Arthur Rothstein “Quack doctor, Pittsburgh, Pennsylvania” 1938

It’ll be like Christmas came early.

• Yellen Says ‘Looking Forward’ To Day Of First Rate Rise In Decade (Reuters)

Federal Reserve Chair Janet Yellen said on Wednesday she was “looking forward” to a U.S. interest rate rise that will be seen as a testament to the economy’s recovery from recession. Fed policymakers are widely seen raising interest rates for the first time in almost a decade at their next meeting on Dec. 15-16, but they continue to parse data and trends carefully given the uneven nature of the U.S. recovery. In her remarks to the Economic Club of Washington, Yellen expressed confidence in the U.S. economy, saying job growth through October suggested the labour market was healing even if not yet at full strength. Yellen also reaffirmed her view that the drag on U.S. economic growth and inflation from weakness in the global economy and falling commodity prices would moderate next year. U.S. consumer spending was “particularly solid”, she noted.

“When the Committee begins to normalize the stance of policy, doing so will be a testament … to how far our economy has come,” she said, referring to the Fed’s policy-setting committee. “In that sense, it is a day that I expect we all are looking forward to.” Investors are already betting the Fed will lift its benchmark federal funds rate this month from the zero to 0.25% range where it has been held since 2008. Economists also see a strong chance of a December rate rise. The U.S. dollar strengthened on Wednesday and stocks fell on Wall Street, after Yellen’s comments. “I was a little surprised she sounded as hawkish as she did given we’re two days away from the non-farm payrolls report and a couple of weeks away from the Fed FOMC meeting,” said Michael O’Rourke at JonesTrading in Greenwich, CT.

Can Draghi get even crazier? You bet. Many others do. But will he fight the Germans?

• Opposition To ECB Stimulus Could Lead To Watered-Down QE Plan (FT)

The ECB will announce further monetary easing on Thursday to fix the eurozone’s creaking economy, but German-led opposition threatens to limit its firepower, potentially disappointing some investors. The ECB will almost certainly take fresh action after a crucial measure of inflation fell in November, underlining the fragility of the eurozone’s recovery. A revamp of the central bank’s €1.1trn quantitative easing package and a cut to the benchmark deposit rate charged on lenders’ reserves from its current level of minus 0.2% are likely, pitting the eurozone at odds with the US where the Federal Reserve is nearing its first rate hike for nine years. Most of the governing council’s policymakers will support the charge led by ECB president Mario Draghi and his chief economist Peter Praet for an injection of fresh stimulus.

But idiosyncrasies in voting rules and concerns that doing too much, too soon risks leaving the central bank out of options in the event of further economic deterioration could produce a less aggressive package than markets have priced in. Europe’s financial markets have rallied strongly in the lead up to the ECB meeting as investors assume that a deposit rate cut and expansion in QE is all but guaranteed. A survey of economists by Bloomberg reveals how strong the consensus is, with all respondents expecting fresh stimulus, and more than three quarters anticipating an extension of the QE programme and deposit rate cut. According to Swiss bank UBS, a 15 basis point cut to the deposit rate has been priced in, although a 20 basis point cut would not be surprising, while Dutch bank Rabobank forecasts €20bn in additional monthly QE purchases.

[..] Some investors warn that anything less than an additional 10 basis point cut in the deposit rate and extension of the QE programme to 2017 is likely to spark a sell-off in European assets. “It would be very surprising if the ECB does not deliver on its hints after it has stoked market expectations so high,” said Mark Dowding, co head of investment at Bluebay Asset Management. “Mario Draghi needs to tread with caution. If he disappoints investors then you will see sentiment towards the eurozone darken immediately.”

Anything to do with buybacks?

• Equities Peak 12-18 Months After A Peak In Margins; We’re Now 15 Months In (ZH)

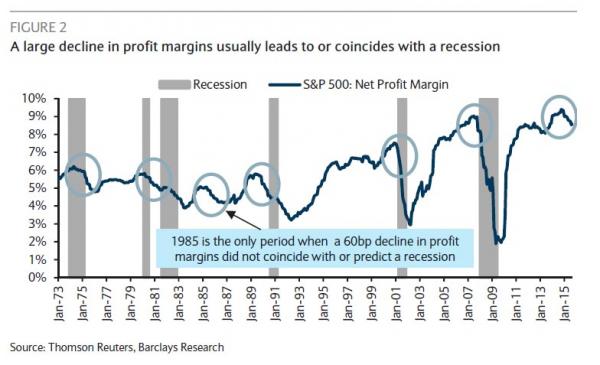

Two months ago, we looked at historical examples of what happens with the US economy any time corporate profit margins suffer a drop as large as the one experienced over the past 12 months when margins have plunged by (at least) 60 bps. The outcome: a recession on 5 out of 6 prior occasions. And while the economy is already feeling the recessionary impact of sliding margins as predicted in early October, with the manufacturing ISM printing at its lowest level since the recession, an even more important question is what happens to the stock market now that margins have peaked.

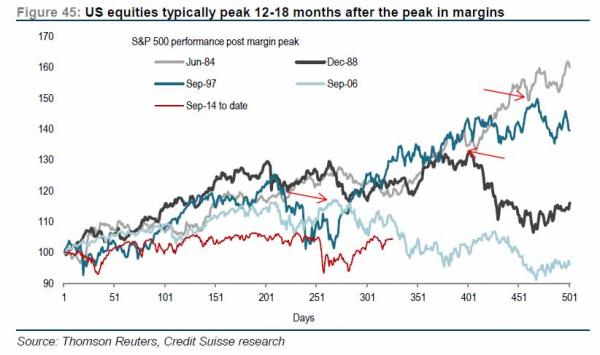

On this topic, most have been mum with the usual “answer” being that margins will keep rising. Alas, as even Goldman recently showed they won’t. So assuming margins have peaked in this cycle, what does that mean for stocks? For the very simple answer we go to Credit Suisse according to which “equities peak 12-18 months after a peak in margins.” Where are we now? “we are now 15 months after the peak in margins.” So, give or take three more months?

Are people thinking of selling?

• Commodity-Related -Junk- Bonds Face Big Losses: Moody’s (MarketWatch)

The oil and gas and metals and mining sectors are facing a spike in defaults and downgrades in 2016 and investors that have piled into their bonds in the hunt for yield are facing major losses, Moody’s warned Wednesday. Companies in those two sectors have issued nearly $2 trillion in bonds globally since 2010, according to the rating agency, many of them in the high-yield — or “junk bond” — category. Now prices of a range of commodities, from oil, to copper, iron ore, gold and coal are at multiyear lows, battered by weak demand and oversupply. “The sheer volume of commodity-related debt poses challenges because it means that credit losses from commodity investments will be substantial for many investors,” said Mariarosa Verde, Moody’s group credit officer and lead author of a report published Wednesday on the credit hazard posed by the current stress in commodity markets.

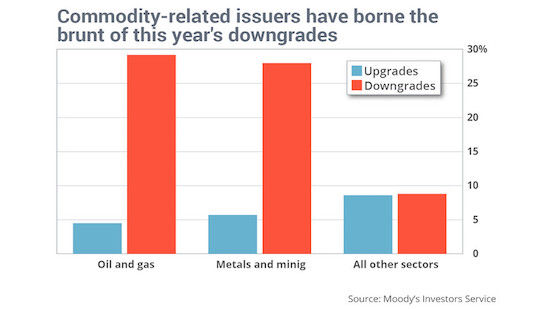

“Considering the maturing stage of the current credit cycle, mounting losses on commodity company debt seem likely to intensify the capital markets’ swing to greater risk aversion,” she said. Oil and gas and metals and mining issuers represent just 14% of Moody’s nonfinance corporate ratings but accounted for 36% of downgrades through October, and 48% of defaults. Moody’s is expecting the trend to continue in 2016, with 34% of companies on watch for a downgrade or on negative outlook. “Many companies were temporarily cushioned by hedging programs and fixed-price contracts in the early stages of the downturn,” said Daniel Gates, a Moody’s managing director. “Others have been sustained by cash balances that are eroding. Diminishing liquidity and restricted access to capital markets are now pushing more firms closer to default.”

Oil and gas companies dominate U.S. junk-bond issuance, many of them shale plays that emerged during the fracking boom. The steep decline in the price of oil has now made many of them unprofitable, just as their debt-servicing costs are rising.

Cutting production is supposed to cut the Saudi deficit? Whatever it cuts, others will produce. There’s no way to win this.

• Oil Speculators Risk ‘Short Squeeze’ If Impulsive Saudi Prince Throws OPEC Surprise (AEP)

Hedge funds have taken their bets. The market is convinced that Saudi Arabia will ignore the revolt within OPEC at a potentially explosive meeting on Friday, continuing to flood the global markets with excess oil. Short positions on US crude and Brent have reached 294m barrels, the sort of clustering effect that can go wildly wrong if events throw a sudden surprise. The world is undoubtedly awash with oil and the last storage sites are filling relentlessly, but speculators need to be careful. They are at the mercy of opaque palace politics in Riyadh that few understand. Helima Croft, a former analyst for the US Central Intelligence Agency and now at RBC Capital Markets, says the only man who now matters is the deputy crown prince, Mohammed bin Salman.

The headstrong 30-year-old has amassed all the power as minister of defence, chairman of Aramco and head of the Kingdom’s top economic council, much to the annoyance of the old guard. “He is running everything and it comes down to whether he thinks Saudi Arabia can take the pain for another year,” she said. The pretence that all is well in the Kingdom is wearing thin. Austerity is becoming too visible. A leaked order from King Salman – marked “highly urgent” – freezes new hiring and halts public procurement, even down to cars and furniture. The system of cradle-to-grave welfare that keeps a lid on public protest and holds the Wahhabi state together risks unravelling. Subsidies are draining away. It will no longer cost 10p a litre to fill a petrol tank. VAT is coming. There will be a land tax. Yet these measures hardly make a dent on a budget deficit running near $140bn a year, or 20pc of GDP.

The German intelligence agency BND issued an extraordinary report warning that Prince Mohammed is taking Saudi Arabia into perilous waters. “The thus far cautious diplomatic stance of the elder leaders in the royal family is being replaced by an impulsive interventionist policy,” it said. The war in Yemen – Saudi Arabia’s “Vietnam” – grinds on at a cost of $1.5bn month. It is far from clear whether the Kingdom can continue to bankroll Egypt as ISIS operations spread from the Sinai to Cairo suburbs. The risk of a Saudi sovereign default over the next 10 years has suddenly jumped to 23pc, measured by credit default swaps. Riyadh’s three-month Sibor rate watched as a gauge of credit stress has spiked to the highest levels since the Lehman crisis.

Nerves are so frayed in Riyadh that the interior ministry is lashing out blindly. There are reports that more than 50 prisoners are to be beheaded, including Sheikh Nimr al-Nimr, the Shia cleric sentenced to death for leading civic protests in 2012. There is no surer way to light the fuse on wholesale conflagration in the Shia stronghold of the Eastern Province, where the oil reserves lie. Shia underground groups in Iraq have threatened a whirlwind of gruesome revenge if the execution is carried out. This, then, is the state of Saudi Arabia a year into an oil crash that the Kingdom itself engineered to drive out rival producers.

Sounds good, but reality is lost in translation: nobody’s sure which emissions.

• China Says To Cut Power Sector Emissions By 60% By 2020 (Reuters)

China will cut emissions of major pollutants in the power sector by 60% by 2020, the cabinet announced on Wednesday, after world leaders met in Paris to address climate change. China will also reduce annual carbon dioxide emissions from coal-fired power generation by 180 million tonnes by 2020, according to a statement on the official government website. It did not give comparison figures but said the cuts would be made through efficiency gains. In Paris, Christiana Figueres, head of the U.N. Climate Change Secretariat, said she had not seen the announcement, but linked it to expectations that China’s coal use would peak by the end of the decade. “I can only assume they are talking about the same thing,” she told Reuters.

Researchers at Chinese government-backed think-tanks said last month that coal consumption by power stations in China would probably peak by 2020. An EU official, speaking on condition of anonymity, said Wednesday’s announcement seemed to relate more to air pollutants than greenhouse gas emissions. China’s capital Beijing suffered choking pollution this week, triggering an “orange” alert, the second-highest level, closing highways, halting or suspending construction and prompting a warning to residents to stay indoors. The smog was caused by “unfavourable” weather, the Ministry of Environmental Protection said. Emissions in northern China soar over winter as urban heating systems are switched on and low wind speeds meant that polluted air does not get dispersed.

The hazardous air, which cleared on Wednesday, underscores the challenge facing the government as it battles pollution caused by the coal-burning power industry and raises questions about its ability to clean up its economy. Reducing coal use and promoting cleaner forms of energy are set to play a crucial role in China’s pledges to bring its greenhouse gas emissions to a peak by around 2030.

They’re not fooling around.

• Russia Presents Proof Of Turkey’s Role In ISIS Oil Trade (RT)

The Russian Defense Ministry has released evidence which it says unmasks vast illegal oil trade by Islamic State and points to Turkey as the main destination for the smuggled petrol, implicating its leadership in aiding the terrorists. The Russian Defense Ministry held a major briefing on new findings concerning IS funding in Moscow on Wednesday. According to Deputy Defense Minister Anatoly Antonov, Russia is aware of three main oil smuggling routes to Turkey. “Today, we are presenting only some of the facts that confirm that a whole team of bandits and Turkish elites stealing oil from their neighbors is operating in the region,” Antonov said, adding that this oil “in large quantities” enters the territory of Turkey via “live oil pipelines,” consisting of thousands of oil trucks. Antonov added that Turkey is the main buyer of smuggled oil coming from Iraq and Syria.

“According to our data, the top political leadership of the country – President Erdogan and his family – is involved in this criminal business.” However, since the start of Russia’s anti-terrorist operation in Syria on September 30, the income of Islamic State (IS, formerly ISIS) militants from illegal oil smuggling has been significantly reduced, the ministry said. “The income of this terrorist organization was about $3 million per day. After two months of Russian airstrikes their income was about $1.5 million a day,” Lieutenant-General Sergey Rudskoy said. At the briefing the ministry presented photos of oil trucks, videos of airstrikes on IS oil storage facilities and maps detailing the movement of smuggled oil. More evidence is to be published on the ministry’s website in the coming says, Rudskoy said. The US-led coalition is not bombing IS oil trucks, Rudskoy said.

For the past two months, Russia’s airstrikes hit 32 oil complexes, 11 refineries, 23 oil pumping stations, Rudskoy said, adding that the Russian military had also destroyed 1,080 trucks carrying oil products. “These [airstrikes] helped reduce the trade of the oil illegally extracted on the Syrian territory by almost 50%.” Up to 2,000 fighters, 120 tons of ammunition and 250 vehicles have been delivered to Islamic State and Al-Nusra militants from Turkish territory, chief of National Centre for State Defense Control Lt.Gen. Mikhail Mizintsev said. “According to reliable intelligence reports, the Turkish side has been taking such actions for a long time and on a regular basis. And most importantly, it is not planning to stop them.”

Fun facts.

• The Greatest Economic Collapses in History (Howmuch.net)

The very first major economic collapse in recorded history occurred in 218-202 BC when the Roman Empire experienced money troubles after the Second Punic War. As a result, bronze and silver currencies were devalued. As depicted in the video below economic collapses date back thousands of years. While many countries today still feel the effects of the most recent Global Financial Crisis, it is important to note that economic troubles are not unique to the present-day, but rather date back to some of the oldest civilizations.

Looks increasingly like Rousseff’s afraid she’ll be persecuted one she steps down. The country pays a high price for that fear.

• Brazil Goes From Crisis to Crisis as Impeachment Bid Moves Ahead (BBG)

Even in Brazil, a country that is no stranger to crisis, the recent, rapid-fire succession of financial, economic and political blows has been breathtaking. After a week in which the nation’s top young financier was thrown in jail alongside a senator – pushing his bank into a struggle for survival – and Goldman Sachs warned the economy was slipping into a full-blown depression, impeachment proceedings were initiated late Wednesday against President Dilma Rousseff. Though the hearings will ultimately center on whether Rousseff violated fiscal laws, the root of her widespread unpopularity is the same that landed the banker, Andre Esteves, in jail and crippled the economy: an unprecedented corruption scandal that’s hamstrung the country’s biggest companies and triggered policy paralysis in the capital city.

With GDP now shrinking at an annualized pace of almost 7% and the budget deficit swelling to the widest in at least two decades, Brazil’s currency and local bond markets have posted deeper losses than those of any other developing nation this year. “The important thing is that Brazil has a political resolution at some point over the next few months,” said Pablo Cisilino at Stone Harbor Investment in New York. “If impeachment is the way to get it then it’ll be welcomed by the market, but there are so many twists and things that can happen between now and then.” Lower house speaker Eduardo Cunha said Wednesday night he accepted one of 34 requests to impeach the president on charges that range from illegally financing her re-election to doctoring fiscal accounts this year and last.

Impeachment hearings could take months, involving several votes in Congress that ultimately may result in the president’s ouster. Rousseff will challenge any proceedings in the Supreme Court, according to a government official with direct knowledge of her defense strategy.

It’ll be a while before we understand the scope of the consequences.

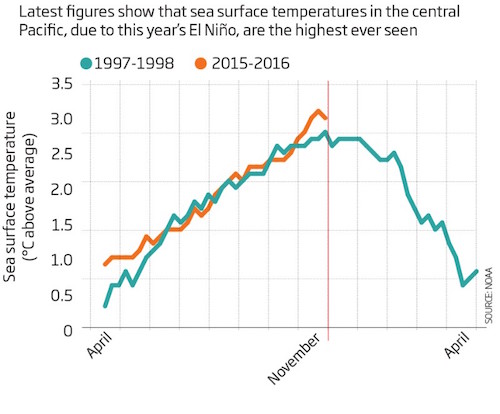

• Massive El Niño Sweeping Globe Is Now The Biggest Ever Recorded (NS)

The current extreme El Nino is now the strongest ever recorded, smashing the previous record from 1997-8. Already wreaking havoc on weather around the world, the new figures mean those effects will probably get worse. Climate change could be to blame and is known to be making the extreme impacts of El Nino on weather more likely. The 1997-8 El Nino killed 20,000 people and caused almost $97 billion of damage as floods, droughts, fires, cyclones and mudslides ravaged the world.

Now the current El Nino has surpassed the 1997-8 El Nino on a key measure, according to the latest figures released by the US National Oceanic and Atmospheric Agency. El Nino occurs when warm water that has piled up around Australia and Indonesia spills out east across the Pacific Ocean towards the Americas, taking the rain with it. A key measure of its intensity is the warmth of water in the central Pacific. In 1997, at its peak on 26 November, it was 2.8C above average. According to the latest measurements, it reached 2.8C on 4 November this year, and went on to hit 3.1C on 18 November – the highest temperatures ever seen in this region.

Who needs birds, right?

• More Than A Quarter Of UK Birds Are Fighting For Survival (Guardian)

More than a quarter of the UK’s birds including much-loved species such as the curlew and puffin are now fighting for survival, a new report warns. The latest assessment of the status of the UK’s 244 birds has “red-listed” 27% as being of “highest conservation concern” – meaning urgent action is needed to prevent their extinction locally. Most of the 67 species have suffered severe declines, with their numbers or range being halved in recent decades. There has been an increase of 15 species on the red list since the last assessment in 2009. The curlew, recognised by its long, curved beak and distinctive call, has suffered a rapid decline in its UK population of 42% between 1995 and 2008. A report last month called for the upland bird to become the country’s highest conservation priority because of the global importance of its UK population – estimated to represent more than 30% of the west European population.

The curlew is one of five upland species added to the red list alongside the dotterel, whinchat, grey wagtail and merlin. This highlights that many of the UK’s upland species are in increasing trouble, the report warns, with the total number of upland birds on the red list now reaching 12. Forestry, shooting, recreation, renewable energy generation and water storage are all increasingly putting pressure on upland bird populations. Other species remain well below historical levels or are considered to be at risk of global extinction. A growing number of seabirds including the shag and kittiwake have been added to the red list, along with the charismatic puffin, which has suffered a worldwide population decline. In October, puffins were added to the International Union for Conservation of Nature (IUCN) red list of species for the first time, putting them at the same risk of extinction as the African elephant and lion.

Europe fails on all fronts.

• Kicking Greece Out Of Schengen Won’t Stop The Refugee Crisis (Guardian)

According to various German, Hungarian, Slovak, Polish and many other EU government officials, Greece this summer openly denied its responsibility to guard the external borders of Europe. Greece is accused of having failed to register people, to prepare checkpoints for refugees and irregular migrants at so-called hotspots on time, and to relocate as many refugees as it promised to. But blaming a weak Greek administration is an easy and popular way to deflect blame that may lie much closer to home. The immigration minister in Athens tells a different story: he claims that he has been waiting in vain for the Eurodac machines required for taking fingerprints; only a few of those promised ever made it to Greece. And yet, between 25 October and 25 November, out of 45,000 people who arrived in hotspot areas, 43,500 were fingerprinted – mostly by national police officers working around the clock.

The EU has for months been dragging its feet in providing support for overworked Greek border staff. On 2 October, Frontex requested 775 border guards from EU member states and Schengen-associated countries, in large part to assist Greece and Italy in handling the record numbers of migrants at their borders. Until 20 October EU partners had contributed just 291. By mid-November, 133 had been deployed to Greek islands, and Frontex was still issuing desperate requests to EU countries to chip in more officers to help with screening and registration. The criticism of Greece’s failure to meet the hotspot deadlines also rings hollow. Surely EU leaders have known for some time how difficult it would be to meet deadlines – as long ago as 25 Oct they pressured the Greek immigration minister to finish establishing the hotspots at the end of November.

Blaming Greece for its ineffectiveness in relocating refugees is also much easier than admitting that the entire relocation system has collapsed before really finding its feet – something the European commission president, Jean-Claude Juncker, implicitly admitted when he estimated that at the current rate the relocation of 160,000 people from Greece and Italy would be completed in around 2101. Greece has so far relocated 30 people to Luxembourg, Italy another 130 to other EU countries. Last week only one single person was relocated from Italy to Sweden. Another 150 in Greece are documented and waiting to go.

For many EU officials, Greece crossed a line when it refused to let Frontex take control of its borders to the Balkans last week. In fact, this wasn’t the case: all Greece had done was to challenge the absurd terms dictated by Frontex. Frontex proposed an operation plan that would reproduce a policy implemented by western Balkan countries to filter arrivals at border checkpoints by nationality – something that is still illegal by European and international standards. It also assumes that people refused at the border will be transferred to “reception facilities” – without going into detail what this means. Does it mean that the Greek authorities would assist Frontex in filtering nationalities at their northern border and then lock up the tens of thousands who don’t have the right profile?

Empty rethoric.

• (Greek) EU Commissioner Tells Athens To Speed Up Border Controls (Kath.)

European Immigration and Home Affairs Commissioner Dimitris Avramopoulos on Wednesday warned that Greece needs to improve its border controls by mid-December, amid media reports that the country may by expelled from the Schengen Agreement if it fails to do so. In exclusive comments made to Kathimerini, the Greek commissioner noted that the country’s timetable for action was clear and that the situation had to improve considerably by December 17, in time for a new EU Summit on the refugee and migrant crisis. Also on Wednesday, Avramopoulos raised the issue at the College of Commissioners. Responding to a question by Kathimerini as to whether or not a Greek exit from the Schengen area was on the table, he noted that the treaty was founded “on the principles of solidarity and responsibility” and that any “effort to challenge it, in essence challenges these very principles, has no benefit and does not offer a solution.”

Avramopoulos further noted that “The refugee crisis we’re faced with is unprecedented. It does not solely concern first reception or destination countries, but Europe as a whole.” “Despite the stifling pressure put on Greece, it is absolutely vital for the country to complete this effort which will lead to tangible results,” the commissioner said. In his comments to Kathimerini, Avramopoulos stressed that “the immediate and complete implementation of agreed measures at recent summits, both by Greece as well as by other members states, will reinforce safety at sea borders as well as reintroduce control at the northern borders, where non-identified migrants are trying to continue their journey toward the north.”

“The Greek government is aware of the need to speed up the process based on the agreed timetables,” he added. Asked about the timetable, Avramopoulos said “the situation must have improved substantially by December 17, both in terms of the sea and the land borders.” “I’m optimistic that this will put an end to theories of either a Schengen zone collapse or the country exiting the treaty,” the commissioner said.

Might as well suspend the euro for two years as well.

• Leaked Memo Reveals EU Plan To Suspend Schengen For Two Years (Zero Hedge)

Earlier today we reported that in a dramatic and, what to many may seem unfair variation of “carrot and stick” negotiations conducted by European bureaucrats, the EU threatened Greece with indefinite suspension from the Schengen passport-free travel zone unless it overhauls its response to the migration crisis by mid-December, as frustration mounted over Athens’ reluctance to accept outside support. The slap on the face of the Greeks was particularly painful because this warnings of an temporary expulsion from the EU happens just days after Turkey not only got a €3 billion check from Europe because it has been far more “amenable” in negotiating the handling of the hundreds of thousands of refugees that exit its borders in direction Europe, but also was promised a fast-track status in negotiations to be considered for EU accession and visa free travel.

Ironically, it is also Turkey which is the source of virtually all Greek refugee headaches. We summarized the situation earlier as follows: “not only do the Greeks suffer under the weight of 700,000 refugees crossing into its borders from Turkey and headed for a “welcoming Germany” which is no longer welcoming, now they have to suffer the indignity of being ostracized by their own European “equals” who are being remarkably generous with non-EU member Turkey, which may very well be funding ISIS by paying for Islamic State oil and thus perpetuating the refugee crisis, while threatening to relegate Greece into the 4th world, and with visa requirements to get into Europe to boot!” However, it appears there is much more to this story than merely a case of vindication against the Greeks.

As Steve Peers from EU Law Analysis writes, according to a leaked Council memo, Europe’s intention is to put the framework in place for a comprehensive suspension of Schengen for all countries, for a period as long as two years, not just Greece in the process effectively undoing the customs union aspect of the European Union, which also happens to be its backbone. “The following is Council document 14300/15, dated 1 December 2015. It’s entitled ‘Integrity of the Schengen area’, and addressed to Coreper (the body consisting of Member States’ representatives to the EU) and the Council – presumably the Justice and Home Affairs ministers meeting Thursday 3 and Friday 4 December.”

“This refusal is not because Greece believes it needs no aid; it is because it thinks the offer grossly deficient. If this sounds familiar, that’s because it is.”

• Greece Is Back At The Heart Of EU’s Existential Crisis (Telegraph)

Europe’s economic and migrant crises may seem to be entirely separate issues, but parallels between the two are becoming ever more impossible to ignore. I touched on this subject in a column this morning, but since writing, a further common element has emerged. One way or another, Greece always seems to be in the vanguard of every European crisis, and now it’s assumed centre stage in the debacle of Schengen. This is of course because Greece is a frontline state; as such it is one of the main portals for migrants into the European Union. Once in, migrants can travel freely, thanks to Schengen, throughout much of the EU until they reach the country where they wish to claim asylum or otherwise work illegally. Most European states believe that Greece has badly mishandled its responsibilities on border control, and following refusal to accept wider European help in tackling the crisis, the EU is now threatening Greece with expulsion from Schengen.

Such action would essentially divorce Greece from the main body of the EU. As with Britain, which is not a member of Schengen, border controls would have to be established to patrol passage from Greece to the rest of the EU. The EU is able to threaten expulsion because Greece is reluctant to accept limited offers of help, including humanitarian aid and a special mission from Frontex, Europe’s hopelessly inadequate version of a federal borders agency. This refusal is not because Greece believes it needs no aid; it is because it thinks the offer grossly deficient. If this sounds familiar, that’s because it is. Exactly the same thing happened over Europe’s sovereign debt crisis. Limited relief was offered by the EU, but on terms and conditions which Greece found unacceptable. In the end, it was forced to capitulate, the alternative being expulsion from the Euro, which even Alexis Tsipras, the Greek prime minister, found unconscionable.

That will very likely be the outcome of the Schengen fiasco too. The big point here is that the EU, and its inner, Eurozone core, pretend to be a kind of United States of Europe, but are still a hundred miles away from the federal system and institutions that would make it so. When push comes to shove, collective problems are regarded as national liabilities, demanding national solutions. The upshot is that almost no crisis can be properly addressed. When times are good, the EU muddles along harmoniously enough, but when the going gets tough, the whole thing fragments and nation quarrels with nation. The irony is that both the economic and the migrant crises have been made very much worse by Europe’s half completed march to federalism. It pretends federal arrangements, but its institutions lack the political legitimacy to mount credible federal solutions. Europe must either urgently march forward, or it must march back.

Detain them where, oh Donald? Greece perhaps? Poland? How about we detain Tusk for a few years?

• Detain Refugees Arriving In Europe For 18 Months, Says Tusk (Guardian)

Refugees arriving in Europe should be detained for up to 18 months in holding centres across the EU while they are screened for security and terrorism risks, the president of the European council has said. Donald Tusk also put himself strongly at odds with Europe’s most powerful politician, Angela Merkel, by declaring that there was no majority among European governments for a binding quotas system to share refugees between them. The mandatory refugee-sharing regime is the German chancellor’s chief policy for dealing with the migration crisis, not least since about 1 million are expected to enter Germany this year.

In a lengthy interview with the Guardian and five other European newspapers, Tusk, the former Polish prime minister, described Merkel’s open-door policy on refugees as “dangerous” and derided data claiming that Syrian-war refugees made up a majority of those trying to get to Europe. Public confidence in governments’ ability to tackle the immigration crisis would only be restored by a stringent new system of controls on the EU’s external borders, he said. Tusk’s remarks contradicted Berlin’s stance and also the asylum policies being drafted across the street from his Brussel’s office in the European commission. In a reference to Merkel’s comment on the migration crisis, Tusk said “some” European leaders “said that this wave of migrants is too big to stop. I’m absolutely sure that we have to say that this wave of migrants is too big not to stop them.

But this change of approach must be a common effort. It’s not about one leader. “I think that what we can expect from our leaders today is to change this mindset, this opinion, [which is] for me one of the most dangerous in this time.” In a warning to the rest of Europe, Merkel recently told the Bundestag that the survival of the EU’s free-travel Schengen area hinged on whether national governments could agree on a permanent new regime of sharing refugees. In September she pressed for a majority vote at an EU summit making the sharing of 160,000 refugees obligatory despite strong resistance from eastern Europe. Berlin and the commission are now pushing for a more ambitious permanent scheme directly resettling refugees across the EU from Turkey and the Middle East.

[..] ccording to the International Organisation for Migration, nearly two-thirds or 64% of people crossing from Turkey into the EU via the Greek islands by October this year were Syrians – 388,000 of a total of 608,000. A quarter of those making the crossing were children, the IOM said this week. Of 12 deaths in the past week, nine were children and 90 died in October alone.

“..to avoid diplomatic complications I will not tell you which country Berlin is in….”

• Half A Million Syrian Refugees Could Be Resettled To EU: Hungary PM (Reuters)

European Union and Turkish leaders may announce a behind-the-scenes agreement later this week to resettle 400,000 to 500,000 Syrian refugees directly from Turkey to the EU, Hungarian Prime Minister Viktor Orban said on Wednesday. Orban has locked horns with EU partners for years over economic policy, political freedoms and most recently the handling of the migrant crisis, in which the Hungarian leader took a hard line and erected a steel fence along the country’s southern border to keep out migrants. Hungary has firmly resisted the idea of resettlement quotas to distribute more evenly the migrants, most of whom wanted to go to Germany or Sweden.

Speaking to a meeting of Hungarian leaders in Budapest, Orban said he expected intense pressure from Europe to accept some part of those half a million refugees, something he said Budapest could not do. He added that the agreement has already been floated at a recent EU summit in Malta but was abandoned and not included in the EU-Turkey agreements signed at the weekend in Brussels after its proponents could not gather the necessary support for it. “The issue (of resettlement) will be a hot potato in the coming period because even though this could be kept in a semi-secret state… someone somewhere – I think in Berlin this week – will announce that 4-500,000 Syrian refugees could be brought straight from Turkey to the EU,” Orban said.

“This nasty surprise still awaits Europeans.” He alluded to the deal being orchestrated by Germany, and said it could frame the political discourse in Europe in the next few days and weeks. “The pressure will be intense on us and the other Visegrad Four countries (Poland, Slovakia and the Czech Republic),” he said. “They will portend that once the agreement is made by certain parties – and to avoid diplomatic complications I will not tell you which country Berlin is in – we should not only bring these people to Europe but divide them amongst ourselves, as an obligation.” “It will not be an easy one because obviously we cannot accept it like this.”

“They don’t dare to ask us ‘drown them’, but if you do push-back on a plastic boat in the middle of the sea with 50 or 70 refugees aboard, you’re asking me to drown them..”

• Greece Spent €1 Billion On Refugees, Got €30 Million In EU Assistance (Reuters)

With no land borders with the rest of the 26-nation Schengen area, Greece has allowed hundreds of thousands of people, many of them Syrian refugees, to travel from its islands off the Turkish coast across Greece to the northern border with non-EU FYROM as they head for Germany. Mouzalas said that as long as Turkey did not shut down people smugglers operating on its coastline, Athens could not stop frail boats packed with refugees from landing on Greek islands in the Aegean Sea. He said he had taken EU ambassadors out to sea to watch arrivals and asked what Athens should do. “They don’t dare to ask us ‘drown them’, but if you do push-back on a plastic boat in the middle of the sea with 50 or 70 refugees aboard, you’re asking me to drown them,” the minister said.

EU diplomats said suspending Greece from the open-border rules – activating Article 26 of the Schengen treaty so that people arriving at ports and airports from Greece were treated as coming from outside the Schengen zone – could be discussed at a meeting of EU interior ministers on Friday. However, some also said that Greece appeared to be moving now to implement EU measures to control migrants and so a common front against Athens was unlikely as early as this week. “It’s a tool for pushing Greece to accept EU help,” one senior diplomat said. Since migrants have rarely used airlines or international ferries, the main impact of other Schengen states imposing passport checks on arrivals from Greece would be on Greeks and tourists who are vital to the Greek economy.

Lithuanian Foreign Minister Linas Linkevicius told Reuters: “It was said because of (Greece’s) reluctance to protect the border. But now the latest signals are coming that they are taking these measures finally.” EU officials accept Greek criticism that other states have failed to organize facilities to take in refugees but say Athens, despite the economic problems that saw it nearly drop out of the euro zone this year, could do more. Mouzalas said Greece has spent €1 billion in additional unbudgeted funds from its strained budget this year on coping with the refugee influx, and had received a mere €30 million so far in EU assistance due to bureaucracy on both sides. He welcomed EU border agency Frontex assistance to register refugees but said that under Greek law, only Greek forces could patrol its border.

Home › Forums › Debt Rattle December 3 2015