Brassaï The Sun King 1930

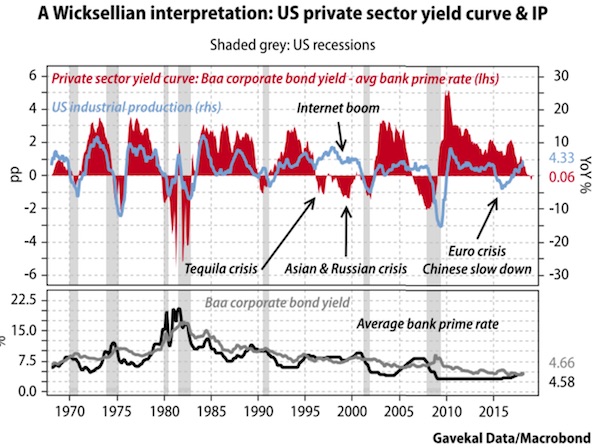

The trouble is in corporate bonds.

• There’s a New Curve in Town and It’s Flashing Red (BBG)

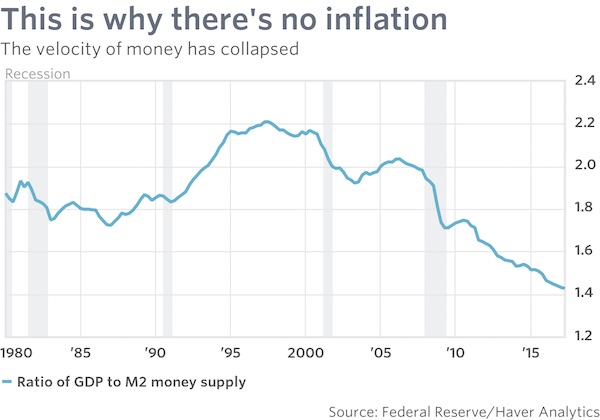

The private sector may hold the real clues to recession risk. While the flattening U.S. yield curve – the difference between short- and longer-dated Treasuries – has been closely-watched as a potential indicator of a looming contraction, investors might do better to watch a measure of the cost of private credit, according to Charles Gave of Gavekal Capital. An inverted yield curve is thought to signal the “market rate of interest,” (shorter-term rates) exceeding the “natural rate of interest” (longer government rates), but may not be a good proxy for economic activity given that the government can always borrow, Gave said.

Instead, he suggests looking at the corporate credit market. Here, the U.S. economy’s natural rate could be represented by the yield of a longer-dated, seasoned industrial bond rated Baa by Moody’s, and the market rate by the prime lending rate charged by U.S. banks. “The private sector yield curve reading stands at zero, or right on the threshold where trouble can be expected to begin,” Gave wrote in a note published on Tuesday. “Should this spread move into negative territory, I would expect a financial accident to occur outside of the U.S., a U.S. recession, or possibly both.” Either a U.S. recession has taken place within a year of the private sector yield curve inverting, or a “financial accident” has occurred in other economies with currency links to the greenback, according to Gave’s data.

Prime rates below the natural rate of corporate credit have allowed banks to generate “artificial” money, kept “zombie” companies alive, and enabled other corporates to engage in “financial engineering” predicated on cheap borrowing costs that risk toppling over if the curve inverts, Gave said.

Trump wants to meet in the DMZ. Reportedly, White House officials want Singapore or Mongolia.

• Trump Says Kim Summit Details To Be Unveiled Within Days (AFP)

US President Donald Trump seemed pleased Tuesday by a suggestion he should get the Nobel Peace Prize for his upcoming summit with North Korean leader Kim Jong Un, promising that a time and place for the historic meeting will soon be announced. “Nobel Peace Prize? I think President Moon was very nice when he suggested it,” Trump said, referring to South Korean President Moon Jae-in. “The main thing, I want to get peace. It was a big problem and I think it’s going to work out well,” he told reporters in the Oval Office. Trump has proposed holding the summit at the truce village in the Demilitarized Zone separating the two Koreas, adding that two or three locations were under consideration.

“We’re setting up meetings right now and I think it’s probably going to be announced over the next couple of days, location and date,” Trump said. The summit, which has come together rapidly after months of tense saber-rattling over the North’s nuclear and missile programs, would be the first ever between a US president and a leader of North Korea. On Monday, Moon had demurred when asked about the prospect of winning the Nobel Peace Prize, suggesting Trump should get it instead. “President Trump can take the Nobel prize. All we need to take is peace,” he said. Trump said it was “very generous of President Moon of South Korea to make that statement and I appreciate it but the main thing is to get it done.” “I want to get it done,” he added.

Apple has become a capital allocation venture.

• Apple Delivers Best-Ever Second Quarter Despite Sales Worries (G.)

Apple on Tuesday shook off worries that its $1,000 iPhone had failed to live up to the hype – but sales of the world’s most valuable company’s most valuable product are slowing, and Apple has announced a plan to buy its way out of trouble. Releasing its latest quarterly report, Apple announced it had sold 52.2m iPhones in the quarter ending 31 March, at an average price of $728.54. Sales were up 3% compared to last year and slightly lower than analysts had expected, but numbers beat the gloomiest forecasts and were enough to deliver Apple its best second quarter ever, with revenues of over $61bn. That beat the record of $58bn set in 2015.

“We’re thrilled to report our best March quarter ever, with strong revenue growth in iPhone, services and wearables,” said Tim Cook, Apple’s chief executive officer. “We are very bullish on Apple’s future,” Cook told analysts after the news broke. Apple sold 9.11m iPads and 4.08m Macs over the quarter. Analysts had worried that the high-priced iPhone X would dent sales. The results came after Apple suppliers including AMS and Taiwan Semiconductors have reported slowing revenues in a sign seen by analysts as proof of shaky demand for iPhone X.

The company announced it would be adding $100bn to its stock buyback programme, plus a 16% increase in its quarterly dividend. Taking advantage of the Trump administration’s new tax laws, Apple is in the process of repatriating the majority of the $252bn in profits it currently holds overseas. The buyback helped Apple’s shares rise over 5% in after-hours trading. The company’s stock has risen by about 80% in the past two years, setting it on course to battle Amazon to become the first company to be valued at $1tn. But Apple’s share price has stumbled recently as fears about slowing iPhone sales took their toll.

These reports about the ‘second tier’ just won’t stop.

• More Evidence Emerges That Apple Is Killing iPhone X – Analyst (CNBC)

More earnings reports from companies linked to Apple have resulted in further evidence that the technology giant could be winding down or stopping production of the iPhone X. Nasdaq-listed Cognex is the latest company to provide clues that Apple may be going down this path. It reported first quarter earnings on Monday that were up 22% year-on-year, a slowdown from the 40% growth seen in the first quarter of 2017. On top of that, guidance for second quarter revenue of between $200 million and $210 million was below Wall Street expectations, according to Neil Campling, co-head of the global thematic group at Mirabaud Securities.

Cognex sells technology that assists factories that assemble the iPhone. Apple’s supply chain relies on this technology to get the OLED screen on the iPhone X fitted perfectly. Campling told CNBC on Tuesday that Apple accounts for about 20% of Cognex revenues, so the slowdown can be attributed to Apple killing off the iPhone X. “Cognex results provide further evidence that the smartphone cycle has turned south, the OLED overcapacity bites and Apple’s iPhone X is over,” Campling wrote in a note Tuesday. “If Apple is stepping back from the iPhone X production cycle, then Cognex is lead indicator of when that is taking place,” the analyst said in a follow-up phone call with CNBC.

Remember Japanese cars?

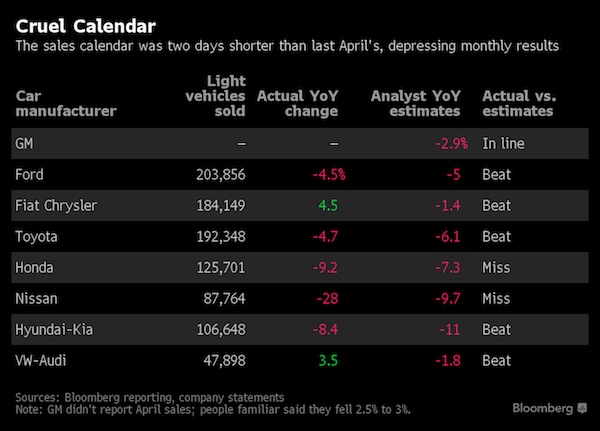

• Nissan Shocks With 28% Sales Plunge (BBG)

Nissan’s U.S. sales plunged last month, shocking some analysts and dragging on what was otherwise a strong April for auto demand. The Japanese automaker’s deliveries declined 28% in April, with almost every model in the Nissan and Infiniti lineups falling. Nissan shares fell as much as 1.8% in Tokyo trading Wednesday. While Ford and Fiat Chrysler beat analysts’ estimates, their shares reversed gains after Nissan’s report. “Our eyes are bugging out here,” Michelle Krebs, senior analyst for researcher Autotrader, said of the Nissan’s numbers. “They’ve been very heavy with rental-car sales and rich incentives. It looks like they’re pulling back.”

Automakers were going to have a difficult time reporting sales gains in April due to a quirk of the calendar. There were two fewer selling days – which excludes Sundays and holidays – last month than a year ago. So while almost all major carmakers posted declining deliveries, as analysts expected, the annualized sales rate accelerated to 17.1 million, according to researcher Autodata. Calculating the annualized sales pace, which topped last April’s 17 million, is becoming more difficult. General Motors announced last month that it would report U.S. sales only on a quarterly basis, complicating efforts to gauge the health of the world’s most lucrative auto market.

Sales of the Altima sedan, usually Nissan’s top car, dropped by almost half compared with a year ago. And the company’s leading sport utility vehicle, the Rogue, dropped 15%. While deliveries to both retail and fleet customers declined, the automaker expects that its results will improve when the new Kicks crossover and redesigned Altima reach dealers, spokesman Chris Keeffe said.

Perhaps.

• The Biggest Player in the History of the World (Alistair Crooke)

Xi Jinping lies at the apex of the Chinese political system. His influence now permeates at every level. He is the most powerful leader since Chairman Mao. Kevin Rudd (former PM of Australia and longtime student of China) notes, “none of this is for the faint-hearted … Xi has grown up in Chinese party politics as conducted at the highest levels. Through his father, Xi Zhongxun … he has been through a “masterclass” of not only how to survive it, but also on how to prevail within it. For these reasons, he has proven himself to be the most formidable politician of his age. He has succeeded in pre-empting, outflanking, outmanoeuvring, and then removing each of his political adversaries. The polite term for this is power consolidation. In that, he has certainly succeeded”.

And here is the rub: the world which Xi envisions is wholly incompatible with Washington’s priorities. Xi is not only more powerful than any predecessor other than Mao, he knows it, and intends to make his mark on world history. One that equates, or even surpasses, that of Mao. Lee Kuan Yew, who before his death in 2015, was the world’s premier China-watcher, had a pointed answer about China’s stunning trajectory over the past 40 years: “The size of China’s displacement of the world balance is such that the world must find a new balance. It is not possible to pretend that this is just another big player. This is the biggest player in the history of the world.”

[..] Made in China 2025 is a broad industrial policy that is receiving massive state R & D funding ($232 billion in 2016), including an explicit potential dual-use integration into military innovation. Its main aim, besides improving productivity, is to make China the world’s ‘tech leader’, and for China to become 70% self-sufficient in key materials and components. This may be well-known in theory, but perhaps the move towards self-sufficiency by both China and Russia suggests something more stark. These states are moving away from the classic liberal trade model to an economic model based on autonomy, and a state-led economy (such as advocated by economists like Friedrich List, before becoming eclipsed by the prevalence of Adam Smith-ian thinking).

Very long essay from Hudson. Always good.

• Debt Is The Great Threat To China’s Development (Michael Hudson)

Subjecting economies to austerity, economic shrinkage, emigration, shorter life spans and hence depopulation, it is at the root of the 2008 debt legacy and the fate of the Baltic states, Ireland, Greece and the rest of southern Europe, as it was earlier the financial dynamic of Third World countries in the 1960s through 1990s under IMF austerity programs. When public policy is turned over to creditors, they use their power for is asset stripping, insisting that all debts must be paid without regard for how this destroys the economy at large. China has managed to avoid this dynamic. But to the extent that it sends its students to study in U.S. and European business schools, they are taught the tactics of asset stripping instead of capital formation – how to be extractive, not productive.

They are taught that privatization is more desirable than public ownership, and that financialization creates wealth faster than it creates a debt burden. The product of such education therefore is not knowledge but ignorance and a distortion of good policy analysis. Baltic austerity is applauded as the “Baltic Miracle,” not as demographic collapse and economic shrinkage. The experience of post-Soviet economies when neoliberals were given a free hand after 1991 provides an object lesson. Much the same fate has befallen Greece, along with the rising indebtedness of other economies to foreign bondholders and to their own rentierclass operating out of capital-flight centers. Economies are obliged to suspend democratic government policy in favor of emergency creditor control.

The slow economic crash and debt deflation of these economies is depicted as a result of “market choice.” It turns out to be a “choice” for economic stagnation. All this is rationalized by the economic theory taught in Western economics departments and business schools. Such education is an indoctrination in stupidity – the kind of tunnel vision that Thorstein Veblen called the “trained incapacity” to understand how economies really work.

“The trade in renminbi is still a minuscule part of the world currency market..”

• China’s Petro-Yuan Isn’t Dislodging the Dollar Yet (Barron’s)

The timing seemed perfect. On March 26, four days after the Trump administration called for new tariffs on $50 billion worth of Chinese imports, Beijing launched an oil-futures contract denominated in yuan. The move seemed logical enough. China surpassed the U.S. as the world’s top oil importer last year, so why not start paying in its own currency? But against the backdrop of a brewing trade war, the newly born “petro-yuan” took on the aspect of a nuclear option, at least to Washington’s many ill-wishers around the globe. China’s initiative would put an end to dollar dominance of the $2 trillion annual oil trade, and thus its hegemony as a global reserve currency, so the argument ran. “Petro-Yuan to Kneecap Petro-Dollar,” crowed a headline from Russian state news service RT.

In fact, the petro-yuan is off to a slow start, and the greenback looks destined to remain almighty for a while yet. The reason is contradictions within China, which wants to play a new global role that is co-equal with the U.S. but maintain the old economic controls that got it there. Chinese exchanges have already co-opted much of the global trade in copper and other basic metals. But China is itself a leading copper producer, and volumes in the metal are one-twentieth the size of oil markets. To grab serious real estate from the petrodollar, the yuan would have to be freely convertible on the order of the greenback, euro, or yen—which it assuredly is not. “The trade in renminbi is still a minuscule part of the world currency market,” says Prakash Sharma, China research director for commodities consultant Wood Mackenzie, using an alternative name for the national coin.

“Paying for oil in Chinese currency looks nearly impossible at this stage.” Beijing authorities seemed bent on convertibility until 2015, when a stock market panic in China spurred some $700 billion in capital flight—from families pouring into Western real estate to corporations snapping up overseas acquisitions. The nation’s reserves shrank to a mere $3.3 trillion, and the yuan fell 10% against the dollar over 18 months. President Xi Jinping’s bureaucrats reacted decisively, limiting individuals to $50,000 a year in currency exchange and informally reeling in corporate globalization. “The events of 2015-16 were quite a surprise to the authorities,” says Jens Nordvig, CEO of FX consultant Exante Data. “They nearly lost control of the currency.”

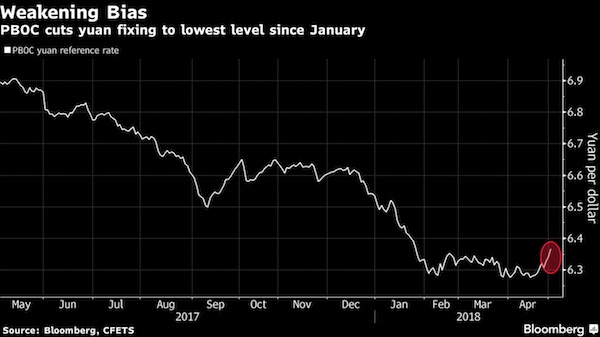

Because the US will demand it strengthen it.

• China Weakens Its Currency Before US Trade Talks Begin (BBG)

China weakened its daily currency fixing by more than traders and analysts had expected before high-ranking U.S. officials arrive in the country to discuss trade issues. The People’s Bank of China cut the reference level to 6.3670 per dollar, weaker than the average estimate of 6.3610 in Bloomberg survey of 21 traders and analysts. The deviation is the biggest since Feb. 7 and continues a pattern set in April when the fixing was weaker than expected on all but one day, according to Bloomberg calculations. “The move in the fixing today is aggressive,” said Ken Cheung at Mizuho Bank in Hong Kong. “China may want to weaken the yuan pre-emptively before the trade talks with the U.S., so that they have room to strengthen the currency” if needed, Cheung said, adding that policy makers may also be keen to arrest the yuan’s advance against a basket of peers.

Netanyahu plays games with his credibility.

• Europeans Cast Doubt On Israel’s Claims About Iran Nuclear Breaches (G.)

European leaders have pushed back against Israel’s claims that it has new evidence showing that Iran is breaching the nuclear deal with the west which was signed in 2015. The US secretary of state, Mike Pompeo, hailed the Israeli claims as significant, as the 12 May deadline approached for the US president, Donald Trump, to decide whether to pull out of the deal. But Pompeo declined to say whether they represented proof that Iran was violating the deal. The overall initial view in European capitals was that the documents did reveal new material about the scale of Iran’s programme prior to 2015 but that there was nothing showing a subsequent breach of the deal.

The French foreign ministry said that the details needed to be “studied and evaluated” but that the Israeli claims reinforced the need for continuation of the deal – which entails Iran accepting nuclear inspections in return for a loosening of economic sanctions. “The pertinence of the deal is reinforced by the details presented by Israel,” a statement said. “All activity linked to the development of a nuclear weapon is permanently forbidden by the deal.” [..] In a bid to push back against Israel, the EU’s foreign affairs chief, Federica Mogherini, said Netanyahu’s allegations had “not put into question” Tehran’s compliance with the deal and that the International Atomic Energy Authority (IAEA) had produced 10 reports saying Iran had met its commitments.

“The International Atomic Energy Authority is the only impartial international organisation in charge of monitoring Iran’s nuclear commitments,” Mogherini said. “If any country has information of non compliance of any kind it should address this information to the proper legitimate and recognised mechanism.” The IAEA said a report by its director in 2015 “stated that the agency had no credible indications of activities in Iran relevant to the development of a nuclear explosive device after 2009”, and that the IAEA’s board of governors “declared that its consideration of this issue was closed”. A German government spokesman said it would analyse the Israeli documents, but added that the JCPOA had unprecedentedly strong monitoring mechanisms. The spokesman said: “It is clear that the international community had doubts that Iran was pursuing an exclusively peaceful nuclear programme. That is why the nuclear agreement was reached in 2015.”

Britain better get rid of all these people.

• Inside Theresa May’s Brexit War Cabinet, Tory Battles Rage (BBG)

The prime minister and her inner circle refer to it simply as “The SN.” To everyone else it is Theresa May’s “Brexit war cabinet,” the group of senior ministers who set the U.K.’s course out of the European Union. These eleven Cabinet members meet regularly in closely-guarded privacy to decide the detail of Brexit policies. On Wednesday afternoon, they convene once again to address an explosive question that could blow up May’s government. What to do about the Irish border and the future customs arrangements between the U.K. and the EU? Unless a satisfactory answer can be found soon, it could be enough to derail the negotiations entirely, forcing Britain out of the bloc with no meaningful deal at all.

The key to understanding the dynamic in the room had been that half of them campaigned to stay in the EU during the 2016 referendum, while the other five voted to leave — with the premier herself having the deciding vote. All that changed this week. Until she resigned as Home Secretary on Sunday, Amber Rudd was among the loudest voices in favor of keeping close ties to the EU. She’s been replaced by Sajid Javid, who is far closer to the pro-Brexit lobby, although he did – reluctantly – campaign for Remain two years ago.

Also on the pro-EU side are Chancellor of the Exchequer Philip Hammond and Business Secretary Greg Clark — both have been keeping low profiles of late. Pro-Brexit ministers are led by Foreign Secretary Boris Johnson and Environment Secretary Michael Gove, both figureheads of the Leave campaign.

They deported tens of thousands of students. On the basis of a questionable test.

• UK Home Office ‘Mistakenly Deported 7,000 Foreign Students’ (Ind.)

The government may have mistakenly deported more than 7,000 foreign students after falsely accusing them of cheating in English language tests. Most of the students were not allowed to appeal the Home Office decision; nor were theyt able to obtain evidence against them, or given the opportunity to prove the proficiency in English Some were detained by immigration officials, lost their jobs, and were left homeless as a result, despite being in the UK legally, the Financial Times reported. The students’ treatment has been blamed on the “hostile environment” policy introduced by Theresa May during her time as home secretary.

The approach, which aims to push illegal immigrants to leave Britain by making their lives difficult, led to the Windrush scandal that forced Ms May’s successor Amber Rudd to resign. The foreign students were targeted by the Home Office after an investigation by the BBC’s Panorama in 2014 exposed systematic cheating at some colleges where candidates sat the Test of English for International Communication (TOEIC). The test is one of several that overseas students can sit to prove their English language proficiency, a visa requirement. After the Panorama broadcast, the government asked the US-based company which runs the test to analyse sound files to investigate whether studies had been enlisting proxies to sit the tests for them.

The firm, English Testing Services, identified 33,725 “invalid” tests taken by students it was confident confident had cheated. The students’ visas were revoked and they were told to leave the country. Another 22,694 test results were classed as “questionable”, meaning the students who sat them were invited for an interview before any action was taken against them.

By the end of 2016, the Home Office had revoked the visas of nearly 36,000 students who took the test. However, when ETS’s automated voice analysis was checked against human analysis, its computer programme was found to be wrong in 20% of cases, meaning that more than 7,000 students were likely to have been wrongly accused of cheating. [..] Immigration barrister Patrick Lewis, who represented several students in successfully appealing their deportation, told the Financial Times: “The highly questionable quality of the evidence upon which these accusations have been based and the lack of any effective judicial oversight have given rise to some of the greatest injustices that I have encountered in over 20 years of practice.”

NHS is 10,000 doctors short, patients dying on trolleys in hallways.

• Theresa May Vetoed Cabinet Pleas Over Visas For NHS Doctors (St.)

Theresa May faces a new immigration crisis after it emerged that she overruled Cabinet ministers pleading for more doctors from overseas to fill empty NHS posts. At least three government departments lobbied for a relaxation of visa rules to let in desperately needed doctors as well as specialist staff sought by businesses, the Evening Standard has learned. The issue erupted on Friday when several NHS trusts went public about fears that patient safety was being put at risk by doctor shortages. The crisis came as then home secretary Amber Rudd was fighting for her political life over the Windrush scandal — but No 10’s hard line meant her hands were tied.

Sources have disclosed that Downing Street was lobbied for several months before the NHS went public to allow a relaxation of the rules. Health Secretary Jeremy Hunt and Ms Rudd are understood to be among those urging No 10 to lift the quota for special cases such as NHS doctors. At the same time Business Secretary Greg Clark was pressing for more exceptions to help firms cope with specialist skills shortages. A Whitehall source said Mrs May “absolutely refused to budge” when asked to lift the cap in recent months. “I think Jeremy and Amber were on the same page on this but No 10 were in a different place entirely,” said a separate source.

No, really, these people DO understand the effect will be the opposite of what they claim.

• OECD Calls For Even Tighter Greek Fiscal Policy To Bolster Growth (K.)

Greece needs to further extend its real age of retirement and to abolish all kinds of tax exemptions, the Organization for Economic Cooperation and Development (OECD) has recommended in a report published on Monday, so that the growth rate accelerates, fiscal revenues expand and the national debt becomes sustainable. Although the report, presented in Athens on the occasion of OECD Secretary-General Angel Gurria’s visit, does speak of a return to growth, it undercuts the official forecast for a 2.3% economic expansion this year, pointing instead to a 2% increase. It adds that a series of reforms could considerably strengthen gross domestic product in the future.

According to the OECD, a four-year rise in the real age of retirement up to 2030 (instead of the already scheduled three-year rise to the age of 65 by the same year) will boost GDP by 10.4 percent points (against 7.5 points with the scheduled extension). The modernization of the public administration and the improvement of the justice system up to OECD standards by 2030 would have an even greater impact, the report says. That would signify a GDP impact of 25.6 percent points, compared to the current plans for a 14.7 percent-point increase.

The organization further recommends new reforms in the commodity markets so that they reach up to Belgium’s level by 2020, and an increase in family benefits to meet the European Union average by 2025. In total, the reforms the OECD has proposed would bolster GDP by 46.1 percent points or almost 100 billion euros per year, against 25.4 percent points projected by the currently planned reforms. Those proposed reforms would also cut the national debt to just 100% of GDP by 2060, the report projects.

It’s about political control, not finance.

• Greece’s Debt Deal To Show How Europe Treats Its Less Fortunate Nations (CNBC)

Speaking in the Bulgarian capital of Sofia last week, European Commissioner for Economic and Financial Affairs Pierre Moscovici told me the EU believes its models may be more accurate, but argued that the best way to win an IMF buy-in would be to agree on a debt repayment mechanism first proposed by his countrymen — and one of his successors as French finance minister — Bruno Le Maire. Macron’s finance chief told me separately that he hoped to win over opponents to his plan, a “growth adjustment mechanism” that would automatically link future debt repayments to Greece’s relative economic success: Athens would repay larger installments if its economy expands quickly, and reduce payments if it slows, a process that its proponents claim provides market participants with greater clarity and transparency.

Arrayed against the French plan is the desire on the part of authorities in countries like Germany, the Netherlands, Finland and Austria to maintain a degree of political control over Greece’s required repayments. This might mean the size and scope of future repayments could be assessed by national parliaments, rather than automatically calculated based on factors like GDP growth. The publicly espoused view in Berlin is that such an approach would force the Greeks to continue with their structural reforms and austerity measures that have helped transform what was a 15% budget deficit in 2009 into a recent surplus.

“Who better to entrust with the most intimate parts of our lives than Mark Zuckerberg, the king of privacy?”

• Facebook’s Dating App Finally Makes Privacy Invasion Sexy (G.)

Thank God Facebook is finally offering a dating app. Who better to entrust with the most intimate parts of our lives than Mark Zuckerberg, the king of privacy? I assume Zuck will be building it off of one of the early projects that established him as a wunderkind: FaceMash. You may remember it – it’s the one where he hacked into campus websites, collecting pictures that allowed Harvard students to rank each other by hotness. With Facebook dating, the FaceMash dream is at last becoming reality. This should make it easy for Facebook’s hottest people – if there are any left; my understanding is most hot people have migrated to Instagram – to match with equally attractive people, leaving the rest of us trolls and gnomes to mingle with each other.

And after a few months, you can bet the data will leak, offering us all an opportunity to find out, based on rigorous computer analyses, how hot we are. I’m a four at best, you’re a seven. But those numbers won’t be based just on looks. What this app has over Tinder is its existing knowledge of every facet of our lives. Romance is, of course, transactional, and Zuckerberg can finally determine a precise formula based on the value each person brings to a potential match. How much money does it take to compensate for suboptimal physical attractiveness? How often do I have to post about working out to balance out my penchant for Ben and Jerry’s? How often do you have to donate to charities to make up for the fact that you bought an alarming amount of toilet paper on Amazon last month?

Then there’s the possibility that Facebook engagement could come into play. Will active users get more profile views than those of us who have largely abandoned the site? Would that mean we’re more likely to end up on dates with the kind of person who posts constantly on Facebook? Sign me up.

7 million per year. That’s just a start.

• More Than 90% Of Air Pollution Deaths Occur In Poorer Countries (Ind.)

Air pollution is involved in the deaths of around seven million people every year, with the vast majority of fatalities taking place in poorer countries. The latest figures released by the World Health Organisation (WHO) show that nine out of 10 people are breathing air containing dangerous levels of pollutants. These results largely echo those released in another global air pollution report in April, and experts have once again pointed to the particular burden falling on the world’s most vulnerable people. “Air pollution threatens us all, but the poorest and most marginalised people bear the brunt of the burden,” said Dr Tedros Adhanom Ghebreyesus, director-general of WHO.

The new figures come as reports emerge concerning residents of Mongolia’s capital, Ulaanbaatar, drinking “oxygen cocktails” in an effort to ward off the harmful effects of air pollution. Ranked by Unicef as the most polluted capital city in the world, Ulaanbaatar is one of the many Asian and African cities highlighted as particularly susceptible to the toxic effects of air pollution by WHO. According to Dr Maria Neira, who leads public health efforts at WHO, many of the world’s megacities – such as Beijing, Delhi and Jakarta – exceed guideline levels for air quality by more than five times.