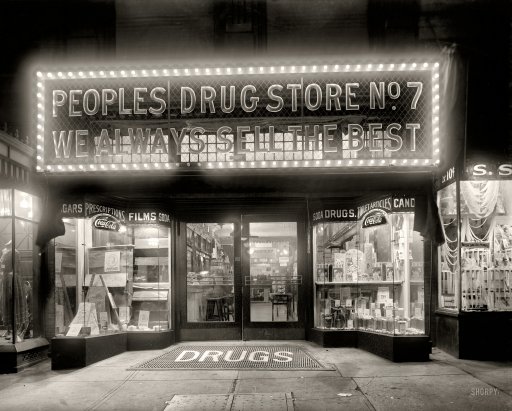

NPC People’s Drug Store, 11th & G streets, Washington DC 1920

Anyone who still calls himself an investor doesn’t understand what goes on.

• After Six Years, U.S. Stocks are Back to Normal: Chaos (Bloomberg)

Nobody said waking up from six years of Federal Reserve-induced slumber would be easy In stocks, volatility is back. The Standard & Poor’s 500 Index, which never went more than three days without a gain in 2014, has twice fallen five straight times since January. Daily equity moves exceeding 1% have jumped 50% from last year and shares tumbled 3% or more over four different stretches in the first quarter. What seems like chaos is a return to normalcy for 70-year-old investor Chris Bertelsen, who says the end of Fed stimulus is long overdue in a market that has tripled since 2009. Volatility indicators bear a resemblance to 2007, the final year of the previous bull market – which this one now exceeds by 12 months.

“We are so skewed by the readily available quantitative easing and that was the abnormal,” said Bertelsen, chief investment officer of Global Financial. “For many investors, particularly those that haven’t seen a period of time like this, it does create queasiness.” The market hasn’t been this turbulent since the European debt crisis three years ago as volatility in currency and energy markets spill over to equities and Fed policy makers signal a rate increase by mid-year.

Less than three months into 2015, the market has seen 15 days when the S&P 500 rose or fell 1% or more, compared with 10 days a quarter in 2014. While the index is little changed for the year and has gone 41 months without a 10% tumble, it’s had more retreats of at least 3% than any time since 2011, data compiled by Bloomberg show. After swinging 0.53% a day in 2014 in the calmest year since 2006, the S&P 500’s daily move has widened to 0.71%, versus the average of 0.76% since 1928. “What we’re seeing in the market today is a preview that this is going to a more volatile year and investors should be positioned,” said Jim McDonald at Northern Trust.

Amen, brother.

• Indeed This Time Is Different: Because It’s Far Worse (Mark St.Cyr)

Suddenly the narrative that “everything is awesome” is showing to not be as “awesome” as it was first proclaimed. Merely a few months have passed since the ending of QE and praises of awesomeness everywhere are morphing into questions more akin to “Oh no: not again!” And with that we are now watching those who pushed, pulled, and levitated that narrative scramble desperately to push another narrative back onto the stage that worked so many times before: “Every sell off over the last 6 years has shown to be a profitable buying opportunity.” i.e., Just buy the dip (JBTFD). Yet it would seem these dips; are far different.

Just for context, over the past week, if you were one of the few remaining “home-gamers” still watching CNBC™, you would have been delighted to see once again their host Jim Cramer go through great pains to explain why he discounts the idea that we’re in a bubble to once again like ringing a bell (he uses buzzers and gongs I believe) the indexes sell off in dramatic fashion bringing back memories of Bear Sterns. As of today any gains for the year have been quelled. But not too worry, for he also contends you should have “dry powder” at the ready. i.e., Be ready to “JBTFD.” My thoughts? “Investing” isn’t going to be so easy this time. Why? Let me be so bold to use the same meme touted by the likes of those who sold it: Because, it truly is – different this time. Without QE, not only is there no one buying.

What’s far, far, far, (did I say far?) worse is: There’s no one to sell too! Effectively through the interventionist policies over the last 6 years via the QE program what the Fed. has accomplished, whether intentionally, or merely complicit in the results were: to systematically exterminate the dreaded “Short sellers.” Today everybody is currently on one side of the market. And that side is: long. The dreaded “Bears” that would even out the markets taking positions on the other side are all about gone. Every empirical statistics, every indicator measured whether it be Investor Intelligence™ data and the like shows, historically – they’ve never been so lopsided. Ever! But that’s only the beginning.

Great rundown.

• It’s Time For A Criminal Probe Into Tim Geithner’s Leaks As Fed Vice Chair (ZH)

Back in January 2013, when looking at the Fed’s 2007 transcripts we stumbled upon something which in a non-banana republic would be the basis of a criminal investigation. What happened, in a nutshell, is that at precisely 8:00 am on August 17, shortly after the infamous Goldman (and other) quant fund blow ups of the summer of 2007 shook the markets, in an attempt to halt the panic selloff in stocks, the Fed announced the following:

To promote the restoration of orderly conditions in financial markets, the Federal Reserve Board approved temporary changes to its primary credit discount window facility. The Board approved a 50 basis point reduction in the primary credit rate to 5-3/4%, to narrow the spread between the primary credit rate and the Federal Open Market Committee’s target federal funds rate to 50 basis points. The Board is also announcing a change to the Reserve Banks’ usual practices to allow the provision of term financing for as long as 30 days, renewable by the borrower. These changes will remain in place until the Federal Reserve determines that market liquidity has improved materially. These changes are designed to provide depositories with greater assurance about the cost and availability of funding. The Federal Reserve will continue to accept a broad range of collateral for discount window loans, including home mortgages and related assets. Existing collateral margins will be maintained. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York and San Francisco.

Why was this abnormal, and why should it be the basis for a criminal inquiry? Simple. As we also wrote previously, hours before the Fed officially announced its primary credit rate cut, the market soared by a whopping 40 points just after 2 pm without any actual public news crossing the tape.

In other words, someone leaked the Fed’s decision to a select few just around 2 pm on Thursday, August 16, which can be further confirmed by the continuation of the market’s exuberance in the moments following the Fed’s announcement. This is a bold accusation, and one we wouldn’t make if none other than the Fed subsequently had confirmed that a member of the FOMC had indeed leaked the news of the upcoming rate cut. The leaker in question: the Vice Chairman of the Federal Reserve and then-head of the NY Fed, Tim Geithner himself. From the August 16, 2007 transcript (page 13 of 37) of the conference call preceding this announcement:

MR. LACKER. If I could just follow up on that, Mr. Chairman.

CHAIRMAN BERNANKE. Yes, go ahead.

MR. LACKER. Vice Chairman Geithner, did you say that [the banks] are unaware of what we’re considering or what we might be doing with the discount rate?

VICE CHAIRMAN GEITHNER. Yes.

MR. LACKER. Vice Chairman Geithner, I spoke with Ken Lewis, President and CEO of Bank of America, this afternoon, and he said that he appreciated what Tim Geithner was arranging by way of changes in the discount facility. So my information is different from that.

CHAIRMAN BERNANKE. Okay. Thank you. Go ahead, Vice Chairman Geithner.

VICE CHAIRMAN GEITHNER. Well, I cannot speak for Ken Lewis, but I think they have sought to see whether they could understand a little more clearly the scope of their rights and our current policy with respect to the window. The only thing I’ve done is to try to help them understand—and I’m sure that’s been true across the System—what the scope of that is because these people generally don’t use the window and they don’t really understand in some sense what it’s about.

“..the words “our boys didn’t die on the beaches of Normandy for this” have been used in conversations between the State Department and the German foreign ministry.”

• Germany And Greece Should Look To Goethe To Resolve Their Standoff (Guardian)

The Greek rebellion against Turkish rule, which began in 1821, threatened to upset the entire diplomatic balance of the western world. It flew in the face of the treaty signed by the so-called Holy Alliance (Russia, Austria and Prussia) to suppress revolutionary movements in Europe. Plus it violated the German enlightenment’s ideal of freedom, which was understood as deriving from the rule of law. Under the influence of the philosopher Kant, the Germans who built central Berlin as an off-white replica of Athens believed all freedom came from obeying authority.

The Greeks fighting the Turks in a dirty war, revelling in their image as brigands and urging revolt across Europe, were seen in the Germany of the 1820s much as the German electorate views hordes of radical Greek youth punching the air and singing Katyusha – with distaste. So Goethe, initially, opposed the Greek revolt. He feared Russian power would fill the vacuum if the Turks were beaten. And beyond that he feared it would spark further outbreak of revolution in Europe. What changed Goethe’s mind was the death of Lord Byron, fighing on the Greek side in 1824. In a sudden surge of creativity Goethe set to work on his unfinished drama Faust, modelling the central character now on Byron himself, and turning the second half of the work into a meditation on the nature of freedom.

His U-turn reframed the Greek “rulebreaking” problem within a broader set of rules: the Christian west versus the Ottoman Empire. Goethe declared his support for the Greeks, in opposition to the will of his political masters in Germany. Today, there are a growing number of diplomats in the Anglo-Saxon world who wish Angela Merkel would do a similar volte-face. The Germans’ intransigence on the Greek debt crisis is rooted in the same philosophical stance that initially guided Goethe’s generation: namely, that freedom derives from conformity to authority and the rules. But there was always another idea of freedom in the west – the one espoused by republican France, radical Britain and revolutionary America: that freedom exists in opposition to authority, and that the ultimate human right is to destroy the established order.

It’s strange to see a 200-year-old philosophical debate played out in the diplomatic backchannels of Nato, but that’s what is happening. If Germany’s cultural centre in Athens does end up draped in the banners of the anarchist left, then – in a way – it will be a fine testimony to the relevance of Goethe himself. And yet another example of the troubled psyche of this place called Europe.

“The conclusion is inevitable: the best way to avoid a Grexident is to prepare for a Grexit.”

• Greek Currency Crisis Calls For Controlled Exit (Münchau)

When German economic illiteracy meets with Greek diplomatic illiteracy, nothing good will come of it. Last week, a Greek minister threatened to swamp Germany with Islamic refugees. The Germans are again debating an accidental Greek exit from the eurozone: Grexident. Alexis Tsipras, the Greek Prime Minister, linked a claim about Second World War reparation payments against Germany to present discussions on the extension of a loan agreement. The reparations claim itself is not frivolous. There are even German lawyers who believe Athens has a case. But it is politically mad to link the two. What we are hearing is not the usual noise: there is a loss of trust. The conclusion I draw from this is that the odds of a Greek exit from the eurozone have shortened dramatically in the past two weeks.

The two sides may tone down their rhetoric in the coming days but I cannot see the creditor countries relenting on the conditions of last month’s debt rollover agreement. Nor can I see the Greek government fulfilling them. Since nobody knows how many days or weeks Athens is from insolvency, the risk of a sudden exit is clear and present. Grexit may never happen – but it is time to get ready. Grexit is not an outcome any rational person would wish for. It will undermine the EU’s geostrategic influence. Economically, it will unmask a hidden truth: that the monetary union is just a beefed-up fixed-exchange system. A large number of financial contracts would instantly default. It is unclear how the global financial system would cope. The eurozone’s fledgling economic recovery would be at risk.

For Greece, an exit may well work in the long run if it is well managed, but it will bring economic misery in the short term. The country is still running a current account deficit, meaning it is reliant on external funding to support domestic consumption. That funding may disappear from one day to the next, should Greece default on its creditors. A preparation for Grexit is not about a Plan B in the top drawer. It means a pre-agreed sequence of actions ready to be implemented. A changeover of a currency regime within a short period of time constitutes an organisational and logistical challenge that goes beyond anything normal states ever do. I would advise against a cold turkey switch into a new currency regime – one that would replace the euro with a new drachma. I doubt this is logically feasible or economically desirable. I would opt for a transitory regime, a smoke-and-mirrors version where nobody knows precisely whether Greece is in or out.

Crystal clear.

• If Greece Leaves Eurozone, Spain And Italy Would Be Next – Minister (ToM)

If Greece were to leave the eurozone, Spain and Italy would also end up quitting the common currency bloc, Greek Defence Minister Panos Kammenos told German newspaper Bild in an interview published yesterday. “If Greece explodes, Spain and Italy will be next and then at some point, Germany. We therefore need to find a way within the eurozone, but this way cannot be that the Greeks keep on having to pay,” he said, according to an advance extract of the broad-ranging interview. He also said Greece did not need a third bailout but rather “a haircut like the one Germany also got in 1953 at the London debt conference”. Athens and Berlin have become engaged in a war of words and Greece has submitted a formal protest to the German Foreign Ministry, accusing Finance Minister Wolfgang Schaeuble of having insulted his Greek counterpart, Yanis Varoufakis.

Schaeuble denies having called Varoufakis “foolishly naive”, as reported by some Greek media. On Schaeuble, Kammenos was quoted as saying: “I don’t understand why he turns against Greece every day in new statements. It’s like a psychological war and Schaeuble is poisoning the relationship between the two countries through that.” The relationship has already been strained by Berlin’s tough stance on Greece’s debt crisis. Kammenos said Schaeuble needed to put up with the new Greek government because it had been elected by the Greek people. He accused Berlin of interfering in Greek domestic affairs, adding: “I get the feeling that the German government is out to get us and some really want to push us out of the eurozone.”

Last week Greece renewed its campaign to seek compensation for the Nazis’ brutal occupation in World War II, an issue Berlin says was settled decades ago. Kammenos called for reparations in the interview, saying, “The gold that the Nazis took to Berlin from Athens was worth a lot of money. We expect compensation for that and also for the forced loan and the destruction of archaeological statues.” Kammenos also suggested Greece would stop taking refugees in the case of a “forced” Greek exit from the eurozone. “Then no agreements would be valid anymore, no treaties, nothing. We would no longer be obliged to take in refugees as a country of arrival. Whoever wants to push us out of the eurozone should know that.”

Quite a find.

• Greece To Use Nazi Army Archives For Reparation Claim (AFP)

Greece will use a trove of Nazi army papers to press its claim for German reparation payments, the defence ministry said on Friday. “This archive contains over 400,000 pages…it will be used toward supporting Greek demands over German obligations in 1941-1944,” the ministry said. “These documents do not just substantiate a historic truth – they are the documents of the Wehrmacht itself, the occupation forces,” said junior defence minister Kostas Isichos. The ministry said it had obtained the papers from US archives. “They are diaries, reports by officers to their superiors…these were not written for publicity, they were mainly secret documents,” he said.

Facing resistance from EU paymaster Germany to its claims for a renegotiation to its bailout, the new radical Greek government has stepped up pressure on Berlin over the controversial issue of war reparations. The Greek justice minister this week said he would activate a 15-year-old Greek Supreme Court ruling allowing the seizure of German assets to pay for war damages. Greece’s parliament also approved a motion to reactivate a special committee to look into war reparations, reimbursement of a forced war loan and the return of archaeological relics seized by German occupation forces.

Berlin argues that the issue of reparations to Greece was settled in 1960 as part of an agreement with several European governments. Isichos said Athens hoped the Wehrmact papers would shed further light on aspects of the occupation period, such as illegal archaeological excavation and looting, “in order to strengthen, not poison” Greek-German relations. “German universities, intellectuals and the German people are invited to join us in discovering this historic treasure…and close this open wound,” he said.

“Small, insignificant problems of liquidity should not divide Europe..”

• Varoufakis: Greece Has Things Under Control (Deutsche Welle)

Finance Minister Yanis Varoufakis told ARD presenter Günther Jauch that Greece would repay its debts while still managing to cover civic needs, social security and a public workforce. In March, Greece is expected to pay €900 million to the IMF. “Small, insignificant problems of liquidity should not divide Europe,” Varoufakis told Jauch. Varoufakis said creditors did not have the right to interfere in Greece’s affairs. The finance minister also repeated a call for Germany to pay 11 billion euros in reparations for Nazi atrocities to Greece. German officials have said that the matter is settled. Varoufakis also addressed a recent video in which he appears to be showing his middle finger at hypothetical German officials at a 2013 speech in Zagreb, two years before he became finance minister. He called it a fake.

Earlier, Greek Prime Minister Alexis Tsipras also said his country was not facing a cash shortage. The denial came as Greece prepares to issue €1 billion in three-month treasury bills on Wednesday to meet debt repayments. “There is absolutely no problem with liquidity,” Tsipras told reporters after meeting with Varoufakis. Negotiations are continuing with creditors on a revised reform plan for Greece. On Sunday, Germany’s Frankfurter Allgemeine Zeitung reported that, with €6 billion in debt bills in March overall on Greece’s books, civil servants should brace themselves for downsized salaries and pensions this month. “Tsipras urgently needs money,” said European Parliament President Martin Schulz in the article. The German parliamentarian, who met Tsipras last week, said Greece would have to convince eurozone nations and the ECB of its determination to carry out reforms.

Stuffed with propaganda. Not a great idea in Germany.

• Germans Tired of Greek Demands Want Country to Exit Euro (Bloomberg)

Berlin cabdriver Jens Mueller says he’s had it with the Greek government and he doesn’t want Germany to send any more of his tax money to be squandered in Athens. “They’ve got a lot of hubris and arrogance, being in the situation they’re in and making all these demands,” said Mueller, 49, waiting for fares near the Brandenburg Gate. “Maybe it’s better for Greece to just leave the euro.” Mueller’s sentiment is shared by a majority of Germans. A poll published March 13 by public broadcaster ZDF found 52% of his countrymen no longer want Greece to remain in Europe’s common currency, up from 41% last month. The shift is due to a view held by 80% of Germans that Greece’s government “isn’t behaving seriously toward its European partners.”

The hardening of German opinion is significant because the country is the biggest contributor to Greece’s €240 billion twin bailouts and the chief proponent of budget cuts and reforms in return for aid. Tensions have been escalating between the two governments since Prime Minister Alexis Tsipras took office in January, promising to end an austerity drive that he blames on Chancellor Angela Merkel. The shift in sentiment comes as Greece, at risk of running out of cash this month, battles with European officials over the release of more bailout funds. Tspipras has also stepped up calls for war reparations from Germany for the Nazi occupation during World War II and Greek Finance Minister Yanis Varoufakis has been locked in a war of words with his German counterpart Wolfgang Schaeuble.

Last week, the Greek government officially complained about Schaeuble’s conduct, to which Schaeuble replied that the whole matter was “absurd.” “The way the Greeks have been behaving has been impossible. Now they’re making their own demands with these reparations,” said Dorli Schneider, an interpreter waiting for a train at Munich’s central station. “Greece should pay back what they owe. We can’t forever give them more money.” German voters’ growing umbrage may make it harder for Merkel to sell any possible deal down the road to the German public and Budestag, which would have to vote on it. She also has to be wary of the anti-euro AfD party trying to peel off her voters, said Juergen Falter, a political scientist at the Johannes Gutenberg University in Mainz.

That’s not what he said.

• Russia Was Ready for Crimea Nuclear Standoff, Putin Says (Bloomberg)

Russian President Vladimir Putin said he was ready to put his country’s nuclear forces on alert when he annexed Ukraine’s Crimean peninsula last year in case of intervention by the U.S. and its allies. “We were ready to do that,” Putin said when asked in a documentary film about Russia’s takeover of Crimea aired Sunday on state television if the Kremlin had been prepared to place its nuclear forces on alert. The Russian leader said he warned the U.S. and Europe not to get involved, accusing them of engineering the ouster of Russian-backed Ukrainian President Viktor Yanukovych. “That’s why I think no one wanted to start a world conflict.”

In the film, called “Crimea: the Road to the Motherland,” broadcast by Rossiya-1, Putin said he sent military intelligence and elite navy marines to spearhead the disarmament of 20,000 Ukrainian troops in the territory. No date was given for the Putin interview. The film was made over eight months. Russia’s seizure of Crimea in March last year provoked the worst geo-political confrontation with the U.S. and Europe since the Cold War. Tensions have escalated during a pro-Russian insurgency in eastern Ukraine that’s killed more than 6,000 people over the past year. Despite a European-brokered cease-fire, the U.S. is considering arming Ukrainian forces.

Putin, 62, whose country has been hit by U.S. and European Union sanctions that have helped to drive the Russian economy toward recession, branded President Barack Obama’s administration as “puppet-masters.” He said the U.S. directed the months of mass protests that overthrew Yanukovych in February last year. The Russian president said he decided to seize Crimea after a crisis all-night meeting with security chiefs from Feb. 22-23 to save the majority-ethnic Russian territory from the “nationalists” in Kiev who would have killed Yanukovych if Russia hadn’t given him refuge. He said the annexation of Crimea wasn’t planned before the overthrow of Yanukovych.

She needs to go.

• More Than a Million Hit Brazil Streets to Protest Rousseff (Bloomberg)

More than 1 million Brazilians, some of them calling for President Dilma Rousseff’s impeachment, took to the nation’s streets Sunday to protest a government beset by scandal and the rising cost of living. The largest protest occurred in Sao Paulo, with 1 million people as of 3:40 p.m. local time, according to its military police. Protests occurred in cites of 16 states and the federal capital, according to O Globo website. Its TV network reported 100,000 protesters in Porto Alegre and 45,000 in Brasilia, citing the military police of those cities. While no violence or vandalism was reported, Sao Paulo police apprehended firework rockets from a group of attendees. Higher taxes and increased prices for government-regulated items like gasoline are rankling Brazilians as the biggest corruption scandal in the nation’s history ensnares elected and appointed officials.

The approval rating of Rousseff’s government has plummeted since she won a close re-election last October. Today’s protests may be bigger than the June 2013 demonstrations in which more than a million people decried deficient public services and demanded an end to corruption. Today’s protest will force the government to present anti-corruption legislation it has already prepared, according to Thiago de Aragao at Arko Advice, a political risk company. Doing so will allow the government to deflect some fire and argue that protests targeted corruption rather than Rousseff or her party, he said. “The government needs to make some response and since, because of the magnitude, they can’t disqualify the size and pressure of the protest, they have to address one of the issues,” De Aragao said by phone.

“The anti-corruption package will be more fluff than anything real, but at this moment it’s one of the main things that the government has to respond with. They don’t have much more than that.” [..] Today marks the 30th anniversary of Brazil’s return to democracy after a 21-year military dictatorship. March 15 will henceforth be remembered as the Day of Democracy, Aecio Neves, who Rousseff bested in the election last year, said in a video posted on his Facebook page, showing him wearing the yellow jersey of the Brazilian national soccer squad. “I’m here to protest against corruption,” said Eliana Batista do Norte, a 55-year-old publicist who marched in Sao Paulo. “It’s not just about throwing the Workers’ Party out. We have to get rid of all the corrupt people. There is already enough information to remove Dilma.”

They want to buy $300 billion worth of US Treasuries AND purchase all of their own bonds? Wow…

• Beware the $300 Billion Shift Into Treasuries Coming From Japan (Bloomberg)

Back in the 1980s, the billions of dollars that the Japanese plowed into U.S. government debt reflected the Asian nation’s burgeoning economic might. Now, they’re at it again, only this time it’s to eke out any return they can. Yields on Japanese debt have been pinned near zero ever since the Bank of Japan embarked on its latest attempt, in April 2013, to end the two decades of stagnation that followed those go-go years. Europe isn’t much of an option, as yields turned negative this year on the region’s own quantitative easing. So why the U.S.? For one, with the Federal Reserve poised to raise interest rates, Treasuries offer the highest yields among debt from the world’s most-industrialized economies.

Then there’s the dollar, whose meteoric rise against virtually every currency has made U.S. assets even more appealing. HSBC says Japanese investors may funnel $300 billion into Treasuries over the next two to three years, double the pace of the nation’s purchases since 2012. “The BOJ is crowding out private investors,” said Yusuke Ito at Mizuho. “They have to find alternatives.” Mizuho’s overseas bond unit, which stepped up buying of Treasuries in mid-2014, has signed up more clients looking for higher-yielding alternatives to Japanese debt, he said. Japan first began to exert its influence in the U.S. government bond market more than three decades ago, when its booming export-driven economy produced trade surpluses that it then plowed into Treasuries year after year.

Japan has since built a stake of $1.23 trillion, making it America’s second-largest overseas creditor, just behind China’s $1.24 trillion. For the U.S. government, maintaining Japanese demand in the $12.6 trillion market for Treasuries is more important than ever, particularly after China pared its own holdings last year by the most on record and as the Fed prepares to raise rates. The good news is that Japanese purchases are poised to accelerate. Of the $500 billion that investors will pull from Japan’s debt market to put abroad through 2017, about 60% will flow into Treasuries, said Andre de Silva, HSBC’s Hong Kong-based head of global emerging-markets rates research.

“..if a 1.5% write down in the assets of a supposedly well-capitalized German bank can lead to almost overnight insolvency, one can almost imagine what will happen when the Austrian black swan wave reaches Europe’s actually “undercapitalized” banks…”

• The Austrian Black Swan Claims Its First Foreign Casualty (Zero Hedge)

Precisely one week ago in “A Black Swan Lands In Southern Austria: The Ripple Effects Of “Mini-Greece Going Off In The Heartland Of Europe”, when analyzing the consequences of the collapse of Austria’s bad bank, we noted perhaps the biggest paradox of Europe’s emergency preparedness response to the Greek collapse and imminent expulsion from the Eurozone: namely that the biggest threat to German banks was no longer in some Mediterranean nation, but in its very own back yard. To wit:

Irony #2, and the biggest one of all: while German banks had spent the past 3 years preparing for the inevitable Grexit and offloading all their exposure to the now insolvent Greek state, it was a waterfall chain of events which started in Germany’s own “back yard”, courtesy of auditors who decided it was unnecessary to mark losses to market until it was far too late, and the immediate outcome is that one ninth of until recently Aaa/AAA-rated Austria is now also insolvent. And that is just the beginning. One can only imagine how many such other “0% risk-weighted” Pandora boxes lie in wait across what are otherwise considered Europe’s safest banks, provinces and nations.

Indeed, it was just the beginning, and moments ago we got confirmation that the next domino has tipped over, following a Reuters report that Germany’s deposit protection fund will take over the property lender Duesseldorfer Hypothekenbank AG (DuesselHyp), which has “run into problems” due to its exposure to Austrian lender Hypo Alpe Adria’s “bad bank” Heta. And while in the US FDIC Failure Fridays works like a well-greased machine, Germany has yet to get the hang of the whole “save the bad news for Friday after market close” thing and has for now has stopped on “Shocker Sundays.” Then again, this being Europe, denial persists even after the moment of failure, and according to Reuters, “the German banking association BdB, which runs the fund, is, however, not planning to wind down the bank, but wants to continue its operations.”

“The deposit protection fund is granting a guarantee for the Heta bonds to eliminate the immediate risks. The goal is a complete takeover of Duesseldorfer Hypothekenbank,” the BdB said in a statement on Sunday.

It’s starting to feel like the last gasps of a fatally distorted system.

• The Full Explanation Of How The ECB Broke Europe’s Bond Market (Zero Hedge)

[..]..it is not just the topic of swapping one asset with a higher collateral velocity for another with a far lower, if not zero, velocity, but also the issue of effective supply. As JPM notes, “another important aspect in Coeuré’s speech regarding market liquidity was the notion of “effective supply”. What matters more for market liquidity and depth is indeed not the overall stock or supply of euro government bonds, but the size of the effective supply as some asset holders may not be willing to sell. And it is effective supply that would determine whether the Eurosystem be able to meet its quantitative targets. While it is inherently difficult to calculate effective supply we believe we can make some reasonable assumptions to proxy it.” But before JPM’s analysis of effective supply in Europe (or lack thereof), it takes one more swipe at just how clueless the Goldman-advised ECB has become:

… we disagree with Coeuré’s view that, similar to their Japanese counterparts, “euro area banks will be more willing to sell euro government bonds to the ECB as they will receive central bank reserves, which in the current low interest rate environment can be viewed by banks as close substitutes for government bonds, and which count towards fulfilling e.g. the required liquidity ratios”. The problem with this argument, in our view, is that the ratio of government bonds + reserves to assets for commercial banks remains low for European banks vs. those in the US or Japan. Euro area and UK banks, in particular, have a ratio of government bonds + reserves to assets of 7% vs. 30% for their US and Japanese counterparts.

If Euro area banks sell no bonds at all to the ECB and at the same time the ECB injects €1.1tr into the Euro area banking system, the ratio of government bonds + reserves to assets would rise to 11%. This will still be well below the 30% for their US and Japanese counterparts. In addition, as we argued above, government bonds are worth more to banks from a collateral point of view given rehypothecation. And this is perhaps one of the reasons that banks are currently willing to hold euro government bonds with yields that are below -20bp. In all, we continue to believe that banks in the Euro area could end up selling bonds to the ECB, but to a much smaller extent than their Japanese counterparts given their much higher need for liquid assets.

He doesn’t get paid to read…

• Krugman Is Told to Read More, Write Less, by Swedish Riksbanker (Bloomberg)

Nobel laureate Paul Krugman is way off when he accuses the Swedish central bank of being guilty of “sadomonetarism,” according to the target of his criticism. Deputy Governor Per Jansson says the U.S. economist’s analysis suggests he hasn’t read enough about Sweden. Krugman has criticized the bank for raising rates at the height of Europe’s debt crisis in 2010 and 2011, and then for not cutting fast enough to fight disinflation. The moves made sense at the time, Jansson said, given a consensus among forecasters that prices were rebounding and as the economy was expanding faster than much of Europe, driving up credit growth and house prices.

“When he described Sweden as sort of a deflationary economy, and makes these parallels to Japan, you wonder, has he ever had a look at the data?” Jansson said in a March 12 interview in Stockholm. “Has he seen how Swedish GDP recovered over these crisis years? It completely outperformed the euro area, of course, but even the U.K. It’s close to the U.S.’s performance.” Krugman and other critics say the Riksbank’s policies drove Sweden into a deflationary trap that could have been avoided. The Riksbank, which in the mid-1990s became one of the first to target inflation, last reached its 2% target in 2011. Annual consumer prices have fallen for 11 of the past 14 months.

“Unfortunately history has shown that even using humanitarian rhetoric as a justification for telling others what to do has never worked.”

• A Green Light for the American Empire (Ron Paul)

The American Empire has been long in the making. A green light was given in 1990 to finalize that goal. Dramatic events occurred that year that allowed the promoters of the American Empire to cheer. It also ushered in the current 25-year war to solidify the power necessary to manage a world empire. Most people in the world now recognize this fact and assume that the empire is here to stay for a long time. That remains to be seen. Empires come and go. Some pop up quickly and disappear in the same manner. Others take many years to develop and sometimes many years to totally disintegrate. The old empires, like the Greek, Roman, Spanish and many others took many years to build and many years to disappear. The Soviet Empire was one that came rather quickly and dissipated swiftly after a relatively short period of time. The communist ideology took many decades to foment the agitation necessary for the people to tolerate that system.

Since 1990 the United States has had to fight many battles to convince the world that it was the only military and economic force to contend with. Most people are now convinced and are easily intimidated by our domination worldwide with the use of military force and economic sanctions on which we generously rely. Though on the short term this seems to many, and especially for the neoconservatives, that our power cannot be challenged. What is so often forgotten is that while most countries will yield to our threats and intimidation, along the way many enemies were created.

The seeds of the American Empire were sown early in our history. Natural resources, river transportation, and geographic location all lent itself to the development of an empire. An attitude of “Manifest Destiny” was something most Americans had no trouble accepting. Although in our early history there were those who believed in a powerful central government, with central banking and foreign intervention, these views were nothing like they are today as a consequence of many years of formalizing the power and determination necessary for us to be the policeman of the world and justify violence as a means for spreading a particular message. Many now endorse the idea that using force to spread American exceptionalism is moral and a force for good. Unfortunately history has shown that even using humanitarian rhetoric as a justification for telling others what to do has never worked.

Why do I keep thinking this is no accident?

• How to Build a $400 Billion F-35 that Doesn’t Fly (Fiscal Times)

The Pentagon’s embattled F-35 Joint Strike Fighter continues to be plagued with so many problems that it can’t even pass the most basic requirements needed to fly in combat, despite soaring roughly $170 billion over budget. As the most expensive weapons program in the Pentagon’s history, the $400 billion and counting F-35 is supposed to be unlike any other fighter jet—with high-tech computer capabilities that can identify a combatant plane at warp speed. However, major design flaws and test failures have placed the program under serious scrutiny for years–with auditors constantly questioning whether the jet will ever actually get off the ground, no matter how much money is thrown at it. Last year, military officials faulted contractors for all of the mistakes.

Contractors claimed they had corrected the issues and that there wouldn’t be more costly problems down the road. During an interview on 60 Minutes, Air Force Lt. Gen. Chris Bogdan, who is in charge of the program said, “Long gone is the time when we will continue to pay for mistake after mistake after mistake. Lockheed Martin doesn’t get paid their profit unless each and every airplane meets each station on time with the right quality.” However, a new progress report from the Defense Department casts serious doubts on the progress of the program. The DoD’s Director of Operational Test and Evaluation cites everything from computer system malfunctions to flaws with its basic design—it even found that the jet is vulnerable to engine fires because of the way it’s built.

A separate report from Military.com unearthed another embarrassing issue with the jet that suggests it won’t take off on time. The “precision-guided Small Diameter Bomb II doesn’t even fit on the Marine’s version of the jet, according to Military.com. On top of that, the software needed to operate the top close-air support bomb won’t even be operational until 2022, inspectors said. The Defense Department’s report also suggested that the program’s office isn’t accurately recording the jet’s problems. “Not all failures are counted in the calculation of mean flight hours between reliability events, but all flight hours are counted, and hence component and aircraft reliability are reported higher than if all of the failures were counted,” the report said.

Home › Forums › Debt Rattle March 16 2015