Gustave Caillebotte Paris Street, Rainy Day 1884

Let me start by saying that is you are surprised that the Guardian publishes hit pieces like the ‘Manafort met Assange’ one, you haven’t been paying attention. Reading the Automatic Earth would have been enough for your first reaction to be: that is BS. But granted, it all spreads deep and wide. For example, picked this up on Twitter just now: Kudos to @ErinBurnett tonight for identifying Wikileaks as “an intelligence arm of the Russian government.” Yeah, Burnett is CNN.

On the other hand, there’s for instance Glenn Greenwald, also on Twitter, who says: Even 2 hours after I read it, I still can’t believe that Politico actually published an article by an ex-CIA agent under a fake name saying that if the Guardian’s blockbuster Assange/Manafort story is false, it’s Russia’s fault. Parodying the US media at this point is futile. Forgive me for not giving that Politico piece any space here.

WikiLeaks has announced they want to sue the Guardian, and Manafort is looking into it. Let’s hope that has some effect. The paper has already been busily redacting its ‘article’ away from liability, but the damage has definitely been done. As a matter of fact, it appears the paper is actively working with the Ecuador government to create a situation where extraditing Assange would be more easily accepted by the world.

To that end, as I’ve often said, it is seen as essential to connect Assange to Russia, even if no such connection exists. But since neither can defend themselves, Assange is cut off and Russia is not believed, it’s easy to just make stuff up. You really should get out of that Matrix, it won’t do anyone any good.

I still remain with a question though, now that the Guardian opens today with another smear piece. That is, Muller has been very secretive. So how did a draft legal doc of his end up at the Guardian? Was it leaked? Did he leak it? Why were there no earlier leaks?

• Trump Adviser Sought WikiLeaks Emails Via Farage Ally – Mueller Document (G.)

An ally of Nigel Farage was asked to obtain secret information from WikiLeaks for Donald Trump’s team during the 2016 election campaign, according to US investigators. Ted Malloch, a London-based academic close to Farage, was allegedly passed a request from a longtime Trump adviser to get advance copies of emails stolen from Trump’s opponents by Russian hackers and later published by WikiLeaks. The allegation emerged in a draft legal document drawn up by Robert Mueller, the special prosecutor investigating Russia’s interference in the 2016 election and any collusion with Trump’s campaign team. In response to a series of questions from the Guardian, including whether he had acted on the request to make contact with WikiLeaks, Malloch said in an email: “No and no comment.”

Trump appeared increasingly anxious on Wednesday following the latest burst of activity from the investigation that has clouded his presidency. He claimed, without evidence, in a tweet that Mueller’s team was “viciously telling witnesses to lie about facts” in return for favourable treatment. The latest revelations come as the role of the former Trump campaign chairman Paul Manafort has come under greater scrutiny amid reports in the US that Mueller is looking into his meeting with the Ecuadorian president in 2017. On Tuesday sources also told the Guardian that Manafort met with Assange in the Ecuadorian embassy in London, a claim denied by both men.

Craig Murray recognizes BS when he sees it.

• Assange Never Met Manafort. Guardian Publishes More MI6 Lies (Murray)

I would love to believe that the fact Julian has never met Manafort is bound to be established. But I fear that state control of propaganda may be such that this massive “Big Lie” will come to enter public consciousness in the same way as the non-existent Russian hack of the DNC servers. Assange never met Manafort. The DNC emails were downloaded by an insider. Assange never even considered fleeing to Russia. Those are the facts, and I am in a position to give you a personal assurance of them. I can also assure you that Luke Harding, the Guardian, Washington Post and New York Times have been publishing a stream of deliberate lies, in collusion with the security services.

I am not a fan of Donald Trump. But to see the partisans of the defeated candidate (and a particularly obnoxious defeated candidate) manipulate the security services and the media to create an entirely false public perception, in order to attempt to overturn the result of the US Presidential election, is the most astonishing thing I have witnessed in my lifetime. Plainly the government of Ecuador is releasing lies about Assange to curry favour with the security establishment of the USA and UK, and to damage Assange’s support prior to expelling him from the Embassy. He will then be extradited from London to the USA on charges of espionage.

Assange is not a whistleblower or a spy – he is the greatest publisher of his age, and has done more to bring the crimes of governments to light than the mainstream media will ever be motivated to achieve. That supposedly great newspaper titles like the Guardian, New York Times and Washington Post are involved in the spreading of lies to damage Assange, and are seeking his imprisonment for publishing state secrets, is clear evidence that the idea of the “liberal media” no longer exists in the new plutocratic age. The press are not on the side of the people, they are an instrument of elite control.

“Maybe it’s better that the public not see what’s been going on with this country.”

• Trump Threatens To Declassify ‘Devastating’ Docs About Democrats (NYP)

In September, a group of Trump allies in the House – led by Rep. Lee Zeldin of New York – called on Trump to declassify scores of Justice Department documents they believe undercut the start of the Russia investigation and show bias against Trump. The documents include Justice officials’ request to surveil Trump campaign adviser Carter Page and memos on DOJ official Bruce Ohr’s interactions with Christopher Steele, the author of a controversial dossier that alleged Trump ties with Russia. Trump initially agreed to declassify the documents, including text messages sent by former FBI officials James Comey, Andrew G. McCabe as well as Peter Strzok, Lisa Page and Ohr.

Trump allies believe the revelations will show favoritism toward Hillary Clinton and a plot to take down Trump. Trump then reversed course, citing the need for further review and concern of US allies. Trump added Wednesday that his lawyer Emmet Flood thought it would be better politically to wait. “He didn’t want me to do it yet, because I can save it,” Trump said. The president also pushed back on the notion that all the Justice Department documents should eventually be released for the sake of transparency. “Some things maybe the public shouldn’t see because they are so bad,” Trump said, making clear it wasn’t damaging to him, but to others. “Maybe it’s better that the public not see what’s been going on with this country.”

The Fed should really try and revive what was once a market. It can only do that by stepping aside.

• Fed Warns A ‘Particularly Large’ Plunge In Market Prices Is Possible (CNBC)

The Federal Reserve issued a cautionary note Wednesday about risks to financial stability, saying trade tensions, geopolitical uncertainty and a buildup in corporate debt among firms with weak balance sheets pose strong threats. In a lengthy first-time report on the banking system and corporate and business debt, the Fed warned of “generally elevated” asset prices that “appear high relative to their historical ranges.” In addition, the central bank said ongoing trade tensions, which are running high between the U.S. and China, coupled with an uncertain geopolitical environment could combine with the high asset prices to provide a notable shock.

“An escalation in trade tensions, geopolitical uncertainty, or other adverse shocks could lead to a decline in investor appetite for risks in general,” the report said. “The resulting drop in asset prices might be particularly large, given that valuations appear elevated relative to historical levels.” The drop in asset prices would make it more difficult for companies to get funding, “putting pressure on a sector where leverage is already high,” the report said. The report further noted that the Fed’s own rate hikes could pose a threat. A market and economy used to low rates could face issues as the Fed continues to normalize policy through rate hikes and a reduction in its balance sheet, or portfolio of bonds it purchased to stimulate the economy.

Powell as a puppet master. He says JUMP and they all jump.

• Fed’s Powell Sends Markets Soaring With Suggestion Rate Hikes May Slow (WaPo)

Federal Reserve Board Chair Jerome H. Powell on Wednesday suggested that the central bank could slow the pace of its interest rate increases, a statement welcomed by investors worried about the strength of the global economy and swooning markets. His comments appeared to mark a change from his position last month, when he said that the Fed still had a “long way” to go before it reached what economists consider an appropriate level. Powell’s description of the central bank’s approach sent the stock market soaring, with investors eager for any sign that the Fed might be preparing to pause its slow but steady effort to raise interest rates.

Powell’s scheduled remarks at the Economic Club of New York came a day after President Trump pilloried Powell — whom he appointed last year — for his stewardship of the central bank. Trump said in an interview with The Washington Post that the Fed is a “much bigger problem than China,” complaining it is taking steps to withdraw stimulus from the economy — the latest in a wave of strong criticism that Trump has leveled at the Fed chair. Fed officials say they operate independently of politics, and there is no evidence that Powell made his comments in response to Trump’s attacks. But the remarks nevertheless could ease concerns among Fed critics, such as Trump, who have accused the central bank of moving too aggressively to slow the economy’s expansion.

The Fed had lowered rates to zero after the 2008 financial crisis, and it kept them there and took other steps to strengthen the economy after the deepest recession since the 1930s. Since December 2015, it has been reversing those efforts to avoid inflation and other risks associated with a hot economy.

Long standing policies. You are right to oppose them, but not to single out Trump when doing so.

• Obama Administration Used Tear Gas, Pepper Spray At Border Dozens Of Times (NW)

As the Trump administration continues to face widespread backlash over its use of tear gas against Central American asylum seekers at the southern border on Sunday, data from the U.S. Customs and Border Protection agency has shone a light on just how common the use of tear gas and pepper spray at the border really is. In a statement sent to Newsweek on Tuesday, the CBP said its personnel have been using tear gas, or 2-chlorobenzylidene malononitrile (CS), since 2010, deploying the substance a total of 126 times since fiscal year 2012. Under President Donald Trump, CBP’s use of the substance has hit a seven-year record high, with the agency deploying the substance a total of 29 times in fiscal year 2018, which ended on September 30, 2018, according to the agency’s data.

However, the data also showed that the substance was deployed nearly the same number of times in fiscal years 2012 and 2013 under former President Barack Obama, with CBP using the substance 26 times in fiscal year 2012 and 27 times in fiscal year 2013. CBP’s use of tear gas appeared to decline in the following years, with 15 uses in fiscal year 2014, eight in fiscal year 2015 and even fewer in fiscal year 2016, with three recorded instances. As Trump took office, the numbers began to rise again in fiscal year 2017, climbing to 18 deployments of tear gas, before reaching fiscal year 2018’s record high of 29 uses. CBP also noted in its statement that in addition to using tear gas, the agency also “regularly uses” Pava Capsaicin, or pepper spray.

[..] CBP spokeswoman Stephanie Malin said that more than 1,000 individuals who were part of the “so-called caravan” “attempted to cross illegally into the U.S. by breaching section of the fence and using vehicle lanes in and near the San Ysidro Port of Entry” on Sunday. “The group ignored law enforcement agencies in Mexico and assaulted U.S. Federal Officers and Agents assigned to respond to the situation in San Diego,” Malin said. The CBP spokesperson said that “in response to the assaults and to defuse this dangerous situation, trained CBP personnel employed less-lethal devices to stop the actions of assaultive individuals attempting to break into the U.S.”

Neocons.

• Yes, Virginia, There Really Are Worse Options Than President Trump (Week)

17 years after the United States overthrew the government of Afghanistan, 15 years after we toppled the government of Iraq, and 7 years after we deposed the government of Libya, neoconservative pundit William Kristol announced the goal of American foreign policy over the coming decades should be “regime change” in China, a nuclear power that also happens to have a population more than four times the size of the United States. This is important — for several reasons. It’s important because it shows that Kristol, despite burnishing his mainstream reputation over the past few years by unwaveringly opposing Donald Trump, remains an unrepentant neocon. It’s important because, along with a tweet storm Kristol produced to explain and defend his endorsement of Chinese regime change, it helps to clarify exactly what’s distinctive about neoconservative foreign policy thinking.

And it’s important, finally, because it so clearly illustrates just how dangerous and deluded that way of thinking really is. Yes, Virginia, there really are worse options than President Trump. In recent years, the term “neoconservative” has been emptied of meaning — used either by anti-Semites to mean “Jewish conservative” or by journalists as a synonym for “foreign policy hawk.” Neither is true to the history of the movement or what’s distinctive about the evolution of its ideas. The word was originally coined as an epithet to describe a group of liberal intellectuals who migrated rightward during the 1970s, eventually coming to support the presidency of Ronald Reagan. (Kristol’s father Irving was among them.)

At the time, these writers endorsed a range of domestic and foreign policy positions: They were tough on crime, defended the conservative side in the culture war, favored work requirements for welfare recipients, and endorsed a revival of the Cold War against the Soviet Union.

Brexit is unraveling, but there’s no time left to change it.

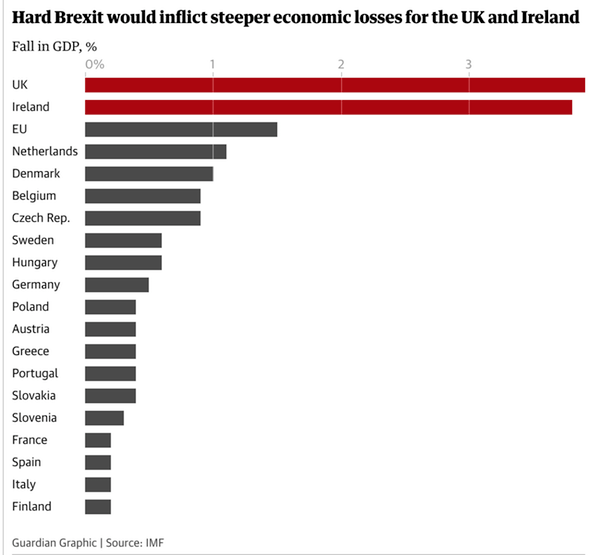

• The Day Brexit Went Bust: BoE Says No Deal Will Cause Worst Slump Since WWII

Britain is set to be poorer under every kind of Brexit according to two major official studies, released as Jeremy Corbyn’s closest ally said a fresh referendum now looks “inevitable”. Pressure to give the British public a Final Say on leaving the EU mounted after Treasury estimates suggested Theresa May’s Brexit deal will leave GDP 3.9 per cent lower than if the UK remain in the bloc. A separate Bank of England study warned of an economic catastrophe in the case of a no-deal departure, including an immediate, savage recession, soaring interest rates and collapsing house prices. Amid the grim data, shadow chancellor John McDonnell gave the strongest signal yet that Labour would swing behind a people’s vote if Ms May’s plans are now blocked by the Commons as expected.

The drive for a new referendum will pick up pace on Thursday as Conservative former minister Jo Johnson delivers a speech warning his party faces electoral armageddon if it forces Ms May’s deal through. The prime minister again tried to defend the deal in parliament as it came under fire from all sides, and she will face a further intense grilling from a committee of the most senior MPs on Thursday morning. [..] The gloomy forecasts were echoed later in the day by the Bank of England, which indicated that under a disorderly no-deal Brexit, the economy could shrink by 8 per cent within a single year, property prices might plunge almost a third, the pound would crash and interest rates soar under a worst-case scenario. Brexiteers attacked the data and the bank itself, with Jacob Rees-Mogg saying: “It is unusual for the Bank of England to talk down the pound and shows the governor’s failure to understand his role. He is not there to create panic.”

The benefits of Airbnb. It creates elites and poor sods.

• Dublin: 30,000 Empty Homes And Nowhere To Live (G.)

About 10,000 people in Ireland are reckoned to be homeless. The number of families who have nowhere to live has increased by more than 20% since 2017. These are national problems, but they are inevitably concentrated in Ireland’s capital, home to more than 10% of the country’s population. In the four months between June and September, 415 Dublin families – including 893 children – became newly homeless, adding to a total across the city of about 1,400. Increasing numbers are being forced to live in hotels. Meanwhile, residential neighbourhoods echo to the clack-clack-clack of suitcase wheels. The city is smattered with key boxes for Airbnb apartments.

A stock line among activists demanding action from the government gets to the heart of all this: in 21st-century Dublin, they say, homeless families stay in hotels, and tourists stay in houses. [..] The Greater Dublin area is reckoned to have more than 30,000 properties that are completely empty, many of which are owned by the local council. Thanks chiefly to Ireland’s corporate tax rate of 12.5%, Dublin is home to the European HQs of Facebook, TripAdvisor, LinkedIn, Twitter, Google, eBay and, poetically enough, Airbnb. The number of high-paid employees who work for such companies is one of the reasons advertised rents in the city now average around €1,900 a month. As Brexit grinds on, there are fears that if companies relocate from the UK to Ireland, it will only add to Dublin’s housing problems.

Why stop producing it if you can make yourself believe there’s a carpet you can sweep it under?

• Pressure Mounts To Bury Carbon Emissions, But Who Will Pay? (R.)

Environmentalists worry the costly technology, known as carbon capture and storage (CCS), will perpetuate the fossil fuel status quo when rapid and deep cuts energy use are needed to limit global warming. But proponents of CCS will be lobbying hard at the two-week climate conference in Katowice, Poland, for the extensive investment and regulatory change required to employ it at scale, citing U.N. assessments that it could play a role. “The expectation is that Katowice will be important,” said Stephen Bull, a senior vice president at Norwegian state-controlled oil company Equinor, which is involved in developing a CCS project called Northern Lights.

“CCS is the only way to go,” he said, arguing that countries need the technology to help fulfil the pledges they made around the time of the breakthrough Paris climate change agreement in 2015. A United Nations report warned on Tuesday that nations would have to triple their current efforts to keep global temperature rises within boundaries scientists say are needed to avoid devastating floods, storms and drought. Along with the United States, Norway is one of the countries at the forefront of drive for CCS, building on 20 years of diverting carbon dioxide from its vast gas output and using some to push out hard-to-reach oil from aging fields.

“We notice the losses,” [..] “It’s the diminishment that we don’t see.”

• The Insect Apocalypse Is Here (NYTM)

In the United States, scientists recently found the population of monarch butterflies fell by 90 percent in the last 20 years, a loss of 900 million individuals; the rusty-patched bumblebee, which once lived in 28 states, dropped by 87 percent over the same period. With other, less-studied insect species, one butterfly researcher told me, “all we can do is wave our arms and say, ‘It’s not here anymore!'” Still, the most disquieting thing wasn’t the disappearance of certain species of insects; it was the deeper worry, shared by Riis and many others, that a whole insect world might be quietly going missing, a loss of abundance that could alter the planet in unknowable ways. “We notice the losses,” says David Wagner, an entomologist at the University of Connecticut. “It’s the diminishment that we don’t see.”

Because insects are legion, inconspicuous and hard to meaningfully track, the fear that there might be far fewer than before was more felt than documented. People noticed it by canals or in backyards or under streetlights at night – familiar places that had become unfamiliarly empty. The feeling was so common that entomologists developed a shorthand for it, named for the way many people first began to notice that they weren’t seeing as many bugs. They called it the windshield phenomenon. To test what had been primarily a loose suspicion of wrongness, Riis and 200 other Danes were spending the month of June roaming their country’s back roads in their outfitted cars.

They were part of a study conducted by the Natural History Museum of Denmark, a joint effort of the University of Copenhagen, Aarhus University and North Carolina State University. The nets would stand in for windshields as Riis and the other volunteers drove through various habitats — urban areas, forests, agricultural tracts, uncultivated open land and wetlands — hoping to quantify the disorienting sense that, as one of the study’s designers put it, “something from the past is missing from the present.” [..] A 1995 study, by Peter H. Kahn and Batya Friedman, of the way some children in Houston experienced pollution summed up our blindness this way: “With each generation, the amount of environmental degradation increases, but each generation takes that amount as the norm.”

[..] Ornithologists kept finding that birds that rely on insects for food were in trouble: eight in 10 partridges gone from French farmlands; 50 and 80 percent drops, respectively, for nightingales and turtledoves. Half of all farmland birds in Europe disappeared in just three decades. At first, many scientists assumed the familiar culprit of habitat destruction was at work, but then they began to wonder if the birds might simply be starving. [..] What we’re losing is not just the diversity part of biodiversity, but the bio part: life in sheer quantity. While I was writing this article, scientists learned that the world’s largest king penguin colony shrank by 88 percent in 35 years, that more than 97 percent of the bluefin tuna that once lived in the ocean are gone.

[..] We’ve begun to talk about living in the Anthropocene, a world shaped by humans. But E.O. Wilson, the naturalist and prophet of environmental degradation, has suggested another name: the Eremocine, the age of loneliness.