Dorothea Lange Broke, baby sick, car trouble, Missouri family, Highway 99, CA February 1937

There’s a persistent story that says (though I don’t think I can confirm it) that a pretty girl prefers to surround herself with less pretty girls – all in the eye of the beholder – in order to look prettier. After seeing yesterday’s -1% (-2% if you include Obamacare) US GDP ungrowth number, a fair segment of the financial press and punditry took a page out of the pretty girl playbook and ran with it. What should really be a deeply disturbing number in a 5 year old recovery (which is about 100 years in human terms) that has cost Americans trillions upon trillions in stimulus measures, is easily turned, without batting an eye, into a solid positive. The awful Q1 print, we are now told, serves to make Q2 look that much better.

I can tell you the problem with that notion with the same ease that these folk invent it. The chunk of the population that is increasingly moving towards becoming the Great American Unwashed has spent a lot of their money on winter heating and on health care costs. But the “experts” still see – since they were told to in school – huge amounts of pent-up demand – snow, don’t you know -, but it just ain’t so. The great unwashed have spent their money, and then some too. They’re not coming back for extra’s because they can’t afford any. The rosy stories about companies ‘slowing the pace of inventory accumulation’ in Q1, only to turn around and rebuilding inventories in Q2, are empty and void.

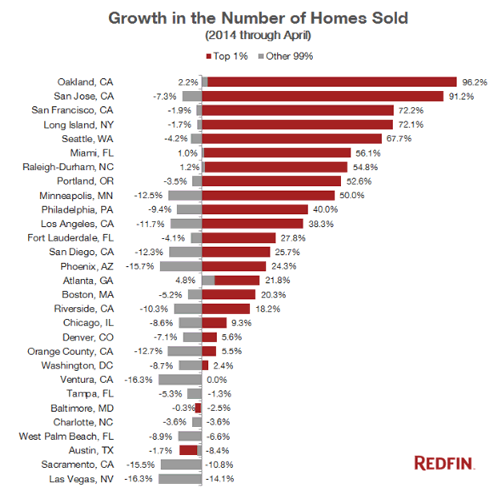

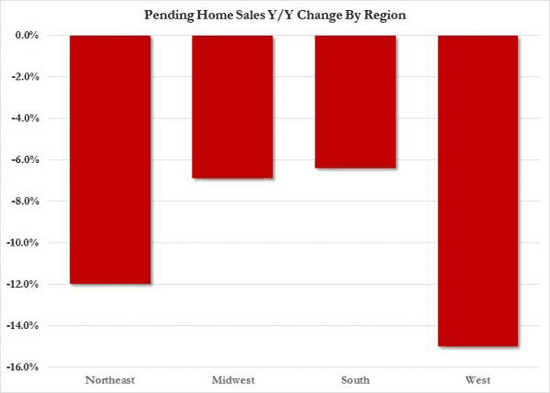

Companies didn’t leave their shelves empty because baby it was cold outside, but because they had no confidence inventory could be sold. And why would that change? US retail numbers are so bad they rival Japan’s. They missed expectations by the most in 13 years (so there hasn’t been any snow since 2001?). There’s no pent-up demand for housing either, and maybe that should be a wake-up call. In the 7th consecutive month of declining YoY sales, these are now down 9.4% YoY. Which won’t keep the industry from talking about more pent-up demand, mind you, but it’s still ugly for those who didn’t see it coming. Guys, on the ground, America is getting much poorer. That’s all there’s to it. Of course sales are still great for the 1%, but you can’t run a housing market or an economy on that.

One more number from yesterday’s GDP report that I think stands out – or should – is “Corporate profits fell at a 9.8% annual rate, the biggest decline since the 2007-09 recession”. Perhaps the pundits should try and justify that away instead of pretending they’re all such pretty girls. I mean, if you want to make the point that the US economy is in a recovery, and Q1 was just a black blimp, how do you explain that companies lost 10% of their profits since Q1 2013, the biggest loss in 5 years? Or try this on for size, hidden inside BusinessWeek’s cheerleading article: “Adding to growth was health-care spending, which, boosted by the Affordable Care Act, grew at a 9.1% pace.”

How is that growth? The average American spent 9.1% more on health care than they did last year, and that’s growth, that’s a positive? It could only be seen as that, and even then with a tome full of doubts, if those Americans had lots of cash on the side just waiting to be spent in pent-up demand, if after taking care of drugs and surgery they’d get into their newly bought vehicles, drive to the mall and see a real estate broker on the way there. Not even kids with a steadfast belief in the Easter bunny would buy it. And on top of that, heating costs went up significantly. Which is why people stayed home, and will continue to stay home, because their money’s all gone. I just, as I’m writing this, see a Bloomberg headline coming in that says “Consumer Spending in U.S. Unexpectedly Declines as Incomes Slow”. Given the above, how can that be unexpected? What do we call that, pent-up demand or job-related delusions? You got far more unemployed and underemployed Americans than official numbers tell you, you know they paid much more on healthcare and heating, and you’re surprised consumer spending is falling? Isn’t that a bit rich – or poor?

Here’s another reality checking sign, from CNBC of all places. Not something the financial press in general will be eager to confirm anytime soon, but no less timely:

Why The Days Of Booming World Trade May Be Over

The drivers that underpinned years of booming global trade, once the engine of the world’s economic growth, may be fading. In the past few decades, trade has played an increasingly important role in the growth of the global economy. But more than three years into one of the weakest recoveries in decades, slack demand from consumers in the U.S. and Europe is weighing on exports in the developing world. “Typically we would want to see trade growing at a few percentage points above growth in gross domestic product,” said Sara Johnson, an IHS Global Insight economist. “The fact that trade is so sluggish just reflects the weak nature of the global economic expansion.” But the days of rapid globalization—and the surge in trade flows it produced—are apparently gone.

Merchandise trade – the total import and exports of goods – rose steadily through the 2000s to make up nearly 53% of the world’s economy in 2008, before plunging the following year as the Great Recession went global, according to the World Bank. Massive government stimulus in the developed world helped revive growth, but as those programs wound down, global trade began declining again in 2011. With the European Union mired in a recession and the United States hit hard by a series of nasty winter storms, that slowdown picked up markedly in the first quarter of this year, according to data released this week by the OECD. On Thursday, a separate report showed that U.S. gross domestic product dropped by 1%, on an annual basis, much worse than economists expected. The U.S. economic reversal was led by a 6% drop in exports year over year, until recently hailed as a key driver of the U.S. recovery, and which had risen 9.5% in the last three months of 2013.

Deathknell, anyone? US corporate profits fell at a 9.8% annual rate, exports dropped at a 6% annual rate, and GDP is down -2%. But there’s nary an expert to be found who doesn’t claim the fundamentals are so strong that 2014 growth will be 3-3.5%. In other words, 5% or so for the rest of the year, just to make up for Q1. In sort of like the same vein, the IMF today stated that the Bank of Japan ‘may need to keep up its stimulus drive for an “extended period”‘. That’s not going to happen, though, because Abenomics has already run so far off track that consumer spending is down, consumer prices are way up, and industrial production is cratering. Not even the likes of Goldman and Barclays see the IMF’s wishes come true anytime soon. So, no, Japan doesn’t look that pretty either. That would make the US economy the ugly girl who fools herself into thinking she’s pretty because her ‘friends’ look even worse. But look into that mirror mirror on the wall, ask the question, and the answer won’t be anywhere near as rosy as the one provided by the punditry.

• Why the GDP Drop Is Good for the U.S. Economic Outlook (BW)

The U.S. economy shrank at a 1% annual rate in the first quarter, but the red ink isn’t nearly as scary as it looks. In fact, the downward blip sets the U.S. up for strong growth in the current quarter covering April to June. “As far as terrible reports go, GDP wasn’t too bad,” reads the headline on the report today by Michael Feroli, chief U.S. economist of JPMorgan Chase. Most of the decline in gross domestic product occurred because companies slowed the pace of inventory accumulation, according to data released on Thursday by the Bureau of Economic Analysis. In other words, output slowed because they weren’t producing as much stuff to go on shelves. Now companies have an incentive to speed up production to rebuild those inventories.

“The economy is in the process of reaccelerating,” David Rosenberg, chief economist and strategist at Gluskin Sheff + Associates (GS:CN), wrote to clients. He said his firm’s model of the economy “suggests near-0% odds of recession for the coming year.” Another not-to-be-repeated drag on the economy in the first quarter was poor weather. Investment in structures fell at a 7.5% rate, partly because construction workers couldn’t work effectively in the unusually excessive cold and snow. Adding to growth was health-care spending, which, boosted by the Affordable Care Act, grew at a 9.1% pace. There were some not-so-good figures in the report. Corporate profits fell at a 9.8% annual rate, the biggest decline since the 2007-09 recession. “Our guess is profits rebound in Q2,” Steve Blitz of ITG Investment Research (ITG) wrote to clients.

• Excluding Obamacare, US Economy Shrank -2% In The First Quarter (Zero Hedge)

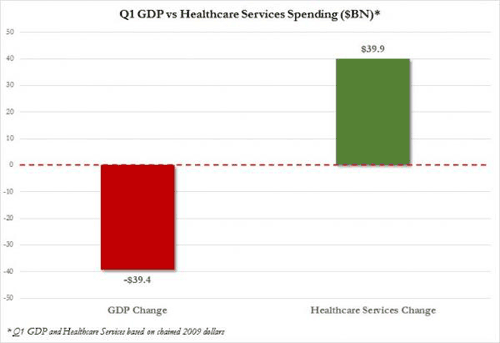

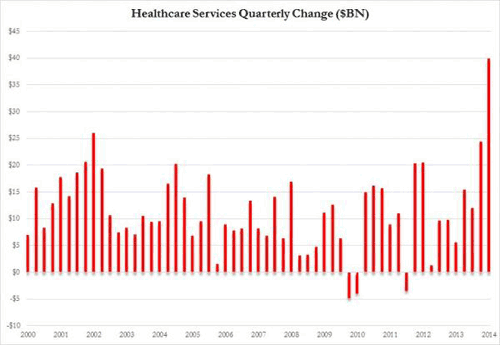

As if the official news that the US economy is just one quarter away from an official recession (and with just one month left in the second quarter that inventory restocking better be progressing at an epic pace) but don’t worry – supposedly harsh weather somehow managed to wipe out $100 billion in economic growth from the initial forecast for Q1 GDP – here is some even worse news: if one excludes the artificial stimulus to the US economy generated from the Obamacare Q1 taxpayer-subsidized scramble, which resulted in a record surge in Healthcare services spending of $40 billion in the quarter, Q1 GDP would have contracted not by 1% but by 2%! The history of healthcare spending’s contribution to GDP. The outlier needs no highlighting:

And here is the breakdown of overall Q1 GDP and just the contribution from healthcare. In other words as the “favorable boost” to the economy from this most epic instance of capital misallocation fades, expect the drag to GDP to be even more acute, and will almost certainly offset the benefits of “unharsh weather.”

• Stocks Surge To Record Highs On Worst Economic Growth In 3 Years (Zero Hedge)

One supremely smart CNBC talking head summed it all up, “today’s negative GDP number was excellent news,” and sure enough, thanks to someone’s multi-billion-dollar bid at the all-time-highs mid-afternoon, we went to the moon, Alice. Trannies are on target for their best month since October (+5.7%). The dash-for-trash has a new life as “most shorted” have now risen 6 days in a row – the biggest squeeze in over 3 months. This all happened as bonds rallied (though yields rose modestly on the day), VIX rose, USDJPY would not play along and aside from the spike in volume, on a total lack of liquidity. Gold and silver were monkey-hammered early on but limped back off their lows as WTI crude rallied from the GDP print on. The S&P 500 is now only 30 points short of Goldman Sachs June 2015 target.

• Why The Days Of Booming World Trade May Be Over (CNBC)

The drivers that underpinned years of booming global trade, once the engine of the world’s economic growth, may be fading. In the past few decades, trade has played an increasingly important role in the growth of the global economy. But more than three years into one of the weakest recoveries in decades, slack demand from consumers in the U.S. and Europe is weighing on exports in the developing world. “Typically we would want to see trade growing at a few percentage points above growth in gross domestic product,” said Sara Johnson, an IHS Global Insight economist. “The fact that trade is so sluggish just reflects the weak nature of the global economic expansion.” But the days of rapid globalization—and the surge in trade flows it produced—are apparently gone.

Merchandise trade—the total import and exports of goods—rose steadily through the 2000s to make up nearly 53% of the world’s economy in 2008, before plunging the following year as the Great Recession went global, according to the World Bank. Massive government stimulus in the developed world helped revive growth, but as those programs wound down, global trade began declining again in 2011. With the European Union mired in a recession and the United States hit hard by a series of nasty winter storms, that slowdown picked up markedly in the first quarter of this year, according to data released this week by the OECD. On Thursday, a separate report showed that U.S. gross domestic product dropped by 1%, on an annual basis, much worse than economists expected. The U.S. economic reversal was led by a 6% drop in exports year over year, until recently hailed as a key driver of the U.S. recovery, and which had risen 9.5% in the last three months of 2013.

The slackening of trade has spread to the developing world, where emerging economies are seeing less demand from the U.S., Europe and China for raw materials and other exports. [..] But even as Europe and the U.S. economies get back on track, the growth in global trade isn’t likely to return to pre-recession levels. That’s because many of the forces driving rapid globalization in the past two decades have faded. “I think we’re past the inflexion point with globalization,” Johnson said. “It’s not going to proceed at the same pace as in the early 1990s up until the recession in 2008.” That’s because the cost savings from outsourcing and offshoring have diminished. Labor costs have been rising much more rapidly in emerging economies than in the developed world, where relatively high unemployment rates have kept a lid on wage gains. For U.S. companies, falling energy costs have further narrowed the cost benefits of moving factories offshore.

• “Pent-Up” Pending Home Sales Demand Missing; Down 9.4% YoY (Zero Hedge)

But it’s the weather… nope… NAR blames excess inventory as giving people too much choice and slowing their purchasing decisions for the notable miss on both MoM and YoY sales. This is the 7th month in a row of declining YoY sales. The 0.4% rise MoM missed expectations of 1.0% as the pent-up demand from a cold winter appears to be missing in action. Of Course NAR is optimistic (but even they are cautious), “an uptrend in closed sales is expected, although some months will encounter a modest setback.” 7th month in a row of YoY declines…

For the longest time the NAR “explained” collapsing pending home sales with the weather. Well, clearly the weather in the west was horrible this year. And now it’s time to give the mic to everyone’s favorite “economist-cum-weatherman”, Larry Yun, who if nothing else is always full of hope and horrible forecasts.

Yun projects the 30-year fixed-rate mortgage to trend up and average 5.5% next year. “The extent to which higher mortgage interest rates will impact housing affordability and sales depends on income growth, ongoing improvement in the labor market and any change to mortgage underwriting conditions.”

With sub-par activity in the first quarter, annual existing-home sales are expected to be modestly below the nearly 5.1 million in 2013, but should be close to 5.3 million in 2015. The national median existing-home price is projected to grow between 5 and 6% this year, and in the range of 4 to 5% in 2015. Lawrence Yun, NAR chief economist, expects a gradual uptrend in home sales. “Higher inventory levels are giving buyers more choices, and a slight decline in mortgage interest rates this spring is raising prospective home buyers’ confidence,” he said. “An uptrend in closed sales is expected, although some months will encounter a modest setback.”

Someone please explain to Larry that higher inventory levels means more supply. We are confident even the NAR knows what more supply does to the equilibrium price.

More new normal.

• US Home Sales Booming For The 1%; Heading Down For Everyone Else (Stockman)

The absurd deformation evident in the latest data on housing bubble 2.0 sticks the fork in monetary central planning. In the attached post, Wolf Richter provides a succinct display of existing home sales on an April YTD basis versus prior year for 30 major markets. The pattern is stunning: Among homes sold to the top 1% of households, volume is up by 20-100% in most markets. By contrast, transaction volume during the last four months was down for the entire remaining 99% of the market in 26 out of 30 cities. And the bottom 99% volume was off by double digit amounts in places like Phoenix, Orange County and Los Vegas. Moreover, a quick peruse of the chart shows that the pattern of soaring volume among the 1% is not just a regional aberration owing to the social media and technology stock boom in the San Francisco Bay area.

Volume of top 1% home sales on Long Island, for example, was up by 72% during the first four months of 2014—bad winter weather notwithstanding. Contrariwise, volume among the less well insulated 99% of Long Island home buyers actually dropped below prior year levels. Likewise, it is always cold during January-April in Minneapolis and this year was apparently no exception. So it is not the weather factor which explains the 50% gain among top 1% home transactions there versus a 13% decline in transactions among the 99%. No, it was not an artic blast coming down from the polar north that explains the pattern below, but the financial storms emanating from the Eccles Building on the Potomac. To wit, the fundamental impact of ZIRP and QE has been to massively levitate the value of existing financial assets—-nearly 50% of which are owned by the top 1% of households and more than 80% by the upper 10%.

Sad?!

• Sale Pending: A Lost Generation In Home Buying (MarketWatch)

Cash is the way to go in a have and have-not real estate market that, despite its recovery, has clearly fractured down the middle, not just in San Francisco but nationally. On one side are older, wealthier buyers. On the other, less well-off, younger potential buyers who traditionally fueled the market. They’ve been left out. There are exceptions, of course. San Francisco’s new wealth is young. But in this way the city isn’t alone, a phenomenon underscored by a report issued Thursday by real estate research firm RealtyTrac. It reports that in 19 U.S. counties, home prices have surpassed pre-recession levels. You can probably guess a few of them: San Francisco, Travis County (Austin, Tex.), Jefferson County (near Denver) and Brazoria County (a wealthy suburb of Houston). A few places are close to or have surpassed record highs: San Francisco (up 11.8% since the 2012 bottom), Denver (up 16.6%) and New York City (up 11.1%).

They each have the common thread of being boomtowns. They have strong, mostly tech-driven economies. Those places are outliers in a nation where just a few years ago housing prices were on a meteoric rise. Today, areas without a significant tech economy have yet to experience a meaningful rebound. Even when including the hot markets, sales volume is either flat or lower — volume fell in 28 of the 50 biggest metro areas, RealtyTrac found — and some previously strong markets have cooled considerably. Among them: Jacksonville, Fla. (down 17% from a year ago), Tampa, Fla. (down 19%) and Tucson, Ariz. (down 15%). And then there are the real laggards: states such as Illinois, Michigan, Nevada and Florida, where distressed sales and foreclosures still make up at least one out of five transactions.

This uneven recovery isn’t surprising. Real estate has always been a business where local economies drive prices. It was only in the bubble years of the 2000s that everyone seemed to be becoming their town’s own Donald Trump. And you know how that turned out: penthouse to poorhouse. What’s unique about today’s limited recovery in non-tech areas is who’s participating. The typical homebuyer today is generally older and wealthier. They’re wealthier because 31% of all U.S. sales were all-cash in the first quarter, a number that’s on the rise, up from 29% in 2012, according to the National Association of Realtors. The association noted that older buyers “trading down” to smaller homes may be driving the move as investors, including hedge funds, pull back. They represented just 20% of buyers in 2013, down from 24% the previous year, NAR said. Unlike in previous recoveries , where they made up 40% of sales, young buyers are mostly shut out.

• IMF Says Japan May Need Monetary Easing For “Extended Period” (AFP)

The Bank of Japan may need to keep up its stimulus drive for an “extended period”, the International Monetary Fund said Friday, as it warned again that Tokyo must follow through on promised economic reforms. Fears that a recent sales tax rise would dent a recovery in the world’s number three economy have boosted speculation that the BoJ would be forced to expand its monetary easing campaign to counter any downturn. The Washington-based IMF said that the bank’s target to reach 2.0% inflation by next year – aimed at conquering years of falling prices which held back growth – would most likely be reached by 2017 instead.

“The BoJ should act quickly if actual or expected inflation stagnates or growth disappoints,” the Fund said in its annual review of Japan’s economy. “The current aggressive pace of monetary easing may need to be maintained for an extended period.” The IMF has been upbeat on Prime Minister Shinzo Abe’s policy blitz — a mixture of big government spending and central bank monetary easing dubbed Abenomics, which is designed to drag the economy out of years of deflation and laggard growth. But the plan’s so-called “third arrow” — reforms that include more flexible labour markets and free-trade deals — have been more talk than action so far.

• Japan’s Industrial Production Falls 2.5% In April (AFP)

Japan’s factory output fell 2.5% in April from a month earlier after a tepid 0.7% rise in March, data showed Friday. “Industrial production appears to be flat,” the ministry of economy, trade and industry said in a statement, downgrading its view from March when it said production continued to “show an upward movement”. Retail sales had got a strong boost ahead of an April 1 sales tax rise – Japan’s first in 17 years – as shoppers made a last-minute dash to buy staples and big-ticket items such as cars and refrigerators. But spending turned down after the levy hike, weighing on activity and exacerbating worries that the higher taxes would weigh on consumer spending and a wider economic recovery. Industrial output grew at its fastest rate in more than two years in January before losing steam. A survey of manufacturers released with the data Friday showed they expect factory production to expand by 1.7% on-month in May before contracting by 2.0% in June.

• Abenomics Crashes, Economy Sputters, Inflation Soars, QE Off Table (Zero Hedge)

Following last night’s record plunge in Japanese retail sales, tonight was another slew of crushingly bad data for Abe and his motley crew of money printers to reflect on. First Household Spending cratered -4.6% YoY – its biggest drop since the Tsunami (and markedly worse than expectations which were bad enough due to the tax hike repurcussions). Then, Industrial Production tumbled -2.5% MoM – its biggest drop since the Tsunami (considerably worse than the 2.0% drop expected and the slowest YoY growth in 8 months). While this would typically be the kind of bad news that is great news for QQE-hopers, it was disastrously capped by a surge in Japanese CPI (well above BoJ target 2% levels) crushing moar-easing hopes as Barclays see no further easing in 2014 (and even Goldman pushes any hope off till October at the earliest).

Blow it up already.

• China’s ’Mini’ Stimulus Starts Expanding (Bloomberg)

China’s so-called mini-stimulus is beginning to morph into something larger. Nomura Holdings Inc. economists said measures including central bank loans for low-income housing are “starting to amount to something quite significant” as they scrapped their forecast for a second-quarter cut in banks’ reserve requirements. UBS AG said the government has gradually strengthened its mini-stimulus over the past couple of months and the central bank “has quietly eased liquidity conditions.”cThe ruling Communist Party is trying to revive the economy without repeating the mistakes of its $586 billion stimulus begun in 2008, which caused a record buildup of debt and inflated property bubbles around the country.

Premier Li Keqiang last week called on regional authorities to help stabilize expansion as he seeks to ensure that the government meets its goal of about 7.5% growth. “It’s definitely getting bigger,” said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. “That’s quite natural, as Premier Li Keqiang has urged local governments to show real action.” Increases in housing and railway investment alone should boost gross domestic product growth by 0.8%, Nomura said in a May 26 report. Dariusz Kowalczyk, senior economist at Credit Agricole SA in Hong Kong, estimated that the government’s quantifiable stimulus steps will add 1%age point to expansion, while UBS Chief China Economist Wang Tao said measures amount to 0.6% of GDP.

” … available for a two-and-a-half-week period only” …

• China Developers Offer Zero Down Payment, Buy One Floor Get One Free (WSJ)

On an empty street in a remote suburb of Beijing, a huge golden unicorn stands guard over Season Joy City, a half-finished development of a dozen tower blocks set in 50,000 square meters of manicured parkland. About a third of the apartments are sold, but with increasing signs that China’s property market is turning sour, the developer behind the project is trying to hurry things along. Season Joy City offers a party bag of bonuses to lure potential buyers. The development’s original selling point was “buy one floor, get one free.” When China Real Time visited last week, helpful sales assistants also offered to throw in kitchen fittings and four air conditioning units for nothing.

But the biggest draw is a “zero down payment” scheme, available for a two-and-a-half-week period only. At first sight this seems to go against government regulations, brought in to keep house prices under control, which stipulate a minimum 30% down payment on ordinary residential purchases. Zero down payment schemes have popped up around China as developers go to ever greater lengths to shift apartments, but Season Joy City may have the distinction of being the first to try it in Beijing, said Tang Li, an analyst at North Square Blue Oak, an investment bank. “They will help homebuyers to apply for this consumer loan that they can use as a down payment,” said Mr. Tang. “It’s very difficult to judge whether this is in line with the regulations or not. So far there’s been no punishment from the government.”

• Greece’s Tsipras Calls Farage Monstrosity Created by Austerity (Bloomberg)

Greece’s main opposition leader distanced his group from other protest parties that made gains in the European elections, calling the U.K. Independence Party and the National Front in France “monstrosities.” Alexis Tsipras, who rocked international markets when he emerged as the political force to counter now-Prime Minister Antonis Samaras in Greek elections two years ago, said on May 28 his Syriza party is “an oasis in this desert.” “We are a pro-European force that wants to change Europe, not dismantle it,” Tsipras, 39, said in his first interview since winning Greece’s European elections on May 25. “Austerity has led to the creation of political monstrosities.”

Voters across Europe deserted the parties that held power during the economic crisis as unemployment across the 28-nation bloc increased to a record last year. While UKIP leader Nigel Farage and France’s nationalist leader Marine Le Pen want to roll back European powers to protect the interests of the British and the French, Tsipras said his Syriza party is focused on transforming EU policy. Syriza, a Greek acronym for Coalition of the Radical Left, got 26.6% in the election, compared with 22.7% for Samaras’s governing New Democracy party.

True.

• Blame the Euro for Europe’s Extremists (Bloomberg)

An “earthquake” is what French Prime Minister Manuel Valls called the election results for the European Parliament in his country, and other countries are feeling the tremors. One news recap summarized the outcome this way: “Across the continent, anti-establishment parties of the far right and hard left more than doubled their representation, harnessing a mood of anger with Brussels over austerity, mass unemployment and immigration.” Europe’s political elites have only themselves to blame for the public’s increasing anger with them. Saddling much of the European Union with a single currency, the euro, has been a quintessentially elite project, pushed by the great and good over the objections of wary populations. The euro has turned out to be a big mistake for many of those countries, one compounded by the perverse way the European Central Bank has managed it.

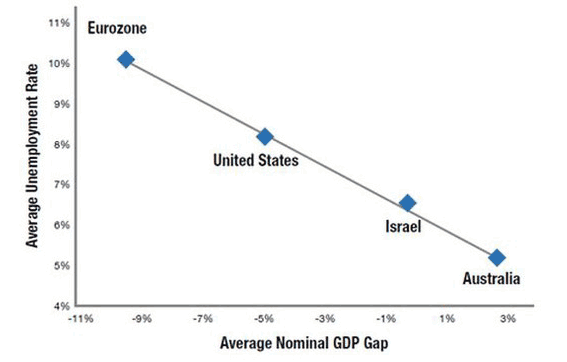

It was a mistake, first, because the countries of the euro area needed different monetary policies, which they couldn’t have within the same currency. For much of the euro’s history, the ECB has set monetary policy in a way that was appropriate for the German economy, but first too loose and then too tight for other countries. Since the financial crisis hit in 2008, the ECB has been much too tight. In a recent issue of National Review, the economist David Beckworth and I looked at the performance of several economies over the past few years. We noted that the more a central bank had done to keep nominal spending growing at a steady rate, the better the economy had performed.

Australia, for example, kept nominal spending on its pre-crisis path and did well. The U.S. allowed nominal spending to fall sharply and then grow slowly, and its economic performance has been mediocre. In the euro area, though, the ECB allowed a gap between nominal spending and its trend path to open up and then keep expanding. It even raised interest rates, tightening monetary policy, as this gap grew. The high unemployment enraging so many voters in Europe is in large part a result of disastrous monetary policy. Throughout this crisis, however, Europe’s leaders have seemed more intent on preserving the single currency than on making it less of a burden for the inhabitants of the euro area. The only thing that’s surprising about the political earthquake in Europe is how mild it has been. So far.

Oh the mystery!

• ‘Mysterious’ Bond Market Move Could Continue (CNBC)

Traders blame the surge in Treasury buying this week on everything from short covering and China buying to a flight to safety amid global economic jitters. But Rick Rieder, BlackRock’s co-head Americas fixed income, said it’s likely a confluence of factors, noting the trend may have turned on the front end. He expects the 10-year yield to rise to 3.0-3.25% by year-end. The move comes as global rates fall and the U.S. market looks attractive relative to German Bunds and Japanese government bonds, he said. [..] Traders said part of this week’s rally is the result of buying from Asia and portfolio managers picking up Treasurys before month-end. Short covering and re-positioning by portfolio managers who were under-invested in bonds this year are also at play, they said.

But Marc Chandler, chief currency strategist at Brown Brothers Harriman, pointed out that investors are actually adding shorts. He said the latest Commitment of Traders data shows that in the week ended May 20, gross short positions on 10-year futures contracts rose by 26,100 contracts to 529,000 contracts – the most since 2004/2005. “Rather than reduce short positions, the bears sold into the rally,” he noted. The Fed is another source of pressure on rates as its balance sheet has ballooned to $4 trillion. But as long as inflation stays low, and the Fed is unhappy with the employment situation, it will likely hold the Fed funds rate at zero until the second half of 2015. “I think the markets are now pricing in that the Fed can’t move and wouldn’t move for any period of time, and I think that’s been overdone in the front end,” Rieder said.

With bonds rallying and stocks hitting new highs, some traders view the divergence from their typical inverse correlation as a signal that one market may have the message on the economy wrong and will have to correct. The S&P 500 rose 10 points, or 0.5% to 1920, a new closing high Thursday, while the Dow edged up 65 points to 16,698. “It’s been a very mysterious move. I think there’s a series of catalysts and technicals that explain it,” Rieder said. “The number of people from the buy side, the sell side, the equity people that were confounded by this move was pretty amazing.” Stock traders were worried about low rates, but better economic data this week helped the market shake off concerns that the bond market’s performance signaled a slowdown. Rieder said the drop in yields should be good for stocks, as it allows companies to borrow cheaply for many purposes, including stock purchases.

How about gambling?

• Drugs And Prostitution To Be Included In UK National Accounts (Guardian)

George Osborne famously declared “we are all in this together” when it comes to Britain’s prosperity. The Office for National Statistics has now taken him at his word, adding up the contribution made by prostitutes and drug dealers. For the first time official statisticians are measuring the value to the UK economy of sex work and drug dealing – and they have discovered these unsavoury hidden-economy trades make roughly the same contribution as farming – and only slightly less than book and newspaper publishers added together. Illegal drugs and prostitution boosted the economy by £9.7bn – equal to 0.7% of gross domestic product – in 2009, according to the ONS’s first official estimate.

A breakdown of the data shows sex work generated £5.3bn for the economy that year, with another £4.4bn lift from a combination of cannabis, heroin, powder cocaine, crack cocaine, ecstasy and amphetamines. According to the estimates there were 60,879 prostitutes in the UK in 2009, who had an average of 25 clients per week – each paying on average £67.16 per visit. There is also detailed data on drugs. The statisticians reckon there were 2.2 million cannabis users in the UK in 2009, toking their way through weed worth more than £1.2bn. They calculate that half of that was home-grown – costing £154m in heat, light and “raw materials” to produce. The ONS will work in the coming months to bring the data more up to date. The figures will then be included in the broad category of household spending on “miscellaneous goods and services” alongside life insurance, personal care products and post office charges.

Nope.

• Will the ECB Get the Euro Right? (El-Erian)

The euro’s appreciation over the past couple of years is largely a good sign, reflecting the ECB’s success in restoring confidence and stabilizing financial markets. Unfortunately, it has also gone too far due to developments elsewhere that affect currency markets, including in the U.S., Japan and emerging economies. As such, the strength of the euro has become an obstacle to converting Europe’s financial gains into durable economic improvements. ECB officials have joined government officials in signaling concern about the euro’s overappreciation, and not only because of its effect on competitiveness, growth and jobs. Another worry is that the currency is contributing to “lowflation” – that is, inflation that has been too low for too long. If people and companies lower their medium-term inflationary expectations in response, the phenomenon could become chronic, increasing the burden of debt, moderating demand and further complicating Europe’s recovery.

The varied concerns help explain the broad range of measures said to be under consideration for the next meeting of the ECB’s Governing Council, including an interest rate cut, stronger forward policy guidance, quantitative easing, credit easing and even selected negative interest rates. The moves, if implemented, would take the ECB to a very unusual place. In addition, the central bank would be loosening monetary conditions at a time when the Federal Reserve is removing accommodation through the reduction, and likely elimination, of its monthly purchases of securities. Indeed, the Bank of Japan could end up being the only systemically important central bank with a more accommodative monetary policy, if that.

Ditto for America.

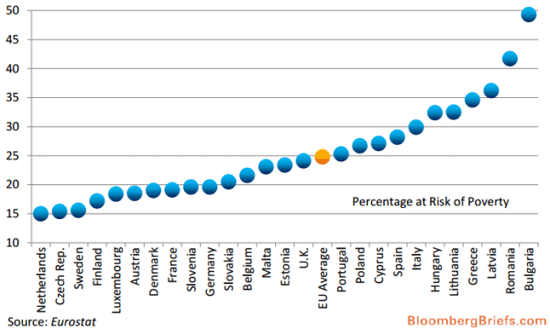

• A Quarter Of Europeans Are At Risk Of Poverty (Zero Hedge)

Wondering why the extreme left (we are not happy and need moar bailouts) and extreme right (this European ‘union’ thing is not working out so well for us) have become so euro-skeptic? Perhaps the following chart from Bloomberg Brief’s Niraj Shah will clear up any questions. The ratio of people at risk of poverty or social exclusion in the EU increased by 0.5 percentage points in 2012 to 24.8% or 124.2 million people, according to figures updated this week. The risk increased most in bailed-out nations Greece and Cyprus, where the rate rose by 3.6 and 2.5 percentage points, respectively. The Netherlands had the lowest risk at 15%.

Blah blah.

• U.S. to Seek More Than $10 Billion Penalty From BNP Paribas (Bloomberg)

U.S. authorities are seeking more than $10 billion from BNP Paribas to settle federal and state investigations into the lender’s dealings with sanctioned countries including Sudan and Iran, according to a person familiar with the matter. A final deal is probably weeks away, said the person, who asked not to be identified because the talks aren’t public. The amount to settle has escalated: the bank said in April that it might need to pay far more than the $1.1 billion it had already set aside for the case. BNP Paribas dropped as much as 6.1% in Paris trading, the biggest decline in 15 months.

Prosecutors are also pressuring the company to plead guilty to moving funds for clients in violation of sanctions against Sudan, Iran and Cuba, people familiar with the matter have said. The settlement could be the largest criminal penalty in the U.S., eclipsing BP Plc’s $4 billion accord with the Justice Department last year. Jean Pierre Lambert, an analyst at Keefe, Bruyette & Woods, said in a May 21 report that he expected BNP to pay a fine of about $7 billion to avoid being excluded from the U.S. dollar payment system. Last week, Bloomberg News reported that prosecutors were seeking more than $5 billion.

Higher heating bills? You ain’t seen nothing yet.

• Calls For End To Crude Oil Export Ban Are Getting Louder (CNBC)

The United States could create nearly a million jobs and lower its domestic energy bills if it ended its crude oil export ban, two reports said on Thursday. Both the American Petroleum Institute—which represents oil producers—and research firm IHS made the case for the U.S. shipping some of its oil supplies abroad, even as consumers struggle with higher prices at home. The API study predicted broad-based economic gains if the oil ban were lifted, repeating its assertion that exporting oil would economically benefit not only oil-producing states but other states as well. The restrictions originally came about during the energy crises of the 1970s. (Since then, the Commerce Department has made exceptions for certain types of oil, but they amount to a total of fewer than 100,000 barrels per day in exports, according to data from the EIA.)

“There are significant consumer benefits to exporting crude,” Kyle Isakower, API’s vice president for regulatory and economic policy, said on a conference call with reporters. “There is a growing realization that this is a new era for American energy.” The studies come as America is producing more oil and gas than it has in nearly 40 years, and Congress is weighing legislation that would ease restrictions on exports. However, increased output has yet to result in lower energy prices domestically, as gasoline and natural gas prices have put a strain on consumers nationwide. The API acknowledged as much on the call, but argued that shipping more U.S. oil abroad would help ease international prices—the primary mechanism by which retail gas prices are set.

No way back.

• NSA Releases Snowden Email After Denying Its Existence (RT)

Former National Security Agency contractor Edward Snowden did raise questions with top NSA lawyers, the agency admitted on Thursday. Snowden responded by saying the released emails are incomplete, and that NSA misdirection “raises serious concerns.” The Office of the Director of the National Intelligence announced through its website on Thursday that it has located a lone email inquiry sent by Mr. Snowden in April 2013 to the Office of General Counsel, confirming in part allegations the former contractor made during an interview with NBC’s Brian Williams that aired Wednesday evening. “I actually did go through channels, and that is documented,” Snowden told Williams when the two sat down in Moscow for an interview recently. “ The NSA has records, they have copies of emails right now to their Office of General Counsel, to their oversight and compliance folks, from me raising concerns about the NSA’s interpretations of its legal authorities.”

“I would say one of my final official acts in government was continuing one of these communications with a legal office. And in fact, I’m so sure that these communications exist that I’ve called on Congress to write a letter to the NSA to verify that they do,” Snowden said. Yet the NSA has, until now, denied the existence of any such correspondence. In fact, previously the agency said any such emails simply couldn’t be found. “After extensive investigation, including interviews with his former NSA supervisors and co-workers, we have not found any evidence to support Mr. Snowden’s contention that he brought these matters to anyone’s attention,” the NSA said last year. [.] This past March, Snowden testified before the European Parliament that he had reported “clearly problematic programs to more than ten distinct officials, none of whom took any action to address them,” before he took a trove of classified NSA documents and supplied them to national security journalists.

Thursday’s blog post from the ODNI falls short of confirming that he reached out to ten individuals, but it does for once discredit the NSA’s earlier statement concerning Mr. Snowden’s supposed failure to speak out about his issues through the appropriate channels. In the April 5 email, the ODNI wrote, Snowden “did not raise allegations or concerns about wrongdoing or abuse, but posed a legal question that the Office of General Counsel addressed.” Indeed, the email published on the ODNI’s blog shows that one month to the day before the first news articles based off of his leaks was published, Snowden pushed the Office of the General Counsel for answers about the hierarchy of governing authorities and documents.

No escape?

• Half Of All US Adults Hacked In Last 12 Months (RT)

Online computer hackers have infiltrated and exposed the personal information of 110 million Americans – nearly half of the US adult population – over the last year alone, according to an alarming new report. The study – formulated by researchers at the Ponemon Institute, which measures data collection and information security in the public and private sectors – also determined that the number of hacked accounts belonging to those individuals numbered at or near 432 million. Many of the people victimized may have inadvertently made available to hackers their names, debit or credit card information, email addresses, phone numbers, birth dates, passwords, security questions, and possibly their physical home addresses, according to CNN Money, which commissioned the study.

The news that so many people have been hacked comes on the heels of a series of vast security flubs at popular companies like Target and eBay. Target was the victim of a malware attack that compromised no less than 40 million credit card numbers (along with 70 million addresses, phone numbers, and other identifying materials) through the height of the holiday shopping season. Snapchat admitted that five million user accounts were hacked, and 33 million Adobe users’ credentials were also taken (along with more than three million stolen debit and credit card details).

Home › Forums › Debt Rattle Mat 30 2014: The Pretty Girl and the US Economy