Paul Gauguin Tahitian village 1892

And not a day too soon. There’s nothing more destructive than schlepping 10 million things 10,000 miles across the planet that don’t neeed to be.

• We May Have Hit ‘Peak Trade’ Even Without Trump’s Tariffs – UBS (CNBC)

The world may have hit ‘peak trade,’ according to an expert who pointed to robotics, digitization and localization as major game-changers for the sprawling supply chains that have defined globalization. Paul Donovan, global chief economist at UBS Wealth Management, said Wednesday that President Donald Trump’s recently announced trade tariffs are not to blame. “I don’t think that the modest taxes imposed by Trump are a driver of peak trade, at this stage. Trade protectionism — mainly non-tariff barriers to trade — have been rising for some years,” he told CNBC. Rather, Donovan said, the peak trade argument is based on “a reversal of the structural way in which globalization took place in recent years.” Globalization as we know it has meant long cross-border supply chains, where many different countries and entities would take part in the production or processing of goods.

The resulting value of trade rose for each country as a proportion of GDP. Trade to GDP, therefore, rose as supply chains lengthened. “What is now happening is that robotics and digitization mean we can produce efficiently, locally,” Donovan said. As an example, he compared the purchase of a compact disc — whose components, intellectual property and packaging would come from different places — a decade ago to downloading music now, which requires only one transaction of intellectual property. This reduces the ratio of trade to GDP. [..] “Robotics, digitization and localization mean that trade wars today are fighting battles from the past,” Donovan said. “I think global trade in goods (not services) revert to something like the old ‘imperial model’ of importing raw materials and then processing close to the consumer.”

Cancer growth.

• China’s Exports Surge At The Fastest Pace In 3 Years (R.)

China’s exports unexpectedly surged at the fastest pace in 3 years in February, suggesting its economic growth remains resilient even as trade relations with the United States rapidly deteriorate. Trade tensions have jumped to the top of the list of risks facing China this year, with proposed U.S. tariffs on steel and aluminium imports suggesting more measures may be on the way, Zhou Hao, senior emerging markets economist at Commerzbank, [said]. China’s February exports rose 44.5% from a year earlier, compared with analysts’ median forecast for a 13.6% increase, and an 11.1% gain in January, official data showed on Thursday. Imports grew 6.3%, the General Administration of Customs said, missing analysts’ forecast for 9.7% growth, and down from a sharper-than-expected 36.9% jump in January.

Analysts caution Chinese data early in the year can be heavily distorted by the timing of the Lunar New Year holiday, which fell in February this year but in January in 2017. But combined January-February trade data also showed a dramatic acceleration in export growth. Exports rose 24.4% on-year in Jan-Feb, much better than 10.8% in December and 4% growth in Jan-Feb last year. The government also releases combined data for the first two months in an attempt to smooth out seasonal distortions. The deceleration in import growth for February may be payback for the previous month’s unusual strength, rather than a sign there has been an abrupt weakening in demand. Robust import growth in January was mostly led by commodities as factories scrambled to restock inventories ahead of the long holiday. Imports in the first two months of the year rose 21.7%, compared with 4.5% in December.

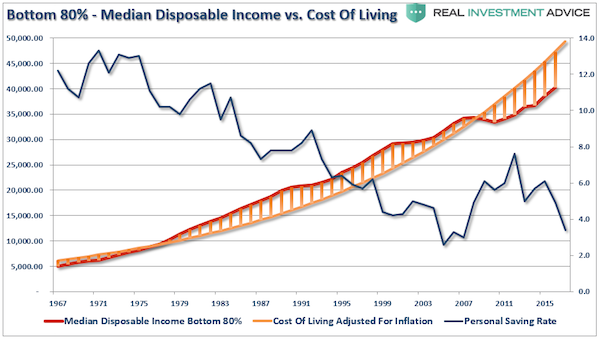

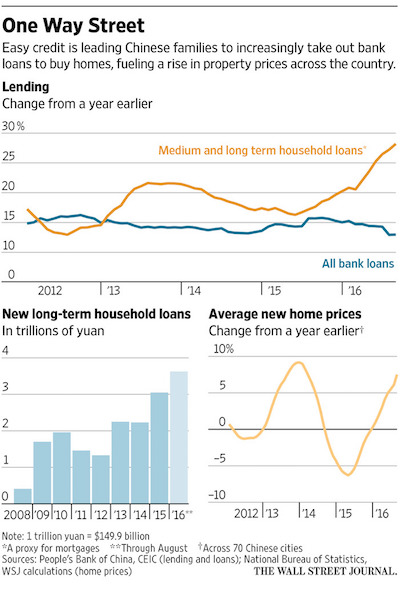

Jesse Colombo’s comment: “And what’s amazing is that these retirement stats are during a massive, Fed-driven asset bubble that has inflated the value of retirement accounts – and people STILL can’t retire! Stick a fork in it…we’re done.”

• 42% of Americans Are Set To Retire Broke (CNBC)

At this rate, retirement is more of a fantasy than a reality for many people in this country. About 42% of Americans have less than $10,000 saved for when they retire, according to a study by GoBankingRates released Tuesday. The No. 1 reason most people cited for not stashing more away was because they didn’t earn enough to save, followed by the fact that they were already struggling to pay bills, GoBankingRates said. The personal finance site polled more than 1,000 adults online in February.

For those with little or no savings, a serious lack of proper investment income and planning, coupled with a longer life expectancy, has destroyed any retirement expectations. Although millennials are most likely to have less than $10,000 saved, older Americans are also becoming steadily more pessimistic about their future economic prospects, according to a separate study by United Income, a start-up that aims to apply big-data analysis to financial planning.

The role of teh reserve currency warrants way more attention.

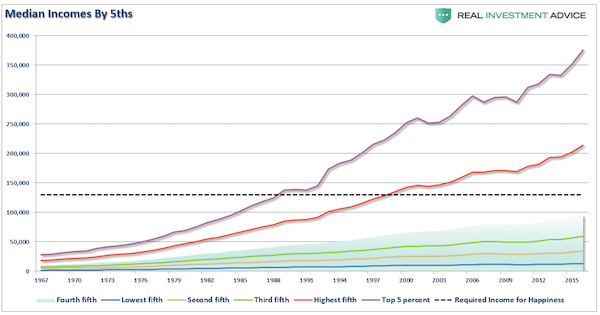

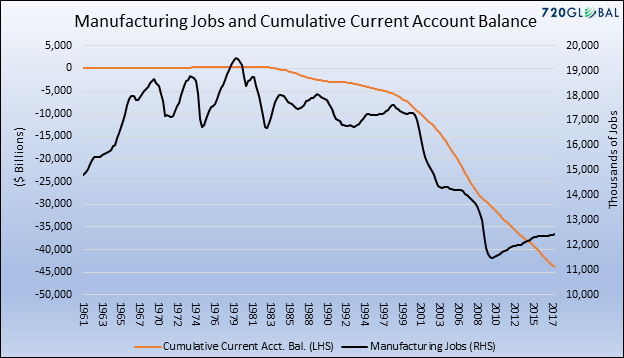

America relinquished its role as the world’s leading manufacturer in exchange for cheaper imported goods and services from other countries. The profits of U.S.-based manufacturing companies were enhanced with cheaper foreign labor, but the wages of U.S. employees were impaired, and jobs in the manufacturing sector were exported to foreign lands. This had the effect of hollowing out America’s industrial base while at the same time stoking foreign appetite for U.S. debt as they received U.S. dollars and sought to invest them. In return, debt-driven consumption soared in the U.S. The trade deficit, also known as the current account balance, measures the net flow of goods and services in and out of a country. The graph shows the correlation between the cumulative deterioration of the U.S. current account balance and manufacturing jobs.

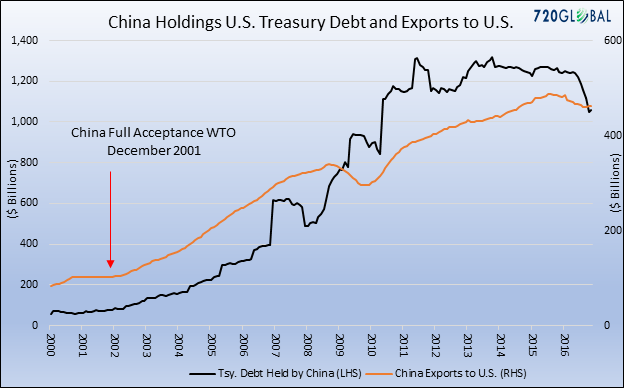

Since 1983, there have only been two quarters in which the current account balance was positive. During the most recent economic expansion, the current account balance has averaged -$443 billion per year. To further appreciate the ramifications of the reigning economic regime, consider that China gained full acceptance into the World Trade Organization (WTO) in 2001. The trade agreements that accompanied WTO status and allowed China easier access to U.S. markets have resulted in an approximate quintupling of the amount of exports from China to the U.S. Similarly, there has been a concurrent increase in the amount of credit that China has extended the U.S. government through their purchase of U.S. Treasury securities as shown below.

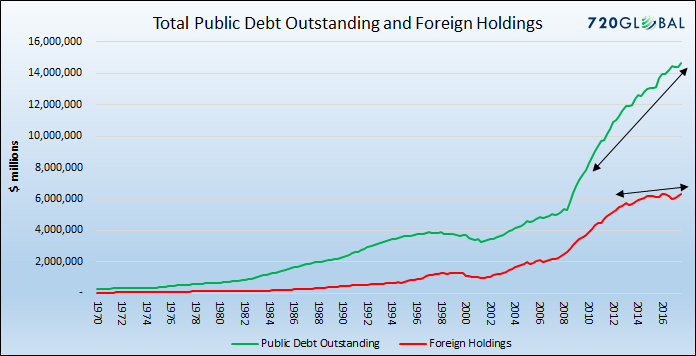

To further understand why the current economic regime is tricky to change, one must consider that the debts of years past have not been paid off. As such the U.S. Treasury regularly issues new debt that is used to pay for older debt that is maturing while at the same time issuing even more debt to fund current period deficits. Therefore, the important topic not being discussed is the United States’ (in)ability to reduce reliance on foreign funding that has proven essential in supporting the accumulated debt of consumption from years past. Trump’s ideas are far more complicated than simply leveling the trade playing field and reviving our industrial base. If the United States decides to equalize terms of trade, then we are redefining long-held agreements introduced and reinforced by previous administrations.

In breaking with that tradition of “we give you dollars, you give us cheap goods (cars, toys, lawnmowers, steel, etc.), we will most certainly also need to source alternative demand for our debt. In reality, new buyers will emerge but that likely implies an unfavorable adjustment to interest rates. The graph below compares the amount of U.S. Treasury debt that is funded abroad and the total amount of publicly traded U.S. debt. Consider further, foreigners have large holdings of U.S. corporate and securitized individual debt as well. (Importantly, also note that in recent years the Fed has bought over $2 trillion of Treasury securities through QE, more than making up for the recent slowdown in foreign buying.)

“Investors still believe in stocks as an asset class.”

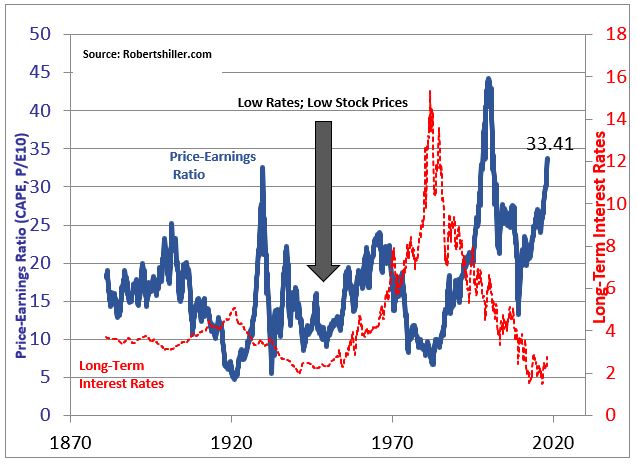

There are many ways of assessing the value of the stock market. The Shiller PE (price relative to the past decade’s worth of real, average earnings) and Tobin’s Q (the value of companies’ outstanding stock and debt relative to their replacement cost) are likely the two best. That doesn’t mean those metrics are accurate crash indicators, or that one can use them profitably as trading signals. Expensive stocks can stay expensive or get more expensive, and cheap stocks can stay cheap or get cheaper for inconveniently long periods of time.

But those metrics do have a good record of forecasting future long-term (one decade or more) returns. And that’s important for financial planning and wealth management. Difficult though it is sometimes, everyone must plug in an estimated return into a formula for retirement savings. And if an advisor is plugging in a 7% or so return for a balanced portfolio currently, he or she is likely not doing their job well. Stocks will almost certainly return less than their long-term 10% annualized average for the next decade or two given a starting Shiller PE over 30. The long-term average of the metric, after all, is under 17.

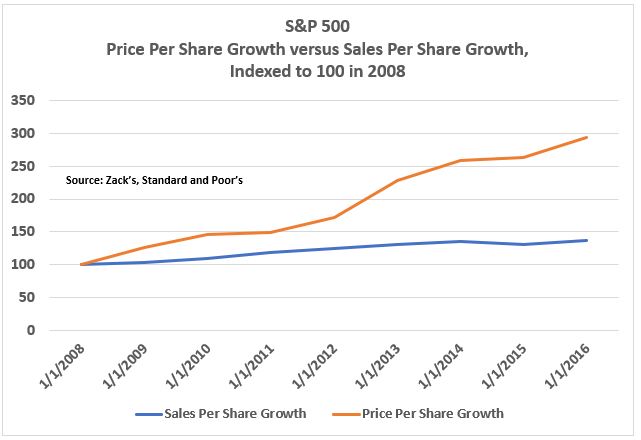

[..] Companies are always manipulating items on income statements to arrive at a particular earnings number. Recently, record numbers of companies have supported net income numbers with non-GAAP metrics. That can be legitimate sometimes. For example, depreciation on real estate is rarely commensurate with reality. But it can also be nefarious[..] So I created a chart showing sales per share growth and price per share growth of the S&P 500 dating back to the end of 2008. From the beginning of 2009 through the end of 2016, companies in the index grew profits per share by nearly 4% annualized, a perfectly respectable number for a mature economy. But price per share grew by a whopping 14.5% over that time. Over that 8 year period, sales grew less than 50% cumulatively, while share prices tripled.

Anyone invested in stocks should worry about this chart. How do share prices get so divorced from underlying corporate sales? One likely answer is low interest rates. But there must be other reasons because we’ve had low interest rates and low stock prices before – namely in the 1940s. That was after the Great Depression, and stocks were still likely viewed as suspect investments. Today, by contrast, stocks are not viewed with much suspicion, despite the technology bubble peaking in 2000 and the housing bubble in 2008. Investors still believe in stocks as an asset class.

Japan cannot do a strong yen for too long.

• A Currency War Is Coming – With Japan (BBG)

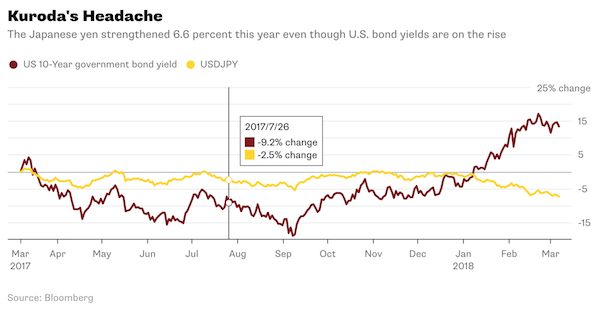

As if a brewing trade war wasn’t enough to worry about, investors also need to be alert to the threat of a major currency conflict. Norihiro Takahashi, president of Japan’s Government Pension Investment Fund, dismissed Donald Trump’s tariffs plan as a “performance” for his supporters, and said U.S. assets are no longer expensive, in an interview with The Wall Street Journal this week. That marks a change in stance since the December quarter, when the world’s largest pension fund scaled back its exposure to foreign assets. Takahashi’s comments could well be a veiled expression of Japan’s displeasure at a stronger yen. The Japanese currency has soared 6.6% against the greenback this year — and we’re only three months into 2018. For a yen-based investor, Treasuries, in particular, do indeed look more reasonably priced than in December.

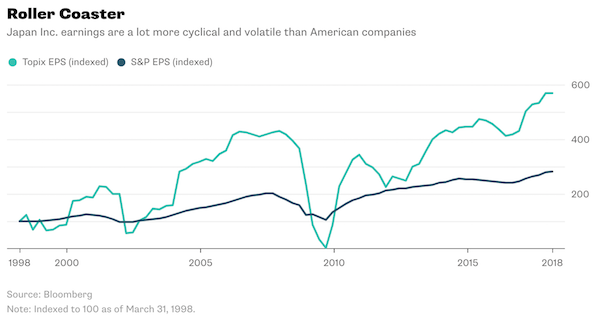

In theory, currency policy falls under the jurisdiction of Japan’s finance ministry. In practice, government agencies from the Bank of Japan to the GPIF co-ordinate their actions. Don’t forget that on Oct. 31, 2014, the central bank expanded its monetary policy on the same day the GPIF adopted a “new policy asset mix” that increased the fund’s exposure to foreign bonds. BOJ Governor Haruhiko Kuroda can deny it, but the central bank has every interest in seeking a weak yen. Japanese corporate earnings are highly cyclical: On a market-weighted basis, companies on the Topix index derive more than 37% of their revenue from abroad, data compiled by Gadfly show. A strengthening yen can cause stocks to plunge, depressing consumption and tipping the economy back into deflation.

With the Topix down more than 10% from its January high, that’s no idle threat. CPI ex-food, the BOJ’s inflation metric, was 0.9% in January, still nowhere near the 2% target that was last breached in 2015. Kuroda’s domestic toolbox, meanwhile, is starting to look empty. With a record 40% of government bonds already in its hands, the central bank is running out of assets to buy.

I was wondering yesterday why not more people were happy about this. Question is: how far do the Squid’s tentacles still reach?

• Hallelujah! The Squid Regency At The White House Is Finally Over (Stockman)

The financial commentariat and the robo-machines are all in a tizzy this morning because Gary Cohn up and quit. But we say good riddance: The man gave Trump bad advice on nearly every single issue – trade, taxes, fiscal policy and the Fed. We didn’t make any bones about that viewpoint during our appearance on Fox Business this AM. When Maria Bartiromo asked us about Cohn’s departure, our reply was: Hallelujah, the Goldman Sachs Regency in the White House is finally over! The fact is, we do have a trade crisis, but Gary Cohn and the Wall Street pseudo-free traders don’t care and never have. That’s because they fiercely support a perverted, self-serving monetary regime that systematically and massively inflates financial assets, even as it strip mines and deflates the main street economy.

As we have been pointing out in this series, there is a perverse symbiosis between the Fed and the Dirty Float central banks of the 10 major countries (China, Vietnam, Mexico, Japan, etc), which account for 90% of the nation’s $810 billion trade deficit (2017). Together they have ripped the guts out of the US industrial economy – effectively sending jobs and production abroad and cash flow and liquidated capital to Wall Street. For its part, the Fed has monkey-hammered US competitiveness. That’s the result of its insensible 2.00% inflation policy, which has fatally inflated nominal dollar wages in a world market drowning in cheap labor priced in artificially under-valued currencies. At the same time, its massive interest rate repression and price-keeping operations in the stock market have turned the C-suites of corporate America into financial engineering joints.

So doing, they have slashed real net business investment by nearly 3o% since the turn of the century, by 20% from the 2007 pre-crisis peak and, actually, to a level in 2016 that barely exceeded real net investment two decades earlier in 1997. Meanwhile, the C-suites shuttled upwards of $15 trillion of cash flow and debt capacity during the last decade alone into stock buybacks, vanity M&A deals and excess dividends and recaps.

Re-negotiate.

• Canada, Mexico to Get Initial Exemption From Trump Tariffs (BBG)

The Trump administration will initially exclude Canada and Mexico from stiff tariffs on steel and aluminum imports, an exemption they would lose if they fail to reach an updated Nafta agreement with the U.S., White House trade adviser Peter Navarro said on Wednesday. The two nations won’t be subject to tariffs on their steel and aluminum if they sign a new NAFTA that meets the satisfaction of the U.S., Navarro said, adding that other American allies could use a similar system to ask for an exemption. If Nafta talks fall through, Canada and Mexico would face the same tariff as other nations, expected to be 25% on steel and 10% on aluminum. “Here’s the situation, and the president has made this public,” Navarro said. “There’s going to be a provision which will exclude Canada and Mexico until the Nafta thing is concluded one way or another.”

The decision-making process regarding the tariffs has evolved and more changes could be made before President Donald Trump formally approves them. China on Thursday vowed to retaliate, its most forceful comments yet on the threatened tariffs. “A trade war is never the right solution,” China’s Foreign Minister Wang Yi told reporters in Beijing. “In a globalized world, it is particularly unhelpful, as it will harm both the initiator and the target countries. In the event of a trade war, China will make a justified and necessary response.” Earlier Wednesday, White House Press Secretary Sarah Huckabee Sanders said the tariff plan would feature “potential carve outs for Canada and Mexico based on national security” considerations and also possible exclusions for specific countries. Australia is among those making the case for exemption, with Foreign Minister Julie Bishop citing her nation’s status as a “close ally and partner” in a Sky News interview on Thursday.

Good headline, followed by shameless promo.

• New iPhones Aren’t Selling In Asia (CNBC)

Apple’s iPhone X may not have wooed Asian consumers during the Lunar New Year holiday — but the company has some new products in the pipeline, according to Rosenblatt Securities’ Jun Zhang. Zhang chopped 5.5 million units off expectations for iPhone X sales for the first half of this year in a Wednesday research note. But with sales of high-end smartphones shrinking, Apple could offset lower iPhone sales with new products. “We are not surprised with the quick cooldown of iPhone X sales following Chinese New Year,” Zhang wrote. “Further iPhone X cuts, in our view, suggest the high-end smartphone market upgrade cycle continues to extend. We are seeing similar issues for Samsung’s S9 model since our research suggests that preorders are weak.”

Apple and Samsung, like many tech companies, and rarely release data on new products or unit sales outside of quarterly reports or launch events. But, Zhang wrote, Apple could sell 6 million to 8 million iPad Pro units with more advanced 3-D sensing, as well as new phones in the fall. A new red iPhone model, lower-end iPhones and a lower-priced HomePod might also be in the works, Zhang said. (Apple has had a partnership with HIV/AIDS organization (RED) for over a decade, and often sells red-colored products to support AIDS research and prevention.) “Since we expect the overall smartphone market to be flat this year, particularly in the mid-to-high end markets, Apple’s upcoming lower priced iPhone model could drive Apple’s unit growth,” Zhang wrote.

Why do I get the idea there’s not an actual plan behind any of this, or a philosophy?

• Vancouver Declares 5% Of Homes Empty And Liable For New Tax (G.)

Thousands of homes in Vancouver have been declared unused and liable for a new empty homes tax as part of a government attempt to tackle skyrocketing home prices and soaring rents. About 4.6% or 8,481 homes in the western Canadian city stood empty or underutilised for more than 180 days in 2017, according to declarations submitted to the municipality by 98.85% of homeowners. Properties deemed empty will be subjected to a tax of 1% of their assessed value. Vancouver has rolled out a raft of measures to cool prices and improve housing affordability in the country’s most expensive real estate market. Empty houses, also a big issue in the UK, are only one aspect of the problem. In 2017 the provincial government of British Columbia raised its foreign buyer tax from 15% to 20% to target offshore investors blamed for pushing up prices.

Toronto, Canada’s biggest city, followed suit with a 15% tax in April. Before the foreign buyer tax, sales agents said investors in Hong Kong, China and other parts of Asia were acquiring up to 40% of Vancouver condominium projects marketed abroad, absorbing the more expensive units that domestic buyers could not afford. Nearly 61% of the homes declared empty in Vancouver were condos, and other multi-family properties made up almost 6%, according to the city government. More than a quarter of the empty properties were in downtown Vancouver. Property owners who did not submit a declaration and those who claimed exemptions, such as for renovations or if the owner was in hospital or long-term care, were included in the empty homes number.

I’m a sucker for headlines. The original says “..women and ethnic minorities..”, but that had me wondering how many immigrants are named David or Steve. More than women, I’d bet.

• More People Called David And Steve Lead FTSE 100 Companies Than Women (Ind.)

There are more people called David or Steve who head up FTSE 100 companies than there are women or ethnic minorities, underscoring the extent to which corporate Britain is still dominated by men. According to research conducted by INvolve, a group that champions diversity and inclusion in business, there are currently five ethnic minority and seven female chief executives of FTSE 100 companies. Nine are named David and four are called Steve. Later this month Royal Mail, which is headed up by Moya Greene, is set to join the index of the UK’s biggest publicly listed companies, taking the total number of female-led firms to eight.

The number highlights how women and ethnic minorities are still dramatically underrepresented on corporate boards across the UK. According to the Government’s Hampton-Alexander Review into female leaders across FTSE companies published last November, only five FTSE 250 companies had at the time achieved a gender-balanced board. Speaking at an event in London to mark International Women’s Day this week, Carolyn Fairbairn, director general of the Confederation of British Industry, said that women are now joining boards in greater numbers than ever, but often as non-executive directors.

He doesn’t give an inch. Why would he?

• ‘Why Would We Want A World Without Russia?’ – Putin (RT)

President Vladimir Putin, who recently startled the world by unveiling Russia’s advanced nuclear arsenal, has again spoken of nuclear arms, clarifying the circumstances in which Moscow is prepared to enter a nuclear war. “Certainly, it would be a global disaster for humanity; a disaster for the entire world,” Putin said, in an interview for a Russian documentary “The World Order 2018,” adding that “as a citizen of Russia and the head of the Russian state I must ask myself: Why would we want a world without Russia?” Even though Putin admitted that any conflict involving the use of nuclear weapons would have dire consequences for humanity, he maintained that Russia would be forced to defend itself using all available means if its very existence is put at stake.

“A decision on the use of nuclear weapons may only be taken if our ballistic missile attack warning system not only detects a launch, but also predicts that the warheads would hit Russian territory. This is called a retaliation strike,” he said in the interview. Russia’s latest edition of its nuclear doctrine allows the use of nuclear weapons in response to a nuclear attack against Russia or its allies, or to a conventional attack that threatens the existence of Russia. Putin also denied Russia was interested in pursuing a nuclear arms race, saying that “to begin with, we did not start this… nuclear bomb was first developed not by us but by the US,” he said in the interview, pointing out that “we have never used nuclear weapons [although] the US used them against Japan.”

A rare dose of reality in a British press -and politics- engaged in full-steam Russia bashing.

• Sergei Skripal Is Not Litvinenko (Ind.)

Boris Johnson just about observed diplomatic protocol when he addressed MPs about the apparent poisoning of Sergei Skripal. He stopped short of accusing the Russian state directly. But his inference – a malevolent and unjustified inference for the Foreign Secretary of a country that harps on about the rule of law – was indeed of Russian guilt. And it was clearest in the parallel he invited MPs to draw with the death of Alexander Litvinenko. Now it may indeed be that Russia – or Russians (something rather different) – are responsible for whatever happened in Salisbury. And it is true that Russians in the UK seem disproportionately accident-prone. But it is premature in the extreme to blame the Russian state, and just as misleading to draw this particular parallel with the Litvinenko case.

Both men may have been Russians branded traitors by their homeland, and both may have been victims of poisoning, but there are important differences. In Russia, Litvinenko worked against organised crime; he was less a spy in the conventional sense than a criminal intelligence officer. He fled the country after blowing the whistle on his corrupt bosses, and applied for asylum in the UK. His first choice, the US, had turned him down on the apparent grounds that the information he had to offer was not valuable enough. Unlike Skripal, he started working for MI5/6 only after arriving in the UK, and even then seems to have had difficulty getting on the payroll. His widow, Marina, is still battling to get the intelligence agencies to pay a pension or recognise a duty of care. It is cruel to say so, but Litvinenko seems almost to have been more use to the UK in death – as a totem of Russia’s general badness – than he was in life.

[..] For the moment, though, I will resist the temptation to delve into my inner Le Carre and return to Litvinenko. As I said, there are crucial differences between the two – differences that should militate against state-sponsored assassination being the favoured explanation for Skripal’s plight. But there should be doubts, too, about this judgment in the case of Litvinenko. The conclusions of the Litvinenko inquiry, now treated as unimpeachable proof of Russian state culpability, are nowhere near as definitive – or credible – as they have since been presented. The much-trumpeted (and over-interpreted) conclusion of the judge, Sir Robert Owen, was that “the FSB operation to kill Litvinenko was probably approved by Mr Patrushev [then head of the FSB] and also by President Putin”. He said there was “a strong probability” that Andrei Lugovoy poisoned Litvinenko “under the direction of the FSB” and the use of polonium-210 was “at very least a strong indicator of state involvement”. What sort of proof is that?

They better be careful….

• Turkey Renews Threat Against Cyprus Offshore Gas Exploration (AP)

Turkey’s prime minister has renewed a threat against efforts to search for offshore gas around Cyprus. Turkey opposes what it says are “unilateral” efforts to search for gas, saying they infringe the rights of Turkish Cypriots to the ethnically split island’s resources. Binali Yildirim said Wednesday during a joint news conference with Tufan Erhurman, the so-called “prime minister” of the breakaway north of Cyprus, that “provocative activities will be met with the appropriate response.” Yildirim’s comments were in response to reports that an ExxonMobil vessel was heading toward the Mediterranean, coinciding with exercises in the area involving the US Navy. Last month, Turkish warships prevented a rig from reaching an area southeast of Cyprus where Italian company Eni was scheduled to drill for gas.

….because the US must defend Exxon.

• US State Department Stresses Cyprus’s Right To Develop Resources In EEZ (K.)

The United States recognizes the right of Cyprus to develop the resources in its Exclusive Economic Zone, and discourages any actions or statements that provoke a rise in tensions in the region, a State Department official has said. In a statement late on Wednesday, the official said that Washington’s policy on Cyprus’ EEZ was longstanding and has not changed, noting that the US “recognizes the right of the Republic of Cyprus to develop its resources in its Exclusive Economic Zone.” “We continue to believe the island’s oil and gas resources, like all of its resources, should be equitably shared between both communities in the context of an overall settlement,” the official said. “We discourage any actions or rhetoric that increase tensions in the region.” The official did not comment directly on threats from Ankara regarding the arrival in the region of a research vessel belonging to US company ExxonMobil.

How is it possible that TEPCO is allowed to just keep on lying?

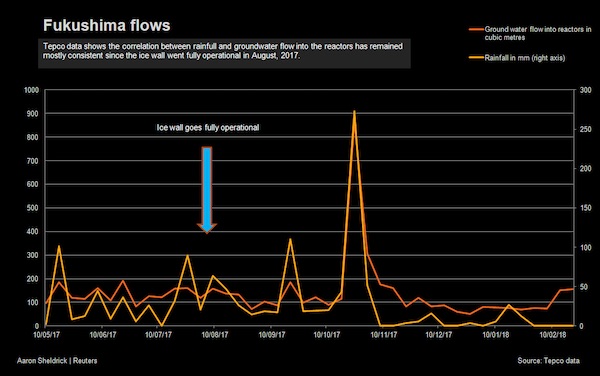

• Tepco’s ‘Ice Wall’ Fails To Freeze Fukushima’s Toxic Water Buildup (R.)

A costly “ice wall” is failing to keep groundwater from seeping into the stricken Fukushima Dai-ichi nuclear plant, data from operator Tokyo Electric Power Co shows, preventing it from removing radioactive melted fuel at the site seven years after the disaster. When the ice wall was announced in 2013, Tepco assured skeptics that it would limit the flow of groundwater into the plant’s basements, where it mixes with highly radioactive debris from the site’s reactors, to “nearly nothing.” However, since the ice wall became fully operational at the end of August, an average of 141 metric tonnes a day of water has seeped into the reactor and turbine areas, more than the average of 132 metric tonnes a day during the prior nine months, a Reuters analysis of the Tepco data showed.

The groundwater seepage has delayed Tepco’s clean-up at the site and may undermine the entire decommissioning process for the plant, which was battered by a tsunami seven years ago this Sunday. Waves knocked out power and triggered meltdowns at three of the site’s six reactors that spewed radiation, forcing 160,000 residents to flee, many of whom have not returned to this once-fertile coast. Though called an ice wall, Tepco has attempted to create something more like a frozen soil barrier. Using 34.5 billion yen ($324 million) in public funds, Tepco sunk about 1,500 tubes filled with brine to a depth of 30 meters (100 feet) in a 1.5-kilometre (1-mile) perimeter around four of the plant’s reactors. It then cools the brine to minus 30 degrees Celsius (minus 22 Fahrenheit).

The aim is to freeze the soil into a solid mass that blocks groundwater flowing from the hills west of the plant to the coast. However, the continuing seepage has created vast amounts of toxic water that Tepco must pump out, decontaminate and store in tanks at Fukushima that now number 1,000, holding 1 million tonnes. It says it will run out of space by early 2021. “I believe the ice wall was ‘oversold’ in that it would solve all the release and storage concerns,” said Dale Klein, the former chairman of the U.S. Nuclear Regulatory Commission and the head of an external committee advising Tepco on safety issues.

The people that see the threats to the entire system are not politicians.

• Over 500 Quebec Doctors Protest Their Own Pay Raises (CNBC)

In Canada, more than 500 doctors and residents, as well as over 150 medical students, have signed a public letter protesting their own pay raises. “We, Quebec doctors who believe in a strong public system, oppose the recent salary increases negotiated by our medical federations,” the letter says. The group say they are offended that they would receive raises when nurses and patients are struggling. “These increases are all the more shocking because our nurses, clerks and other professionals face very difficult working conditions, while our patients live with the lack of access to required services because of the drastic cuts in recent years and the centralization of power in the Ministry of Health,” reads the letter, which was published February 25.

“The only thing that seems to be immune to the cuts is our remuneration,” the letter says. Canada has a public health system which provides “universal coverage for medically necessary health care services provided on the basis of need, rather than the ability to pay,” the government’s website says. The 213 general practitioners, 184 specialists, 149 resident medical doctors and 162 medical students want the money used for their raises to be returned to the system instead. “We believe that there is a way to redistribute the resources of the Quebec health system to promote the health of the population and meet the needs of patients without pushing workers to the end,” the letter says.

“We, Quebec doctors, are asking that the salary increases granted to physicians be canceled and that the resources of the system be better distributed for the good of the health care workers and to provide health services worthy to the people of Quebec.” A physician in Canada is paid $260,924 ($339,000 Canadian) for clinical services by the government’s Ministry of Health per year on average, according to a report from the Canadian Institute for Health Information published in September 2017. On average, a family physician is paid $211,717 ($275,000 Canadian) for clinical services and a surgical specialist is paid $354,915 ($461,000 Canadian), according to the same report.