Esther Bubley The gas behind the gun, Columbus, Ohio Sep 1943

I want to start off by expressing my deeply felt admiration and gratitude for the way the Scots and Brits alike have made the run-up to the September 18 referendum a peaceful and civil affair. It’s not at all hard to imagine how this could have been very different.

Hats off to y’all for that. And may it be an example for future independence referendums elsewhere. It should, the entire world should feel profoundly indebted to you for this. The reason why will soon become clear as other peoples pursue their rights to independence.

It’s precisely because there’s so much pressure from incumbent politicians and political-industrial power blocks to keep existing larger entities intact, that they should be broken. Because in the end that is all there is: the question(s) of power, and of losing – some of – it. Of power and money.

And those are simply and plainly the wrong questions. These are not the things that should guide our decisions. If you vote either Yes! or No! in Scotland tomorrow because you think your choice will make you richer, you’re on the wrong track. Not everything in life is about money.

Nobody should want their leaders to be driven by a desire, even hunger, for power. Our leaders should be motivated by the best interests of their people, their voters, not by their own personal interests. That may sound naive, given what our societies, and the international bonds and ties they have forged, have turned into, but that only means we must repair those societies, and the ties with others. And make sure we pick our leaders for the right reasons next time around.

As I write this, Obama is addressing US troops in Tampa, telling them how important they are to the nation and all that. And the first image that evokes is of how the US treats its army veterans. US troops are disposable, they’re cannon fodder, no matter what this or that president says. US soldiers are disposable pawns in a power game.

Earlier today Spanish PM Mariano Rajoy ‘threatened’ the Scots Yes! voters that it will take years before their independent nation could join the EU. Mr. Rajoy has no business talking about Scotland’s referendum. He does so anyway, solely to scare off the Catalans from holding their own referendum. Mr. Rajoy wants power. That’s why he is where he is.

The Catalans should break free from Spain if only because of that. The entire western world is stuck and lost in power bonds and systems that may once have been useful, but have been contorted into something entirely different from the ideals they once stood for, and now do unspeakable damage to us.

This is no longer the world of the 1960’s or 70’s or 80’s. And though it may be understandable that it’s hard for people to see that, and to leave behind the picture of the world they grew up in, it’s no less true. Clinging onto a picture, and a model, that’s died and gone, can be hugely destructive.

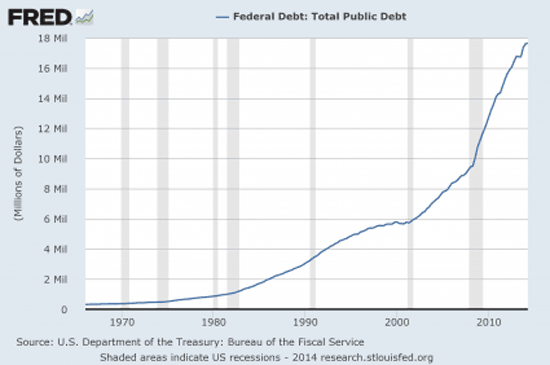

Our political and economic model is well and truly broken. All that’s been keeping our nation states, and the organizations they have signed up to, alive over the past 3 or 4 decades, is the – seemingly – never-ending growth of additional debt. This is a very crucial point I think you should lock into your memory and never forget as long as you live: in our growth driven and obsessed economic model there’s only one thing left that actually grows, and that is our debt.

The only way our present leaders can even imagine boosting economic growth – against the tides – is by heaping more debt upon the already, certainly by historical standards, flabbergasting levels of it.

Why would anyone want to remain part of that model, in which, moreover, many if not most of the important decisions affecting their lives are taken by distant others, if they have a choice not to? The only people who choose to do that are those who don’t understand what happens to them and the world around them.

Scottish friends and readers have been telling me over the past fortnight that Yes! leader Alex Salmond is not a fine guy, and that he may well bring a lot of destruction to the country if he gets his way. That he of all people is your typical money and power guy.

But I think of him as an instrument. Salmond can’t possibly be worse than David Cameron is for Scotland (and the UK as a whole). And once the vote is in, Salmond will be replaced soon enough if he screws up the job. And at least the Scots will be free to make their own decisions, which includes getting rid of Salmond. It’s called freedom, liberty. Something you should never take for granted.

The UK, US, EU, NATO, they’re all organizations that no longer serve any purpose other than to make sure their leaders retain the national and supra-national power they have accumulated. And these leaders have their finger on the trigger. Not just when it comes to guns, but also when it comes to economics.

The Scottish referendum shows all of us that there is a peaceful way to get rid of those fingers on the trigger. A potentially invaluable lesson. If we care to learn.

Because the economic model we built our world on and around has failed, gone bankrupt and died, we need another model. But instead all we do is try to resuscitate the corpse. As if change as a function of time passing is somehow inherently wrong, and we should instead cling and hang and hold on to what once was with all we can.

But if we choose to try and hold on what has gone, we choose to keep in place the very model that has already failed. Which is not in our interest, but in that of the leaders who’ve presided over the failed model and won’t give up.

Scotland should vote Yes! on September 18 to show us the way. It won’t be all smooth and pretty and hosannah from day 1 if Yes! wins, but Scotland will figure it all out down the line. By themselves. That is the key: they’ll do it by themselves. As every nation, people, culture should be able to do.

That’s why it’s important that the Scots vote Yes! Not just for themselves, though they have plenty reasons to, but to set an example for Europe – and the world – of how these things can and should be done. Because without such an example, Catalunya threatens to turn into a battlefield, and we shouldn’t allow it to. Let alone all the hundreds of other regions around the globe.

Scotland, you have much more to gain than you have to lose. And so do a billion people or so elsewhere.

When you’re in that voting booth tomorrow, think Braveheart and Robert the Bruce, and everyone who lost live and limbs fighting for Scotland in your proud past. The world needs you to pave the way. And you need that way yourselves.

It’s a new world out there, and even if you don’t fully see that, you can play a huge role in making others see it. Moreover, the old world no longer holds any promises for you.

We’re just getting started.

• One In 10 Americans’ Paychecks Get Seized To Pay Off Debts (MarketWatch)

One in 10 Americans between the ages of 35 and 44 had money seized from a paycheck and sent off to pay a debt last year, a new report finds. More than one-third of those wage garnishments were for student and consumer loans, like credit card or medical bill debt, according to the payroll processor ADP, which analyzed data for 13 million employees for the first study of its kind. The data comes as American credit card debt hits post-recession highs, with the average household’s balance at about $6,802. And one in three Americans is dogged by collections, or debts more than 180 days past due, for credit card balances, child-support, medical or utility bills. For most people, garnished wages went toward child support (41.5%). After student and consumer loans (35.4%), workers’ pay was also docked to pay off tax debts (18.3%) and bankruptcies (4.9%).

Those who earned $25,000 to $40,000 had their wages garnished for consumer debts more often than child support. The data suggest a relationship between blue-collar jobs and pay seizures. “The employees living paycheck to paycheck are often hit with these garnishments,” says Julie Farraj, vice president of ADP wage garnishment services. [..] The wage-docking process was meant to curb cases where people would avoid paying off debts by transferring their assets to a third party and pleading poverty. Federal law limits the weekly amount that employers can withhold from someone’s paycheck, protecting 75% of someone’s disposable earnings or about 30 hours a week of pay at the federal minimum wage — whichever is greater. Disposable income is the money left after deductions like taxes, Social Security and retirement contributions.

‘ … more government debt per capita than Greece, Portugal, Italy, Ireland or Spain”

• US Debt Grows By More Than $1 Trillion In Past 12 Months (Snyder)

The idea that the Obama administration has the budget deficit under control is a complete and total lie. According to the U.S. Treasury, the federal government has officially run a deficit of 589 billion dollars for the first 11 months of fiscal year 2014. But this number is just for public consumption and it relies on accounting tricks which massively understate how much debt is actually being accumulated. If you want to know what the real budget deficit is, all you have to do is go to a U.S. Treasury website which calculates the U.S. national debt to the penny. On September 30th, 2013 the U.S. national debt was sitting at $16,738,183,526,697.32. As I write this, the U.S. national debt is sitting at $17,742,108,970,073.37. That means that the U.S. national debt has actually grown by more than a trillion dollars in less than 12 months. We continue to wildly run up debt as if there is no tomorrow, and by doing so we are destroying the future of this nation.

• The U.S. national debt has increased by more than $7 trillion dollars since Barack Obama has been in the White House. By the time Obama’s second term is over, we will have accumulated about as much new debt under his leadership than we did under all of the other U.S. presidents in all of U.S. history combined.

• The United States already has more government debt per capita than Greece, Portugal, Italy, Ireland or Spain.

• In August, the average rate of interest on the government’s marketable debt was 2.028%. In January 2000, the average rate of interest on the government’s marketable debt was 6.620%. If we got back to that level today, we would be paying well over a trillion dollars a year just in interest on the national debt.

• At this point the U.S. government has accumulated more than $200 trillion of unfunded liabilities that will need to be paid in future years.

Risk on. Get out!

• Citigroup Embraces Derivatives as Deals Soar (Bloomberg)

Citigroup is diving deeper into derivatives. In the past five years, the firm that took the largest U.S. bank bailout of the financial crisis increased the total amount of derivatives on its books by 69%, surpassing most U.S. peers and closing the gap with the market leader, JPMorgan. At the end of June, Citigroup had $62 trillion of open contracts, up from $37 trillion in June 2009, company filings show. JPMorgan trimmed its holdings 14% to $68 trillion. Citigroup is expanding as regulators try to rein in instruments that helped fuel the 2008 credit contraction. The third-largest U.S. lender has amassed the largest stockpile of interest-rate swaps, a type of derivative that can swing in value when central banks raise rates. More than 92% of the bank’s derivatives don’t trade on exchanges, making it harder for regulators to spot dangers in the market.

“Risk-taking is in their DNA,” said Arthur Wilmarth, a law professor at George Washington University, who wrote a 2013 paper describing failures that led New York-based Citigroup to seek a $45 billion bailout and more than $300 billion in asset guarantees during the crisis. Even taking the winning side of a derivative carries a risk the other party can’t pay, he said. It’s “basically a speculative trading business.” Derivatives typically require parties to make payments to each other based on the value of underlying stocks, bonds, commodities or interest rates. Airlines and farmers use the contracts to offset price swings for fuel, vegetables and meat. Bond buyers rely on them to insure against defaults, and some investors use them to speculate.

Swap swap swap.

• Bill Gross Used $45 Billion Derivatives to Lift Fund Gain (Bloomberg)

Bill Gross is relying on derivatives rather than Janet Yellen to raise his returns on government bonds. The co-founder of Pacific Investment Management Co. sold most of the $48 billion of U.S. Treasuries held by his $221.6 billion Pimco Total Return Fund in the second quarter, replacing them with about $45 billion of futures, according to an August filing. The contracts require small up-front payments, freeing up money for Gross to invest in higher-yielding securities including Brazilian, Spanish and Italian debt.

“They are taking the cash and buying all these peripheral bonds that have a lot of spread on them relative to Treasuries,” said Erik Schiller, a Newark, New Jersey-based senior money manager at Prudential Fixed Income, referring to bonds issued by European countries other than France and Germany. “It is levering their fund.” Pimco in May said that interest rates in the U.S. will remain lower than they had been before the financial crisis, as the economy enters a “new neutral” characterized by global growth converging toward lower, more stable speeds. The Newport Beach, California-based firm is recommending that clients consider strategies implemented with futures, options and swaps to lift subpar returns.

No, really!

• High-Risk, High-Leverage Credit Suisse Loans Draw Fed Scrutiny (WSJ)

Credit Suisse is under fire from U.S. regulators over concerns the bank isn’t heeding warnings to stop making loans regulators see as risky, according to a person familiar with the matter. The Swiss bank in recent weeks received a letter from the Federal Reserve demanding the bank immediately address problems with its underwriting and sale of leveraged loans, or high-interest-rate loans used by private-equity firms and others to finance purchases of companies, among other uses. The letter to Credit Suisse, known as a Matters Requiring Immediate Attention, found problems with the bank’s adherence to guidance issued last year, warning banks to avoid deals that included too much debt or too few protections for the lenders in case of a default, according to the person familiar with the matter.

The Fed’s letter to Credit Suisse comes as regulators, some of whom have been taken aback by the lack of response to their guidance, are preparing to take tougher action against firms that don’t follow Washington’s marching orders, according to people familiar with the matter. It is unclear if other banks beyond Credit Suisse have received such a letter. Officials at the Fed and the Office of the Comptroller of the Currency are using private communications with banks to rein in relaxed underwriting and debt-laden deals, according to people familiar with the matter. People familiar with regulators’ thinking said they plan to take action on a firm-by-firm basis when they see compliance problems.

Ha!

• Investors Lose Big As Head Of Russia’s No.1 Holding Under House Arrest (RT)

Russia’s largest publicly traded holding company AFK Sistema has lost about 37% of its value in Moscow by midday, after boss Vladimir Yevtushenkov was put under house arrest for alleged money laundering late Tuesday. Investors have seen the price of their shares plummeting, with billions of dollars wiped off the company’s value. Shares in Sistema, a company which Yevtushenkov controls and manages, fell by 37% on the Moscow Exchange at 13.00, Moscow Time, which means the company has seen its capitalization lose an estimated $3.55 billion. In the first half hour of Wednesday trading it was down 28%. Sistema controls Russia’s largest mobile phone operator MTS, the oil company Bashneft as well as other lucrative assets. MTS was down 8% and Bashneft lost 23.5% on the Moscow Exchange.

Vladimir Yevtushenkov’s net worth is estimated by Russia’s Forbes magazine at $9 billion, making him the 15th richest man in the country. Russia’s investigative committee accused the billionaire of acquiring shares in oil producer Bashneft, in the Russian province of Bashkiria, by “criminal means.” Sistema insists the deal was “legal and transparent.” “The company is fully cooperating with the investigation and intends to use all legal means to defend its position,” an official press release said Wednesday. Dmitry Peskov, the press secretary to President Putin, denied any allegations that Yevtushenkov’s arrest was politically motivated. “Any attempts to add political context to this issue don’t have the right to exist,” as ITAR-TASS quotes Peskov denouncing attempts by some experts to draw a parallel with the Yukos case.

It’ll keep on cutting.

• Knife-Edge Scottish Vote Cuts Deep Divide (CNBC)

One of Scotland’s most influential chief executives, Martin Gilbert, says the debate over Scottish independence has become so bitter that whatever the outcome, either Scotland or the United Kingdom will become deeply divided. In Edinburgh, most people on the streets are in the “yes” camp as passions intensify ahead of Thursday’s vote. The polls remain as tight as ever. The latest survey carried out by the Scottish Daily Mail found 48% of Scots (excluding those who said they were undecided) would vote in favor of independence, while 52% would vote against. In one popular hair salon, women have apparently come to blows, leading stylists to refuse to admit their voting preference to customers. The problem, according to the Aberdeen Asset Management boss, is that people don’t know what to believe from the campaign, and that has fueled distrust and over-the-top behavior.

It seems the knives are also coming out in London, with growing criticism of the better together campaign. This could become particularly tricky for U.K. Prime Minister David Cameron. The head of the British business lobby group CBI, John Cridland, says business bosses were forced to speak out in recent days after politicians bungled the “no” campaign so much so that they have totally failed to connect with the Scottish people. On Tuesday night, First Minister of Scotland Alex Salmond seemed in ebullient mood in one of his final TV interviews, declaring that Scotland had invented the very idea of the modern world and after independence would become more influential on the global stage. He also played down Westminster’s last-ditch attempts to keep the union together by promising more devolution and powers for Scottish parliament. Although Gilbert claims to be neutral, he argues that there is little reality to fears that Scotland risks a flight of capital – up to £17 billion has already gone by some estimates.

Selling England by the pound.

• Millions Of Banknotes Sent To Scotland For Yes Win Bank Runs (Independent)

Britain’s banks have been quietly moving millions of banknotes north of the border to cope with any surge in demand by Scots to withdraw cash in the event of a Yes vote in Thursday’s independence referendum, it has emerged. Sources told The Independent the moves have been taking place over the past week or so in order to make sure ATMs do not run out on Friday in the event of a panic reaction to a “yes” vote. There have been some suggestions that people will want to move their money to English banks in the event of an independence vote.

Bankers stressed there has been no sign yet of any increase in the amount of withdrawals from deposit accounts or ATMs, stressing that there was no need because the Bank of England has pledged to stand behind all accounts for at least 18 months in the event of a “yes” vote. However, concerns about how safe is their cash still linger. It was this that led to RBS and Lloyds last week to reassure customers that they would be moving their registration addresses south of the border. As a result, part of the banks’ contingency plans has been to ship more cash to secure locations in Scotland in readiness to keep up with the potential increase in demand. Sources at major banks said they had been issuing clear instructions to their Scottish branches to reassure customers there was no reason to panic.

Dominoes.

• China Property Trusts Pull Support as Default Risks Rise (Bloomberg)

Property trusts are funneling the least amount of money into Chinese developers in almost five years as maturing debt balloons, escalating default concerns. Issuance of trusts for real-estate projects, which target wealthy individuals, slid to 30 billion yuan ($4.9 billion) this quarter from 67.8 billion yuan in the three months to June 30, the least since the start of 2010, data from research firm Use Trust show. Borrowing costs are rising as developers face $9.1 billion in bonds and loans maturing by year-end. Hubei Fuxin Science & Technology Co. sold AA rated securities with a 9.2% coupon Aug. 26, above the 6.38% average yield for similar-rated notes.

Cash from operations are also facing a squeeze as home sales fell 10.9% in the first eight months of the year in the world’s second-largest economy, which is forecast by the government to expand at the slowest pace in 24 years. Standard & Poor’s sees a risk that a developer may default in the coming 12 months, highlighting weak earnings at Renhe Commercial Holdings Co. and Glorious Property Holdings Ltd. “Given the bad housing sales, fewer trust companies are willing to help property companies raise money,” said Li Ning, a bond analyst in Shanghai at Haitong Securities Co., the nation’s second-biggest brokerage. “Default risks are rising rapidly before so much debt is due next quarter.”

Stealth QE.

• China Joins ECB in Adding Stimulus as Fed Scales Back (Bloomberg)

China’s central bank joined its European counterpart in boosting liquidity to address weakening growth, underscoring a divergence in direction among the world’s biggest economies as the U.S. reduces stimulus. The People’s Bank of China is injecting 500 billion yuan ($81 billion) into the nation’s largest banks, according to a government official familiar with the matter, signaling the deepest concern yet with an economic slowdown. Federal Reserve Chair Janet Yellen will announce another $10 billion cut to its monthly bond purchases after this week’s meeting, economists forecast, as she steers toward gradual interest-rate increases. China’s credit expansion builds on targeted measures to shore up growth while stopping short of broad-based stimulus seen in the U.S. in the wake of the global financial crisis and still being pushed in Europe and Japan. By attaching a three-month term to its injection, China is taking a step down that path while maintaining control of a process designed to fuel demand for credit in an already debt-laden economy.

“It’s like quantitative easing with Chinese characteristics,” said Louis Kuijs, Royal Bank of Scotland Group Plc’s chief Greater China economist in Hong Kong, who formerly worked at the World Bank. “The threat is that growth is slowing down below the comfort level of policy makers and that will then also warrant further easing steps.” The PBOC will funnel 100 billion yuan each to the five biggest banks for a three-month period, said the official, who asked not to be identified because the measure hasn’t been formally announced. “It shows China’s monetary policy is leaning toward easing, and the easing stance may last throughout next year,” said Hua Changchun, a China economist at Nomura Holdings Inc. in Hong Kong. The lack of an official announcement shows that the PBOC “doesn’t want to send a strong signal” of policy easing, Hua said.

He needs to go.

• Hollande’s Narrow Confidence Win Flags Looming Budget Battle (Bloomberg)

President Francois Hollande’s shrinking parliamentary backing suggests his government is losing control over economic policy and flags a looming battle over France’s 2015 budget. Prime Minister Manuel Valls won a confidence vote by 25 votes yesterday with the backing of just 269 lawmakers, robbed of an absolute majority of 289 by abstaining rebel members of parliament in his own camp. In a confidence vote on April 8, Valls obtained the support of 306 lawmakers. The result shows how Hollande’s authority has been weakened by a stalled economy and record-low popularity halfway into his five-year term. Socialist lawmakers who avoided bringing down the government yesterday also warned that they will keep the Hollande administration on a short leash.

“We didn’t give the government a blank check,” Socialist Karin Berger said after yesterday’s vote. “The push to change policy will come in the budget debate. What is crucial is that the government ensure investment.” The problem for Hollande and Valls is that they are squeezed between demands from their base to bolster the economy with stimulus spending and insistence from France’s European partners that the country stick to the bloc’s fiscal rules. Finance Minister Michel Sapin said last week that the budget deficit would rise in 2014 for the first time in five years and barely improve in 2015. The shortfall will be 4.4% of gross domestic product this year, instead of the 3.8% France had promised in April. Next year it will be 4.3%, instead of the 3% originally planned. Sapin will present an official budget to cabinet Oct. 1 and has a deadline of Oct. 15 of filing the tax and spending plans with the European Commission in Brussels.

Mayhem in the streets of Paris.

• Sarkozy Poised For Comeback As France’s Socialists Suffer (CNBC)

France’s former conservative president, Nicolas Sarkozy, is likely to announce his return to politics as early as this week following the very narrow victory for the struggling socialist government in a confidence vote, political analysts predict. Sarkozy now stands a decent chance in the 2017 presidential election, as the current French government’s popularity has reached record lows. However analysts have warned that corruption probes surrounding Sarkozy could stymie his chances.In a crucial confidence vote in parliament on Tuesday evening, French Prime Minister Manuel Valls scraped through after deputies in the National Assembly voted 269 to 244 in favor of the government’s policies. Valls urged parliament to embrace more business-friendly reforms, asking why France should be the only large country that doesn’t help businesses.

He has proposed a €50 billion ($64.8 billion) cut in public spending that will fund €40 billion in tax breaks for companies, with the unveiling of the government’s full 2015 budget set for October 1. Incoming European economic and financial commissioner and former French finance minister Pierre Moscovici said it was a “necessity” the pro-reform agenda found confidence. “It is up to this government to work at cutting public expenses because that is a necessity – to work on helping the businesses to invest because it’s the only way to create growth and jobs. And to enforce structural reforms that are needed for the French economy, that is a tough job,” he told CNBC. The government’s attempted shift to more pro-business policies follows the decision to oust far the leftwing economy minister Arnaud Montebourg, replacing him with former Rothschild banker Emmanuel Macron.

IMF accuses Kiev, but zero follow-up.

• Ukraine Currency At Record Low As IMF Blasts “Gross Abuses” (Zero Hedge)

Despite celebrations of de-escalations and truce in US equity markets (by asset-gathering commission-takers), the situation continues to go from bad to worse in the nation almost forgotten now that ISIS is stealing American headlines. The Hryvnia plunged 7.5% this morning – its biggest single-day drop on record – following the release of a scathing IMF letter and devaluation warnings from BofA. The IMF blasted Ukraine’s “premature emission of extra money,” and demanded it “immediately halt these gross abuses,” as BofA warns of risk of “10-20% devaluation” in the next year is high given reserves are at a “critical level.” UAH plunges 7.5% to record lows this morning…

BofA’s warning of the potential for a Hyrvnia devaluation: “Central bank may have to further deplete FX reserves, now near “critical level” of $15b, Bank of America Merrill Lynch economist Vadim Khramov says in report. Natural gas purchases for winter to widen current-account deficit. We see risks of 10%-20% hryvnia devaluation from the current level within a year”

War coming up. Congrats, Victoria Nuland!

• Luhansk Wants to Introduce Ruble as National Currency (RIA)

The self-proclaimed Luhansk People’s Republic (LPR) wants to switch from Ukrainian hryvna to Russian ruble as the local currency in the future, LPR leader Igor Plotnitsky said Tuesday. “Of course, we want ruble [as currency], but a lot of issues still remain, including political ones. So far, we are using hryvna. But I don’t think it will stay for long,” Plotnitsky told reporters, adding that the country has yet to solve a number of economic and financial problems, including the establishment of a banking system. On September 10, Ukrainian President Petro Poroshenko said he had introduced “a bill about temporary self-administration in separate districts of the Donetsk and Luhansk regions,” intended “to ensure the peaceful return of these regions under the sovereignty of Ukraine.” He ruled out “any kind of federalization or secession” for the two regions.

Prime Minister of the Donetsk People’s Republic (DPR) Alexander Zakharchenko said that the self-proclaimed republics will seek independence anyway, adding that the point of the Minsk talks protocol concerning the special status is not final. LPR spokesman said the self-proclaimed people’s republics of Donetsk and Luhansk have no interest in the presidential bill on their status within Ukraine. DPR and LPR announced their independence in May, refusing to acknowledge the legitimacy of the newly-instated Ukrainian government that came to power after the February 22 coup.

What a useless fight this has become.

• Argentina Slams US For Using ‘D’ Word (Reuters)

Argentina called in the United States’ top diplomat in the country on Tuesday to express its “deep indignation” over a local newspaper interview in which he made reference the South American country’s latest debt default. Argentina missed a coupon payment on its restructured sovereign bonds in July after a U.S. judge ordered that $539 million deposited by Buenos Aires with an intermediary bank and intended for bondholders not be paid out. Pointing to the fact that the government tried to make the payment, Argentina denies being in default. U.S. chargé d’affaires in Argentina Kevin Sullivan nonetheless told local newspaper Clarin that “it is important that Argentina get out of default” in an interview published on Monday. Outside of government circles, the term default is commonly used in Argentina to describe the missed July payment.

Sullivan was called into the office of Foreign Minister Hector Timerman on Tuesday after Timerman issued a statement expressing “deep indignation and energetic rejection” of Sullivan’s comments to Clarin. “If this kind of intrusion into the internal affairs of Argentina is repeated, severe measures will be taken,” Timerman’s statement said. Sullivan is Washington’s ranking diplomat in Buenos Aires, as no replacement has been named since its ambassador to Argentina left last year. The U.S. embassy had no comment on the spat with the Argentine government or the Sullivan-Timerman meeting. Debt is a touchy subject in Argentina after millions of people in the middle class were thrown into poverty in 2002 when the government defaulted on about $100 billion in bonds. More than 93% of the bad debt was swapped in 2005 and 2010 for paper offering less than 30 cents on the dollar.

At least we know who to blame.

• IS Seeks ‘Lone Wolves In America’ To Attack Times Square, Las Vegas (Yahoo)

Bomb-making instructions and potential targets for “lone wolves in America” to attack were recently posted to an online message board sympathetic to the Islamic State militant group, also known as ISIS or ISIL, Vocativ reports. The post — entitled “To the lone wolves in America: How to make a bomb in your kitchen, to create scenes of horror in tourist spots and other targets” — suggests targeting popular tourist destinations, such as New York’s Times Square and the Las Vegas Strip, as well as train and subway stations throughout the United States. The instructions appear to be similar to those previously published by the al-Qaida magazine Inspire and reportedly used by the Tsarnaev brothers to build pressure cooker bombs used in their attack on the 2013 Boston Marathon.

The posting appears to be similar to one that surfaced in an online publication last month calling for would-be terrorists to attack Times Square, Las Vegas casinos, oil tankers and military colleges with car bombs. “This is a new world, if you will, or the evolving world of terrorism, and we’re staying ahead of it,” NYPD commissioner Bill Bratton told reporters on Tuesday. “We’ve been focused on it, and I believe that we are as prepared as any entity could be to deal with the threats.” On Monday, New York City Mayor Bill de Blasio, New York Gov. Andrew Cuomo and New Jersey Gov. Chris Christie met with U.S. Homeland Security Secretary Jeh Johnson in Manhattan to discuss ways to secure the metropolitan region from a terror attack. “As New Yorkers, we know our city is the No. 1 terror target,” de Blasio said.

Hi guys!

• Governments Use Weaponized Malware To Spy On Journalists – WikiLeaks (RT)

Journalists and dissidents are under the microscope of intelligence agencies, Wikileaks revealed in its fourth SpyFiles series. A German software company that produces computer intrusion systems has supplied many secret agencies worldwide. The weaponized surveillance malware, popular among intelligence agencies for spying on “journalists, activists and political dissidents,” is produced by FinFisher, a German company. Until late 2013, FinFisher used to be part of the UK-based Gamma Group International, revealed WikiLeaks in the latest published batch of secret documents.

FinFisher’s spyware exploits and monitors systems remotely. It’s capable of intercepting communications and data from OS X, Windows and Linux computers, as well as Android, iOS, BlackBerry, Symbian and Windows Mobile portable devices. Three back-end programs are required for the spy program to operate. FinFisher Relay and FinSpy Proxy programs are FinFisher suite components that route and manage intercepted traffic, redirecting it to the FinSpy Master collection program. The spyware can steal keystrokes, Skype conversations, and even connect to your webcam and watch you in real time. The whistleblower has a list of FinFisher surveillance software buyers. Among the German malware developer’s clients are intelligence agencies and police forces from Australia, Bosnia, Estonia, Hungary, Italy, Mongolia, the Netherlands, Pakistan and Qatar.

According to WikiLeaks’ estimates, FinFisher has already earned about €50 million in sales. “FinFisher continues to operate brazenly from Germany selling weaponized surveillance malware to some of the most abusive regimes in the world,” the founder and editor-in-chief of Wikileaks, Julian Assange, said. Earlier this year, the tapping of Chancellor Angela Merkel’s mobile phone by the American National Security Agency (NSA) created a scandal that rocked the German political establishment: a revelation made thanks to documents exposed by the former NSA contractor and whistleblower Edward Snowden. Yet, despite all this, FinFisher continues its activities in Germany unhindered. “The Merkel government pretends to be concerned about privacy, but its actions speak otherwise. Why does the Merkel government continue to protect FinFisher?” Assange asked.

Fun!

• Chinese Shoe Firm Bosses Vanish With Tens of Millions in Cash (BBC)

Chinese footwear firm Ultrasonic has announced the disappearance of its chief executive and chief operating officer, along with most of its cash. The firm, which is listed in Germany, said that both the men, Qingyong Wu and Minghong Wu, had “apparently left their homes and are not traceable”. At the same time, its cash reserves in China and Hong Kong had been transferred and were “no longer in the company’s range of influence”. Ultrasonic shares immediately fell 79%. The Cologne-based firm said its German holding company still had a “relevant six-figure amount” of money under its control, so it was still able to meet its payment obligations as normal. Ultrasonic’s chief financial officer, Chi Kwong Clifford Chan, and the company’s supervisory board were in talks with authorities and business partners in an effort to clarify matters, the firm said. “As soon as new, reliable facts can be verified, they will be disclosed immediately,” Ultrasonic’s statement on its website concluded.

Ultrasonic specialises in the design, production and sale of shoe soles, sandals, slippers, urban footwear and high-end accessories. With several facilities in the People’s Republic of China, it targets the country’s burgeoning middle class. Ultrasonic had been enjoying steadily rising revenues and profits. Revenues had grown nearly 10% to 163.8m euros (£130.7m) over the last five years, while net income had risen nearly 14% to 35m euros. In 2013, the company had over €100 million of cash reserves. Tuesday’s share price collapse will have wiped about 57m euros off the company’s stock market value. Earlier this year, another Germany-listed Chinese manufacturer, Youbisheng Green Paper, said its chief executive had gone missing without explanation. It later initiated insolvency proceedings.

Home › Forums › Debt Rattle Sep 17 2014: Scotland Must Vote Yes! For All Of Us