participate in the Future Leaders Exchange program, funded by the US State Department.

The Biden administration, which is in possession of a “killer corruption dossier” on members of Zelenksy’s inner circle, is threatening to make this information public if Ukrainian leader refuses to greenlight the desired personnel decisions, the spy chief claimed. “Zelensky realizes that the damaging data that the Americans have is capable of destroying him as president. In this situation, he’ll continue to dance to the tune of his American masters,” Naryshkin predicted. The US, which has provided Zelensky’s government with $111 billion in military and economic assistance since the start of the conflict with Russia, already has advisers embedded in all key Ukrainian ministries, but Washington believes this is not enough and is “steadily increasing Kiev’s feudal dependence,” Naryshkin said.

“What are [the Ukrainians] waiting for? That the Russians will leave Donbass and Lugansk, or that they will leave Crimea? It’s unrealistic,” Fico insisted.”

• Ukraine Must Give Up Territory – Fico (RT)

Ukraine should concede the loss of some of the territories that were previously under its control in order to end the conflict with Russia, Slovakia’s prime minister Robert Fico has said. Fico made the statement during a weekend interview with broadcaster RTVS dedicated to his upcoming visit to Ukraine. The Slovak PM is scheduled to travel on Wednesday to Uzhgorod, a city near the border between the two countries, for a meeting with his Ukrainian counterpart Denis Shmygal. The ongoing conflict between Moscow and Kiev can’t be resolved through military means and should end in compromise that might be “painful for both sides,” he said. “What are [the Ukrainians] waiting for? That the Russians will leave Donbass and Lugansk, or that they will leave Crimea? It’s unrealistic,” Fico insisted.

The People’s Republics of Donetsk and Lugansk were officially incorporated into the Russian state in the fall of 2022, together the Kherson and Zaporozhye regions, as a result of referendums held in those areas. Crimea has been a part of Russia since 2014. The continuation of the fighting that has been underway since February 2022 will only make Moscow stronger, Fico added. The Slovak premier also said Ukraine was “not a sovereign, independent country” due to it being “under the absolute influence of the US.” He criticized the EU for making “a huge mistake” of following Washington’s lead when it comes to dealing with Kiev, instead of developing its own “sovereign” view on the issue. As for his talks this week with Shmygal, Fico promised to tell his Ukrainian counterpart that he’s against Kiev’s membership in NATO, as that would be “exactly the basis of World War Three,” and to reiterate that President Vladimir Zelensky’s government won’t be getting any more weapons from Bratislava.

The prime minister’s interview caused angry reaction in Kiev, with the head of the Ukrainian parliament’s Foreign Affairs Committee Aleksandr Merezhko demanded that Fico’s trip to Ukraine be canceled for his “disgraceful statements” that crossed “the red line.” “Every country should have at least minimal self-respect. It’s absolutely unacceptable to pretend that nothing is happening when the leader of another state makes statements that question the sovereignty of a state” that he’s about to visit, Merezhko wrote on Facebook. Fico made a comeback as Slovakia’s prime minister in October after his party won the snap election in the EU country, campaigning on promises of, among other measures, cutting military aid to Kiev and improving ties with Moscow.

Scott Ritter: The Ukraine Scam is Coming to an End

New Rules sat down with Scott Ritter to discuss his recent trip to the Donbass, pro-Ukraine grifters on social media, and the contempt that Western elites have for ordinary Ukrainians.

#Ukraine #Zelensky #NewRulesPodcast pic.twitter.com/k6E9I0IlTR— NewRulesGeopolitics (@NewRulesGeo) January 22, 2024

The MO: crazy claims.

• Zelensky Brands Parts Of Russia ‘Historically’ Ukrainian (RT)

Ukrainian President Vladimir Zelensky declared six Russian regions to be “historically inhabited by Ukrainians” in a decree published on Monday. The list does not include any of the territory that Kiev claims sovereignty over in the ongoing conflict with Moscow, and focuses on globally recognized parts of Russia. The document includes Bryansk, Kursk, and Belgorod regions, all of which border Ukraine. It also lists Voronezh, Rostov, and Krasnodar regions, all of which bordered Ukraine before 2014, when Crimea decided to join Russia in a referendum and the Donetsk and Lugansk People’s Republics declared independence from Kiev. Zelensky claimed the population of these territories had been subjected to “the policy of forced Russification,” and ordered the government in Kiev to develop “an action plan” to “preserve” Ukrainian “national identity” in Russia.

The decree calls on Russia to “provide Ukrainians living in its territories” with access to education in the Ukrainian language, as well as access to Ukrainian-language mass media and special “civil, social, cultural, and religious rights.” Moscow has never imposed any restrictions on the Ukrainian language. Russia’s education minister, Sergey Kravtsov, said in July 2022 that “no one was banning” it, and that it would be taught in schools where necessary. Zelensky’s decree also tasks the Ukrainian government and the National Security and Defense Council with “collecting and studying facts and testimonies about crimes” supposedly committed against Ukrainians in Russia throughout its history, as well as “countering disinformation and propaganda” about Ukrainian history, allegedly spread by Moscow.

The president also instructed the Ukrainian Academy of Sciences to “prepare materials” on the “thousand-year-old history” of Ukraine and distribute them around the world. The country’s educational programs and textbooks should also contain “the true history of ethnic Ukrainians,” Zelensky added. The Russian regions mentioned in the decree have repeatedly been targeted by Ukrainian missile and drone attacks as well as shelling since the start of hostilities with Moscow in February 2022. Zelensky’s decree comes just weeks after Kiev launched a major attack on the city of Belgorod. The strike, which according to the Russian Defense Ministry involved the use of banned cluster munitions, claimed the lives of 25 people, including children, and left more than a hundred injured. In mid-January, a child was injured in a Ukrainian drone attack on the city of Voronezh – the capital of another region Zelensky claimed was “historically inhabited by Ukrainians.”

The developments come amid Kiev’s attempts to ban the Ukrainian Orthodox Church (UOC) – the country’s biggest Christian denomination, which is reported to have more than 8,000 parishes. The Ukrainian government has long accused it of having ties with the Russian Orthodox Church (ROC). Russian President Vladimir Putin has repeatedly stated that Ukraine in its pre-2014 borders was largely “created” by the Soviet leadership over the course of the 20th century. Historically, “Ukrainian lands” included a much smaller territory, he has argued. When the Cossacks living on the territory of modern Ukraine broke away from the Polish-Lithuanian Commonwealth in the 17th century following the Bogdan Khmelnitsky uprising and asked the then-Tsardom of Russia to take them in, the territory they controlled effectively amounted to present-day Kiev, Chernigov, and Zhitomir regions – three areas in the north of Ukraine, the Russian president said in 2022.

https://twitter.com/i/status/1749432104612405410

“Medvedev dismissed the decree as a “crude PR stunt” aimed at drawing public attention away from the Ukrainian forces’ failures on the front lines..”

• Medvedev Denounces Zelensky’s ‘Territorial Claims’ To Russia (RT)

The latest decree by Ukrainian President Vladimir Zelensky essentially amounts to “territorial claims” on sovereign Russian regions, former Russian president Dmitry Medvedev said on Monday. Posting on Telegram, he was referring to a document declaring six Russian regions to be “historically inhabited by Ukrainians.” Signed on Monday, Ukraine’s Day of Unity, the presidential decree claims that six territories that are universally recognized as a part of Russia – the Krasnodar, Rostov, Voronezh, Belgorod, Kursk and Bryansk regions – had been “historically” populated by “ethnic Ukrainians” that were then supposedly subjected to “forced Russification.” The document then orders the Kiev government to develop an “action plan” to “preserve” the Ukrainian national identity in Russia and demands the “true history” of Ukraine be made known to the “world.”

It also demands Russia provide people living in these regions with access to Ukrainian-language mass media and to some special “civil, social, cultural and religious rights.” Medvedev dismissed the decree as a “crude PR stunt” aimed at drawing public attention away from the Ukrainian forces’ failures on the front lines. He also said there was even no need to comment on the contents of the order, since the territories mentioned in it have always been part of Russia. The former president (2008-2012) also said it was high time Zelensky “stopped” such policies and abandoned them, or he might end up “annexing Canada in the near future.” Zelensky himself described signing the decree as a way to promote “truth about Ukrainians… and their history.” He also claimed that it was aimed at “restoring the truth about the historical past for the Ukrainian future.”

The Russian regions mentioned in the decree have been regularly subjected to drone and missile attacks as well as shelling by the Ukrainian troops. In December, Belgorod – the capital of one of the regions supposedly “historically inhabited by Ukrainians” – was struck by a major Ukrainian attack. The strike claimed the lives of 25 people, including children. The Russian Defense Ministry also said that Kiev’s forces used banned cluster munitions in an attack targeting the city center just a day before New Year’s Eve celebrations.

Scholz will try to ban the AfD.

• AfD Leader Calls for German ‘Dexit’ Vote to Break From EU (Sp.)

The Alternative for Germany party promotes direct voting on legislation and strict immigration controls. It was the subject of nationwide protests last week after some of its members were spotted at a meeting that advocated for mass deportation of immigrants in Germany, including those with German passports. Britain was “dead right” to leave the European Union and Germany should consider its own “Dexit,” the leader of the right-wing populist party Alternative for Germany (AfD) Alice Weidel said in an article published in US media on Monday. “If reform isn’t possible, if we fail to rebuild sovereignty of the EU member states, we should let the people decide, just as Britain did,” she said, adding that “we could have a referendum on ‘Dexit’ – a German exit from the EU.”

A recent poll found that only 45% of AfD members would currently vote to leave the EU and only 10% of the general population said they would. It is worth noting that opinions can shift rapidly. In late 2014, only 36% of Britons said they would support the UK leaving the EU; less than two years later, more than half voted for “Brexit.” The AfD is leading the polls in five East German states and is polling second nationally at 22%. The party hopes to make gains at both the European Parliamentary elections in June and the regional elections in September. However, AfD’s high polling numbers may not reflect how much power the party will have in the near term. Establishment parties, including conservative-leaning ones, have ruled out forming a coalition with the AfD, limiting its potential power.

Weidel admitted that the issue will limit her party’s power in the short term but believes the “firewall” will not last forever, pointing to the conservative establishment CDU party, which includes former chancellor Angela Merkel, as the first likely to break. “The CDU will not be able to maintain its firewall in the long term,” Weidel said. She added that the last year proved “that we can form a clear right-wing majority. And the CDU can’t refuse to accept that in the long term, especially in the eastern states.” Weidel admitted her party is unlikely to take control until 2029 at the earliest. It is currently polling only behind the CDU but is ahead of every other party, including Chancellor Olaf Scholz’s three coalition parties.

X thread. War games.

• Russian Attack On Nato In 2044 (Zlatko)

Europe is being frightened by the “scenario of a Russian attack on NATO” in 2044. Former US commander Hodges and defense analyst Sam Cranny-Evans put together “their” scenario: “This is not about Russia trying to take over all of NATO. This is not what their goal will be in 20 years. It would be about destroying NATO as an alliance by invading the eastern flank and conquering critical places – like the Arctic – that would benefit them,” General Hodges said. In their opinion, everything will begin with cyber attacks on transport chains, after which a missile attack will be launched on key infrastructure facilities in Europe.

The ground operation will begin in Finland, where tanks controlled by artificial intelligence will “enter.” At the same time, the Suwalki corridor will be taken under control and the Baltic countries will be attacked. The Russian Navy, as planned by Hodges, will take control of the Arctic regions. “There is even the possibility of some kind of conflict in space, where satellites are used to attack each other or jam satellites, which has already been done at a lower level in Ukraine,” Cranny-Evans added. Ostashko reports.

The best take on this, from a commenter:

Then aliens will come down and mate with all the women in Sweden, Orcs will invade France and steal all the wine, and Zelensky will have run off with Von Der Layen and fathered 20 children……..

“..events described under oath by two Capitol Police officers in the first Oath Keepers trial in 2022 could not have happened, based on Mr. Baker’s examination of security video..”

• DOJ Seeking Retribution Against Journalist for Recent Jan. 6 Coverage (ET)

Attorneys for a journalist threatened with prosecution for being at the U.S. Capitol on Jan. 6, 2021, are challenging federal prosecutors to try his case outside the District of Columbia, suggesting prosecutors are seeking retribution for his recent reporting on possible Capitol Police perjury and the Jan. 6 pipe bombs. Six attorneys who said they volunteered to represent Stephen Baker of Raleigh, N.C., released a statement on Jan. 22 expressing belief that the DOJ is seeking even more serious Jan. 6 charges as retaliation. Mr. Baker, a former independent journalist, now writes for Blaze Media. “We now have information that Steve’s reporting has so agitated officials in multiple federal agencies that an effort is now underway to find a basis to charge Steve with more serious crimes and to use those more serious crimes as a pretext for early morning raids to execute search and arrest warrants on him and his family,” the statement read.

“If this is true, and search and arrest warrants are used to drag Steve out of his house in the early morning hours someday soon, that will be evidence of retaliation against a journalist exercising his First Amendment rights to report information that is embarrassing to government officials.” The statement is signed by five well-known Jan. 6 defense attorneys: James Lee Bright, Brad Geyer, Phillip Linder, William Shipley, and Edward Tarpley Jr. It was also signed by Mr. Baker’s Raleigh-based attorney, Matthew Ceradini. Mr. Geyer and Mr. Shipley were federal prosecutors for more than two decades. “After not having indicted me for three years, it is clear that any move to do so now will be in retaliation for my reporting,” Mr. Baker wrote in a news release. “I will not be intimidated. I will continue to report the findings of my investigation into the evidence being made available to me to review,” he said.

The attorneys challenged the DOJ to try any case against Mr. Baker in the eastern district of North Carolina where Mr. Baker lives, or the northern district of Texas, where his employer, Blaze Media, is located. “Are citizens of those two districts not suitable jurors in Steve’s case?” the statement asked. “Is the federal judiciary in those two districts not able to provide a fair and impartial trial? “On what basis does the United States Department of Justice believe the ‘United States’ can only get a fair trial in the District of Columbia and not one of those ‘United’ States?” Mr. Baker’s most recent coverage identified the person who found one of the two pipe bombs on Jan. 6 as an undercover U.S. Capitol Police officer and not a “passerby.” Since October 2023, he wrote a series of stories that said events described under oath by two Capitol Police officers in the first Oath Keepers trial in 2022 could not have happened, based on Mr. Baker’s examination of security video.

Mr. Geyer suggested that reporting should result in the Oath Keepers’ convictions being thrown out. Mr. Baker was one of dozens of journalists at the U.S. Capitol on Jan. 6. His video footage appeared in an HBO film and was licensed by the BBC, The New York Times, and The Epoch Times. Mr. Baker was first contacted by the FBI in July 2021 about his presence at the Capitol. He voluntarily sat down with FBI special agents in November 2021. He said he was told the DOJ was considering charging him with interstate racketeering because he received money from licensing his Jan. 6 video. In March 2023, he said he was warned by a high-profile journalist that his reporting was chafing some high-level DOJ officials. In August, he was served a subpoena for his Jan. 6 video. In December, the FBI told his attorney that his arrest was imminent, although that plan was subsequently delayed.

Investigative journalist for @theblaze Steve Baker (@TPC4USA) refuses to let the Biden DOJ intimidate him as he continues to uncover more truth regarding what really happened on J6. He tells @EmeraldRobinson there's much more to come! pic.twitter.com/6YvclIkUIj

— The Absolute Truth with @EmeraldRobinson (@AbsoluteWithE) January 23, 2024

“..the falsely-elected, tyrannically corrupt, and epically deranged regime fronted by the ghost-in-the-White House, “Joe Biden.”

• The Pipe-Bomb Caper (Kunstler)

“The FBI must come forward with the whole truth, immediately. If they will not, then Republicans have a duty to tear the FBI down to its foundation, and ensure that no government organization is allowed to amass this kind of power ever again.” — Charlie Kirk . Kudos to Darren J. Beattie of Revolver News and Rep. Thomas Massie (R-KY) for doing the FBI’s work for the FBI, smoking out the role of law enforcement (including the FBI) in but one module of the J6 operation that turned a peaceful mass assembly of disgruntled voters into a riot in order to color it as an “insurrection” and so destroy opposition to the falsely-elected, tyrannically corrupt, and epically deranged regime fronted by the ghost-in-the-White House, “Joe Biden.”

Mr. Massie arranged to extract previously unseen video from the Capitol Police vaults showing the exceedingly strange behavior of various law-men in the minutes after one of their number reported a pipe-bomb beside a park bench, a few steps away from their parked vehicles, outside the DNC headquarters near the US Capitol building around one o’clock in the afternoon on J6/21, just around the time that a joint session of Congress would commence the entertainment of official complaints and objections to the certification of votes in the 2020 presidential election. Of course, that proceeding was disrupted by events outside and inside the US Capitol, and those many complaints and objections were never registered.

Two cars are shown parked blocking the driveway to the basement garage: a white Washington DC Metro Police SUV and a black Secret Service cruiser — because Veep Kamala Harris happened to be in the building at the time. A man with a backpack, later identified as a plainclothes Capitol Police officer, steps up first to the Metro car, then to the Secret Service cruiser, cueing minutes of slow milling-about by the officers in the two cars. Eventually several cops dawdle over to the bench to inspect what turns out to be a pipe-bomb planted in plain sight on the ground there. The video shows no effort to cordon-off the area or to stop cars or pedestrians (children) from entering the scene near the bomb.

“The power they tasted during the lockdowns opened Pandora’s Box..”

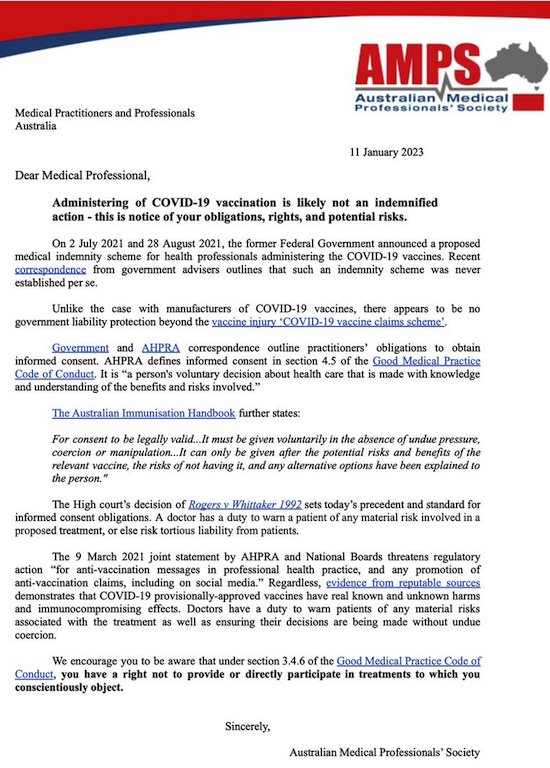

• Dutch Queen Promotes Digital ID at Davos (Martin Armstrong)

Queen Maxima of the Netherlands took to the Davos stage to declare that digital IDs are necessary for nearly every aspect of social engagement. The Dutch queen told the World Economic Forum (WEF) that they can no longer trust the people, and digital IDs will provide governments with a clear way to track our behavior. Vaccine passports are necessary to tell “who actually got a vaccination or not,” highlighting how those at the top do not trust the public. They want complete unilateral control. In fact, she believes that children should not be allowed to enroll in school unless they have a digital ID that includes their vaccination passport. “It [digital ID] is also good for school enrollment; it is also good for health – who actually got a vaccination or not; it’s very good actually to get your subsidies from the government,” she said to a room of nodding heads. Want to open a bank account? You must present a digital ID.

Now the Netherlands implemented a COVID certificate that was required for travel throughout the EU. Citizens were provided yellow vaccination booklets that they were required to carry throughout the pandemic. Mass protests erupted, but the government did not drop restrictions until 72% of the population was already injected. Over 40% of restaurants said they would not ask patrons to show proof of vaccination to enter. Prime Minister Mark Rutte immediately fired Deputy Economic Affairs Minister Mona Keijzer for questioning the vaccine passport. “If we end up in a society where we have to be afraid of each other unless we can show proof, then you really have to scratch your head and ask yourself: Is this the direction we want to go?” Dissent is no longer tolerated. The power they tasted during the lockdowns opened Pandora’s Box. The Dutch government must realize they will be met with resistance as the Dutch people will not allow the government to control them without a fight.

Foal

This kind-hearted man brings a newborn foal that can't breathe back to life with a professional touch pic.twitter.com/FkE6t5oxS0

— Enez Özen | Enezator (@Enezator) January 22, 2024

Bouzouki bear

https://twitter.com/i/status/1749553698412335104

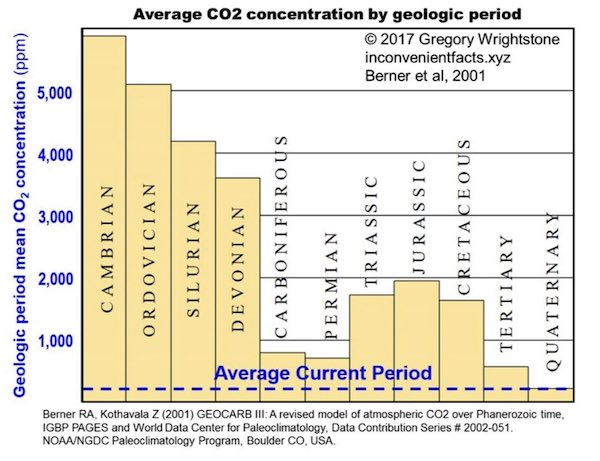

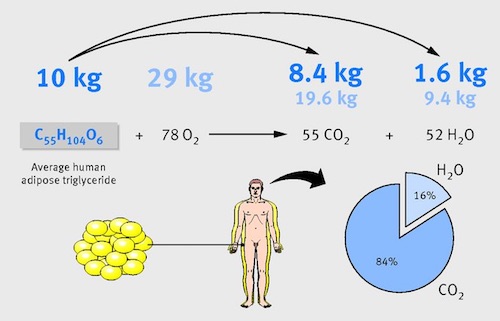

When humans lose weight, fat is eliminated and leaves the body. 80% of the fat is exhaled through the lungs as carbon dioxide

Lyrebird

The superb lyrebird is an Australian songbird. It is one of the world's largest songbirds, and is renowned for its elaborate tail and courtship displays, and its excellent mimicry pic.twitter.com/WD1mXFqhHS

— Massimo (@Rainmaker1973) January 22, 2024

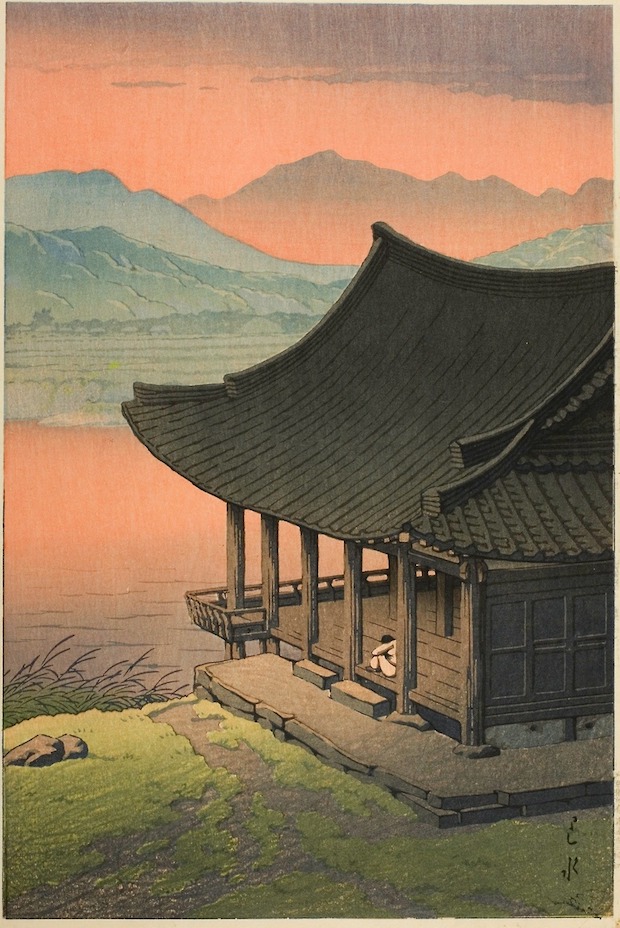

Cathedral

https://twitter.com/i/status/1749361361044517131

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.