Edward Hopper Rooms by the sea 1951

Deutsche is enormous. Its derivatives portfolio is gigantic. This is a big story.

• Deutsche Bank Downgraded By S&P Over Restructuring Plans (MW)

Deutsche Bank was downgraded Friday by S&P Global Ratings, which cited concerns over the German lender’s restructuring plans. The ratings agency cut the long-term issuer credit rating to ‘BBB+’ from ‘A-‘on the bank and its core operating subsidiaries. The troubled bank last week announced plans to cut thousands of jobs in a bid to overhaul its operations and cut costs, but S&P said they see “significant execution risks in the delivery of the updated strategy amid a continued unhelpful market backdrop, and we think that, relative to peers, Deutsche Bank will remain a negative outlier for some time,” in a statement. Investors also demanded the resignation of the bank’s chairman, Paul Achleitner, at the Annual General Meeting last week.

Shares have tumbled 42% so far this year. The agency kept a stable rating on the bank’s outlook, saying that management will execute the plan over time and achieve longer-term objectives. Meanwhile, Australia’s consumer watchdog on Friday announced that it would be bringing criminal cartel charges against Deutsche Bank, Citigroup and Australia & New Zealand Banking. Shares of Deutsche Bank opened up 1.5%, bouncing off a 7% drop Thursday, which came after the Federal Reserve designated the German lender’s U.S. business in “troubled condition,” people familiar with the matter told The Wall Street Journal.

Deutsche again. Insult and injury.

• ANZ, Deutsche Bank and Citigroup Face ‘Criminal Cartel’ Charges (BBC)

Financial institutions ANZ, Deutsche Bank and Citigroup will be prosecuted on criminal cartel charges, Australia’s consumer watchdog says. The allegations concern arrangements for the sale of A$2.5bn (£1.4bn; $1.9bn) worth of ANZ shares in 2015. The three banks said they would fight the charges. ANZ said it would also defend allegations against an employee. Australia’s scandal-plagued financial sector is at the centre of a national inquiry into misconduct. Several “other individuals” are also expected to be charged by prosecutors, the Australian Competition and Consumer Commission (ACCC) said.

“The charges will involve alleged cartel arrangements relating to trading in ANZ shares following an ANZ institutional share placement in August 2015,” chairman Rod Sims said in a statement. “It will be alleged that ANZ and the individuals were knowingly concerned in some or all of the conduct.” ANZ, one of Australia’s so-called “big four” banks, said the charges related to a placement of 80.8 million shares. The deal was underwritten by global giants Deutsche Bank, Citigroup and JP Morgan, as part of a bid by ANZ to raise capital to meet regulatory requirements. ANZ said regulators were now investigating whether it should have stated that 25.5 million shares of the placement had been taken up by “joint lead managers”.

And it’s OK to keep that from -potential- shareholders, bondholders for over a year?!

• Deutsche Bank’s US Ops Deemed “Troubled” By Fed A Year Ago (R.)

The United States Federal Reserve last year designated Deutsche Bank U.S. operations to be in “troubled condition”, The Wall Street Journal reported on Thursday, citing people familiar with the matter. The Fed’s assessment has not previously been made public, it said, sending shares in the German lender down 7.2% to 9.16 euros, their lowest level in more than a year and a half. The “troubled condition” status is one of the lowest designations employed by the Fed, The WSJ said. The report comes a month after Deutsche Bank’s new Chief Executive Christian Sewing announced plans to cut back bond and equities trading, where it has been unable to compete with U.S. powerhouses such as Goldman Sachs and JP Morgan.

Deutsche Bank’s attempts to break into the U.S. markets, which are seen as an essential plank for delivering a global investment banking platform, proved to be costly as it ended up paying out billions of dollars to settle regulatory breaches, prompting speculation at one point of a bailout by Berlin. The WSJ said that the Fed downgrade of Deutsche Bank’s U.S. operations caused the U.S. Federal Deposit Insurance Corporation (FDIC) to put Deutsche Bank Trust Company Americas on its list of “Problem Banks”.

Clear enough.

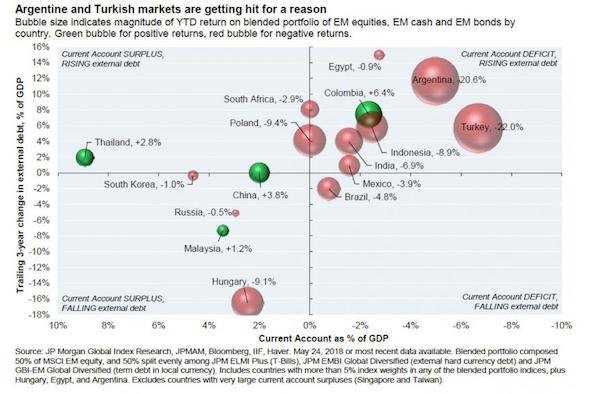

• Why Turkey And Argentina Are Doomed (ZH)

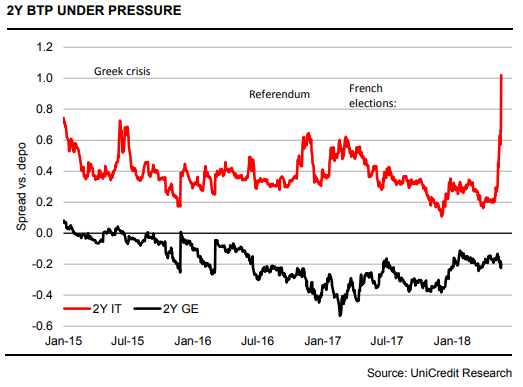

It was all the rage in 2017. Not long after contrarians like Jeff Gundlach and Russell Clark said to go long Emerging Markets, suddenly everyone was doing it, either as a standalone trade or as part of a pair trade shorting one or more DMs. Of course, maybe all they were doing was indirectly shorting the USD, which was arguably the biggest driver behind EM outperformance. But, in no small part due to the recent surge in the dollar, after outperforming developed equity markets by 20% in 2016-2017, EM is underperforming by 2.5% so far this year. Of course, it’s not just the dollar, but also interest rates, which until the recent Italian fiasco, were at 4 year, or greater, highs.

And, as JPM’s Michael Cembalest writes in his latest “Eye on the market” note, investor fears are predictably focused on the impact of rising US interest rates and the rising US dollar on EM external debt, and on rising oil prices. And yet, despite the occasional scream of terror from EM longs who refuse to throw in the towel, a closer look shows that the market reaction has been orderly so far, with two exceptions: Argentina and Turkey, which are leading the way down. However, as the JPM Asset Management CIO shows below, the collapse in these two countries has been largely a function of state-specific/idiosyncratic reasons.

The chart below, courtesy of Cembalest, shows each country’s current account (x-axis), the recent change in its external borrowing (y-axis) and the return on a blended portfolio of its equity and fixed income markets (the larger the red bubble, the worse the returns have been). This outcome looks sensible given weaker Argentine and Turkish fundamentals. And while Cembalest admits that the rising dollar and rising US rates will be a challenge for the broader EM space, most will probably not face balance of payments crises similar to what is taking place in Turkey and Argentina, of which the latter is already getting an IMF bailout and the former, well… it’s only a matter of time.

1: look if present conditions are fair. 2: adapt them.

• US On Brink Of Trade War With EU, Canada and Mexico (G.)

The United States and its traditional allies are on the brink of a full-scale trade war after European and Canadian leaders reacted swiftly and angrily to Donald Trump’s decision to impose tariffs on steel and aluminium producers. The president of the European commission, Jean-Claude Juncker, promised immediate retaliation after the US commerce secretary, Wilbur Ross, said EU companies would face a 25% duty on steel and a 10% duty on aluminium from midnight on Thursday. Europe, along with Canada and Mexico, had been granted a temporary reprieve from the tariffs after they were unveiled by Donald Trump two months ago.

However, Ross sent shudders through global financial markets when he said insufficient progress had been made in talks with three of the US’s traditional allies to reduce America’s trade deficit and that the waiver was being lifted. Wall Street slumped as the Dow Jones Industrial Average closed down more than 250 points as investors sold off shares in manufacturers and corporations with global reach. Shares across Europe also declined. The move from Washington – which comes at a time when Trump is also threatening protectionist action against China – triggered an immediate and angry response from Canada, Brussels and from individual European capitals.

Juncker called the US move “unjustified” and said the EU had no choice but to hit back with tariffs on US goods and a case at the World Trade Organisation in Geneva. “We will defend the Union’s interests, in full compliance with international trade law,” he added. Brussels has already announced that it would target Levi’s jeans, Harley-Davidson motorbikes and bourbon whiskey.

Something’s working.

• China To Slash Import Tariffs On Many Consumer Products By 60% From July 1 (R.)

China will cut import tariffs on nearly 1,500 consumer products ranging from cosmetics to home appliances from July 1, in a bid to boost imports as part of efforts to open up the economy. The move would be in step with Beijing’s pledge to its trade partners – including the United States – that China will take steps to increase imports, and offers a boon to global brands looking to deepen their presence in China. The finance ministry published a detailed list of products affected and their new reduced tax rates on Thursday, following early announcements of the broader plan. Starting next month, the average tariff rate on 1,449 products imported from most favored nations will be reduced to 6.9% from 15.7%, which is equivalent to a cut of about 60%, the finance ministry said in a statement on its website.

That followed an announcement from the State Council, or the country’s Cabinet, on Wednesday that China will cut import tariffs on consumer items including apparel, cosmetics, home appliances, and drugs. The tariff cuts this time are more broad-ranging than previous reductions. Import tariffs for apparel, footwear and headgear, kitchen supplies and fitness products will be more than halved to an average of 7.1% from 15.9%, with those on washing machines and refrigerators slashed to just 8%, from 20.5%. Tariffs will also be cut on processed foods such as aquaculture and fishing products and mineral water, from 15.2% to 6.9%.

Savona comes out strong. His replacement as finance minister is no fan of the euro, and he himself is EU minister.

• Populist Government To Be Sworn In As Italy’s Political Deadlock Ends (G.)

A populist government will be sworn into power in Italy on Friday after president Sergio Mattarella agreed to a revised slate of ministers – just days after a bitter row over the incoming leaders’ stance on the euro ended their initial bid to assume power. A joint statement by the anti-establishment Five Star Movement (M5S) and the far-right League announced that political newcomer Giuseppe Conte, who had been seen as a controversial choice, would serve as prime minister. The relatively unknown law professor met Mattarella late on Thursday night to put forward a list of ministers, which the president has accepted.

“All the conditions have been fulfilled for a political, Five Star and League government,” said Luigi Di Maio, the Five Star chief, and Matteo Salvini, the League leader, in a joint statement after a day of talks in Rome. The deal will bring at least temporary calm to a political crisis that has embroiled Italy for weeks. The tumult raised questions – in Brussels and among investors around the world – about whether the rise in Italian populism and the collapse of traditional parties posed a fundamental threat to the country’s future in the eurozone.

The formation of the new government will at least temporarily allay those concerns, because it will remove for now the threat that snap elections will be called later this summer, a prospect which worried investors because it could have bolstered support for anti-EU parties. The populist leaders stepped back from their insistence that Paolo Savona, an 81-year-old Eurosceptic, should serve as finance minister. The choice had been vetoed by Mattarella, prompting the M5S and the League to call off their deal. Savona will now serve as EU minister instead. But there are still many unknowns about how the new administration – an uneasy alliance between two former political opponents, both jockeying for power – will govern Italy.

If the EU doesn’t adapt to its new reality, it’s doomed.

• Italians Back Euro But Rail Against EU’s Rules (G.)

Ever since the inception of the EU, Italians have been among the staunchest defenders of the European project. But the political crisis that engulfed the bloc’s third largest economy this week, centring on a debate over Italy’s commitment to the eurozone, has spooked investors and worried Brussels. It has raised a question that just a few years ago would have seemed unfathomable: are Italians ready to ditch the euro? The answer, like most aspects of Italian politics, is complicated. Opinion polls show that a majority of Italians – 59%, according to Eurobarometer – support the country’s continued inclusion in the eurozone. But that does not mean they want to continue to abide by the rules set by Brussels, which Italy agreed to when it adopted the currency.

Instead, more Italians are seeking a tougher and more antagonistic approach towards Brussels, after years of frustration over fiscal constraints set by the EU coupled with a feeling that Europe has abandoned Italy to cope on its own with the migration crisis. The latest Eurobarometer survey found that only 3 in 10 Italians believed their voices counted within the EU. While a full break from the EU – an “Italexit” – is not a matter of public debate (such a move is considered implausible even among the most hardline Eurosceptics), surveys show Italians generally have a dim view of the bloc. Eurobarometer found that 39% believed Italy’s inclusion in the EU was a “good thing” and 44% believed Italy benefited from being in the EU.

In March, stagnant economic growth and concerns about immigration drove voters across Italy to vote in large numbers for two populist parties – the Five Star Movement and the League, formerly the Northern League – while the most pro-EU party, the Democratic party (PD), suffered a humiliating defeat. Josef Janning, a senior policy fellow at the European Council on Foreign Relations, said: “There is no desire to exit. But there is a willingness to follow the League and the Five Star Movement and to say ‘we don’t want to follow the rules’. That seems to be the new consensus.”

It’s like he’s talking about himself.

• Juncker: Italians Need To Work Harder And Be Less Corrupt (G.)

Jean-Claude Juncker has said Italians need to work harder, be less corrupt and stop looking to the EU to rescue the country’s poor regions, in comments unlikely to ease the fraught political battle over Italy’s future relationship with Brussels. Days after the Italian president, Sergio Mattarella, defended Italy’s place in the eurozone against the country’s populist leaders, the president of the European commission said he was in “deep love” with “bella Italia”, but could not accept that all the country’s problems should be blamed on the EU or the commission. “Italians have to take care of the poor regions of Italy. That means more work; less corruption; seriousness,” Juncker said.

“We will help them as we always did. But don’t play this game of loading with responsibility the EU. A country is a country, a nation is a nation. Countries first, Europe second.” Officials in Brussels and markets around the world are awaiting the outcome of ongoing talks between Italy’s two populist leaders, Luigi Di Maio of the Five Star Movement (M5S) and Matteo Salvini of the far-right League, on forming a new government. After making the remarks during a question and answer session in Brussels, Juncker added it would be best to be “silent and prudent and cautious” this week, whenever he was asked about Italy. “I have full confidence in the genius of the Italian people,” he said.

“..the PP’s former treasurer, as well as 28 others previously linked to the party, sentenced to jail for 33 years for fraud and money-laundering..”

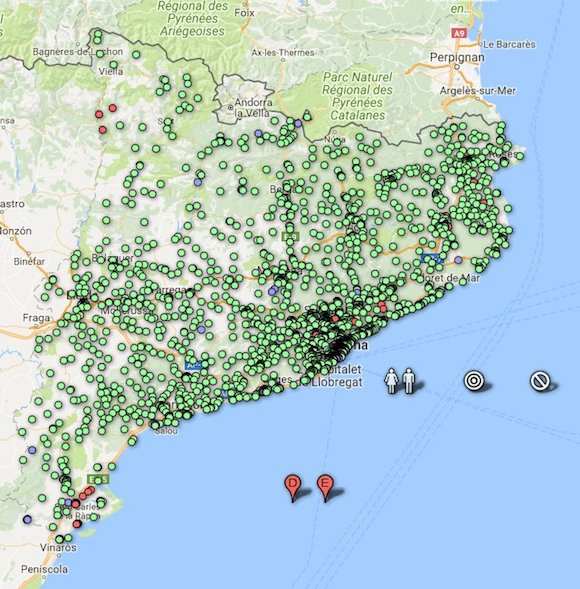

• Spain’s Government Poised To Fall As Socialists Prepare For Power (Ind.)

Mariano Rajoy’s chances of remaining Spanish Premier evaporated almost completely after the moderate Basque Nationalist Party (PNV) confirmed that its MPs would vote in favour of a parliamentary no-confidence motion against him if he did not resign. Despite its tiny number of MPs – five deputies in a 350 seater parliament – it is widely believed that the PNV’s decision will tip the balance against Mr Rajoy in a no-confidence motion, by a mere four votes. If successful, the Socialist party leader Pedro Sánchez, who tabled the no-confidence motion last week, would be automatically elected as Spanish PM, ending seven years of centre-right rule by the Partido Popular (PP) in Spain.

However, given that those voting in favour of the motion – ranging from Catalan Republican Nationalists, currently at daggers drawn with almost all Spain’s mainstream political parties, through to the left-wing Podemos coalition – have little in common beyond a desire to depose Mr Rajoy so a new government could prove highly unstable. Should Mr Rajoy lose the vote, he will be Spain’s first PM to leave office as a result of a no-confidence motion since democracy was restored to the country more than four decades ago.

[..] the impact of a court verdict last week in the so called Gurtel case, a cash-for-kickback scandal that saw the PP’s former treasurer, as well as 28 others previously linked to the party, sentenced to jail for 33 years for fraud and money-laundering, coupled with a €240,000 (£210,000) fine for the PP itself, left Mr Rajoy looking unexpectedly vulnerable.

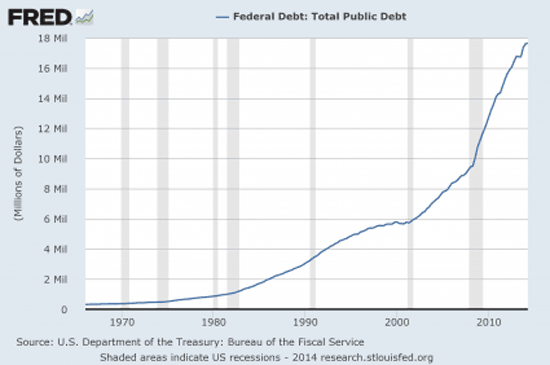

“Mum & dad are lending money to their kids so their kids can afford to pay the prices demanded by mum & dad & their friends..” “It’s like a giant Ponzi scheme but where the victims are your children.”

• UK’s “Bank of Mum & Dad” is Running Out of Liquidity (DQ)

Mortgages for 100% (or above) of the purchase price not only help fuel high-octane housing bubbles, they also make them a lot riskier when home prices decline, and when more and more borrowers end up with negative equity – where someone’s home is worth less than their debt. That, in turn, significantly raises the likelihood of borrowers defaulting on their loans. And that’s why these 100% mortgages are risky for banks. Today’s new breed of 100% mortgages has a twist in its tail: to provide the banks extra security, they are insisting on family members acting as guarantors for parts of the loans. In other words, if a borrower falls behind on repayments, a parent’s home can also be put at risk.

This kind of deal is becoming increasingly common in the UK, where property prices still remain close to their all-time high despite fears prompted by Brexit and the recent cooling of London’s property market. Underpaid and over-indebted, many young people cannot afford to put down even a 5% deposit on houses whose prices, after they’re adjusted for inflation, have almost doubled in the last 20 years. And a 10% or 15% down-payment is totally out of reach. Their only hope of getting onto the “property ladder” is to get a financial leg up from their parents.

So widespread is this phenomenon that in 2017 the so-called “Bank of Mum and Dad” became the ninth biggest mortgage lender in the UK shelling out some £6.5 billion in loans. Parents helped provide deposits for more than 298,000 mortgages last year — the equivalent of 26% of all transactions. “The Bank of Mum and Dad continues to grow in importance in helping young people take their early steps onto the housing ladder,” said Nigel Wilson, chief executive of the financial service company Legal & General.

It is not driven purely by altruism. The UK’s multi-decade property boom, propelled by artificially low interest rates and supportive government policies, has provided a huge source of wealth for baby boomers. If the Bank of Mum and Dad didn’t lend this money to the new generation, demand for new mortgages would dry up and the UK’s multi-decade housing bubble would have begun to deflate some time ago. As a result, the houses that mum and dad own would lose much of their “value” and their respective net worth would plummet. “Mum & dad are lending money to their kids so their kids can afford to pay the prices demanded by mum & dad & their friends,” explained buyers agent Henry Pryor. “It’s like a giant Ponzi scheme but where the victims are your children.”

A glimmer of hope.

• Ecuador’s President Says Assange Can Stay In Embassy ‘With Conditions’ (G.)

Lenín Moreno, the president of Ecuador, has said Julian Assange’s asylum status in the country’s London embassy is not under threat – provided he complies with the conditions of his stay and avoids voicing his political opinions on Twitter. However, in an interview with Deutsche Welle on Wednesday, Moreno said his government would “take a decision” if Assange didn’t comply with the restrictions. “Let’s not forget the conditions of his asylum prevent him from speaking about politics or intervening in the politics of other countries. That’s why we cut his communication,” he said. Ecuador suspended Assange’s communication’s system in March.

Moreno’s statements come two weeks after an investigation by the Guardian and Focus Ecuador revealed the country had bankrolled a multimillion-dollar spy operation to protect and support Assange, employing an international security company and undercover agents to monitor his visitors, embassy staff and even the British police. Over more than five years, Ecuador put at least $5m (£3.7m) into a secret intelligence budget that protected him while he had visits from Nigel Farage, members of European nationalist groups and individuals linked to the Kremlin. Earlier this month, Moreno withdrew additional security assigned to the Ecuadorian embassy in London, where the WikiLeaks founder has remained for almost six years.

Moreno has previously described Assange’s situation as “a stone in his shoe” and repeatedly hinted that he wants to remove the Australian from the country’s London embassy. In an interview in Quito, the president said granting Assange Ecuadorian citizenship in December last year had not been his idea but that of the foreign minister, María Fernanda Espinosa. He had delegated all decisions related to the case to her, Moreno told Deutsche Welle.