Paul Cezanne Sugar Bowl, Pears and Blue Cup c.1866

State of the Union on Tuesday. Look for grand plans. $1.5 trillion?!

• Trump Moving On to Infrastructure Push (BBG)

President Donald Trump plans to use Tuesday’s State of the Union address to build momentum for sweeping legislation on infrastructure and immigration that could buoy the White House and fellow Republicans ahead of crucial midterm elections. Emboldened by a booming economy and victory in his stare-down with Senate Democrats over government funding, Trump will make the case that the Republican tax cuts passed in December and his administration’s efforts to curb regulations are drawing investment to the U.S. and creating jobs, said a White House official who discussed the speech on condition of anonymity. There are few obvious areas for compromise, and little incentive to do so among increasingly polarized lawmakers whose chief concern remains an upcoming election season primed for a wave of votes protesting Trump.

Yet the president also aims to strike a bipartisan tone, the official said – a stark departure from his address to Congress a year ago. That speech delighted supporters, who saw his on-script performance as evidence that Trump, a mercurial political novice, could seize the power of the bully pulpit. This year, aides say, he’ll offer a future-focused vision. His agenda, the official said, includes a long-anticipated plan to rebuild and improve the nation’s infrastructure, continuing efforts to cut regulations, and an overhaul of the immigration system – campaign promises that got set aside last year as the administration focused on efforts to repeal Obamacare and pass the tax overhaul.

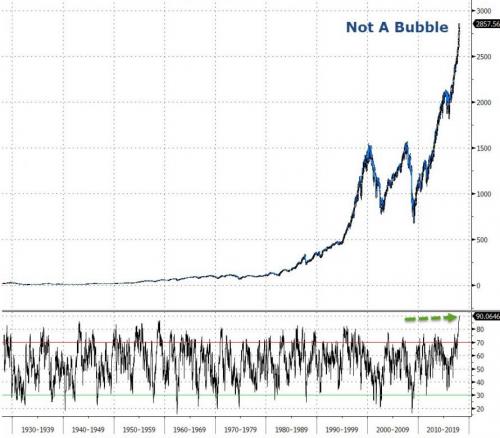

Hell no, no bubble.

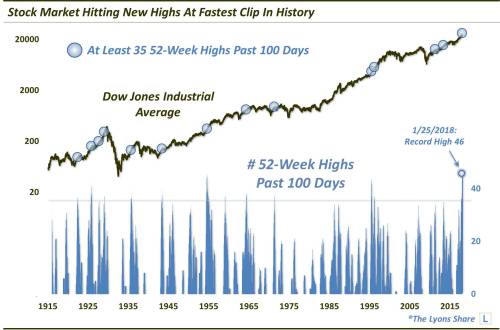

• Stock Market Setting Records In Levitation (Lyons)

In our habitation within the investment-based social media realm, we have noticed a ongoing discussion between market observers related to the present stock rally. On the one hand, there is a loud chorus from folks (likely many of whom are frustrated non-participants in the rally) pointing out the unusual, and perhaps inorganic, nature of the incessant rally. On the other hand, you have the assured (condescending?) reminders from the other side (i.e., folks “killing it” at the moment) that an upward trajectory is the “normal” course of action for stocks, historically speaking. So which contingent is correct? They both are, to an extent. Yes, it has been far more typical for stocks to rise than fall over the past 100-plus years.

Thus, we should not be surprised by a rally, even in the face of elevated valuations, sentiment, etc. However, an unwillingness to acknowledge the noteworthy, even historic, nature of the current rally, would be an indication of either willful denial or potentially harmful ignorance. This week, we take a look at some of the ways in which our current rally is truly unique from a broad historical basis. Today, we note the torrid pace at which the stock market is racking up new 52-week highs. Specifically, the Dow Jones Industrial Average (DJIA) is in the midst of a historic run of new highs. Over the past 100 days, the index has scored no fewer than 46 new 52-week highs. That is the most new highs the DJIA has ever accumulated over a 100-day stretch.

This new record surpasses the former mark of 45 set in 1954. And looking back over the last 100-plus years, there have now been just 14 unique occasions with even 35 new highs over a 100-year span. So will the new highs continue from here – or is there nowhere to go but down at this point? Well, we’re not going to pretend that a new high is a bad thing. In fact, it’s about the most bullish thing a security or index can do – no resistance at all-time highs, you know. Furthermore, the momentum often generated by moves to new highs can be a powerful and (at least, temporarily) persisting phenomenon. That is, until the final high of the run. Obviously one high will eventually mark the top and the upward momentum will cease. Are we at that point now? Are stocks going to come crashing back to earth – or can the market continue its levitation act a little longer?

“How long do you think the equity indexes will levitate once the bond market implodes?”

• Happy Landings (Jim Kunstler)

A financial smash-up is really the only thing that will break the awful spell this country is in: the belief that everyday life can go on when nothing really adds up. It seems to me that the moment is close at hand. Treasury Secretary Mnuchin told the Davos crowd that the US has “a weak dollar” policy. Is that so? Just as his department is getting ready to borrow another $1.2 trillion to cover government operations in the year to come. I’m sure the world wants nothing more than to buy bucket-loads of sovereign bonds backed by a falling currency — at the same time that the Treasury’s partner-in-crime, the Federal Reserve, is getting ready to dump an additional $600 billion bonds on the market out of its over-stuffed balance sheet. I’d sooner try to sell snow-cones in a polar bomb-cyclone.

When folks don’t want to buy bonds, the interest rates naturally have to go higher. The problem with that is your country’s treasury has to pay the bond-holders more money, but the only thing that has allowed the Treasury to keep borrowing lo these recent decades is the long-term drop of interest rates to the near-zero range. And the Fed’s timid 25-basis-point hikes in the overnight Fed Fund rate have not moved the needle quite far enough so far. But with benchmark ten-year bond rate nosing upward like a mole under the garden toward the 3.00% mark, something is going to give.

How long do you think the equity indexes will levitate once the bond market implodes? What vaporizes with it is a lot of the collateral backing up the unprecedented margin (extra borrowed money) that this rickety tower of financial Babel is tottering on. A black hole is opening up in some sub-basement of a tower on Wall Street, and it will suck the remaining value from this asset-stripped nation into the vacuum of history like so much silage. Thus will begin the harsh era of America screwing its head back on and commencing the salvage operation. We’ll stop ricocheting from hashtag to hashtag and entertain a few coherent thoughts, such as, “…Gee, it turns out you really can’t get something for nothing….” That’s an important thought to have when you turn around and suddenly discover you’ve got nothing left.

Founding fathers and inequality.

• The Founding Fathers Worst Nightmare Come True (CH)

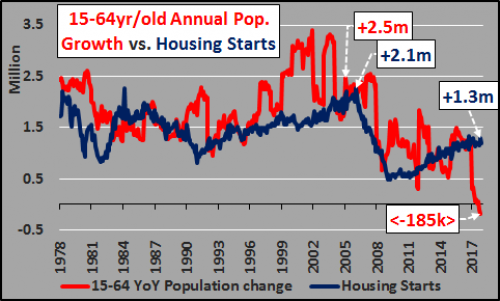

As the total debt grows (total debt now essentially equals GDP), the denominator is larger and the resultant debt spending must be that much larger to have the same impact. For example, to have the same impact as the ’09 debt binge, a $4+ trillion increase (annually) would be necessary to have the same impact as the $0.2 trillion spent in ’83 or the $2.1 trillion spent in ’09. However, in the next “crisis”, we should expect a $4 trillion jolt (annual) and perhaps as much as $20 trillion in the next episode of this ongoing “crisis” to achieve an ’83 or ’09 like stimuli. But this may not have nearly the impact as previous.

Typically, deficit spending and interest rate cuts have gone hand in hand but with rates having been at zero for nearly a decade before the recent, minor rise…a move to cut rates from anywhere near current levels back to zero will likely have little impact and not be capable of amplifying the deficit spending. Perhaps significantly greater debt creation will be necessary to have a like impact as that of ’83 or ’09. But, of course, the impact on the debt to GDP ratio will be an irrevocable moon shot into Japan style debt to GDP levels. Perhaps the sanity of an economy built on building new homes for a core population that is now shrinking is highly questionable (chart below)?

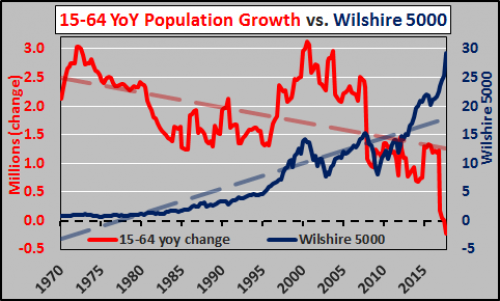

And to round it out, the annual growth of the 15-64yr/old US core population versus the Wilshire 5000 (representing the value of all publicly traded US stocks).

What should already be clear will be obvious for everyone…the federal “debt” being created isn’t actually “debt” at all. It is being created and spent with no intention of ever repaying it and the move back to zero % interest rates (or more likely NIRP) on that “debt” will make clear that it is simply centrally created and centrally directed monetization. And the resultant wealth is being centrally directed to a shrinking minority of asset holders at the expense of the vast majority. The founding fathers worst nightmare come true.

Where greed meets despair.

• Illinois Ponders Pension-Fund Moonshot: a $107 Billion Bond Sale

Lawmakers in Illinois are so desperate to shore up the state’s massively underfunded retirement system that they’re willing to entertain an eye-popping wager: Borrowing $107 billion and letting it ride in the financial markets. The legislature’s personnel and pensions committee plans to meet on Jan. 30 to hear more about a proposal advanced by the State Universities Annuitants Association, according to Representative Robert Martwick. The group wants Illinois to issue the bonds this year to get its retirement system nearly fully funded, assuming that the state can make more on its investments than it will pay in interest. It would be by far the biggest debt sale in the history of the municipal market, and in one fell swoop would be more than Puerto Rico amassed in the run up to its record-setting bankruptcy.

“We’re in a situation in Illinois where our pension debt is just crushing,” Martwick, a Democrat who chairs the committee, said in a telephone interview. “When you have the largest pension debt in the world, you probably ought to be thinking big.” Illinois owes $129 billion to its five retirement systems after years of failing to make adequate annual contributions. Because the state’s constitution bans any reduction in worker retirement benefits, the government’s pension costs will continue to rise as it faces pressure to pay down that debt, a squeeze that has pushed Illinois’s bond rating to the precipice of junk. Many American governments have sold bonds for their pensions, albeit on a much smaller scale. Illinois did so in 2003, when it issued a record $10 billion of them.

New Jersey also tried it, only to see its pension shortfall soar again after the state failed to make adequate payments into the system for years. Detroit’s pension-fund borrowing in 2005 and 2006 helped push it into bankruptcy. On the whole, the track record has been mixed, according to a study by the Center for Retirement Research at Boston College. Much hinges on timing the stock market: While most pension bonds have been profitable because of equity gains since the recession, those sold after the late 1990s rally or before the 2008 crash lost money, the study found. The S&P 500 Index climbed 19 percent last year and has continued to hit new highs.

Oil is power.

• The Dark Side of America’s Rise to Oil Superpower (BV)

The last time U.S. drillers pumped 10 million barrels of crude a day, Richard Nixon was in the White House. The first oil crisis hadn’t yet scared Americans into buying Toyotas, and fracking was an experimental technique a handful of engineers were trying, with meager success, to popularize. It was 1970, and oil sold for $1.80 a barrel. Almost five decades later, with oil hovering near $65 a barrel, daily U.S. crude output is about to hit the eight-digit mark again. It’s a significant milestone on the way to fulfilling a dream that a generation ago seemed far-fetched: By the end of the year, the U.S. may well be the world’s biggest oil producer. With that, America takes a big step toward energy independence. The U.S. crowing from the top of a hill long occupied by Saudi Arabia or Russia would scramble geopolitics. A new world energy order could emerge.

That shuffling will be good for America but not so much for the planet. For one, the influence of one of the most powerful forces of the past half-century, the modern petrostate, would be diminished. No longer would “America First” diplomats need to tiptoe around oil-supplying nations such as Saudi Arabia. OPEC would find it tougher to agree on production guidelines, and lower prices could result, reopening old wounds in the cartel. That would take some muscle out of Vladimir Putin’s foreign policy, while Russia’s oligarchs would find it more difficult to maintain the lifestyles to which they’ve become accustomed. President Donald Trump, sensing an opportunity, is looking past independence to what he calls energy dominance. His administration plans to open vast ocean acreage to offshore exploration and for the first time in 40 years allow drilling in the Arctic National Wildlife Refuge.

It may take years to tap, but the Alaska payoff alone is eye-popping—an estimated 11.8 billion barrels of technically recoverable crude. It sounds good, but be careful what you wish for. The last three years have been the hottest since recordkeeping began in the 19th century, and there’s little room in Trump’s plan for energy sources that treat the planet kindly. Governors of coastal states have already pointed out that an offshore spill could devastate tourism—another trillion-dollar industry—not to mention wreck fragile littoral environments. Florida has already applied for a waiver from such drilling. More supply could lower prices, in turn discouraging investments in renewables such as solar and wind. Those tend to spike when oil prices rise, so enthusiasm for nonpolluting, nonwarming energies of the future could wane. For now, though, the petroleum train is chugging. And you can thank the resilience of the U.S. shale industry for it.

Oil is power. Twitter shares are not. They’re just money.

• Saudi Frees Billionaires Including Alwaleed as Ritz Jail Empties (BBG)

Saudi Arabia freed Prince Alwaleed bin Talal and several of the kingdom’s most prominent businessmen from detention, clearing out the Ritz-Carlton hotel that served as a jail for the country’s elite during a controversial crackdown on corruption. Prince Alwaleed, the billionaire chairman of Riyadh’s Kingdom Holding Co. who owns stakes in Citigroup and Twitter, returned home on Saturday after reaching a settlement with authorities, a senior government official said on condition of anonymity. He will remain at the helm of his company, the official said, declining to provide the other terms of the deal. Waleed al-Ibrahim, head of a major media firm, and retail billionaire Fawaz Al Hokair were also freed after agreeing to deals, another government official said.

The prince’s release came just hours after Alwaleed told Reuters in an interview that he expected to go home soon and retain control of his company, calling his detention a “misunderstanding” and expressing support for the kingdom’s rulers. With the suspects’ names and evidence against them never officially announced, the detentions had raised concerns about transparency among foreign investors – vital to Crown Prince Mohammed bin Salman’s plan to diversify the economy away from oil. The departures from the hotel mark the end of the first phase of Prince Mohammed’s anti-corruption campaign, which shook the kingdom when it was launched in November. Hundreds of suspects were arrested, including some of the country’s richest men and its top economic policymaker.

Officials say the government expects to reap more than $100 billion from settlements with detainees in exchange for their freedom. Others have been transferred to prison to face trial, the Wall Street Journal reported. Also released after agreeing to settlements were Khalid al-Tuwaijri, head of the royal court under the late King Abdullah, and Prince Turki bin Nasser, who was involved in a massive arms sale that led to corruption probes in the U.K. and the U.S., one of the government officials said. Several of those released from detention earlier appear to be returning to their lives as usual. Among them is former finance minister and minister of state, Ibrahim al-Assaf, who recently led Saudi Arabia’s delegation to the World Economic Forum in Davos, Switzerland.

While taking over and buying up southern Europe, Germans protect their own economy from the very same.

• German Minister Urges Fast Passage Of EU Law On Chinese Takeovers (R.)

Germany wants to acquire the legal means to take a closer look at bids from Chinese companies to acquire German and European companies in order better to protect technologies, a German minister told newspaper Welt am Sonntag. Matthias Machnig, state secretary in Germany’s economics ministry, said it was urgent that proposed Europe-wide measures to police surging Chinese investment be adopted by the end of this year. “It is essential that we get a tougher law in the European Union this year to resist takeover fantasies or outflows of technology or know-how,” he said in an interview, excerpts of which were made available on Saturday.

The paper cited a study by the Cologne Institute for Economic Research that showed the volume of known Chinese investments in Germany had risen to €12.1 billion ($15.03 billion) in 2017 from around €11 billion the year before and just €100 million seven years ago. Concern has been growing across Europe at China’s buying spree on the continent, with investors snapping up often iconic businesses in a way many fear could threaten Europe’s position as a high-value economy. “With its innovative companies, the EU is attractive for many around the world,” Machnig said. “Takeovers are becoming more frequent, often under market-distorting conditions.”

Rajoy lost two elections, one of which he himself called. This is very much how democracy is viewed in Europe.

• Spanish Court Suspends Puigdemont’s Return To Power In Catalonia (AFP)

Spain’s constitutional court on Saturday announced it was blocking Catalonia’s ousted separatist leader Carles Puigdemont from returning to power in the region while he remains the subject of legal action. The court said in a statement that its 12 magistrates had decided unanimously “to preventively suspend the investiture of Puigdemont unless he appears in the (regional) parliament in person with prior judicial authorisation”. Puigdemont, who fled to Belgium after the Catalan parliament declared independence in October, was earlier this week chosen as candidate to lead Catalonia again, with the regional parliament set to vote on the issue in Barcelona on Tuesday . This despite the fact that he faces arrest for rebellion, sedition and misuse of public funds over his attempt to break Catalonia from Spain as soon as he returns to the country.

He has said he could be sworn in to office remotely, via videoconference from Brussels, a plan Spain’s central government opposes. The constitutional court warned all members of the Catalan parliament of “their responsibilities” and warned against disobeying the order to suspend any investiture. The magistrates said they needed six more days to consider a government bid to annul the nomination of Puigdemont as a candidate for the regional presidency. Puigdemont has said he would rather return to Spain, but without any risk of arrest. “The government must use every tool made available by the laws and the constitution to make sure that a fugitive, someone who is on the run from the law and the courts, cannot be illegitimately be sworn in,” Spain’s Deputy Prime Minister Soraya Saenz de Santamaria said Friday after the government lodged the legal bid to keep Puigdemont from returning to power.

It’s getting hard to predict where Brexit will be by the end of 2018. Not where it is now, that’s for sure.

• British Lords Get Ready to Disrupt Brexit (BBG)

The bumpy journey toward Brexit reaches another fork in the road this week as the upper chamber of the British parliament plans to rewrite a key piece of Prime Minister Theresa May’s legislation. What happens to the European Union Withdrawal Bill in the predominantly pro-EU House of Lords could lead to a smoother divorce, a showdown with the government or even a constitutional crisis. It makes planned changes by the peers more than just a perfunctory stage in the sometimes complex democratic machinery of Westminster. The law aims to replicate thousands of existing EU regulations so there’s no legal black hole on the day Britain’s membership ceases, currently set for March 29 next year. That process could go awry if the lords halt or, more likely, demand changes that might include delaying the exit date or increasing the chance of second public vote on the issue.

“Drama is not a word usually associated with the House of Lords,” said Tom Strathclyde, a Conservative peer who used to guide legislation through the upper house. “On this occasion, there really could be high drama.” Already the passage of the law has been far from smooth as opponents of May’s vision for Brexit – taking Britain out of the EU single market and customs union – try to tear it up. She suffered a serious defeat in the House of Commons last month at the hands of mutineers from her own Conservative party who are opposed to Brexit in its current form. She slapped down Chancellor of the Exchequer Philip Hammond last week after he said Brexit would only herald modest changes to Britain’s relationship with the EU. Now more rebels are set to vent their frustration in the Lords.

The role of the unelected lords is supposed to be to revise rather than block legislation that the elected members of parliament have passed. In the case of Brexit, a majority of lawmakers in the House of Commons also opposed it, although most cite the need to uphold the result of the referendum in 2016 that kicked off the whole Brexit process dominating U.K. politics. The key Commons amendment last month was that parliament will now get a final vote on the Brexit deal after an agreement with the EU on the cost of the divorce and future trading relationship. The lords can start proposing more changes on Jan. 31. A list of them will be published two days later and the government will decide how to proceed. “There is a large majority of people in the Lords who feel that Brexit is a national disaster, and we will be trying to mobilize that majority as we go through,” said Dick Newby, who leads the Liberal Democrat peers.

But Corbyn was never a fan of the EU.

• Corbyn Under Pressure To Change Direction On Brexit (G.)

Jeremy Corbyn has called key members of his shadow cabinet to an “away day” to re-examine the party’s policy and strategy on Brexit amid growing frustration in Labour ranks that it is failing to exploit mounting Tory turmoil over Europe. Party sources confirmed to the Observer that the meeting, scheduled for early February, would look at adapting and developing Labour’s approach during “phase two” of the Brexit process. The gathering – which will be seen as a response to unrest and the threat of rebellions by dozens of Labour MPs – will be held at a location “away from Westminster”, and will involve senior shadow cabinet members in policy areas most affected by the UK’s departure from the EU.

The news suggests Labour may soon announce a major shift in policy that would see it back permanent membership of some form of customs union with the EU after Brexit – opening a potentially decisive dividing line with Theresa’s May’s increasingly fractured government. A senior figure aware of the meeting said: “There are several among those who will attend who want the party to move on the single market and customs union. But Jeremy is a lifelong eurosceptic and there is still opposition to doing so. “The greatest pressure for change is from those who insist we must back permanent membership of a customs union with the EU after Brexit, not just a fudge position of backing it during a transition and leaving open what happens after, which we have at present.”

Those who have been asked to attend are understood to include members of the shadow cabinet Brexit subcommittee. They include the shadow chancellor John McDonnell, shadow Brexit secretary Keir Starmer, the shadow home secretary Emily Thornberry, and shadow home secretary Diane Abbott. Shadow ministers responsible for Northern Ireland, Scotland and Wales will also attend. With Theresa May’s government increasingly split over Brexit, and the EU withdrawal bill heading into the House of Lords on Tuesday, where it is expected to be savaged by pro-Remain peers of all parties as well as crossbenchers, a growing number of Labour MPs and peers are pressing the leadership to open up clearer dividing lines with the Tories.

“People say they’re interested in a broad range of news from different political preferences, but Facebook knows they really want angry, outraged articles that confirm political prejudices.”

• Facebook Doesn’t Care (Atlantic)

Facebook’s crushing blow to independent media arrived last fall in Slovakia, Cambodia, Guatemala, and three other nations. The social giant removed stories by these publishers from users’ news feeds, hiding them in a new, hard-to-find stream. These independent publishers reported that they lost as much as 80% of their audience during this experiment. Facebook doesn’t care. At least, it usually seems that way. Despite angry pushback in the six countries affected by Facebook’s algorithmic tinkering, the company is now going ahead with similar changes to its news feed globally. These changes will likely de-prioritize stories from professional publishers, and instead favor dispatches published by a user’s friends and family. Many American news organizations will see the sharp traffic declines their brethren in other nations experienced last year—unless they pay Facebook to include their stories in readers’ feeds.

At the heart of this change is Facebook’s attempt to be seen not as a news publisher, but as a neutral platform for interactions between friends. Facing sharp criticism for its role in spreading misinformation, and possibly in tipping elections in the United States and in the United Kingdom, Facebook is anxious to limit its exposure by limiting its role. It has long been this way. This rebalancing means different things for the company’s many stakeholders—for publishers, it means they’re almost certainly going to be punished for their reliance on a platform that’s never been a wholly reliable partner. Facebook didn’t talk to publishers in Slovakia because publishers are less important than other stakeholders in this next incarnation of Facebook. But more broadly, Facebook doesn’t talk to you because Facebook already knows what you want.

Facebook collects information on a person’s every interaction with the site—and many other actions online—so Facebook knows a great deal about what we pay attention to. People say they’re interested in a broad range of news from different political preferences, but Facebook knows they really want angry, outraged articles that confirm political prejudices. Publishers in Slovakia and in the United States may warn of damage to democracy if Facebook readers receive less news, but Facebook knows people will be perfectly happy—perfectly engaged—with more posts from friends and families instead. For Facebook, our revealed preferences—discovered by analyzing our behavior—speak volumes. The words we say, on the other hand, are often best ignored.

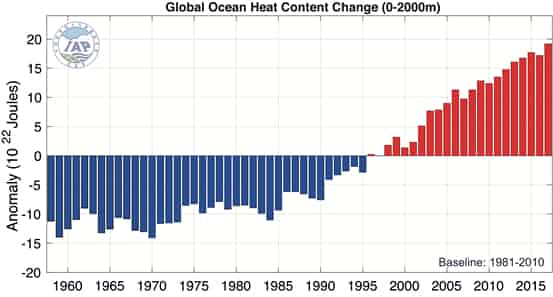

Lots of Joules.

• In 2017, The Oceans Were By Far The Hottest Ever Recorded (G.)

Among scientists who work on climate change, perhaps the most anticipated information each year is how much the Earth has warmed. That information can only come from the oceans, because almost all heat is stored there. If you want to understand global warming, you need to first understand ocean warming. This isn’t to say other measurements are not also important. For instance, measurements of the air temperature just above the Earth are really important. We live in this air; it affects us directly. A great commentary on 2017 air temperatures is provided by my colleague Dana Nuccitelli. Another measurement that is important is sea level rise; so too is ocean acidification. We could go on and on identifying the markers of climate change.

But in terms of understanding how fast the Earth is warming, the key is the oceans. This important ocean information was just released today by a world-class team of researchers from China. The researchers (Lijing Cheng and Jiang Zhu) found that the upper 2000 meters (more than 6000 feet) of ocean waters were far warmer in 2017 than the previous hottest year. We measure heat energy in Joules. It turns out that 2017 was a record-breaking year, 151×1022 Joules hotter than any other year. For comparison, the annual electrical generation in China is 600 times smaller than the heat increase in the ocean. The authors provide a long history of ocean heat, going back to the late 1950s.

By then there were enough ocean temperature sensors to get an accurate assessment of the oceans’ warmth. Their results are shown in the figure below. This graph shows ocean heat as an “anomaly,” which means a change from their baseline of 1981–2010. Columns in blue are cooler than the 1981-2010 period, while columns in red are warmer than that period. The best way to interpret this graph is to notice the steady rise in ocean heat over this long time period.

Home › Forums › Debt Rattle January 28 2018