Arthur Rothstein Scene along Bathgate Avenue in the Bronx 1936

Brimming with confidence. Deutsche buying back its debt at this point in the game screams EXIT.

• Europe’s Dead Cats Bounce, Deutsche Up 10% (BBG)

European stocks rebounded from their lowest level since October 2013 as investors assessed valuations following seven days of declines. A measure of lenders posted the best performance of the 19 industry groups on the Stoxx Europe 600 Index, with Deutsche Bank rising 10% as a person familiar with the matter said the German bank is considering buying back some of its debt. Commerzbank climbed 6%. Greece’s Eurobank Ergasias recovered 11% after falling to its lowest since at least 1999 on Tuesday, and Italy’s UniCredit SpA gained 10%. The Stoxx 600 advanced 1.6% to 314.39 at 9:27 a.m. in London, moving out of so-called “oversold” territory.

Global equities have been battered in 2016 in volatile trading amid investor concern over oil prices, earnings, the strength of the U.S. and Chinese economies, as well as the creditworthiness of European banks. The Stoxx 600 now trades at 13.9 times estimated earnings, about 20% below its April 2015 peak. A gauge tracking stock swings has jumped 47% this year. “When it feels this bad, it’s usually a good buying opportunity,” said Kevin Lilley at Old Mutual Global Investors in London. “But we’ve just been through a huge crisis of confidence and I think a long-term rebound is still very dependent on central-bank policy and global macro data. You’re fighting negative newsflow with very low valuations at the moment, and that’s the trade off.”

Not just in Europe either.

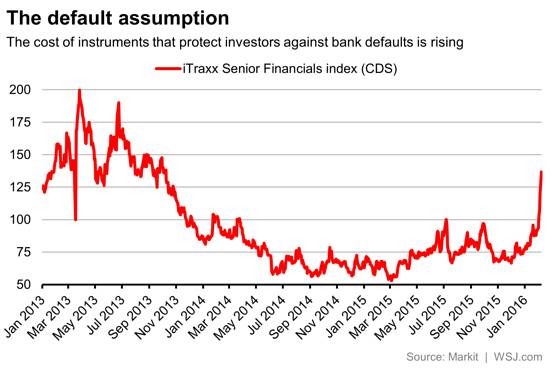

• Surging Credit Risk for Banks a Major Issue in European Markets (WSJ)

If there’s one thing on the mind of analysts and investors in Europe right now, it’s credit risk. The recent selloff in equities has sparked questions over whether a similar bearishness on credit is justified, particularly among European banks that have been slammed in stock markets over the last month. The iTraxx Senior Financials index tracks the cost of credit default swaps, which protect the investors buying them against a company’s default, for major financial institutions in Europe. More credit risk means pricier CDS, and the cost of European bank CDS has taken off. The index is still far from the extremely elevated levels reached in 2012, during the dismal days of the euro crisis.

Some of the latest analysts to weigh in on the subject come from Bank of America Merrill Lynch. In a research note out on Monday titled “the tide has turned,” analysts Ioannis Angelakis, Barnaby Martin and Souheir Asba argue that risk is becoming more systematic. The authors go on: “Risks are not contained any more within the EM/oil related names. Global growth outlook fears and risks of quantitative failure have led to weakness into cyclical names. Add also the recent sell-off in financials and you have the perfect recipe for a market sell-off that looks and feels systemic.” Within the last week we’ve spoken to analysts and investors that disagreed, suggesting that European bank credit was quite secure. Either way, it’s clear that the worries about credit risks have become heightened. How far the threat to balance sheets now goes is one of the biggest questions in European markets right now.

The more you try to look confident, the less you do.

• Banks Eye More Cost Cuts Amid Global Growth Concerns (Reuters)

Goldman Sachs and other U.S. banks are looking at ways to slash expenses further this year as market turmoil, declining oil prices and concerns about Germany’s Deutsche Bank have sent the sector’s shares down sharply. “We can absolutely do a lot more on the cost side if we have to, especially now, when you have to deliver a return,” Goldman Chief Executive Officer Lloyd Blankfein said on Tuesday at the Credit Suisse financial services forum in Miami. “We take a particular and energetic look at continued cost cuts when revenues are stalled,” he said. ” … Necessity is the mother of invention.” U.S. Bancorp CFO Kathy Rogers echoed Blankfein’s comments at a separate panel, saying her bank would continue cutting costs this year. She cited a smaller chance that interest rates would rise, which would have indicated a stronger economy and more revenue for the bank.

As executives were speaking at the conference, Deutsche Bank shares hit a record low, following their 9.5% plunge on Monday. Although the bank has said it has sufficient reserves, investors have worried that it will not be able to repay some bonds that are coming due. The bonds, called AT1 securities, convert into equity in times of market stress. Deutsche Bank’s woes reflect broader concerns about the health and profitability of euro zone banks. Last week, for instance, Sanford Bernstein analyst Chirantan Barua said Barclays should spin off its investment bank in an effort to revive its core UK retail and commercial business. Major Wall Street banks have also had a brutal start to 2016, with the KBW Nasdaq Bank index down nearly 20% on concerns about profitability.

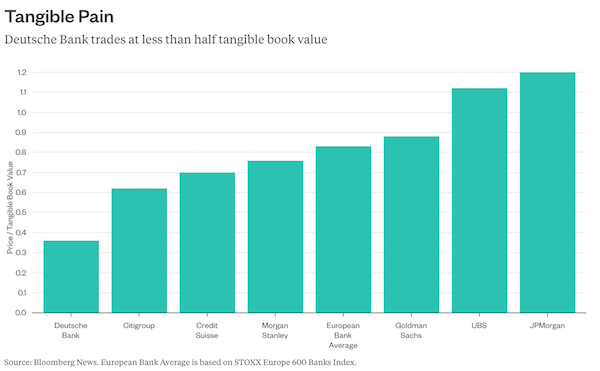

Since demand for U.S. bank shares began to weaken in late November, the sector’s top five stocks have lost 20% of their market capitalization, or around $120 billion. Almost 70% of the banks deemed globally significant are trading below their tangible book values, or what they would be worth if liquidated. Analysts say if this continues, banks may have to restructure more drastically to cut costs. Investors said bank executives would need to look at other ways to boost profitability now that hopes for further interest rates hikes have faded. “They’re going to have to come up with other levers to pull, whether it is investing in technology or reducing headcount,” said John Fox at Feinmore Asset Management, which invests in financials. “There will be more pressure on expenses because of the interest rate environment.”

Bloomberg lowballing.

• Europe Banks May Face $27 Billion Energy-Loan Losses (BBG)

European banks face potential loan losses from energy firms of $27 billion, or about 6% of their pretax profit over three years, according to analysts at Bank of America. “We believe European banks with large exposures to energy and commodities lending will be increasingly challenged over these positions by shareholders,” analysts Alastair Ryan and Michael Helsby wrote in a note to clients on Tuesday. “While long-term oil- and metal-price forecasts are well above current levels, we expect the equity market to continue to stress exposures to current market prices and deduct potential losses from the earnings multiple of the banks.”

The $27 billion estimate is “potentially a smaller figure than is implied in the share prices of a number of banks,” and lenders’ potential losses aren’t a threat to the capitalization of the banking system or its ability to provide credit to the economy, they wrote. European banks are getting walloped by the global market rout and plunge in global oil prices while struggling to bolster their capital buffers amid record low interest rates in the euro zone. The 46-member Stoxx Europe 600 Banks Index has lost about 27% this year, outpacing the 15% drop by the wider Stoxx 600.

Tyler Durden doesn’t lowball.

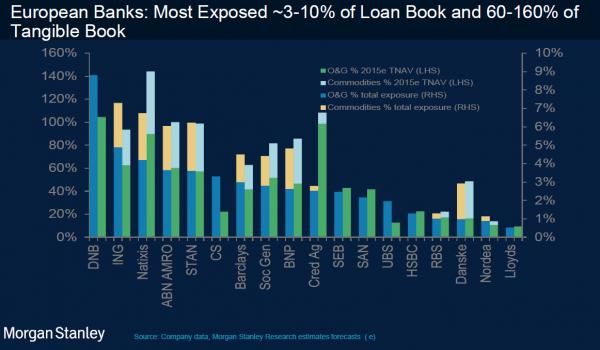

• European Banks: Oil, Commodity Exposure As High As 160% Of Tangible Book (ZH)

[..] Morgan Stanley writes, “Europeans have not typically disclosed reserve levels against energy exposure, making comparison to US banks challenging. Moreover, quality of books can vary meaningfully. For example, we note that Wells Fargo has raised reserves against its US$17 billion substantially non-investment grade book, while BNP and Cred Ag have indicated a significant skew (75% and 90%, respectively) to IG within energy books. Equally we note that US mid-cap banks typically have a greater skew to higher-risk support services (~20-25%) compared to Europeans (~5-10%) and to E&P/upstream (~65% versus Europeans ~10-20%).” Morgan Stanley then proceeds to make some assumptions about how rising reserves would impact European bank income statements as reserve builds flow through the P&L: in some cases the hit to EPS would be .

A ~2% reserve build in 2016 would impact EPS by 6-27%, we estimate:We believe noticeable differences exist between US and EU banks’ portfolios in terms of seniority and type of exposure. As such, applying the assumption of a ~2% further build in energy reserves in 2016, versus ~4% assumed for large US banks, we estimate that EPS would decline by 6-27% for European-exposed names (ex-UBS), with Standard Chartered, Barclays, Credit Agricole, Natixis and DNB most exposed. [..] But the biggest apparent threat for European banks, at least according to MS calulcations, is the following: while in the US even a modest 2% reserve on loans equates to just 10% of Tangible Book value…

… in Europe a long overdue reserve build of 3-10% for the most exposed banks, would immediately soak up anywhere between 60 and a whopping 160% of tangible book!

Which means just one thing: as oil stays “lower for longer”, and as many more European banks are forced to first reserve and then charge off their existing oil and gas exposure, expect much more diluation. Which, incidentlaly also explains why European bank stocks have been plunging since the beginning of the year as existing equity investors dump ahead of inevitable capital raises. And while that answers some of the “gross exposure to oil and commodities” question, another outstanding question is what is the net exposure to China. As a reminder, this is what Deutsche Bank’s credit analyst Dominic Konstam said in his explicit defense of what needs to be done to stop the European bloodletting:

The exposure issue has been downplayed but make no mistake banks are heavily exposed to Asia/MidEast and while 10% writedown might be worst case for China but too high for the whole, it is what investors shd and do worry about — whole wd include the contagion to banking hubs in Sing/HKong

Ironically, it is Deutsche Bank that has been hit the hardest as the full exposure answer, either at the German bank or elsewhere, remains elusive; it is also what has cost European banks billions (and counting) in market cap in just the past 6 weeks.

“..Liquidity is totally drained and it is very difficult to exit trades. You can’t find a buyer..”

• Europe’s ‘Doom-Loop’ Returns As Credit Markets Seize Up (AEP)

Credit stress in the European banking system has suddenly turned virulent and begun spreading to Italian, Spanish and Portuguese government debt, reviving fears of the sovereign “doom-loop” that ravaged the region four years ago. “People are scared. This is very close to a potentially self-fulfilling credit crisis,” said Antonio Guglielmi, head of European banking research at Italy’s Mediobanca. “We have a major dislocation in the credit markets. Liquidity is totally drained and it is very difficult to exit trades. You can’t find a buyer,” he said. The perverse result is that investors are “shorting” the equity of bank stocks in order to hedge their positions, making matters worse. Marc Ostwald, a credit expert at ADM, said the ominous new development is that bank stress has suddenly begun to drive up yields in the former crisis states of southern Europe.

“The doom-loop is rearing its ugly head again,” he said, referring to the vicious cycle in 2011 and 2012 when eurozone banks and states engulfed in each other in a destructive vortex. It comes just as sovereign wealth funds from the commodity bloc and emerging markets are forced to liquidate foreign assets on a grand scale, either to defend their currencies or to cover spending crises at home. Mr Ostwald said the Bank of Japan’s failure to gain any traction by cutting interest rates below zero last month was the trigger for the latest crisis, undermining faith in the magic of global central banks. “That was unquestionably the straw that broke the camel’s back. It has created havoc,” he said. Yield spreads on Italian and Spanish 10-year bonds have jumped to almost 150 basis points over German Bunds, up from 90 last year.

Portuguese spreads have surged to 235 as the country’s Left-wing government clashes with Brussels on austerity policies. While these levels are low by crisis standards, they are rising even though the ECB is buying the debt of these countries in large volumes under quantitative easing. The yield spike is a foretaste of what could happen if and when the ECB ever steps back. Mr Guglielmi said a key cause of the latest credit seizure is the imposition of a tough new “bail-in” regime for eurozone bank bonds without the crucial elements of an EMU banking union needed make it viable. “The markets are taking their revenge. They have been over-regulated and now are demanding a sacrificial lamb from the politicians,” he said.

Mr Guglielmi said there is a gnawing fear among global investors that these draconian “bail-ins” may be crystallised as European banks grapple with €1 trillion of non-performing loans. Declared bad debts make up 6.4pc of total loans, compared with 3pc in the US and 2.8pc in the UK.

Pop some more.

• Options Bears Circle Nasdaq (BBG)

Options traders are betting the pain is far from over in the Nasdaq 100 Index. Unconvinced a two-day decline of 5% found the bottom, they’re loading up on protection in the technology-heavy index, pushing the cost of options on a Nasdaq 100 exchange-traded fund to the highest in almost two years versus the Standard & Poor’s 500 Index, data compiled by Bloomberg show. It’s the latest exodus from risk in the U.S. equity market, with selling that started in energy shares spreading to everything from health-care to banks. Technology companies, which until recently had been spared because of their low debt burden and rising earnings, joined the rout as investors focus on elevated valuations among the industry’s biggest stocks.

“Exuberance has turned to panic pretty quickly,” said Stephen Solaka at Belmont Capital. “Technology stocks have had quite a run, and now they’re seeing momentum the other way.” The S&P 500 slipped less than 0.1% to 1,852.21 at 4 p.m. in New York, extending its three-day decline to 3.3%. The Nasdaq 100 lost 0.3%. Options are signaling more trouble ahead just as professional speculators dump bullish wagers on the group. Hedge funds and large speculators have pared back their long positions on the Nasdaq 100 for a fourth week out of five, data from the Commodity Futures Trading Commission show. Investors were dealt a blow on Friday when disappointing results from LinkedIn and Tableau sent both companies down more than 40%.

The selloff has been heaviest in a handful of momentum stocks that boosted returns in the Nasdaq 100 last year, sending the gauge’s valuation to a one-year high versus the S&P 500’s in December. Since then, the Nasdaq multiple has tumbled faster than the S&P 500’s, dropping 20% versus 13%, as stocks from Amazon to Netflix faced scrutiny from investors amid broader economic concerns. Even after a 16% plunge from a record in November, Nasdaq 100 companies still trade at 16.3 times projected profits, higher than the S&P 500’s 15.4 ratio. Scott Minerd at Guggenheim Partners said in an interview that technology stocks will tumble even further this year as investors flee to safety and buyers stay on the sidelines.

Tick. Tock.

• Deutsche Bank’s Big Unknowns (BBG)

Regulation is forcing banks to retrench from some previously lucrative businesses. Lacklustre economic growth and low interest rates are stymieing profit growth in other areas. Concerns about China’s economy and the energy industry are rippling through markets, reducing activity among bank clients.There are specific concerns about Deutsche Bank. Cryan is trying to reshape the business while facing these ominous economic and market headwinds. There’s still a slew of litigation costs to be settled. And he’s trying to offload parts of the bank that don’t fit any more, including Postbank, the domestic German retail unit. The announced full-year net loss of €6.8 billion darkened the mood.

The bank’s shares now trade at about 35% of the tangible book value of the bank’s assets, partly because equity investors can’t get a clear handle on what lies ahead. In the credit market, concerns were fueled Monday by a note from CreditSights analyst Simon Adamson that spelled out “a base case” for Deutsche Bank to pay AT1 coupons this year and next year. But there is a caveat – a bigger than expected loss this financial year, because of a major fine or other litigation cost, could wipe out the bank’s capacity to pay. In other words, what happens if a big unknown strikes? Deutsche Bank, for its part, made the case that it has more than enough capacity for the 2016 payment due in April – 1 billion euros of capacity compared with coupons of about €350 million.

The bank says it estimates it has €4.3 billion of capacity for the April 2017 payment, partly driven by the proceeds from selling its stake in a Chinese lender. That sale is still pending regulatory approval but should go through in coming months. So, Deutsche Bank ought to have enough to make its payments and will be desperate to do so. Can pay, will pay. Unless, the bank is hit with a big shock, like a major, unforeseen litigation cost. Nervous investors await further communication.

“I have said before that Deutsche Bank should be broken up. Now is the time to do it.”

• The Market Isn’t Buying That Deutsche Bank Is ‘Rock Solid’ (Coppola)

This has been a terrible day for Deutsche Bank. The stock price has collapsed, and shares are now trading lower than they were in the dark days of 2008 after the fall of Lehman. Yields on CoCos and CDS are spiking too. Despite a reassuring statement from the German Finance Minister that he had “no concerns” about Deutsche Bank, markets are clearly worried that Deutsche Bank may be in serious trouble. And when “serious trouble” means that shareholders, subordinated debt holders and even senior unsecured bondholders could lose part or all of their investment, because of the bail-in rules under the EU’s Bank Recovery and Resolution Directive (BRRD), it is hardly surprising that investors are running for the hills. Even if Deutsche Bank were not in trouble before, it is now.

Unsurprisingly, the CEO, John Cryan, is upbeat about it. Today he issued a statement to staff advising them how to address the concerns of clients:

Volatility in the fourth quarter impacted the earnings of most major banks, especially those in Europe, and clients may ask you about how the market-wide volatility is impacting Deutsche Bank. You can tell them that Deutsche Bank remains absolutely rock-solid, given our strong capital and risk position. On Monday, we took advantage of this strength to reassure the market of our capacity and commitment to pay coupons to investors who hold our Additional Tier 1 capital. This type of instrument has been the subject of recent market concern. The market also expressed some concern about the adequacy of our legal provisions but I don’t share that concern. We will almost certainly have to add to our legal provisions this year but this is already accounted for in our financial plan.

I reviewed Deutsche Bank’s financial position as stated in their interim results last week. My findings do not support John Cryan’s statement that the bank is “rock solid”. Its capital and leverage ratios were not particularly strong by current standards, and have deteriorated since the full-year results. More worryingly, I found evidence that profits in two of the four divisions were only achieved by risking-up: the other two divisions were loss-making. Risking-up to generate profits would, if sustained over the medium-term, require substantially more capital than Deutsche Bank currently has. For two divisions of a bank that is currently delivering NEGATIVE return on equity to adopt strategies which would in due course require more capital does not appear remotely sensible.

Though I suppose actually admitting that the bank cannot generate anything like a reasonable return for shareholders without taking significantly more risk would be even worse. I also share the market’s concern about lack of legal provisions. A large part of the write-off of 5.2bn Euros due to litigation costs and fines in the interim results arose from cases already settled, particularly the record multi-jurisdictional fine for benchmark rate rigging in April 2015, though it also includes the 1.3bn Euros increase in provisions announced in October 2015 to cover charges potentially arising from the investigation of Deutsche Bank’s Russian operation for money laundering. But since these provisions seem light for what is a serious offense, and Deutsche Bank faces other potentially very expensive regulatory investigations and legal cases, I do not consider this write-off adequate.

They’re so f**ked. Biggest bank, biggest derivatives portfolio. Run for the hills. When you even need your finance minister to do a reassurance call, you know you’re cooked.

• Deutsche Considers Multibillion Bond Buyback (FT)

Deutsche Bank is considering buying back several billion euros of its debt, as Germany’s biggest bank steps up efforts to shore up the tumbling value of its securities against the backdrop of a broader rout of financial stocks. After European banks suffered a second consecutive day of sharp falls, Deutsche Bank is expected to focus its emergency buyback plan on senior bonds, of which it has about €50bn in issue, according to the bank. The move was unlikely to involve so-called contingent convertible bonds which, along with the bank’s shares, have been the butt of a brutal investor sell-off in recent days, people briefed on the plan said. The news came as Germany’s finance minister Wolfgang Schäuble and Deutsche CEO John Cryan both sought to assuage market fears.

Mr Schäuble said he had “no concerns” about the bank, while Mr Cryan insisted Deutsche’s position was “absolutely rock-solid”. The bank’s shares still fell 4%, taking the decline since the start of the year to 40%. Other European banks fared even worse on Tuesday, with Credit Suisse falling 8% and UniCredit 7%, as investor nervousness intensified over the relative weakness of European bank capital and earnings amid broader market turmoil. US banks, which have been hit hard in recent weeks, too, were only marginally weaker at lunchtime on Tuesday. Investors have also been rattled by the prospect of negative interest rates spreading across the developed world.

On Tuesday Japan became the first major economy with a sub-zero borrowing rate for 10-year debt as the total of government bonds trading with negative yields climbed to a new peak of $6tn. Concern about the solidity of bank debt — principally European bank cocos, which can suspend coupons and may convert into equity in a crisis — has prompted an investor dash to buy protection. A popular credit derivatives index that tracks the likelihood of default of investment-grade debt of European companies and banks was trading at 119 basis points on Tuesday, near its highest level since June 2013. Broader investor concerns about the health of the financial sector have coincided with more specific questions about Deutsche’s nascent restructuring programme.

Ouch. Peddling fiction, sir?

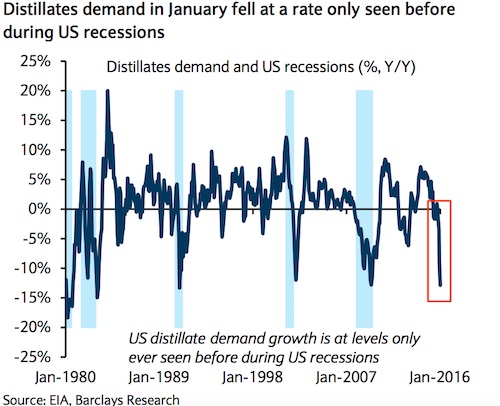

• Distillates Demand Signals US Recession Is Imminent (BI)

The US economy is flashing warning signs, particularly the industrial and manufacturing sectors. Demand for oil, and particularly so-called distillates – which are refined oil products such as jet fuels and heating oils – is crashing. Here’s the Barclays commodities team on the indicator:

January US demand for the four main refined products came in at -568k b/d (-3.9% y/y), compared with January 2015. Distillates were the weakest sector, down 18% y/y. Whether or not the data itself point to much weaker underlying growth in the US economy is still open to question, but not much. As illustrated in Figure 4, the scale of the decline in distillates demand in January has only ever been seen before during full-blown US recessions.

And here’s that chart:

Barclays does cite some mitigating factors, such as unusually warm winter weather and the fact this is based on preliminary data that may get revised upward later on. But it doesn’t look great.

And counting.

• US Oil Drillers Must Slash Another $24 Billion This Year (BBG)

North American oil and natural gas drillers will need to cut an additional 30% from their capital budgets to balance their spending with the cash coming in their doors even if crude rises to $40 a barrel, according to an analysis by IHS Inc. A group of 44 North American exploration and production companies are planning to spend $78 billion on capital projects this year, down from $101 billion last year. Those companies need to cut another $24 billion this year to get their spending in line with a historical 130% ratio of spending to cash flow, IHS said Monday.

“These spending cuts will be particularly troublesome for the highly leveraged companies,” said Paul O’Donnell at IHS Energy. “These E&Ps are torn between slashing spending further to avoid additional weakening of their balance sheets, and the need to maintain sufficient production and cash flow to meet financial obligations.” The analysis is based on IHS’s low-case price scenario of $40-a-barrel oil and $2.50-per-million-cubic-feet natural gas prices. IHS cited Concho Resources, Whiting Petroleum, WPX Energy, and PDC Energy. as examples of companies displaying the best spending discipline.

“..“There is not any kind of imaginary line where you can say, ‘OK this has gone down enough,’ and it’s now a recovery play or a turnround play. They just go down more, until they are done going down..”

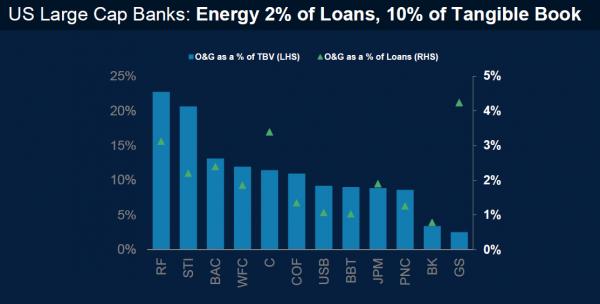

• Five Reasons Behind US Bank Stocks Selloff (FT)

US bank stocks have suffered a brutal start to 2016. Out of the 90 stocks on the S&P financials index, just eight were in positive territory for the year at mid-morning on Tuesday. Two of the biggest losers, Bank of America and Morgan Stanley, are down 27% and 28% respectively. Citigroup, also down 27%, is now trading at just 6.5 times earnings, not far off its post-crisis trough of 5.9 times, reached during the depths of the European debt crisis five years ago.

• Collapsing expectations of US interest rate rises Analysts offer a lot of different reasons for the big sell-off, but on this they agree. “Lift-off” in December was supposed to usher in an era of higher interest rates — which are always good news for the banks. In previous rate-raising cycles, assets have always re-priced faster than liabilities, earning banks a bigger spread between the yields on their loans and the cost of their funds. But worsening data since then from big economies, notably China, has investors worried that the world economy is a lot sicker than they had assumed. Expectations of another three rate rises from the Fed this year have collapsed in a matter of weeks. Talk of a rate cut, or even a move to negative rates, is entering the picture.

• Worsening credit quality In itself, a lower oil price will not do much direct damage to the big banks’ balance sheets, say analysts. Total energy exposures amount to less than 3% of gross loans at the big banks, which have mostly investment-grade assets, and which have already pumped up reserves. Perhaps more worrying are the second-round effects: if weakness in oil-dependent communities begins to spill into commercial real estate loan books, say, or if consumers find they cannot afford repayments on loans for their new gas-guzzling cars. In an environment of precious little growth — the big six US banks produced exactly the same amount of revenue last year as they did in 2014 — rising credit costs are likely to lead to lower profits.

• Deutsche Bank Every sell-off needs a point of focus and in recent days it has been Deutsche Bank. The contortions of the Frankfurt-based lender weighed on the entire banking sector on Monday, as it fought to dispel fears that it could not pay a coupon on a bond. “I think maybe counterparty risk is emerging,” says Shannon Stemm at Edward Jones in St Louis. “At the root, are some of these [European] banks as well capitalised as the US banks? Probably not. Can they continue to build capital in an environment where there is not a lot of revenue growth, and a lot of expenses have already been taken out of the business?”

• Banks are banks These are confidence stocks. When markets are doing well, banks tend to do well, as companies feel better about doing deals and raising money, investors put on a lot of trades, and asset management arms benefit from big inflows. But when confidence disappears, banks tend to bear the brunt of the sell-off. Matt O’Connor at Deutsche Bank notes that in 15 corrections going back to 1983, the US banks sector has been hit roughly twice as hard as the rest of the market — regional banks about 1.8 times worse, and capital markets-focused banks about 2.3 times worse. “At the end of the day when markets get scared, banks go down more, that is just what happens,” he says. “There is not any kind of imaginary line where you can say, ‘OK this has gone down enough,’ and it’s now a recovery play or a turnround play. They just go down more, until they are done going down or markets feel better about macro conditions.”

• Bank stocks were not cheap before the slide At the peak last July, the S&P 500 was trading about 20% above historical levels, and bank stocks were up to 25% higher than their historical averages, based on multiples of estimated earnings.* But none of these reasons is providing much comfort to investors at the moment. At Edward Jones, Ms Stemm is recommending clients ride out the turmoil by switching big global universal banks for steadier, US-focused lenders such as Wells Fargo and US Bancorp. “If there are global macro concerns, if recession concerns really are on the table, investors would rather get out than wait to see what happens,” she says.

Japan is getting cooked. Fried. Roasted. Torched.

• 10-Year Japanese Government Bond Yield Falls Below Zero (FT)

The universe of government bonds trading with negative yields climbed to a new peak of $6tn on Tuesday as Japan became the first major economy with a sub-zero borrowing rate for 10-year debt. Benchmark bonds issued by the world’s third-largest economy dropped to a yield of minus 0.05%, as investors sought shelter from market convulsions triggered by sliding oil prices, concern for the health of the global economy and mounting fears over parts of the financial system. Japan’s recent decision to introduce a charge on new reserves parked with the central bank has rippled out across global government bond markets as investors expect central banks in Europe to push their overnight borrowing rates further into negative territory. That has spurred strong buying of positive yielding government debt across the eurozone, US and UK markets, while also bolstering other havens such as gold and the yen.

“The bear market in risk assets is evolving very quickly,” said Andrew Milligan at Standard Life. “A month ago the focus was China, then oil, then the prospect of US recession, now it is European financial companies.” The move comes just 11 days after the Bank of Japan’s surprise decision to follow in the footsteps of Switzerland, Denmark, Sweden and the eurozone by adopting negative interest rates, raising fresh concern about the side-effects of ultra-loose monetary policy by central banks. The growing trend of negative yields within the $23tn universe of developed world government debt tracked by JP Morgan has also sapped sentiment for financial shares and bonds, intensifying the demand for havens, as investors reassess their holdings of equities and corporate bonds. David Tan at JPMorgan said negative interest rates were being viewed as negative for bank earnings.

“The principal driver of negative JGB yields was the Bank of Japan’s deposit rate cut to -10bp, and the market now expects additional cuts during this year starting from as soon as the next Bank of Japan meeting,” he said. “This has contributed to a sell-off in banking stocks and a renewed flight to safety into government bonds.” Leading the slide among financials has been Deutsche Bank, with investors worried that it may have trouble repaying its debts. David Ader, CRT Investment Banking bond strategist, said market skittishness was understandable, if not expected. “The European banking system clearly remains a meaningful concern and memories of the credit crisis in the sector are still fresh,” he said.

For Japan’s government, the appreciating yen looms as an uncomfortable development. A weak currency is one of the major hallmarks of Prime Minister Shinzo Abe’s economic revival plan, dubbed Abenomics. Investors now suspect Japan Inc’s assumptions of an average rate of Y117.5 against the dollar during 2016 could leave companies missing profit forecasts and force the BoJ and government into fresh action — if more is possible. “If a 20 basis points cut won’t stop the yen rising, what can the Japanese authorities do? That is the question the market is asking,” said Shusuke Yamada at Bank of America. Investors, especially foreign funds that poured into the Japanese stock market during 2013, are increasingly taking the view that the magic of the “Abenomics” growth programme has worn off. Foreigners sold a net Y1.66tn of Japanese equities in January, according to official figures.

Why not have another one of these scams?

• EU Probes Suspected Rigging Of $1.5 Trillion Debt Market (FT)

European regulators have opened a preliminary cartel investigation into possible manipulation of the $1.5tn government-sponsored bond market, in the latest efforts to root out rigging involving financial traders. The European Commission’s early-stage inquiry comes amid revelations that the US Department of Justice and the UK’s Financial Conduct Authority are also investigating the market. The investigations are part of a campaign by antitrust regulators to root out collusion in financial markets following revelations that groups of traders worked together to manipulate Libor, a key rate that underpins the price of loans around the world. Further allegations followed that traders colluded to rig foreign exchange markets.

The commission’s powerful competition department has sent questionnaires to a number of market participants as part of an early-stage probe into possible manipulation of the price of supranational, subsovereign and agency debt, known as the SSA market. This market covers a diverse range of debt issuers including organisations such as the European Bank for Reconstruction and Development and regional borrowers like Germany’s Länder. A common feature is that the bonds often have a form of implicit or explicit state guarantee. Banks and interdealer brokers have so far been fined around $20bn by authorities around the world in response to the Libor and foreign exchange rate scandals which saw over a dozen leading financial institutions investigated by antitrust authorities.

The findings also led to criminal prosecutions of individual traders, and spurred investigations into other markets such as derivatives trading. The Financial Times reported last month that Crédit Agricole, Nomura and Credit Suisse are among a number of banks being investigated by the DOJ as part of its investigation into possible manipulation of SSA markets. London-based traders at these three banks, in addition to another trader at Bank of America, have been put on leave in response to the DOJ investigations, according to people familiar with the matter. It is understood that the commission’s inquiry started around the same time as the DoJ probe.

The commission’s enquiries concern a possible cartel or “concerted practice” according to the person familiar with the investigation, who did not provide further details. The questionnaires will help Margrethe Vestager, the commission’s competition chief, decide whether there are the grounds to launch a formal probe. Complex cartel cases typically take a minimum of four years to complete and are usually based on evidence from tip-offs provided by whistleblowers. The commission can fine a company involved in a cartel up to 10% of its global turnover.

I picked one detail from the longer article on eurozone banks.

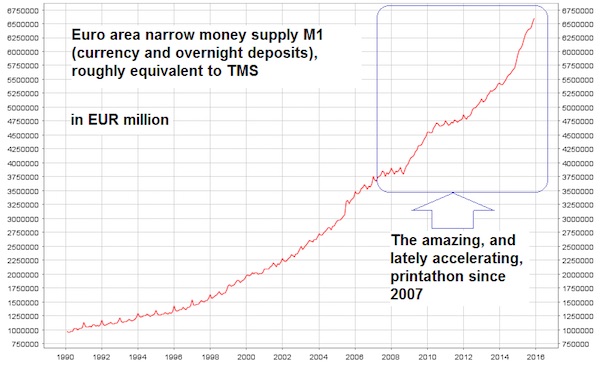

• Italy, A Ponzi Scheme Of Gargantuan Proportions (Tenebrarum)

Ever since the ECB has begun to implement its assorted money printing programs in recent years – lately culminating in an outright QE program involving government bonds, agency bonds, ABS and covered bonds – bank reserves and the euro area money supply have soared. Bank reserves deposited with the central bank can be seen as equivalent to the cash assets of banks. The greater the proportion of such reserves (plus vault cash) relative to their outstanding deposit liabilities, the more of the outstanding deposit money is in fact represented by “covered” money substitutes as opposed to fiduciary media.

Euro area true money supply (excl. deposits held by non-residents) – the action since 2007-2008 largely reflects the ECB’s money printing efforts, as private banks have barely expanded credit on a euro area-wide basis since then.

Many funny tricks have been employed to keep euro area banks and governments afloat during the sovereign debt crisis. Essentially these consisted of a version of Worldcom propping up Enron, with the central bank’s printing press as a go-between. As an example here is how Italian banks and the Italian government are helping each other in pretending that they are more solvent than they really are: the banks buy government properties (everything from office buildings to military barracks) from the government, and pay for them with government bonds. The government then leases the buildings back from the banks, and the banks turn the properties into asset backed securities. The Italian government then slaps a “guarantee” on these securities, which makes them eligible for repo with the ECB. The banks then repo these ABS with the ECB and take the proceeds to buy more Italian government bonds – and back to step one.

Simply put, this is a Ponzi scheme of gargantuan proportions. Still, in view of these concerted efforts to reliquefy the banking system, one would expect that European banks should be at least temporarily solvent, more or less. Since they have barely expanded credit to the private sector, preferring instead to invest in government bonds, the markets should in theory have little to worry about.

Overinvested.

• Maersk Profit Plunges as Oil, Container Units Both Suffer (BBG)

A.P. Moeller-Maersk A/S reported an 84% plunge in 2015 profit after its oil unit was hit by lower energy prices and its container division got squeezed between sluggish trade growth and overcapacity. Maersk said net income was $791 million last year compared with $5.02 billion in 2014. The result includes a writedown in the value of Maersk’s oil assets by $2.6 billion, the Copenhagen-based company said. “Given our expectation that the oil price will remain at a low level for a longer period, we have impaired the value of a number of Maersk Oil’s assets,” CEO Nils Smedegaard Andersen said in the statement. “We will continue to strengthen the Group’s position through strong operational performance and growth investments.”

In October, Maersk started cost cut programs for both of its two biggest units to address what analysts have described as a perfect storm for the conglomerate, which historically has found support from positive market conditions for at least one the two divisions. Maersk said Wednesday that 2016’s underlying profit will be “significantly below” last year’s $3.1 billion. The Maersk Line unit’s profit will also be “significantly below” 2015’s level, which was $1.3 billion. Maersk Oil will report a loss this year, it said. The unit currently breaks even when oil prices are in a range of $45 to $55 a barrel, the company said.

“..with the Australian economy suddenly desperate for lower rates from the RBA, one can ignore the propaganda lies, and focus once again on the far uglier truth…”

• Australia Admits Recent Stellar Job Numbers Were Cooked (ZH)

Two months ago the Australian media, which unlike its US counterpart refuses to be spoon fed ebullient economic propaganda, called bullshit on the spectacular October job numbers, when instead of adding 15,000 jobs as consensus expected, Australia’s Bureau of Statistics reported that a whopping 58,600 jobs had been added. [.] One month later, the situation got even more ridiculous, when instead of the expected 10,000 drop in November, the “statistical” bureau announced that 71,400 jobs had been added, the most in 15 years, and the equivalent of 1 million jobs added in the US. Once again the local media cried foul.

Two months later we find that the media, and all those mocking the government propaganda apparatus, were spot on, because moments ago today, Australia Treasury Secretary John Fraser, during testimony to parliamentary committee, admitted that jobs growth for the two months in question “may be overstated.” What’s the reason? The same one the propaganda bureau always uses when its lies are exposed: “technical issues”, the same explanation the Atlanta Fed used in its explanation for a strangely belated release of its GDP Now estimate one month ago. Here’s Bloomberg with more:

Australia has had some technical issues with its labor data, which “look a little bit better” than would otherwise have been the case, the secretary to the Treasury said, commenting on record employment growth in the final quarter of 2015. John Fraser, the nation’s top economic bureaucrat, told a parliamentary panel in Canberra Wednesday that he held discussions on the employment figures with the chief statistician this week. He didn’t elaborate on the meeting but said the recent strength in the jobs market is encouraging.

There were some “technical issues” in October and November that may have made the employment figures “look a little bit better than otherwise would be the case,” he said. The technical issues relate to “rolling off” of participants in the labor survey. Australia’s economy added 55,000 jobs in October and a further 74,900 in November, before shedding 1,000 in December to produce the record quarterly gain. Questions regarding the accuracy of the data have been raised following acknowledgment by the statistics agency in 2014 of measurement challenges.

Why the sudden admission it was all a lie? Simple: weakness in commodity prices “is far greater than people had been expecting,” Fraser said in earlier remarks to the panel. Australia is now “swimming against the tide” because of uncertainties in the global economy, he added. Translation: “we need more easing, and to do that, the economy has to go from strong to crap.” And with the Australian economy suddenly desperate for lower rates from the RBA, one can ignore the propaganda lies, and focus once again on the far uglier truth.

Which makes us wonder: with the Yellen Fed in desperate need of political cover for relenting on its terrible rate hike strategy, and once again lowering rates to zero or negative, a recession – something JPM hinted at yesterday – will be critical. And what better way to admit the US has been in one for nearly a year than to drastically revise all the exorbitant labor numbers over the past 12 months. You know, for “technical reasons”…

The crazies are in charge: “Ash Carter said he would ask for spending on US military forces in Europe to be quadrupled in the light of “Russian aggression”. The allocation for combating Islamic State, in contrast, is to be increased by 50%.”

• Pentagon Fires First Shot In New Arms Race (Guardian)

As the voters of New Hampshire braved the snow to play their part in the great pageant of American democracy on Tuesday, the US secretary of defence was setting out his spending requirements for 2017. And while the television cameras may have preferred the miniature dramas at the likes of Dixville Notch, the reorientation of US defence priorities under the outgoing president may turn out to exert the greater influence – and not in a good way, at least for the future of Europe. In a speech in Washington last week, previewing his announcement, Ash Carter said he would ask for spending on US military forces in Europe to be quadrupled in the light of “Russian aggression”. The allocation for combating Islamic State, in contrast, is to be increased by 50%. The message is unambiguous: as viewed from the Pentagon, the threat from Russia has become more alarming, suddenly, even than the menace that is Isis.

If this is Pentagon thinking, then it reverses a trend that has remained remarkably consistent throughout Barack Obama’s presidency. Even before he was elected there was trepidation in some European quarters that he would be the first genuinely post-cold war president – too young to remember the second world war, and more global than Atlanticist in outlook. And so it proved. From his first day in the White House, Obama seemed more interested in almost anywhere than Europe. He began his presidency with an appeal in Cairo addressed to the Muslim world, in an initiative that was frustrated by the Arab spring and its aftermath, but partly rescued by last year’s nuclear agreement with Iran. He had no choice but to address the growing competition from China, and he ended half a century of estrangement from Cuba.

But Europe, he left largely to its own devices. When France and the UK intervened in Libya, the US “led from behind”. Most of the US troops remaining in Europe, it was disclosed last year, were to be withdrawn. Nor was such an approach illogical. Europe was at peace – comparatively, at least. The European Union was chugging along, diverted only briefly (so it might have seemed from the US) by the internal crises of Greece and the euro. Even the unrest in Ukraine, at least in its early stages, was treated by Washington more as a local difficulty than a cold war-style standoff. Day to day policy was handled (fiercely, but to no great effect) by Victoria Nuland at the state department; Sanctions against Russia were agreed and coordinated with the EU. All the while – despite the urging of the Kiev government – Obama kept the conflict at arm’s length.

Congress agitated for weapons to be sent, but Obama wisely resisted. This was not, he thereby implied, America’s fight. In the last months of his presidency, this detachment is ending. The additional funds for Europe’s defence are earmarked for new bases and weapons stores in Poland and the Baltic states. There will be more training for local Nato troops, more state-of-the-art hardware and more manoeuvres. Now it is just possible that the extra spending and the capability it will buy are no more than sops to the “frontline” EU countries in the runup to the Nato summit in Warsaw in July, to be quietly forgotten afterwards. More probably, though, they are for real – and if so the timing could hardly be worse. Ditto the implications for Europe’s future.

By planning to increase spending in this way, the US is sending hostile signals to Russia at the very time when there is less reason to do so than for a long time. It is nearly two years since Russia annexed Crimea and 18 months since the downing of MH17. The fighting in eastern Ukraine has died down; there is no evidence of recent Russian material support for the anti-Kiev rebels, and there is a prospect, at least, that the Minsk-2 agreement could be honoured, with Ukraine (minus Crimea) remaining – albeit uneasily – whole.

These people are inventing a entire parallel universe, and nobody says a thing. NATO to patrol the Med on refugee streams? NATO is an aggression force, an army way past its expiration date. It has zero links to refugees. There is no military threat there. Oh, but then we bring in Russia.. “Stoltenberg said naval patrols would fit into “reassurance measures” to shield Turkey from the war in neighboring Syria..” ‘We’ have lost our marbles. ‘We’ are on the war path.

• NATO Weighs Mission to Monitor Mediterranean Refugee Flow (BBG)

NATO will weigh calls for a naval mission in the eastern Mediterranean Sea to police refugee streams as a fresh exodus from Syria adds to European leaders’ desperation. Such a mission, proposed by Germany and Turkey, would thrust the 28-nation alliance into the humanitarian trauma aggravated by the Russian-backed offensive by Syrian troops that drove thousands out of Aleppo and toward Turkey. “We will take very seriously a request from Turkey and other allies to look into what NATO can do to help them cope with and deal with the crisis,” NATO Secretary General Jens Stoltenberg told reporters in Brussels on Tuesday. NATO is confronted with Russian intervention in the Middle East – including airspace violations over Turkey, an alliance member – after reinforcing its eastern European defenses in response to the Kremlin’s annexation of Crimea and fomenting rebellion in Ukraine in 2014.

Allied warships now on a counter-terrorism mission in the Mediterranean and anti-piracy patrols off the coast of Somalia could be reassigned to monitor and potentially go after human traffickers in the Aegean Sea between Greece and Turkey. A naval mission, to be discussed Wednesday and Thursday at a meeting of defense ministers in Brussels, is controversial. It could produce unpleasant images of NATO sailors and soldiers herding refugee children behind barbed wire, handing a propaganda victory to Islamic radicals and the alliance’s detractors in the Kremlin. With her political standing in jeopardy as German public opinion turns against her open-arms approach, German Chancellor Angela Merkel went to Ankara on Monday with limited European leverage to persuade Turkey to house more refugees on its soil instead of pointing them toward western Europe.

Stoltenberg said naval patrols would fit into “reassurance measures” to shield Turkey from the war in neighboring Syria that already include Patriot air-defense missiles and air surveillance over Turkish territory and the coast. U.S. Ambassador to NATO Douglas Lute called on European Union governments to take the lead on civilian emergency management, with the alliance confined to offering backup. He said military planners will draw up options. “This is fundamentally an issue that should be addressed a couple miles from here at EU headquarters, but it doesn’t mean NATO can’t assist,” Lute told reporters.

I could have spared them the research.

• Border Fences Will Not Stop Refugees, Migrants Heading To Europe (Reuters)

Efforts by European countries to deter migrants with border fences, teargas and asset seizures will not stem the flow of people into the continent, and European leaders should make their journeys safer, a think-tank said on Wednesday. The Overseas Development Insitute (ODI) said Europe must act now to reduce migrant deaths in the Mediterranean, where nearly 4,000 people died last year trying to reach Greece and Italy, and more than 400 have died so far this year. European governments could open consular outposts in countries like Turkey and Libya which could grant humanitarian visas to people with a plausible asylum claim, the think-tank said. Allowing people to fly directly to Europe would be safer and cheaper than for them to pay people smugglers, and would help cripple the smuggling networks that feed off the migrant crisis, the London-based ODI said.

More than 1.1 million people fleeing poverty, war and repression in the Middle East, Asia and Africa reached Europe’s shores last year, prompting many European leaders to take steps to put people off traveling. But the ODI said new research showed such attempts either fail to alter people’s thinking or merely divert flows to neighboring states. Researchers interviewed 52 migrants from Syria, Eritrea and Senegal who had recently arrived in Germany, Britain and Spain. Their journeys had cost an average 2,680 pounds ($3,880) each. More than one third had been victims of extortion, and almost half the Eritreans had been kidnapped for ransom during their journey. Researchers said that, contrary to popular perception, many migrants left home without a clear destination in mind. Their experiences along the way and the people they met informed where they would go next.

Information from European governments was unlikely drastically to alter migrants’ behavior, the ODI said. “Our research suggests that while individual EU member states may be able to shift the flow of migration on to their neighbors through deterrent measures such as putting up fences, using teargas and seizing assets, it does little to change the overall number … coming to Europe,” said report co-author Jessica Hagen-Zanker. “As one of the people we interviewed put it ‘When one door shuts, another opens’.”

Home › Forums › Debt Rattle February 10 2016