Gerard Dou A woman playing a clavichord 1665

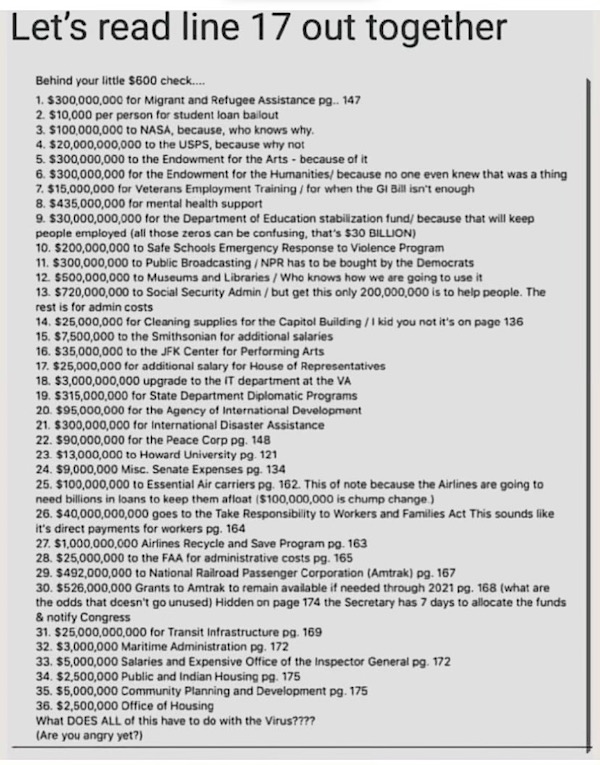

Lying scumbags

They are lying scumbags and will do everything in their power to fool you so you give up your human rights!!!

They are the virus! pic.twitter.com/wdju8pMLFL

— Luke Rudkowski (@Lukewearechange) November 25, 2021

Jan 23: March To Defeat Mandates, DC.

Jan 24: Decision due Monday 10.45am GMT on whether to permit Julian Assange to appeal the US extradition decision to UK Supreme Court “on points of law of general public importance”.

Jan 24: Ron Johnson Senate hearing with Kory, McCullough etc.

“What is clearly evident both from the hospitalizations and deaths is that the double-vaccinated are now worse off per capita even against critical illness, and that pattern appears to be accelerating.”

• The Very Concerning Data From Scotland (Horowitz)

“The vaccines are incredibly safe. They protect us against Omicron; they protect us against Delta; they protect us against COVID.” Those were the words of fully vaccinated CDC Director Rochelle Walensky while testifying before the Senate Health Committee with two masks on her face on Jan. 11. Scottish data shows that the COVID-19 age-standardized case rate is highest among the two-dose vaccinated and lowest among unvaccinated! It further shows this trend of negative efficacy for the double-vaccinated persisting for hospitalizations and deaths. Something is very wrong here, and together with other data points, it raises concerning questions about the negative effect of waning antibodies, constant boosting, and the consequences of a leaky vaccine with narrow-spectrum suboptimal antibodies against an ever-evolving virus.

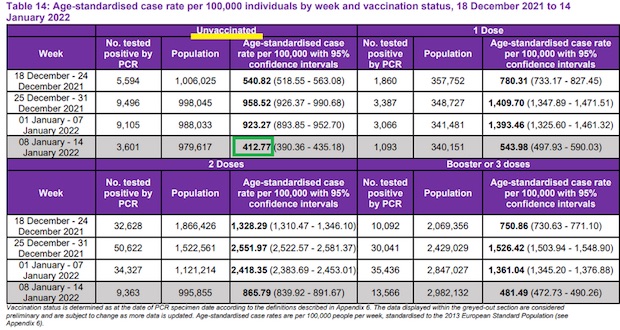

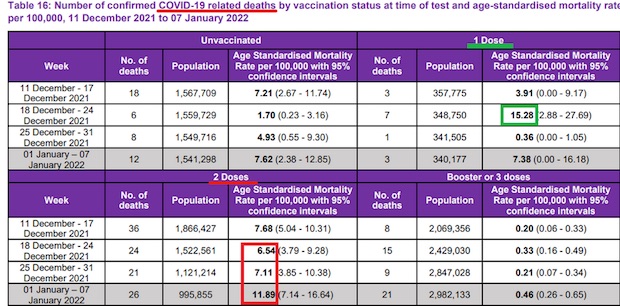

Every Wednesday, Public Health Scotland (PHS) has been publishing a weekly report on COVID data juxtaposed to vaccination rates. Table 14 of this week’s “Public Health Scotland COVID-19 & Winter Statistical Report” lays bare in plain English (and math) a rate of negative efficacy for the vaccine:

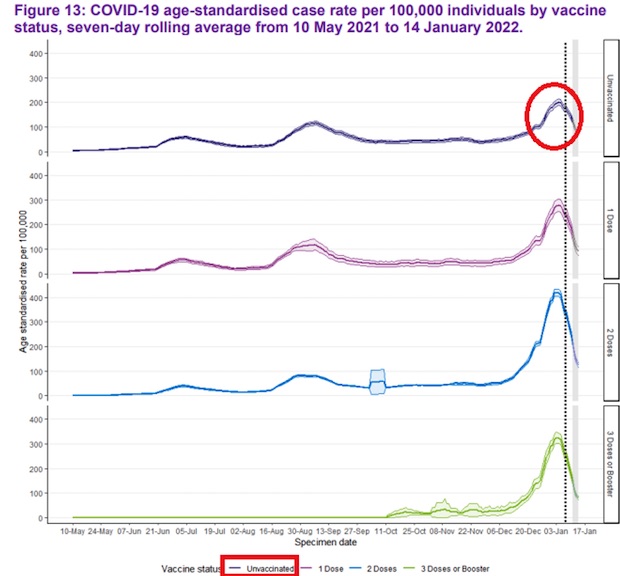

As you can see, while the overall Omicron wave seems to be receding in Scotland, age-standardized case rates per 100,000 people were the lowest in the unvaccinated cohort every week for the past four weeks. Thus, it’s not just the fact that the unvaccinated accounted for only 11.5% of cases the past two weeks, but even adjusted for age-stratified vaccination rates (PHS already does the math for you) the unvaccinated had the lowest infection rate out of the four cohorts – especially during the peak of Omicron. Furthermore, we see that even the triple-vaccinated clearly have no efficacy against infection, although they have some degree less negative efficacy than the double-vaccinated. Here is a linear presentation of the depth of the Omicron wave by vaccination status, where you can see that the unvaccinated had the shallowest wave:

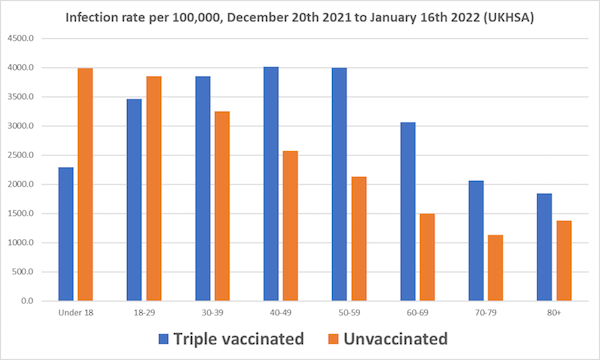

This also coincides with the latest data from the U.K. Health Security Agency of the entire United Kingdom. This data now shows higher rates of infection among the triple-vaccinated in all but the youngest people.

Full stop right here. Any public policy measure – from vaccine passports to discrimination – cannot be justified under the science, even if one’s conscience is OK with apartheid. In fact, clearly this shows that, especially with Omicron, the vaccinated are the super-spreaders. Before we get to hospitalizations and deaths, the notion that the unvaccinated are somehow responsible for the continued spread of this virus is completely contradicted by the data. Some might suggest without evidence that the unvaccinated possibly have a higher rate of prior infection; however, Omicron seems to attack even those who already had previous versions of SARS-CoV-2.

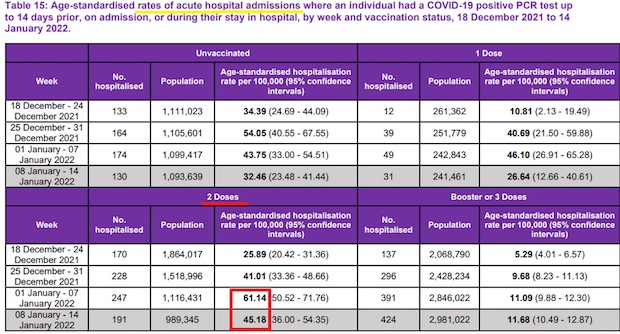

[..] let’s take a look at tables 15 and 16 – the acute COVID hospitalization and death rates, respectively:

What is clearly evident both from the hospitalizations and deaths is that the double-vaccinated are now worse off per capita even against critical illness, and that pattern appears to be accelerating. Again, this evidently shows a pattern of negative efficacy even against critical illness over time as the shots wear off, increasingly quickly with Omicron. Why is there no desire to study the source of this negative efficacy and whether the fact that the vaccine is non-sterilizing, wanes quickly with sub-optimal antibodies, is narrow-spectrum, and is increasingly out of synch with the changing virus is going to make the pandemic worse in the long run?

And you ask that after a whole year?

“Big pharma is the least trusted industry.”

• Covid-19 Vaccines and Treatments: We Must Have Raw Data, Now (BMJ)

As well as access to the underlying data, transparent decision making is essential. Regulators and public health bodies could release details27 such as why vaccine trials were not designed to test efficacy against infection and spread of SARS-CoV-2.28 Had regulators insisted on this outcome, countries would have learnt sooner about the effect of vaccines on transmission and been able to plan accordingly.29

Big pharma is the least trusted industry.30 At least three of the many companies making covid-19 vaccines have past criminal and civil settlements costing them billions of dollars.31 One pleaded guilty to fraud.31 Other companies have no pre-covid track record. Now the covid pandemic has minted many new pharma billionaires, and vaccine manufacturers have reported tens of billions in revenue.32

The BMJ supports vaccination policies based on sound evidence. As the global vaccine rollout continues, it cannot be justifiable or in the best interests of patients and the public that we are left to just trust “in the system,” with the distant hope that the underlying data may become available for independent scrutiny at some point in the future. The same applies to treatments for covid-19. Transparency is the key to building trust and an important route to answering people’s legitimate questions about the efficacy and safety of vaccines and treatments and the clinical and public health policies established for their use.

Twelve years ago we called for the immediate release of raw data from clinical trials.1 We reiterate that call now. Data must be available when trial results are announced, published, or used to justify regulatory decisions. There is no place for wholesale exemptions from good practice during a pandemic. The public has paid for covid-19 vaccines through vast public funding of research, and it is the public that takes on the balance of benefits and harms that accompany vaccination. The public, therefore, has a right and entitlement to those data, as well as to the interrogation of those data by experts.

Pharmaceutical companies are reaping vast profits without adequate independent scrutiny of their scientific claims.33 The purpose of regulators is not to dance to the tune of rich global corporations and enrich them further; it is to protect the health of their populations. We need complete data transparency for all studies, we need it in the public interest, and we need it now.

“If delta is replaced, then omicron has no ‘biological need’ to increase transmission efficiency..”

• Omicron Might Be The Worst Covid Gets When It Comes To Transmissibility (CNBC)

It’s too soon to know if Covid’s omicron variant will hasten the end of the nearly two-year-long Covid-19 pandemic. But some experts say that when it comes to contagiousness, omicron could be the “most transmissible the virus can get.” The reason: Due to “evolutionary constraints” on how many mutations and changes the virus can make, omicron could be “the ultimate version of this virus,” Dr. William Moss, executive director of the International Vaccine Access Center at the Johns Hopkins Bloomberg School of Public Health, tells CNBC Make It. Studies show that omicron is more than four times as transmissible as Covid’s delta variant, and that it evades immunity better than delta.

As long as the virus keeps spreading, Moss says, it’ll continue to mutate going forward, creating more variants down the road. But those mutations will probably be like “sons of omicron,” he says — not so different that the virus can escape immunity from vaccines or previous omicron infections. For Covid to stop spreading, a significant portion of a population needs to maintain some level of simultaneous immunity — a challenge, since so-called “natural immunity” provides inconsistent levels of protection for unpredictable amounts of time. It’s estimated that 94% of the population must carry some form of immunity to interrupt the chain of transmission, according to the Mayo Clinic.

Moss’ theory is “my own kind of gut feeling, and I know other people don’t agree with this,” he admits. Other experts say his theory could be accurate, but it’s simply too soon to tell. “By the looks and behavior, my guess is for SARS-CoV-2, this is probably as high as it will/need climb” in terms of transmissibility, says Dr. T. Jacob John, a retired professor and head of departments of clinical virology and microbiology at CMC Vellore. But it’s a waiting game to see if omicron will displace delta as fully as delta displaced variants like alpha, beta, and gamma, John says. That matters: “If delta is replaced, then omicron has no ‘biological need’ to increase transmission efficiency,” John says.

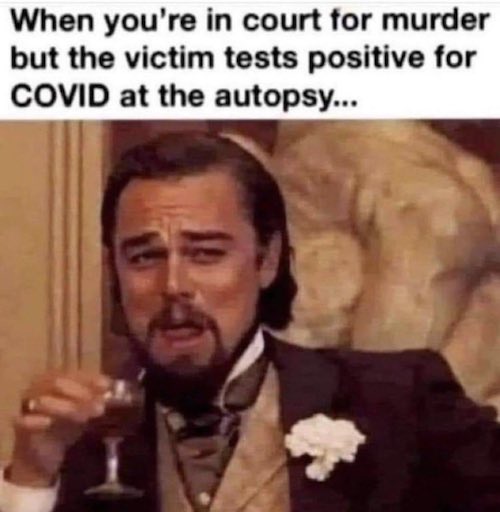

Didn’t we ditch the term Breakthrough Infections?

• Breakthrough Infections With Omicron Despite mRNA Vaccine Booster Dose (Lancet)

A group of German visitors who had received three doses of SARS-CoV-2 vaccines, including at least two doses of an mRNA vaccine, experienced breakthrough infections with omicron between late November and early December, 2021, while in Cape Town, South Africa. The group consisted of five White women and two White men) with an average age of 27·7 years (range 25–39) and a mean body-mass index of 22·2 kg/m2 (range 17·9–29·4), with no relevant medical history. Four of the individuals were participating in clinical elective training at different hospitals in Cape Town, whereas the others were on vacation. The individuals were members of two unlinked social groups and participated in regular social life in Cape Town, in compliance with applicable COVID-19 protocols.

Upon arrival during the first half of November, 2021, each individual tested negative for SARS-CoV-2 by PCR and provided records of complete vaccination, including booster or third, doses administered via intramuscular injection using homologous (n=5) and heterologous (n=2) vaccination courses.. Six individuals were fully vaccinated with BNT162b2 (Comirnaty, Pfizer–BioNTech, Mainz, Germany), five of whom received a third (booster) dose of BNT162b2 in October or early November, 2021. One individual had received a full dose of CX-024414 (Spikevax, Moderna, Cambridge, MA, USA) in early October, 2021; this was not in line with the European Medicines Agency recommendations at that time, which suggested a half dose to boost healthy individuals.5 The seventh individual received an initial dose of ChAdOx1-S (Vaxzevria, AstraZeneca, Cambridge, UK), followed by a dose of BNT162b2 for completion of primary immunisation, and a booster dose of the same vaccine.

[..] All seven individuals were infected with omicron (PANGO lineage B.1.1.529, Nextstrain clade 21K) [..] These were the first documented breakthrough infections with the omicron variant in fully vaccinated individuals after receipt of booster vaccine doses. Some of these individuals had received heterologous vaccine doses, in line with emerging global practice. Booster doses were administered 21–37 weeks after the second vaccine doses, and breakthrough infections occurred 22–59 days thereafter.

“You got statistically nothing out of that jab of value but you took risk — maybe very serious risk and permanent harm. This isn’t my claim or data this is the CDC’s data.”

• Why You Don’t Say…. (Denninger)

By early October, compared with unvaccinated people who didn’t have a prior infection, case rates were:

“— 6-fold lower in California and 4.5-fold lower in New York in those who were vaccinated but not previously infected.— 29-fold lower in California and 15-fold lower in New York in those who had been infected but never vaccinated.

— 32.5-fold lower in California and 20-fold lower in New York in those who had been infected and vaccinated.”

So being infected and recovered was anywhere from three to nearly five times as protective as being “vaccinated.” There was no statistically-significant improvement if “vaccinated” after infection. I put “vaccinated” in quotes because from this data it is clear that these are not *******s at all; they do not induce immunity, sterilizing or otherwise, at anything approaching that which occurs if you get infected. By any rational set of analytical standards they are defective products and grossly unfit for purpose.

What’s even worse for the jabs is that when Delta hit there were no jabs more than six months old, approximately, yet there were many infections that occurred more than a year prior. Therefore being infected was not only three to five times as protective it was protective over a much longer period as well! So if you were infected and then talked into or even coerced or forced into taking the jabs you were conned. You got statistically nothing out of that jab of value but you took risk — maybe very serious risk and permanent harm. This isn’t my claim or data this is the CDC’s data.

“The Science personified by Dr. Anthony Fauci is not medical science after all but rather political science.”

• Win-Win, Lose-Lose (Kunstler)

Isn’t it refreshing to not have to lede with Covid-19? It looks like “Joe Biden’s” effort to change the channel is working. Even so, there is some interesting Covid-19 news, like: the whole endless, heartbreaking, demoralizing episode is winding down. Whoa! That’s a shock! What will Western Civ do without it? In the UK, Boris Johnson put a stop to all restrictions, mask mandates, and vaxx passports, just like that (snap) on Wednesday. Then France announced it would lift most Covid-19 restrictions in February, which is a little more than a week from now, for those of you who haven’t mastered the new maff. Then, on Thursday, Austria’s parliament voted to approve mandatory vaccinations for everybody in the country — say, what? — leading the casual observer to wonder whether half of everybody in that country is maybe super pissed-off at their government, seeing how France and the UK are going the opposite way.

Let’s be honest: it’s getting laughable to seriously advocate vaxxing up a whole goshdarn population when it’s perfectly obvious now that the vaxxes don’t work and are making a lot of people sick with everything that can go wrong in a human body, plus Covid-19. Are nations such as Austria and Germany not looking plumb insane now? Can the European Union endure such wildly contradictory policy among its member states, and not make itself ridiculous? Let’s just say, the situation in Europe is in flux and events are moving fast.

Here in our exceptional nation, it is lately discovered — to the chagrin of the elite managerial classes — that The Science personified by Dr. Anthony Fauci is not medical science after all but rather political science. Ah! I see now why so much confusion has been sown over Dr. Fauci’s management of the Covid-19 pandemic. If he actually represented medical science, he might not have killed several hundred thousand people in this country by withholding and suppressing effective treatments and promoting deadly vaccines. He might not have disgraced the entire medical establishment and half-wrecked the system it works in. But, to paraphrase another eminent political scientist of yore, Josef Stalin, while one death is a tragedy, a half-million is a mere statistic. There’s science anyone can understand!

Someone asked me to include this. Fine, though I think the premise is flimsy. This is about headaches and fatigues, not heart inflammation.

• More Than 2/3 of Adverse COVID-19 Vaccine Events Due to Placebo Effect (STD)

In a new meta-analysis of randomized, placebo-controlled COVID-19 vaccine trials, researchers at Beth Israel Deaconess Medical Center (BIDMC) compared the rates of adverse events reported by participants who received the vaccines to the rates of adverse events reported by those who received a placebo injection containing no vaccine. While the scientists found significantly more trial participants who received the vaccine reported adverse events, nearly a third of participants who received the placebo also reported at least one adverse event, with headache and fatigue being the most common. The team’s findings are published in JAMA Network Open.

“Adverse events after placebo treatment are common in randomized controlled trials,” said lead author Julia W. Haas, PhD, an investigator in the Program in Placebo Studies at BIDMC. “Collecting systematic evidence regarding these nocebo responses in vaccine trials is important for COVID-19 vaccination worldwide, especially because concern about side effects is reported to be a reason for vaccine hesitancy.” Haas and colleagues analyzed data from 12 clinical trials of COVID-19 vaccines. The 12 trials included adverse effects reports from 22,578 placebo recipients and 22,802 vaccine recipients. After the first injection, more than 35 percent of placebo recipients experienced systemic adverse events – symptoms affecting the entire body, such as fever – with headache and fatigue most common at 19.6 percent and 16.7 percent, respectively.

Sixteen percent of placebo recipients reported at least one local event, such as pain at site of injection, redness, or swelling. In comparison after the first injection, 46 percent of vaccine recipients experienced at least one systemic adverse event and two-thirds of them reported at least one local event. While this group received a pharmacologically active treatment, at least some of their adverse events are attributable to the placebo – or in this case, nocebo – effect, as well given that many of these effects also occurred in the placebo group. Haas and colleagues’ analysis suggested that nocebo accounted for 76 percent of all adverse events in the vaccine group and nearly a quarter of all local effects reported.

Why is this still being discussed? Just to slow down the real discussion?

• CDC Admits Natural Immunity Superior to Vaccinated Immunity (BN)

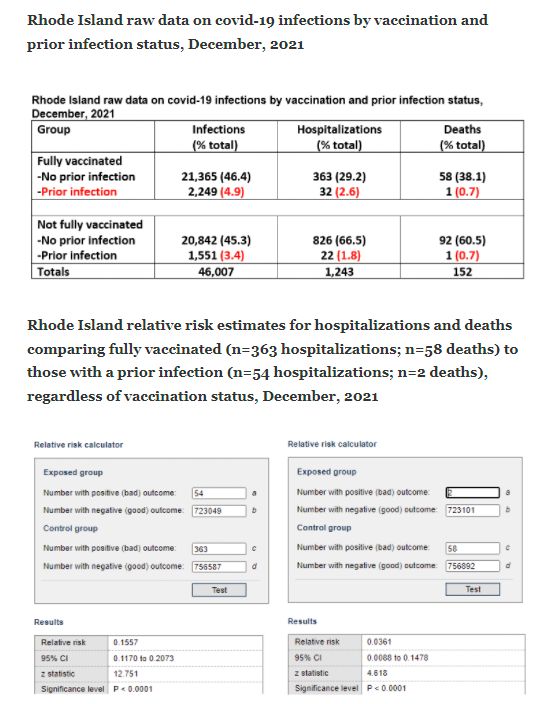

Dr. Andrew Bostom, an epidemiologist, delved into the data and provided the statistical breakdown that helps us fully understand what is going on: There was ~6X lower risk of covid-19 hospitalization and ~28X lower risk of covid-19 death, comparing those with natural immunity to covid-19, regardless of vaccination status, to those fully vaccinated… Rhode Island raw data on covid-19 infections by vaccination and prior infection status, December, 2021

If you take these base numbers, which come from the Rhode Island Department of Health’s website, you come to some startling conclusions. After verifying the data and the epidemiologist’s methodology (Dr. Bostom changes some of the Rhode Island Health Department’s terms and does some simple math before running the statistics), you can see that cases, hospitalizations, and deaths are all greatly reduced by natural immunity. The strongest takeaway is regarding deaths. Even when correcting for scale, survival of a prior infection was by far the greatest predictor of surviving another Covid infection. However, if one did not have a prior infection (or does not know if one had a prior infection), the argument can be made that vaccination appears to provide the best strategy of surviving one. (It is important to note that the vaccinated community in Rhode Island is much larger than the unvaccinated community; it is about twice as large, therefore the incidence rate for unvaccinated deaths is about three times as high).

Yet, even as the CDC estimated that as of September there were 146.6 million Americans with prior infections, the state-by-state breakdown, including Rhode Island, proves to be substantially higher after the Omicron surge, as Becker News had earlier predicted would be the case. Rhode Island’s percent of prior infections: 92 percent. [..] For perspective, the Mayo Clinic once considered 200 million Americans with vaccinated or natural immunity to be sufficient to claim “herd immunity.” The latest Omicron numbers, based on CDC’s Covid burden estimates, lead us to assess there may be as many as 250 million Americans with prior infections. (Cases, however, may be counted more than once.)

Number 4 before you know it.

• The CDC Officially Moves the Goalposts on COVID-19 Vaccination (RS)

The CDC has officially moved the goalposts on what it means to be vaccinated from COVID-19. We all knew this day was coming, even as an onslaught of “fact-checkers” assured us it was “misinformation” to assert such a change was coming publicly. But first, let’s talk about the details. CDC Dir. Rochelle Walensky appeared on CBS News and shared the news that the two-dose regiment will no longer suffice to be considered “fully vaccinated.” Instead, you will need a booster jab in order to be classified as “up to date.” That comes as part of a “pivot” in language by the government, one that many were maligned for predicting. I could have just headlined this story “Ron DeSantis was right again,” but I figured that gets a bit repetitive after a while.

The Florida governor, just a few months ago, predicted the government would make this shift. In response, the media trashed him for supposedly spreading misinformation. Well, who’s spreading misinformation now? But past the politics of this, let’s talk about how deep unnecessary it is. For example, are boosters helping quell the spread of COVID-19, which would be the primary justification for mandates? The answer is a resounding no. And if you want proof, look no further than Israel, which is already giving four shots of the vaccine to some populations. The small, isolated nation (which makes it perfect as a real-world case study) now leads the entire world in COVID-19 case rate.

Now, if the booster shots aren’t actually stopping the spread of COVID-19, and to be sure, they appear to be having no effect whatsoever on that front, are they at least preventing hospitalization and death at a dramatically different rate than two doses or natural immunity? The answer to that question also appears to be no, at least when talking about a major statistical difference. Yes, a three-dose regime cuts hospitalization down by a significant percentage compared to two doses (at least per the CDC’s claims), but the overall numbers aren’t that different because the hospitalization rate with two doses was already extremely low. When you keep chopping up a tiny fraction, you aren’t left with much change in absolute numbers.

From November 2021, but very relevant. Where is the research?

• NHS Panic As Mortuaries Fill With Thousands Of Non-Covid Deaths (Exp.)

Figures from the Office for National Statistics suggest that over the last four months, England and Wales registered 20,823 more deaths than the five-year average in the past 18 weeks. Only 11,531 deaths involved Covid. It means that around 45 percent of recent deaths were related to other causes. Experts called for an urgent inquiry into whether the deaths were preventable. Professor Carl Heneghan, director of the Centre for Evidence-Based Medicine at the University of Oxford, said: “I’m calling for an urgent investigation.” He continued: “If you look at where the excess is happening, it’s in conditions like ischemic heart disease, cirrhosis of the liver and diabetes, all of which are potentially reversible.”

Worried that this is not just a natural occurrence, he said: “This goes beyond just looking at the raw numbers and death certificates. We need to go back and find if these deaths have any preventable causes.” With the NHS suffering huge patient backlogs, the professor told the Telegraph: “This could be the fallout from the lack of preventable care during the pandemic, and what happens downstream of that.” Calling for action to be taken, Profesor Heneghan said: “We urgently need to understand what’s going wrong and an investigation of the root causes to determine those actions that can prevent further unnecessary deaths.” Weekly figures for the week ending November 5 showed that there were 1,659 more deaths than would normally be expected at this time of year.

Of those, 700 were not caused by Covid. The excess is likely to grow as more deaths are registered in the coming weeks. Data from the UK Health Security Agency show there have been thousands of more deaths than the five-year average in heart failure, heart disease, circulatory conditions and diabetes since the summer. The number of deaths in private homes is also 40.9 percent above the five-year average, with 964 excess deaths recorded in the most recent week, which runs up to November 5.

Worth the read.

“Yadav’s 265-page complaint stands out for the extensive legal precedent it draws upon, from Indian and common law, calling into question the legality of mandatory vaccination and other compelled medical acts.”

• Bill Gates, Indian Gov’t Targeted in Lawsuit Alleging Vaccine Killed Man (CHD)

In what may be the first legal case of its kind globally, a petitioner in India is seeking to prosecute Bill Gates, Indian vaccine czar Adar Poonawalla, and Indian government and public health officials over the death of a 23-year-old man who died after receiving AstraZeneca’s Covishield vaccine. Kiran Yadav late last year filed a criminal writ petition for murder, Smt. Kiran Yadav v. The State of Maharashtra & Ors. (herein referred to as Yadav v. Maharashtra), with the Bombay High Court of Judicature, on behalf of her deceased son, Shri Hitesh Kadve. Her son was vaccinated on Sept. 29, 2021. According to the complaint, he died that same day due to side effects brought on by the vaccine.

The complaint alleges Kadve died “due to [an] act of willful commission and omission attributable to some public servants who are misusing their position to bring policies to help the pharma mafia and thereby [are] responsible [for] mass murders.” The complaint further states Yadav’s son was “unwillingly” compelled to get vaccinated based on the “false narrative” that the vaccine was entirely safe, and because the State of Maharashtra prohibited the non-vaccinated from riding on railroads or entering retail spaces such as shopping malls. The complaint alleges Maharashtra’s restrictions “are against the Central Government’s policy that, there cannot be any discrimination between vaccinated and unvaccinated people.”

Other defendants in the case include the commissioner and director-general of the Maharashtra State Police, the Indian Central Bureau of Investigation and the principal secretary of the Indian Ministry of Health and Family Welfare. The complaint also brings charges against Bill Gates and Adar Poonawalla, CEO of the Serum Institute of India, the world’s largest vaccine manufacturer by number of doses produced and sold. The Serum Institute produces the Covishield vaccine, as well as over half of the world’s vaccines that are administered to babies. In all, Yadav is requesting 1,000 crores (10 billion rupees, or $134 million USD) in compensation, including 100 crores ($13.4 million USD) in interim compensation. She is seeking lie detector and narcoanalysis tests from Gates, Poonawalla and others.

Prepare to hear the term “Big Lie” a lot this year.

• Democrats Fuel Doubts Over the Legitimacy of the Coming Elections (Turley)

This month, President Biden pivoted away from the false claim of preventing people from voting to the more Trumpian claim of questioning whether ballots would be counted: “not as to who can vote but who gets to count the vote, count the vote, count the vote — it’s about election subversion, not just whether or not people get to vote.” Any vote miscount allegation can be (as it was with the Trump litigation) reviewed by the courts. Indeed, many of the provisions alluded to by Democrats have been reviewed and — at least temporarily — upheld. Requiring voter identification has been repeatedly cited as clear evidence of an effort to steal the election. However, 80 percent of the public supports voter identification rules.

The courts have overwhelmingly upheld these rules as constitutional. Nevertheless, the drumbeat of the Democrats’ “Big Lie” continues. This month, Washington Post columnist Paul Waldman heralded Biden for confronting the “Big Lie” of Trump, but claimed that elections were still being stolen: “That dagger is still held at democracy’s throat. The lie about 2020 justifies and enables all the things Republicans are doing now to establish the means and the willingness to overturn the next election.” Once again, Waldman does not actually state how the elections are being stolen. They just are, he says.

What is most interesting is how this claim is being amplified by Biden and others despite every indication that the public isn’t buying it, with election reforms barely registering on some polls as a major concern for voters. That is the problem with big lies. If the lies are not accepted by the public, they may just reduce faith in you rather than the election. Friedrich Nietzsche observed, “I’m not upset that you lied to me, I’m upset that from now on I can’t believe you.” Biden seems to be facing such a Nietzsche moment. With polls showing the president plunging and voters turning toward the GOP, there is clearly doubt over whether there really is a “dagger at democracy’s throat.”

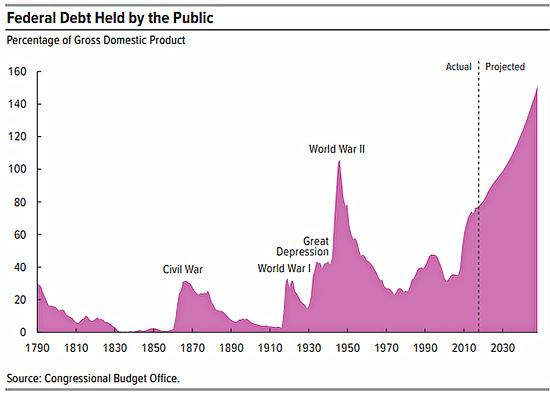

“..the country’s debt in relation to GDP is one of the lowest in the world..”

• Is The Plan To Bankrupt Russia Working? (RT)

Economic coercion is the West’s favourite tool to influence Russian behaviour. But with oil prices rising, Russia’s economy growing, and the West backing off from pledges to exclude Russia from SWIFT, this policy seems to have reached a dead-end. In 2014, the Russian economy was struck by a double-whammy. First, the oil price collapsed. And second, Western states imposed a series of sanctions in response to events in Ukraine. The immediate impact on Russia’s economy was dire, sending GDP plummeting. Economists had problems determining which was more responsible for Russia’s problems – the oil price or the sanctions – but most came down in favour of the former. Cheaper oil translated into a less valuable ruble, which increased the price of imports and created inflationary pressures. To this end, the Central Bank responded with higher interest rates, depressing demand and thereby GDP.

The economic crisis of 2014 created hopes in the West that Russia could be brought to its knees. Pundits predicted that cheap oil was here to stay. Beyond that, the introduction of so-called ‘sectoral sanctions’, targeting Russia’s energy, financial, and military industries, was meant to strangle what were seen as the most vital sectors of the Russian economy. It would not be long before Russia would be bankrupt, some claimed. Speaking in Ottawa in November 2014, former Russian Finance Minister Mikhail Kasyanov stated that within two years, Russia would have used up all its financial reserves and would have to severely cut government spending. The Russian people would then turn away from the government en masse. In the face of cheap oil and sanctions, the ‘Putin regime’ was doomed.

It didn’t turn out that way. Sanctions had a rather marginal impact on the Russian economy. The government responded effectively by important substitution, providing financial aid to threatened sectors, and finding new sources of much-needed technologies (most notably China). This came at a price, but Russia weathered the sanctions storm quite well. Rather than declining, Russian oil and gas production has remained steady. Moreover, the price of hydrocarbons has rebounded. This week, Goldman Sachs issued a prediction that oil would reach $100 a barrel by the end of the year, as the world economy recovers from the Covid-induced recession, and demand for oil and plastics increases.

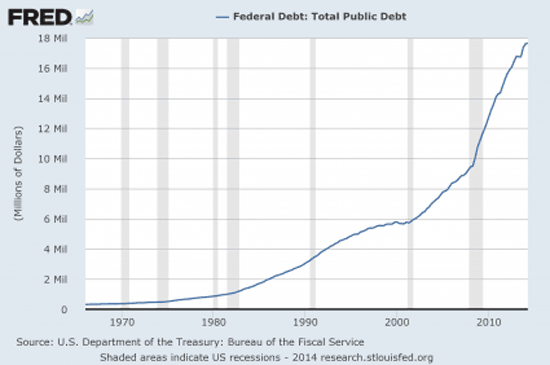

Suddenly, the picture is looking very different from what it did in 2014. In fact, the Russian government is flush with cash. Russia’s international currency reserves hit a record high of $600 billion last year. Meanwhile, the country’s debt in relation to GDP is one of the lowest in the world – especially given that, much like other former Soviet states, much of its GDP is uncounted, off the books in the black and grey economies. This compares very favourably to Western states, who have borrowed on a massive scale during the Covid pandemic and are afloat in a sea of debt. It’s the West that is looking bankrupt, not Russia.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.