Edward Hopper Gas 1940

Even hurricanes run out of energy eventually. And water.

• Irma Weakens But Continues To Batter Central Florida (NPR)

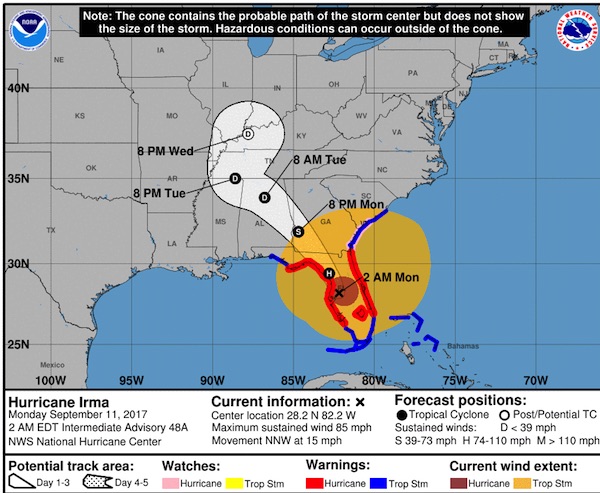

Irma has weakened since beginning its push up central Florida, but is still a Category 1 hurricane with winds near 85 mph and higher gusts, according to the National Hurricane Center. Its center is about 25 miles northeast of Tampa and continues to move toward the north-northwest. The NHC says Irma is expected to turn northwest later today and further weaken to a tropical storm. Irma’s hurricane force winds extend at least 80 miles from the storm’s center and tropical storm force winds extend as far as 415 miles. The hurricane is forecast to reach the southeastern United States later tonight. The NHC warns coastal areas could see rising water moving inland over the next 36 hours. “This is a life threatening situation,” it said in a bulletin issued at 2 a.m. ET.

Hurricane Irma had touched land again as a Category 3 Sunday afternoon, hitting Marco Island on Florida’s southwest coast, after it plowed through the Florida Keys as a Category 4 earlier in the day. Miami International Airport announced it will remain closed to passenger flights at least through Monday, though some airlines will fly personnel to the airport in preparation for reopening. The airport’s director, Emilio Gonzalez, said via Twitter that the airport had endured wind gusts near 100 mph and “sustained significant water damage throughout.” “The interaction with the Florida Peninsula along with strong southwesterly shear should cause significant weakening, but Irma’s large and powerful circulation will likely maintain hurricane strength until Monday morning at the earliest,” according to the National Hurricane Center’s latest forecast.

The industry works from Bermuda.

• Reinsurers Will Largely Be Writing the Checks to Pay for Irma Damage (WSJ)

A global array of reinsurance companies will bear the financial brunt of Hurricane Irma’s damage to potentially millions of homes across Florida. Irma’s winds are expected to leave tens of billions of dollars in insured damage. And when the insurance money arrives for many homeowners, much of it will be via reinsurance companies—not the carrier on their contract. Reinsurers play an especially large role in Florida’s home-insurance market. Andrew, Katrina and other severe hurricanes from 1992 through 2005 devastated the state’s insurance marketplace. Most brand-name national home insurers sharply reduced their presence. Picking up the slack today is a state-run “insurer of last resort,” Citizens Property Insurance, and some 50 small to midsize home insurers.

Those carriers all are required to buy ample amounts of reinsurance to help ensure they have money for their policyholders, because they don’t have the fat capital cushions of the national carriers. These reinsurance firms are specialty insurers that take on the risk of some of the policies sold by primary insurers. They send insurers money to help pay claims once claims reach contractual, designated levels. As a result, the reinsurers “might end up holding the bag” for much of Irma’s damage to residential properties, said Taoufik Gharib, a senior director at Standard & Poor’s Global Ratings. In addition to reinsurance, the U.S. government’s National Flood Insurance Program will face payouts to those homeowners who hold its policies. Under standard homeowners contracts, insurers cover wind damage but exclude flooding.

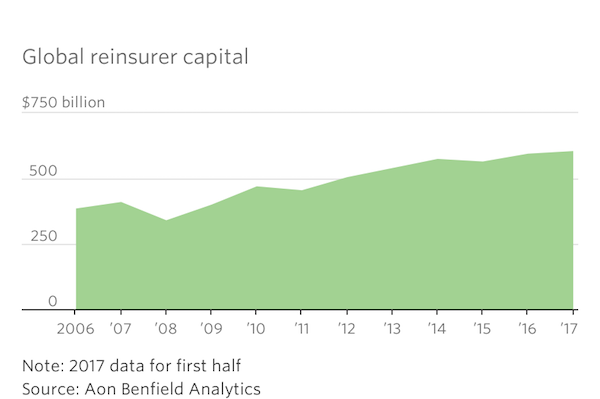

Much of Irma’s damage is expected to come from storm surge. The use of so much reinsurance introduces a few worries into the marketplace. The home insurers are exposed to potential disputes with their reinsurers over claims payments, industry analysts note. It also ties the home insurers’ fates to the financial health of their reinsurers. Irma’s arrival is well-timed from one perspective: The global reinsurance industry is awash in capital. As of March, it had a record $605 billion capital cushion, which was built up thanks in large part to relatively few major natural disasters in the U.S. since 2005. “Every company in Florida has reinsurance,” said Joseph Petrelli, president of Demotech, an insurance ratings firm with a specialty in Florida’s homeowners market. “They buy reinsurance for multiple storms, and it is across the entire season.”

Good luck to all who need it.

• Insurers Ache For Qualified Inspectors After US Hurricanes (R.)

Insurers are scrambling to find inspectors in Texas and Florida after fierce hurricanes battered the states one after the other, causing tens of billions of dollars’ worth of property damage in less than two weeks. Although insurers maintain some number of inspectors, known as claims adjusters, across the U.S. year-round, they must redeploy staff from other areas or hire contract workers to fill gaps when catastrophes like Hurricanes Harvey and Irma strike. The speed with which they can do so is critical to residents and business owners awaiting insurance payments. “The one-two punch of Harvey and Irma is no question challenging to the industry,” said Kenneth Tolson, who heads the U.S. property and casualty division of Crawford, which provides claims adjusters and staff after disasters.

Adjusters investigate claims on behalf of property insurers like Travelers, Hartford, Allstate, State Farm and Farmers Insurance. Many other policies are backed by federal or state flood insurance programs. Texas and Florida together have more than 340,000 licensed adjusters, according to state agencies, but it was unclear precisely how many were on the ground. Insurers and industry groups said thousands were headed to affected areas from other parts of the United States. [..] Insurers have been put to the test before. After Hurricanes Katrina and Sandy in 2005 and 2012, it took months for many property owners to receive payouts, partly because there were too few adjusters with the needed expertise. Novice errors like not pulling off drywall to inspect for hidden damage, or not being familiar with software used for loss estimates, can reduce or delay insurance payments, adding to hardships residents are already facing.

This is the craziest thing. You pay an arm and a leg for a car and then the maker pre-cripples it.

• Elon Musk Magically Extends Battery Life Of Teslas Fleeing Irma (ZH)

In what is either a generous act of charity or an unnerving example of the control Tesla exercises over the vehicles it producers, or perhaps both, Tesla CEO Elon Musk has magically unlocked the batteries of every Tesla in Florida to maximize the distance that people fleeing from Hurricane Irma can travel before stopping to refuel at one of the company’s “superstation” charging centers. Typically, these types of over-the-air upgrades can cost thousands – if not tens of thousands – of dollars. But Musk is temporarily offering full battery capacity to all owners of Model S/X 60/60D vehicles with 75 kilo watt battery packs, according to Electrek, a blog that covers electric vehicles. The upgrade will surely help Floridians who are still rushing to escape as the now category 3 storm makes its second landfall near Naples. The upgrade will last through Saturday.

As a Tesla spokesperson explained to Electrek, the company decided on the mass-unlocking strategy after a customer called and asked if the company could upgrade his battery because he was trying to flee the storm. Tesla’s Supercharger network is fairly extensive in Florida and most owners should be able to get by even with a Model S 60 (the shortest range option). A Tesla Model S 60 owner in Florida told Electrek that his Tesla was getting 40 more miles without a charge after Tesla had temporarily unlocked the remaining 15 kilo watts of the car’s software-limited battery pack. “The company says that a Tesla owner in a mandatory evacuation zone required another ~30 more miles of range to optimize his evacuation route in the traffic and they reached out to Tesla who agreed to a temporary access to the full 75 kWh of energy in the battery pack, an upgrade that has cost between $4,500 and $9,000 depending on the model and time of upgrade.”

“..market trend of rising valuations and falling economic earnings..”

• US Earnings Recovery Remains An Illusion (F.)

While analysts hail “the best earnings season in 13 years,” the market has delivered a solidly lackluster response. Over the past month, the S&P 500 is down roughly 1% despite a string of earnings beats. With valuations this stretched, the market no longer appears willing to reward companies merely for beating quarterly expectations. Perhaps more investors now understand that GAAP net income numbers omit valuable information. They include non-operating items, are subject to manipulation, and don’t account for the cost of capital. GAAP earnings don’t drive valuation. What investors should focus on are economic earnings, which make adjustments to exclude non-operating items and account for all sources of capital, both on and off the balance sheet.

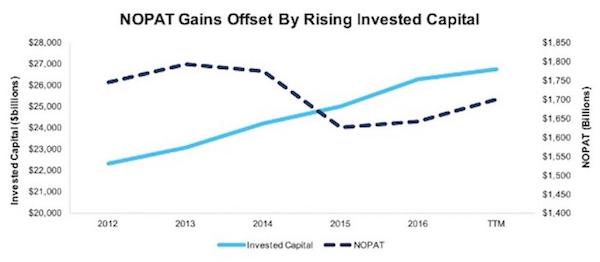

My analysis of the latest 10-K and 10-Q filings for the S&P 500 shows that the GAAP earnings growth in the market has not translated to an increase in economic earnings. Through the first two quarters of 2017, GAAP earnings are up $61 billion from their 2016 levels, while economic earnings have declined by $28 billion. Figure 2 shows the source of the discrepancy between GAAP and economic earnings comes mostly from invested capital growth that has outpaced growth in NOPAT. Companies are generating more operating profits, but they require an ever-larger invested capital base to do so. In other words, companies are growing their balance sheets faster than they are growing profits.

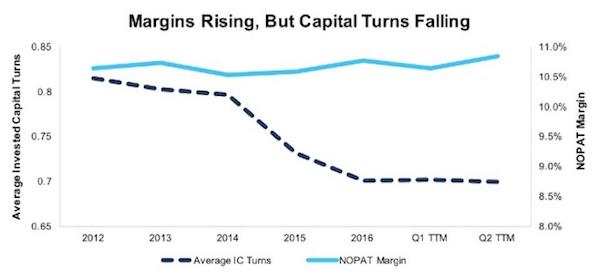

Figure 3 expands upon the trend shown in Figure 2. Companies are earning more profit for each dollar of revenue, but they’re also having to invest more capital to earn that revenue. When investors such as Jeremy Grantham argue that margins are higher today than in the past, they miss the balance sheet side of the story. Declining capital turns more than offset the rise in margins.

Everybody has trouble with their earnings.

• Cracks In China Inc’s Rosy Earnings Reveal A Patchier Picture (R.)

At first glance, China Inc’s earnings are off to a roaring start to 2017: first-half net profits surged by nearly a quarter, helped by healthy expansion in the world’s second-largest economy. Last year, the rise was a mere 6%. Robust profits have been a key factor in pushing the benchmark Hong Kong index .HSI to three-year highs and its Shanghai counterpart .SSEC to its strongest levels in 20-months. But the corporate investment and M&A that is driving those earnings is being fueled by growth in debt that is too rapid for comfort, analysts say. Frequent use of one-off gains to lift results and unhealthy fundamentals in some sectors may also give investors pause for thought.

Total debt at some 1,200 firms listed in Shanghai, Shenzhen and Hong Kong as of end-June grew 13% from a year earlier, Reuters calculations show, much faster than the first half of 2016 when the rate was 7.5%. Profits were not used to retire debt in significant quantities over the period and cash levels at those firms, selected for the survey as they have reported earnings for at least two years in a row, shot up 12%. All in all, debt-to-equity ratios were little changed from last year, an indication that hopes of a broad deleveraging for Chinese firms, widely seen as having worrisome debt levels, seem premature. “These earnings improvements are credit driven and I have doubts about the sustainability,” said Andrew Kemp Collier at independent research firm Orient Capital.

China’s property developers have led the way in debt creation, and even if some of the most heavily burdened like China Evergrande did cut back, others kept borrowing. Acquisition-hungry Sunac saw contract sales almost double and gross profit climb 86%, but its total borrowing also jumped, up 60% to nearly $28 billion. “The picture is not as rosy as shown by rising earnings – credit is accumulating faster than nominal growth,” said Natixis Chief Economist Alicia Garcia Herrero, also noting that very short term debt is not captured in conventional leverage ratios.

“Old users will definitely still trade, but the entry threshold for new users is now very high.”

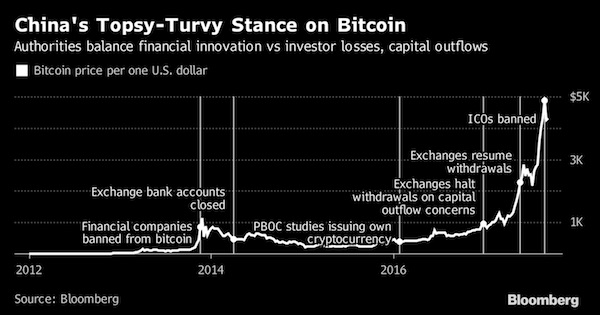

• China Said to Ban Bitcoin Exchanges While Allowing OTC Trades (BBG)

China plans to ban trading of bitcoin and other virtual currencies on domestic exchanges, dealing another blow to the $150 billion cryptocurrency market after the country outlawed initial coin offerings last week. The ban will only apply to trading of cryptocurrencies on exchanges, according to people familiar with the matter, who asked not to be named because the information is private. Authorities don’t have plans to stop over-the-counter transactions, the people said. China’s central bank said it couldn’t immediately comment. Bitcoin slumped on Friday after Caixin reported China’s plans, capping the virtual currency’s biggest weekly retreat in nearly two months. The country accounts for about 23% of bitcoin trades and is also home to many of the world’s biggest bitcoin miners, who use vast amounts of computing power to confirm transactions in the digital currency.

“Trading volume would definitely shrink,” said Zhou Shuoji, Beijing-based founding partner at FBG Capital, which invests in cryptocurrencies. “Old users will definitely still trade, but the entry threshold for new users is now very high. This will definitely slow the development of cryptocurrencies in China.” While Beijing’s motivation for the exchange ban is unclear, it comes amid a broad clampdown on financial risk in the run-up to a key Communist Party leadership reshuffle next month. Bitcoin has jumped about 600% in dollar terms over the past year, fueling concerns of a bubble. The People’s Bank of China has done trial runs of its own prototype cryptocurrency, taking it a step closer to being the first major central bank to issue digital money.

One third lies on their loans.

• Australian Banks Sitting on A$500 Billion of ‘Liar Loans’ – UBS (BBG)

Here’s something else for policy makers to worry about as they attempt to engineer a soft landing in Australia’s property market. The country’s lenders could be sitting on A$500 billion ($402 billion) of “liar loans,” or mortgages obtained on inaccurate financial information, according to an estimate from. A survey by the firm of 907 Australians who took out a mortgage in the last 12 months found only 67% stated their application was “completely factual and accurate,” down from 72% the previous year. The most common inaccuracies were overstating income and understating living expenses, the survey found. These findings “suggest mortgagors are more stretched than the banks believe, implying losses in a downturn could be larger than the banks anticipate,” analysts including Jonathan Mott wrote in a note to clients dated Sept. 11. UBS is underweight bank stocks. And “liar loans,” the analysts say, was a term coined in the U.S. during the financial crisis. An ominous moniker for Australian lenders.

Just go away.

• Canadian Gold Company Suspends Investments In Greek Mines (AP)

Canadian mining company Eldorado Gold, one of Greece’s largest foreign investors, said Monday it planned to suspend investment at its mines in Greece following what it said are government delays in the issuing of permits and licenses. Eldorado, which runs Greek subsidiary Hellas Gold, operates mines in northern Greece that have faced vehement opposition from parts of local communities on environmental grounds, with protests often turning violent. Eldorado said in an announcement it would continue maintenance and environmental safeguards but would make no further investment in three mines in the Halkidiki area of northern Greece and two projects in the northeastern province of Thrace.

“Despite repeated attempts by Eldorado and its Greek subsidiary, Hellas Gold, to engage constructively with the Greek government, the Ministry of Energy and Environment … and other government agencies, delays continue in issuing routine permits and licences for the construction and development of the Skouries and Olympias projects in Halkidiki, northern Greece,” the company said. “These permitting delays have negatively impacted Eldorado’s project schedules and costs, ultimately hindering the Company’s ability to effectively advance development and operation of these assets.” [..] the Halkidiki mines have been mired in controversy for decades, with Eldorado’s predecessors facing similar protests. Many in the local communities are vehemently opposed to the development of the mines on environmental grounds, saying local forests would be decimated and groundwater could be contaminated.

“If it’s impacting [wildlife], then how do we think that it’s not going to somehow impact us?”

• Plastic Fibres Found In 83% of Tap Water Around The World (G.)

Microplastic contamination has been found in tap water in countries around the world, leading to calls from scientists for urgent research on the implications for health. Scores of tap water samples from more than a dozen nations were analysed by scientists for an investigation by Orb Media, who shared the findings with the Guardian. Overall, 83% of the samples were contaminated with plastic fibres. The US had the highest contamination rate, at 94%, with plastic fibres found in tap water sampled at sites including Congress buildings, the US Environmental Protection Agency’s headquarters, and Trump Tower in New York. Lebanon and India had the next highest rates.

European nations including the UK, Germany and France had the lowest contamination rate, but this was still 72%. The average number of fibres found in each 500ml sample ranged from 4.8 in the US to 1.9 in Europe. The new analyses indicate the ubiquitous extent of microplastic contamination in the global environment. Previous work has been largely focused on plastic pollution in the oceans, which suggests people are eating microplastics via contaminated seafood. “We have enough data from looking at wildlife, and the impacts that it’s having on wildlife, to be concerned,” said Dr Sherri Mason, a microplastic expert at the State University of New York in Fredonia, who supervised the analyses for Orb. “If it’s impacting [wildlife], then how do we think that it’s not going to somehow impact us?”

The revenge of carbon?!

• Sea Salt Around The World Is Contaminated By Plastic (G.)

Sea salt around the world has been contaminated by plastic pollution, adding to experts’ fears that microplastics are becoming ubiquitous in the environment and finding their way into the food chain via the salt in our diets. Following this week’s revelations in the Guardian about levels of plastic contamination in tap water, new studies have shown that tiny particles have been found in sea salt in the UK, France and Spain, as well as China and now the US. Researchers believe the majority of the contamination comes from microfibres and single-use plastics such as water bottles, items that comprise the majority of plastic waste. Up to 12.7m tonnes of plastic enters the world’s oceans every year, equivalent to dumping one garbage truck of plastic per minute into the world’s oceans, according to the United Nations.

“Not only are plastics pervasive in our society in terms of daily use, but they are pervasive in the environment,” said Sherri Mason, a professor at the State University of New York at Fredonia, who led the latest research into plastic contamination in salt. Plastics are “ubiquitous, in the air, water, the seafood we eat, the beer we drink, the salt we use – plastics are just everywhere”. Mason collaborated with researchers at the University of Minnesota to examine microplastics in salt, beer and drinking water. Her research looked at 12 different kinds of salt (including 10 sea salts) bought from US grocery stores around the world. The Guardian received an exclusive look at the forthcoming study. Mason found Americans could be ingesting upwards of 660 particles of plastic each year, if they follow health officials’ advice to eat 2.3 grammes of salt per day. However, most Americans could be ingesting far more, as health officials believe 90% of Americans eat too much salt.

Home › Forums › Debt Rattle September 11 2017