Vincent van Gogh Courtyard of the hospital in Arles 1889

I’ve been saying for a long time that the BRI (Belt and Road) is China’s attempt at exporting its overcapacity. They make poor countries borrow billions, which these can’t pay back. And then… Only now do other parties wake up to that. And Xi is trying to do some damage control.

• China’s ‘Silk Road’ Project Runs Into Debt Jam (AFP)

China’s massive and expanding “Belt and Road” trade infrastructure project is running into speed bumps as some countries begin to grumble about being buried under Chinese debt. First announced in 2013 by President Xi Jinping, the initiative also known as the “new Silk Road” envisions the construction of railways, roads and ports across the globe, with Beijing providing billions of dollars in loans to many countries. Five years on, Xi has found himself defending his treasured idea as concerns grow that China is setting up debt traps in countries which may lack the means to pay back the Asian giant. “It is not a China club,” Xi said in a speech on Monday to mark the project’s anniversary, describing Belt and Road as an “open and inclusive” project.

Xi said China’s trade with Belt and Road countries had exceeded $5 trillion, with outward direct investment surpassing $60 billion. But some are starting to wonder if it is worth the cost. During a visit to Beijing in August, Malaysia’s Prime Minister Mahathir Mohamad said his country would shelve three China-backed projects, including a $20 billion railway. The party of Pakistan’s new prime minister, Imran Khan, has vowed more transparency amid fears about the country’s ability to repay Chinese loans related to the multi-billion-dollar China-Pakistan Economic Corridor. Meanwhile the exiled leader of the opposition in the Maldives, Mohamed Nasheed, has said China’s actions in the Indian Ocean archipelago amounted to a “land grab” and “colonialism”, with 80 percent of its debt held by Beijing.

Sri Lanka has already paid a heavy price for being highly indebted to China. Last year, the island nation had to grant a 99-year lease on a strategic port to Beijing over its inability to repay loans for the $1.4-billion project.

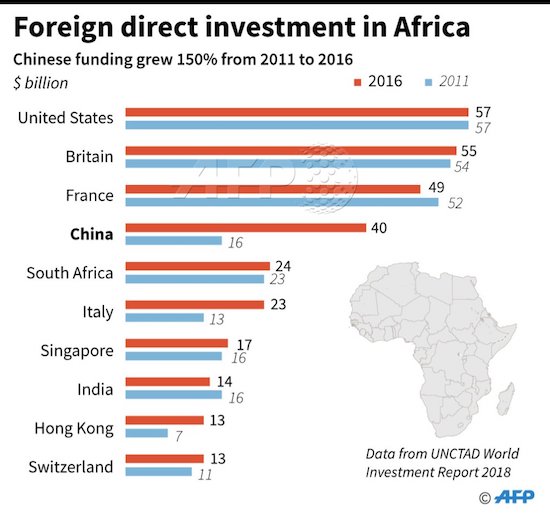

“This debt acquired from China comes with huge business for Chinese companies, particularly construction companies that have turned the whole of Africa into a construction site..”

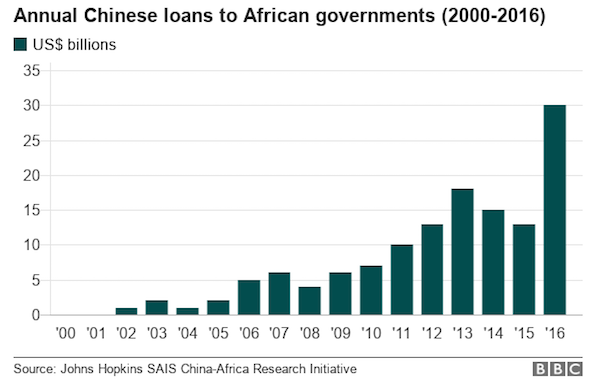

• Should Africa Be Wary Of Chinese Debt? (BBC)

African countries have shown a healthy appetite for Chinese loans but some experts now worry that the continent is gorging on debt, and could soon choke. The Entebbe-Kampala Expressway is still something of a tourist attraction for Ugandans, nearly three months after it opened. The 51km (31 mile), four-lane highway that connects the country’s capital to the Entebbe International Airport was built by a Chinese company using a $476m (£366m) loan from the China Exim Bank. It has cut what was a torturous two-hour journey through some of Africa’s worst traffic into a scenic 45-minute drive into the East Africa nation’s capital. Uganda has taken $3bn of Chinese loans as part of a wider trend that Kampala-based economist Ramathan Ggoobi calls its “unrivalled willingness to avail unconditional capital to Africa”.

“This debt acquired from China comes with huge business for Chinese companies, particularly construction companies that have turned the whole of Africa into a construction site for rails, roads, electricity dams, stadia, commercial buildings and so on,” the Makerere University Business School lecturer told the BBC. The Chinese loans come as many African countries are once again in danger of defaulting on their debts more than a decade after many had their outstanding borrowing written off. At least 40% of low-income countries in the region are either in debt distress or at high risk, the International Monetary Fund warned in April.

Chad, Eritrea, Mozambique, Congo Republic, South Sudan and Zimbabwe were considered to be in debt distress at the end of 2017 while Zambia and Ethiopia were downgraded to “high risk of debt distress”. “In 2017 alone, the newly signed value of Chinese contracted projects in Africa registered $76.5bn,” Standard Bank’s China Economist Jeremy Stevens wrote in a note. “However, despite a sizeable remaining infrastructure deficit on the continent, there is a concern that African countries’ debt-service ability will soon dissolve,” he says.

Until you can’t pay up. China knows many countries won’t be.

• China’s Xi Says No Strings Attached To Funds For Africa (R.)

Xi said at a business forum before the start of a triennial China Africa summit their friendship was time-honoured and that China’s investment in Africa came with no political strings attached. “China does not interfere in Africa’s internal affairs and does not impose its own will on Africa. What we value is the sharing of development experience and the support we can offer to Africa’s national rejuvenation and prosperity,” Xi said. “China’s cooperation with Africa is clearly targeted at the major bottlenecks to development. Resources for our cooperation are not to be spent on any vanity projects but in places where they count the most,” he said.

China has denied engaging in “debt trap” diplomacy but Xi is likely to use the gathering of African leaders to offer a new round of financing, following a pledge of $60 billion at the previous summit in South Africa three years ago. Chinese officials have vowed to be more cautious to ensure projects are sustainable. China defends continued lending to Africa on the grounds that the continent still needs debt-funded infrastructure development. Beijing has also fended off criticism it is only interested in resource extraction to feed its own booming economy, that the projects it funds have poor environmental safeguards, and that too many of the workers for them are flown in from China rather than using African labour.

The Wall Street Journal is the only remaining paper of record. This is an editorial.

• Anatomy Of A Fusion Smear (WSJ)

A partner at Foley & Lardner, Ms. Mitchell was astonished to find herself dragged into the Russia investigation on March 13 when Democrats on the House Intelligence Committee issued an interim report. They wrote that they still wanted to interview “key witnesses,” including Ms. Mitchell, who they claimed was “involved in or may have knowledge of third-party political outreach from the Kremlin to the Trump campaign, including persons linked to the National Rifle Association (NRA).” Two days later the McClatchy news service published a story with the headline “NRA lawyer expressed concerns about group’s Russia ties, investigators told.” The story cited two anonymous sources claiming Congress was investigating Ms. Mitchell’s worries that the NRA had been “channeling Russia funds into the 2016 elections to help Donald Trump.”

Ms. Mitchell says none of this is true. She hadn’t done legal work for the NRA in at least a decade, had zero contact with it in 2016, and had spoken to no one about its actions. She says she told this to McClatchy, which published the story anyway. Now we’re learning how this misinformation got around, and the evidence points to Glenn Simpson of Fusion GPS, the outfit that financed the infamous Steele dossier. New documents provided to Congress show that Mr. Simpson, a Fusion co-founder, was feeding information to Justice Department official Bruce Ohr. In an interview with House investigators this week, Mr. Ohr confirmed he had known Mr. Simpson for some time, and passed at least some of his information along to the FBI.

In handwritten notes dated Dec. 10, 2016 that the Department of Justice provided to Congress and were transcribed for us by a source, Mr. Ohr discusses allegations that Mr. Simpson made to him in a conversation. The notes read: “A Russian senator (& mobster) . . . [our ellipsis] may have been involved in funneling Russian money to the NRA to use in the campaign. An NRA lawyer named Cleta Mitchell found out about the money pipeline and was very upset, but the election was over.”

But they still claim damage won’t be long-lasting..

• No-Deal Brexit: Study Warns Of Severe Short-Term Impact On UK (G.)

The short-term impact of a no-deal Brexit on Britain’s economy would be “chaotic and severe”, jeopardising jobs and disrupting trade links, warn experts from the thinktank UK in a Changing Europe. The Brexit secretary, Dominic Raab, has said he believes 80% of the work on completing an exit deal with the EU27 is already done, as negotiations enter their final phase. But his cabinet colleague Liam Fox recently suggested a no-deal scenario – which would occur if negotiations broke down, or both sides agreed to disagree – was the most likely outcome. In a 30-page updated assessment of the impact of no deal, the thinktank said on Monday it would mean “the disappearance without replacement of many of the rules underpinning the UK’s economic and regulatory structure”.

Its analysis claimed that in the short term: • Food supplies could be temporarily disrupted – the beef trade could collapse, for example, as Britain is heavily reliant on EU imports, and would be forced to apply tariffs, in accordance with World Trade Organisation (WTO) rules. • European health insurance cards, which allow British tourists free healthcare in the EU, would be invalid from Brexit day. • There would almost certainly have to be a “hardening of the border” between Northern Ireland and the Irish Republic, including some “physical manifestation”. • The status of legal contracts and commercial arrangements with EU companies would be unclear, as the UK would become a “third country” overnight. • Increased and uncertain processing times for goods at the border would be “nearly certain”, risking queues at Dover and forcing firms to rethink their supply chains.

In the longer term, UK in a Changing Europe’s experts say, the UK would have time to normalise its trading status, and agreements could be struck with the EU27 to tackle many other practical challenges. “It should not be assumed that the damage, while real, will necessarily be long-lasting,” the report says.

6 months to go. It’ll be a spectacle.

• Boris Johnson Launches Fresh Attack On May’s Brexit Plans (G.)

Boris Johnson has used his first newspaper column of the new parliamentary term to attack Theresa May’s Chequers plan, saying it means the UK enters Brexit negotiations with a “white flag fluttering”. The declaration amounts to a significant escalation the former foreign secretary’s guerrilla campaign against the prime minister and her Chequers plan a day before the Commons returns and at a time when party disquiet over the direction of the divorce talks is mounting. Johnson wrote that “the reality is that in this negotiation the EU has so far taken every important trick. The UK has agreed to hand over £40 billion of taxpayers’ money for two thirds of diddly squat”.

Johnson added that by adopting the Chequers plan, which will see the UK adopt a common rule book for food and goods, “we have gone into battle with the white flag fluttering over our leading tank”. It will be “impossible for the UK to be more competitive, to innovate, to deviate, to initiate, and we are ruling out major free trade deals,” he added. The intervention comes after a summer in which the former minister, who resigned over the Chequers deal, had avoided touching on Brexit in his Daily Telegraph column – although he did unleash a storm of complaint by describing fully veiled Muslim women as looking like letter boxes and bank robbers. It will be seen as preparing the ground for a leadership challenge to May just as the Brexit negotiations reach their critical phase in the autumn, which is to culminate in any final deal agreed by the UK government being put to parliament for a vote.

“..the average age of workers left in the department is 32..”

• Half The Staff Leaves UK’s Brexit Department (Ind.)

The number of officials who have left the Whitehall department trying to deliver Brexit is equivalent to more than half of its total staff, shock new figures reveal. Data seen by The Independent shows hundreds of civil servants went elsewhere as the department tried to get on its feet and cobble together a negotiating stance for the UK over the last two years. The exodus means the average age of workers left in the department is 32, though they are tasked with winning a complex deal that could change Britain for a generation.

The information obtained by the Liberal Democrats appears to corroborate previous reports about an extraordinarily high turnover at the Department for Exiting the European Union (Dexeu), with critics now claiming it points to “deep instability” at the heart of the government’s Brexit operation. According to the turnover data obtained under freedom of information, a staggering 357 staff have left the Dexeu in just two years. Yet the total number of those employed at the Whitehall department amounts to only 665, indicating a turnover rate of more than 50 per cent in that period.

Expect many more similar examples.

• Britain Loses Medicines Contracts As EU Body Anticipates Brexit (G.)

Britain’s leading role in evaluating new medicines for sale to patients across the EU has collapsed with no more work coming from Europe because of Brexit, it has emerged. The decision by the European Medicines Agency to cut Britain out of its contracts seven months ahead of Brexit is a devastating blow to British pharmaceutical companies already reeling from the loss of the EMA’s HQ in London and with it 900 jobs. All drugs sold in Europe have to go through a lengthy EMA authorisation process before use by health services, and the Medicines & Healthcare products Regulatory Agency (MHRA) in Britain has built up a leading role in this work, with 20-30% of all assessments in the EU.

The MHRA won just two contracts this year and the EMA said that that work was now off limits. “We couldn’t even allocate the work now for new drugs because the expert has to be available throughout the evaluation period and sometimes that can take a year,” said a spokeswoman. In a devastating second blow, existing contracts with the MHRA are also being reallocated to bloc members. Martin McKee, the professor of European health at the London School of Hygiene and Tropical Medicine, who has given evidence to select committees about Brexit, said it was a disaster for the MHRA, which had about £14m a year from the EMA. The head of the Association of British Pharmaceutical Industry said it was akin to watching a “British success story” being broken up.

Draghi!!

• Emerging Markets Haunt Spanish Banks (DQ)

Almost exactly six years ago, the Spanish government requested a €100 billion bailout from the Troika (ECB, European Commission and IMF) to rescue its bankrupt savings banks, which were then merged with much larger commercial banks. Over €40 billion of the credit line was used; much of it is still unpaid. Yet Spain’s banking system could soon face a brand new crisis, this time not involving small or mid-sized savings banks but instead its alpha lenders, which are heavily exposed to emerging economies, from Argentina to Turkey and beyond. In the case of Turkey’s financial system, Spanish banks had total exposure of $82.3 billion in the first quarter of 2018, according to the Bank for International Settlements.

That’s more than the combined exposure of lenders from the next three most exposed economies, France, the USA, and the UK, which reached $75 billion in the same period. According to BIS statistics, Spanish banks’ exposure to Turkey’s economy almost quadrupled between 2015 and 2018, largely on the back of Spain’s second largest bank BBVA’s madcap purchase of roughly half of Turkey’s third largest lender, Turkiye Garanti Bankasi. Since buying its first chunk of the bank from the Turkish group Dogus and General Electric in 2010, BBVA has lost over 75% of its investment under the combined influence of Garanti’s plummeting shares and Turkey’s plunging currency.

But the biggest fear, as expressed by the ECB on August 10, is that Turkish borrowers might not be hedged against the lira’s weakness and begin to default en masse on foreign currency loans, which account for a staggering 40% of the Turkish banking sector’s assets. If that happens, the banks most exposed to Turkish debt will be hit pretty hard. And no bank is as exposed as BBVA, though the lender insists its investments are well-hedged and its Turkish business is siloed from the rest of the company. In Argentina, whose currency continues to collapse and whose economy is now spiraling down despite an IMF bailout, Spanish banks’ total combined investments amounted to $28 billion in the first quarter of 2018. That represented almost exactly half of the $58.9 billion that foreign banks are on the hook for in the country. The next most at-risk banking sector, the US, has some $10 billion invested.

Maybe you should define capitalism first.

• Capitalism Is Beyond Saving, and America Is Living Proof (TD)

Real wage growth has been nonexistent in the United States for more than 30 years. But as America enters the 10th year of the recovery—and the longest bull market in modern history—there are nervous murmurs, even among capitalism’s most reliable defenders, that some of its most basic mechanisms might be broken. The gains of the recovery have accrued absurdly, extravagantly to a tiny sliver of the world’s superrich. A small portion of that has trickled down to the professional classes—the lawyers and money managers, art buyers and decorators, consultants and “starchitects”—who work for them. For the declining middle and the growing bottom: nothing.

This is not how the economists told us it was supposed to work. Productivity is at record highs; profits are good; the unemployment rate is nearing a meager 4 percent. There are widely reported labor shortages in key industries. Recent tax cuts infused even more cash into corporate coffers. Individually and collectively, these factors are supposed to exert upward pressure on wages. It should be a workers’ market. But wages remain flat, and companies have used their latest bounty for stock buybacks, a transparent form of market manipulation that was illegal until the Reagan-era SEC began to chip away at the edifice of New Deal market reforms.

The power of labor continues to wane; the Supreme Court’s Janus v. AFSCME decision, while ostensibly limited to public sector unions, signaled in certain terms the willingness of the court’s conservative majority—five guys who have never held a real job—to effectively overturn the entire National Labor Relations Act if given the opportunity. The justices, who imagine working at Wendy’s is like getting hired as an associate at Hogan & Hartson after a couple of federal clerkships, reason that every employee can simply negotiate for the best possible deal with every employer.

Home › Forums › Debt Rattle September 3 2018