Unknown

Warming up for the fight. Get your gloves on, check ’em twice, practice some jabs in front of the mirror, have a last drink of water and let the trainer put in your mouthguard. This may get ugly.

• Nadler Says Dems Unwilling To Negotiate Hunter Biden Testimony (Fox)

Rep. Jerry Nadler, D-N.Y., one of the House impeachment managers, dismissed on Sunday any notion that Democrats would be willing to negotiate on witnesses called during the Senate trial – adding that Republicans who want to block or negotiate what witnesses testify are “part of the cover-up.” Nadler, who as chairman of the House Judiciary Committee led the writing of the articles of impeachment brought against President Trump, said that all “relevant witnesses must be heard” and balked at the idea of Democrats agreeing to having former Vice President Joe Biden’s son Hunter testify in exchange for the witnesses Democrats want to hear from.

“This whole controversy about whether there should be witnesses is really a question about does the Senate want to have a fair trial or are they part of the cover-up of the president,” Nadler said during an interview on CBS’ “Face The Nation.” Nadler added that “Hunter Biden has no knowledge of the accusations against the president.” “Any Republican senator who says there should be no witnesses, or even that witnesses should be negotiated, is part of the cover-up,” Nadler added.

The Warren campaign has noticed Bernie’s gains after attacking Biden. They want a piece of the action.

• Warren Joins Bernie in Jabbing Biden on Social Security (Pol.)

Elizabeth Warren hit Joe Biden for his past stances on changing Social Security and expressed solidarity with Bernie Sanders on the issue as the two liberal senators seek to move past their recent feud. “Bernie Sanders and I established the ‘Expand Social Security Caucus’ in the Senate,” Warren said in a quick interview as she hopped into her car outside a candidate forum in Iowa. “As a senator, Joe Biden had a very different position on Social Security, and I think everyone’s records on Social Security are important in this election.” Warren’s comments come as Sanders has been relentlessly bashing Biden for his past openness to freezing cost-of-living spikes or raising the retirement age as part of larger bipartisan deals — proposals that Sanders opposed during his time in Congress.

Warren linking arms with Sanders on the issue also comes after long-simmering tensions between the two exploded into the open this week. The campaigns have been trying to move on from the conflict — which climaxed Tuesday night when each accused the other of calling them a “liar” on the stage immediately following the debate —and are largely not responding to media questions about the rift. The Social Security issue provides a potential opportunity for a liberal tag-team against Biden as both senators have long fought to expand the program and have rolled out plans on the campaign trail.

It’s midnight. That means 1 year from today #BernieSanders will be sworn in as President of the United States.

If we do the work to make it happen. #NotMeUs

— Ari Rabin-Havt (@AriRabinHavt) January 20, 2020

The NYT endorsed Warren and Klobuchar yesterday. Everyone yawned. At least seeing Klobuchar praise McCain and Poroshenko means there’s no doubt where she stands. War it is.

• Lindsey Graham Broke My Heart’ (Amy Klobuchar)

Transcript from Sen. Amy Klobuchar interview with the editorial board of The New York Times:

Who has broken my heart? O.K., so here we go. Lindsey Graham’s broken my heart lately in the political system. Senator Lindsey Graham has transformed from a Trump critic, who called the president “xenophobic” and “race-baiting,” to one of his most staunch supporters. He told The Times Magazine, “If you don’t want to get re-elected, you’re in the wrong business.” Just because I like him and know him really well and traveled with him and Senator McCain all over the, all over the world. I’m just more thinking of Senator McCain and how much I miss him right now because I think he would have been really strong on Ukraine and on standing up against some of the things the president did and he’s no longer with us.

And Lindsey and McCain and I were actually on the front line with former President Poroshenko in a blizzard on New Year’s Eve, and I think about this now every New Year’s Eve — because John McCain wanted to show — after Trump got elected — wanted to show those countries that we were on their side. And so of course I was disappointed with how the Kavanaugh hearing was handled. I think everyone could see me on TV to see that, but I just hope that he has the ability to rise up here, and has a very important job right now as chair of the Judiciary Committee and certainly smart enough and has shown some tendency in the past to stand up for things and I just wish he would do it again when it comes to this conduct and a whole range of issues about our judicial system.

Meanwhile, in the background:

• John Durham Investigaties Months Before Mueller Appointment (WE)

A trail of documents has reportedly led Attorney General William Barr’s handpicked federal prosecutor to focus his inquiry into the origins of the Russia investigation on the first several months of President Trump’s tenure. John Durham, a U.S. attorney from Connecticut, is zeroing in on the period spanning from January 2017, when Trump took office, to May of that year. A “strong” paper trail, as CBS News senior investigative correspondent Catherine Herridge put it on Friday, has led the investigation into possible misconduct by federal law enforcement and intelligence officials to that time frame.

While Trump and his allies have championed Durham’s effort, Democrats have dismissed the allegations of wrongdoing during the Trump-Russia investigation and are concerned the inquiry may be an effort to discredit the work of special counsel Robert Mueller. Trump gave Barr full declassification authority for the endeavor. Barr and Durham have traveled around the world for the investigation, and Durham’s team has already asked witnesses about possible anti-Trump bias among former FBI officials.

The secretive DOJ inquiry includes scrutiny of former CIA Director John Brennan, former Director of National Intelligence James Clapper, former FBI special agent Peter Strzok, and British ex-spy Christopher Steele. In October, it was reported that Durham was expanding the scope of his investigation, adding agents and resources, to examine the post-election timeline up to the appointment of Mueller as special counsel in May 2017. The “investigation into the investigators” was reported to be upgraded to a criminal inquiry later that month, which would give Durham the power to impanel a grand jury and hand down indictments. Durham has also reviewed the Intelligence Community’s conclusions about Russian interference in the 2016 election.

Little else is known about the investigation other than that Durham is exploring whether a crime was committed by Kevin Clinesmith, a former FBI lawyer who was found by the Justice Department Inspector General Michael Horowitz to have altered a document during the FBI’s efforts to obtain a Foreign Intelligence Surveillance Act warrant renewal to continue wiretapping onetime Trump campaign adviser Carter Page. Among those known to be cooperating with Barr is retired Adm. Michael Rogers, the former director of the National Security Agency who has a history of uncovering FISA violations.

US, EU, China, India, everyone gets their turn.

• India’s Half-Finished “Ghost Towns” Leave Middle Class In Crisis (ZH)

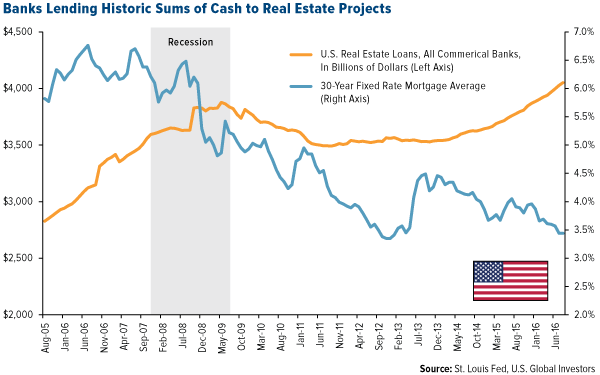

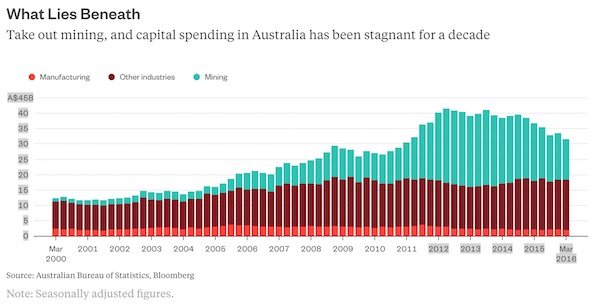

If you thought the American housing market was a mess during the immediate aftermath of the collapse, wait until you read about what’s going in India. Rapid economic growth and the government’s gradual economic liberalization have caused the ranks to India’s middle class to boom. The emerging Hindu middle class is already reshaping Indian society: Prime Minister Narendra Modi owes his electoral victories to this group, and his reform agenda was designed with the goal of sheparding even more of the country’s 1.4 billion citizens into the higher income bracket.

Modi’s first term included several important reforms, including simplifying India’s byzantine tax system and instituting a simplified system for taxing goods and services (though some argue that it must still be simplified further. He’s also helped modernize the country’s bankruptcy laws. But as the country’s growing wealth has sparked a flight from India’s crowded urban slums to its more spacious suburbs, they’re struggling with a shortage of homes, a shortage that has been made even more intense thanks to roughly half a million apartments that have been sitting unfinished for years.

Across the country, outside major cities like New Delhi and Mumbai, hundreds of developments have been stranded by developers, many of which have declared bankruptcy, or simply run out of money to finish the projects, according to the Wall Street Journal. India’s banks, already saddled with bad loans, are refusing to lend any more money to the developers. As a result, millions of Indians who put up their life savings as a down payment on a new, yet-to-be-built apartment have essentially been left bereft, with no money and nowhere to live. Most are now making ends meet by cutting out any and all luxuries, and relying on friends and family, as they wait to see if the apartments they paid for will ever be finished.

If the Royal Family can’t unite the nation, there’s always the Big Bad Wolf.

• Boris Johnson Urged To Publish Report On Russian Meddling (G.)

The SNP’s leader at Westminster has written to Boris Johnson demanding that he take immediate steps to allow the suppressed report into Russia’s interference in the British political system to be published. Ian Blackford, the leader of the third-largest party in the Commons, called on the prime minister to begin appointing members of parliament’s intelligence and security committee, necessary to allow the controversial document to be released. “It is unacceptable that your government has repeatedly and intentionally failed to take steps to establish the committee and has sought to escape scrutiny on vital issues,” Blackford writes in a letter that has been shared with the Guardian.

“The public interest and the imperative is and has always been clear: lift your sanction on publishing this report and re-establish the intelligence and security committee so that it can be immediately published,” the SNP MP added. A report on Russia’s spying activities against the UK and its attempts to penetrate the British establishment had been prepared by the committee in the last parliament, and had been made ready to publish when the election was called. Members of the committee saw evidence of Russian infiltration in Conservative political circles, but it is unclear how much of that concern reached the final document, which some sources say was watered down even before it went to Johnson.

Ministers have repeatedly said there are no examples of “successful Russian interference” in the 2016 EU referendum or an election, although there is scepticism as to whether that has been properly investigated. The report was nevertheless awaiting final clearance from Downing Street, to check it did not contain any classified information, when the election was called. No 10 said it was not possible to clear it in time, a point disputed by the previous chairman of the committee, former MP Dominic Grieve. Downing Street eventually said after the election that the report was cleared. But its release depends on the appointment of nine cross-party backbench MPs and peers to the committee’s membership, a task that falls to Johnson after consulting with other parties.

And what are you going to do about it?

• World’s Richest 2,000 People Hold More Than Poorest 4.6 Billion Combined (R.)

The world’s richest 2,153 people controlled more money than the poorest 4.6 billion combined in 2019, while unpaid or underpaid work by women and girls adds three times more to the global economy each year than the technology industry, Oxfam said on Monday. The Nairobi-headquartered charity said in a report released ahead of the annual World Economic Forum of political and business leaders in Davos, Switzerland, that women around the world work 12.5 billion hours combined each day without pay or recognition. In its “Time to Care” report, Oxfam said it estimated that unpaid care work by women added at least $10.8 trillion a year in value to the world economy – three times more than the tech industry.

“It is important for us to underscore that the hidden engine of the economy that we see is really the unpaid care work of women. And that needs to change,” Amitabh Behar, CEO of Oxfam India, told Reuters in an interview. To highlight the level of inequality in the global economy, Behar cited the case of a woman called Buchu Devi in India who spends 16 to 17 hours a day doing work like fetching water after trekking 3km, cooking, preparing her children for school and working in a poorly paid job. “And on the one hand you see the billionaires who are all assembling at Davos with their personal planes, personal jets, super rich lifestyles,” he said.

Davos counts in trillions. This is just shipping. And that is just 2.2% of CO2 emissions.

• UN Decarbonisation Target For Shipping To Cost Over $1 Trillion (R.)

At least $1 trillion of investment in new fuel technology is needed to enable the shipping industry to meet U.N. targets for cuts in carbon emissions by 2050, a study published on Monday showed. The global shipping fleet, which accounts for 2.2% of the world’s CO2 emissions, is under pressure to reduce those emissions and other pollution. About 90% of world trade is transported by sea. U.N. shipping agency, the International Maritime Organization (IMO), aims to reduce the industry’s greenhouse gas emissions by 50% from 2008 levels by 2050, a target that will require the swift development of zero or low emission fuels and new ship designs using cleaner technology.

In the first study into costs, researchers estimated that the cumulative investment needed between 2030 and 2050 would be between $1 trillion to $1.4 trillion, or an average of $50 billion to $70 billion annually for 20 years. If the shipping industry was to fully decarbonise by 2050, this would require further investment of some $400 billion over 20 years, bringing the total to $1.4 trillion to $1.9 trillion. “Our analysis suggests we will see a disruptive and rapid change to align to a new zero carbon system, with fossil fuel aligned assets becoming obsolete or needing significant modification,” said Tristan Smith, reader at University College London’s (UCL) Energy Institute, which was involved in the study.

Apart from more than a decade of tough market conditions, the shipping industry is also contending with the exit of many European banks from providing finance, leaving a capital shortfall of tens of billions of dollars annually. Around 87% of investments needed would be in land-based infrastructure and production facilities for low-carbon fuels, the study said. This includes investments in the production of low-carbon fuels as well as the land-based storage and bunkering infrastructure needed for their supply. The remaining 13% of investments are related to the ships themselves including the machinery and onboard storage required for a ship to run on low-carbon fuel. “Sustainable investing is here to stay,” said Michael Parker, chairman of Global Shipping Logistics & Offshore at Citigroup.

Let’s see what shareholders have to say.

• Oil Firms Risk Public Backlash If Profits Put Before Climate, Says IEA (G.)

The world’s energy watchdog has warned the oil and gas industry that it risks a public backlash by failing to act on the climate crisis in favour of making short-term profits. The International Energy Agency (IEA) said oil companies must balance their desire for near-term returns and a long-term future by playing a much more significant role in combating the climate crisis. The IEA is preparing to make its most direct call for oil companies to help tackle the climate crisis at the World Economic Forum’s annual meeting in Davos on Tuesday. The oil and gas industry faces “twin threats” to its financial profitability and social acceptability, according to the IEA.

“There are already signs of both, whether in financial markets or in the reflexive antipathy towards fossil fuels that is increasingly visible in the public debate, at least in parts of Europe and North America,” it said. Fatih Birol, the IEA’s executive director, said: “No energy company will be unaffected by clean-energy transitions. Every part of the industry needs to consider how to respond. Doing nothing is simply not an option.” The report said that although some oil and gas companies have taken steps to support efforts to combat the climate crisis, the industry as a whole could play a much more significant role. Oil companies could do more now to help shrink the industry’s giant carbon footprint but most companies were yet to play a meaningful role, according to the report.

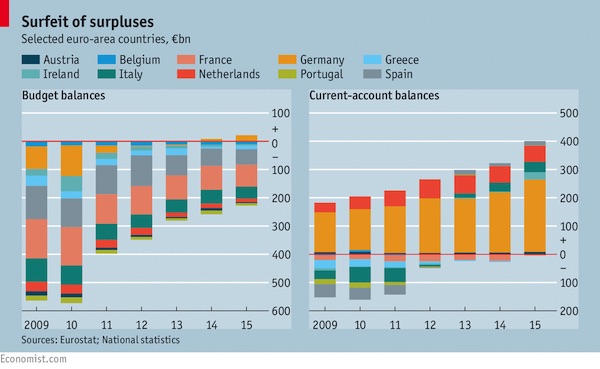

Basically: be careful what you waste our money on.It’s fine to waste those €29bn on that climate action plan.

• EU Could Waste €29bn On Gas Projects Despite Climate Action Plan (G.)

The European Investment Bank risks wasting €29bn (£25bn) of EU taxpayers’ money by overinvesting in gas projects which will be unnecessary under Europe’s climate action plans, according to a report. The EIB vowed late last year to end its support for fossil fuels within the next two years to become the world’s first “climate bank”, but 32 gas projects are still eligible for funding before the crackdown. The majority of these projects would waste billions of euros of taxpayers’ money, according to Artelys, an independent data science company, because they would be left as “stranded assets” in the move towards cleaner energy.

The report warns that gas investments will be unnecessary in the decades ahead because Europe already has enough infrastructure – such as pipelines and processing plants – to meet the continent’s future demand. The European commission set out a sweeping Green Deal plan late last year which aims to create a carbon-neutral EU by 2050, in part by increasing renewable energy and energy efficiency. Under Europe’s climate action roadmap, gas demand is expected to fall by almost 30% by 2030 compared with 2015 levels. But even in scenarios in which gas demand climbs higher, the report found that new investments in gas infrastructure would be “superfluous” from an economic perspective.

[..] Claude Turmes, Luxembourg’s energy minister, said it “makes absolutely no sense” that EU decision-makers are supporting investments in new gas infrastructure with public funds. “This report debunks the argument that these investments would be needed for the EU’s security of gas supply. We risk wasting €29bn on future stranded assets while locking our energy system into fossil gas addiction for the next 40 years,” he said.

Some 90 years after the US dust bowl.

• Huge Dust Storms In Australia Hit Central New South Wales (AAP)

Damaging winds produced by thunderstorms across central New South Wales have whipped up dust storms that turned daytime into night in some towns. The Bureau of Meteorology issued a series of severe thunderstorm warnings on Sunday evening for inland NSW with the associated winds generating massive dust clouds. Videos posted to social media showed dust storms descending on Dubbo and nearby towns that were so thick they blocked out the sun. A gust of 94 km/h was recorded at Parkes about 6.30pm while a gust of 107 km/h was recorded at Dubbo about 7.45pm, the bureau said.

A bureau meteorologist, Rose Barr, said Sunday’s significant rain was concentrated across central and northern parts of the state on, and east, of the ranges. Rain and hail also lashed Victoria, sparking almost 1500 calls for assistance with more severe weather on the way as bushfires continue. The State Emergency Service received 1453 calls for assistance since Sunday morning, more than 1000 of them for building damage. Many towns on the NSW mid-north coast and the northern rivers regions received between 100mm and 180mm from 9am to 10.30pm on Sunday. In the southern part of the state, high winds saw storms race overhead quickly, resulting in lower measured falls.

Drone footage shows massive dust storm in Australia sweeping across central New South Wales https://t.co/iaTSa7xUYG pic.twitter.com/rz0RuvgwCU

— The Guardian (@guardian) January 20, 2020

Social behaviour of striped catfish.

Amazing social behaviour of striped catfish, forming a creature like shape.

Fish at the bottom graze, while those at the top are on the lookout. pic.twitter.com/swoWv6ZyEr— Lionel Page (@page_eco) January 19, 2020

Include the Automatic Earth in your 2020 charity list. Support us on Paypal and Patreon.