Arnold Genthe. Street scene with horse and wagon, Charleston, South Carolina 1920

On the political front, there are three clear battlegrounds in the world today. In Thailand, Prime Minister Yingluck Shinawatra has found out that being pretty isn’t enough. In the run-up to an election this Sunday, which she forced through in spite of calls for a delay because she thinks she’ll win, bombs are going off on a regular basis, planted by protesters who want her corrupt clan to take a hike.

In Ukraine, protesters have been on the streets for weeks in Arctic conditions because they want to force their president out, after the latter signed a “rescue” deal with Vladimir Putin instead of Brussels. Heavyweight boxing champ Vladimir Klitschko stands ready in the wings waiting to take over. They won’t allow their country to go back to Russian rule.

In Turkey, PM Erdogan, who’s been in office for 11 years, in under immense scrutiny for corruption charges. Turkey is a very large country in a pivotal geographic location, in which long time secularism has a hard time fighting off pressure from the muslim population.

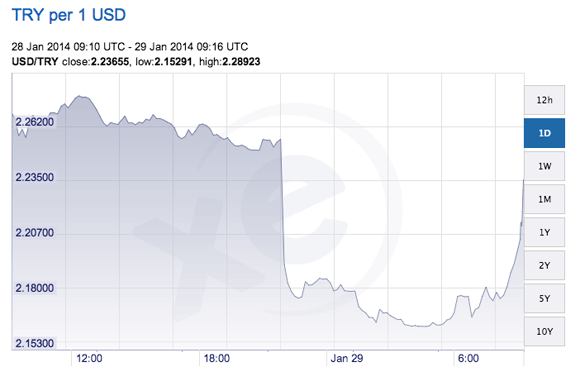

And here we connect, in one fell swoop, politics and economics: Turkey’s central bank, against Erdogan’s explicit wishes, took dramatic action to support the lira at midnight, by hiking interest rates far more than anyone held possible. Which seemed to work initially, but has just about entirely backfired within 12 hours:

That cost a lot of Turkish people a lot of money. The country’s back where it was yesterday, before the rate hike, only with much higher interest rates and a deep loss of confidence and trust in its economy. It wouldn’t be unexpected if speculators now start targeting Ankara and Istanbul even more. Not a nice place to be in. And an even larger threat to Turkey’s long held tradition of separating church and state.

Until very recently, Turkey was praised as an example of what emerging markets could accomplish. But take a look now: Turkey, literally overnight, has become an example of how vulnerable and volatile emerging markets are, or at least can be. Obviously, when you mention Turkey, you must ponder about its neighbor Greece, which no longer has the power to hike rates or protect its currency, may have wished until today that it could, and could now be thinking the cloud of EU overbearance is perhaps not such a bad thing. Even if it starts to feel like paying the mob for protection.

In any case, EU stock markets are absolutely plummeting right now, and increasing fear and uncertainty rule the day. Let’s see if Bernanke has a goodbye gift later today that can throw some more oil on the fire. What’s certain is that what we see happening, across the board, in “stronger” and “weaker” economies, is a wide variety in failures to present new bubbles placed on top of existing bubbles as inspiring trust, confidence, optimism and economic growth. There will be someone, always, in the crowd who shouts out that the emperor is naked. Why we don’t simply accept that as a fact of life, and choose to chase the mirages painted in the markets and the media instead of acting on what’s real, will always be hard to figure for me. There’s a difference between being blinded and plain blind.

The way in which Europe fails to get agree on a plan to make sure that its banks won’t cost its taxpayers yet another round or two or three of bailouts is exemplary in this regard. Brussels talks and talks, but finally presents a half baked plan, from which any hint of a Glass/Steagall-like wall between consumer deposits and investment banking – aka gambling – has been carefully erased. What plan is left is made public at the exact moment it is utterly useless in the face of upcoming EU elections and the musical chairs game that will follow it.

I can’t help wondering from time to time why there are still governments in Brussels and Washington. Wouldn’t it be much more efficient, not to mention cheaper, to relocate them to Frankfurt, the City, and Wall Street? That’s where all important decisions are made anyway.

The US Office of the Comptroller of the Currency has issued a junk warning. Well, actually, a warning against the rise of junk loans, but the warning itself is junk too. An OCC “senior deputy comptroller for large bank supervision” manages to get this gem to leave his mouth without choking on it: “Transferring future losses from banks to pension funds does not aid long-term financial stability for the U.S. economy”. No kidding. In essence, American companies are forced to move into junk territory to keep business going. The banks use that to blow a junk bubble, and they sell it off as “this parrot is not dead” to pension funds, the only place where there is either still actual wealth available or nobody cares to look at the small print. A society in the process of being gutted like a fish.

• U.S. banking regulator, fearing loan bubble, warns funds (Reuters)

A U.S. bank regulator is warning about the dangers of banks and alternative asset managers working together to do risky deals and get around rules amid concerns about a possible bubble in junk-rated loans to companies. The Office of the Comptroller of the Currency has already told banks to avoid some of the riskiest junk loans to companies, but is alarmed that banks may still do such deals by sharing some of the risk with asset managers.

“We do not see any benefit to banks working with alternative asset managers or shadow banks to skirt the regulation and continue to have weak deals flooding markets,” said Martin Pfinsgraff, senior deputy comptroller for large bank supervision at the OCC, in a statement in response to questions from Reuters. Among the investors in alternative asset managers are pension funds that have funding issues of their own, he said. “Transferring future losses from banks to pension funds does not aid long-term financial stability for the U.S. economy,” he added.

The breadth of the statement from the OCC is unusual because it technically oversees banks and not asset managers. Regulators are eyeing a number of risks to the financial system as they aim to prevent a repeat of the mortgage bubble that spurred the 2008-2009 financial crisis. They are not comfortable with different players sharing risk if the total level of risk in the system is getting dangerously high.

That may be happening with leveraged loan issuance, which hit a record $1.14 trillion in the U.S. in 2013, up 72 percent from the year before, according to Thomson Reuters Loan Pricing Corp (LPC). A measure of the riskiness of these loans has also been rising – the average size of the debt for companies taking these loans in 2013 was 6.21 times a form of cash flow known as EBITDA or earnings before interest, tax, depreciation and amortization, up from 5.86 times in 2012 and the highest since 2007, LPC said.

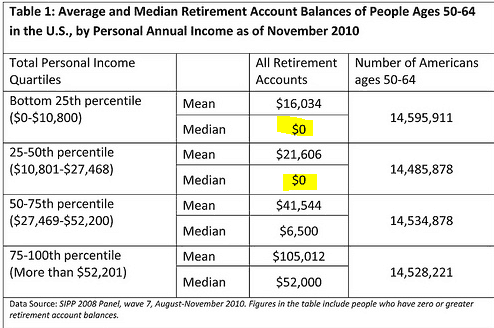

If and when “Transferring future losses from banks to pension funds does not aid long-term financial stability for the U.S. economy”, it of course absolutely destroys the stability of the pension funds the losses are transferred to. Retirement has, not tomorrow but today, once again become a faraway dream for most Americans.

When you think about this, how your (grand)parents fought for the right not to have to work until they literally dropped dead, and how that right has now completely vanished only 50-60 years later, how would you explain that? And how, in that light, would you explain the stories about economic recovery, and great technological and medical progress, that you read about every single day?

Really, this is a serious question from me to you: How, in your head, do you make that rhyme? We got all these new things, big TVs, smartphones, endless supermarket aisles with 100 times more products than in your grandparents’ days, everybody has a car, homes have gotten much bigger and much further away, but we can now no longer retire. We have all this stuff, but we must work for it, once again, until we physically no longer can, and even then it all threatens to be taken away on a daily basis. How is that progress? How do you define that, justify that, in your head? I would like you to answer that for me. because I don’t understand how that works, I don’t understand why people accept that.

• Why millions of Americans will never retire (MyBudget360)

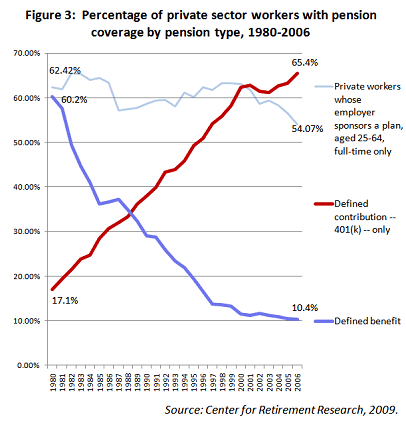

In the past, you worked until you died. Short of royalty, this was the typical life path. Retirement, at least how it was presented to modern American workers, meant a time in life when financial worries were gone thanks to a lifetime of work. In more practical terms this meant a combination of a pension, 401k/403b, and Social Security. Social Security was never intended to be the main retirement income stream for Americans but it is. Pensions are now nearly extinct in this low wage economic system.

Many Americans in the early 1980s were presented with the Wall Street vision of retirement where many simply set aside money in 401ks and IRAs generating untold wealth to the financial kings. Wall Street was supposed to exercise some fiduciary duty to the American people but the opposite occurred. A massive bait and switch. Retirement is going to take on an entirely new definition given the current state of wealth in America.

The number of Americans with a pension has fallen dramatically. In the early 1980s, close to 60 percent of private sector workers had a defined benefit plan (pensions). Today defined contribution plans are now the norm. The trend is rather clear:

So one leg of that already weak stool has been taken away for a massive portion of the population. Not off to a good start when the chopping down of this leg is hitting right when millions of Americans are hitting retirement age.

The second leg of the retirement stool is basically non-existent. Of those 50 to 64, in the prime years before retirement, half have nothing saved up. You would think those with higher incomes would be doing much better but the figures don’t look so promising here either. You would have to go to the top one percent of the country to see where the real wealth gains have gone in the last generation.

Turkey, see above.

• Turkey Central Bank Intervention Halflife 12 Hours (Zero Hedge)

So much for the credibility of the CBRT? After the Lira soared, and the USDTRY plummeted by just under 1000 pips yesterday when the Turkish Central Bank announced its “shock and awe” intervention, it has since pared back virtually all gains, and at last check was just over 2.24 having nearly roundtripped in 12 hours.

Why the loss of faith? Two reasons: First, as we pointed out yesterday, suddenly the domestic situation in Turkey takes front stage again, with 4.25% added elements of instability, causing the political instability to soar, leading to an even higher probability of a social and political overhaul. Second, as Goldman pointed out overnight, “the CBRT stated that liquidity “… will be provided primarily from one-week repo rate instead of the marginal funding rate in the forthcoming period”.

This implies that the effective rate hike is 225bp (to 10.00%; the 1-week repo rate), as the Non-PD lending rate was 7.75% prior to the announcement.” In other words, when looked at on a corridor basis, the CBRT hiked not by a shocking and awing 425 bps but by precisely the predicted 225 bps!

Turkey is one emerging market. China is THE emerging market. If China starts to wobble, risk is off and dollars will start flooding back into the US with a vengeance. Not just investment dollars, but also those of Chinese businesspeople who made those dollars on the back of highly questionable and even higher leveraged credit issuance, and who will now start using those, essentially fantasy, dollars to buy up assets inside the US.

In one other emerging market, the Russian ruble is plunging as we speak.

• Why Turkey’s dramatic move may not save emerging markets (CNBC)

A massive interest-rate hike from Turkey is a decisive step to shore up its battered currency, but by no means marks the beginning of the end of troubles for beleaguered emerging markets, analysts say. Turkey’s central bank late on Tuesday delivered a hefty 425 basis point rise in overnight lending rates to defend a crumbling lira.

Investors gave the move a clear thumbs up, with the Turkish lira bouncing. At 2.25 per dollar on Wednesday, the lira held comfortably above this week’s record low of about 2.39 per dollar. U.S. stock futures jumped after the rate hike, while Asian stock markets opened sharply higher, painting a positive backdrop for European markets which open later in the day. While analysts applauded the aggressive action from Turkey’s central bank, especially in the face of opposition from the country’s prime minister, they added that emerging market woes are far from over. [..]

“The critical question is how China handles a soft landing and the jury on that is still out,” he said. “One break in the Chinese banking system could precipitate a much bigger source of turmoil than we’re seeing right now.” Fears about China’s banking system have flared up recently because of a financial product known as a wealth management product that was expected to default this week until an 11th-hour agreement resolved the situation.

Analysts said individual action by central banks should go some way to shore up local markets. Earlier on Tuesday, India delivered a surprise interest rate hike and said it was better placed to deal with the risk of major capital outflows from emerging markets. And the spotlight is likely to turn to South Africa’s central bank, which meets later in the day. “Turkey’s move does raise the bar for them [South Africa]. They will have to stave off speculators … ”

Yeah, get the lazy bastards! A gentler cut to the US foodstamps program. Isn’t that just so sweet? Gutted like a fish, I said.

• Food stamps: how House, Senate agreed to cut $800 million a year

The proposed food stamp cuts are coming at a time when more Americans are on food stamps than at almost any other time in the past decade. In fiscal year 2006, one year before the recession curdled the job market, the number of people on food stamps was about 26,000. As of July 2013, that number is 48 million.

But how to interpret the surge in food stamp participation has been split along partisan lines. Republicans have said that the expanding program is flush with participants who are not in true need, but are rather taking advantage of loopholes or poor oversight. Democrats, though, have said that the program has burgeoned with people who have not yet found their footing after the recession jolted their communities.

“Only in Washington could a final bill that doubles the already egregious cuts to hungry families while somehow creating less total savings than originally proposed be called progress,” said Sen. Kirsten Gillibrand (D) of New York, according to The Washington Post.

It’s not in the news much at the moment, but don’t you worry, it’ll be back. The PIIGS + France are going to need a lot more support soon, but nobody will move until the EU elections are done. Which are going to be a degrading spectacle, with perhaps 15-20% of voters casting ballots, and right-wing parties all over getting their turn in the limelight. Prediction: Mario Draghi will look a lot less regal at the end of the year than he does now. We’ll do whatever it takes sounds good only until people figure out what “whatever” means exactly.

• Rising risk that German court will block rescue for Southern Europe (AEP)

The risk is rising that the German constitutional court will severely restrict the eurozone bond rescue scheme for Italy and Spain, and may reignite the euro debt crisis by prohibiting the German Bundesbank from taking part. The Frankfurter Rundschau newspaper reports that the verdict has been delayed until April due to the complexity of the case and “intense differences of opinion” among the eight judges.

The longer the case goes on the less likely it is that the court – or Verfassungsgericht – will rubber stamp requests from the German government for a ruling that underpins the agreed bail-out machinery. “This is potentially very serious, particularly at a time when people are already worried about emerging markets,” said one expert close to the case. “We doubt that the Court will ban bond purchases outright but they could demand changes that greatly complicate the picture.” [..]

The European Central Bank’s back-stop plan for southern Europe – known as the OMT – has never been activated or tested. The mere pledge to do “whatever it takes” was enough to calm the bond markets in July 2012. However, this rhetorical effect works both ways. If markets start to doubt whether the OMT really exists, confidence could evaporate again.

A leaked draft of the Bundesbank’s submission to the Court systematically unpicked every line of argument used by the ECB’s Mario Draghi to justify the bond plan, concluding that the ECB has no mandate to uphold the “current composition of monetary union” or to “rescue states in crisis”.

The text said the OMT entails the purchase of “bad bonds”, violates ECB independence and entails a high risk of heavy losses in the “not unlikely” event that debtor states are forced out of EMU. The Frankfurter Rundschau said it would be a “spectacular” reversal of prior rulings if the court agreed to any arrangement that eroded ECB’s independence, especially its seminal ruling on the Maastricht Treaty in the 1990s. [..]

Chief justice Andreas Vosskuhle says Germany has exhausted the scope for further EU integration under German constitutional law. If it wishes to take revolutionary steps towards fiscal union, it must equip itself with a “new constitution”. This would require a referendum. Markets have assumed all along that the Verfassungsgericht is essentially bluffing, unwilling to do anything that would imperil EMU rescue plans. The latest leaks from Frankfurt and Karlsruhe suggest that caution may be in order.

Shadow dancing in Brussels, on playbook straight out of Capitol Hill. Announce big plans, then start watering them down until no recognizable taste remains. Been there, done that, Rinse and repeat. Who governs your country?

• E.U. Deal on Winding Down Failed Banks in Peril

Barely a month after European officials announced the creation of a system for winding down failed banks, it appears the plan could fall victim to a disagreement between member states on the European Council and the European Parliament.

Finance and economic officials of the 28 European Union member states agreed in December on a plan to create the “Single Resolution Mechanism” and a fund to help pay the cost of banks that have to be shuttered. European Union officials hailed the deal — along with a new bank supervisory body under the aegis of the European Central Bank — as the pillars of a banking union for the 18-member euro zone and a crucial safeguard against messy cross-border bank failures. Now they are fighting over the details of the plan, which still must be approved by the European Parliament.

Even before the deal was announced, members of Parliament and officials of the central bank, including Mario Draghi, its president, had argued that it was unnecessarily complicated and would slow decision making. They were also concerned that it would take 10 years for the resolution fund to reach its full strength of 55 billion euros, or about $75 billion, leaving questions about what would happen if a bank needed to be shut down before then.

Negotiators from the Parliament, the European Commission and the European Council, which is made up of representatives from the member states, are holding talks to reconcile their demands. If they cannot reach a deal by the time Parliament holds its final plenary session, from April 14 to 17, the plan will have to wait for the new Parliament and a new European Commission to be seated after elections in May. With the disruption that follows such changes, action could be delayed well into the second half of the year or into 2015. [..]

Officials worry that a failure to get a deal could leave Europe without a sufficient backstop just as the central bank, in its new role as banking supervisor, begins a round of stress tests of systemically important banks.

Well, isn’t that just sad? All those millions spent on a banking plan, and then having to throw it out. Or was that perhaps the whole idea all along?

• Too-Big-to-Fail Plan for EU Banks Seen Too Late to Win Approval (Bloomberg)

Michel Barnier, the European Union’s financial services chief, faces opposition as he prepares to unveil plans to curb the activities of about 30 of the bloc’s biggest banks to prevent them being too big to fail.

While France and Germany say parts of today’s proposals may hamper lending and threaten an exodus of banking services, European Parliament lawmakers argue the plans have simply come too late for them to review and approve ahead of May elections. Many will have left office or switched jobs by the time the assembly gets a chance to vote on the measures.

“It’s a bit insulting to present this now,” Sharon Bowles, chairwoman of the EU assembly’s economic and monetary affairs committee, said in an e-mail. “Barnier should have presented this much sooner before the election, or not at all. The deadline for the parliament to receive new, non-emergency, proposals before the elections expired in July last year.”

Barnier’s initiative, which would ban the lenders from proprietary trading and hand regulators the power to split them up, are seen as a “cornerstone” of the EU’s fight against too-big-to-fail lenders that has dominated his 5-year-tenure. Barnier, whose term ends on Oct. 31, has argued for EU-level measures responding to a flurry of national measures in the 28-nation bloc and the U.S., where regulators last year approved a proprietary trading ban, the Volcker Rule.

A Danish reader asked about his country’s deal to sell part of their energy company, DONG. What was the question again? Is it a good idea to sell your energy (aka independence) to Goldman Sachs? Remember what happened in Greece? You guys should be storming your parliament building, and I’m not kidding. Tell them their careers are over if they even try. Question: which one of the puppets in your government is a former Goldman employee? It’s a pattern!

• Goldman Defended by Danish Lawmaker in Dong Buyout Dispute (Bloomberg)

Goldman Sachs is the right investor for Dong Energy A/S, a top official of Denmark’s ruling Social Democrats said, defending the Wall Street firm against criticism from other parliament members. [..]

“We would have liked if the government had considered who Goldman are and what they want,” Stine Brix, the deputy financial speaker for the party, said in an interview. “Goldman has a very doubled-faced story. On one hand, everybody is fascinated with how good they are, but they also act without guilt or remorse.” [..]

Selling to Goldman Sachs is morally wrong, jeopardizes Denmark’s green agenda and will prove to be a financial mistake, Poul Nyrup Rasmussen, a former Danish prime minister, was quoted as saying in an interview published by newspaper Politiken today. [..]

The Danish People’s Party, which has 22 seats in Denmark’s assembly, initially backed the government’s plan to find private investors for Dong. Now the party has threatened to withdraw its support. “We don’t understand why Goldman should be able to hire and fire the management or why they need to be able to veto the strategy when it’s already in place,” said Rene Christensen, financial spokesman for the party. “The government says there’s no need to worry about the clauses, but that only made us more curious as to why they had to make them in the first place.”

But of course, there are always people who see a country selling its independence to the highest bidder as a profit opportunity. Whether it’s the UK, or the US, or Denmark. Tried and tested. And no more retirement for you!

• Goldman Distaste in Denmark Turns Dong Into Buy (Bloomberg)

Opposition to Goldman Sachs’s planned investment in Dong Energy A/S has opened up a bet on debt sold by the Danish power and oil producer. Yields on the bonds climbed amid rising resistance to the 8 billion kroner ($1.5 billion) investment, with a former prime minister saying that selling to the Wall Street firm is morally and financially wrong and jeopardizes Denmark’s environmental agenda. The government is seeking to sell a stake to shore up the utility’s finances after failed natural gas bets.

“I would use these recent small declines to buy the bonds as the debate is only white noise,” Jens H. Thomsen, a credit analyst at Jyske Bank A/S, said by phone. “It’s very likely that the deal goes through and that would be very positive for the credit profile.” [..]

As part of the investment, Goldman will be able to veto a possible sale of new shares or hybrid capital, changes in senior management or acquisitions before a possible initial public offering in 2018. The state will retain a 57.3 percent stake in Skaerbaek-based Dong, which operates offshore wind parks and explores for oil and gas. Other minority owners are ATP and PFA, the country’s two largest pension funds, as well as five local energy companies. No other investor gets the same veto powers as Goldman.

Pete Seeger. Symbol of perhaps the – only – greatest thing ever to come out of America: music.

• Pete Seeger. The Power of Song (PBS doc)

You can’t just say you have rights. You have to use them to prove than you have them.

“You can’t just say you have rights. You have to use them to prove than you have them.”

• ‘This Machine Surrounds Hate and Forces It to Surrender’ (The Atlantic)

Sure, the banjo has a jaunty, inviting sound. Sure, it can be played in a variety of ways, making it suitable for a range of musical genres. But these qualities did not prevent it from being a prop of racist entertainment. They did not make it a symbol of community. They did not transform it into a “machine [that] surrounds hate and forces it to surrender.”

That was the work of man. One man, really.

Seeger’s banjo now resides at the Rock and Roll Hall of Fame in Cleveland, Ohio, where he donated it following an ill-fated attempt to sell it on eBay to raise money for Haitian earthquake relief. After watching bids climb to unimagined heights, Seeger canceled the auction. No machine to surround hate and force it to surrender should live in a private living room of a fancy home, after all.

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

Home › Forums › Debt Rattle Jan 29 2014: Gutted Like a Fish